Holter Monitoring Systems Market Size and Trends

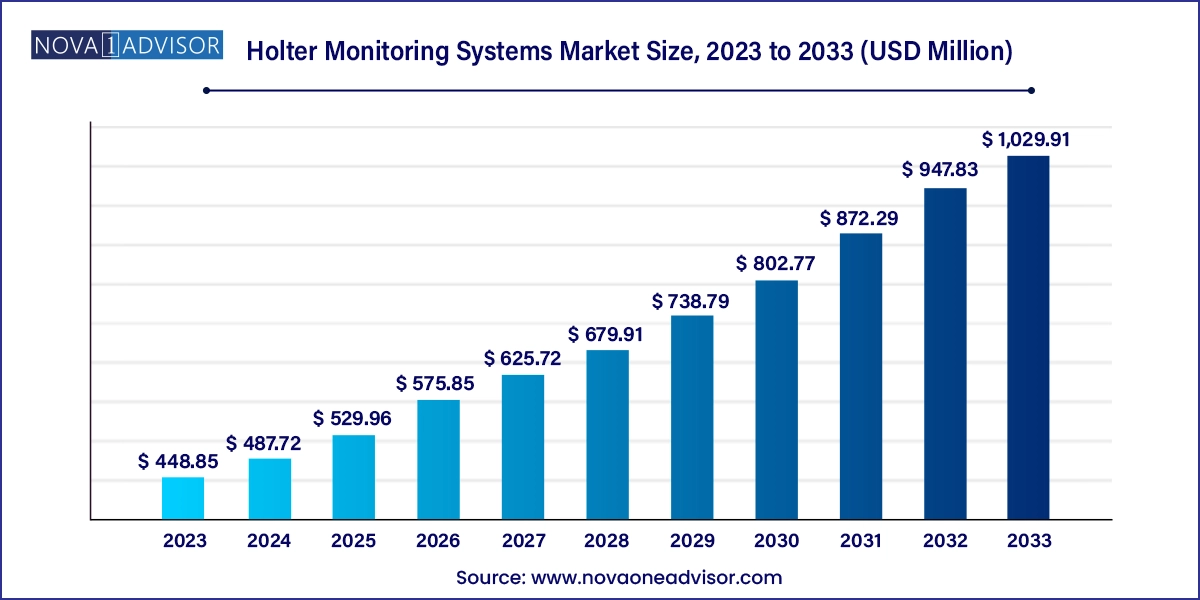

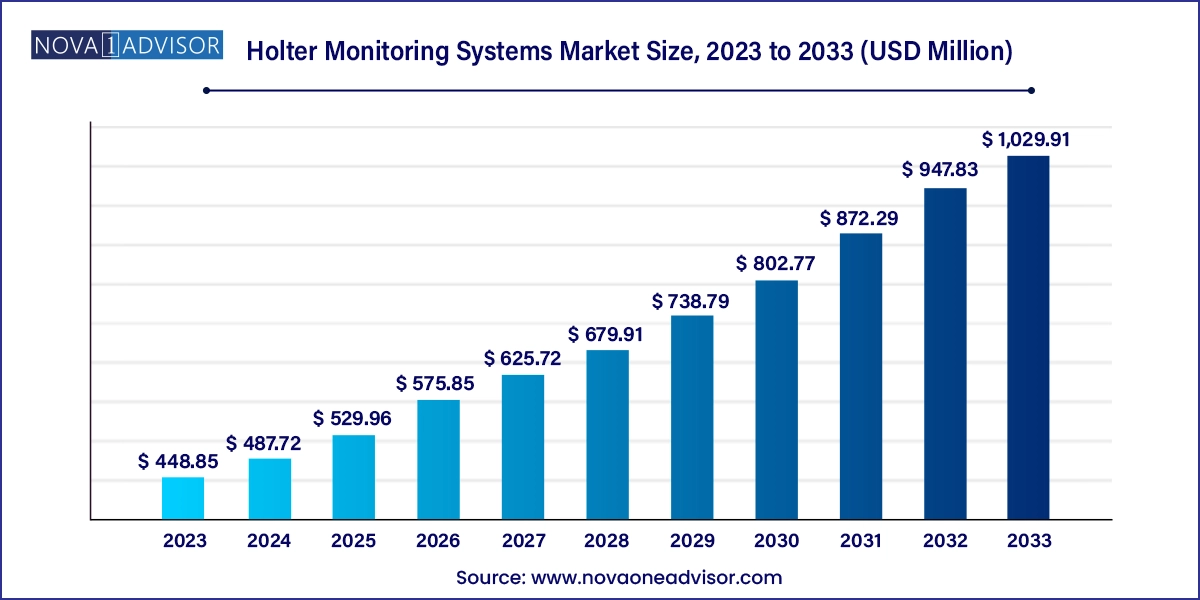

The holter monitoring systems market size was exhibited at USD 448.85 million in 2023 and is projected to hit around USD 1,029.91 million by 2033, growing at a CAGR of 8.66% during the forecast period 2024 to 2033.

Market Overview

The Holter Monitoring Systems Market plays a pivotal role in modern cardiac diagnostics and preventive healthcare. A Holter monitor is a portable, battery-operated device that continuously records the heart's electrical activity (ECG) over 24 to 48 hours, or longer in extended cases. It helps detect irregular heartbeats, arrhythmias, silent ischemia, and other cardiovascular anomalies that may not appear during a standard ECG test conducted in a clinical setting. These devices offer real-time cardiac event detection, enabling timely medical intervention and reducing the risk of undiagnosed cardiac events.

With cardiovascular diseases (CVDs) emerging as the leading cause of death globally, the need for precise and non-invasive heart rhythm monitoring is more critical than ever. Holter monitors, including event monitors and long-term ECG patches, are now becoming standard tools in cardiology, emergency care, and home-based diagnostics. The increasing incidence of lifestyle-related conditions—such as obesity, hypertension, and diabetes—also contributes to rising cardiac complications, thereby boosting the demand for reliable ambulatory ECG systems.

The market is also experiencing a technological shift, with miniaturized, Bluetooth-enabled, and AI-integrated Holter systems gaining prominence. Remote monitoring, cloud-based ECG analysis, and wearable cardiac telemetry devices are transforming how clinicians manage patient care. As healthcare systems adopt preventive strategies and at-home care models, the Holter monitoring systems market is poised for steady expansion across both developed and emerging economies.

Major Trends in the Market

-

Rise of remote and home-based monitoring: Increasing preference for home-based ECG diagnostics is accelerating demand for wearable Holter devices that transmit real-time data to healthcare providers.

-

Miniaturization and wearable innovation: Traditional bulky Holter monitors are being replaced by lightweight, discreet patch-style devices with longer monitoring durations.

-

Integration of AI and machine learning: Holter monitoring software now includes AI-driven arrhythmia detection, reducing diagnostic turnaround and physician workload.

-

Cloud-based data management: Real-time cloud integration is enabling clinicians to access, analyze, and store ECG data from remote locations, improving response time.

-

Increase in long-term monitoring systems: There's a rising preference for 7–14-day and even month-long event monitors to detect infrequent arrhythmias not captured in 24-hour recordings.

-

Focus on post-surgical and chronic disease management: Hospitals and ambulatory centers are using Holter monitors to track cardiac recovery after surgery or in patients with chronic heart conditions.

-

Expansion of ambulatory care infrastructure: Growth in ambulatory surgical centers and diagnostic labs is fueling the uptake of portable cardiac monitors.

-

Growth of subscription-based diagnostics: Some providers are offering Holter monitoring as a service, including device rental, analytics, and physician reporting on a subscription basis.

Report Scope of Holter Monitoring Systems Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 487.72 Million |

| Market Size by 2033 |

USD 1,029.91 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 8.66% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By ProductType, By End-User, and By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Bio-Medical Electronics Co., Koninklijke Philips N.V., Nihon Kohden Corporation, General Electric Company, Midmark Corp., BPL Medical Technologies, Shenzhen Mindray Ltd., Schiller, Fukuda Denshi, Hill-Rom Services Inc., Medtronic, and others. |

Key Market Driver: Rising Prevalence of Cardiovascular Diseases

One of the most prominent growth drivers in the Holter monitoring systems market is the surging global prevalence of cardiovascular diseases (CVDs). According to the World Health Organization, over 17.9 million people die from CVDs each year, accounting for nearly 32% of all global deaths. Many of these are due to arrhythmias or asymptomatic ischemia, which are difficult to detect with standard diagnostic tools.

Holter monitors provide a critical advantage by offering continuous monitoring over an extended period, capturing transient or sporadic cardiac events. In elderly populations—where atrial fibrillation (AFib) and other arrhythmias are more common—Holter devices are used for pre- and post-operative care, medication effectiveness assessment, and general cardiac monitoring. As the global population ages and lifestyles become increasingly sedentary, the burden of cardiac diseases is expected to rise, ensuring strong and sustained demand for Holter systems across hospitals and outpatient care facilities.

Key Market Restraint: Data Overload and Interpretation Challenges

Despite the expanding application of Holter monitoring, a major restraint is the sheer volume of data generated by these devices and the complexities involved in accurate interpretation. A 24-hour Holter monitor can produce up to 100,000 ECG data points per patient, and longer-term monitors generate exponentially more. This data needs to be parsed for significant patterns, requiring advanced analytics and, often, manual verification by trained cardiologists.

In many settings, especially in developing countries, there is a shortage of specialists who can process and interpret the data efficiently. Even with AI-powered algorithms, there are risks of false positives or negatives, which could lead to misdiagnosis. Moreover, the challenge of integrating Holter data into electronic health records (EHRs) and ensuring compatibility across software platforms adds another layer of complexity. Until standardization improves, data management and interpretation will remain a bottleneck in clinical efficiency.

A promising opportunity lies in the integration of Holter monitoring systems with telemedicine and mobile healthcare platforms. As healthcare delivery models evolve toward virtual and remote formats, the ability to monitor cardiac health in real time—beyond the confines of a hospital has become a necessity. Patients can now wear lightweight Holter patches or devices at home, and clinicians can monitor vital cardiac parameters through a mobile app or web-based dashboard.

This opportunity is particularly relevant in rural and underserved regions where access to specialized cardiac care is limited. Wearable Holter devices connected via 4G/5G or Wi-Fi can help bridge the care gap. Companies are exploring smart device integration, enabling patients to receive alerts directly to their smartphones and send data securely to physicians. As reimbursement models expand to support remote monitoring, this segment is likely to see exponential growth, particularly in chronic disease management and elderly care.

By Product Type

Holter monitoring devices dominated the market in 2024. These include traditional 3-lead and 12-lead portable recorders, newer wearable ECG patches, and wireless units capable of longer-term monitoring. The demand for such devices is growing as cardiologists increasingly prefer multi-day monitoring to detect intermittent arrhythmias. Continuous hardware innovation—such as longer battery life, waterproof designs, and integration with smartphone apps—is fueling their widespread use across clinical and home settings.

Holter monitoring software is the fastest-growing segment. As device deployment increases, the need for sophisticated software tools to interpret, analyze, and visualize ECG data is surging. AI-driven platforms can now automate arrhythmia detection, reduce analysis time, and improve diagnostic accuracy. Cloud-based ECG management platforms are also gaining popularity among healthcare institutions due to their ability to enable real-time data sharing, remote consultations, and scalable patient management.

By End-User

Hospitals were the largest end-user segment in 2024. Given their access to high patient volumes, inpatient and emergency care units, and specialized cardiologists, hospitals remain the primary users of Holter monitoring systems. These institutions often use Holter devices for patients undergoing heart surgeries, monitoring post-operative arrhythmias, or as part of diagnostic workups for chest pain and palpitations. Tertiary care hospitals also lead in early adoption of AI-integrated Holter technologies.

Ambulatory surgical centers (ASCs) are the fastest-growing end-user segment. ASCs are gaining popularity due to their convenience, reduced costs, and shorter waiting times. These centers increasingly offer outpatient cardiac diagnostics as part of their preventive care services. As reimbursement frameworks evolve and device miniaturization continues, more ASCs are expected to incorporate Holter monitoring as part of their service portfolio. Their flexibility in adapting to mobile and cloud-based monitoring solutions further accelerates their growth.

Regional Analysis

North America led the global Holter monitoring systems market in 2024. The region benefits from high healthcare expenditure, early adoption of medical technologies, and a well-established ecosystem of cardiac care infrastructure. The U.S. alone has over 6 million people with atrial fibrillation and experiences approximately 1 million cardiac-related hospitalizations annually. This enormous clinical burden supports the wide deployment of Holter devices across hospitals, clinics, and home care networks.

Additionally, the presence of leading market players such as GE Healthcare, iRhythm Technologies, and Hillrom (now part of Baxter) ensures constant innovation and product availability. The expansion of telehealth during and after the COVID-19 pandemic has further propelled demand for wireless, real-time ECG monitoring solutions. Government initiatives focused on preventive care and chronic disease management continue to reinforce the region’s leadership in this market.

Asia Pacific is projected to be the fastest-growing Holter monitoring market. The region is experiencing a rise in cardiovascular diseases driven by changing lifestyles, increased urbanization, and growing elderly populations. India and China, in particular, are witnessing a rapid increase in cardiac arrhythmias and hypertension among younger populations. However, access to cardiac specialists remains limited in rural and tier-2 cities.

This has created a strong demand for portable, remote ECG solutions like Holter monitors. Governments and private players are investing in mobile health and diagnostic centers to bridge care gaps. Regional companies are also entering the market with cost-effective, compact Holter devices tailored for local needs. As Asia continues to digitize its healthcare systems and adopt value-based care models, demand for scalable cardiac monitoring tools like Holter systems is expected to accelerate.

Some of the prominent players in the holter monitoring systems market include:

Recent Developments

-

iRhythm Technologies (February 2025): Launched its latest Zio® XT patch in Europe with extended 14-day ECG recording and AI-powered arrhythmia detection, approved under new MDR regulations.

-

GE HealthCare (January 2025): Collaborated with AliveCor to develop a cloud-integrated Holter monitor for remote cardiac diagnostics in underserved regions of the U.S. and Latin America.

-

Medtronic (March 2025): Introduced an updated mobile ECG analysis platform integrated with its Holter software, offering real-time clinician alerts and patient dashboards.

-

Philips (November 2024): Enhanced its ePatch Holter system with 5G compatibility and announced partnerships with hospitals in Southeast Asia to scale remote cardiac monitoring.

-

Hillrom (August 2024): Expanded its cardiac diagnostic product portfolio with a new event monitor that integrates with its AI-based software for improved arrhythmia classification.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the holter monitoring systems market

By Product Type Segment Analysis

- Holter monitoring devices

- Holter monitoring software

- Event monitoring devices

By End-User Segment Analysis

- Clinics

- Hospitals

- Diagnostic centers

- Ambulatory surgical centers

By Regional Segment Analysis

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa