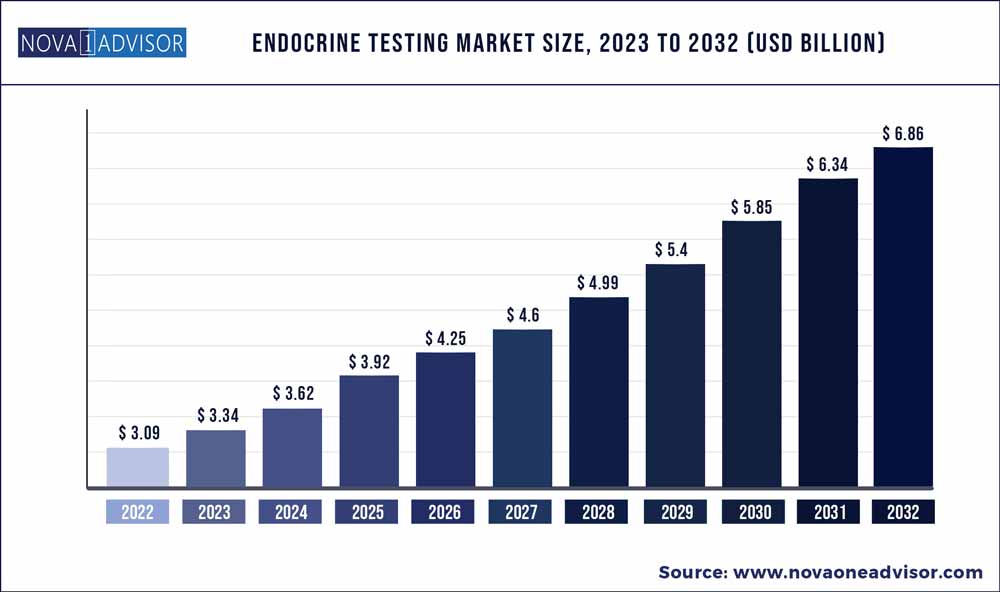

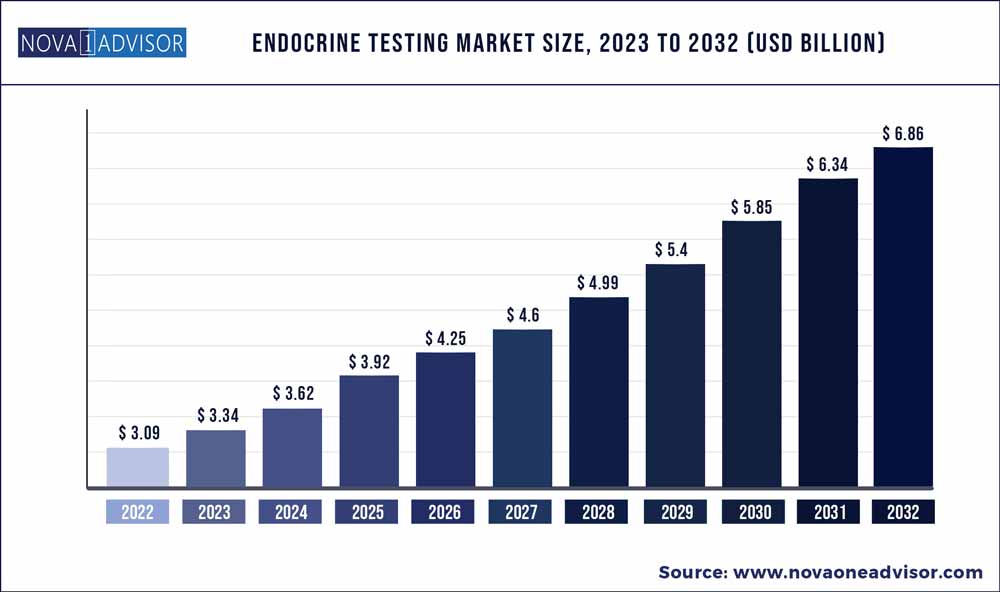

The global endocrine testing market size was exhibited at USD 3.09 billion in 2022 and is projected to hit around USD 6.86 billion by 2032, growing at a CAGR of 8.32% during the forecast period 2023 to 2032.

Key Pointers:

- North America held the largest market share in the endocrine testing market with a share of 46.24% in 2022.

- By test type, the human Chorionic Gonadotropin (hCG) hormone testing accounted for the largest share in 2022, driven by the presence of self-test kits at pharmacy stores, along with tests in laboratories or hospitals for quantitative evaluation. Moreover, the frequency of testing during different weeks of pregnancy and high number of fertile female population are also the contributing factors.

- In 2022, immunoassay based detection techniques generated a significant revenue of USD 1.85 Billion in the endocrine testing market.

- The insulin testing is expected to demonstrate a fastest growth rate of 9.82% in the forecast period.

- Based on end-user, commercial laboratories held the largest market share of 48.19% in 2022.

Endocrine Testing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 3.34 Billion

|

|

Market Size by 2032

|

USD 6.86 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 8.32%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Test type, technology, end-user

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Abbott Laboratories; AB Sciex; Agilent Technologies Inc.; bioMerieux SA, Bio-Rad Laboratories; DiaSorin S.p.A.; F.Hoffmann-La Roche Ltd; Laboratory Corporation of America Holdings; Quest Diagnostics Incorporated; Ortho Clinical Diagnostics;

|

The growing prevalence of life style diseases such as obesity coupled with diabetes & thyroid among the adult as well as the geriatric population is driving the need for endocrine testing. The routine endocrine testing in individuals will help in overall maintenance of health and thus this awareness of better health is significantly contributing to the global endocrine testing market growth.

As per the statistics by WHO, more than 39 million children in 2020 who were under the age of 5 were overweight or obese. The sedentary life along with unhealthy diet choices have contributed to obesity as well as diabetes in the general population. This occurrence of diseased conditions has also prompted many researches into the metabolic functions and related hormonal disorders.

Funding from government and private organizations has also driven the scientific community. For instance, the NIDDK (National Institute of Diabetes and Digestive and Kidney Diseases) by NIH drives many sponsored research programs towards improving health by better understanding of diseases. One such effort by NIDDK was the mid-atlantic symposium conducted in September 2022 for diabetes and obesity research. This will enable scientific knowledge exchange and interactions and allow collaboration at the regional level. Such initiatives will drive the understanding of endocrine function in the human body and will further enable the endocrine testing market growth.

The lack of awareness in underdeveloped and developing countries is anticipated to slow the growth of endocrine testing market. The developing health care settings and absence of reimbursement models restrain the individuals in these regions to undergo routine endocrine testing. However, with the growing consciousness of a healthy system during the COVID-19 pandemic is expected to upswing the testing frequency for these countries as well.

The outbreak of COVID-19 has created lucrative opportunities for the application of endocrine testing. COVID-19 infections cause a systemic disease that injures many organs. Therefore, these patients have many metabolic and hormonal disturbances that led to an increase in the number of endocrine research. For instance, in March 2021, Endocrine society members sanctioned USD 10 billion to support COVID-19 research to identify and understand the short and long-term COVID-19 effects on the endocrine system. Similarly, in September 2020, The American Diabetes Association invested USD 1 million to fund various research projects for investigating the link between diabetes and COVID-19. Thus, it will increase the demand and further boost market growth.

In addition, the limitation of movement and restrictions due to the lockdown encouraged the digital platform for medical consultation and at home sample collection services as well. The availability of point-of-care devices and kits for the detection of hormone levels at home is also driving the overall growth of endocrine testing market.

The market players are also expanding their regional presence due to various factors that are anticipated to grow the endocrine testing market. Collaboration, partnerships and global expansions are some of the business strategies by the key players to drive revenue generation. For instance, in February 2022 Laboratory Corporation of America Holdings (Labcorp) announced opening of a new laboratory in Indiana, U.S. The new diagnostics business in South Bend, Indiana will enhance the company’s services and make their offerings accessible to both patients as well as physicians in this region.

Test Type Insights

The human Chorionic Gonadotropin (hCG) hormone test dominated the endocrine testing market in 2022. High number of easy to use self-test pregnancy kits and need of quantitative estimation of hCG at hospitals or laboratories is contributing to the hCG test’s growth. Moreover, determination of hCG levels to detect abnormalities during different stages of pregnancy along with the growing number of fertile female population is also propelling the revenue generation of this segment. Furthermore, the role of hCG in treatment of infertility in both men & women will also drives the growth in endocrine testing market.

Additionally, TSH testing also generated significant revenue in 2022. TSH is a key regulator in immune response and is also associated in maintaining multiple hormone levels such as progesterone, hCG among others within the human body. These afore-mentioned roles of TSH along with prevalence of thyroid ailments such as cancer drives the market growth for TSH testing. As per Cancer.Net, it is estimated that in 2022 more than 43,500 adults will be diagnosed with thyroid cancer in the U.S.

Technology Insights

In 2022, immunoassay based detection techniques generated a significant revenue of USD 1.85 Billion in the endocrine testing market. This is due to the presence of multiple instruments and analyzers which uses different types of immunoassay technologies for detection. Also, the presence of immunoassay based tests panel for endocrine and reproductive function offered by many key players further contributes to the highest revenue generation of the segment.

On the contrary, owing to the advancements in technology since past few years, novel methods have been developed for hormone tests. Methods such as mass spectroscopy, chromatography, and nucleic acid based detection methods are taking over and providing accurate and precise results with a shorter turnaround time for endocrine testing panels. Furthermore, coupling of methods such as mass spectrometry with liquid chromatography offers consistent results and overcomes the drawbacks of traditional methods such as cross-reactivity.

The insulin testing is expected to demonstrate a fastest growth rate of 9.82% in the forecast period. Studies from scientists have also demonstrated the fact that thyroid dysfunction and diabetes are the most frequently occurring endocrine disorders which has a large effect on cardiovascular health. As per a scientific article published in December 2021 by the researchers from the Qatar University, it was observed that the occurrence of thyroid disorders are more prevalent in diabetic patients ranging from 9% to even 48%. Also, the researchers concluded that this prevalence was even higher for women (about 32%) than in men in a diabetic population. Such statistics will determine and fuel the insulin testing market in the future.

End-user Insights

Based on end-user, commercial laboratories held the largest market share of 48.19% in 2022. The availability of variety of tests panels and feasibility of at home collection services is boosting the revenue generation of this segment. Furthermore, commercial laboratories are also expected to observe the fastest growth in forthcoming years. This can be considered due to the growing health consciousness among individuals and the continuous endocrine testing to monitor existing disease and control the predisposed hereditary conditions. Also, the availability of reports over digital platforms by these commercial settings furthers their growth trajectory. For example, Laboratory Corporation of America Holdings or LabCorp, a U.S. based diagnostics company in February 2022 launched a digital portal allowing online orderings of tests and subsequently in April 2022, the company also launched a diagnostic test collection services at home.

In addition, hospitals also observed some market relevance in 2022, as they’re the center for disease identification as well as further treatment. The increased availability of endocrine testing at hospitals and the prognosis by the help of medical professionals are factors attributable for the segment’s share.

Regional Insights

North America held the largest market share in the endocrine testing market with a share of 46.24% in 2022. This can be attributed to factors such as the high number of diabetic and obese population, affordable & accessible options due to presence of reimbursing bodies, government funding initiatives for the betterment of healthcare settings, as well as the availability of multiple diagnostic companies. For example, the American Thyroid Association, an organization dedicated to support research for treatment of thyroid diseases has funded over USD 2.8 million across 105 grants since the inception of its funding program. Additionally, the presence of key players in this region drives the competition and results in multiple product offerings in the endocrine testing market.

From the past decades, factors such as developing medical & diagnostics industry, better healthcare systems, prevalence of disease among the geriatric population and growing personal healthcare expenditure have resulted in fueling the demand for routine endocrine testing in the Asia Pacific. Besides this, the APAC region is also observing growing research activities towards understanding of diseases leading to better disease diagnosis & treatment. All this will result in a significant growth and causes Asia Pacific to exhibit the fastest CAGR.

Some of the prominent players in the Endocrine Testing Market include:

- Abbott Laboratories

- AB Sciex

- Agilent Technologies Inc.

- bioMerieux SA

- Bio-Rad Laboratories Inc.

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Laboratory Corporation of America Holdings

- Quest Diagnostics Incorporated

- Ortho Clinical Diagnostics

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Endocrine Testing market.

By Test Type

- Estradiol (E2) Test

- Follicle Stimulating Hormone (FSH) Test

- Human Chorionic Gonadotropin (hCG) Hormone Test

- Luteinizing Hormone (LH) Test

- Dehydroepiandrosterone Sulfate (DHEAS) Test

- Progesterone Test

- Testosterone Test

- Thyroid Stimulating Hormone (TSH) Test

- Prolactin Test

- Cortisol Test

- Insulin Test

- Others

By Technology

- Mass Spectroscopy

- Immunoassay

- Chromatography

- Nucleic Acid Based

By End-user

- Hospitals

- Commercial Laboratories

- Ambulatory Care Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)