Location Intelligence Market Size and Research

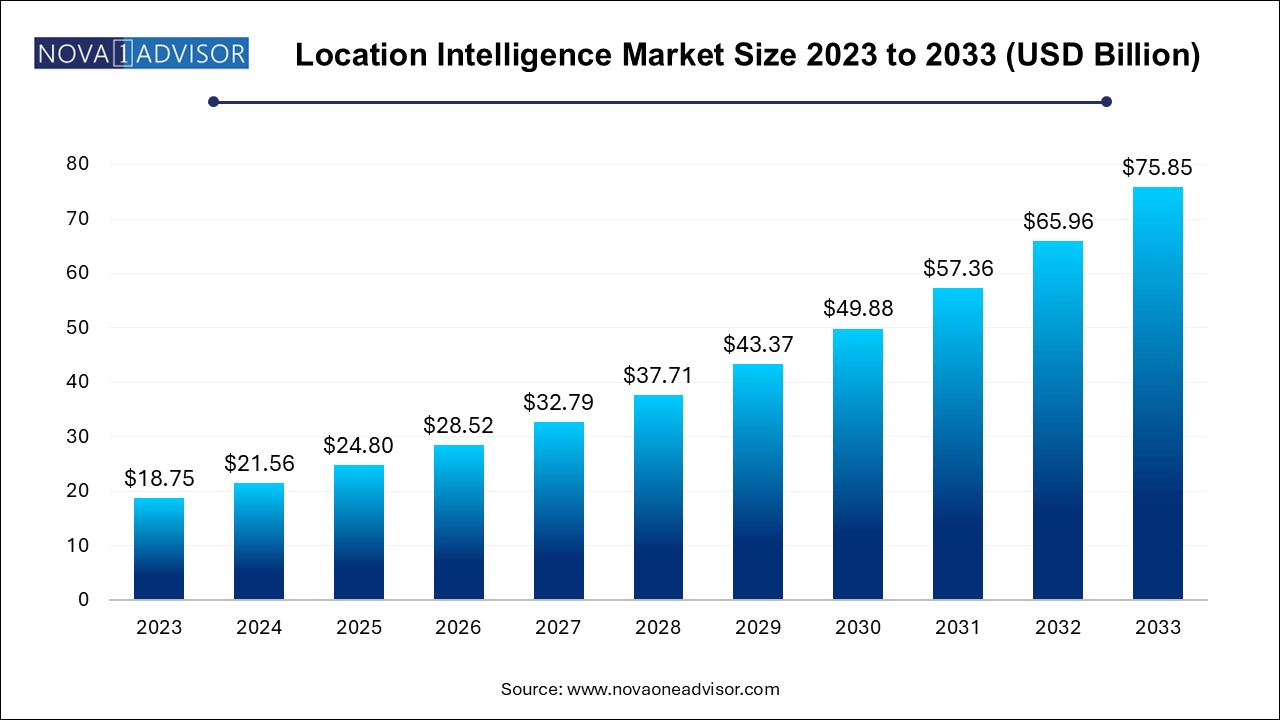

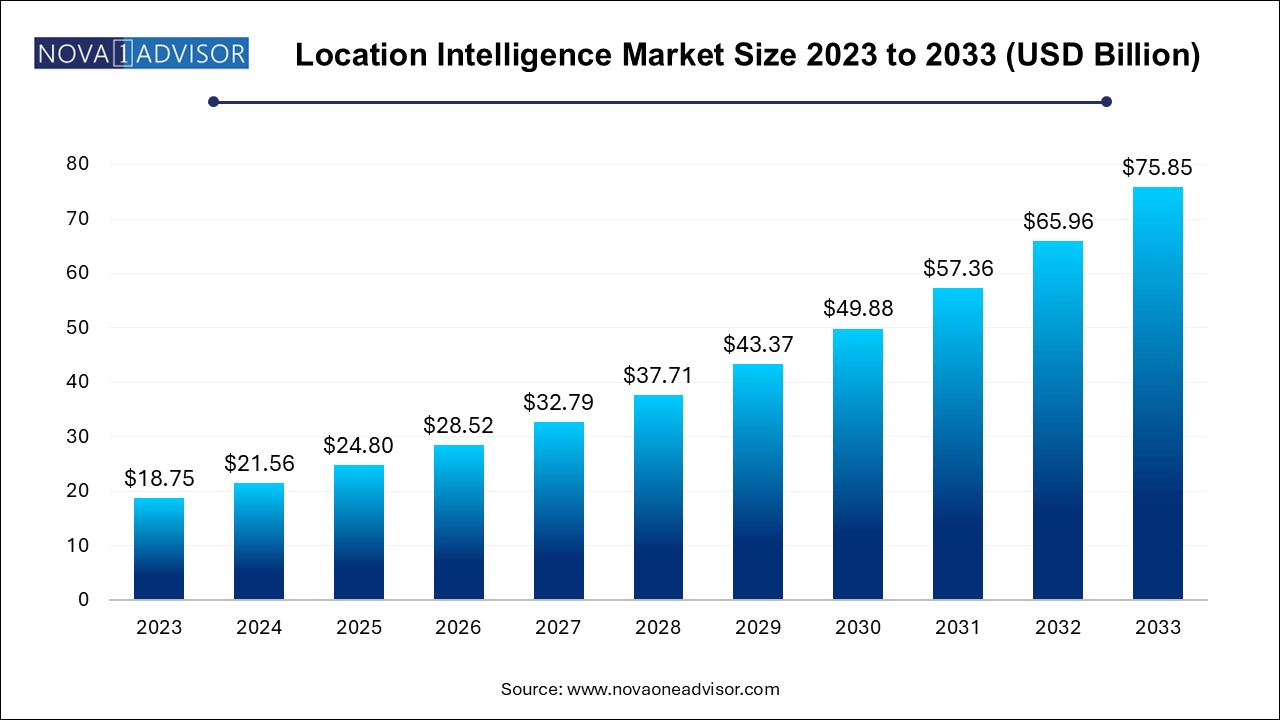

The global location intelligence market size was exhibited at USD 18.75 billion in 2023 and is projected to hit around USD 75.85 billion by 2033, growing at a CAGR of 15.0% during the forecast period 2024 to 2033.

Location Intelligence Market Key Takeaways:

- The sales & marketing optimization application segment dominated the global industry in 2023

- The system integration category segment dominated the industry and accounted for the maximum share of more than 45% of the overall revenue.

- The transportation & logistics segment dominated the industry in 2023 and accounted for the largest share of more than 19% of the overall revenue.

- The retail and consumer goods segment is expected to record the fastest growth rate over the forecast period.

- North America dominated the industry in 2023 and accounted for the largest share of more than 33% of the overall revenue.

Market Overview

The global location intelligence (LI) market is experiencing exponential growth, driven by the increasing need for spatial data analysis to enhance decision-making across sectors such as retail, logistics, government, and financial services. Location intelligence involves the use of geographic information systems (GIS), spatial analytics, artificial intelligence, and big data to derive actionable insights from geospatial data. It enables organizations to understand where events are happening, why they are happening there, and how that information can influence operations.

In today’s digital economy, businesses are integrating location intelligence into core operations—from site selection and risk assessment to asset tracking and customer profiling. The expansion of IoT devices, proliferation of mobile applications, and real-time data collection are generating massive volumes of location-tagged information. When fused with contextual datasets (such as demographics, weather, and traffic), this data becomes a powerful tool for driving strategic decisions.

Applications of location intelligence range from logistics optimization (route planning and last-mile delivery) to retail site planning, urban planning, disaster response, and public safety management. In financial services, LI is being used for fraud detection and credit scoring by assessing behavioral and locational patterns. Moreover, the rise of smart cities and connected infrastructure is propelling demand for spatial analysis in traffic monitoring, public transport planning, and energy efficiency.

From a technology standpoint, cloud-native platforms and AI-powered GIS tools are making LI more accessible and scalable. Meanwhile, government initiatives in geospatial data standardization and open data sharing are further boosting adoption. As digital transformation accelerates globally, location intelligence is no longer a niche function but a core strategic enabler.

Major Trends in the Market

-

Integration of AI with Geospatial Analytics: Artificial intelligence is enhancing spatial pattern detection, anomaly prediction, and real-time geofencing capabilities.

-

Real-Time Location Intelligence with IoT: The convergence of IoT and LI is enabling continuous monitoring of assets, vehicles, and environmental factors.

-

Indoor Location Intelligence Growth: Applications in smart buildings, retail stores, and manufacturing plants are fueling demand for precise indoor tracking solutions.

-

Geospatial Data Monetization: Enterprises are commercializing geospatial insights by offering location-based services and personalized experiences.

-

Augmented Reality (AR) with Location Data: AR-driven wayfinding and field operations are leveraging real-world coordinates to enhance user interaction.

-

Cloud-Based Location Intelligence Platforms: Cloud deployment is driving scalability, data integration, and analytics automation.

-

Open-Source GIS Expansion: Open-source platforms are gaining popularity among developers and smaller enterprises due to flexibility and cost-effectiveness.

-

Increasing Regulatory Emphasis on Geospatial Data Privacy: Data localization laws and privacy frameworks are shaping how location data is collected, stored, and shared.

Report Scope of Location Intelligence Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 21.56 Billion |

| Market Size by 2033 |

USD 75.85 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 15.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Component, Application, Location Type, Deployment, Organization, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Autodesk, Inc.; Bosch Software Innovations GmbH; ESRI; Foursquare.; HERE Technologies; IBM Corporation; LocationIQ; MDA Corp.; Microsoft; Pitney Bowes, Inc.; Qualcomm Technologies, Inc.; Supermap Software Co., Ltd.; Tibco Software, Inc.; Trimble, Inc.; Wireless Logic |

Market Driver: Growing Adoption Across Industries for Strategic Decision-Making

The foremost driver of the location intelligence market is its widespread adoption across multiple industries for data-driven strategic decision-making. Businesses today operate in highly dynamic environments, where understanding customer behavior, operational efficiency, and external risks in real-time is paramount. LI allows enterprises to overlay operational data with geospatial context, uncovering trends and patterns that would be invisible in tabular datasets.

For instance, in retail, LI tools enable foot traffic analysis, demographic segmentation, and store placement optimization, directly impacting profitability. In logistics, companies leverage LI to optimize fleet routes, reduce fuel consumption, and meet delivery SLAs. In government and urban planning, geospatial analytics is vital for infrastructure development, zoning, and public service delivery. Even in insurance, LI is being used to evaluate policy risks based on location-based weather, crime, or environmental factors.

As the volume and granularity of location data increase, organizations that harness this information effectively are gaining a competitive edge, leading to a rapid uptake of LI platforms and services.

Market Restraint: Data Privacy Concerns and Regulatory Barriers

A key restraint affecting the location intelligence market is the growing scrutiny over data privacy and usage. With the proliferation of location-enabled applications and IoT sensors, vast amounts of personal movement and behavior data are collected—raising concerns around consent, security, and misuse. Regulatory frameworks such as the General Data Protection Regulation (GDPR) in Europe and California Consumer Privacy Act (CCPA) in the U.S. have introduced stringent guidelines on how location data can be collected, stored, and processed.

Compliance with these regulations is complex, especially for multinational companies handling cross-border data flows. There is also a growing call for data minimization, anonymization, and transparency in consumer-facing applications. In sectors like defense, healthcare, and finance, where sensitive data is involved, these concerns become even more critical.

To sustain market growth, companies must invest in privacy-first architectures, consent management tools, and secure data pipelines while maintaining compliance across jurisdictions—a costly and technically challenging undertaking.

Market Opportunity: Expansion of Location Intelligence in Smart Cities

One of the most promising opportunities in the location intelligence market lies in its application in smart city development. As urbanization continues, cities are turning to digital solutions to manage resources efficiently, reduce congestion, and improve citizen quality of life. Location intelligence is foundational to smart city infrastructure—it enables real-time traffic management, waste collection optimization, utility monitoring, emergency response coordination, and more.

Smart city initiatives in regions like Europe (e.g., Amsterdam Smart City), North America (e.g., Smart Columbus), and Asia (e.g., Smart Tokyo) are incorporating geospatial analytics as a critical layer for decision-making. The proliferation of connected vehicles, street cameras, and public transit sensors is generating vast location-based datasets, creating fertile ground for LI applications.

Private-public partnerships are increasingly funding location-aware platforms to manage everything from parking to pollution monitoring. As more cities adopt digital twins and 5G networks, the demand for real-time, cloud-integrated location intelligence platforms will surge, unlocking substantial growth opportunities.

Segmental Analysis

By Component

Software dominates the global location intelligence market, accounting for the majority share of revenue. Location intelligence software includes GIS platforms, spatial data visualization tools, geocoding engines, and location analytics dashboards. These tools empower organizations to collect, process, analyze, and visualize spatial data for better decision-making. Leading software providers such as Esri, CARTO, and Google Maps Platform offer customizable platforms that serve a wide range of industries, including transportation, retail, and public safety.

However, the services segment is the fastest-growing, fueled by the complexity of implementing and managing end-to-end location intelligence solutions. Services include consulting, system integration, data cleansing, and managed analytics. As organizations increasingly adopt location-based analytics, they require support in deploying cloud-native platforms, integrating with CRM/ERP systems, and training staff. In particular, outsourced analytics-as-a-service (AaaS) models are gaining popularity in mid-sized enterprises that lack in-house geospatial expertise.

By Application

Sales & marketing optimization is the leading application area for location intelligence, especially in retail, telecom, and consumer goods. LI platforms help marketers profile consumer behavior by geography, identify market gaps, run hyperlocal campaigns, and measure campaign impact using footfall analytics. Location-based customer segmentation, store heatmaps, and catchment analysis are standard tools for companies aiming to maximize ROI. For instance, Starbucks uses LI to decide store locations based on traffic patterns and neighborhood demographics.

Remote monitoring is the fastest-growing application, driven by the rise of IoT and connected assets. Industries such as utilities, energy, manufacturing, and logistics rely on real-time geospatial feeds to track pipelines, power grids, delivery fleets, and critical infrastructure. During the pandemic, remote monitoring tools enabled real-time tracking of COVID-19 outbreaks and vaccine distribution. Going forward, as autonomous systems and drones become mainstream, remote monitoring will be central to risk mitigation and operational continuity.

By Location Type

The outdoor location intelligence segment dominates due to its long-standing applications in transportation, agriculture, logistics, and weather forecasting. Outdoor LI is facilitated by GPS, GNSS, and satellite imagery, allowing for large-scale spatial mapping, asset tracking, and environmental monitoring. Use cases include ride-sharing optimization, disaster relief logistics, and outdoor retail planning.

Indoor location intelligence is growing rapidly, thanks to the emergence of smart buildings, indoor wayfinding, and real-time employee monitoring. Indoor Positioning Systems (IPS), powered by BLE beacons, Wi-Fi, and UWB (Ultra-Wideband), enable high-precision location tracking inside facilities. In retail, indoor mapping is used to track shopper movements. In healthcare, indoor LI is being applied to track critical medical equipment and staff. This segment will grow substantially as organizations seek to optimize internal workflows and safety.

By Deployment

Cloud-based deployment models dominate due to their scalability, cost efficiency, and ease of integration with modern analytics stacks. Cloud platforms enable real-time data processing, remote access, and seamless integration with APIs and third-party datasets. Providers such as AWS, Azure, and Google Cloud are offering location-based services through modular platforms, enabling businesses of all sizes to incorporate LI without heavy IT investments.

On-premise deployment remains significant in government, defense, and financial services, where data sovereignty and privacy concerns are paramount. These industries often handle sensitive or classified geospatial data, requiring robust internal hosting and encryption protocols. As hybrid architectures evolve, organizations may adopt a mix of on-prem and cloud deployments.

By Vertical

Transportation and logistics lead all verticals in location intelligence adoption. Fleet tracking, route optimization, and real-time shipment visibility are standard in logistics operations, and location analytics is vital for reducing delivery times, managing fuel costs, and improving customer satisfaction. Companies like UPS, DHL, and Amazon have heavily invested in location data platforms for real-time delivery insights.

The BFSI (Banking, Financial Services, and Insurance) sector is one of the fastest-growing verticals. Insurers are using LI to assess risks based on geography—such as proximity to flood zones or high-crime areas—while banks use it to optimize ATM placement, branch expansion, and assess creditworthiness by analyzing regional economic indicators. Fraud detection using location-based behavior is another growing use case.

Location Intelligence Market By Regional Insights

North America dominates the global location intelligence market, driven by early adoption, strong IT infrastructure, and a large concentration of major LI software vendors. The U.S., in particular, is home to industry giants like Esri, Google, Oracle, and Trimble, all of whom offer enterprise-grade GIS platforms. The region benefits from widespread use of geospatial data in retail, defense, transportation, and city planning.

North American cities are at the forefront of smart city development, further accelerating LI adoption. Public and private sector collaboration, federal funding, and advanced regulatory frameworks make North America the global leader in geospatial innovation.

Asia Pacific is the fastest-growing market, with rising investments in smart infrastructure, logistics modernization, and digital governance. Countries like China, India, Japan, and South Korea are aggressively expanding their capabilities in geospatial intelligence. China's Belt and Road Initiative and India's Smart Cities Mission have injected significant capital into urban planning, where LI plays a crucial role.

Growing e-commerce, expanding telecom networks, and widespread mobile penetration are enabling massive data generation. Local startups and government agencies are increasingly adopting LI platforms to improve governance, resource management, and economic development. As cloud computing and 5G rollout continue, Asia Pacific will remain a key growth frontier for location intelligence technologies.

Location Intelligence Market Recent Developments

-

April 2024 – Esri launched ArcGIS Insights AI, an advanced spatial analytics platform powered by machine learning and generative AI. The update allows deeper pattern recognition and predictive geospatial analysis across industries. [Source: PR Newswire]

-

January 2024 – CARTO announced a partnership with Snowflake to deliver a native cloud-based spatial analytics solution for real-time location intelligence.

-

December 2023 – Google Cloud expanded its location-based services with the integration of Google Maps Platform into BigQuery, enabling direct geospatial querying for enterprise clients.

-

October 2023 – HERE Technologies released a next-generation location platform with 3D mapping and indoor-outdoor tracking capabilities, aimed at logistics and urban development.

Some of the prominent players in the global location intelligence market include:

- Autodesk, Inc.

- Bosch Software Innovations GmbH

- ESRI

- Foursquare.

- HERE Technologies

- IBM Corporation

- LocationIQ

- MDA Corp.

- Microsoft

- Pitney Bowes, Inc.

- Comp11

- Qualcomm Technologies, Inc.

- Supermap Software Co., Ltd.

- Tibco Software, Inc.

- Trimble, Inc.

- Wireless Logic

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global location intelligence market

Component

Application

- Workforce Management

- Asset Management

- Facility Management

- Risk Management

- Remote Monitoring

- Sales & Marketing Optimization

- Customer Management

- Others

Location Type

Deployment

Vertical

- Retail & Consumer Goods

- Government & Defense

- Manufacturing & Industrial

- Transportation & Logistics

- BFSI

- IT & Telecom

- Utilities & Energy

- Media & Entertainment

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)