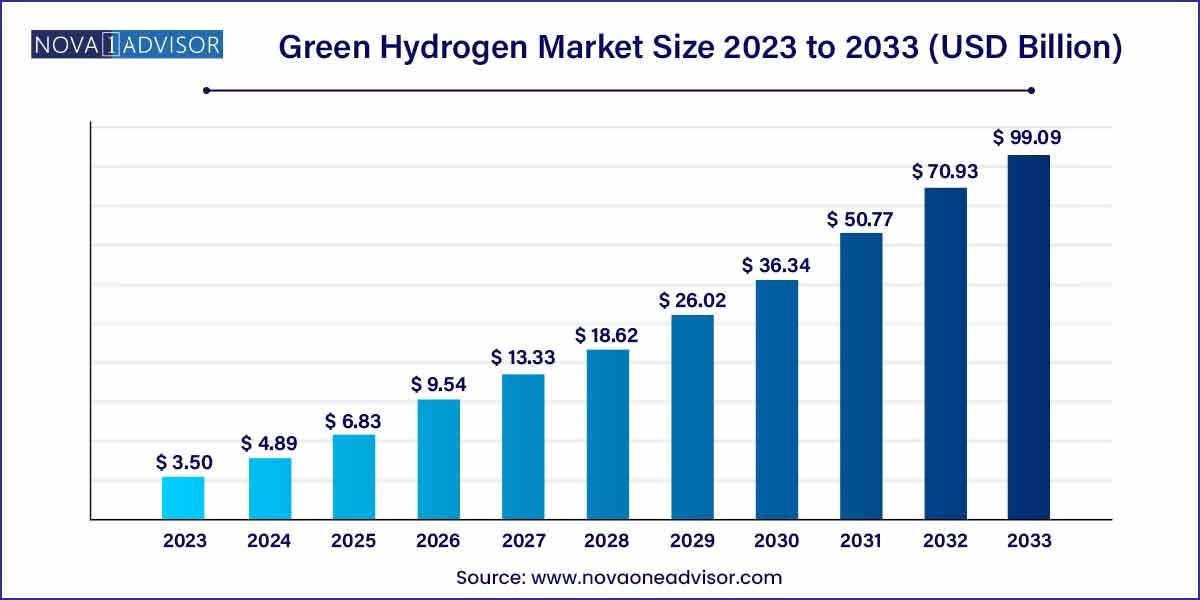

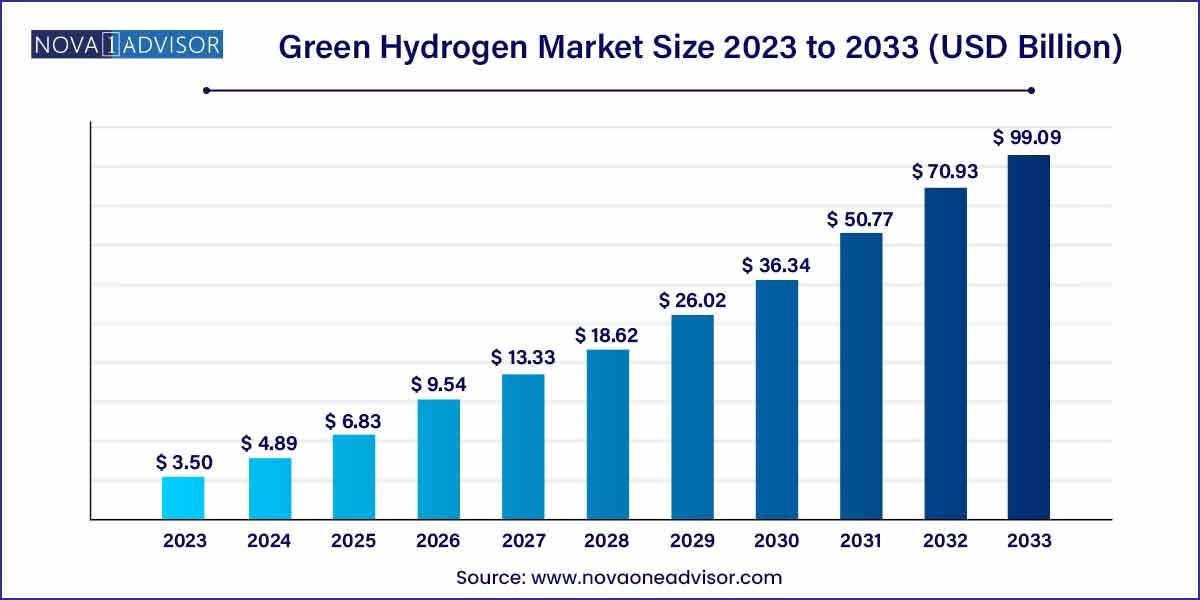

The global green hydrogen market size was exhibited at USD 3.50 billion in 2023 and is projected to hit around USD 99.09 billion by 2033, growing at a CAGR of 39.7% during the forecast period of 2024 to 2033.

Key Takeaways:

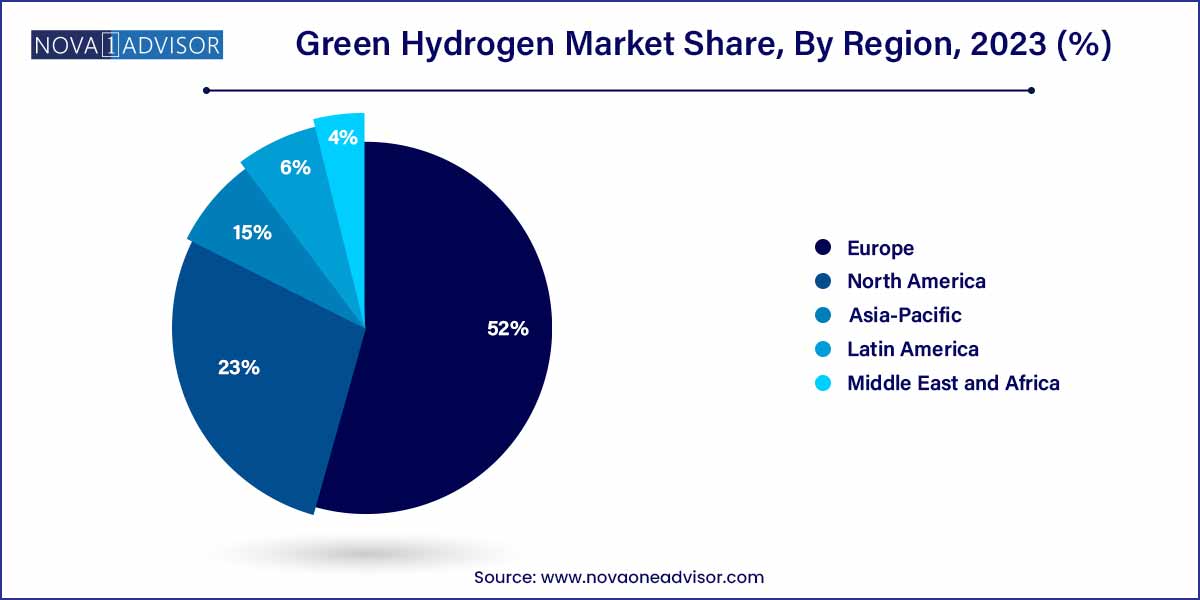

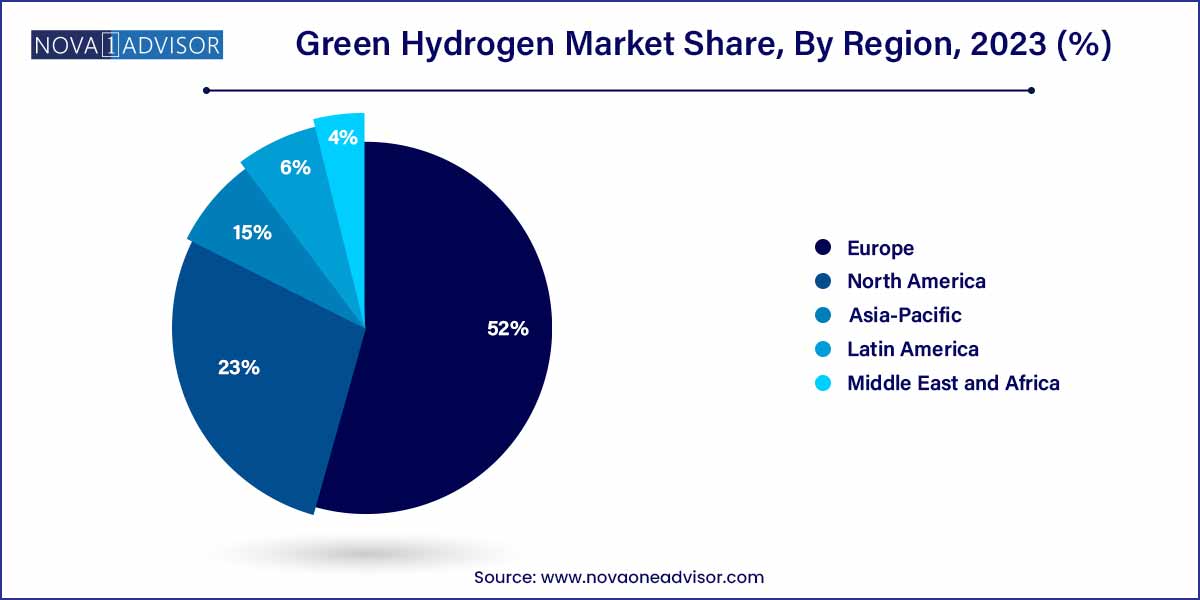

- Europe accounted for a significant revenue share of about 52% in 2023

- The alkaline electrolyzer segment accounted for the largest revenue share of 66.18% in 2023

- The pipeline segment accounted for 62.07% of the revenue share of the green hydrogen market in 2023.

- The transport segment accounted for the largest revenue share of 42.0% in 2023.

Market Overview

The Green Hydrogen Market is gaining significant momentum as industries and governments worldwide seek sustainable solutions to mitigate climate change. Green hydrogen is produced by electrolysis of water using renewable energy sources like solar, wind, and hydropower, resulting in zero carbon emissions. It is seen as a critical enabler of the global transition to a low-carbon economy, supporting sectors such as energy, transportation, industrial processes, and chemicals.

Amid growing commitments to achieve net-zero emissions, green hydrogen is poised to play a pivotal role in decarbonizing hard-to-abate sectors such as heavy industry and long-haul transportation. Key initiatives, including the European Green Deal and the U.S. Hydrogen Energy Earthshot program, are driving investments in green hydrogen technologies and infrastructure.

Leading companies such as Siemens Energy, Plug Power, and Nel ASA are aggressively pursuing innovations to enhance electrolyzer efficiency and scale up green hydrogen production. The market's growth trajectory is further reinforced by falling renewable energy costs, supportive regulatory frameworks, and an increasing number of public-private partnerships.

Major Trends in the Market

-

Surge in Electrolyzer Manufacturing Capacity: Companies are scaling up electrolyzer production to meet anticipated demand.

-

Integration of Green Hydrogen into Energy Storage Systems: Hydrogen is being used to store surplus renewable energy.

-

Emergence of Hydrogen Valleys: Integrated regional ecosystems producing, storing, and consuming green hydrogen.

-

Government-led Incentives and Subsidies: Financial support for green hydrogen projects is rising globally.

-

Development of Hydrogen Fueling Infrastructure: Expansion of hydrogen refueling stations for vehicles.

-

Strategic Partnerships and Joint Ventures: Companies are collaborating to reduce costs and accelerate technology deployment.

-

Technological Advancements in PEM and Alkaline Electrolyzers: Focus on increasing efficiency and reducing costs.

Green Hydrogen Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.50 Billion |

| Market Size by 2033 |

USD 99.09 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 39.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Linde plc.; Air Products Inc.; Air Liquide; Cummins Inc.; Engie; Nel ASA; Siemens Energy; Toshiba Energy Systems & Solutions Corporation; Uniper SE; Bloom Energy. |

Market Dynamics:

Driver for global green hydrogen market

High demand from FCEVs and power industry

Hydrogen's versatility has expanded beyond its traditional role in fuel cells for electric vehicles, now encompassing the production of alternative fuels like ammonia, methanol, and synthetic liquids. These energy carriers are gaining prominence and are poised to drive future demand. In developing economies, green hydrogen presents a pathway to a low-carbon future, offering a nearly carbon-free fuel option for marine transportation, hydrogen fuel cells in electric vehicles (EVs), and industrial backup power. The diverse array of applications positions the green hydrogen sector as a lucrative venture with significant growth potential. The market for green hydrogen in vehicle fuel cells is rapidly evolving, providing the convenience of fossil fuels without the associated emissions.

Restraint for global green hydrogen market

High cost of green hydrogen

The high cost of green hydrogen production is a restraint in the market. Current production methods, particularly electrolysis, are more expensive than conventional fossil fuel-based methods, making green hydrogen less competitive. This cost disparity is due to factors like high capital costs for electrolyzers, expensive renewable energy sources, and the lower efficiency of electrolysis. Additionally, the infrastructure for green hydrogen production, distribution, and storage adds to the overall cost. Efforts to reduce costs include technological advancements and increasing the use of renewable energy sources. However, restraints remain, such as high initial production costs, infrastructure limitations for transportation and storage, and the higher cost of fuel cells compared to fossil fuel technologies.

Opportunity for global green hydrogen market

Increasing government investments

The increasing government investments in the green hydrogen market present a significant opportunity for industry growth. Many emerging countries, particularly in Asia and the European Union, along with some American and Middle Eastern countries, are actively developing infrastructure for green hydrogen. This infrastructure development will enable manufacturers to expand their reach and capacity, ultimately leading to a reduction in the price of green hydrogen. The global green hydrogen market is expected to grow significantly in the coming years, driven by the need to decarbonize energy systems and reduce greenhouse gas emissions. The India-Middle East-Europe Economic Corridor (IMEC) includes a hydrogen pipeline to facilitate exports to the EU, as per a memorandum of understanding signed by the governments of the US, India, Saudi Arabia, UAE, France, Germany, and Italy.

Challenge for global green hydrogen market

High initial investments

The primary obstacle for green hydrogen manufacturers is the substantial initial investment needed to establish production facilities and manage transportation costs. The establishment of renewable energy power plants and the implementation of efficient electrolysis technology are key challenges. These tasks require significant research and development expenditures to develop viable technologies. The fixed costs associated with solar and wind power plants remain relatively high compared to traditional non-renewable energy sources, adding to the overall initial investment for hydrogen plants. Additionally, post-production, the development of transportation infrastructure is essential for the efficient and cost-effective transport of hydrogen, further elevating the overall cost of establishing green hydrogen plants.

Segments Insights:

Technology Type Insights

Alkaline Electrolyzers dominated the technology segment in 2024. Alkaline electrolyzers are well-established, cost-effective, and reliable for large-scale hydrogen production. They are favored for industrial applications due to their mature technology and lower capital costs compared to PEM electrolyzers. Companies such as Nel ASA and thyssenkrupp are heavily invested in scaling up alkaline electrolyzer manufacturing capacities to cater to the growing green hydrogen market.

Polymer Electrolyte Membrane (PEM) Electrolyzers are the fastest-growing technology. PEM electrolyzers offer several advantages, including compact design, higher hydrogen purity, and faster response times, making them ideal for integration with intermittent renewable energy sources. As renewable energy generation fluctuates, the flexibility of PEM systems makes them increasingly attractive for dynamic operations. In March 2024, Plug Power expanded its PEM electrolyzer production facility to meet surging demand across North America and Europe.

Distribution Channel Insights

Pipeline distribution dominated the distribution channel segment. Pipelines offer a cost-effective solution for transporting large volumes of hydrogen over relatively short distances, particularly for industrial clusters and hydrogen valleys. Retrofitting existing natural gas pipelines for hydrogen transport is being actively explored to lower infrastructure costs. In March 2024, a European consortium launched the "HyGrid" project, repurposing old natural gas pipelines for green hydrogen delivery across key industrial hubs.

Cargo transport (via ships and tankers) is the fastest-growing distribution channel. As global trade in green hydrogen expands, shipping hydrogen in liquefied or ammonia forms is becoming a priority for exporting countries. In January 2024, Kawasaki Heavy Industries conducted its first successful trial shipment of liquefied hydrogen from Australia to Japan, showcasing the potential for transcontinental hydrogen logistics.

Application Insights

Power Generation dominated the application segment in 2024. Green hydrogen is being increasingly used for grid balancing, long-duration energy storage, and as a feedstock for green ammonia production. Utilities are integrating hydrogen into their energy storage strategies to store excess wind and solar power, enhancing grid stability. In April 2024, Iberdrola announced the completion of a 20 MW green hydrogen plant in Spain dedicated to renewable energy storage.

Transportation is the fastest-growing application segment. Hydrogen fuel cell vehicles (FCEVs) for buses, trucks, trains, and ships are gaining popularity due to their long-range and fast refueling advantages over battery-electric vehicles. Public and private investments in hydrogen refueling infrastructure are bolstering the adoption of hydrogen-powered transport solutions. In February 2024, Toyota launched its second-generation hydrogen fuel cell truck for commercial operations in California, reflecting the transport sector's growing shift toward hydrogen.

Regional Insights

Europe dominated the global green hydrogen market in 2024. The European Union’s Green Deal, Hydrogen Strategy, and REPowerEU plan have provided a comprehensive policy framework supporting green hydrogen development. Countries like Germany, the Netherlands, France, and Spain are aggressively investing in electrolyzer projects, infrastructure, and cross-border hydrogen trade corridors. In March 2024, Germany launched the "H2Global" initiative to facilitate long-term green hydrogen imports and domestic consumption.

.

.

Asia-Pacific is the fastest-growing region. Countries such as Japan, South Korea, China, and Australia are heavily investing in green hydrogen as a cornerstone of their energy transition strategies. Australia, in particular, is emerging as a global green hydrogen powerhouse, with mega-projects like the Asian Renewable Energy Hub aiming to produce green hydrogen at scale for domestic use and exports. In April 2024, Japan increased its hydrogen investment budget to $1.5 billion, accelerating research, development, and pilot deployments across the country.

Some of the prominent players in the green hydrogen market include:

- Air Liquide

- Air Products Inc.

- Bloom Energy

- Cummins Inc.

- Engie

- Linde plc.

- Nel ASA

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Uniper SE

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global green hydrogen market.

Technology

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

Application

- Power Generation

- Transportation

- Others

Distribution Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.

.