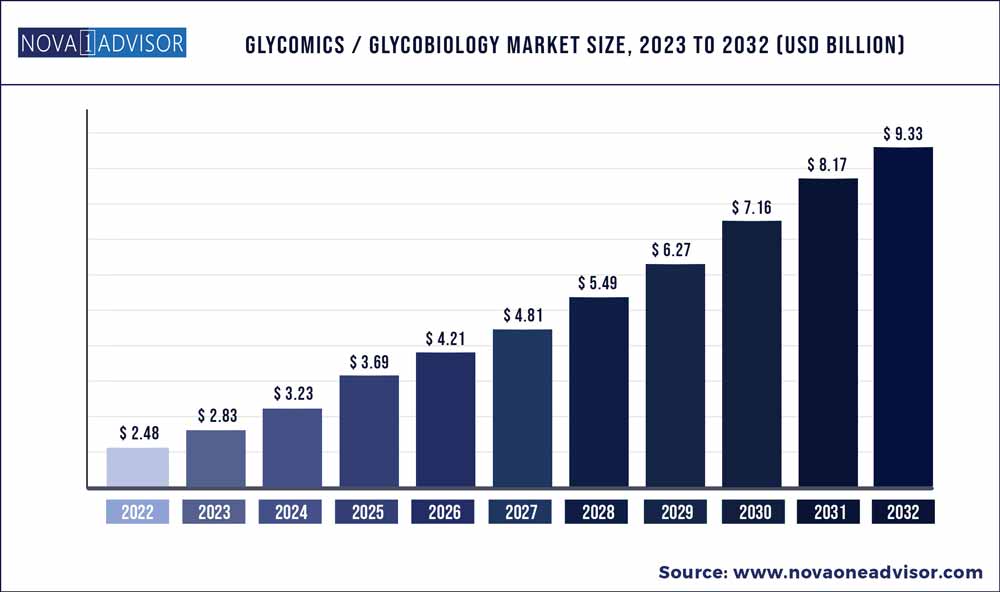

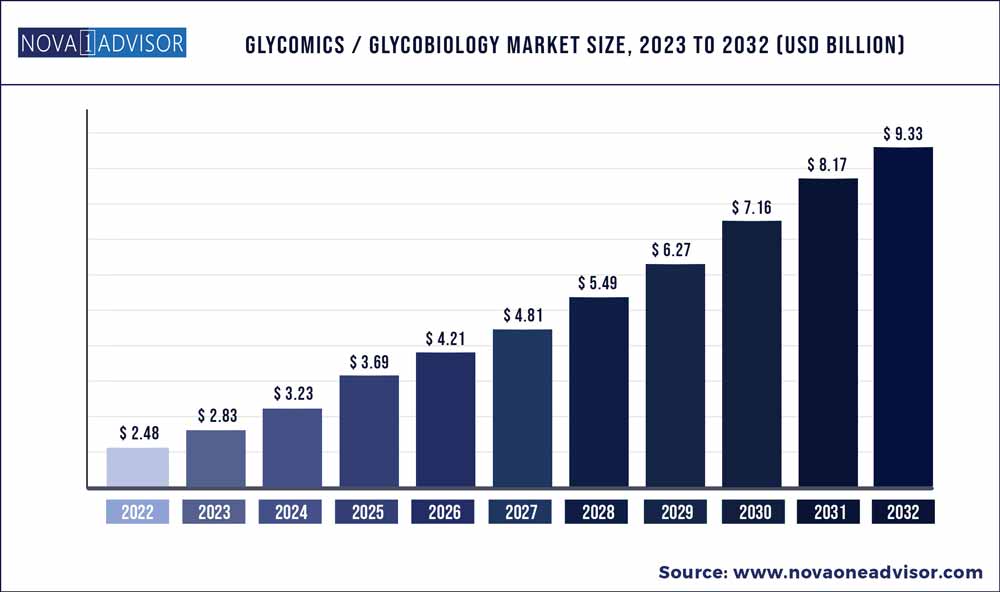

The global Glycomics and Glycobiology market size accounted for USD 2.48 billion in 2022 and is estimated to achieve a market size of USD 9.33 billion by 2032 growing at a CAGR of 14.18% from 2023 to 2032.

Key Pointers:

- Kits segment accounted for the largest revenue share in the global Glycomics/Glycobiology market in 2022

- Diagnostics segment accounted for the largest revenue share in 2022.

- The drug discovery & development segment accounted for a significant revenue share in 2022.

- Academic research institutions segment accounted for a significant revenue share in 2022.

Glycomics and Glycobiology Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 2.83 Billion

|

|

Market Size by 2032

|

USD 9.33 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 14.18%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Product, Application and End User

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Key companies profiled

|

Thermo Fisher Scientific (US), New England Biolabs (US), Merck KGaA (Germany), Promega Corporation (US), Waters Corporation (US), Takara Bio Inc, (Japan), Bio-Techne (US), Agilent Technologies (US), Sumitomo Bakelite Co. Ltd. (Japan), Bruker Corporation (US), Shimadzu Corporation (Japan), Danaher Corporation (US), AMS Bio (UK), Ludger Ltd (UK), Z Biotech, LLC (US), Chemily Glycoscience (US), CD BioGlyco (US), GlycoDiag (France), Kode Biotech Limited (New Zealand), Glyxera GmBH (Germany), Lectenz Bio (US), Glycomix Ltd (UK), IEC Group (Italy), Asparia Glycomics (Spain), and Ray Biotech Life Inc. (US).

|

The steady market revenue growth of Glycomics/Glycobiology can be attributed to increasing application of quantitative glycomics in clinical settings, rising potential of glycan biomarkers for prognosis and diagnosis of various diseases, as well as rapid technological advancements in glycomics/glycobiology field such as high-throughput serum glycomic profiling.

The variety of glycans and their multiple biological functions open up entirely new horizons of existing research that can be investigated and used in the fields of animal and human health, biotechnology, and environmental sustainability. Glycomics provides fresh approaches for controlling and observing biological processes. A new wave of scientific and industrial attention is focused on this mostly untapped potential, with ground-breaking discoveries assisting in resolving urgent global issues. Several regional countries sponsor consortiums or institutions for glycomics research and commercialization to maximize innovation. Examples include GlycoNet (Canadian Glycomics Network) in Canada, the National Center for Biomedical Glycomics in the U.S., the Institute for Glycomics in Australia, and CarboMet in the European Union.

One of the major factors driving the growth of this industry is the growing use of quantitative glycomics in clinical settings. The need for efficient and reliable glycomic quantitative techniques is continuously increasing as attention focuses on the discovery and characterization of glycomic to the minute fluctuations in site occupancy. The quantification of glycomics enables accurate and sensitive monitoring of glycan alterations linked to various biological disorders and situations. In recent years, the number of new quantitative glycomics approaches has skyrocketed. Numerous methods for glycomic quantification using mass spectrometry have been developed, including enzymatic catalyzed labeling, deposition of quality difference and quality defect isotopes, metabolic labeling of stable isotopes, isobaric chemical labeling, and metabolic labeling of stable isotopes. These techniques give researchers the right instruments for precise and trustworthy quantification.

Furthermore, more glycans or glycan patterns have been identified as better potential biomarkers of many diseases and have shown to have higher diagnostic/diagnostic sensitivity and specificity than existing markers as a result of the advent of quantitative glycomics techniques, which is contributing significantly to the revenue growth of glycomics/glycobiology market.

The advancement of glycomic technology in recent years has made it possible to search for potential glycan biomarkers. N-glycans are an important biomarker for a variety of physiological and pathological diseases because stress conditions like cancer, infections, etc. can modify how glycans are processed. Recent research reveals that glycan structural changes are present in malignancies, and glycan-based biomarkers are a promising new field for cancer detection and diagnosis. Numerous investigations have demonstrated abnormal glycosylation in AD-related proteins, including as Beta-Secretase 1 (BACE1), tau, Amyloid Precursor Protein (APP), and Nicastrin (NCSTN). Several biological processes, including neuroinflammation, cell adhesion, and cell signaling, are impacted by dysregulated glycosylation in AD brains. Other disorders like ovarian cancer and breast cancer can be detected using plasma glycan-based measures.

As a result, major pharmaceutical companies are studying and utilizing glycomics research for the crucial role that glycans play in the progression of the disease, and more research and clinical studies about the use of glycan biomarkers in different diseases are being conducted by these companies and researchers, which is accelerating the growth of this market. For instance, on 9 December 2022, Israeli authorities approved the business's pivotal patent, according to Medicortex Finland Oy, a biopharmaceutical company with headquarters in Turku that specializes in the creation of diagnostics and medication treatments for mild Traumatic Brain Injury (TBI). The main technology of the company's cutting-edge diagnostic kit and biomarker for detecting brain injury is covered by the Israeli patent ‘Prognostic and Diagnostic Glycan-Based Biomarkers of Brain Damage’ (IL patent number 254980), which was recently granted.

One of the significant challenges hindering the growth of this industry is the high complexity of analytical methods for individual classes of glycans. Each category requires various techniques for glycan release or extraction, as well as various techniques for analysis or combinations of techniques, such as HPLC, mass spectrometry, NMR, etc. Even so, each of these approaches has been modified to offer comprehensive insights into the glycan structure for the specific glycosyl class. Scientists are having trouble characterizing low-abundant glycans and pinpointing minute changes in the glycome because of the limitations of analytical tools like mass spectrometry. The community of glycobiologists is still faced with difficulties due to the innate variability of the glycome and the enormous number of glycosylated proteins in most living systems. The specific methods required for each glycosyl type increase the complexity of the glycomics study.

A recent trend in the market is rapid technological advancements in the glycomics/glycobiology field such as high-throughput serum glycomic profiling. Glycan structure, amount, and function are difficult to identify and analyze. The development of science and technology, along with the persistent work of researchers, has, however, made this effort simpler in recent years. Currently, glycomics is utilized in conjunction with genomes, epigenomics, proteomics, lipidomics, and metabolomics to provide a more comprehensive understanding of how biological pathways function and how they alter in response to disease.

Strong correlations between variations in glycan structure and different diseases, disease stages and features, variations in circulating tumor cells, and age-related physiologic alterations have proliferated in the field of human blood glycomics. High-Performance Liquid Chromatography (HPLC), lectin-based technologies, and approaches based on mass spectrometry are only a few examples of the high-resolution and very sensitive techniques that are now available. For instance, Agilent Technologies has developed the Agilent AdvanceBio Gly-X N-glycan prep with InstantPC kit, 96 ct (GX96-IPC) for high-throughput, high-sensitivity glycan profiling. Rapid deglycosylation, glycan derivatization, purification, and detection of InstantPC-labeled N-glycans from two monoclonal antibodies—EG2-hFc and rituxima with differing molecular sizes are all made possible by this kit.

Some of the prominent players in the Glycomics and Glycobiology Market include:

- Thermo Fisher Scientific (US)

- New England Biolabs (US)

- Merck KGaA (Germany)

- Promega Corporation (US)

- Waters Corporation (US)

- Takara Bio Inc (Japan)

- Bio-Techne (US)

- Agilent Technologies (US)

- Sumitomo Bakelite Co. Ltd. (Japan)

- Bruker Corporation (US)

- Shimadzu Corporation (Japan)

- Danaher Corporation (US)

- AMS Bio (UK)

- Ludger Ltd (UK)

- Z Biotech

- LLC (US)

- Chemily Glycoscience (US)

- CD BioGlyco (US)

- GlycoDiag (France)

- Kode Biotech Limited (New Zealand)

- Glyxera GmBH (Germany)

- Lectenz Bio (US)

- Glycomix Ltd (UK)

- IEC Group (Italy)

- Asparia Glycomics (Spain)

- Ray Biotech Life Inc. (US).

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Glycomics and Glycobiology market.

Glycomics/ Glycobiology Market, By Product

- Enzymes

- Glycosidases

- Transferases

- Other Enzymes

- Instruments

- Mass Spectrometry Instruments

- Chromatography Instruments

- Arrays

- Other Instruments

- Kits

- Glycan Releasing Kits

- Glycan Purification Kits

- Glycan Labeling Kits

- Other Kits

- Carbohydrates

- Oligosaccharides

- Polysaccharides

- Other Carbohydrates

- Reagents & Chemicals

Glycomics/ Glycobiology Market, By Application

- Drug Discovery & Development

- Diagnostics

- Cancer Diagnostics

- Other Diagnostics

- Other Applications

Glycomics/ Glycobiology Market, By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Clinical Laboratories

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)