The global vaginal slings market size was exhibited at USD 1.90 billion in 2023 and is projected to hit around USD 2.99 billion by 2033, growing at a CAGR of 4.63% during the forecast period of 2024 to 2033.

Key Takeaways:

- Europe dominated the market with a revenue share of 46.0% in 2023.

- The transobturator slings segment dominated the global market with a revenue share of 38.2% in 2023.

- The midurethral sling segment dominated the global market in 2023 with a revenue share of 79.7%.

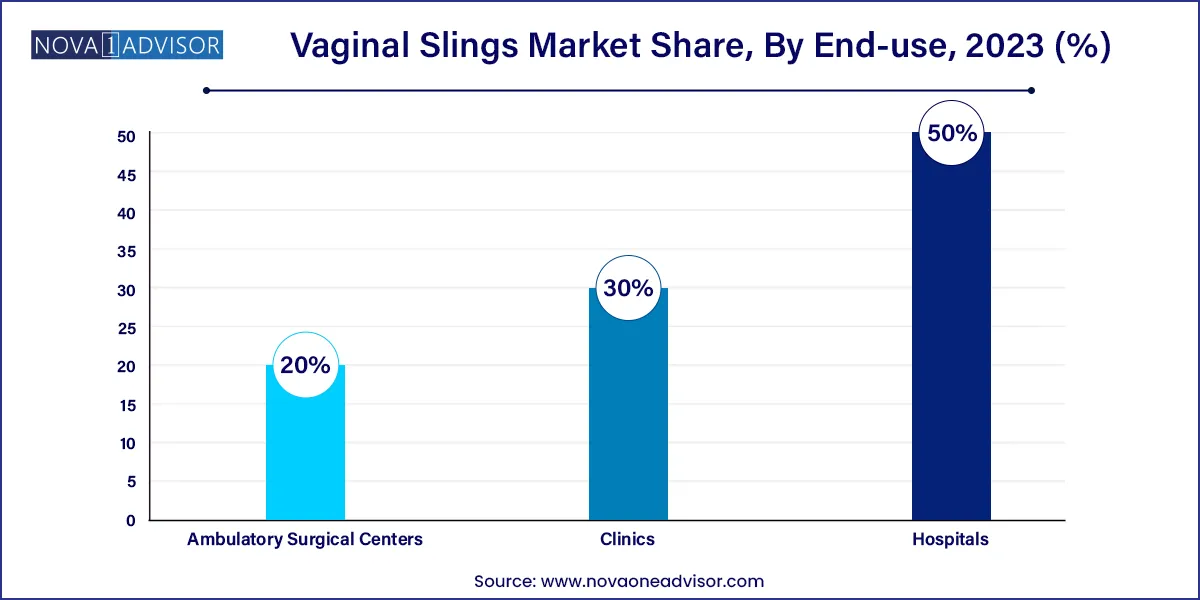

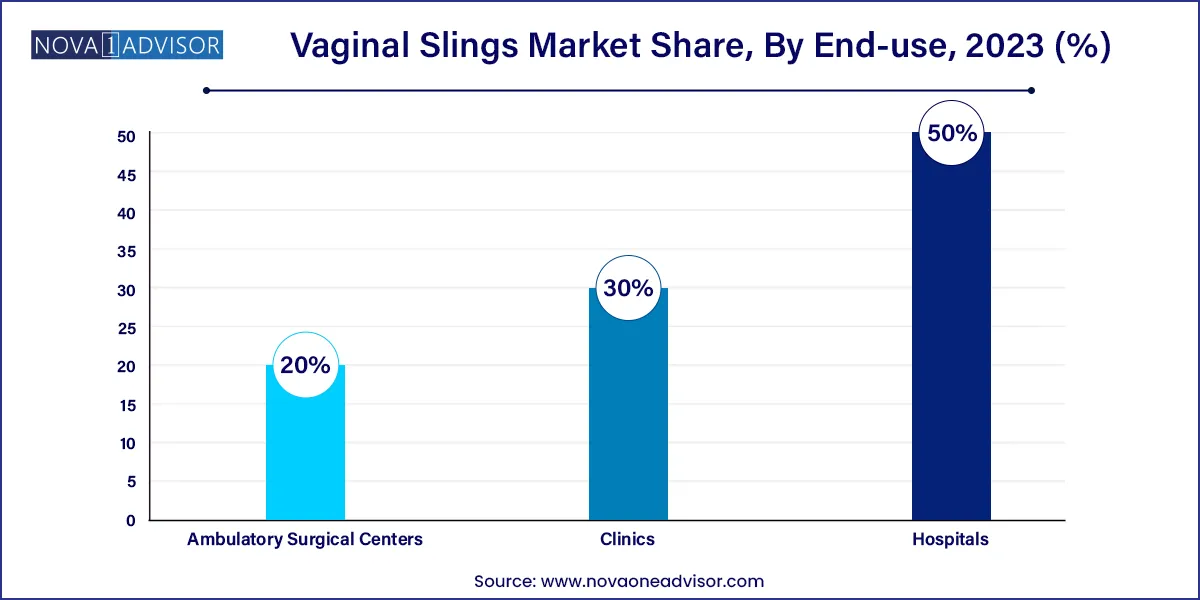

- The hospitals segment held the largest revenue share of 50.0% in 2023.

Market Overview

The Global Vaginal Slings Market is a vital segment within the broader urogynecological devices industry, serving a growing patient population primarily affected by stress urinary incontinence (SUI)—a condition marked by involuntary urine leakage during activities that increase intra-abdominal pressure such as coughing, laughing, or lifting. Vaginal slings, including both synthetic and biologic materials, are surgically implanted to support the urethra and prevent urinary leakage.

This market has been driven by both medical necessity and demographic shifts. SUI affects over 200 million individuals worldwide, the majority of whom are women. The incidence increases significantly with age, childbirth, pelvic surgeries, and menopause. Vaginal sling procedures have emerged as the gold standard for treating moderate to severe SUI, offering a minimally invasive solution with high success and patient satisfaction rates.

The last decade has seen tremendous evolution in sling design, material safety, and surgical techniques. Midurethral slings (MUS), especially tension-free types like Transobturator Tape (TOT) and Tension-Free Vaginal Tape (TVT), are now preferred over more invasive procedures due to their quicker recovery, outpatient feasibility, and low complication rates. Furthermore, ongoing innovations in mini-slings are broadening procedural choices for both surgeons and patients.

As healthcare systems shift towards minimally invasive and outpatient care models, and awareness of pelvic floor disorders increases globally, the vaginal slings market is poised for sustained growth. Regulatory scrutiny, device recalls, and patient advocacy movements have also led to more stringent safety protocols and robust clinical validation, making today’s slings safer and more effective than their predecessors.

Major Trends in the Market

-

Rising preference for minimally invasive procedures: Surgeons and patients alike favor TVT and TOT slings due to quicker recovery, reduced hospitalization, and fewer complications.

-

Increased adoption of mini-slings: These newer, single-incision devices offer potential benefits in operative time, comfort, and postoperative outcomes.

-

Growing awareness of pelvic floor health: Education campaigns and better diagnosis are leading to earlier intervention and increased treatment-seeking behavior.

-

Shift to outpatient and ambulatory surgical centers (ASCs): Procedures are increasingly conducted in ASCs due to lower costs and improved surgical efficiency.

-

Focus on biocompatible and non-mesh materials: Following litigation and safety concerns, research is expanding into slings made from biologics and absorbable synthetics.

-

Elderly population growth: An aging global population drives demand, as urinary incontinence is highly prevalent among women over 60.

-

Technological advancements in sling kits: Integrated kits with needles, mesh, and anchors are streamlining surgical workflow and improving precision.

-

Regulatory and legal scrutiny: Class-action lawsuits and FDA advisories have reshaped the competitive landscape and increased emphasis on clinical data.

Vaginal Slings Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.90 Billion |

| Market Size by 2033 |

USD 2.99 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.63% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Boston Scientific Corporation; Coloplast Corp; Promedon S.A.; A.M.I. GmbH; Johnson & Johnson Services Inc.; Betatech Medical; Caldera Medical; Neomedic International; Cousin Surgery; Lotus Surgicals; UroCure. |

Key Market Driver: Rising Prevalence of Stress Urinary Incontinence in Aging and Postpartum Women

A primary market driver is the high and growing prevalence of stress urinary incontinence (SUI), particularly in aging, postpartum, and post-menopausal women. SUI occurs when weakened pelvic floor muscles are unable to properly support the urethra, resulting in leakage during physical activities. The condition severely impacts quality of life, causing emotional distress, social withdrawal, and loss of independence.

In the U.S. alone, SUI affects up to 35% of adult women, while the rates in Europe and Asia-Pacific are climbing due to lifestyle factors and longevity. Importantly, women often delay seeking treatment due to stigma, lack of awareness, or misconceptions about aging. However, growing public health campaigns and digital platforms are changing this trend, leading more women to pursue effective surgical interventions such as vaginal slings.

With midurethral sling procedures demonstrating 80–90% success rates and proven long-term durability, the market continues to benefit from strong clinical confidence and adoption among gynecologists and urologists worldwide.

Key Market Restraint: Legal Challenges and Safety Concerns Around Mesh-Based Implants

Despite procedural efficacy, the vaginal slings market has faced considerable restraint due to mesh-related litigation, regulatory warnings, and adverse events. The most notable instance was the U.S. FDA’s 2019 reclassification of transvaginal mesh used for pelvic organ prolapse (POP) as high-risk, leading to the withdrawal of several mesh devices from the market. Although this ruling did not apply to slings used for SUI, public confusion and media coverage adversely affected perception of all pelvic implants.

Numerous lawsuits alleging complications such as erosion, pain, infection, and organ perforation have led to significant settlements by manufacturers. This legal environment has increased compliance costs and made surgeons more cautious about recommending sling procedures. Regulatory agencies in Europe, Australia, and Canada have also issued safety guidelines, which, while well-intentioned, have slowed market momentum.

As a result, companies must now demonstrate greater transparency, post-market surveillance, and extensive clinical data to gain provider and patient trust—factors that, while necessary, may restrict short-term growth.

Key Market Opportunity: Expansion of Ambulatory Surgical Centers and Office-Based Procedures

A promising opportunity lies in the increasing use of ambulatory surgical centers (ASCs) and office-based settings for vaginal sling implantation, driven by advancements in anesthesia, surgical technique, and patient demand for same-day discharge. These environments offer lower costs, shorter wait times, and reduced risk of hospital-acquired infections—making them ideal for treating benign conditions like SUI.

Healthcare payers and governments are also incentivizing outpatient surgery to reduce systemic costs. The expansion of ASCs, especially in North America and Western Europe, provides a high-throughput, cost-efficient model for vaginal sling procedures. Moreover, mini-slings and tension-free systems designed for shorter, less invasive operations are well suited for these settings.

Device manufacturers can capitalize on this trend by developing streamlined surgical kits and offering training programs tailored to outpatient environments. As the shift to ambulatory care accelerates, the vaginal slings market is well positioned to benefit from this structural transformation in global healthcare delivery.

Segments Insights:

Product Insights

Tension-Free Vaginal Tape (TVT) slings dominated the market in 2024. As the gold standard in treating SUI for over two decades, TVT slings provide strong urethral support without the need for tension adjustment. Introduced in the late 1990s, TVT devices have consistently delivered high success rates, minimal invasiveness, and durability across age groups. Their broad clinical adoption and extensive evidence base continue to make them the first-line choice in most surgical guidelines globally. Devices such as Ethicon’s GYNECARE TVT remain mainstays in hospitals and clinics worldwide.

Mini-slings are the fastest-growing product category. These are single-incision devices offering reduced operative time, faster recovery, and minimal postoperative discomfort. Especially popular in outpatient and ASC settings, mini-slings have gained traction among younger and elderly patients alike. Their ease of use and comparable efficacy in select patient groups make them appealing to both novice and experienced surgeons. Ongoing trials evaluating long-term outcomes and complication rates will further support their rapid adoption across diverse geographies.

Type Insights

Midurethral slings held the majority market share by type. These slings, placed at the mid-urethral position using retropubic or transobturator approaches, provide effective treatment for SUI with lower morbidity than traditional bladder neck slings. They represent the standard of care globally and are endorsed by organizations such as the American Urological Association (AUA) and the International Urogynecological Association (IUGA). Their long-term effectiveness, short recovery time, and consistent outcomes reinforce their dominance.

Traditional slings are witnessing slower but steady use. Often reserved for complex or recurrent cases, traditional slings require more extensive dissection and hospitalization. However, they are valuable in patients with intrinsic sphincter deficiency or those who have failed midurethral sling therapy. Their role remains relevant in academic centers and high-risk patient populations despite declining volume compared to modern techniques.

End Use Insights

Hospitals remained the largest end-user segment. Due to the complexity of sling procedures and patient comorbidities, most surgeries are still performed in hospitals equipped with advanced imaging, trained urologists, and postoperative monitoring. Hospitals also serve as centers for research and education, conducting high volumes of pelvic reconstructive surgeries and sling trials. Their centralized infrastructure ensures optimal care for both routine and complicated cases.

Ambulatory Surgical Centers (ASCs) are the fastest-growing end-use setting. Outpatient care models align well with the minimally invasive nature of vaginal sling procedures. ASCs offer competitive pricing, faster scheduling, and patient convenience, making them attractive for elective surgeries like sling implantation. With healthcare policy increasingly favoring value-based care, ASCs are expected to account for a growing share of procedural volume in the next 5–10 years.

Regional Insights

North America led the global vaginal slings market in 2024. The U.S. accounts for the largest share due to advanced healthcare infrastructure, high awareness levels, and early adoption of innovative surgical techniques. Reimbursement systems under Medicare and private insurers support sling procedures, particularly midurethral options. Moreover, the presence of leading players such as Boston Scientific and Coloplast, along with extensive physician training programs, facilitates clinical adoption.

Despite previous legal challenges, the region continues to be a key hub for research and development, with numerous ongoing trials for new sling types and materials. Increasing demand for outpatient procedures and the growth of ASCs further reinforce North America’s dominant position in the global landscape.

Asia-Pacific is projected to be the fastest-growing market. Rising healthcare expenditure, improved women’s health awareness, and expanding access to urogynecological care are driving demand in countries like China, India, Japan, and South Korea. Cultural stigma around urinary incontinence is slowly diminishing due to public health campaigns and media education, encouraging more women to seek treatment.

Government investments in maternal and elderly health, along with the growth of private hospitals and minimally invasive surgery capabilities, are accelerating sling adoption. Additionally, domestic manufacturers are entering the market with cost-effective products tailored to regional needs. As infrastructure and physician expertise continue to mature, Asia-Pacific is poised to become a key engine of growth in the vaginal slings industry.

Some of the prominent players in the vaginal slings market include:

- Boston Scientific Corporation

- Coloplast Corp

- Promedon S.A.

- A.M.I. GmbH

- Johnson & Johnson Services, Inc.

- Betatech Medical

- Caldera Medical

- Neomedic International

- Cousin Surgery

- Lotus Surgicals

- UroCure

Recent Developments

-

Boston Scientific (January 2025): Announced expanded availability of its Solyx™ Single-Incision Sling System across Europe, positioning it as a leading solution for outpatient settings.

-

Coloplast (February 2025): Released new clinical data on Altis® Single-Incision Sling, showing improved 5-year continence rates and low erosion risk, presented at the International Urogynecological Association annual meeting.

-

Caldera Medical (December 2024): Secured FDA clearance for its Desara® TVS sling system with a redesigned ergonomic handle to enhance surgical control and reduce operative time.

-

Promedon (March 2025): Launched the Surgimesh™ Mini Sling System in select Latin American countries, emphasizing affordable options with comparable efficacy for emerging markets.

-

Betatech Medical (April 2024): Expanded its sling production capacity in Turkey to meet growing demand in Middle Eastern and Central Asian countries, with a focus on public sector tenders.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2033. For this study, Nova one advisor, Inc. has segmented the global vaginal slings market.

Product

- Tension-Free Vaginal Tape Slings

- Transobturator Slings

- Mini-Slings

Type

- Midurethral Sling

- Traditional Sling

End Use

- Hospitals

- Clinics

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)