Shape Memory Alloys Market Size and Research

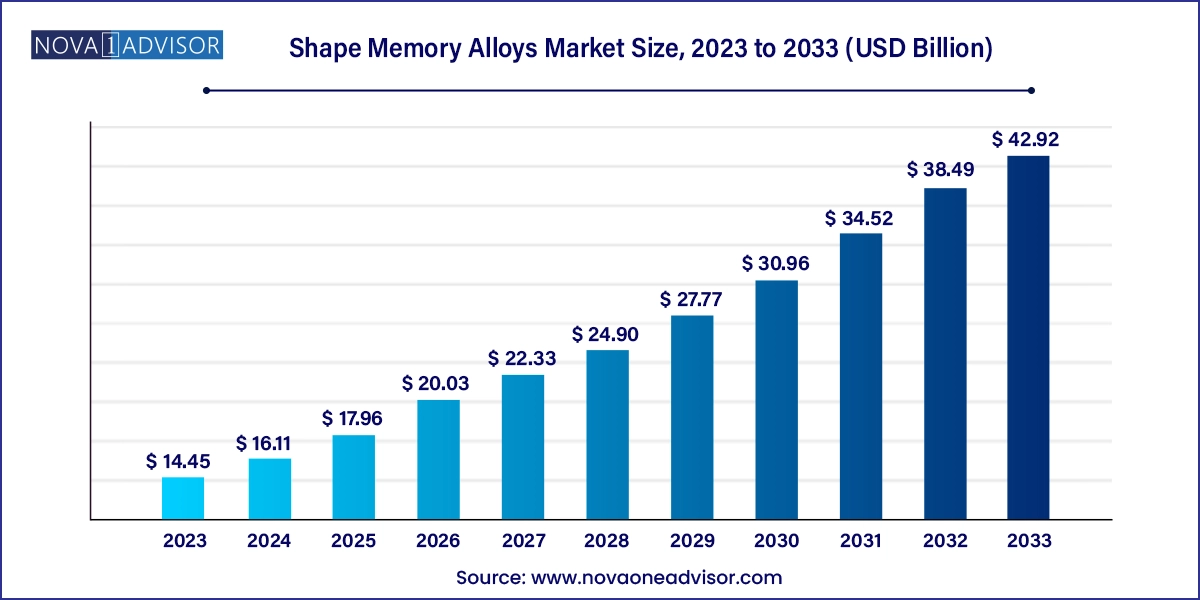

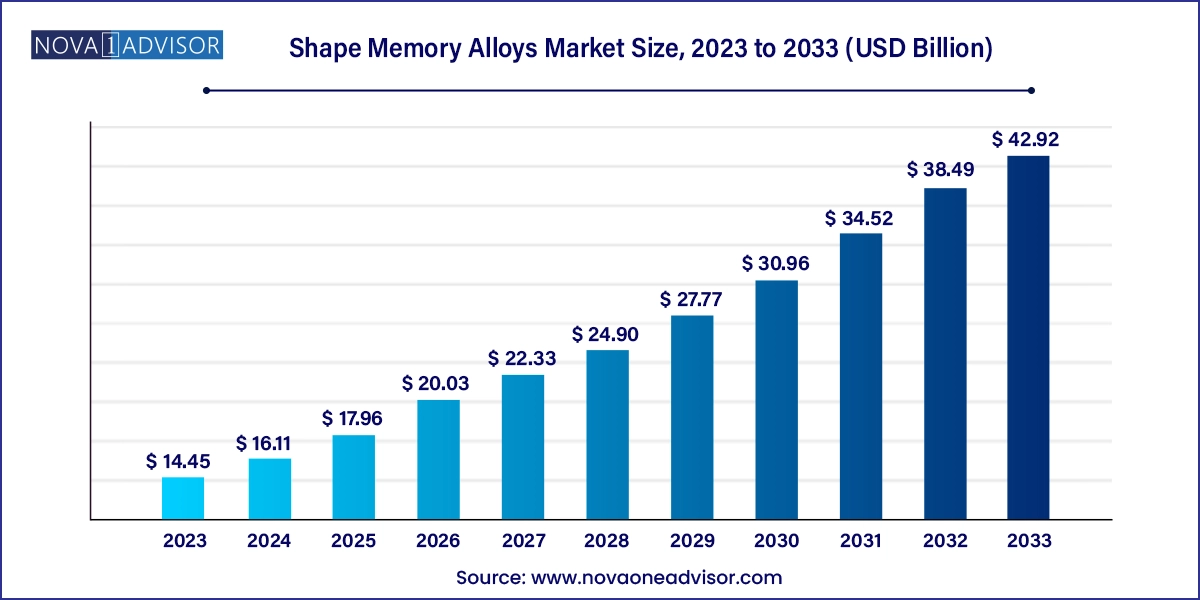

The shape memory alloys market size was exhibited at USD 14.45 billion in 2023 and is projected to hit around USD 42.92 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2024 to 2033.

Shape Memory Alloys Market Key Takeaways:

- By product segmentation, nickel-titanium held the largest revenue share of over 88% in 2023.

- Biomedical accounted for the highest revenue share of over 68% in 2023.

- The U.S. held over 25% revenue share of the global shape memory alloys market.

- The North America shape memory alloys market held a global revenue share of over 35% in 2023.

Market Overview

The global Shape Memory Alloys (SMA) market is undergoing a remarkable transformation, driven by growing applications across diverse industries such as biomedical devices, aerospace, automotive, robotics, and consumer electronics. Shape memory alloys are unique materials that can recover their original shape after deformation when exposed to specific thermal or mechanical stimuli. This transformation occurs due to a reversible phase change between martensite and austenite structures—a characteristic that makes SMAs invaluable for designing smart, lightweight, and compact actuators, stents, valves, connectors, and springs.

Nickel-titanium (NiTi or Nitinol) is the most widely used type of SMA due to its excellent thermal memory, corrosion resistance, and biocompatibility. Copper-based alloys such as copper-aluminum-nickel (Cu-Al-Ni) and copper-zinc-aluminum (Cu-Zn-Al) also offer shape memory properties but are more commonly used in less demanding or cost-sensitive applications. The market for SMAs is rapidly expanding as materials science advances and designers seek more intelligent, adaptive, and energy-efficient solutions for motion control and structural applications.

In the medical field, SMAs are used in guidewires, stents, orthopedic implants, and surgical tools, where their ability to exert controlled forces and adapt to anatomical constraints is critical. Meanwhile, aerospace and automotive industries use SMAs to reduce weight, enhance performance, and introduce self-healing and adaptive structures. Consumer electronics are also beginning to incorporate SMAs into foldable devices, wearable tech, and microactuation mechanisms.

Driven by innovation, increased R&D investments, and rising demand from emerging markets, the global shape memory alloys market is poised for sustained growth over the next decade.

Major Trends in the Market

-

Rapid adoption of SMAs in biomedical applications, particularly in minimally invasive surgeries and cardiovascular implants.

-

Increasing demand for lightweight and smart actuators in aerospace and automotive industries for enhanced fuel efficiency and system performance.

-

Emergence of SMA-based robotics and automation components, especially in soft robotics and microgrippers.

-

Growing use of SMAs in wearable technology and flexible consumer electronics, including shape-adaptive devices and retractable components.

-

Development of high-temperature shape memory alloys for advanced aerospace and industrial environments.

-

Expansion of additive manufacturing (3D printing) capabilities, enabling customized SMA parts for complex applications.

-

Rising focus on eco-friendly, self-healing materials, where SMAs provide passive safety and adaptive behavior.

-

Collaborations between academic institutions and industry players to commercialize novel SMA formulations and actuation systems.

Report Scope of Shape Memory Alloys Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 16.11 Billion |

| Market Size by 2033 |

USD 42.92 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Brazil |

| Key Companies Profiled |

ATI, Baoji Seabird Metal Material Co., Ltd., Dynalloy, Inc., Fort Wayne Metals Research, Furukawa Electric Co., Ltd., Johnson Matthey, Mishra Dhatu Nigam Limited (MIDHANI), Nippon Seisen Co., Ltd., Nippon Steel Corporation, SAES Group |

Key Market Driver: Expanding Biomedical Applications of Shape Memory Alloys

A major driver propelling the shape memory alloys market is the expanding use of these materials in biomedical applications. The unique properties of SMAs, especially Nitinol, make them ideal for devices that require superelasticity, biocompatibility, and thermal actuation. In cardiovascular procedures, for example, SMAs are used in self-expanding stents that conform to blood vessels once deployed. Their ability to resume a predefined shape at body temperature enhances procedural accuracy and patient outcomes.

Orthopedic and dental implants also benefit from SMAs, as they enable better fixation and adaptability. Nitinol wires are increasingly used in orthodontic treatments due to their gentle, continuous force, while surgical tools leverage SMA tips for flexibility and temperature responsiveness during minimally invasive procedures.

With the rise in chronic diseases, aging populations, and demand for less invasive surgical solutions, the biomedical sector has become a major growth engine for SMAs. Moreover, regulatory approvals and patient acceptance of SMA-based implants are increasing, making this a high-value and fast-evolving segment.

Key Market Restraint: High Material and Processing Costs

Despite their advantageous properties, the adoption of shape memory alloys faces significant restraint due to high production and processing costs. Materials like Nitinol require precise alloying, vacuum melting, and heat treatment processes to achieve the desired memory and superelastic behavior. The cost of nickel and titanium both essential to Nitinol is also relatively high, and any fluctuation in their global availability can directly impact SMA pricing.

Moreover, the machining and forming of SMAs pose technical challenges. Due to their hardness and work-hardening behavior, standard machining techniques are often ineffective or result in rapid tool wear. This necessitates the use of specialized equipment or non-traditional processing methods like electrical discharge machining (EDM) or laser cutting, further increasing manufacturing costs.

These challenges make SMAs cost-prohibitive for certain high-volume or price-sensitive applications, especially when compared to conventional metals or polymers. While innovation in production techniques continues to reduce costs over time, economic barriers remain a limiting factor in the wider adoption of SMAs, particularly in developing economies.

Key Market Opportunity: Integration in Smart Textiles and Consumer Electronics

A promising opportunity for the shape memory alloys market lies in their integration into next-generation smart textiles and consumer electronics. The convergence of advanced materials with wearable and flexible electronics is creating demand for actuators and components that are compact, responsive, and energy-efficient. SMAs meet these needs by offering motion, grip, or deformation in response to thermal or electrical signals, without the need for bulky mechanical systems.

In smart clothing, SMAs are being explored for adaptive fit, dynamic insulation, or posture correction features. For example, garments embedded with SMA fibers could adjust tightness in response to temperature changes or physical activity. In consumer electronics, SMAs are enabling retractable smartphone cameras, foldable hinges, and tactile feedback systems.

The miniaturization and multi-functionality of devices such as smartwatches, VR headsets, and health-monitoring bands demand actuators with high force-to-weight ratios—an ideal application for SMAs. As the Internet of Things (IoT) expands and wearable technology gains mainstream adoption, SMAs are expected to play a vital role in enabling innovation in compact, interactive hardware.

Shape Memory Alloys Market By Product Insights

Nickel-titanium (Nitinol) alloys accounted for the largest share of the shape memory alloys market due to their exceptional superelasticity, corrosion resistance, and biocompatibility. Nitinol exhibits both shape memory and pseudoelastic behavior, making it uniquely suited for a wide array of applications, especially in the biomedical and aerospace sectors.

In medical devices, Nitinol is preferred for its biocompatibility and ability to expand at body temperature, enabling self-deploying stents, guidewires, and filters. Its corrosion resistance also allows for long-term implantation. In the aerospace sector, Nitinol is used in actuators for airfoil control surfaces, morphing structures, and vibration dampers. These applications demand materials that can withstand mechanical fatigue and temperature variations—conditions under which Nitinol excels.

Conversely, copper-based alloys are the fastest-growing sub-segment due to their lower cost and suitability for applications that do not require the high precision or biocompatibility of Nitinol. Alloys like Cu-Zn-Al and Cu-Al-Ni are being explored in civil structures, household electronics, and actuators in commercial products. Their ability to undergo large recoverable strains and provide thermal actuation at moderate costs makes them attractive for large-scale deployments, especially in developing economies.

Shape Memory Alloys Market By End-use Insights

The biomedical sector dominated the shape memory alloys market due to widespread use of Nitinol in stents, orthopedic implants, dental braces, and minimally invasive surgical instruments. The unique properties of SMAs allow them to conform to anatomical structures and exert gentle, controlled forces, enhancing patient safety and clinical outcomes. In a market that demands precision, reliability, and miniaturization, Nitinol-based SMAs have proven to be superior to traditional materials.

The aging population and rise in non-communicable diseases like cardiovascular disorders have led to increased surgical interventions that use SMA-based devices. For example, endovascular aneurysm repair (EVAR) procedures use self-expanding SMA stents to reinforce weakened blood vessels with minimal trauma. Similarly, SMA-enabled guidewires improve navigation through complex vasculature during catheterization.

Consumer electronics & household applications represent the fastest-growing segment. SMAs are now being utilized in foldable smartphone components, wearable technology, and even smart home appliances. Devices with moving or adaptive parts, such as retractable lenses, robotic toys, and self-opening windows, are incorporating SMAs for compact actuation. The consumer electronics sector is embracing these materials as it pushes for smaller, lighter, and smarter products with intuitive functionality and form factors.

Shape Memory Alloys Market By Regional Insights

North America held the dominant position in the shape memory alloys market, primarily due to its strong biomedical device industry, high R&D spending, and early adoption of advanced materials. The United States is a global leader in minimally invasive surgeries and medical innovation, with companies like Boston Scientific, Medtronic, and Abbott utilizing Nitinol-based products extensively.

North America is also a hub for aerospace and defense technology. Companies such as Boeing and Lockheed Martin are pioneering the use of SMAs in adaptive components like variable geometry nozzles and thermal actuators for aircraft. The robust research infrastructure supported by agencies like NASA and DARPA further supports commercial development of novel SMA applications.

Asia Pacific is the fastest-growing region in the shape memory alloys market, driven by rapid industrialization, rising healthcare demand, and expanding manufacturing capabilities. Countries like China, Japan, South Korea, and India are experiencing a boom in medical infrastructure and are increasingly adopting SMA-based implants and surgical tools.

China is investing heavily in aerospace R&D and consumer electronics, both of which are significant end-users of SMAs. Meanwhile, Japan's mature electronics sector is exploring SMAs in microelectronics and precision tools. Local manufacturers in Asia are also working to develop cost-effective copper-based and nickel-titanium SMAs for domestic and export markets.

The region’s large population base and increasing healthcare access make it a fertile ground for SMA adoption in biomedical and consumer sectors. Additionally, partnerships between universities and material science companies are helping bridge the technology gap and bring localized innovations to market.

Shape Memory Alloys Market Recent Developments

-

April 2025 – SAES Getters Group announced the expansion of its Nitinol production line in the U.S. to meet rising demand for biomedical and aerospace applications, with a focus on superelastic alloys for guidewires and actuators.

-

February 2025 – G.RAU GmbH & Co. KG launched a new range of customizable SMA wires and tubes for integration into wearable robotic exoskeletons and flexible consumer electronics.

-

December 2024 – Memry Corporation partnered with a European medical device startup to co-develop next-gen vascular implants using high-precision Nitinol stents.

-

October 2024 – Fort Wayne Metals introduced a new processing technique to improve fatigue resistance in Nitinol wires used in structural heart devices.

-

August 2024 – Johnson Matthey announced its exit from non-core shape memory alloy business lines to focus on sustainable technologies, selling its SMA operations to a Japanese specialty metals firm.

Some of the prominent players in the shape memory alloys market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the shape memory alloys market

Product

- Nickel-titanium (Nitinol) Alloys

- Copper-Based Alloys

- Others

End Use

- Biomedical

- Automotive

- Aerospace & Defense

- Consumer Electronics & Household

- Others

Regional

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East & Africa