GLP-1 Targeted Peptide Weight Loss Drugs Market Size and Growth 2025 to 2034

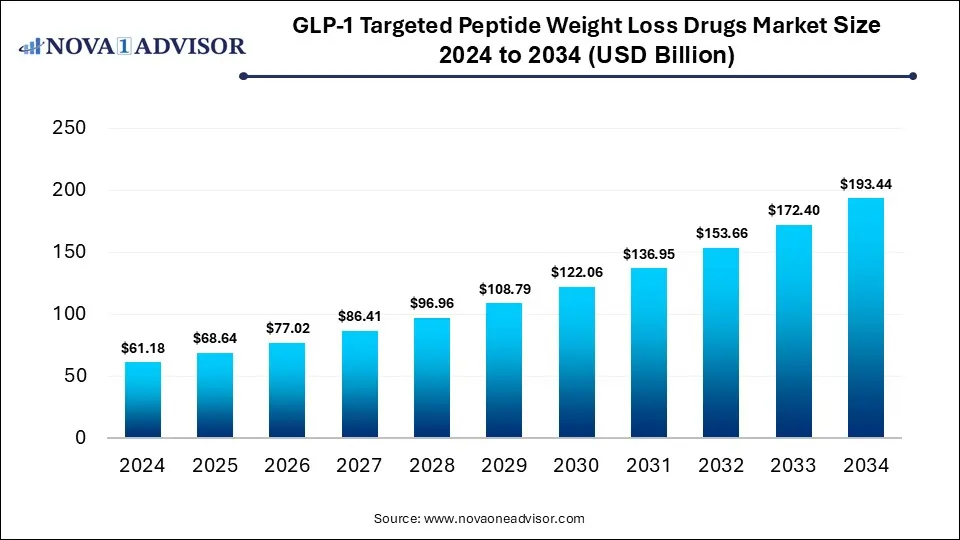

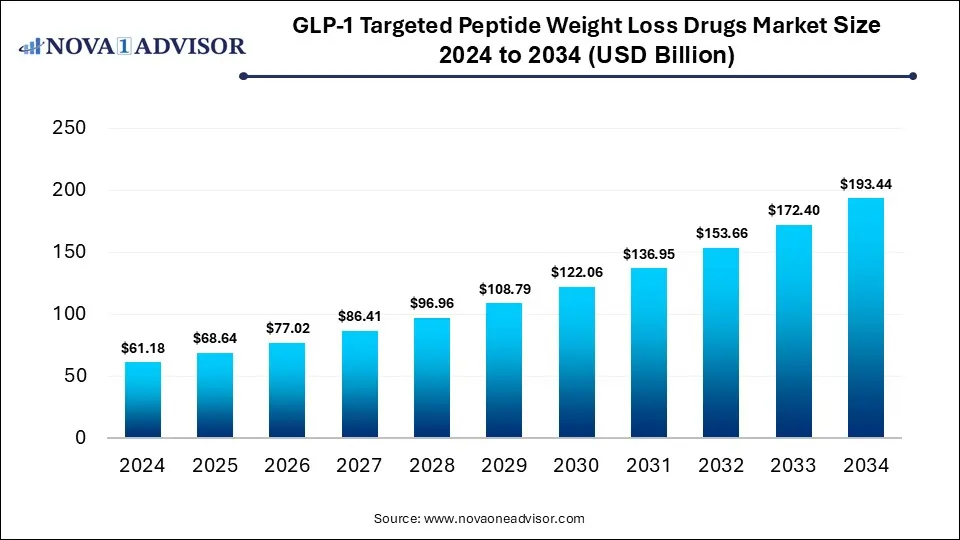

The global GLP-1 targeted peptide weight loss drugs market size was calculated at USD 61.18 billion in 2024 and is expected to reach USD 193.44 billion by 2034, expanding at a CAGR of 12.2% between 2025 and 2034. The growth of the market is driven by rising obesity rates, increasing demand for effective anti-obesity therapies, and expanding clinical approvals.

GLP-1 Targeted Peptide Weight Loss Drugs Market Key Takeaways

- By region, North America held the largest share of the GLP-1 targeted peptide weight loss drugs market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By drug, the Semaglutide segment led the market with the largest share in 2024.

- By drug, the Tirzepatide (Zepbound) segment is likely to grow at the fastest rate in the upcoming period.

- By route of administration, the injectable segment dominated the market in 2024.

- By route of administration, the oral segment is expected to expand at the fastest CAGR over the projection period.

- By distribution channel, the retail pharmacies segment led the market in 2024.

- By distribution channel, the online pharmacies segment is expected to expand at the highest CAGR in the upcoming period.

- By dosage strength, the high dose segment dominated the market in 2024.

- By dosage strength, the low dose segment is expected to grow at a significant rate over the forecast period.

- By end user, the hospitals segment contributed the largest market share in 2024.

- By end user, the clinics segment is likely to grow at a rapid pace in the coming years.

- By therapy line, the first line segment continues to dominate the market between 2025 and 2034.

- By patient age group, the adults segment led the market in 2024.

- By patient age group, the adolescents segment is expected to grow at the fastest rate during the projection period.

- By BMI category, the class III segment dominated the market in 2024.

- By BMI category, the class II segment is likely to register significant growth in the upcoming period.

Impact of AI on the GLP-1 Targeted Peptide Weight Loss Drugs Market

AI is significantly impacting the GLP-1 targeted peptide weight loss drugs market by accelerating drug discovery, optimizing clinical trials, and enhancing personalized treatment approaches. Machine learning models are being used to identify novel GLP-1 analogs with improved efficacy and safety profiles, reducing the time and cost of R&D. In clinical development, AI is helping to predict patient responses, streamline trial design, and identify optimal dosing strategies. Additionally, AI-driven analytics are improving patient monitoring and adherence, especially in digital health platforms that support GLP-1 therapy management. These advancements are collectively driving innovation, efficiency, and patient outcomes in the market.

Market Overview

The GLP-1 targeted peptide weight loss drugs market refers to the segment of pharmaceuticals that utilize glucagon-like peptide-1 (GLP-1) receptor agonists to promote weight loss and improve metabolic health. These drugs, such as Semaglutide and Tirzepatide, mimic natural hormones that regulate appetite, insulin secretion, and glucose metabolism, offering effective and sustained weight reduction. Key advantages include their dual benefit for both weight loss and type 2 diabetes management, along with favorable cardiovascular outcomes. The market growth is driven by the rising global prevalence of obesity, increased awareness of medical weight management solutions, and strong clinical outcomes supporting early adoption. Additionally, technological advancements in drug delivery and expanding indications for younger populations are contributing to market expansion.

What are the Major Trends in the GLP-1 Targeted Peptide Weight Loss Drugs Market?

- Rising Demand for Dual and Multi-Agonist Therapies: There is increasing interest in drugs like Tirzepatide, which act on both GLP-1 and GIP receptors, offering enhanced weight loss and metabolic control. These combination therapies are setting new efficacy standards and expanding treatment possibilities beyond single-agonist drugs.

- Shift Toward Oral GLP-1 Formulations: Oral versions of GLP-1 drugs, such as oral Semaglutide, are gaining attention for improving patient compliance and accessibility. This trend is especially important for needle-averse populations and regions with limited access to injectable care.

- Expansion into Younger and Pre-Obese Populations: Pharmaceutical companies are increasingly targeting adolescents and patients with lower BMI thresholds, driven by early intervention strategies. Clinical trials and regulatory changes are paving the way for the use of GLP-1 drugs in younger, at-risk populations.

- Integration of Digital Health and AI: AI and digital platforms are being integrated into treatment plans for monitoring patient adherence, predicting responses, and personalizing therapy. This tech-driven approach is improving real-world outcomes and enabling more efficient healthcare delivery.

- Increased Focus on Long-Term Outcomes and Cardiometabolic Benefits: There is a growing emphasis on the cardiovascular and metabolic benefits of GLP-1 therapies beyond weight loss, supported by large-scale outcome trials. This is encouraging broader adoption among patients with obesity-related comorbidities such as type 2 diabetes and heart disease.

Report Scope of GLP-1 Targeted Peptide Weight Loss Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 68.64 Billion |

| Market Size by 2034 |

USD 193.44 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Drug, By Route of Administration, By Distribution Channel, By Dosage Strength, By End User, By Therapy Line, By Patient Age Group, By BMI Category, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Prevalence of Obesity and Related Metabolic Disorders

The rising prevalence of obesity and related metabolic disorders is one of the key factors driving the growth of the GLP-1 targeted peptide weight loss drugs market. As global obesity rates continue to climb, so does the demand for effective, long-term pharmacological solutions beyond lifestyle interventions. GLP-1 receptor agonists have shown strong efficacy in promoting weight loss and improving glycemic control, making them a preferred choice for patients with obesity, type 2 diabetes, and cardiovascular risk factors. This increasing burden of chronic metabolic diseases is prompting healthcare providers and policymakers to adopt these therapies earlier in treatment plans.

- Obesity is a major global health challenge, affecting over 1 billion people (13% of the population) in 2022. Since 1975, obesity rates have tripled, with projections estimating 1.9 billion adults (25%) affected by 2035 and 3.8 billion (over half) by 2050.

Proven Efficacy and Safety of GLP-1 Therapies

The proven efficacy and safety of GLP-1 therapies are also driving the growth of the market. Clinical trials have consistently demonstrated significant weight loss outcomes, improved glycemic control, and cardiovascular benefits, even in high-risk patient populations. These strong clinical results have built trust among healthcare providers, leading to earlier and more frequent prescriptions of GLP-1 drugs. Moreover, the well-tolerated safety profile, with manageable side effects, has made these therapies attractive for long-term use. This combination of effectiveness and safety is accelerating their adoption across both diabetic and non-diabetic obese populations.

Increasing Investment in R&D

Increasing investment in R&D is another major factor driving the growth of the GLP-1 targeted peptide weight loss drugs market, as it accelerates the development of more effective, longer-acting, and patient-friendly therapies. Pharmaceutical companies are channeling significant resources into improving peptide stability, exploring oral formulations, and creating multi-agonist drugs that enhance treatment outcomes. These innovations not only expand therapeutic options but also address unmet needs in obesity and metabolic care, attracting wider clinical adoption. As a result, R&D efforts are fueling both product innovation and market expansion on a global scale.

Restraints

High Cost of GLP-1 Targeted Peptide Drugs

The high cost of GLP-1 targeted peptide drugs is a significant barrier to widespread adoption, especially in low- and middle-income countries. These therapies often come with premium pricing due to complex manufacturing processes, patent protections, and high R&D investments, making them inaccessible for many patients without robust insurance coverage. Even in developed markets, affordability challenges can limit long-term adherence and patient uptake. Payers and healthcare systems may hesitate to fully reimburse these treatments for non-diabetic weight loss, further restricting their use. As a result, cost-related issues are slowing the market’s growth despite strong clinical demand and efficacy.

Potential Side Effects and Limited Long-Term Safety Data

Potential side effects and limited long-term safety data are restraining the growth of the GLP-1 targeted peptide weight loss drugs market. Common side effects such as nausea, vomiting, and gastrointestinal discomfort can deter patient adherence, especially during the early stages of treatment. While short-term efficacy is well-documented, concerns remain about the long-term impact of prolonged GLP-1 receptor activation, particularly in non-diabetic populations. The lack of extensive longitudinal studies creates hesitation among some healthcare providers and regulatory bodies. This uncertainty can delay wider adoption and reimbursement approvals, especially for off-label or preventive use.

Regulatory Challenges and Lengthy Approval Processes

Regulatory challenges and lengthy approval processes pose significant restraints to the growth of the market. These drugs must undergo extensive clinical trials and safety evaluations before gaining approval, which can delay time-to-market and increase development costs. Variations in regulatory standards across regions further complicate global expansion, requiring companies to navigate multiple approval pathways. Additionally, gaining approval for obesity treatment, especially in non-diabetic populations, can be more stringent due to concerns over long-term safety and cost-effectiveness. These regulatory hurdles slow innovation, limit patient access, and create uncertainty for manufacturers and investors.

Opportunities

Development of Combination Therapies

The development of combination therapies presents a significant opportunity in the GLP-1 targeted peptide weight loss drugs market by enhancing treatment efficacy and expanding therapeutic options. By combining GLP-1 receptor agonists with other agents, such as GIP or glucagon receptor agonists, researchers are achieving greater weight loss, improved glycemic control, and broader metabolic benefits. These multi-agonist therapies, like tirzepatide, have shown superior clinical outcomes compared to monotherapies, attracting strong interest from both clinicians and patients. Additionally, combination drugs can address multiple aspects of obesity and related conditions in a single treatment, improving convenience and adherence. This trend opens the door to innovation and new market segments.

Rising Demand for Oral and Non-Injectable GLP-1 Formulations

The rising demand for oral and non-injectable GLP-1 formulations creates immense opportunities in the market by improving patient convenience and adherence. Many patients prefer oral medications over injections due to ease of use, reduced discomfort, and better acceptance, especially among those with needle anxiety. Advances in drug delivery technology are enabling the development of effective oral GLP-1 therapies, such as oral semaglutide, expanding the potential patient base. This shift not only enhances market accessibility but also encourages earlier adoption of GLP-1 therapies in weight management. As a result, pharmaceutical companies are investing heavily in non-injectable formulations to capitalize on this growing preference.

Eli Lilly announced Phase 3 ATTAIN-1 trial results for orforglipron, an oral GLP-1 receptor agonist, showing significant weight loss in adults with obesity or overweight without diabetes. At 72 weeks, all doses (6 mg, 12 mg, 36 mg) met the primary endpoint of superior body weight reduction versus placebo and achieved key secondary goals including ≥10%, ≥15%, and ≥20% weight loss and reduced waist circumference. Results were presented at the 2025 EASD meeting and published in The New England Journal of Medicine.

Advances in Personalized Medicine

Advances in personalized medicine are creating new opportunities in the GLP-1 targeted peptide weight loss drugs market by enabling tailored treatment strategies that improve efficacy and minimize side effects. Through genetic profiling and biomarker analysis, healthcare providers can better predict which patients will respond optimally to GLP-1 therapies. This individualized approach enhances patient outcomes and satisfaction, leading to higher adherence and long-term success. Additionally, personalized medicine supports the development of precision dosing and combination therapies, further refining treatment protocols. These innovations are driving the market toward more targeted, effective, and patient-centric weight loss solutions.

What Macroeconomic Factors Impact the Growth of the GLP-1 Targeted Peptide Weight Loss Drugs Market?

GDP and Economic Growth

Economic growth and rising GDP positively impact on the growth of the market by improving healthcare infrastructure, insurance coverage, and patient affordability. In high-GDP countries, increased public and private healthcare spending allows for broader access to advanced therapies like GLP-1 receptor agonists. As economies grow, demand for chronic disease management and preventive care, such as obesity treatment, also rises, supporting market expansion.

Inflation Rates

High inflation rates negatively impact the market by increasing the overall cost of healthcare and reducing consumer purchasing power. As drug prices rise due to inflation-driven manufacturing and distribution costs, patients may delay or forgo treatment, especially in markets with limited insurance coverage. This economic pressure can also lead to tighter healthcare budgets and slower adoption of premium-priced therapies like GLP-1 drugs.

Demographic Trends

Demographic trends generally drive market growth, particularly due to the rising prevalence of obesity among adults and adolescents. Aging populations, sedentary lifestyles, and urbanization contribute to increasing rates of metabolic disorders, creating a larger target patient pool for GLP-1 therapies. Additionally, growing health awareness across age groups is boosting demand for medically supervised weight loss solutions, further supporting market expansion.

Monetary and Fiscal Policies

Monetary and fiscal policies can have both positive and negative impact on the market, depending on how they influence healthcare funding and economic stability. Expansionary fiscal policies, such as increased public healthcare spending or subsidies, can enhance access to high-cost therapies like GLP-1 drugs and support market growth. Conversely, tight monetary policies that lead to higher interest rates and reduced consumer spending may limit investments in healthcare and reduce patient affordability, thereby restraining market expansion.

Segment Outlook

Drug Insights

How Does the Semaglutide Segment Lead the Market in 2024?

The Semaglutide segment led the GLP-1 targeted peptide weight loss drugs market while holding the largest share in 2024. This is primarily due to its proven efficacy in weight management and its robust clinical data supporting its use. Semaglutide, originally developed for diabetes management, showed significant weight loss results in both clinical trials and real-world settings, which attracted widespread adoption. Additionally, its once-weekly administration and FDA approvals for obesity management helped bolster its position in the market.

The high demand for effective weight loss treatments, coupled with increasing awareness of Semaglutide's benefits, contributed to its market leadership, despite the presence of other GLP-1 drugs. Furthermore, the growing trend toward personalized medicine and lifestyle interventions accelerated Semaglutide's uptake among healthcare professionals and patients alike.

The Tirzepatide (Zepbound) segment is expected to grow at the fastest rate during the forecast period due to its dual-action mechanism, targeting both GLP-1 and GIP receptors, which enhances weight loss outcomes. Early clinical trials and real-world studies have demonstrated that Tirzepatide offers superior weight loss results compared to other GLP-1 drugs, positioning it as a highly promising treatment. Its unique mechanism of action provides additional metabolic benefits, such as improved glucose control and appetite suppression, making it appealing for both weight loss and diabetes management. With increasing patient demand for more effective and faster-acting weight loss solutions, Tirzepatide's potential for broader indications and ongoing positive clinical outcomes are expected to drive segmental growth in the coming years.

GLP-1 Targeted Peptide Weight Loss Drugs Market By Drug, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Semaglutide |

33.65 |

36.38 |

39.28 |

42.34 |

45.57 |

48.95 |

52.48 |

56.15 |

59.93 |

63.79 |

67.70 |

| Tirzepatide (Zepbound) |

13.46 |

16.34 |

19.72 |

23.68 |

28.31 |

33.72 |

40.04 |

47.38 |

55.93 |

65.86 |

77.37 |

| Liraglutide (Saxenda) |

9.18 |

9.88 |

10.63 |

11.41 |

12.22 |

13.05 |

13.91 |

14.79 |

15.67 |

16.55 |

17.41 |

| Others |

4.89 |

6.04 |

7.39 |

8.99 |

10.86 |

13.05 |

15.62 |

18.63 |

22.13 |

26.21 |

30.95 |

Route of Administration Insights

What Made Injectable the Dominant Segment in the Market in 2024?

The injectable segment dominated the GLP-1 targeted peptide weight loss drugs market in 2024 because of the proven efficacy and convenience of injectable formulations, particularly with drugs like Semaglutide and Tirzepatide. These injectable therapies, often administered once weekly, provide sustained, controlled release, ensuring steady therapeutic effects with minimal intervention. Injectable drugs are also favored for their faster onset of action and are highly effective in weight loss management, leading to strong adoption among both healthcare providers and patients.

Despite the preference for oral medications in other therapeutic areas, the clinical benefits and patient adherence rates for injectable GLP-1s have driven their uptake weight loss. Additionally, regulatory approvals and growing patient awareness around injectable options have further bolstered segmental growth.

The oral segment is expected to expand at the fastest CAGR in the upcoming period, owing to increasing patient preference for non-injectable options and advancements in drug formulation technology. Oral formulations of GLP-1 drugs, like oral Semaglutide, offer the convenience of daily administration without the need for injections, making them more appealing to individuals who are averse to needles. The development of novel delivery systems, such as oral formulations that bypass the digestive enzymes, ensures the drugs retain their efficacy while providing a user-friendly option.

As patients seek more accessible, less invasive treatments for weight management, the oral segment is expected to expand, offering an alternative to injectable therapies while maintaining strong clinical efficacy. Additionally, with ongoing research and positive clinical results, oral GLP-1 drugs are anticipated to gain broader acceptance among healthcare providers and patients alike.

Distribution Channel Insights

Why Did the Retail Pharmacies Segment Dominate the Market in 2024?

The retail pharmacies segment led the GLP-1 targeted peptide weight loss drugs market in 2024 due to their widespread accessibility and convenience for patients. As demand for weight loss treatments like Semaglutide and Tirzepatide surged, retail pharmacies provided a reliable and familiar channel for prescription fulfillment. Their ability to offer in-person consultation, easy refill options, and insurance processing made them the preferred choice for both patients and healthcare providers. Additionally, retail chains expanded their role in chronic disease management and weight loss support, further cementing their position in this market.

The online pharmacies segment is expected to expand at the highest CAGR over the projection period. This is mainly due to the increasing demand for convenience, privacy, and home delivery services. As more patients seek discreet and hassle-free access to medications like Semaglutide and Tirzepatide, digital platforms offer a seamless experience, ranging from virtual consultations to doorstep delivery. The rise of telemedicine and digital health platforms has further boosted the reach of online pharmacies, especially for those in remote or underserved areas. Additionally, competitive pricing, subscription models, and improved digital infrastructure are making online pharmacies a more attractive option.

Dosage Strength Insights

What Made High Dose the Dominant Segment in the Market in 2024?

The high dose segment dominated the GLP-1 targeted peptide weight loss drugs market in 2024. This is primarily due to its superior efficacy in achieving significant weight loss outcomes. Clinical studies and real-world evidence consistently showed that higher doses of drugs like Semaglutide and Tirzepatide led to greater reductions in body weight, which drove higher demand among both patients and prescribers. As obesity management became a priority, healthcare providers increasingly opted for high-dose regimens to meet patient expectations and clinical goals.

Regulatory approvals for higher doses specifically for weight loss, rather than diabetes alone, also contributed to the segment’s dominance. Furthermore, patients who responded well to initial lower doses were often titrated to higher doses for sustained and enhanced results, reinforcing the growth of the segment.

The low dose segment is expected to grow at a significant rate over the forecast period due to its role in initiating therapy and minimizing side effects during early treatment stages. Many patients begin with lower doses of GLP-1 drugs like Semaglutide or Tirzepatide to allow their bodies to adjust and to reduce the risk of gastrointestinal side effects, which are common with these medications. As awareness and adoption of GLP-1 therapies increase, especially among first-time users, the demand for low-dose formulations is likely to rise.

Additionally, some patients with milder weight loss goals or those using GLP-1s for preventive health management may achieve desired results with lower doses. This growing emphasis on personalized and stepwise treatment approaches supports the expansion of the low dose segment in the market.

End User Insights

Why Did Hospitals Hold the Largest Market Share in 2024?

The hospitals segment held the largest share of the GLP-1 targeted peptide weight loss drugs market in 2024, owing to their comprehensive healthcare infrastructure and ability to manage complex obesity cases requiring close monitoring. Hospitals often serve as primary centers for specialized obesity treatment programs, offering multidisciplinary care that includes medical, nutritional, and psychological support alongside drug therapy. The availability of trained healthcare professionals and advanced facilities enables hospitals to safely initiate and adjust GLP-1 treatments, especially injectable forms like Semaglutide and Tirzepatide. Additionally, hospitals tend to handle patients with comorbidities such as diabetes and cardiovascular conditions, where GLP-1 drugs provide dual benefits, further driving their use in this setting.

The clinics segment is expected to grow at a rapid pace in the coming years due to their increasing role in providing specialized, accessible, and personalized weight management services. Clinics, including obesity and metabolic health centers, offer focused care with shorter wait times and more frequent patient follow-ups, which appeals to individuals seeking targeted weight loss treatments like GLP-1 therapies. Their flexibility in adopting new treatment protocols and emphasis on lifestyle counseling alongside medication enhances patient outcomes and satisfaction. Moreover, the rise of outpatient and ambulatory care trends supports clinic growth as a preferred setting for ongoing weight loss management.

GLP-1 Targeted Peptide Weight Loss Drugs Market By End User, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Clinics |

18.35 |

21.01 |

24.03 |

27.48 |

31.41 |

35.90 |

41.01 |

46.84 |

53.47 |

61.03 |

69.64 |

| Hospitals |

33.65 |

37.07 |

40.82 |

44.94 |

49.45 |

54.39 |

59.81 |

65.74 |

72.22 |

79.31 |

87.05 |

| Home Care Facilities |

9.18 |

10.57 |

12.17 |

14.00 |

16.09 |

18.49 |

21.24 |

24.38 |

27.97 |

32.07 |

36.75 |

Therapy Line Insights

Why is the First Line Segment Dominating the Market in 2024?

The first line segment dominated the GLP-1 targeted peptide weight loss drugs market in 2024 and is expected to continue its growth trajectory in the upcoming period, as these drugs are increasingly being prescribed early in the treatment of obesity and related metabolic conditions. GLP-1 therapies like Semaglutide have demonstrated strong efficacy and safety profiles, encouraging healthcare providers to use them as initial interventions rather than as last-resort options. Early use helps achieve significant weight loss and improved metabolic outcomes, which can reduce the need for more invasive treatments later. Additionally, growing awareness and updated clinical guidelines support the integration of GLP-1 drugs as frontline therapies.

Patient Age Group Insights

What Made Adults the Dominant Segment in the Market in 2024?

The adults segment dominated the GLP-1 targeted peptide weight loss drugs market in 2024 because obesity prevalence is highest among adults, making them the primary target population for these therapies. Clinical trials and regulatory approvals for GLP-1 drugs like Semaglutide have largely focused on adult patients, driving widespread adoption in this age group. Adults are also more likely to have obesity-related comorbidities such as type 2 diabetes and cardiovascular diseases, where GLP-1 therapies provide additional benefits, increasing their use. Moreover, adults typically have greater healthcare access and are more proactive in seeking weight loss treatments compared to younger populations.

- In 2022, 2.5 billion adults aged 18 and older were overweight, including over 890 million with obesity, representing 43% of adults (43% men, 44% women). This marks a significant rise from 25% in 1990.

The adolescents segment is expected to grow at the fastest rate during the projection period due to rising awareness of childhood and adolescent obesity and its long-term health risks. Increasing clinical research and emerging approvals for GLP-1 therapies in younger populations are enabling safer and more effective treatment options for adolescents. Early intervention with these drugs can help prevent the progression of obesity-related conditions, making them a valuable tool for pediatric healthcare providers. Additionally, parents and caregivers are becoming more proactive in seeking medical solutions to manage weight in adolescents, further driving demand. This growing focus on adolescent obesity management is fueling segmental growth.

- In 2022, over 390 million children and adolescents aged 5–19 were overweight, with prevalence rising from 8% in 1990 to 20%. The increase was similar for both genders, with 19% of girls and 21% of boys overweight.

BMI Category Insights

Why Did the Class III Segment Dominate the Market in 2024?

The class III segment dominated the GLP-1 targeted peptide weight loss drugs market in 2024 because individuals with severe obesity have the greatest clinical need and are more likely to be prescribed effective pharmacological treatments. GLP-1 drugs like Semaglutide demonstrated significant weight loss benefits for patients with a BMI over 40, making them a preferred option for managing high-risk obesity cases. These patients often experience multiple comorbidities, such as diabetes and cardiovascular disease, where GLP-1 therapies offer additional health benefits beyond weight loss. Furthermore, insurance coverage and clinical guidelines tend to prioritize treatment for higher BMI categories, facilitating greater access to these medications.

The class II segment is likely to register significant growth in the upcoming period, owing to increasing recognition of the health risks associated with moderate obesity and a shift toward earlier intervention. Patients with a BMI between 35 and 39.9 are increasingly being targeted for pharmacological treatment to prevent progression to more severe obesity and related complications. Clinical guidelines are expanding to recommend GLP-1 therapies for this group, supported by evidence showing effective weight loss and metabolic benefits at this stage. Additionally, greater awareness and accessibility of these drugs encourage patients and providers to adopt treatment earlier.

Regional Insights

What Made North America the Dominant Region in the Market in 2024?

North America dominated the GLP-1 targeted peptide weight loss drugs market by holding the largest share in 2024. This is mainly due to the high prevalence of obesity and related metabolic disorders in the region, driving strong demand for effective treatments. The well-established healthcare infrastructure and widespread access to advanced medications like Semaglutide and Tirzepatide facilitated rapid adoption. Additionally, favorable reimbursement policies and strong awareness among healthcare providers and patients supported market growth. The region also benefits from significant investments in research and development, leading to early approvals and availability of innovative GLP-1 therapies.

The U.S. is the major contributor to the North America GLP-1 targeted peptide weight loss drugs market, driven by its large population affected by obesity and metabolic diseases. The country has a well-developed healthcare system with widespread access to advanced pharmaceuticals, including GLP-1 therapies like Semaglutide and Tirzepatide. Strong insurance coverage and government initiatives aimed at addressing the obesity epidemic further support market growth. Additionally, the U.S. benefits from significant investment in clinical research and faster regulatory approvals, ensuring early availability of innovative treatments. Moreover, the rising development of novel formulations further supports market growth.

- In September 2025, Novo Nordisk announced plans for a full-scale U.S. launch of oral semaglutide in early 2026, according to its Head of Product and Portfolio Strategy. The company viewed its Wegovy pill as a strong competitor to Eli Lilly’s obesity pill. Helfgott also referred to the ongoing semaglutide trial for Alzheimer’s as “a lottery ticket,” indicating uncertainty. The oral version marked a key expansion of Novo Nordisk’s weight loss and diabetes portfolio, offering an alternative to injectables.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest growth throughout the forecast period due to the rising prevalence of obesity and diabetes driven by rapid urbanization, changing lifestyles, and increasing awareness of metabolic health. Growing healthcare infrastructure, expanding access to advanced therapies, and rising disposable incomes are enabling more patients to afford GLP-1 treatments. Additionally, increasing government initiatives focused on obesity management and supportive regulatory frameworks are facilitating faster drug approvals and market penetration. The region’s large and diverse population presents a significant opportunity for market expansion, especially as awareness of innovative weight loss therapies continues to rise.

- In 2024, an estimated 35 million children under 5 were overweight, with nearly half of them living in Asia. Once seen as a high-income country issue, childhood overweight is now rising rapidly in low- and middle-income countries, particularly across Asia.

China is the major contributor to the Asia Pacific GLP-1 targeted peptide weight loss drugs market due to its large population and rapidly increasing prevalence of obesity and diabetes. The country’s expanding healthcare infrastructure and growing middle class have improved access to advanced medications like GLP-1 therapies. Additionally, government initiatives aimed at tackling non-communicable diseases and growing awareness about weight management have accelerated market growth. China also benefits from increasing local clinical research and faster regulatory approvals, which help introduce innovative treatments sooner.

India is emerging in the GLP-1 targeted peptide weight loss drugs market due to its large and growing population affected by obesity and diabetes, creating a substantial patient base. The country offers cost-effective manufacturing capabilities, enabling the production of affordable generic versions of high-priced drugs like semaglutide. Additionally, increasing healthcare infrastructure, rising awareness about metabolic diseases, and supportive government policies are boosting market growth. These factors make India a strategic hub for both domestic demand and global generic drug supply. Domestic players are also making efforts to meet the growing demand for weight loss drugs, supporting market growth.

- In July 2025, Torrent Pharmaceuticals planned to catch the first wave of semaglutide launch after Novo Nordisk's patent expired early next year. The Ahmedabad-based company aimed to be present in both oral and injectable versions of the weight loss drug. Torrent was conducting Phase 3 trials for oral products and had partnered for the injectables.

Region-Wise Breakdown of the GLP-1 Targeted Peptide Weight Loss Drugs Market

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 25.4 Bn |

5.9% |

High obesity rates, advanced healthcare infrastructure, strong R&D, and favorable reimbursement policies

|

High drug costs and regulatory scrutiny |

Dominant region |

| Asia Pacific |

USD 17.9 Bn |

7.01% |

Rapid urbanization, rising obesity and diabetes rates, expanding healthcare access, and government support |

Limited awareness in rural areas, pricing pressure, and reimbursement challenges |

Fastest-growing region |

| Europe |

USD 14.3 Bn |

9.93% |

Increasing obesity prevalence, improved healthcare access, and rising awareness of GLP-1 therapies |

Pricing pressures and diverse healthcare policies across countries |

Steady growth |

| Latin America |

USD 4.9 Bn |

4.79% |

Increasing obesity prevalence and growing healthcare investments |

Economic disparities and limited drug availability in some countries |

Moderate growth |

| MEA |

USD 3.1 Bn |

3.45% |

Rising obesity and diabetes rates and expanding healthcare infrastructure |

Limited healthcare access and regulatory hurdles |

Gradual growth |

GLP-1 Targeted Peptide Weight Loss Drugs Market Value Chain Analysis

1. Research & Development (R&D)

This initial stage involves discovering and developing GLP-1 peptide molecules with the potential for effective weight loss. Pharmaceutical companies invest heavily in clinical trials to establish safety, efficacy, and optimal dosage, which is critical for regulatory approval and market success.

2. Manufacturing

After successful R&D, the manufacturing stage focuses on producing GLP-1 peptide drugs at scale. This requires specialized biotechnological processes to maintain the integrity and bioactivity of peptides, alongside strict quality control to ensure consistent product standards.

3. Regulatory Approval

Regulatory bodies such as the FDA, EMA, and others evaluate clinical trial data to approve GLP-1 drugs for weight loss indications. This stage is crucial as it determines market entry and helps build trust among healthcare providers and patients.

4. Marketing & Distribution

Pharmaceutical companies develop marketing strategies targeted at healthcare professionals and patients to raise awareness about the benefits of GLP-1 therapies. Distribution channels include hospitals, retail pharmacies, and increasingly, online pharmacies, ensuring wide accessibility.

5. Sales & Patient Support

Sales teams work closely with healthcare providers to promote drug prescriptions, while patient support programs help with medication adherence, education on administration (especially for injectables), and managing side effects. This stage enhances patient outcomes and loyalty.

6. Post-Market Surveillance & Feedback

Ongoing monitoring of the drug’s safety and effectiveness continues after market launch. Real-world data and patient feedback are collected to identify adverse effects or new indications, guiding future improvements or expanded use cases.

Key Players Operating in the Market

1. Novo Nordisk A/S

Novo Nordisk is a global leader with its blockbuster drug Semaglutide, which has revolutionized weight loss and diabetes treatment through high efficacy and safety. Their continuous R&D investment and extensive global marketing make them the dominant force in the market.

2. Eli Lilly and Company

Eli Lilly is gaining significant market share with Tirzepatide (Zepbound), a dual GLP-1 and GIP receptor agonist showing superior weight loss and metabolic benefits. Their strong clinical pipeline and strategic partnerships accelerate innovation and broaden patient access.

3. Pfizer Inc.

Pfizer leverages its vast distribution network and expertise in metabolic diseases to promote GLP-1 therapies targeting obesity and type 2 diabetes. They are actively involved in research to develop new formulations and enhance therapeutic efficacy.

4. Boehringer Ingelheim International GmbH

Boehringer Ingelheim invests in innovative peptide research and collaborates on GLP-1 related compounds, focusing on improving treatment outcomes for metabolic disorders. Their global presence and partnerships support market expansion.

5. Roche Holding AG

Roche contributes through diagnostics and personalized medicine initiatives that complement GLP-1 therapy, helping optimize treatment strategies for obesity and diabetes. Their technological advancements assist in better patient management alongside peptide therapies.

6. AstraZeneca PLC

AstraZeneca is strengthening its portfolio with GLP-1 targeted drugs and actively engaging in clinical trials for obesity-related metabolic conditions. Their strategic collaborations and R&D investments drive their presence in this competitive market.

7. Sanofi S.A.

Sanofi focuses on developing next-generation peptide therapeutics and forming alliances with biotech firms to enhance metabolic disease treatment options. Their efforts in improving affordability and access contribute to wider adoption.

8. Amgen Inc.

Amgen is exploring novel biologics and peptide-based therapies, including GLP-1 receptor agonists, aiming to expand treatment options for obesity and diabetes. Their strong R&D infrastructure supports pipeline innovation and long-term growth.

9. Merck & Co., Inc.

Merck is advancing its metabolic disease portfolio by researching GLP-1 analogs and combination therapies that offer improved weight loss and glycemic control. Their global reach and clinical expertise help accelerate market penetration.

10. Johnson & Johnson

Johnson & Johnson leverages its extensive healthcare ecosystem to develop and distribute GLP-1 targeted therapies while focusing on patient education and support programs. Their diversified portfolio and innovation efforts strengthen their competitive position in this market.

11. MannKind Corporation

MannKind is advancing inhalable peptide therapies and other innovative delivery methods for GLP-1 drugs. Their unique drug delivery technologies aim to improve patient compliance and broaden treatment options.

12. Ipsen

Ipsen focuses on specialty biopharmaceuticals, including GLP-1 receptor agonists targeting obesity. Their strategic alliances and expanding global reach help drive growth in emerging markets.

13. AbbVie Inc.

AbbVie is investing in the development of novel GLP-1-based compounds and combination therapies to enhance weight loss efficacy. Their strong R&D capabilities and marketing expertise support competitive positioning.

14. Bristol Myers Squibb

Bristol Myers Squibb engages in exploring innovative peptide therapeutics and combination treatments. Their global presence and clinical trial initiatives contribute to pipeline expansion.

15. Hikma Pharmaceuticals

Hikma is working on generic versions and biosimilars of GLP-1 drugs to improve accessibility and affordability in developing markets.

Recent Developments

- In July 225, Dr. Reddy's CEO Erez Israeli announced plans to launch a cheaper generic version of Novo Nordisk’s weight-loss drug Wegovy in 87 countries next year, starting with Canada, India, Brazil, Turkey, and other emerging markets, subject to patent expiry. The U.S. and European markets are expected to open between 2029 and 2033.

- In 2025, Biocon Ltd. planned to seek regulatory approvals for generic versions of Novo Nordisk’s Ozempic and Wegovy, an anti-obesity medication used for long-term weight management, in key markets ahead of upcoming patent expiries. The company aimed to file in Canada by September, targeting a potential launch of off-patent semaglutide as early as 2026.

Segments Covered in the Report

By Drug

- Semaglutide

- Tirzepatide (Zepbound)

- Liraglutide (Saxenda)

- Others

By Route of Administration

-

- Prefilled Pen

- Refillable Cartridge

- Smart Pen Integration

- Vial

- Oral

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacy

By Dosage Strength

- High Dose

- Low Dose

- Medium Dose

By End User

- Clinics

- Hospitals

- Home Care Facilities

By Therapy Line

- First Line

- Second Line

- Third Line

By Patient Age Group

- Adolescents

- Adults

- Senior

By BMI Category

- Obesity Class I

- Obesity Class II

- Obesity Class III

- Overweight

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

-

Table 1: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market, by Drug, 2024–2034

-

Table 2: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market, by Route of Administration, 2024–2034

-

Table 3: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market, by Distribution Channel, 2024–2034

-

Table 4: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market, by Dosage Strength, 2024–2034

-

Table 5: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market, by End User, 2024–2034

-

Table 6: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market, by Therapy Line, 2024–2034

-

Table 7: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market, by Patient Age Group, 2024–2034

-

Table 8: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market, by BMI Category, 2024–2034

-

Table 9: Canada GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 10: Mexico GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 11: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market, by Drug, 2024–2034

-

Table 12: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market, by Route of Administration, 2024–2034

-

Table 13: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market, by Distribution Channel, 2024–2034

-

Table 14: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market, by Dosage Strength, 2024–2034

-

Table 15: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market, by End User, 2024–2034

-

Table 16: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market, by Therapy Line, 2024–2034

-

Table 17: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market, by Patient Age Group, 2024–2034

-

Table 18: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market, by BMI Category, 2024–2034

-

Table 19: France GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 20: UK GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 21: Italy GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 22: Rest of Europe GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 23: China GLP-1 Targeted Peptide Weight Loss Drugs Market, by Drug, 2024–2034

-

Table 24: China GLP-1 Targeted Peptide Weight Loss Drugs Market, by Route of Administration, 2024–2034

-

Table 25: China GLP-1 Targeted Peptide Weight Loss Drugs Market, by Distribution Channel, 2024–2034

-

Table 26: China GLP-1 Targeted Peptide Weight Loss Drugs Market, by Dosage Strength, 2024–2034

-

Table 27: China GLP-1 Targeted Peptide Weight Loss Drugs Market, by End User, 2024–2034

-

Table 28: China GLP-1 Targeted Peptide Weight Loss Drugs Market, by Therapy Line, 2024–2034

-

Table 29: China GLP-1 Targeted Peptide Weight Loss Drugs Market, by Patient Age Group, 2024–2034

-

Table 30: China GLP-1 Targeted Peptide Weight Loss Drugs Market, by BMI Category, 2024–2034

-

Table 31: Japan GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 32: South Korea GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 33: India GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 34: Southeast Asia GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 35: Rest of Asia Pacific GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 36: Brazil GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 37: Rest of Latin America GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 38: GCC Countries GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 39: Turkey GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 40: Africa GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Table 41: Rest of MEA GLP-1 Targeted Peptide Weight Loss Drugs Market, by Segments, 2024–2034

-

Figure 1: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Drug, 2024–2034

-

Figure 2: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Route of Administration, 2024–2034

-

Figure 3: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Distribution Channel, 2024–2034

-

Figure 4: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Dosage Strength, 2024–2034

-

Figure 5: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by End User, 2024–2034

-

Figure 6: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Therapy Line, 2024–2034

-

Figure 7: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Patient Age Group, 2024–2034

-

Figure 8: U.S. GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by BMI Category, 2024–2034

-

Figure 9: Canada GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 10: Mexico GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 11: Germany GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Drug, 2024–2034

-

Figure 12: France GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 13: UK GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 14: Italy GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 15: China GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Drug, 2024–2034

-

Figure 16: Japan GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 17: South Korea GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 18: India GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 19: Brazil GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 20: GCC Countries GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 21: Turkey GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034

-

Figure 22: Africa GLP-1 Targeted Peptide Weight Loss Drugs Market Share, by Segments, 2024–2034