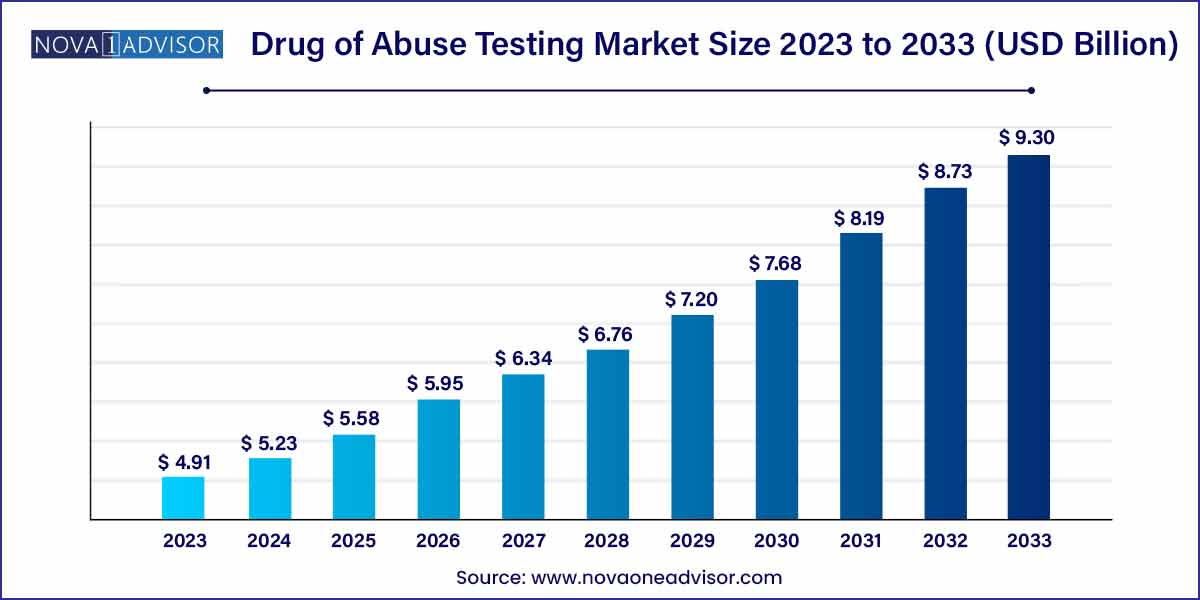

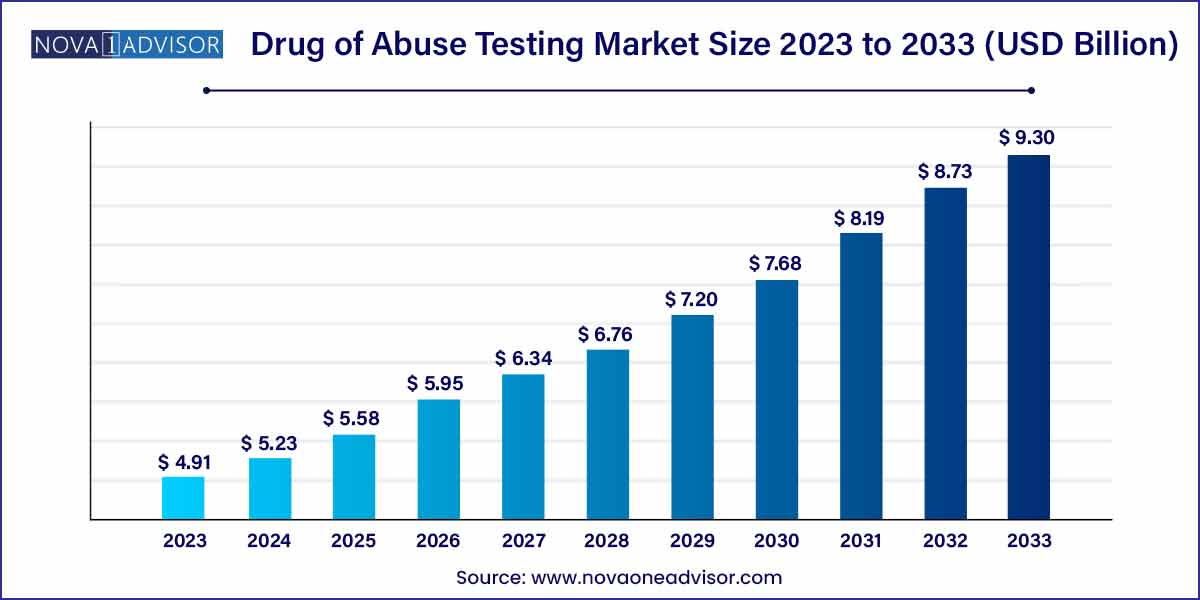

The global drug of abuse testing market size was exhibited at USD 4.91 billion in 2023 and is projected to hit around USD 9.30 billion by 2033, growing at a CAGR of 6.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- By drug type, the cannabis/marijuana segment hit the highest revenue share of over 27% in 2023.

- In 2023, North America region captured a revenue share of over 39.6%.

- By product, analyzers segment is expected to grow at a 5.7% CAGR from 2023 to 2033.

- The North America drug of abuse testing market is expected to reach a CAGR of 5.5% over the forecast period of 2023–2023.

Market Overview

The global drug of abuse testing market plays an indispensable role in monitoring and curbing the misuse of illicit and prescription substances. This market encompasses a range of diagnostic technologies and tools used to detect the presence of substances such as alcohol, opioids, marijuana, cocaine, LSD, and other narcotics across various biological samples. From pre-employment screenings to post-accident investigations and rehabilitation monitoring, these tests are deployed in diverse settings including workplaces, hospitals, sports organizations, and law enforcement.

The growing societal and economic burden of drug misuse has significantly elevated the demand for drug testing. According to the United Nations Office on Drugs and Crime (UNODC), over 296 million people globally used drugs in 2021, marking a 23% increase over the previous decade. This rise in substance abuse, especially opioids and synthetic drugs like fentanyl, is leading governments and organizations to implement more stringent testing regulations and enforcement mechanisms.

Technological advances, particularly in rapid diagnostics and point-of-care testing kits, have expanded the reach and efficiency of drug testing procedures. Portable breathalyzers, saliva-based screening devices, and hair analysis methods are increasingly being adopted for their convenience and accuracy. Moreover, increasing public safety concerns, occupational health mandates, and the integration of testing within rehabilitation programs are further driving the market.

The market’s expansion is also supported by private sector initiatives, sports governance bodies, and global anti-doping efforts. As awareness around addiction prevention and public health management continues to grow, the drug of abuse testing market is poised to witness sustained and diversified demand globally.

Major Trends in the Market

-

Shift Towards Saliva and Hair-Based Testing: Non-invasive, longer detection window methods are gaining popularity over conventional urine-based testing.

-

Growth in Rapid Testing and Point-of-Care Kits: Increased demand for on-the-spot, real-time results in workplaces and law enforcement settings is fueling rapid test kit usage.

-

Technological Integration with Cloud and AI: New-age devices incorporate data management platforms and AI-based interpretation to enhance test reliability and remote monitoring.

-

Legalization of Cannabis Driving Testing Reforms: As more countries and states legalize marijuana, testing regulations are being updated to distinguish between recreational use and impairment.

-

Increased Testing in Pain Management Programs: With rising scrutiny of opioid prescriptions, healthcare providers are integrating drug testing into chronic pain treatment regimens.

-

Workplace Testing Becoming Standard Practice: Corporations are implementing routine and random drug screening to ensure workplace safety and productivity.

-

Rise in Home-Based and Over-the-Counter (OTC) Test Kits: Consumers are increasingly purchasing test kits for personal use or family monitoring, especially in households with teenagers.

Drug of Abuse Testing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.91 Billion |

| Market Size by 2033 |

USD 9.30 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Drug Type, Sample Type, End User, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Danaher Corporation, Abbott Laboratories, Quest Diagnostics, Inc., LabCorp, Cordant Health Solutions, Legacy Medical Services, Mayo Clinic Laboratories, DrugScan, LGC Group, Precision Diagnostics. |

Market Dynamics

Driver:

The market for drug abuse testing has risen substantially due to drug and substance abuse growing more and more common, particularly within student populations. Peer pressure, stress, and easy access to drugs are some of the factors that have led to rising rates of substance abuse in different parts of the world. For instance, 45.7% of students in a recent study carried out in Nigeria were found to be abusing drugs or other substances. This finding highlights the critical need for drug abuse testing services to detect and treat these alarming problems. Furthermore, legal and occupational requirements have been a major factor in increasing the demand for drug testing services. To ensure the security and well-being of their communities, numerous employers and educational institutions have put in place drug testing policies. For instance, drug testing is required by a few American universities for students participating in extracurricular or sports activities, which increases the demand for drug testing services on campuses.

Furthermore, there is a greater focus on addressing this issue as part of growing awareness of the risks to the public's health that drug abuse poses, including addiction, accidents, and mental health issues. Governments and health authorities are placing a higher priority on the fight against drug abuse, and a key component of this strategy is drug testing. For instance, the US opioid crisis led to a greater focus on drug abuse testing as part of all-encompassing strategies to address opioid addiction and lower the number of overdose deaths. Technological developments in drug testing have improved the accessibility and efficiency of testing, particularly regarding quick and non-invasive procedures. These developments have made it easier to implement drug testing in a range of contexts, including educational institutions, which has contributed to the market for drug abuse testing growth. Programs to raise public awareness and educate the public about the risks associated with drug abuse have additionally highlighted the significance of routine testing to identify and treat substance abuse problems. Educational institutions frequently work with local government agencies and groups to run awareness campaigns, offer support services to students who are struggling with substance abuse, and encourage the use of drug testing as a preventative and intervention strategy.

Restraint:

The belief that drug testing violates people's rights is an important hindrance to the market for drug abuse testing. Some people oppose drug testing and are reluctant to participate in drug abuse treatment programs as they believe that doing so violates their civil rights and invades their privacy. This point of view hinders the market's growth, particularly in countries where strong legal or cultural protections for people's privacy and autonomy are in place. For instance, drug and alcohol testing is permitted in specific circumstances in Canada. Similar bans in other nations prevent drug and alcohol testing from becoming widely used, which limits the market's ability to grow.

Opportunity:

The growing demand for drug testing in emerging markets, especially in the Asia-Pacific and LAMEA regions, offers a significant opportunity in the drug abuse testing market. Due to the rising incidence of drug abuse, a growing understanding of the value of drug testing, and the development of the local healthcare system, these markets present bright opportunities for the growth of the drug abuse testing sector. Furthermore, a major key driver of market growth is expected to be the increase in clinics and research labs providing drug abuse testing services in these regions. Furthermore, there is a rise in demand for drug testing goods and services due to government initiatives to address drug abuse issues in these areas. Major players in the drug abuse testing market are diversifying their product lines and allocating resources to research and development. Drug abuse testing becomes even more necessary as the Asia-Pacific region, with an emphasis on developing nations like China and India, is predicted to be the most promising market over the projection period.

Segments Insights:

Drug Type Insights

Alcohol has historically dominated the drug of abuse testing market, primarily due to its widespread use, legal status, and direct correlation with public safety incidents, particularly impaired driving and workplace accidents. Breathalyzers, which are now a standard tool for law enforcement, make alcohol testing fast and non-invasive. Moreover, alcohol testing is frequently mandated in occupational health programs, especially for transportation, construction, and security sectors.

In medical settings, alcohol testing is critical for managing withdrawal protocols and identifying comorbid addiction behaviors. Random and post-incident testing in schools, military, and rehabilitation centers further solidifies its prevalence. With growing focus on mental health and behavioral health linkages, alcohol testing remains a central pillar of substance abuse control programs.

Opioids are the fastest-growing segment, reflecting the severity and complexity of the opioid crisis globally. From fentanyl to oxycodone, opioid testing has become a clinical imperative, particularly in the United States, Canada, and parts of Europe where overdose rates have reached epidemic levels. Hospitals and addiction centers rely on blood, saliva, and urine-based panels to monitor patient adherence and detect misuse.

The rise of synthetic opioids, often undetected by traditional test kits, has spurred innovation in high-sensitivity immunoassays and LC-MS technologies. Moreover, opioid testing is becoming routine in pain management programs, maternal health, and even in emergency rooms to identify overdose cases and administer naloxone quickly. As public health systems invest more in harm reduction, opioid detection is expected to remain a priority.

Sample Type Insights

Urine remains the most commonly used sample type for drug of abuse testing due to its ease of collection, wide detection window, and established clinical validation. Urine tests are capable of detecting a broad spectrum of drugs and their metabolites, making them a standard choice across workplaces, legal systems, and healthcare settings. Most rapid test kits and laboratory-based panels are designed for urine samples due to cost-effectiveness and scalability.

Urine testing is particularly effective in post-accident investigations and pre-employment screenings, where recent drug use needs to be confirmed. Additionally, advancements in split-sample methods and privacy-preserving collection tools have helped address some concerns around sample integrity and tampering.

Hair testing is growing rapidly, particularly in forensic, sports, and chronic substance use analysis. Unlike urine or saliva, hair samples can detect drug use over weeks or months, making them valuable for long-term monitoring. This makes hair analysis especially useful in family court cases, child custody evaluations, and probation compliance.

Hair testing is also increasingly used by elite sports bodies to detect banned substances over an extended timeframe, helping uncover doping behaviors that might be missed by traditional short-window tests. Although slightly more expensive, the extended utility and higher resistance to sample tampering make hair a rising star in the market.

End User Insights

Workplaces constituted the dominant end-user segment due to the widespread adoption of drug-free workplace policies. From logistics companies to mining operations, organizations are investing in employee wellness and compliance by adopting onsite and offsite drug testing mechanisms. Occupational health clinics, third-party administrators (TPAs), and diagnostic chains offer scalable workplace testing solutions.

Regulatory frameworks such as the U.S. Department of Transportation (DOT) drug testing mandate have institutionalized the practice, and similar policies are being adopted globally. Employers view drug testing not only as a compliance measure but also as a productivity enhancer and reputational safeguard.

Criminal justice systems, including correctional facilities, probation departments, and law enforcement agencies, are emerging as a fast-growing end-user segment. The demand for on-the-spot drug testing during arrests, custody, and rehabilitation programs is growing significantly. Courts are also mandating regular testing as part of parole or diversion programs.

Police departments are increasingly adopting rapid saliva and breath tests for roadside drug detection to combat impaired driving. As legal systems become more focused on rehabilitation over punishment, drug testing will remain an essential component of behavioral monitoring and legal compliance.

Region Insights

North America, particularly the United States, dominates the global drug of abuse testing market due to its extensive infrastructure, regulatory mandates, and high substance use rates. The U.S. leads in both institutional and consumer-based testing due to robust workplace regulations (DOT), insurance policies, and anti-doping rules. The opioid crisis has further accelerated government investment in drug surveillance systems and pain management screening protocols.

Additionally, the presence of leading manufacturers, research institutions, and forensic labs supports market maturity. Drug testing is deeply embedded in employment practices, school safety programs, and clinical care across the region, making North America the most advanced market in terms of product availability and adoption.

Asia-Pacific is the fastest-growing region due to increasing drug abuse incidents, evolving healthcare regulations, and expanding public health initiatives. Countries such as China, India, and Indonesia are reporting rising narcotic use among youth and urban populations. Governments are responding with national drug de-addiction programs and stricter enforcement policies that include mandatory drug testing.

Healthcare infrastructure development, particularly in diagnostics and emergency services, is supporting the adoption of testing technologies in hospitals and mobile clinics. Additionally, the rise of sports academies and professional leagues in the region is driving anti-doping demand, further boosting the market.

Some of the prominent players in the drug of abuse testing market include:

- Danaher Corporation

- LabCorp

- Abbott Laboratories

- Quest Diagnostics, Inc.

- Cordant Health Solutions

- DrugScan

- Legacy Medical Services

- Mayo Clinic Laboratories

- LGC Group

- Precision Diagnostics

Recent Developments

-

Abbott Laboratories (March 2025): Launched a new saliva-based rapid drug test capable of detecting 10 different drugs in under 10 minutes, targeting workplace and emergency use.

-

Thermo Fisher Scientific (January 2025): Announced the expansion of its forensic toxicology lab systems in Europe with integrated LC-MS technology for high-sensitivity opioid testing.

-

Quest Diagnostics (February 2025): Partnered with the U.S. Department of Health and Human Services to provide expanded drug testing services for addiction recovery programs.

-

OraSure Technologies (April 2025): Released an at-home saliva drug test for cannabis and opioids, available OTC with digital results via mobile app.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global drug of abuse testing market.

By Drug Type

- Alcohol

- Cocaine

- Marijuana/Cannabis

- LSD

- Opioids

- Others

By Sample Type

- Urine

- Saliva

- Blood

- Hair

- Breath

- Others

By Product

- Equipment

- Immunoassay Analyzers

- Chromatography Instruments

- Breath Analyzers

- Consumables

- Rapid Test Kits

- Reagents

- Others

By Application

- Medical Screening

- Monitoring Pain Management

- Forensic & Legal Information

- Employment Drug Testing

- Sports & Athletics Testing

By End User

- Workplaces

- Criminal Justice Systems

- Hospitals

- Research Labs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)