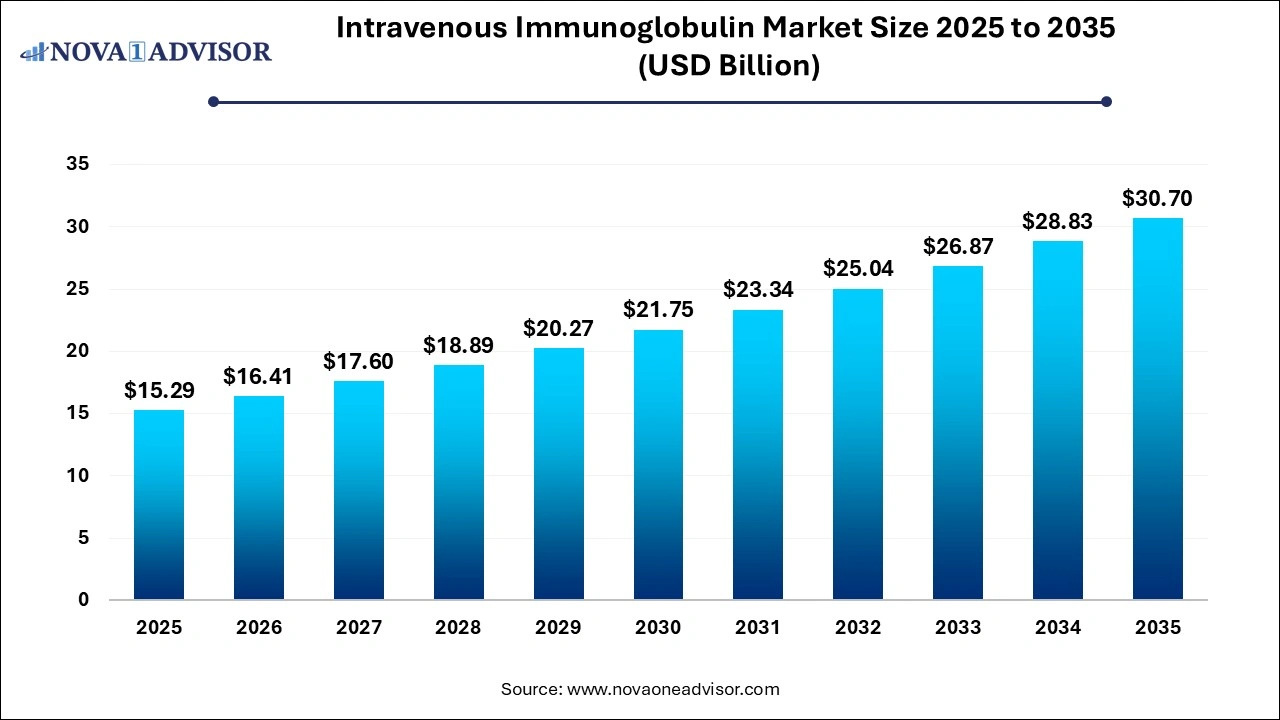

Intravenous Immunoglobulin Market Size and Trends 2026 to 2035

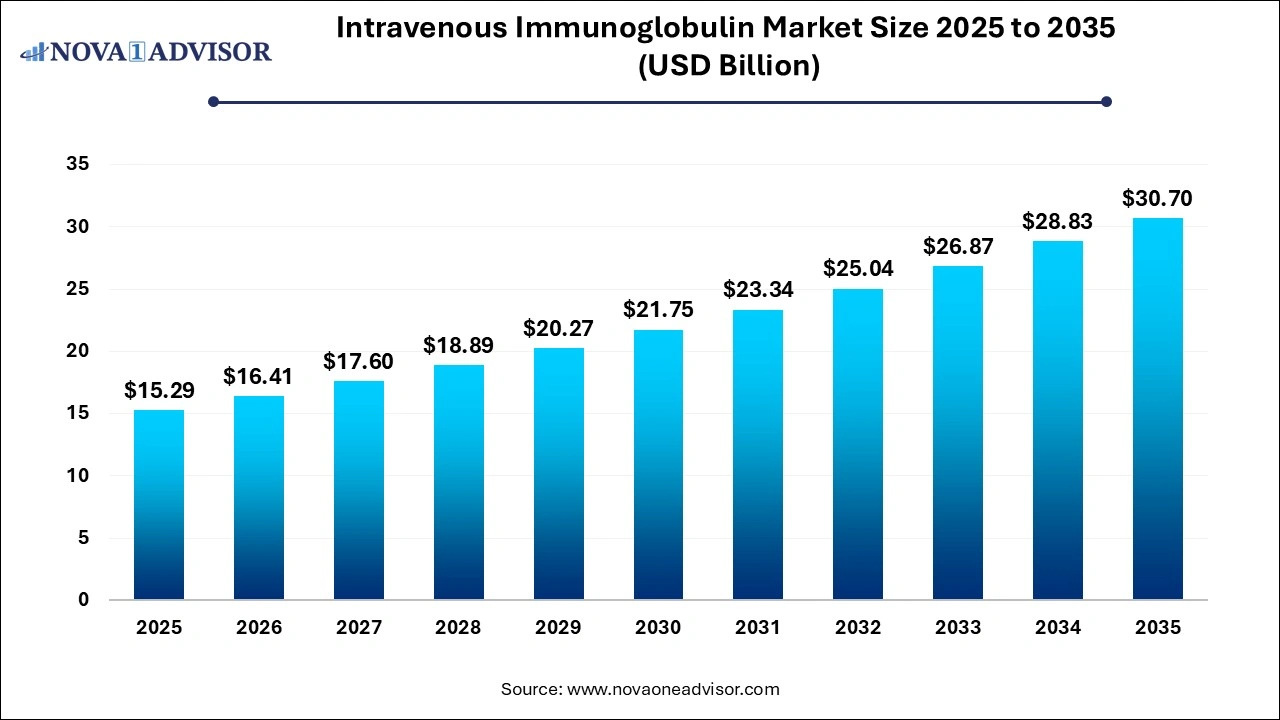

The intravenous immunoglobulin market size was exhibited at USD 15.29 billion in 2025 and is projected to hit around USD 30.70 billion by 2035, growing at a CAGR of 7.22% during the forecast period 2026 to 2035.

Intravenous Immunoglobulin Market Key Takeaways:

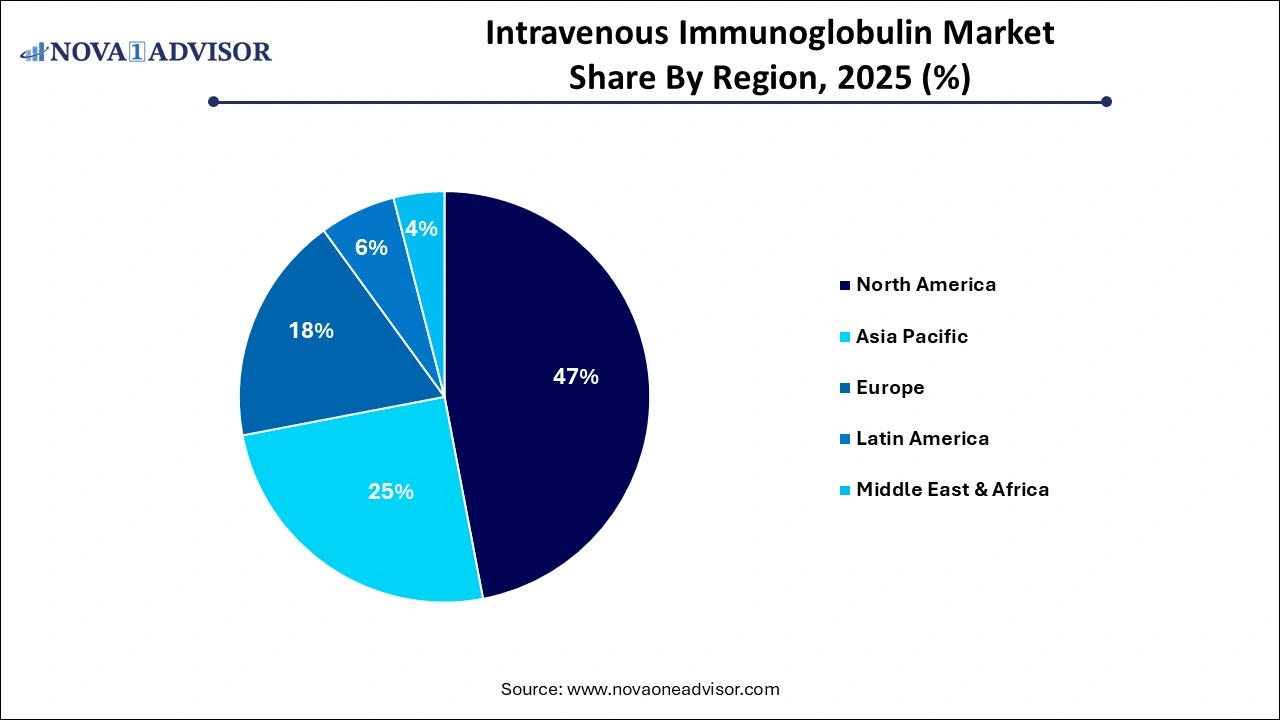

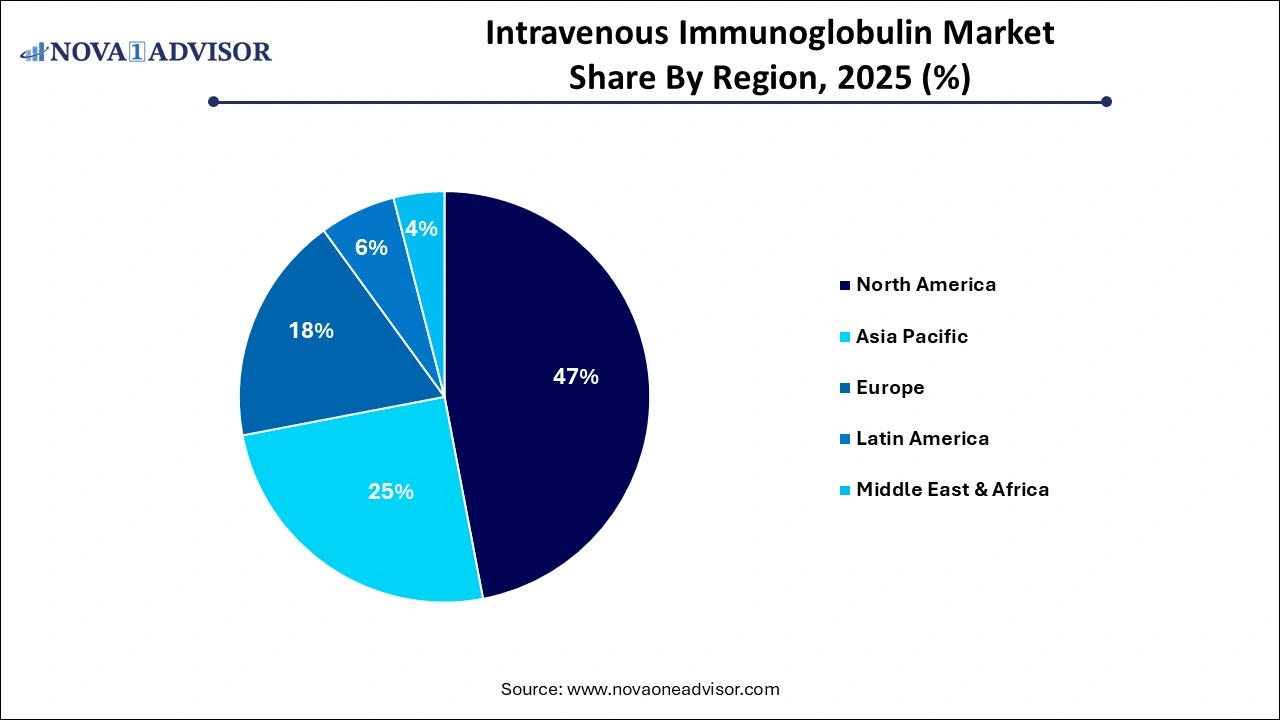

- North America dominated the market with highest share of 47% in 2025.

- The immunodeficiency diseases segment accounted for the largest revenue share of 19.78% in 2025.

- The Kawasaki disease segment is expected to exhibit the fastest growth in the market over the forecast period.

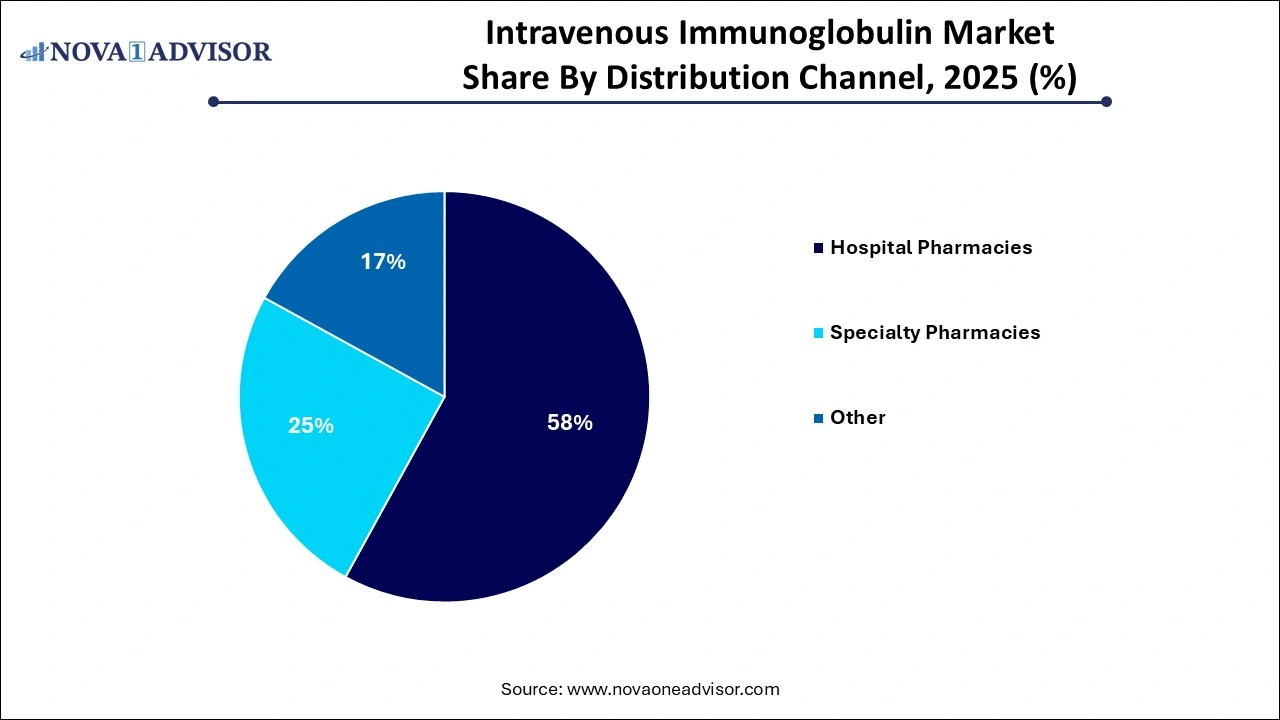

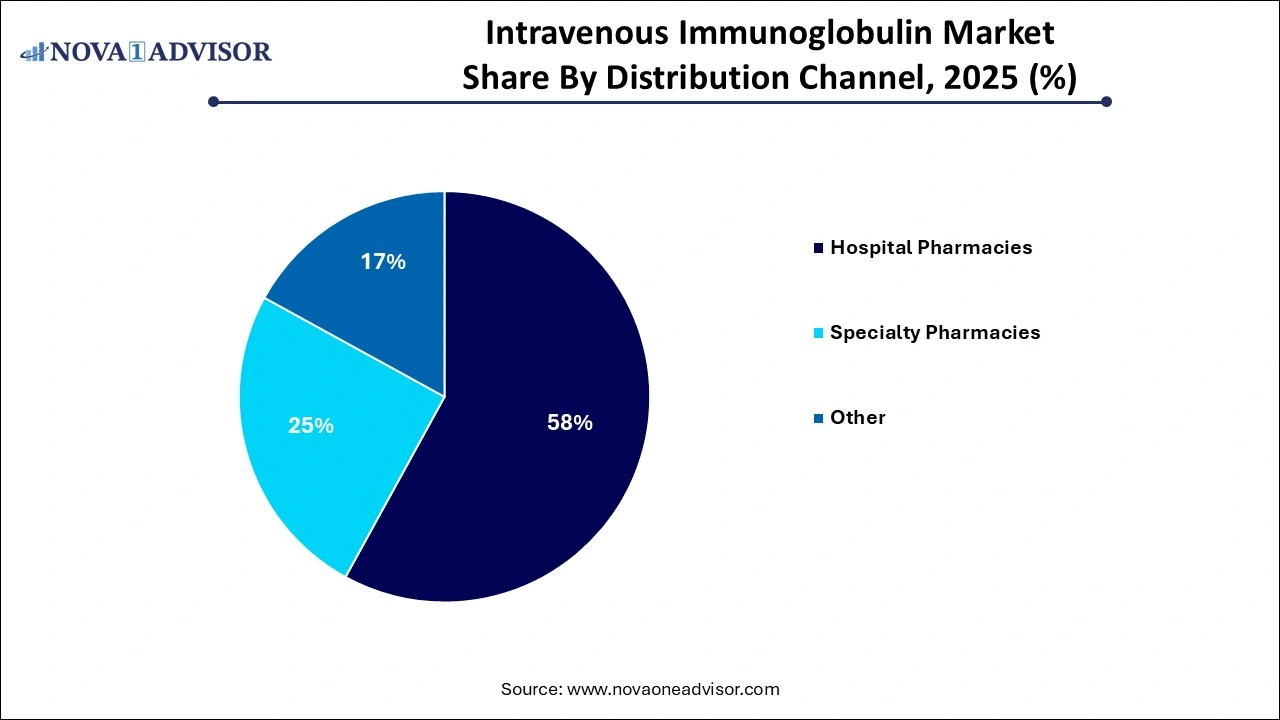

- The hospital pharmacies segment held the largest revenue share of 58% in 2025.

- Specialty pharmacy is expected to grow considerably over the forecast period.

Intravenous Immunoglobulin Market Overview

The Intravenous Immunoglobulin (IVIG) market is a critical component of the biopharmaceutical sector, providing life-saving treatments for a range of immune system-related diseases. IVIG is a sterile, highly purified immunoglobulin (antibody) solution derived from large pools of human plasma, primarily used in the treatment of primary immunodeficiency diseases (PIDD), autoimmune disorders, and various acute and chronic infections. The therapy works by modulating the immune system, replacing missing antibodies, or neutralizing pathogenic autoantibodies, depending on the condition being treated.

This market has seen consistent growth owing to increased awareness of immunological disorders, an aging population more susceptible to such conditions, and improvements in diagnostic capabilities. Furthermore, the expansion of applications beyond primary immunodeficiencies to neurological disorders like Guillain-Barré syndrome, chronic inflammatory demyelinating polyneuropathy (CIDP), and myasthenia gravis has broadened the therapy's scope. IVIG also plays a role in hematological disorders such as idiopathic thrombocytopenic purpura (ITP) and Kawasaki disease.

The high cost of IVIG therapy and the complexity of plasma collection and purification processes remain challenges. However, advancements in recombinant technology and growing investments in plasma collection infrastructure are helping to mitigate supply-demand imbalances. Regulatory approvals and orphan drug designations for IVIG-related therapies are boosting innovation, particularly in North America and Europe.

Report Scope of Intravenous Immunoglobulin Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 16.41 Billion |

| Market Size by 2035 |

USD 30.70 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.22% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Application, By Distribution Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Biotest AG; Baxter; Octapharma AG; LFB; Grifols SA; CSL; China Biologics Products Inc.; Kedrion; BDI Pharma Inc. |

Intravenous Immunoglobulin Market Segmental Insights

By Application Insights

Immunodeficiency diseases form the largest application segment for IVIG therapies. Patients with primary immunodeficiency lack sufficient antibodies to combat infections, making IVIG therapy essential for their survival and quality of life. Long-term, regular IVIG infusions help these individuals maintain immune homeostasis and reduce the frequency and severity of infections. In countries with robust newborn screening programs and health insurance systems, such as the United States and Germany, immunodeficiency treatment accounts for a significant portion of IVIG usage. This foundational role ensures its dominance in both volume and value across global markets.

Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), on the other hand, is emerging as the fastest-growing application segment. CIDP is a rare neurological disorder characterized by chronic nerve inflammation and weakness. IVIG is increasingly being used as a first-line treatment due to its ability to modulate immune responses and reduce nerve damage. Clinical guidelines in multiple regions now recommend IVIG for CIDP, and continued research is reinforcing its efficacy. This rising prevalence, along with improved diagnosis rates and patient access to specialty neurology centers, is driving growth in this segment

By Distribution Channel Insights

Hospital pharmacies currently dominate the IVIG distribution channel landscape, primarily due to the nature of the therapy. IVIG administration requires clinical supervision, often involving inpatient settings, particularly for initial doses or treatment of acute conditions like Guillain-Barré syndrome. Hospitals also have the necessary cold chain logistics and trained personnel to ensure safe handling and infusion, making them the preferred channel for most immunoglobulin therapies. Moreover, hospital-based outpatient infusion centers are becoming common, further consolidating their role in the distribution chain.

Specialty pharmacies are gaining ground rapidly as more patients transition to home-based infusions for chronic IVIG therapy. This model offers convenience, cost savings, and greater adherence, especially for conditions like hypogammaglobulinemia or myasthenia gravis, where long-term therapy is needed. Specialty pharmacies are equipped to handle the storage and transport requirements of IVIG and provide nursing support for home infusions. Their role is expanding in developed healthcare systems such as the U.S., where insurance coverage for at-home infusions is growing. As this model proves successful, specialty pharmacies are set to play a larger role in decentralized healthcare delivery.

U.S. Intravenous Immunoglobulin Market Size and Growth 2026 to 2035

The U.S. intravenous immunoglobulin market size is evaluated at USD 5.39 billion in 2025 and is projected to be worth around USD 10.82 billion by 2035, growing at a CAGR of 6.54% from 2026 to 2035.

.webp)

North America, led by the United States, holds the largest share of the global IVIG market. The region benefits from a strong network of plasma collection centers, advanced manufacturing capabilities, and a well-established healthcare reimbursement system. The U.S. accounts for more than 40% of the world’s plasma collection, supported by regulatory frameworks that incentivize donation and ensure quality. Additionally, the presence of major market players such as Grifols, CSL Behring, and Takeda Pharmaceuticals has led to robust supply chains and extensive product portfolios. In June 2024, Grifols announced the expansion of its U.S. plasma donation network by opening 20 new centers, aiming to meet rising demand.

Asia Pacific is the Fastest Growing Region

Asia Pacific is the fastest-growing region in the IVIG market, fueled by increased healthcare spending, growing awareness of rare diseases, and expanding plasma infrastructure. Countries like China, India, and South Korea are investing in biopharmaceutical manufacturing and have initiated local plasma collection initiatives to reduce dependency on imports. Additionally, rising incidences of autoimmune diseases and better diagnostic outreach are contributing to higher IVIG consumption. In March 2025, China’s National Medical Products Administration (NMPA) approved a domestic IVIG formulation for the treatment of Kawasaki disease, signifying the region’s progress in becoming self-reliant in plasma-based therapies.

Some of the prominent players in the intravenous immunoglobulin market include:

Intravenous Immunoglobulin Market Recent Developments

-

March 2025 – China’s NMPA approved a new IVIG formulation for pediatric use in Kawasaki disease.

-

February 2025 – CSL Behring announced plans to invest $250 million to expand plasma fractionation capacity in Germany.

-

January 2025 – Grifols opened 20 new plasma donation centers across the U.S. to boost raw material availability.

-

December 2024 – Takeda Pharmaceuticals partnered with a South Korean biotech firm to co-develop subcutaneous immunoglobulin therapies.

-

October 2024 – Octapharma launched an advanced IVIG formulation with reduced infusion time in the EU market.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the intravenous immunoglobulin market

By Application

- Immunodeficiency diseases

- CIDP

- Hypogammaglobulinemia

- Congenital AIDS

- Chronic Lymphocytic Leukemia

- Myasthenia Gravis

- Multifocal motor neuropathy

- ITP

- Kawasaki disease

- Guillain-Barre syndrome

- Others

By Distribution Channel

- Hospital Pharmacies

- Specialty Pharmacies

- Other

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Specialty pharmacies are gaining ground rapidly as more patients transition to home-based infusions for chronic IVIG therapy. This model offers convenience, cost savings, and greater adherence, especially for conditions like hypogammaglobulinemia or myasthenia gravis, where long-term therapy is needed. Specialty pharmacies are equipped to handle the storage and transport requirements of IVIG and provide nursing support for home infusions. Their role is expanding in developed healthcare systems such as the U.S., where insurance coverage for at-home infusions is growing. As this model proves successful, specialty pharmacies are set to play a larger role in decentralized healthcare delivery.

Specialty pharmacies are gaining ground rapidly as more patients transition to home-based infusions for chronic IVIG therapy. This model offers convenience, cost savings, and greater adherence, especially for conditions like hypogammaglobulinemia or myasthenia gravis, where long-term therapy is needed. Specialty pharmacies are equipped to handle the storage and transport requirements of IVIG and provide nursing support for home infusions. Their role is expanding in developed healthcare systems such as the U.S., where insurance coverage for at-home infusions is growing. As this model proves successful, specialty pharmacies are set to play a larger role in decentralized healthcare delivery..webp)