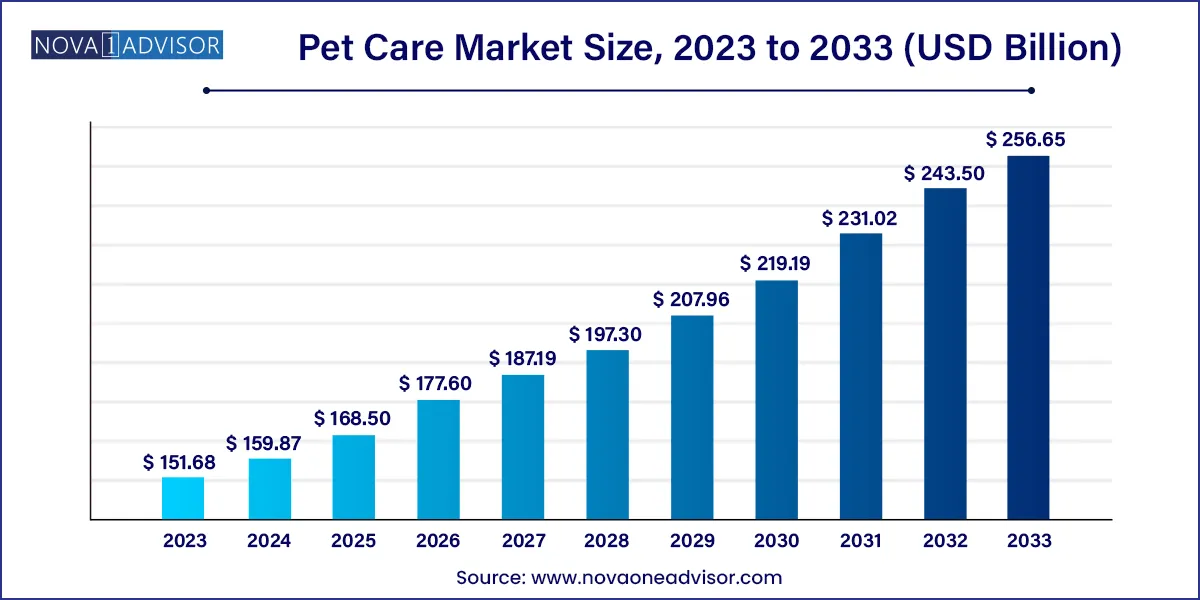

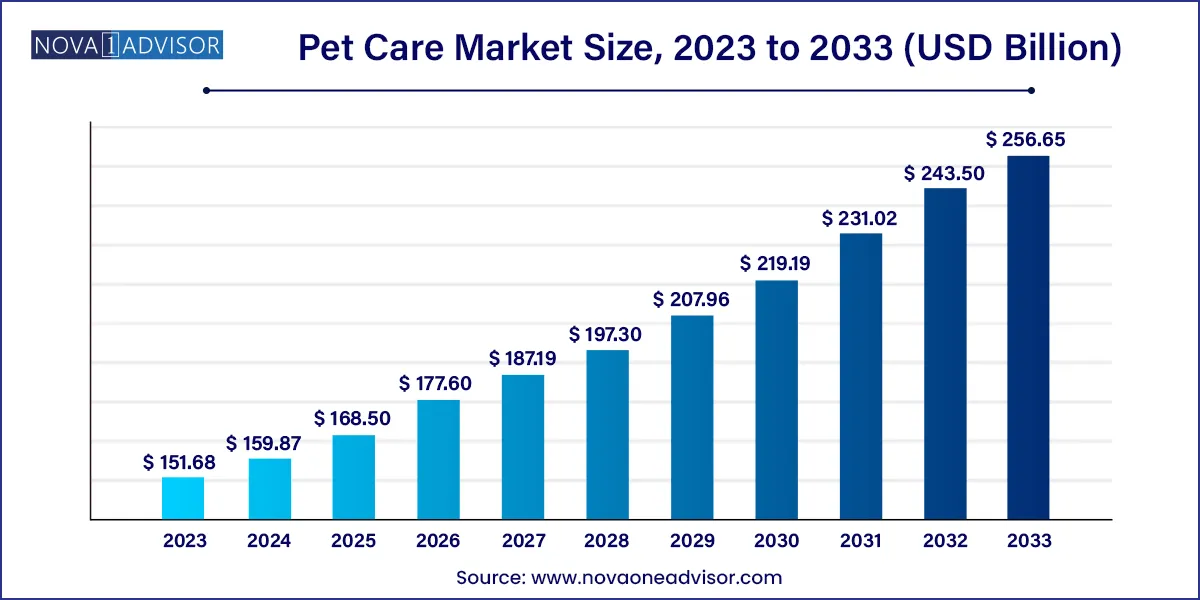

The global pet care market size was exhibited at USD 151.68 billion in 2023 and is projected to hit around USD 256.65 billion by 2033, growing at a CAGR of 5.4% during the forecast period of 2024 to 2033.

Key Takeaways:

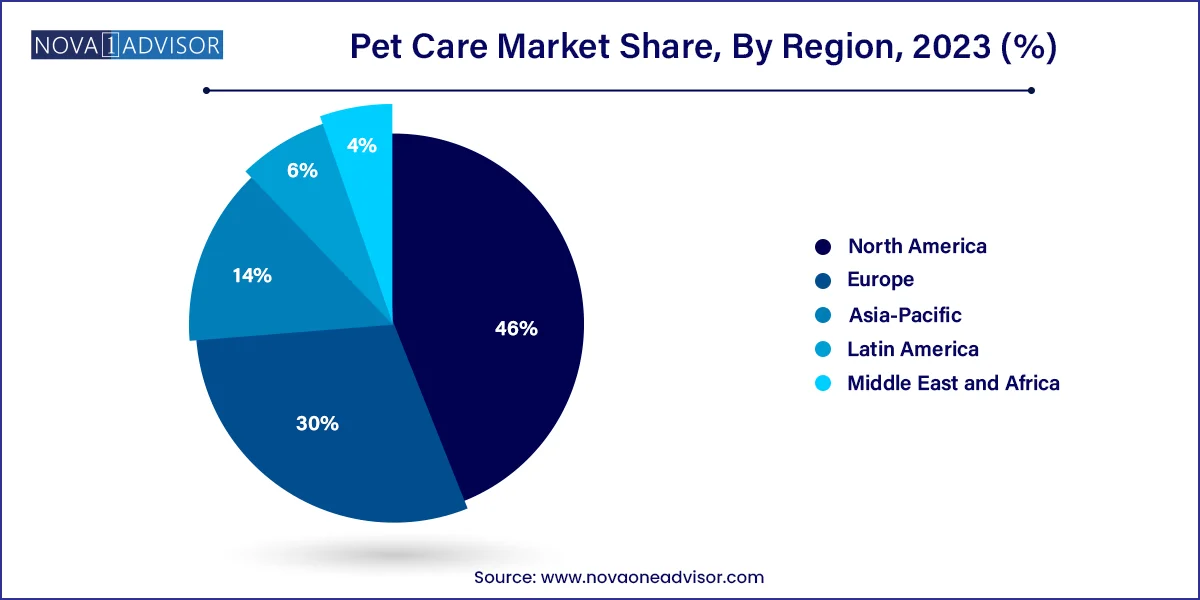

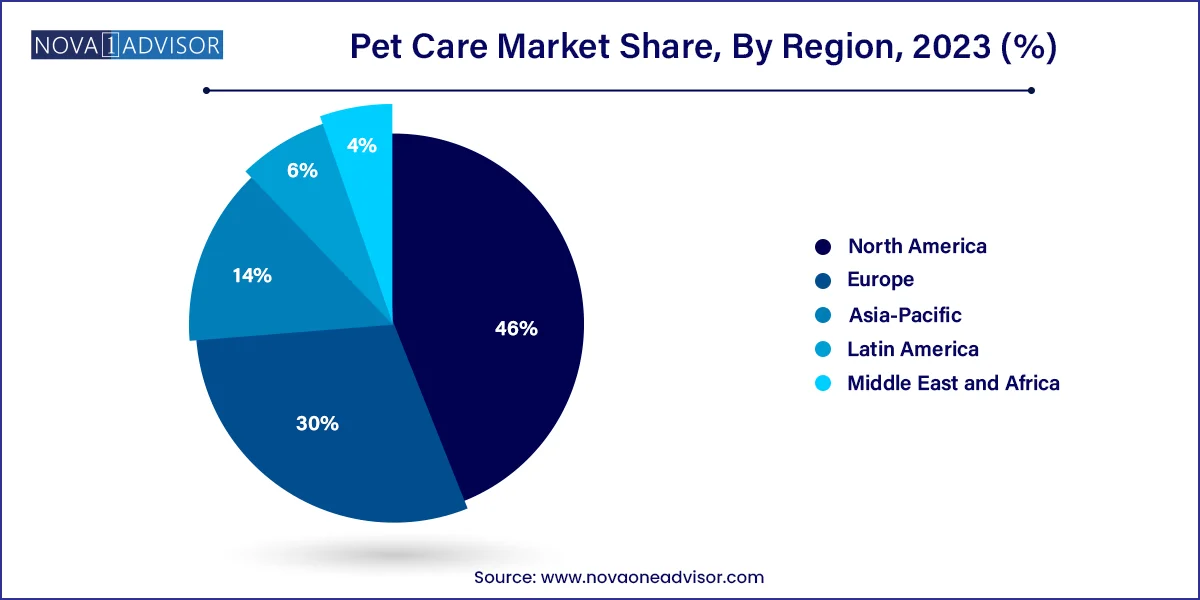

- North America accounted for the largest revenue share of around 46% in 2023.

- The dog segment accounted for over 39% of the revenue share in 2023.

- The product type segment accounted for over 57% of the revenue share in 2023.

Market Overview

The global pet care market has undergone a significant transformation over the past decade, evolving from a niche industry into a robust, multi-billion-dollar global ecosystem. At the heart of this expansion is the deepening emotional bond between humans and their pets, which has redefined pets not merely as animals but as family members. The demand for advanced, personalized, and premium pet care products and services is at an all-time high, driven by rising pet adoption rates, urbanization, increasing disposable incomes, and a cultural shift toward pet humanization.

As of the mid-2020s, the market encompasses a wide variety of products and services, ranging from nutritionally balanced pet foods, toys, grooming items, and litter solutions to specialized healthcare, insurance, fashion, and even mental wellness products for pets. Innovations such as DNA testing kits for breed analysis, wearable fitness trackers, and AI-based feeding systems are testament to the sophistication and scale of the pet care industry today.

Dog and cat ownership dominate globally, with a particularly high concentration in urban households. However, niche pet categories such as birds, fish, rabbits, and exotic animals are also gaining market presence, each supported by tailored products and community-specific service models. Notably, the post-pandemic landscape saw a spike in pet adoption, with pets serving as a source of emotional support during lockdowns. This resulted in accelerated demand for pet-related goods and services across all regions.

E-commerce has emerged as a major distribution channel, supported by subscription models, doorstep delivery, and the availability of a wide product range. Major retailers and DTC brands are leveraging this digital shift, further intensifying competition and consumer expectations. The market is characterized by a strong presence of both global multinationals and regional players, with increasing emphasis on sustainability, health-focused formulations, and personalization.

Major Trends in the Market

-

Humanization of Pets: Owners increasingly treat pets like family members, fueling demand for premium and wellness-oriented products.

-

E-commerce and Subscription Models: Online platforms are dominating pet care retail, offering convenience, variety, and auto-replenishment services.

-

Sustainable and Natural Products: Rising awareness about the environment and pet health is pushing demand for eco-friendly, organic, and biodegradable offerings.

-

Pet Health and Wellness Focus: Increased spending on pet health, including supplements, dental care, weight management, and veterinary diagnostics.

-

Rise in Pet Insurance and Veterinary Services: A growing number of owners are investing in comprehensive pet insurance plans and advanced healthcare.

-

Technological Integration: Smart collars, feeding devices, GPS trackers, and AI-based behavior monitoring tools are gaining popularity.

-

Growth in Emerging Economies: Expanding middle-class populations and increasing pet adoption in Asia and Latin America are fueling new demand.

-

Customized and Breed-Specific Diets: Tailored nutrition, breed-specific formulations, and functional treats are shaping the food segment.

Pet Care Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 151.68 Billion |

| Market Size by 2033 |

USD 256.65 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Pet Type, Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Ancol Pet Products Limited; Blue Buffalo Co., Ltd.; Champion Petfoods LP; Hill`s Pet Nutrition, Inc.; Mars, Incorporated; Nestle Purina PetCare; Petmate Holdings Co; Saturn Petcare GmbH; Tail Blazers; The Hartz Mountain Corporation. |

Key Market Driver: Increasing Pet Ownership and Humanization Trends

One of the strongest drivers of the global pet care market is the surge in pet ownership and the rising humanization of pets. Across both developed and developing economies, pets are increasingly seen as integral family members. This psychological and cultural transformation is influencing spending habits, with owners willing to invest in premium, natural, and functional products that promote their pets' health and happiness.

The COVID-19 pandemic played a crucial role in accelerating this trend. Social isolation and remote work arrangements led many individuals and families to adopt pets for companionship. According to industry sources, pet adoption spiked by over 20% in regions like North America and Europe during 2020–2021, with continued elevated adoption rates even in the post-pandemic era. This expansion of the pet population translated directly into increased demand for food, healthcare, grooming, and lifestyle products.

Moreover, younger generations such as Millennials and Gen Z, now the dominant pet-owning demographics, are more inclined toward proactive health management, digital shopping, and eco-conscious consumption—trends that are fueling innovation and growth in the industry.

Key Market Restraint: High Cost of Premium Pet Products and Services

While the market is booming, a significant restraint lies in the rising cost of pet care, particularly in high-income regions. Premiumization has driven prices up across the board—from grain-free, protein-rich foods and designer accessories to specialized veterinary services and diagnostics. For many households, the ongoing costs of owning a pet—food, medical care, grooming, and accessories—can amount to hundreds or even thousands of dollars annually.

This financial burden can deter potential adopters or force current owners to shift toward more budget-conscious purchasing behavior. The cost factor is particularly significant in developing markets, where disposable incomes are lower and price sensitivity is higher. In these regions, limited access to affordable veterinary care or quality pet food options can also hinder market expansion.

Moreover, inflationary pressures, economic slowdowns, and global supply chain disruptions have added further pricing volatility, especially for imported goods. While many consumers remain committed to their pets, affordability concerns continue to limit market reach.

Key Market Opportunity: Expanding Pet Ownership in Emerging Economies

A major opportunity lies in the expansion of pet ownership and pet product adoption in emerging economies such as India, Brazil, Indonesia, Mexico, and parts of Africa. As urbanization spreads and middle-class populations grow, an increasing number of households are acquiring pets for companionship, security, or social status.

In India, for instance, the pet population has seen double-digit growth annually, with dogs being the most popular choice. Pet care startups and multinational brands are actively entering these markets with localized strategies offering smaller pack sizes, affordable price points, and region-specific flavors or breeds.

Moreover, awareness campaigns by veterinary groups and animal welfare organizations are improving knowledge around responsible pet ownership. As infrastructure develops including veterinary clinics, pet specialty stores, and digital marketplaces consumer confidence is rising. The market potential is massive, considering the current penetration rates are still far lower compared to developed countries, indicating significant room for growth.

Segments Insights:

Pet Type Insights

Dogs dominate the global pet care market, accounting for the largest share in both product and service consumption. Dogs require regular feeding, grooming, healthcare, and physical activity, which drives consistent demand for a wide array of products. Premium dog foods enriched with functional ingredients like omega fatty acids and probiotics have seen strong uptake. Toys, apparel, bedding, and even dog-specific tech devices are also widely used, particularly in urban settings. Brands have responded with breed-specific nutrition, customizable accessories, and seasonal fashion lines tailored for dogs.

Cats represent the fastest-growing segment, particularly in urban apartments where space is limited. Cats are generally lower maintenance than dogs, making them a preferred choice among young professionals and elderly individuals. The demand for specialized litter products, self-cleaning litter boxes, hairball control foods, and scratching toys has increased. Cats are also benefiting from the shift toward indoor living, which requires owners to invest in enrichment and mental stimulation products. Additionally, wet food and treat categories for cats have seen diversification, with gourmet and functional options gaining popularity.

Type Insights

Food dominates the global pet care type segment, particularly the dry food sub-segment, which is favored for its convenience, longer shelf life, and cost-effectiveness. Brands like Royal Canin, Pedigree, Hill’s Science Diet, and Orijen offer a wide range of dry food products tailored to age, breed, and health needs. Consumers are increasingly seeking food options that promote digestive health, skin and coat health, joint function, and weight management. The dry food category also supports innovation in kibble shape, ingredient diversity, and packaging solutions.

Pet grooming products and accessories are the fastest-growing segments under the product category. This includes shampoos, conditioners, brushes, dental care items, colognes, and de-shedding tools, reflecting rising hygiene awareness. Pet fashion and accessories—like leashes, collars, winter jackets, raincoats, and GPS-enabled collars—are gaining popularity, especially among millennials and Gen Z. Specialty grooming salons and mobile grooming services are also expanding in urban centers. The toy category has also seen innovation with enrichment toys, interactive puzzles, and tech-enabled play tools becoming mainstream.

Regional Insights

North America remains the largest market for pet care, accounting for the highest revenue share globally. The United States is a mature and highly sophisticated pet care market, supported by widespread pet ownership (over 65% of U.S. households), high disposable income, and a culture that deeply values pet companionship. North American consumers are willing to spend on premium foods, regular veterinary visits, grooming, daycare, pet spas, and even behavioral therapy. The region also leads in pet insurance adoption and pet-related startups, with companies offering DNA testing kits, dog walking apps, and AI-based food dispensing systems.

Asia-Pacific is the fastest-growing region, driven by changing socio-economic dynamics and increasing pet adoption in China, India, Japan, and Southeast Asia. Rapid urbanization, nuclear family setups, and growing disposable incomes are propelling pet ownership. In China, younger generations are leading the charge, with urban professionals investing in cats and small dog breeds. E-commerce platforms like Alibaba and Amazon are enabling pet owners to access premium global brands, and local brands are also innovating with region-specific offerings. With growing awareness of pet health and the rise of veterinary infrastructure, Asia-Pacific is expected to maintain its growth momentum.

Some of the prominent players in the pet care market include:

- Ancol Pet Products Limited

- Blue Buffalo Co., Ltd.

- Champion Petfoods LP

- Hill`s Pet Nutrition, Inc.

- Mars, Incorporated

- Nestle Purina PetCare

- Petmate Holdings Co

- Saturn Petcare GmbH

- Tail Blazers

- The Hartz Mountain Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global pet care market.

Pet Type

Type

-

- Pet Litter

- Pet Grooming Products

- Fashion, Toys, and Accessories

-

- Dry Food

- Wet/ Canned

- Treats/ Snacks

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)