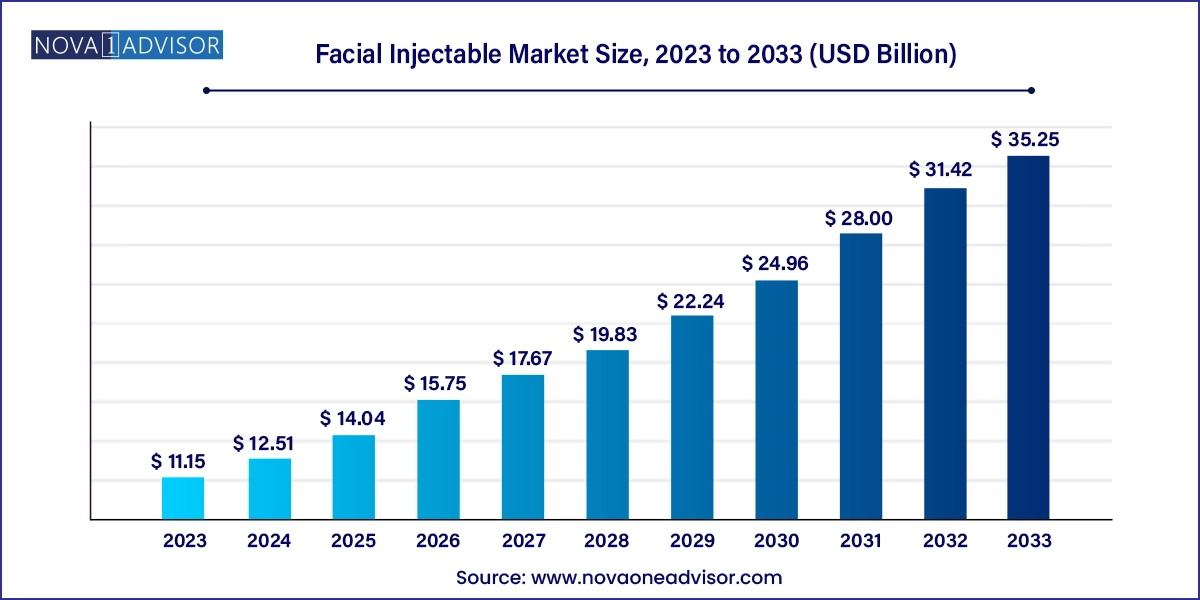

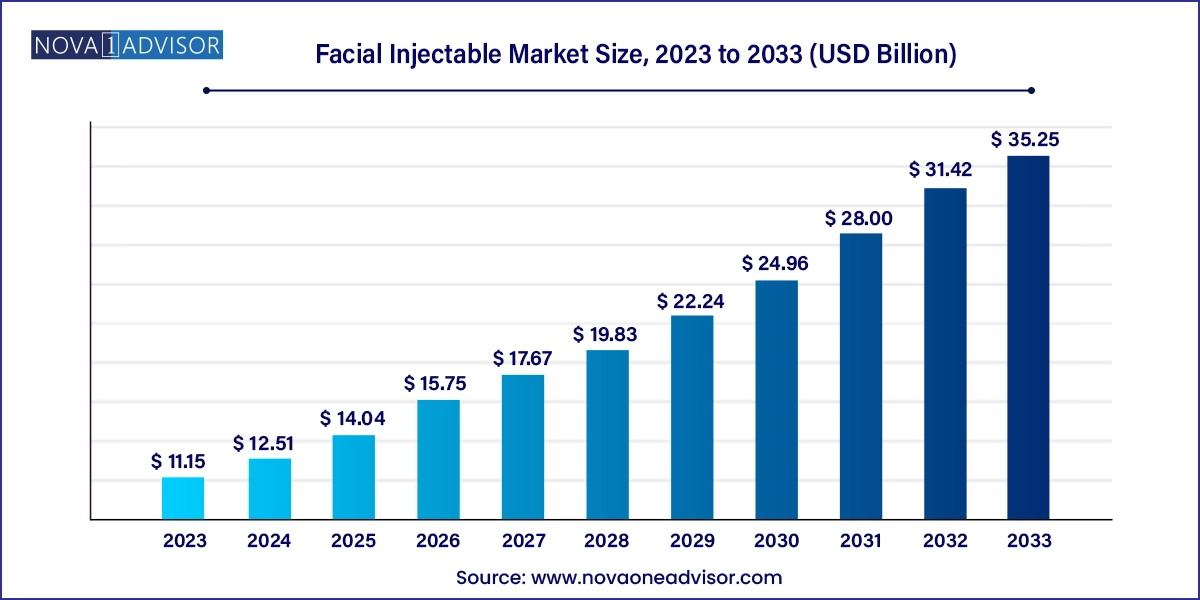

Facial Injectable Market Size and Growth

The global facial injectable market size was exhibited at USD 11.15 billion in 2023 and is projected to hit around USD 35.25 billion by 2033, growing at a CAGR of 12.2% during the forecast period 2024 to 2033.

Facial Injectable Market Key Takeaways:

- Based on product, the botulinum toxin segment dominated the marketand accounted for the largest revenue share of 53.0% in 2023.

- The Hyaluronic Acid (HA) segment is projected to witness the fastest CAGR of 12.3% during the forecast period.

- Based on application, the facial line correction segment dominated the marketand accounted for thelargest revenue share of 33.1% in 2023.

- Based on end-use, the medSpa segment dominated the market and accounted for the largest revenue share of 46.8% in 2023.

- It is anticipated to continue its dominance with a CAGR of 12.2% over the forecast period.

- North America dominated the market and accounted for the largest revenue share of 39.7% in 2023.

- In the Asia Pacific, the market is projected to witness the highest CAGR of 15.7% during the forecast period.

Market Overview

The global facial injectable market has evolved into one of the most dynamic sectors within aesthetic and cosmetic medicine. With growing social acceptance of minimally invasive aesthetic procedures, the market has experienced sustained growth in recent years. Facial injectables, which include dermal fillers and neuromodulators like botulinum toxin, are widely used for facial line correction, lip enhancement, contour augmentation, and rejuvenation procedures. These treatments are favored not only for their cosmetic results but also for their convenience, short downtime, and relatively low risk compared to surgical alternatives.

The surge in demand is driven by a confluence of factors. The aging global population, especially in developed economies, has increased the desire for youthful appearances. Concurrently, millennials and Gen Z consumers, influenced by social media and celebrity culture, are also increasingly seeking aesthetic enhancements, albeit with an emphasis on subtlety and natural results. This widening demographic is expanding the consumer base beyond traditional targets.

Technological advancements in product formulations have also significantly impacted the market. Newer injectables offer longer-lasting effects, reduced side effects, and improved safety profiles. For instance, innovations in cross-linking technology in hyaluronic acid (HA) fillers allow for better tissue integration and durability. Additionally, off-label applications of existing products—for chin contouring, nose reshaping, and jawline enhancement—have broadened the clinical use of injectables beyond wrinkle reduction.

As non-invasive aesthetic procedures gain popularity across emerging and developed regions alike, the facial injectable market is expected to continue its upward trajectory. This growth is further supported by the increasing number of MedSpas and dermatology clinics offering such treatments, greater physician awareness, and rising consumer disposable income.

Major Trends in the Market

-

Rising Popularity of Preventive Aesthetic Treatments: Younger demographics are opting for early interventions using facial injectables to delay visible signs of aging.

-

Combination Therapies Gaining Ground: Practitioners increasingly combine neuromodulators and dermal fillers for synergistic and comprehensive aesthetic results.

-

Male Aesthetic Market Expanding: There is growing acceptance and demand for facial injectables among men, particularly for jawline enhancement and wrinkle reduction.

-

Growth in Customized Injection Protocols: Physicians are tailoring injectable treatments to individual facial anatomies and ethnic profiles, ensuring more personalized outcomes.

-

Increased Regulatory Approvals: Global regulatory bodies are increasingly approving new injectable formulations and indications, expanding market offerings.

-

Rise of Home-Based and DIY Trends: While medically controversial, the availability of at-home injectable kits on unauthorized platforms is a notable market disruptor.

-

Training and Certification Surge: As aesthetic medicine grows, demand for certified aesthetic practitioners and training programs has risen sharply.

Report Scope of Facial Injectable Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 12.51 Billion |

| Market Size by 2033 |

USD 35.25 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Ispen; Abbvie; Medytox Inc.; Merz GmbH and Co.; KGaA; Revance Therapeutics, Inc.; Galderma; Sinclair Pharma |

Key Market Driver: Increasing Preference for Minimally Invasive Cosmetic Procedures

A primary driver of the facial injectable market is the rising consumer preference for minimally invasive procedures over traditional cosmetic surgery. With increasing awareness of aesthetics and a desire for natural-looking enhancements, individuals are moving toward procedures that offer noticeable results without the need for surgery, long recovery periods, or hospitalization.

Injectables like botulinum toxin and dermal fillers can be administered in under 30 minutes, often with immediate visible effects. Patients can resume normal activities shortly after treatment, a benefit especially attractive to working professionals and socially active individuals. Furthermore, as innovations reduce discomfort, downtime, and bruising, more first-time users are willing to try injectable treatments. This trend has led to higher patient retention and regular repeat procedures, forming a dependable revenue stream for clinics and MedSpas.

Key Market Restraint: Side Effects and Counterfeit Products

Despite the growing popularity of facial injectables, a key restraint is the risk of side effects and the proliferation of counterfeit or unregulated products. While most FDA-approved injectables have strong safety records, improper administration or substandard products can lead to complications such as bruising, infection, allergic reactions, granulomas, and vascular occlusion.

Counterfeit injectables, often available through unauthorized online retailers, pose significant health risks and undermine public trust in aesthetic treatments. Additionally, practitioners without formal medical training offering low-cost procedures have led to adverse outcomes in some regions. These issues can create regulatory backlash, increase consumer skepticism, and prompt legal limitations that hamper market expansion. Education and stricter regulation are necessary to mitigate these risks.

Key Market Opportunity: Expansion in Emerging Economies

An important market opportunity lies in the rapid expansion of facial aesthetic services in emerging economies, particularly in Asia Pacific and Latin America. Urbanization, rising disposable income, and growing awareness of aesthetic options are driving demand in countries like Brazil, India, China, and Mexico. Local consumers are increasingly investing in appearance-enhancing procedures, with a strong emphasis on natural-looking and non-permanent enhancements.

The increasing availability of MedSpas, international beauty clinics, and skilled practitioners in these regions is helping to meet growing demand. Additionally, global brands are partnering with local distributors and training centers to expand their footprint and offer standardized services. As cultural taboos around cosmetic procedures diminish and younger populations seek appearance enhancements, these regions represent high-growth zones for both established and emerging injectable brands.

Facial Injectable Market By Product Insights

Hyaluronic acid (HA) dominated the product segment due to its favorable safety profile, reversibility, and natural-looking results. HA-based fillers are used widely for nasolabial folds, lip enhancement, under-eye volume loss, and more. Their ability to retain water and integrate well with skin tissue makes them the go-to choice for both new and experienced patients. Brands like Juvederm and Restylane have become household names in the aesthetic space, often chosen for their longevity and minimal risk of allergic reactions.

Botulinum Toxin Type A is the fastest-growing product segment, attributed to its expanding application in both cosmetic and therapeutic use. While traditionally used to smooth dynamic wrinkles like crow’s feet and frown lines, new off-label applications in masseter reduction, brow lifting, and migraine treatment are propelling growth. Moreover, its preventive use among younger patients to delay wrinkle formation is gaining traction. The market is also benefiting from new entrants offering lower-cost alternatives to established brands like Botox, thereby increasing accessibility and market competitiveness.

Facial Injectable Market By Application Insights

Facial line correction held the largest market share, driven by its broad applicability and high consumer demand. Forehead lines, crow’s feet, and glabellar lines are among the earliest visible signs of aging, and patients frequently seek treatments to reduce these lines. Injectable treatments offer immediate and visible improvements with relatively minimal intervention, leading to high satisfaction rates. The appeal of smoothing wrinkles without surgery has made facial line correction the cornerstone application of the injectable market.

Lip augmentation is emerging as the fastest-growing application, fueled by trends driven by celebrities, social media influencers, and evolving beauty standards. Millennials and Gen Z individuals are particularly drawn to this procedure, often seeking fuller, well-defined lips through HA-based fillers. Brands have responded with specialized lip formulations designed to offer volume and hydration while maintaining softness. Short recovery times and a surge in "selfie culture" continue to fuel the lip augmentation boom, especially in North America and Europe.

Facial Injectable Market By End-use Insights

Dermatology clinics dominate the end-use segment, attributed to their clinical expertise, reputation, and the presence of certified medical professionals. Patients typically prefer dermatology clinics for first-time and repeat procedures due to the assurance of medical-grade safety and efficacy. Clinics are often equipped with a wide array of filler and toxin options, allowing for personalized treatment protocols. Dermatologists are also more adept at managing complications, reinforcing patient trust and retention.

MedSpas are the fastest-growing end-use category, reflecting the shift toward accessible, lifestyle-oriented aesthetic services. MedSpas combine the luxury of spa environments with non-invasive clinical treatments, offering injectables as part of broader beauty enhancement packages. These facilities appeal to a younger and more image-conscious demographic seeking convenience and affordability. Strategic partnerships with dermatologists or nurse practitioners have also enabled MedSpas to offer safe procedures under medical supervision, boosting their popularity and geographic spread.

Facial Injectable Market By Regional Insights

North America holds the dominant share in the facial injectable market, largely due to high consumer spending on aesthetic procedures, well-established healthcare infrastructure, and the presence of leading injectable brands such as Allergan (AbbVie), Revance, and Evolus. The U.S., in particular, has a mature aesthetic medicine industry, with regulatory clarity and widespread availability of certified injectors. Social acceptance, a culture of preventive aging, and a strong digital marketing presence have normalized injectables across various age groups. Moreover, insurance coverage for therapeutic uses of botulinum toxin (e.g., for migraines) further strengthens the market in this region.

Asia Pacific is the fastest-growing regional market, propelled by increasing beauty consciousness, rising middle-class income, and greater access to aesthetic services. South Korea, known as the global hub for cosmetic procedures, has led the way in integrating facial injectables with cutting-edge skincare and cosmetic surgery offerings. China and India are also witnessing double-digit growth rates in aesthetic medicine adoption, with an expanding network of trained practitioners and urban MedSpas. Government initiatives to regulate and standardize aesthetic practices are expected to further facilitate market development in the region.

Some of the prominent players in the global facial injectable market include:

Recent Developments

-

Allergan Aesthetics (March 2025) announced the expansion of its Juvederm Volux range in new global markets, targeting chin and jawline contouring with enhanced viscosity formulations.

-

Revance Therapeutics (February 2025) launched a new marketing campaign for Daxxify, positioning it as a longer-lasting alternative to Botox for wrinkle correction.

-

Evolus Inc. (January 2025) reported FDA approval for expanded indications of Jeuveau for midface volume loss, enhancing its competitiveness in the filler segment.

-

Medytox and Hugel (December 2024) entered a strategic agreement to co-develop next-gen botulinum toxin injectables optimized for the Asia Pacific market.

-

Ipsen (November 2024) invested in a new R&D facility in France focusing on advanced neurotoxins and filler innovations to expand its product portfolio.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global facial injectable market

Product

- Collagen & PMMA Microspheres

- Hyaluronic Acid (HA)

- Botulinum Toxin Type A

- Calcium Hydroxylapatite (CaHA)

- Poly-L-lactic Acid (PLLA)

- Others

Application

- Facial Line Correction

- Lip Augmentation

- Face Lift

- Acne Scar Treatment

- Lipoatrophy Treatment

- Others

End-use

- MedSpas

- Dermatology Clinics

- Hospitals

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa