E-cigarette And Vape Market Size and Growth

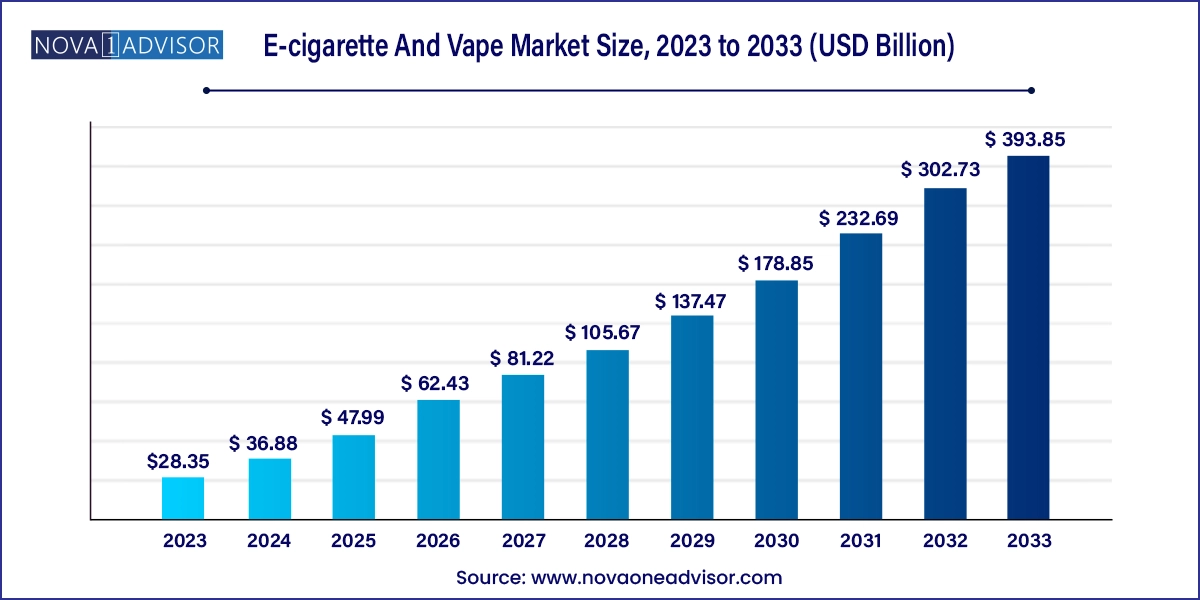

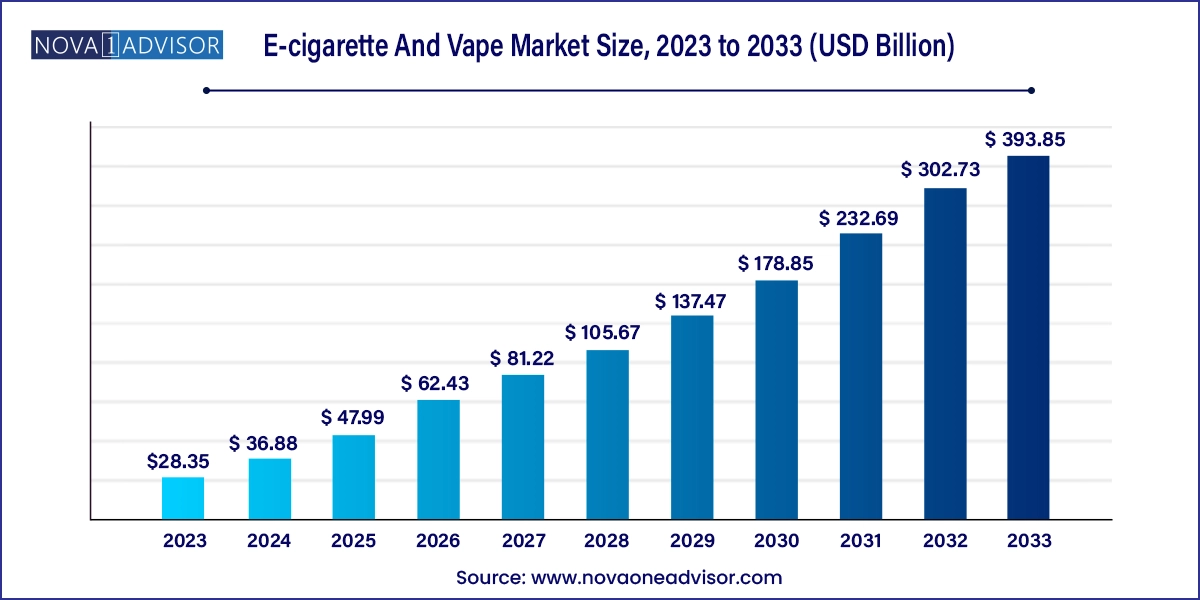

The global e-cigarette and vape market size was exhibited at USD 28.35 billion in 2023 and is projected to hit around USD 393.85 billion by 2033, growing at a CAGR of 30.1% during the forecast period 2024 to 2033.

E-cigarette And Vape Market Key Takeaways:

- The rechargeable segment accounted for the highest market share of over 40% in 2023.

- The modular devices segment is anticipated to register a significant growth rate over the forecast period.

- The retail store segment accounted for the highest market share of over 80% in 2023.

- The online segment is anticipated to register a significant growth rate over the forecast period.

- North America dominated the global market with a share of over 40% in 2023.

Market Overview

The Global E-cigarette and Vape Market has evolved from a niche consumer trend into a dynamic, multibillion-dollar global industry. Designed as alternatives to traditional combustible cigarettes, e-cigarettes and vaping devices deliver nicotine or flavored vapor without combustion, creating a smokeless experience that appeals to both smokers seeking cessation tools and lifestyle-driven consumers. Initially marketed as harm-reduction products, these devices have diversified into an extensive ecosystem of styles, flavors, and formats that cater to varying demographics and usage preferences.

The market includes a wide spectrum of products, from disposable devices intended for quick and convenient use to sophisticated modular systems customizable with different tanks, coils, and nicotine levels. Manufacturers continue to innovate with sleek designs, longer battery lives, nicotine salt integration, and controlled heating technologies, contributing to broader consumer adoption.

With the rising global consciousness around health and wellness, the shift away from combustible tobacco is evident. Many consumers view vaping as a less harmful alternative, although public health authorities remain divided over its long-term implications. Regulatory frameworks have also emerged as a defining force encouraging, restricting, or reshaping market dynamics based on taxation, marketing rules, and age-restrictions.

The industry’s recent evolution reflects both disruption and innovation. In April 2025, for example, Juul Labs announced plans for a strategic international relaunch after facing continued sales restrictions and regulatory scrutiny in the U.S. The move indicates a shift in focus toward emerging markets and reflects broader trends of global repositioning within the sector.

Major Trends in the Market

-

Emergence of Nicotine Salts and High-nicotine E-liquids

These offer smoother throat hits and faster nicotine absorption, appealing to transitioning smokers.

-

Surge in Disposable Vapes and Convenience-based Products

Compact, maintenance-free, and often flavored, these devices are dominating new-user adoption.

-

Flavor Innovation and Customization

Beyond traditional tobacco and menthol, fruity, dessert, and beverage-inspired flavors continue to expand, especially among younger adults.

-

Tech Integration and Smart Vapes

Devices with puff counters, app integration, temperature control, and child-lock mechanisms are gaining popularity.

-

Regulatory Rebalancing Across Major Markets

Governments are shifting between outright bans, flavor restrictions, and structured legalizations to balance health concerns with demand.

-

Rise of Refill Pods and Eco-friendly Systems

Environmental pressure is pushing brands to create recyclable, refillable, and biodegradable components.

-

Expansion into Emerging Economies

Companies are increasingly targeting Latin America, Southeast Asia, and Africa due to their large youth populations and underdeveloped regulations.

-

Growing Influence of Online Communities and Vape Culture

Social media, YouTube reviewers, and influencer marketing continue to play an outsized role in product adoption and loyalty.

Report Scope of E-cigarette And Vape Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 36.88 Billion |

| Market Size by 2033 |

USD 393.85 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 30.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Category, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Altria Group, Inc.; British American Tobacco; Imperial Brands; International Vapor Group; Japan Tobacco Inc.; NicQuid; JUUL Labs, Inc.; Philip Morris International Inc.; R.J. Reynolds Vapor Company; Shenzhen IVPS Technology Co., Ltd.; Shenzhen KangerTech Technology Co., Ltd. |

Key Market Driver: Perceived Harm Reduction and Smoking Cessation Support

The primary force driving the e-cigarette and vape market is the increasing perception of these devices as a safer alternative to traditional tobacco products. Research has highlighted that, although not risk-free, vaping is likely less harmful than smoking combustible cigarettes, which release over 7,000 chemicals during combustion many of which are toxic or carcinogenic.

This harm-reduction narrative has been embraced by many public health agencies, including Public Health England (prior to its restructuring), which once claimed that vaping was 95% less harmful than smoking. As a result, smokers seeking cessation tools often turn to e-cigarettes as transition devices. Brands like NJOY and Vuse (British American Tobacco) have developed structured transition programs with varying nicotine concentrations to help users taper their intake.

Additionally, flavored and lower-nicotine options appeal to social and recreational users who wish to avoid conventional cigarettes but still enjoy the sensory experience. This perception has catalyzed demand in developed markets like the UK, where vaping is even prescribed under medical supervision, and in emerging markets where traditional tobacco control strategies have failed to achieve full traction.

Key Market Restraint: Regulatory Uncertainty and Health Backlash

Despite their popularity, e-cigarettes and vapes continue to face regulatory volatility and rising public health scrutiny. Governments are increasingly cautious about youth access and nicotine dependency, especially given the surge in teen vaping witnessed across the U.S., Europe, and parts of Asia.

This has led to flavor bans, advertising restrictions, and legal battles in various countries. For instance, the U.S. FDA has issued multiple marketing denial orders (MDOs), impacting even major brands like Juul. In some regions, such as India and Thailand, comprehensive bans on e-cigarettes have been enacted, citing public health risks and lack of long-term safety data.

Such inconsistent regulations hinder market expansion, create uncertainty for investors, and force companies to frequently adjust supply chains, marketing strategies, and product portfolios. Furthermore, media narratives linking vaping to respiratory illnesses (such as EVALI e-cigarette or vaping-associated lung injury) have dented public trust and reshaped consumer behavior in some regions.

Key Market Opportunity: Expansion into Regulated Emerging Markets

A key opportunity for the e-cigarette and vape industry lies in expanding into regulated but underpenetrated emerging markets, especially where combustible cigarette use remains high. Countries in Southeast Asia, Latin America, and parts of Africa are experiencing growing urbanization, a young consumer base, and rising health awareness ideal conditions for vape adoption.

As international brands retreat from restrictive markets like the U.S., they are looking to develop localized strategies in regions with less rigid laws but increasing regulatory clarity. Governments that legalize vaping within a structured framework such as South Africa’s evolving nicotine laws or the Philippines’ vape bill create fertile ground for investment.

Moreover, these regions offer scalability at lower costs, enabling both premium and budget-oriented product lines. Companies that adapt to local flavor preferences, device affordability, and language-specific branding can rapidly gain market share. Offering cessation guidance and complying with medical-grade production standards can further build legitimacy and long-term loyalty.

E-cigarette And Vape Market By Product Insights

Disposable e-cigarettes dominated the product segment, owing to their ease of use, affordability, and growing appeal among first-time users. Disposable vapes are pre-filled, pre-charged devices that require no maintenance an ideal solution for users seeking convenience without commitment. These devices are particularly popular among young adults and casual users in urban settings. Their wide variety of flavors, sleek designs, and availability at convenience stores make them a primary entry point into vaping. Even high-nicotine variants with long-lasting battery life are now available, extending their appeal beyond occasional users.

Modular devices are the fastest-growing, particularly among experienced vapers who seek customization and performance. These systems allow users to modify tanks, coils, airflow, and power settings, creating personalized vaping experiences. The appeal lies in higher vapor production, improved throat hit, and flexibility in choosing e-liquid types. Modular kits also appeal to DIY communities who experiment with buildable coils and high-capacity batteries. Brands like Vaporesso and SMOK continue to launch advanced mods with OLED displays, AI integration, and coil memory presets, transforming vaping from a habit into a hobby.

E-cigarette And Vape Market By Distribution Channel Insights

Retail channels dominated the distribution segment, especially through convenience stores and specialty e-cigarette shops. Brick-and-mortar stores enable impulse purchases, customer education, and product trials. Specialty vape shops, in particular, have cultivated communities of loyal customers who seek in-person guidance and product demonstrations. These stores offer a broad range of hardware and liquid options, often supporting small-batch local e-liquid brands and coil-building workshops. Tobacco outlets and newsstands continue to provide accessible entry points, particularly for disposable and closed-system devices.

Online channels are growing fastest, especially in the wake of e-commerce expansion and consumer preference for discrete, doorstep-delivered products. Online platforms allow customers to explore a wider selection of brands, flavors, and price points. Subscription services, online bundles, and exclusive releases are also adding to the online channel’s attractiveness. However, age verification and regulatory compliance remain critical challenges in some markets, leading to policy-driven platform adjustments. Still, digital convenience and broader availability are fueling significant growth.

E-cigarette And Vape Market By Regional Insights

North America dominated the global e-cigarette and vape market, primarily driven by early adoption, strong brand recognition, and advanced product ecosystems. The U.S. and Canada together constitute a significant portion of the global vape user base. Despite regulatory tightening, consumer interest in alternatives to combustible tobacco remains high. Leading brands like Juul, Vuse, and NJOY still maintain strong footholds in specific product segments. The region is also characterized by a rich culture of vape customization, with hardware and e-liquid innovations often debuting in North America before global rollouts.

Asia Pacific is the fastest-growing region, propelled by urbanization, youth population growth, and relatively lax regulations in certain countries. China, the world’s largest producer of vape hardware through OEMs like SMOORE and Vaporesso, is increasingly influencing both supply and demand. Meanwhile, countries like Malaysia and the Philippines are establishing formal legal frameworks that allow structured market growth. In India, despite national bans, discussions around legalization are intensifying, with stakeholders advocating harm reduction. E-commerce expansion and cultural shifts are rapidly increasing market penetration across Southeast Asia.

E-cigarette And Vape Market Recent Developments

-

April 2025 – Juul Labs announced plans for a comprehensive international relaunch targeting markets in Europe, Southeast Asia, and Latin America, following continued U.S. regulatory restrictions. This move includes new product formulations and age-restricted marketing initiatives.

-

March 2025 – British American Tobacco (Vuse brand) launched a new line of eco-friendly vape pods in the UK and Germany, focusing on recyclable materials and minimal plastic use to align with ESG commitments.

-

February 2025 – SMOORE International Holdings expanded its OEM operations into Mexico, creating a regional hub to support Latin American market growth and reduce dependency on Asia-Pacific logistics.

-

January 2025 – RELX Technology unveiled a next-gen closed pod system with biometric lock features aimed at preventing unauthorized youth access.

Some of the prominent players in the global e-cigarette and vape market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global e-cigarette and vape market

Product

- Disposable

- Rechargeable

- Modular Devices

Category

Distribution Channel

-

- Convenience Store

- Drug Store

- Newsstand

- Tobacconist Store

- Specialty E-cigarette Store

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- MEA