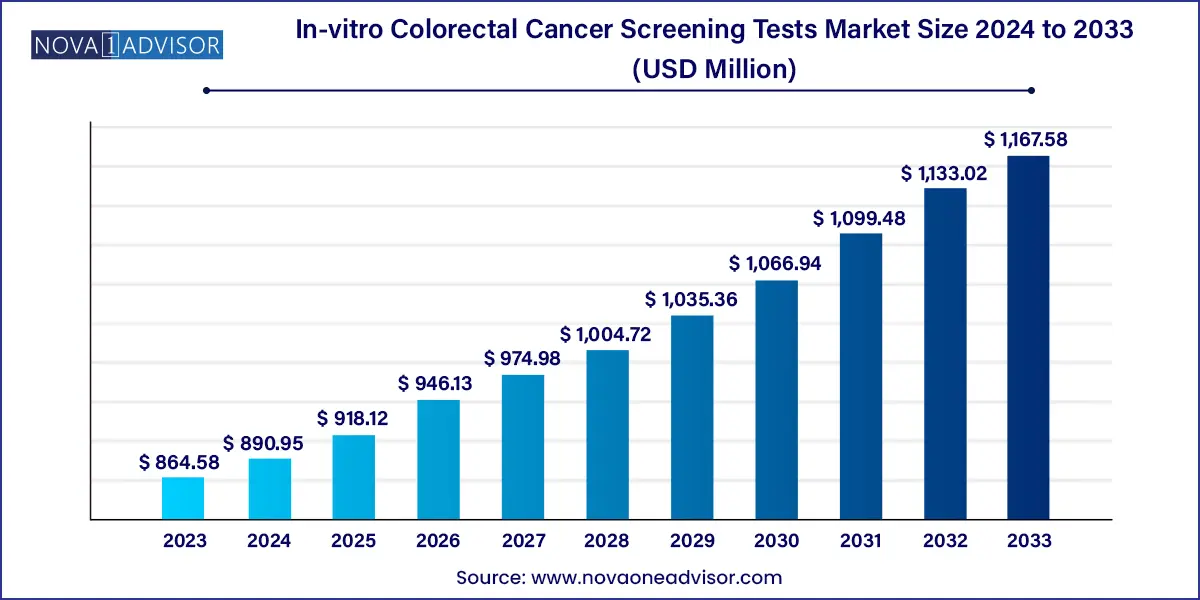

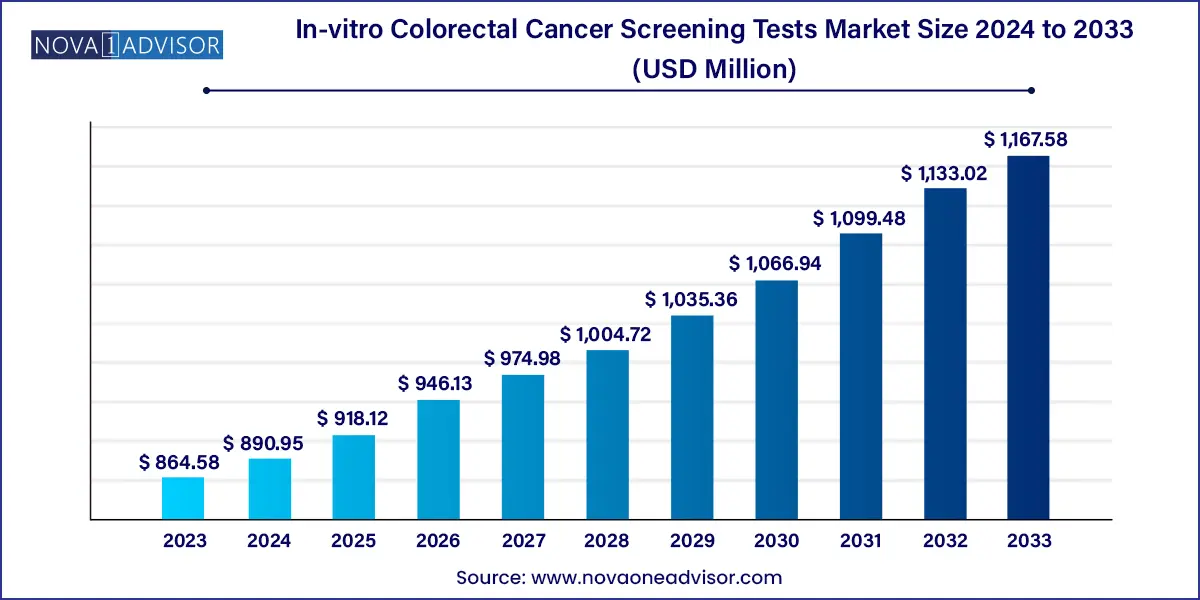

The global in-vitro colorectal cancer screening tests market size was exhibited at USD 864.58 million in 2023 and is projected to hit around USD 1,167.58 million by 2033, growing at a CAGR of 3.05% during the forecast period of 2024 to 2033.

Key Takeaways:

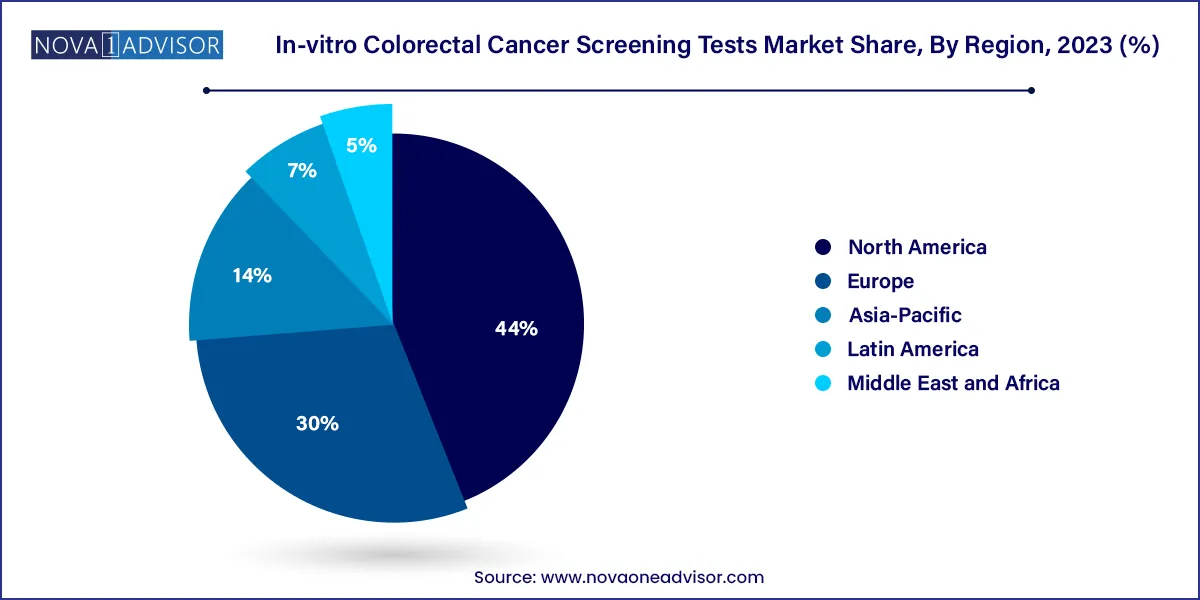

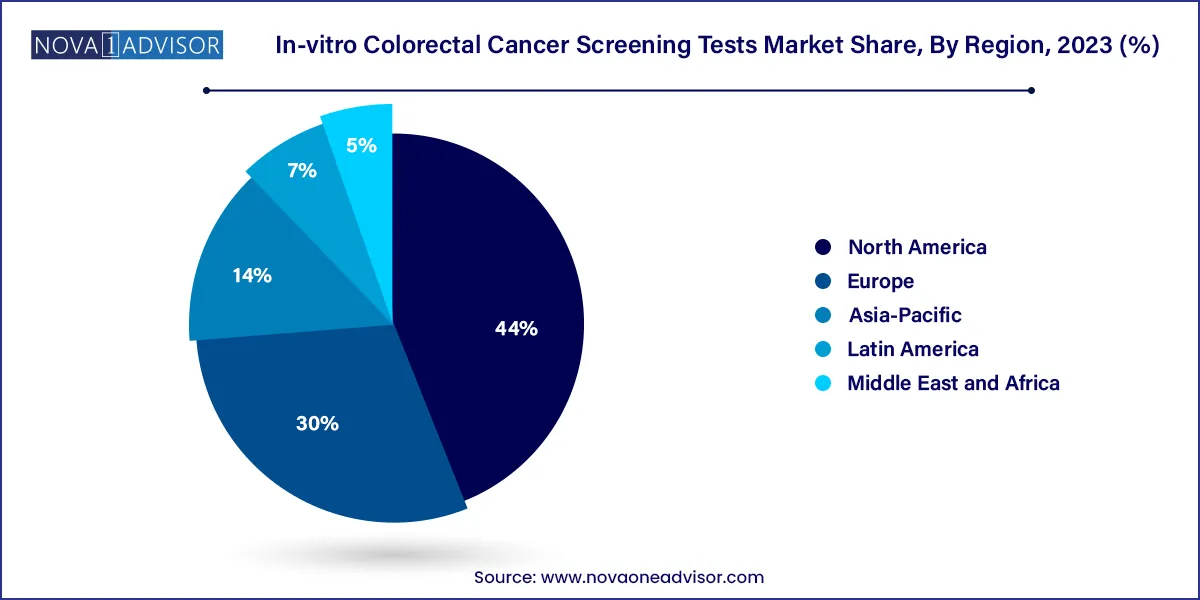

- The North America region dominated the market with a share of over 44% in 2023.

- Based on test type, fecal occult blood tests dominated the market with a revenue share of 83.0% in 2023.

Market Overview

The global in-vitro colorectal cancer (CRC) screening tests market is undergoing a significant transformation driven by rising awareness, expanding diagnostic capabilities, and increasing government support for early cancer detection. Colorectal cancer remains one of the most prevalent and deadly forms of cancer worldwide, especially in aging populations. According to the World Health Organization (WHO), colorectal cancer is the third most commonly diagnosed cancer globally and the second leading cause of cancer-related deaths, underscoring the critical need for effective, early-stage screening.

In-vitro screening tests for colorectal cancer are non-invasive or minimally invasive diagnostic tools that analyze biological samples—typically stool or blood—to detect cancer markers. These tests can detect occult blood, abnormal DNA, or specific biomarkers associated with the presence of colorectal tumors. Unlike colonoscopy, which is invasive and often underutilized due to cost, inconvenience, or fear, in-vitro testing provides an accessible, scalable, and cost-effective alternative for mass screening programs.

The market is growing at a robust pace due to advances in molecular diagnostics, a shift toward preventative healthcare, and rising investments from both public and private sectors. Countries with well-developed healthcare infrastructure are integrating in-vitro CRC tests into national cancer screening programs. Simultaneously, diagnostic innovators are focusing on improving the sensitivity and specificity of these tests, as well as developing home-based kits to increase compliance.

The in-vitro CRC screening market encompasses a wide range of test types, including fecal occult blood tests (FOBT), biomarker assays, and DNA-based tests. Each of these segments addresses different clinical and logistical needs, enabling broad adoption across diverse healthcare settings.

Major Trends in the Market

-

Increased adoption of home-based screening kits for fecal occult blood and DNA tests, promoting greater compliance and accessibility.

-

Shift toward molecular diagnostics and biomarker-based testing to enhance specificity and sensitivity of early-stage cancer detection.

-

Rising integration of AI and data analytics in interpreting test results, aiding in faster and more accurate diagnostics.

-

Government initiatives promoting early detection programs, particularly in North America and Europe, often including subsidies for at-risk populations.

-

Growing use of multi-target stool DNA tests like Cologuard, combining fecal occult blood and gene mutation detection in one sample.

-

Emergence of liquid biopsy-based screening tools, aiming to detect circulating tumor DNA (ctDNA) from blood samples.

-

Expansion of CRC testing in emerging economies, driven by rising healthcare budgets and international collaborations.

-

Increased collaboration between diagnostic companies and pharmaceutical firms for integrated care pathways in oncology.

In-Vitro Colorectal Cancer Screening Tests Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 864.58 Million |

| Market Size by 2033 |

USD 1,167.58 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 3.05% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Test Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abbott, Beckman Coulter, Inc., Epigenomics, Eiken Chemical Co., Ltd., Sysmex Corporation, Siemens Healthcare GmbH, Quest Diagnostics Incorporated, OncocyteCorporation, Merck KGaA, ImmunosticsInc., Kyowa Kirin Co., Ltd., Randox Laboratories Ltd. and R-Biopharm AG |

Key Market Driver: Emphasis on Early Diagnosis to Reduce Mortality Rates

A major driver fueling the in-vitro colorectal cancer screening market is the increasing emphasis on early cancer detection to improve survival rates. Colorectal cancer, when detected early, has a five-year survival rate of over 90%. However, because early-stage symptoms are often absent or non-specific, most cases are diagnosed at an advanced stage when treatment options are limited and outcomes are poor.

Governments and healthcare organizations are prioritizing early detection as a cost-effective strategy to reduce cancer burden. For instance, the U.S. Preventive Services Task Force (USPSTF) recommends routine CRC screening for adults aged 45 to 75. These policy endorsements are driving the adoption of in-vitro tests that are simpler, cheaper, and more scalable than endoscopic methods.

Moreover, awareness campaigns and educational programs are helping destigmatize CRC testing and encouraging proactive health behaviors. The convenience of mailing stool samples for at-home testing and receiving results digitally is proving to be a game-changer, especially in remote or underserved populations.

Key Market Restraint: Limited Sensitivity in Some Test Types

Despite the promising outlook, the market faces a critical challenge in the form of inconsistent test sensitivity, especially in low-cost options like guaiac-based FOBTs. While these tests are economical and easy to implement, they can produce false positives due to dietary or medicinal interferences, or false negatives if the bleeding is intermittent.

Low specificity and sensitivity not only reduce clinical utility but also undermine patient trust in test outcomes. In cases where positive results require follow-up colonoscopy, limited test accuracy can lead to unnecessary procedures, anxiety, and increased healthcare costs. Furthermore, the interpretation of certain tests requires lab infrastructure and expertise, limiting their effectiveness in low-resource settings.

As a result, ongoing innovation is essential to develop in-vitro screening tests that combine accuracy with accessibility, minimizing both overdiagnosis and missed detections.

Key Market Opportunity: Rising Demand for Multi-Target DNA Testing

The evolution of genetic and epigenetic science is opening new avenues in colorectal cancer screening, particularly through multi-target DNA testing. These advanced in-vitro tests, such as those that analyze methylated gene panels or mutations in genes like KRAS, have shown higher sensitivity in detecting early-stage cancers and precancerous lesions.

The opportunity lies in developing affordable, high-throughput DNA-based tests that can be adopted in national screening programs. Cologuard by Exact Sciences has set a precedent by combining hemoglobin detection with molecular markers, achieving strong clinical uptake in the U.S. This hybrid approach is expected to inspire further innovations and competition.

Furthermore, as the cost of genome sequencing continues to decline, DNA-based in-vitro tests will become increasingly feasible in emerging markets, creating vast untapped potential. Personalized screening schedules based on genetic risk profiling are also on the horizon, making DNA tests a cornerstone of future precision oncology strategies.

Segments Insights:

Test Type Insights

Fecal occult blood tests (FOBTs) dominated the test type segment due to their affordability, simplicity, and widespread acceptance in public health programs. Within this group, guaiac-based FOBT and immunochemical FOBT (iFOBT) remain the most commonly used, particularly in government-funded screening initiatives. Guaiac tests, while less sensitive, are cost-effective and suitable for large-scale screening. In contrast, iFOBTs, including ELISA-based and lateral flow formats, offer improved specificity by targeting human hemoglobin, and require no dietary restrictions.

The immuno-FOB ELISA test, in particular, has gained traction in hospital settings and private clinics due to its lab-based high sensitivity. These tests are ideal for detecting bleeding from adenomas and carcinomas in the lower gastrointestinal tract. Moreover, the lateral flow version allows point-of-care use and is popular in rural and semi-urban settings where laboratory infrastructure may be limited. Collectively, FOBTs account for the largest volume of CRC screenings globally, especially in countries with national health programs like Japan, Canada, and the UK.

Among all test types, biomarker tests are the fastest-growing segment, driven by the need for more specific and non-invasive tools. Biomarkers such as Tumor M2-PK and transferrin are gaining clinical relevance for their ability to detect metabolic changes associated with colorectal tumors. Tumor M2-PK, for instance, identifies abnormal glycolytic pathways found in cancerous cells, while transferrin assays detect blood-based proteins indicative of mucosal lesions.

The rise of these tests is attributed to the growing recognition of molecular changes as earlier indicators of cancer than structural abnormalities. Biomarker tests are also less affected by sample degradation or interference, improving their reliability. Their versatility across different sample types (stool, serum, plasma) makes them suitable for integration into broader diagnostic workflows. Investment in proteomics and metabolomics is expected to further diversify the biomarker landscape, attracting interest from both diagnostics startups and established lab networks.

Regional Insights

North America held the largest share of the in-vitro CRC screening tests market, driven by advanced healthcare infrastructure, high public awareness, and supportive insurance policies. The United States, in particular, leads global CRC screening rates due to strong backing from the Centers for Disease Control and Prevention (CDC), American Cancer Society (ACS), and U.S. Preventive Services Task Force (USPSTF). Programs like Medicare and Medicaid cover both stool-based and DNA tests, encouraging broad uptake.

Moreover, North America is home to leading diagnostic players such as Exact Sciences, Epigenomics, and Labcorp. These firms have invested heavily in research, partnerships, and direct-to-consumer strategies to improve compliance. Additionally, cancer advocacy organizations have successfully normalized routine screening starting at age 45, broadening the eligible patient pool and fueling market growth.

Asia-Pacific is the fastest-growing market for in-vitro CRC screening, driven by an increasing cancer burden, improving healthcare access, and growing awareness. Countries like Japan, South Korea, and China are witnessing a surge in CRC cases due to dietary changes, sedentary lifestyles, and aging populations. Japan already has well-established CRC screening programs utilizing FOBTs, while China and India are scaling up efforts through pilot programs and public-private partnerships.

Government-led initiatives and collaborations with international health agencies are paving the way for mass screening adoption. For instance, in India, private diagnostic chains are rolling out affordable home screening kits in urban centers. Additionally, the rise of digital health platforms is supporting the distribution and interpretation of test results remotely. These factors are transforming Asia-Pacific into a high-potential growth engine for in-vitro colorectal cancer diagnostics.

Some of the prominent players in the In-vitro colorectal cancer screening tests market include:

- Abbott

- Epigenomics

- Beckman Coulter, Inc.

- Eiken Chemical Co., Ltd.

- SysmexCorporation

- Siemens Healthcare GmbH

- Quest Diagnostics Incorporated

- OncocyteCorporation

- Merck KGaA

- ImmunosticsInc.

- Kyowa Kirin Co., Ltd.

- Randox Laboratories Ltd.

- R-Biopharm AG

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global in-vitro colorectal cancer screening tests market.

Test Type

-

- Guaiac FOB Stool Test

- Immuno-FOB Agglutination Test

- Lateral Flow Immuno-FOB Test

- Immuno-FOB ELISA Test

-

- Tumor M2-PK Stool Test

- Transferrin Assays

-

- Methylated Gene Testing

- Panel DNA Tests

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)