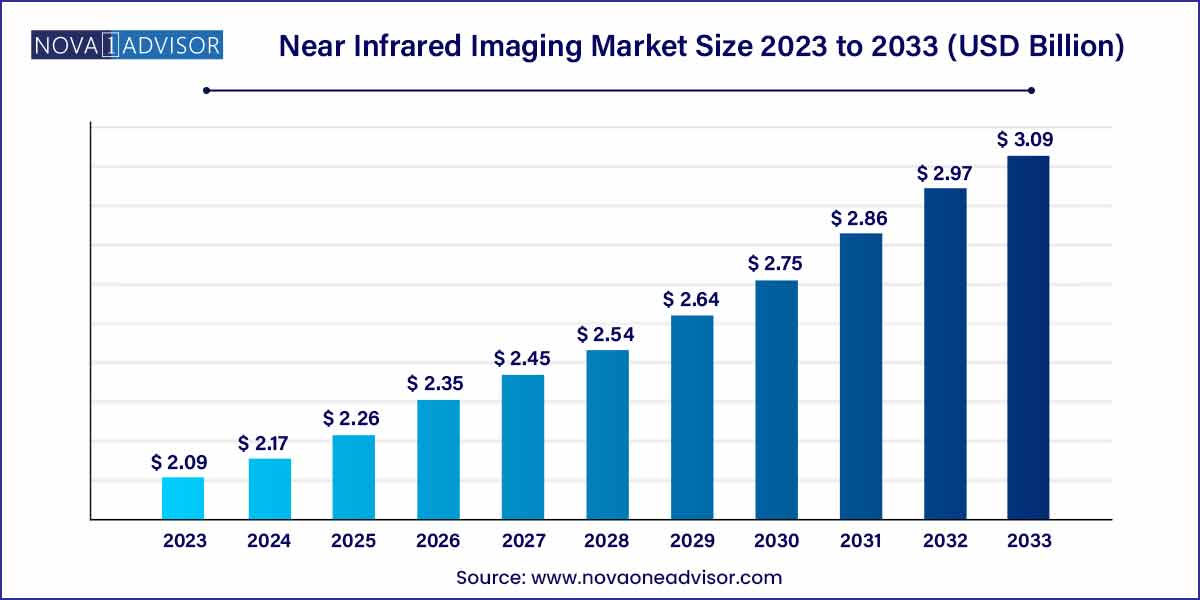

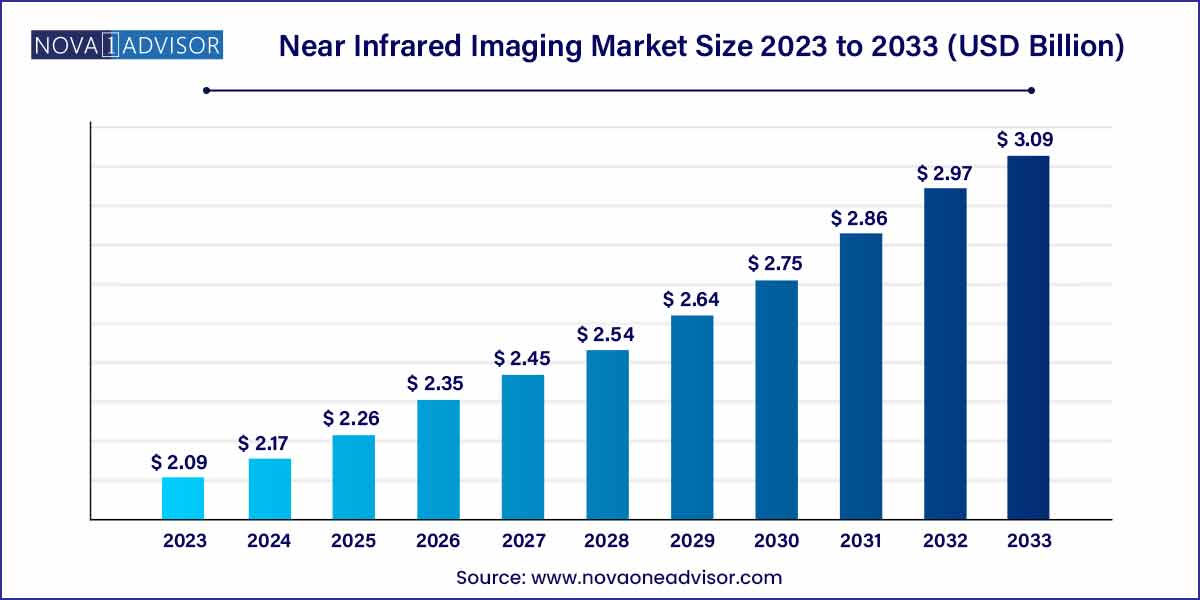

The global near-infrared imaging market size was exhibited at USD 2.09 billion in 2023 and is projected to hit around USD 3.09 billion by 2033, growing at a CAGR of 4.0% during the forecast period of 2024 to 2033.

Key Takeaways:

- The reagents segment dominated the market for near-infrared imaging and accounted for the largest revenue share of 56.6% in 2023.

- The preclinical imaging segment dominated the market for near-infrared imaging and held the largest revenue share of 34.90% in 2023.

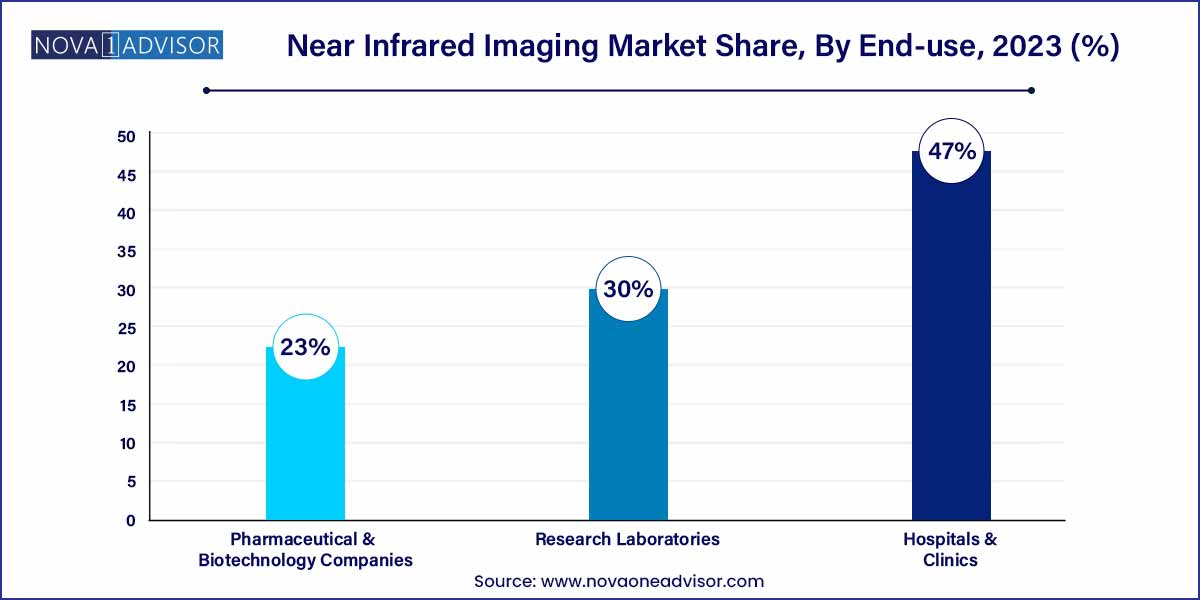

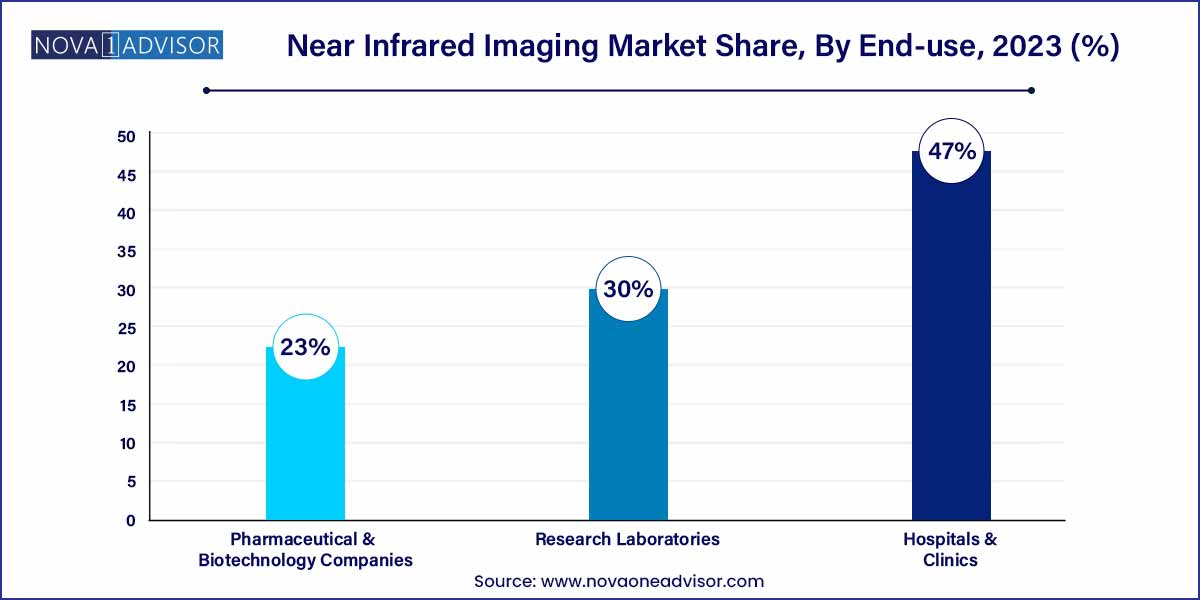

- The hospitals and clinics segment captured the largest revenue share of over 47.0% in 2023 and is expected to grow at a fastest rate during the forecast period.

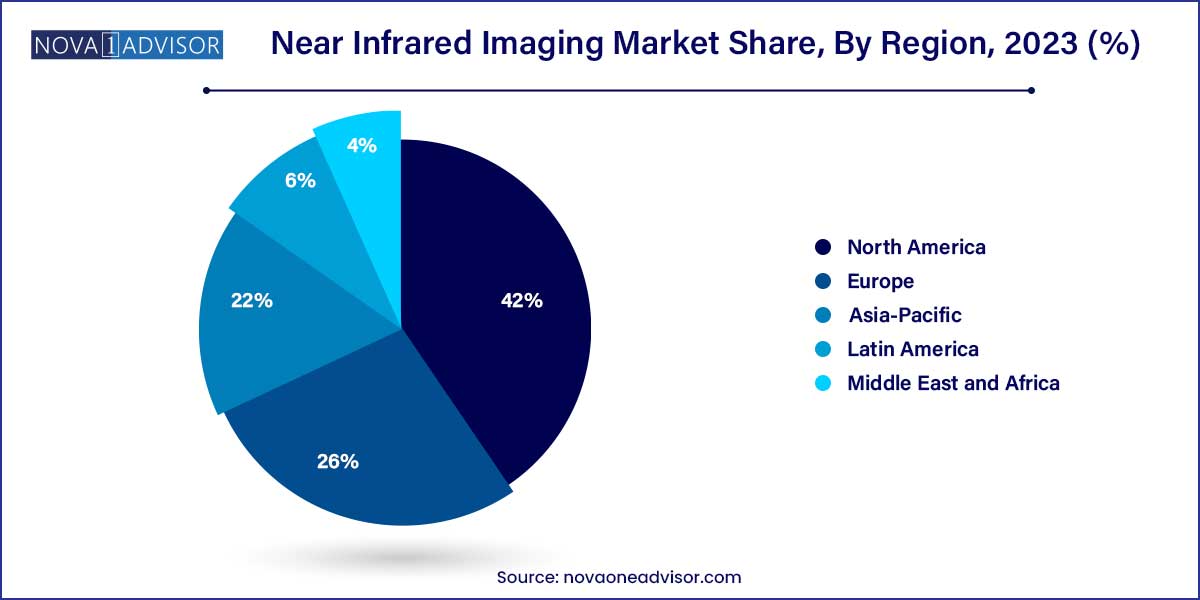

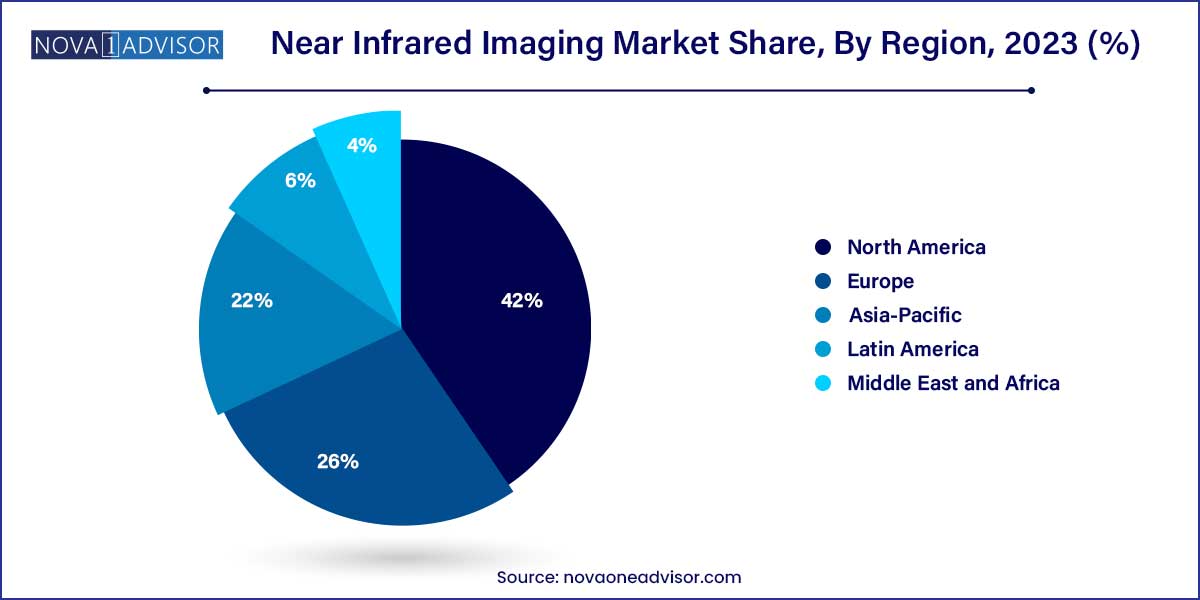

- North America dominated the market for near-infrared imaging and accounted for the largest revenue share of 42.0% in 2023

Near-Infrared infrared imaging Market: Overview

The Near Infrared (NIR) Imaging market has emerged as a transformative force in the field of medical diagnostics and surgical visualization. Utilizing light in the near-infrared spectrum (700 nm to 900 nm), NIR imaging systems enable non-invasive, high-contrast visualization of tissues and biological processes that are otherwise invisible under conventional imaging methods. This technology has become indispensable in applications such as cancer surgery, preclinical imaging, cardiovascular surgeries, and gastrointestinal procedures.

Advancements in fluorophores like Indocyanine Green (ICG), integration with fluorescence-guided surgery systems, and expanding adoption across hospitals, research centers, and pharmaceutical companies are propelling market growth. The pandemic period further highlighted the need for precision surgical tools, fast-tracking investment into technologies like NIR imaging. Additionally, the broader push towards minimally invasive procedures and personalized medicine further solidifies the role of NIR imaging in the future of healthcare.

As companies innovate to develop higher sensitivity devices, real-time imaging solutions, and hybrid imaging modalities combining bioluminescence and NIR fluorescence, the market outlook remains robust, promising significant clinical and economic benefits.

Near-infrared imaging Market Growth

The near-infrared imaging market is experiencing robust growth, driven by several key factors. One primary catalyst is the increasing adoption of this technology in healthcare for precise diagnostics, cancer detection, and neurological studies, propelling demand for advanced medical imaging solutions. Additionally, the agriculture sector is witnessing a surge in the utilization of near-infrared imaging for crop monitoring and quality assessment, empowering farmers to optimize yields. In pharmaceuticals, the demand for stringent quality control measures has led to the integration of near-infrared imaging in drug development processes, contributing to the sector's growth. Technological advancements, including improvements in imaging technologies and the integration of artificial intelligence, further fuel market expansion by enhancing the efficiency and capabilities of near-infrared imaging devices. The market's growth is also sustained by increasing awareness across various industries regarding the diverse applications and benefits of near-infrared imaging technology. As these factors converge, the near-infrared imaging market is poised for sustained expansion and continued innovation.

Near Infrared Imaging Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.09 Billion |

| Market Size by 2033 |

USD 3.09 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Quest Medical Imaging B.V.; Stryker; KARL STORZ SE & Co. KG; Olympus; Hamamatsu Photonics K.K.; Mizuho Medical Co, Ltd.; Shimadzu Corporation; Leica Microsystem (Danaher); Medtronic (Visionsense); Perkinelmer Inc.; Fluoptics; Carl Zeiss Meditec AG |

Market Dynamics

- Technological Advancements Driving Innovation:

The near-infrared imaging market is dynamically influenced by continuous technological advancements. Innovations in imaging technologies, sensor capabilities, and data processing have significantly elevated the capabilities of near-infrared imaging devices. Integration with artificial intelligence (AI) and machine learning (ML) algorithms has further enhanced the analysis and interpretation of imaging data, providing users with more accurate and actionable insights. This dynamic technological landscape not only ensures that near-infrared imaging remains at the forefront of scientific and industrial applications but also stimulates market growth as businesses seek cutting-edge solutions for diagnostics, quality control, and surveillance.

- Expanding Applications Across Industries:

A key dynamic shaping the near-infrared imaging market is the expanding range of applications across diverse industries. Originally gaining prominence in healthcare for medical diagnostics, near-infrared imaging has rapidly diversified its utility. From agriculture, where it aids in crop monitoring and quality assessment, to the pharmaceutical industry, where it plays a crucial role in drug development and quality control, the versatility of near-infrared imaging has propelled its adoption. Industrial applications, including process monitoring and quality assurance, as well as security and surveillance measures, further contribute to the widespread integration of near-infrared imaging. This broad spectrum of applications fosters market growth by catering to a multitude of industry-specific needs and requirements.

Market Restraint

- Cost and Complexity of Equipment:

One significant restraint impacting the near-infrared imaging market is the cost and complexity associated with the equipment. The advanced technologies and precision required for near-infrared imaging devices contribute to higher manufacturing costs, making these systems relatively expensive for end-users. The complexity of the equipment also poses challenges in terms of operation and maintenance, requiring skilled personnel for effective deployment. As a result, the upfront investment and ongoing operational expenses may limit the widespread adoption of near-infrared imaging technologies, particularly in smaller enterprises and sectors with budget constraints.

- Need for Skilled Personnel:

Another notable restraint in the near-infrared imaging market is the demand for skilled personnel for effective utilization of the technology. Interpreting near-infrared imaging data, maintaining equipment, and troubleshooting issues require a level of expertise that may not be readily available in all settings. The need for specialized training and knowledge can be a barrier for certain industries or regions, hindering the seamless integration of near-infrared imaging solutions. This constraint emphasizes the importance of investing in education and training programs to bridge the skills gap and unlock the full potential of near-infrared imaging technologies across diverse applications.

Market Opportunity

- Rising Demand for Portable and Compact Devices:

A significant opportunity in the near-infrared imaging market lies in the growing demand for portable and compact devices. The market is witnessing an increasing trend towards the development and adoption of smaller, more mobile near-infrared imaging solutions. These devices offer flexibility and accessibility in various applications, such as point-of-care diagnostics in healthcare or on-field crop monitoring in agriculture. The surge in demand for portable devices creates an opportunity for manufacturers to cater to diverse industries seeking agile and convenient near-infrared imaging solutions, thereby expanding their market presence.

- Integration with Internet of Things (IoT) and Big Data Analytics:

The integration of near-infrared imaging with Internet of Things (IoT) and big data analytics presents a promising opportunity for market growth. By connecting near-infrared imaging devices to IoT networks, real-time data collection and analysis become more efficient. This connectivity allows for seamless integration into smart systems, enabling applications like predictive maintenance in industrial settings or continuous monitoring in healthcare. The incorporation of big data analytics further enhances the value proposition by extracting meaningful insights from the vast amount of data generated. This opportunity positions near-infrared imaging as a key player in the era of interconnected technologies, offering innovative solutions across multiple industries.

Market Challenges

- High Initial Investment and Equipment Costs:

One of the primary challenges confronting the near-infrared imaging market is the high initial investment and associated equipment costs. The advanced technology and precision required for near-infrared imaging devices contribute to elevated manufacturing expenses, making these systems relatively costly. This financial barrier can pose a challenge for businesses, especially smaller enterprises or those operating within budget constraints. The need for a substantial upfront investment may deter potential adopters, limiting the market penetration of near-infrared imaging technologies across various industries.

- Complex Data Interpretation and Integration:

The complex nature of near-infrared imaging data presents a significant challenge, requiring sophisticated interpretation and integration methods. Analyzing and extracting meaningful insights from the vast amount of data generated by near-infrared imaging devices demand specialized expertise. Integrating this technology into existing systems, particularly in industries with diverse applications such as healthcare and agriculture, can be a complex process. Addressing the challenge of data interpretation and integration is crucial for ensuring the seamless adoption of near-infrared imaging across industries and unlocking its full potential in various applications.

Segments Insights:

Product Insights

Devices dominated the Near Infrared Imaging market in 2023, accounting for the largest revenue share. Within devices, near-infrared fluorescence imaging systems led the way due to their extensive adoption in surgical procedures. Hospitals and surgical centers are investing heavily in systems that integrate seamlessly with existing surgical workflows, offering real-time imaging without significantly extending operative times.

Meanwhile, near-infrared fluorescence & bioluminescence imaging systems are expected to witness the fastest growth during the forecast period. The combination of these two modalities allows researchers and clinicians to visualize both anatomical structures and molecular events simultaneously. Pharmaceutical companies and preclinical research laboratories are increasingly adopting these hybrid systems to enhance drug development processes and translational research initiatives.

Application Insights

Indocyanine Green (ICG) was the dominating reagent segment in 2023. ICG's FDA approval, broad clinical application, established safety profile, and effective fluorescence properties in the NIR spectrum have ensured its leadership position. It remains the primary agent for intraoperative imaging across diverse surgical specialties.

However, the "Other Reagents" category, encompassing next-generation fluorophores like ZW800-1 and tumor-targeted dyes, is projected to grow at the fastest pace. Ongoing R&D and rising demand for targeted and personalized imaging solutions are fueling the introduction of new reagents that offer superior performance over conventional agents. Pharmaceutical partnerships and clinical trials evaluating these novel agents are further accelerating their commercial prospects.

End-use Insights

Hospitals and clinics dominated the Near Infrared Imaging market in 2023. The rapid integration of fluorescence imaging systems into operating rooms, particularly those specializing in cancer, cardiovascular, and gastrointestinal surgeries, has reinforced this segment's leadership. Enhanced patient outcomes, shorter hospital stays, and the rising number of minimally invasive surgeries have contributed to sustained demand.

Pharmaceutical and biotechnology companies are anticipated to be the fastest-growing end-user segment. NIR imaging is playing a crucial role in preclinical imaging, drug biodistribution studies, and translational research. Investments in research and clinical trials focusing on new fluorophores, imaging biomarkers, and drug delivery systems are catalyzing adoption within this sector.

Regional Insights

North America, particularly the United States, remained the dominant region in the Near Infrared Imaging market in 2024. The region’s leadership is supported by factors such as high healthcare spending, early adoption of cutting-edge surgical technologies, and strong presence of major industry players like Stryker Corporation, PerkinElmer, and Carl Zeiss Meditec AG.

Additionally, robust government funding for cancer research, widespread availability of skilled surgeons trained in fluorescence-guided procedures, and well-established healthcare infrastructure have facilitated rapid market growth. Regulatory support from agencies like the FDA for new NIR devices and dyes further accelerates innovation and commercialization.

Asia-Pacific is projected to register the fastest growth during the forecast period. Increasing investments in healthcare infrastructure, rising cancer incidence rates, growing awareness about advanced surgical technologies, and improving reimbursement frameworks are driving market expansion across the region.

Countries such as China, Japan, South Korea, and India are leading the regional surge. Japan's strong focus on technological innovation and surgical excellence makes it a critical market, while China's government initiatives to modernize healthcare and encourage medical innovation are creating fertile ground for Near Infrared Imaging adoption.

Some of the prominent players in the near-infrared imaging market include:

- Quest Medical Imaging B.V.

- Stryker

- KARL STORZ SE & Co. KG

- Olympus

- Hamamatsu Photonics K.K

- Mizuho Medical Co, Ltd.

- Shimadzu Corporation

- Leica Microsystems

- Medtronic (Visionsense)

- PerkinElmer, Inc.

- Carl Zeiss Meditec

- Fluoptics

Recent Developments

-

March 2025: Stryker Corporation launched its latest version of the SPY Portable Handheld Imaging System, designed for improved intraoperative perfusion assessment in plastic and reconstructive surgeries.

-

January 2025: Carl Zeiss Meditec announced the FDA clearance of its ZEISS TumorMap, a real-time NIR imaging module for intraoperative tumor margin assessment.

-

November 2024: Quest Medical Imaging received CE Mark approval for its Quest Spectrum 3.0, a hybrid fluorescence and bioluminescence imaging system targeting oncology applications.

-

October 2024: PerkinElmer acquired NIR fluorophore development startup VisEn Medical to strengthen its molecular imaging portfolio.

-

August 2024: Hamamatsu Photonics introduced a new series of highly sensitive InGaAs cameras optimized for second-window NIR (NIR-II) imaging applications.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global near infrared imaging market.

Product

-

- Near-infrared Fluorescence Imaging Systems

- Near-infrared Fluorescence & Bioluminescence Imaging Systems

-

- Indocyanine Green (ICG)

- Other Reagents

Application

- Preclinical Imaging

- Cancer Surgeries

- Gastrointestinal Surgeries

- Cardiovascular Surgeries

- Plastic/Reconstructive Surgeries

- Other Applications

End-use

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Research Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)