Medical Biomimetics Market Size and Research

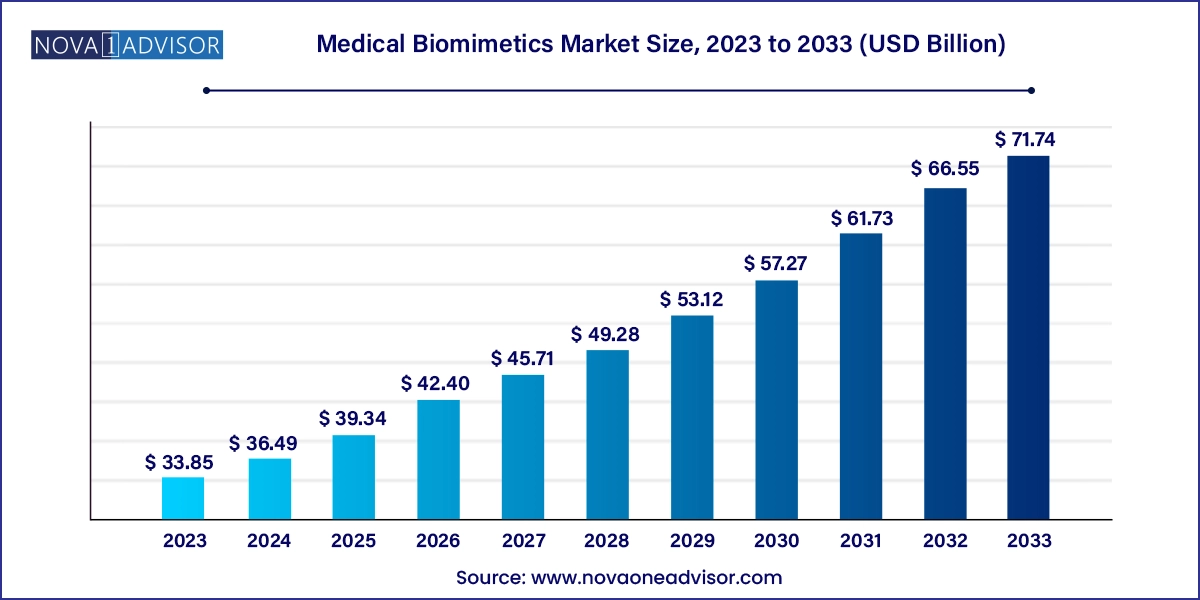

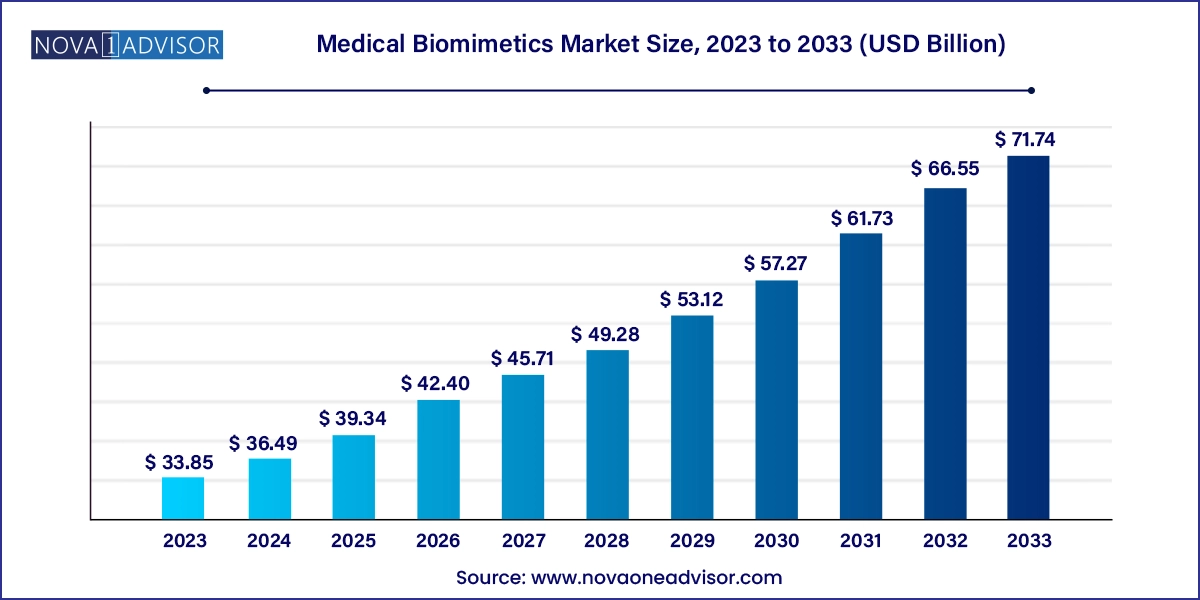

The medical biomimetics market size was exhibited at USD 33.85 billion in 2023 and is projected to hit around USD 71.74 billion by 2033, growing at a CAGR of 7.8% during the forecast period 2024 to 2033.

Medical Biomimetics Market Key Takeaways

- Cardiovascular dominated the market and accounted for a share of 34.8% in 2023.

- Orthopedics is expected to register the fastest CAGR during the forecast period.

- The wound healing segment dominated the market in 2023 with a share of 39.1%.

- The drug delivery segment is anticipated to witness a significant CAGR of 9.9% over the forecast period.

- North America medical biomimetics market dominated the market in 2023.

Market Overview

The medical biomimetics market represents one of the most interdisciplinary and transformative sectors in modern healthcare. Biomimetics, inspired by biological systems and processes found in nature, involves developing medical solutions that mimic the structure, function, or behavior of natural organisms. In the medical field, biomimetics has led to the innovation of advanced devices, materials, and therapeutics that replicate natural biological mechanisms to enhance healing, restore function, and improve patient outcomes.

Applications of medical biomimetics span a broad spectrum—from tissue regeneration and wound healing to orthopedic implants and cardiovascular devices. For instance, synthetic bone grafts modeled after natural bone structures, heart valves mimicking real valvular tissue dynamics, and drug delivery systems that emulate cellular uptake mechanisms are key examples of biomimetics in clinical practice. The field also includes ocular implants that simulate retinal behavior, dental prosthetics designed after enamel, and nano-carriers for site-specific drug delivery that imitate virus-like movement and targeting.

The global medical biomimetics market is expanding rapidly due to several factors, including the increasing prevalence of chronic diseases, rising geriatric population, and growing demand for minimally invasive and regenerative medical solutions. Advances in materials science, nanotechnology, and bioengineering are enabling the development of complex biomimetic products that were previously impossible to fabricate. Furthermore, interdisciplinary collaborations between biologists, materials scientists, and clinicians have accelerated the pipeline of innovative therapies and devices.

As healthcare systems move toward personalized and regenerative medicine, the demand for biomimetic technologies is expected to surge. However, commercialization challenges, such as regulatory complexity and manufacturing scalability, still present hurdles. Nonetheless, with strong R&D investments and clinical validation, the medical biomimetics market is poised to become a cornerstone of 21st-century medicine.

Major Trends in the Market

-

Growing Integration with 3D Printing and Biofabrication: Custom implants and tissues using biomimetic materials and bioprinting technologies are becoming more common.

-

Nanotechnology-Driven Drug Delivery Systems: Bio-inspired nanoparticles that mimic cellular interactions are revolutionizing targeted therapeutics.

-

Rise in Tissue Engineering and Regenerative Medicine Applications: Biomimetic scaffolds and matrices are essential for tissue reconstruction and healing.

-

Expansion of Orthopedic and Dental Biomimetics: Increasing preference for materials that mimic bone and enamel in form and function.

-

Cross-Disciplinary Collaborations and Academic-Industrial Partnerships: More joint ventures between universities and biotech companies are accelerating innovation.

-

Bioinspired Cardiovascular Devices: Development of heart valves, stents, and vascular grafts that replicate natural hemodynamic behavior is gaining traction.

-

Personalized Medicine through Biomimetic Platforms: Patient-specific prosthetics and implants modeled after unique anatomical or molecular profiles.

-

Emphasis on Sustainability and Biodegradability: Biomimetic materials that are biodegradable and reduce post-surgical complications are being prioritized.

Report Scope of Medical Biomimetics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 36.49 Billion |

| Market Size by 2033 |

USD 71.74 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

| Key Companies Profiled |

Otsuka Medical Devices Group, Stryker, Abbott, AVINENT Science and Technology,

SynTouch Inc., Osteopore International Pte Ltd, Vandstrom, Inc., Biomimetics Technologies Inc, Swedish Biomimetics 3000 ApS, Keystone Dental Group, LifeMatrix, Curasan, Inc.

CorNeat Vision

|

Key Market Driver: Increasing Demand for Regenerative and Functional Medical Solutions

A primary driver for the medical biomimetics market is the rising demand for regenerative medicine and functionally superior therapeutic solutions. As populations age and the incidence of degenerative diseases such as osteoarthritis, cardiovascular disorders, and age-related macular degeneration increases, conventional treatment options are becoming insufficient or suboptimal.

Biomimetics offers a paradigm shift by enabling restorative rather than merely symptomatic treatment. For example, a biomimetic heart valve designed to replicate the natural flow and flexibility of native tissue not only improves performance but also reduces complications such as thrombosis or calcification. Similarly, synthetic bone grafts that mimic trabecular bone structure integrate better with host tissue and accelerate regeneration compared to inert implants.

The concept of functional healing" restoring the natural architecture and physiology of damaged tissueis central to the appeal of biomimetics. This approach resonates with modern clinical strategies focused on long-term patient outcomes, reduced surgical revisions, and improved quality of life.

Key Market Restraint: High Development Costs and Regulatory Barriers

Despite its promise, the biomimetics market faces a substantial restraint in the form of high development costs and complex regulatory pathways. The process of translating bioinspired concepts into clinically viable products involves rigorous testing for biocompatibility, durability, and safety, which can extend development timelines and increase financial risk.

For example, creating a prosthetic joint that mimics the biomechanics of a real joint requires advanced materials, precise engineering, and often animal and human trials making the R&D cycle capital-intensive. Additionally, navigating regulatory approvals for new biomimetic devices often demands extensive documentation and clinical validation, especially in major markets like the U.S. (FDA) and Europe (EMA/CE marking).

Smaller startups in the biomimetics space often struggle to bring their innovations to market due to a lack of funding or manufacturing scalability. These barriers limit market accessibility and may delay the widespread adoption of breakthrough technologies, even when the clinical need is well-established.

Key Market Opportunity: Emergence of Smart and Responsive Biomimetic Materials

An exciting opportunity lies in the development of smart, responsive biomimetic materials that dynamically interact with biological environments. These materials often referred to as “intelligent biomimetics can change their structure, shape, or function in response to stimuli such as pH, temperature, electrical signals, or enzymatic activity.

For instance, researchers are creating drug delivery capsules that mimic immune cells, capable of homing in on tumors and releasing payloads only when inside the target tissue. Similarly, self-healing biomaterials inspired by skin are being developed for chronic wound management and implant coatings.

These next-generation biomimetics not only enhance clinical outcomes but also offer greater therapeutic precision, lower side effects, and improved patient compliance. As artificial intelligence and wearable health technologies evolve, there is potential for integrating responsive biomimetic materials into smart implants or diagnostic systems, further expanding market scope.

Medical Biomimetics Market By Type Insights & Trends

Cardiovascular biomimetics dominated the market, driven by the increasing prevalence of heart diseases and the growing demand for minimally invasive yet durable cardiovascular solutions. Bioinspired heart valves, vascular grafts, and stents have revolutionized how clinicians manage complex conditions like aortic stenosis and coronary artery disease. For instance, transcatheter heart valves that replicate the mechanical behavior of native valves are now widely used in patients who are ineligible for open-heart surgery. Similarly, vascular grafts coated with endothelial-like linings help prevent thrombosis and mimic the natural healing processes of blood vessels.

Orthopedic biomimetics are the fastest-growing segment, with extensive application in joint replacements, bone grafts, and cartilage regeneration. As orthopedic surgery moves toward biologically integrated implants, biomimetic materials such as hydroxyapatite and collagen-mimicking polymers are in high demand. 3D-printed bone scaffolds modeled after trabecular bone geometry are being used to treat complex fractures, spinal fusions, and even limb reconstructions. These implants facilitate natural bone growth, reduce inflammation, and integrate seamlessly with host tissue particularly valuable in elderly or osteoporotic patients.

Medical Biomimetics Market By Application Insights & Trends

Tissue engineering is the leading application segment, primarily due to the role of biomimetics in developing biocompatible scaffolds, matrices, and engineered tissues. In applications ranging from skin grafts to heart tissue regeneration, biomimetic designs that mimic the extracellular matrix (ECM) are critical for promoting cell adhesion, proliferation, and vascularization. For example, in burn victims, engineered skin tissues that mimic dermal and epidermal layers help accelerate healing and reduce scar formation. In bone regeneration, ECM-mimicking scaffolds loaded with osteogenic growth factors have shown promising results in both preclinical and clinical trials.

Drug delivery is the fastest-growing application segment, with biomimetics enabling high-precision therapeutic targeting and controlled release. Nanoscale delivery systems that mimic the behavior of viruses or immune cells are being used in oncology, autoimmune disorders, and chronic inflammation. These smart carriers can navigate complex biological environments, bypass immune defenses, and release drugs only when they reach the desired tissue or organ. For instance, liposomes and micelles inspired by cell membrane behavior are used in delivering chemotherapy drugs with minimal toxicity. The potential to combine diagnostics and therapeutics (theranostics) also positions this segment for rapid expansion.

Medical Biomimetics Market Regional Insights & Trends

North America dominates the global medical biomimetics market, attributed to its advanced healthcare infrastructure, substantial investment in R&D, and presence of leading biotech companies. The U.S. in particular has fostered a favorable ecosystem for biomimetic innovation, with top academic institutions like MIT, Stanford, and Harvard leading cutting-edge research in synthetic biology, tissue engineering, and bioinspired design. Additionally, FDA support for breakthrough devices and regenerative medicine technologies provides a robust framework for commercialization. Public-private partnerships and venture capital funding further enhance North America’s leadership position in this field.

Asia Pacific is the fastest-growing region, driven by rapid healthcare modernization, increasing government support for biomedical research, and a growing middle class with access to advanced treatments. Countries like China, India, South Korea, and Japan are investing in medical technology hubs and incubators to encourage local innovation. For instance, Japan’s focus on regenerative medicine has propelled the adoption of biomimetic implants and tissue scaffolds. Meanwhile, Chinese firms are entering global markets with competitively priced biomimetic solutions, often co-developed with international collaborators. As awareness and access improve, Asia Pacific is expected to become a major engine of market growth.

Medical Biomimetics Market Recent Developments

-

BioHorizons (March 2025): Announced the launch of a biomimetic dental implant surface coating that mimics natural bone texture to enhance osseointegration and healing.

-

PeptiGelDesign (February 2025): Secured funding for its peptide-based scaffolds used in tissue engineering applications that closely mimic the body’s ECM.

-

Harvard’s Wyss Institute (January 2025): Unveiled a new bioinspired cardiac patch using nanoscale materials that beat rhythmically and support myocardial healing.

-

BiomimX (December 2024): Partnered with a European pharmaceutical company to develop organ-on-chip platforms for personalized drug screening using biomimetic microenvironments.

-

Zimmer Biomet (November 2024): Released a next-generation orthopedic implant with a biomimetic surface design to enhance bone-implant integration and reduce recovery time.

Some of the prominent players in the Medical Biomimetics Market include

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Medical Biomimetics Market

Type

- Cardiovascular

- Orthopedic

- Ophthalmology

- Dental

- Others

Application

- Wound Healing

- Tissue Engineering

- Drug Delivery

- Other Applications

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa