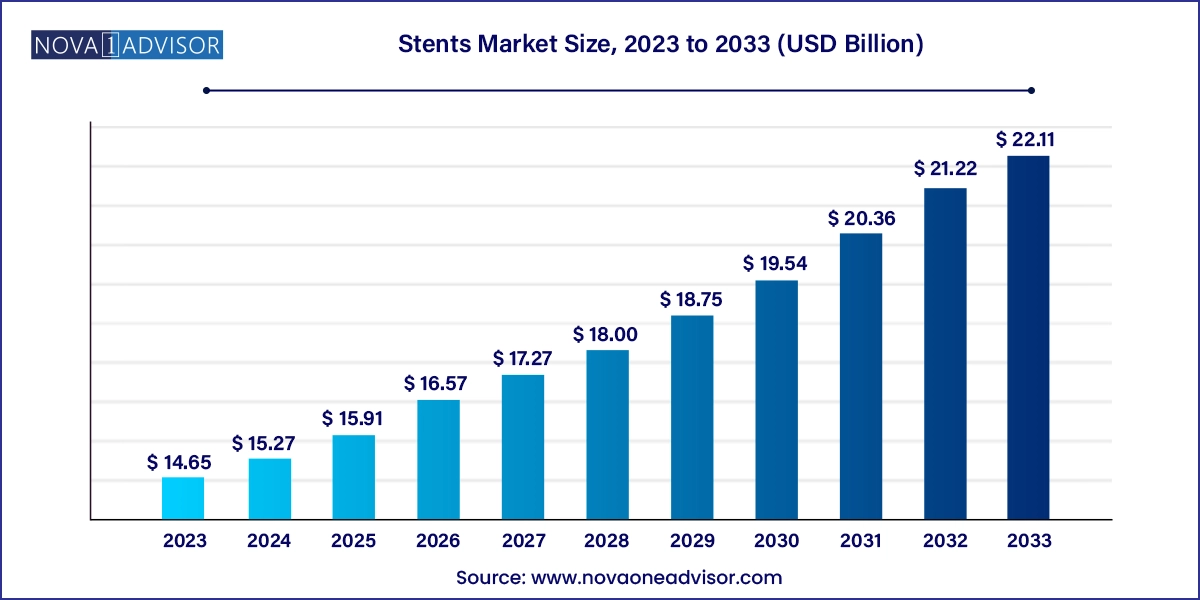

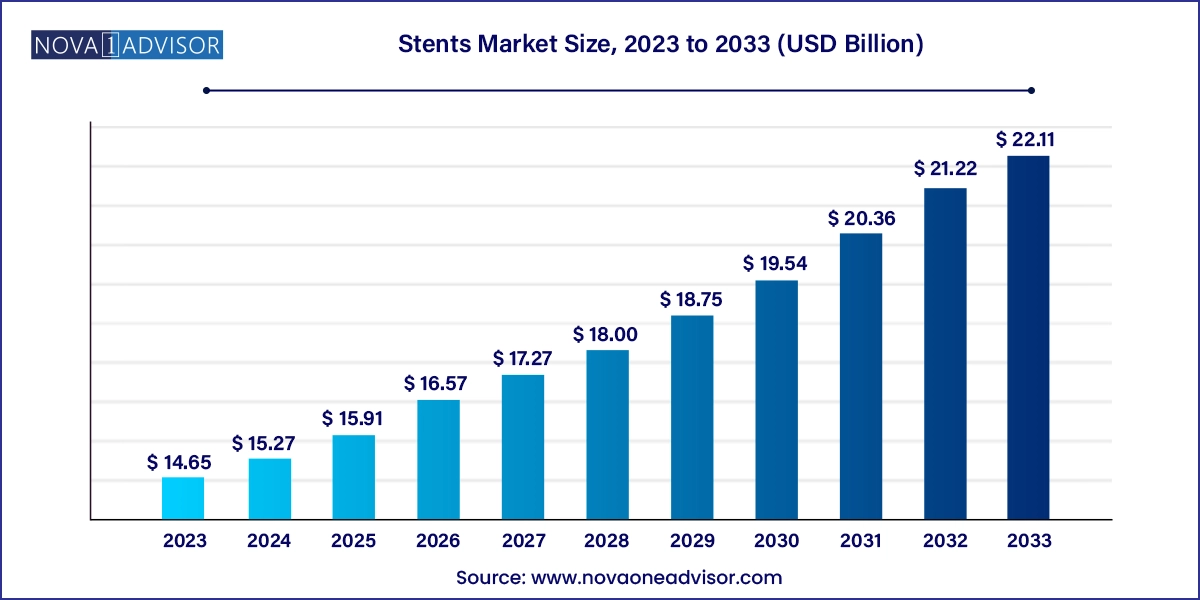

Stents Market Size and Growth

The stents market size was exhibited at USD 14.65 billion in 2023 and is projected to hit around USD 22.11 billion by 2033, growing at a CAGR of 4.2% during the forecast period 2024 to 2033.

Stents Market Key Takeaways

- The vascular stents segment, categorized by product, held the largest market share of 88.40% in 2023.

- The non-vascular stents segment is predicted to grow substantially during the forecast period.

- In 2023, metallic stents held the largest market share of 62.10%.

- The non-metallic stents segment is anticipated to witness significant growth in the market during the forecast period.

- The hospital segment dominated the market with a share of 74.24% in the year 2023.

- The ambulatory care centers segment is expected to grow at the fastest CAGR during the forecast period.

- In 2023, North America held the predominant position in the market with a share of 43.69%.

- The U.S. accounted for the largest share of the stents industry in North America in 2023.

Market Overview

The global stents market stands at the intersection of life-saving innovation and clinical necessity. Stents small mesh-like tubes implanted in the body are critical medical devices used to treat a wide array of conditions, primarily related to vascular blockages and organ constrictions. Their primary role is to restore or maintain patency in blood vessels or ducts by acting as a structural scaffold. The market for stents spans a vast array of medical applications, from coronary artery disease (CAD) and peripheral artery disease (PAD) to neurological disorders, biliary obstructions, and airway strictures.

Cardiovascular stents continue to form the backbone of this industry, largely driven by the global rise in lifestyle diseases such as atherosclerosis, diabetes, hypertension, and obesity, which elevate the risk of vascular complications. As per the WHO, cardiovascular diseases account for nearly 17.9 million deaths annually, most of which involve conditions amenable to stent-based intervention.

Simultaneously, stents have carved out significant roles in non-vascular domains. In gastrointestinal (GI) oncology, for example, biliary and esophageal stents are widely used to alleviate obstructions caused by tumors, improving patient quality of life. Similarly, urological and airway stents are increasingly utilized to relieve urinary and pulmonary obstructions respectively.

Technological advancements have redefined the landscape of stent design and performance. Modern iterations feature drug-eluting properties, bioresorbability, anti-migration coatings, and flexibility enhancements. Materials have evolved from bare metal to cobalt-chromium, nitinol, and even biodegradable polymers. Companies are now developing next-generation flow diverters and neurovascular stents that cater to the intricacies of cerebral circulation.

With expanding indications, increased procedural volumes, growing geriatric population, and a shift toward minimally invasive interventions, the stents market is poised for robust growth. However, challenges such as pricing pressures, product recalls, and regulatory hurdles remain key considerations for stakeholders.

Major Trends in the Market

-

Rise in Drug-Eluting and Bioresorbable Stents: Technological enhancements are leading to stents that combine mechanical support with drug delivery and even complete dissolution post-functionality.

-

Miniaturization and Precision in Neurovascular Stents: Cerebral aneurysm treatment is driving demand for highly flexible, flow-modulating stents.

-

Non-vascular Stents Gaining Popularity: Pulmonary, GI, and urological stents are seeing increased use in oncology and chronic disease management.

-

Increased Use in Ambulatory and Outpatient Settings: Growth of ambulatory surgical centers is reshaping stent procedure delivery models.

-

Emphasis on Biocompatibility and Anti-inflammatory Coatings: Material science innovations aim to reduce restenosis and thrombotic events.

-

Hybrid and Dual-Therapy Stents: Devices that combine drug-elution with endothelialization-promoting features are being developed.

-

Personalized and Image-Guided Stent Implantation: Use of 3D imaging and patient-specific vascular mapping is enhancing procedural accuracy.

Report Scope of Stents Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 15.27 Billion |

| Market Size by 2033 |

USD 22.11 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Material, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

| Key Companies Profiled |

Abbott Laboratories; B. Braun Melsungen AG; Biotronik SE & Co. KG; Biosensors International Group; Ltd.; Boston Scientific Corporation; Elixir Medical Corporation; Medtronic Plc; Meril Life Science; MicroPort Scientific Corporation; Stryker; Terumo Corporation; and W.L Gore & Associates; BD; CONMED Corporation |

Key Market Driver: Global Burden of Cardiovascular Diseases

A central driver of the global stents market is the rising prevalence of cardiovascular diseases (CVDs) particularly ischemic heart disease and peripheral artery disease. With unhealthy diets, sedentary lifestyles, smoking, and stress contributing to arterial plaque buildup, more people are requiring coronary revascularization procedures such as percutaneous coronary intervention (PCI), where stents are commonly deployed.

Advancements in interventional cardiology have made stenting a frontline therapy for managing acute myocardial infarctions (heart attacks), chronic stable angina, and restenotic lesions. Notably, in high-risk populations like diabetics, the use of drug-eluting stents (DES) has significantly reduced adverse events by minimizing in-stent restenosis.

Countries across Asia and Latin America are witnessing a rise in coronary disease burden. This epidemiological shift is driving both procedural volumes and investments in catheterization labs. Consequently, the demand for coronary stents continues to climb globally.

Key Market Restraint: Product Recalls and Safety Concerns

A major restraint hampering growth in the stents market is the incidence of product recalls due to performance failures or safety concerns. As stents are permanent or semi-permanent implants, any defect in design or manufacturing can lead to serious complications such as stent thrombosis, migration, vessel rupture, or restenosis.

Several leading companies have faced regulatory scrutiny or class I recalls—especially of drug-eluting or covered stents—due to delivery system malfunctions, coating defects, or incomplete expansion in vivo. In such scenarios, healthcare providers may opt for alternate treatment modalities, impacting sales and brand trust.

Additionally, in low- and middle-income regions, affordability and reimbursement limitations restrict access to newer-generation stents, especially when generic bare-metal options are still available. These factors collectively restrain full market penetration.

Key Market Opportunity: Growth of Non-Vascular Stent Applications

An emerging and lucrative opportunity lies in the expansion of non-vascular stents, particularly in gastrointestinal, pulmonary, and urological indications. For example, biliary stents are widely used in patients with pancreatic or bile duct cancers to relieve jaundice and improve digestive function. Similarly, esophageal stents provide palliative relief in obstructive esophageal cancer, while colonic stents offer non-surgical decompression in acute bowel obstructions.

Urological stents, like ureteral or prostatic stents, are gaining favor for managing benign prostatic hyperplasia (BPH) and urinary strictures in aging men. The increase in lung cancer and chronic obstructive pulmonary disease (COPD) cases globally has also led to growing demand for airway stents that can help maintain bronchial patency.

As cancer rates rise and palliative care becomes more advanced, non-vascular stents represent a high-margin, underpenetrated segment with room for technological innovation and geographic expansion.

Stents Market By Product Insights

Coronary stents dominated the product segment, accounting for the largest revenue share due to the widespread use of these devices in interventional cardiology. Within this category, drug-eluting stents (DES) are the standard of care for most PCI procedures due to their ability to significantly reduce restenosis rates compared to bare-metal stents. Companies like Abbott, Boston Scientific, and Medtronic have introduced multiple generations of DES that feature thinner struts, improved coatings, and controlled drug release profiles. The sheer volume of global coronary interventions—over 7 million annually—continues to sustain demand for advanced coronary stents.

Neurovascular stents are the fastest-growing product category, fueled by rising incidence of ischemic strokes and cerebral aneurysms. In particular, flow diverters and intracranial stents are revolutionizing treatment options for aneurysms that were previously considered inoperable. Devices such as the Pipeline Embolization Device or Wingspan Stent System offer targeted solutions for neurovascular pathologies with minimal invasiveness. As imaging and navigation technologies improve, and as clinical trials validate their efficacy, the neurovascular segment is witnessing significant traction in both developed and emerging markets.

Stents Market By Material Insights

Metallic stents dominate the material segment, owing to their mechanical strength, biocompatibility, and reliability in maintaining vessel patency. Stainless steel, cobalt-chromium, and nitinol are the most widely used metals due to their radiopacity, elasticity, and resistance to corrosion. Metallic stents remain indispensable in both vascular and non-vascular applications, particularly in complex anatomical areas that require structural support for extended periods.

Non-metallic stents especially bioresorbable ones are the fastest-growing material segment, reflecting a paradigm shift toward temporary scaffolding solutions. These stents dissolve within a few months to years after implantation, eliminating long-term complications associated with permanent implants. While early-generation bioresorbable stents faced performance setbacks, newer formulations made from polylactic acid (PLA) or magnesium-based polymers are showing promise in preclinical and early clinical trials. Non-metallic stents are especially attractive in younger patients and in indications where permanent implants are not ideal.

Stents Market By End-use Insights

Hospitals remain the dominant end-use setting for stent procedures due to the complexity and critical nature of vascular and neurovascular conditions. Most cardiac catheterizations, neurointerventions, and GI endoscopies involving stent placement occur in tertiary care hospitals that are equipped with advanced diagnostic, imaging, and surgical infrastructure. Hospitals also benefit from bulk procurement and collaborations with stent manufacturers for clinical trials and training programs.

Ambulatory care centers (ACCs) are the fastest-growing segment, particularly in the United States and parts of Europe. As minimally invasive procedures gain popularity, many stent-based interventions especially coronary angioplasty and ureteral stenting are being safely conducted in outpatient settings. Lower procedural costs, shorter recovery time, and favorable insurance reimbursements are driving this shift. Additionally, growing adoption of same-day discharge models for PCI is further promoting the use of stents in ambulatory centers.

Stents Market By Regional Insights

North America is the largest market for stents, underpinned by high healthcare spending, advanced hospital infrastructure, and a large patient pool with cardiovascular and metabolic disorders. The United States alone accounts for the highest number of coronary interventions globally. The region’s strong regulatory oversight via the FDA ensures safety and quality, encouraging widespread adoption of technologically advanced stents. Furthermore, favorable reimbursement policies for PCI, carotid stenting, and GI interventions support market expansion.

Asia Pacific is the fastest-growing region, driven by a rapidly aging population, increasing prevalence of chronic diseases, and improvements in healthcare infrastructure. Countries like China, India, and South Korea are witnessing a surge in interventional cardiology procedures. Local players are manufacturing cost-effective stents tailored to domestic needs, while global manufacturers are expanding partnerships and R&D in the region. Government-led initiatives to reduce treatment costs and improve rural access are also contributing to increased stent utilization.

Stents Market Recent Developments

-

Boston Scientific (March 2025): Launched its Synergy XD Bioabsorbable Polymer DES in Europe, designed for complex PCI procedures with improved deliverability and healing response.

-

Medtronic (February 2025): Received CE Mark approval for its Evolut FX Plus, an advanced stent-integrated transcatheter valve platform with enhanced coronary access features.

-

Abbott Laboratories (January 2025): Announced enrollment for a global trial evaluating its new Magmaris 2.0 Bioresorbable Scaffold, aimed at next-generation resorbable stenting solutions.

-

MicroPort Scientific (December 2024): Expanded its Firehawk DES to Latin American markets, targeting cost-effective PCI solutions in emerging economies.

-

Terumo Corporation (November 2024): Unveiled its Woven EndoBridge (WEB) Device for cerebral aneurysm treatment, combining stent and flow-diversion technologies.

Some of the prominent players in the Stents Market include:

- Abbott Laboratories

- B. Braun Melsungen AG

- Biotronik SE & Co. KG

- Biosensors International Group, Ltd.

- Boston Scientific Corporation

- Elixir Medical Corporation

- Medtronic Plc

- Meril Life Science

- MicroPort Scientific Corporation

- Stryker

- Terumo Corporation

- W.L Gore & Associates

- BD

- Conmed Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Stents Market

Product

-

- Coronary Stents

- Peripheral Stents

-

-

- Iliac Artery Stents

- Femoral Artery Stents

- Carotid Artery Stents

- Renal Artery Stents

- Other Peripheral Stents

-

-

- Intracranial Stents

- Flow Diverters

-

-

- Biliary

- Duodenal

- Colonic

- Pancreatic

- Esophageal Stents

-

- Pulmonary (Airway) Stents

-

-

- Silicone Airway

- Metallic Airway

- Urological Stents

- Others

Material

- Metallic Stents

- Non-metallic Stents

End-use

- Hospitals

- Ambulatory Care Centers (ACS)

- Specialty Clinics

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa