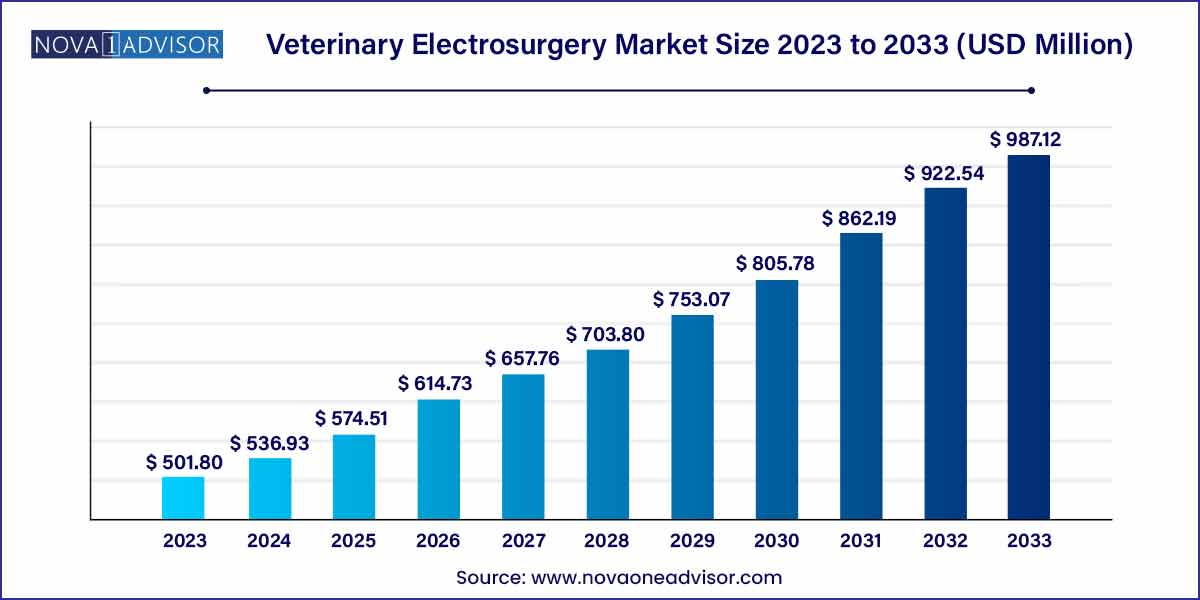

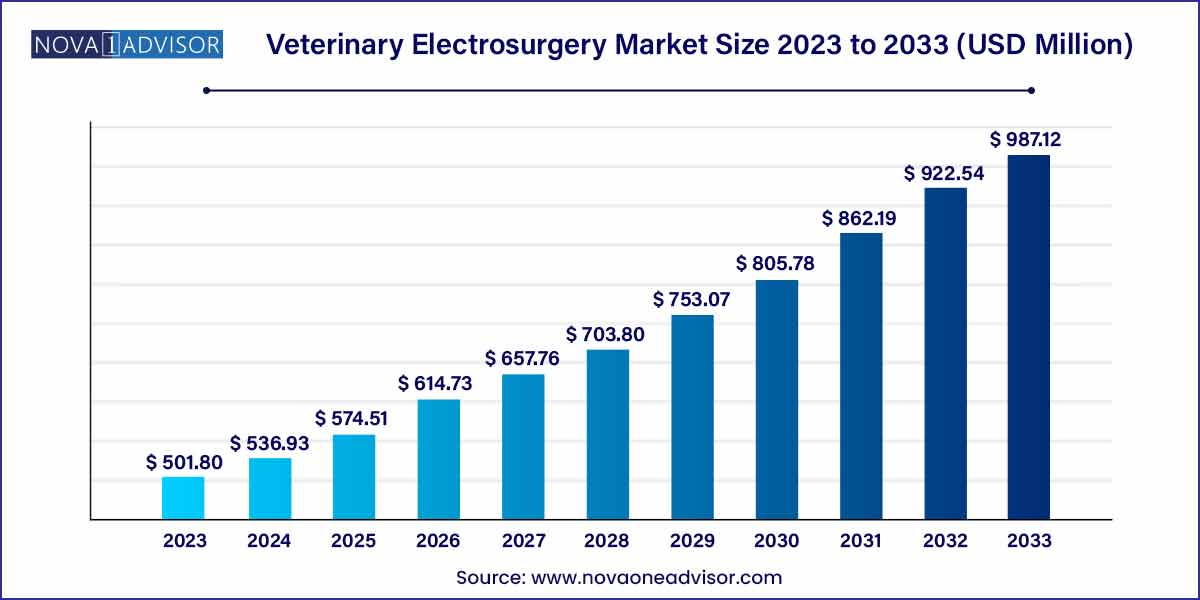

The global veterinary electrosurgery market size was exhibited at USD 501.80 million in 2023 and is projected to hit around USD 987.12 million by 2033, growing at a CAGR of 7.0% during the forecast period of 2024 to 2033.

Key Takeaways:

- The bipolar electrosurgery instruments segment dominated the market for veterinary electrosurgery and held the largest revenue share of over 43.0% in 2023.

- The small animals segment dominated the market for veterinary electrosurgery and held the largest revenue share of over 64.0% in 2023.

- The general surgery segment dominated the market and held the dominant share of over 25.0% in 2023.

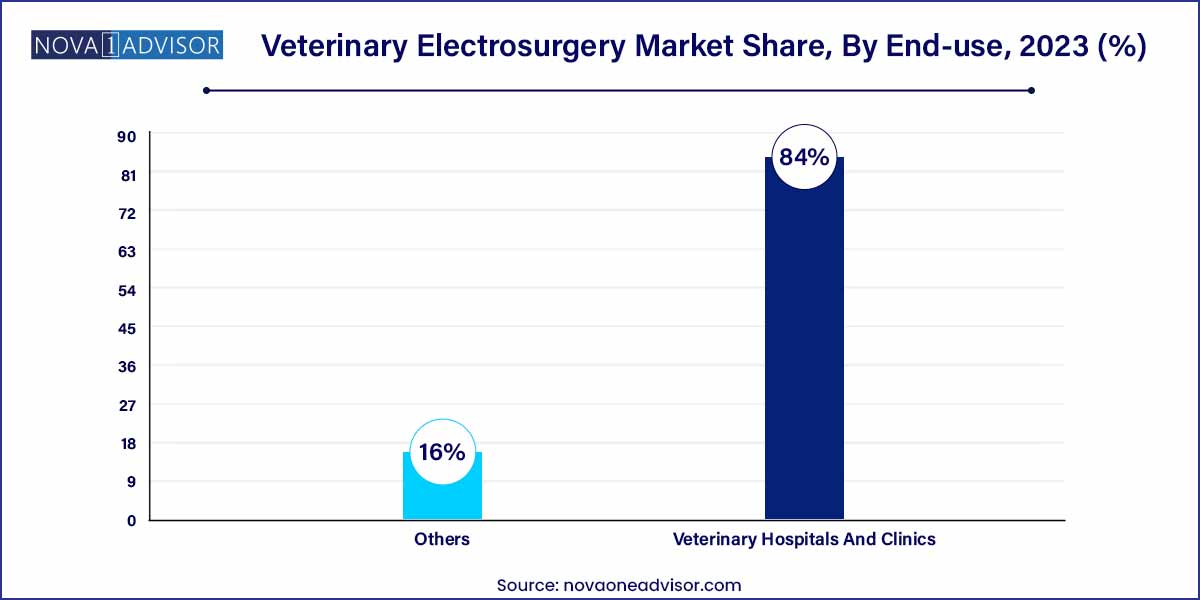

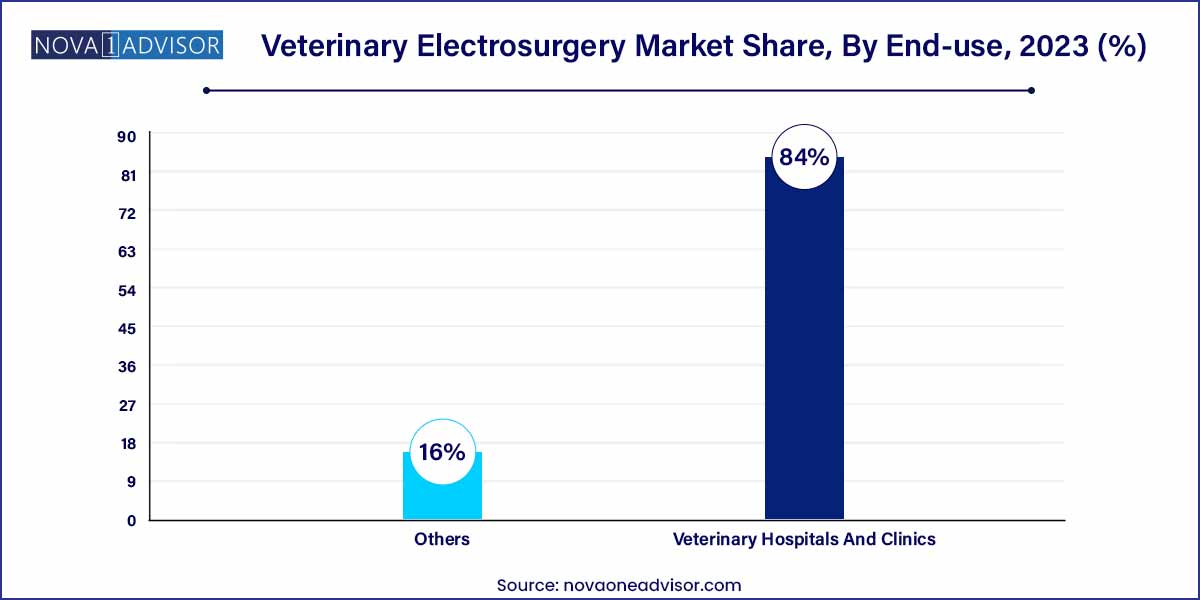

- The veterinary hospitals and clinics segment held the largest revenue share of over 84.0% in 2023.

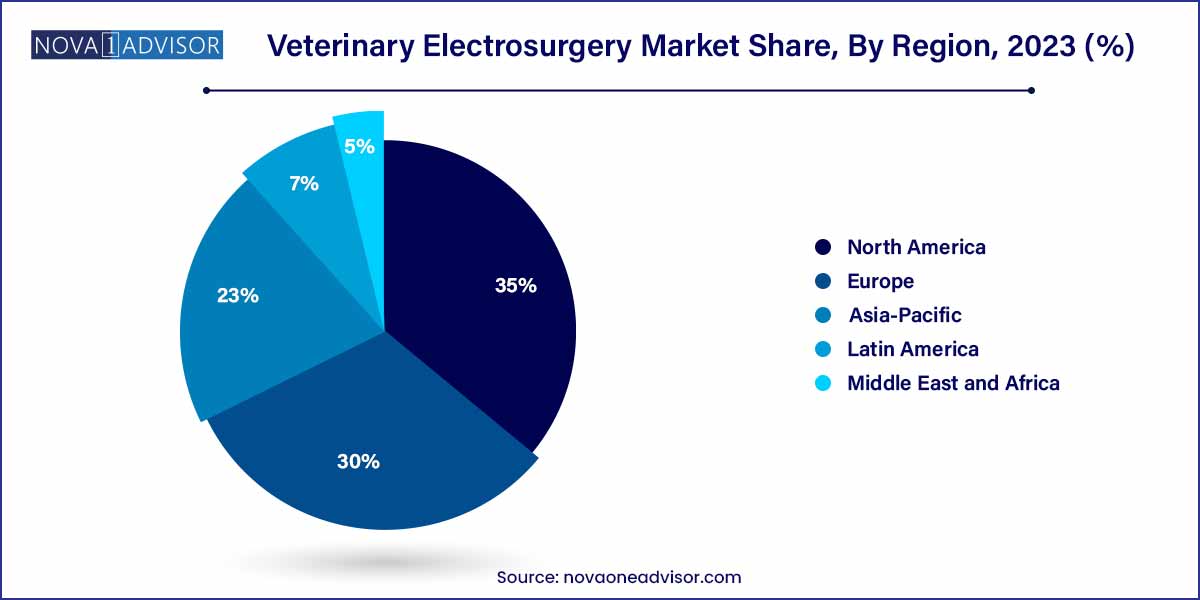

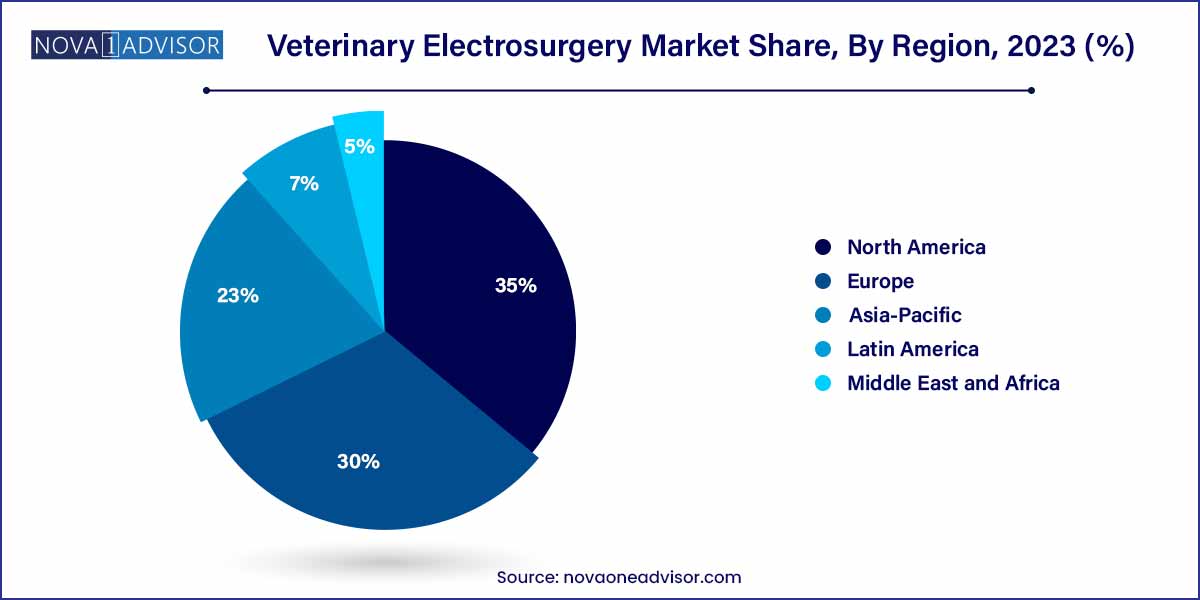

- North America dominated the market and accounted for the largest market share of over 35.0% in 2023.

Market Overview

The global Veterinary Electrosurgery Market is experiencing significant growth, fueled by the rising demand for advanced surgical procedures in veterinary care. Electrosurgery, which uses high-frequency electrical currents to cut tissue and coagulate blood, has become an essential tool in veterinary medicine, offering precision, efficiency, and minimized bleeding during surgical interventions.

As pet ownership continues to increase globally, accompanied by growing awareness of pet health and wellness, demand for sophisticated veterinary services is surging. Electrosurgical techniques are widely used across various veterinary applications, including general surgery, dental procedures, orthopedic operations, gynecological interventions, and urological surgeries. This market is also driven by technological innovations, an increasing focus on minimally invasive surgical techniques, and the expanding network of veterinary hospitals and clinics.

Moreover, the increasing economic importance of livestock in agricultural economies has heightened demand for advanced veterinary care for large animals. Veterinary electrosurgery not only improves surgical outcomes but also reduces postoperative complications, recovery times, and healthcare costs, making it an attractive investment for veterinary practices worldwide.

Major Trends in the Market

-

Increasing Demand for Minimally Invasive Veterinary Surgeries: Pet owners prefer surgical methods that offer quicker recovery and reduced complications.

-

Technological Innovations in Electrosurgery Devices: Introduction of portable, wireless, and smart electrosurgery systems.

-

Growing Focus on Dental Electrosurgery: Rising prevalence of dental diseases in pets is boosting dental electrosurgery procedures.

-

Surge in Veterinary Specialty Clinics: Expansion of specialized veterinary clinics dedicated to surgery and orthopedics.

-

Integration of Bipolar and Monopolar Modalities: Devices offering dual functionalities for greater surgical versatility are gaining traction.

-

Increased Veterinary Education and Training: Surgeons are increasingly trained in advanced electrosurgical techniques.

-

Rise in Pet Insurance Coverage: Increased insurance penetration is supporting higher expenditure on veterinary surgeries.

-

Expansion into Emerging Markets: Growth opportunities in Asia-Pacific and Latin America due to increasing pet ownership and improved veterinary infrastructure.

Veterinary Electrosurgery Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 501.80 Million |

| Market Size by 2033 |

USD 987.12 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 7.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Animal Type, Application, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Symmetry Surgical Inc.; KARL STORZ; DRE Veterinary; B. Braun Melsungen AG; Medtronic; Summit Hill Laboratories; Kwanza Veterinary; Burtons Medical Equipment Ltd.; EICKEMEYER; Macan Manufacturing. |

Driver: Rising Pet Ownership and Expenditure on Animal Healthcare

A primary driver fueling the Veterinary Electrosurgery Market is the rising rate of pet ownership and the corresponding increase in expenditure on animal healthcare. Pets are increasingly considered family members, leading owners to seek advanced medical treatments that were once reserved for human healthcare.

According to the American Pet Products Association (APPA), U.S. pet industry expenditures exceeded $136 billion in 2024, with veterinary care representing a significant portion. Similar trends are observed globally, with countries like China, Brazil, and India witnessing rapid growth in companion animal adoption. This surge is translating into higher demand for sophisticated surgical interventions, where electrosurgery is highly favored for its precision, safety, and efficiency.

Restraint: High Cost of Advanced Electrosurgical Devices

One notable restraint in the Veterinary Electrosurgery Market is the high cost associated with advanced electrosurgical units (ESUs). State-of-the-art bipolar and monopolar systems with integrated safety features, touchscreen interfaces, and multiple modalities can be expensive, especially for small to medium-sized veterinary practices.

In addition to initial purchase costs, expenses related to maintenance, training, and the need for compatible accessories further elevate operational costs. Limited budgets in certain regions, particularly among independent veterinarians and rural practices, can hinder the adoption of cutting-edge electrosurgical technologies, restraining market growth to some extent.

Opportunity: Technological Advancements in Portable and User-friendly Devices

An exciting opportunity within the Veterinary Electrosurgery Market lies in the development of portable, compact, and user-friendly electrosurgical devices. Manufacturers are investing in technologies that enhance mobility, ease of use, and safety for veterinary surgeons.

Portable electrosurgical units equipped with battery power, intuitive interfaces, customizable settings, and automated safety features are increasingly in demand, especially in mobile veterinary practices and rural clinics. These innovations allow veterinarians to deliver high-quality surgical care outside traditional hospital settings, expanding the reach of veterinary electrosurgery.

Product Insights

Monopolar Electrosurgery Instruments dominated the Veterinary Electrosurgery Market in 2024. These instruments are widely utilized for their versatility in cutting, coagulating, desiccating, and fulgurating tissue across a broad range of surgical procedures. Their ability to efficiently manage both small and large tissue areas makes them indispensable in general veterinary surgery.

Conversely, Bipolar Electrosurgery Instruments are expected to witness the fastest growth during the forecast period. Bipolar devices offer greater precision and localized tissue effects, minimizing collateral damage and reducing the risk of thermal injury. This advantage is critical in delicate surgeries such as ophthalmic, neurological, and specific orthopedic procedures, making bipolar electrosurgery increasingly popular among specialized veterinary surgeons.

Animal Type Insights

Small Animals accounted for the largest market share in 2023. With rising pet ownership of dogs, cats, and exotic small mammals, there is growing demand for surgical interventions tailored to small animal anatomy. Veterinary clinics focusing on companion animal care represent a significant consumer base for electrosurgical devices.

Large Animals, including livestock and equines, represent the fastest-growing segment. Agricultural modernization, increased focus on animal health in livestock management, and the economic importance of horses in sports and leisure activities are fueling demand for advanced surgical care, including electrosurgical solutions for large animals.

Application Insights

General Surgery dominated the Veterinary Electrosurgery Market by application in 2023. Electrosurgical techniques are extensively used in procedures such as tumor removal, wound management, spaying/neutering, and mass excision due to their ability to control bleeding and reduce surgery time.

Meanwhile, Dental Surgery is projected to experience the fastest growth. Dental health issues in pets, such as periodontal disease, are increasingly diagnosed and treated through specialized dental surgeries that leverage electrosurgical technologies for precision and reduced trauma.

End-use Insights

Veterinary Hospitals and Clinics held the dominant share in 2023. These facilities possess the necessary infrastructure, surgical teams, and financial capacity to invest in advanced electrosurgical units, ensuring high standards of care.

"Others," including mobile veterinary practices and academic veterinary institutes, are forecasted to grow rapidly. Mobile clinics, in particular, benefit from portable electrosurgical systems that enable them to perform complex procedures outside traditional hospital settings, expanding access to veterinary surgical services.

Regional Insights

North America led the Veterinary Electrosurgery Market in 2023, primarily driven by high pet ownership rates, well-established veterinary healthcare infrastructure, strong insurance coverage, and the presence of key market players. The United States, in particular, has a mature veterinary services market with a strong emphasis on adopting cutting-edge surgical technologies.

Continuous investments in veterinary education, availability of advanced surgical facilities, and increasing awareness regarding preventive pet healthcare further bolster market growth in the region.

Asia-Pacific is expected to register the fastest growth over the forecast period. Rising disposable incomes, growing urbanization, increasing pet adoption, and government initiatives promoting animal welfare are driving demand for advanced veterinary care in countries like China, India, Australia, and Japan.

Furthermore, improvements in veterinary education, expansion of private veterinary hospitals, and the establishment of global veterinary brands in emerging markets are accelerating the adoption of veterinary electrosurgery devices across the Asia-Pacific region.

Some of the prominent players in the Veterinary electrosurgery market include:

- Symmetry Surgical Inc.

- KARL STORZ

- DRE Veterinary

- B. Braun Melsungen AG

- Medtronic

- Summit Hill Laboratories

- Kwanza Veterinary

- Burtons Medical Equipment Ltd.

- EICKEMEYER

- Macan Manufacturing

Recent Developments

-

March 2025: B. Braun Vet Care GmbH launched a new line of ergonomic bipolar electrosurgery handpieces designed specifically for small animal surgeries.

-

February 2025: Eickemeyer Veterinary Equipment announced the release of the "Eicktronic VetSurg ESU," a compact, high-frequency electrosurgery unit optimized for mobile veterinary clinics.

-

January 2025: Medtronic's veterinary division introduced enhanced safety features in its "Valleylab LigaSure Veterinary Platform," offering improved vessel sealing capabilities for large and small animal surgeries.

-

November 2024: Kwanza Veterinary announced strategic distribution partnerships across Southeast Asia to introduce affordable electrosurgery solutions for emerging veterinary markets.

-

September 2024: Symmetry Surgical expanded its animal health division, releasing new veterinary-specific accessories and consumables compatible with existing electrosurgical generators.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global veterinary electrosurgery market.

Product

- Bipolar Electrosurgery Instruments

- Monopolar Electrosurgery Instruments

- Consumables & Accessories

Animal Type

- Small Animal

- Large Animal

Application

- General Surgery

- Dental Surgery

- Gynecological & Urological Surgery

- Orthopedic Surgery

- Others

End-use

- Veterinary Hospitals And Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)