Gynecological Cancer Drugs Market Size and Forecast 2025 to 2034

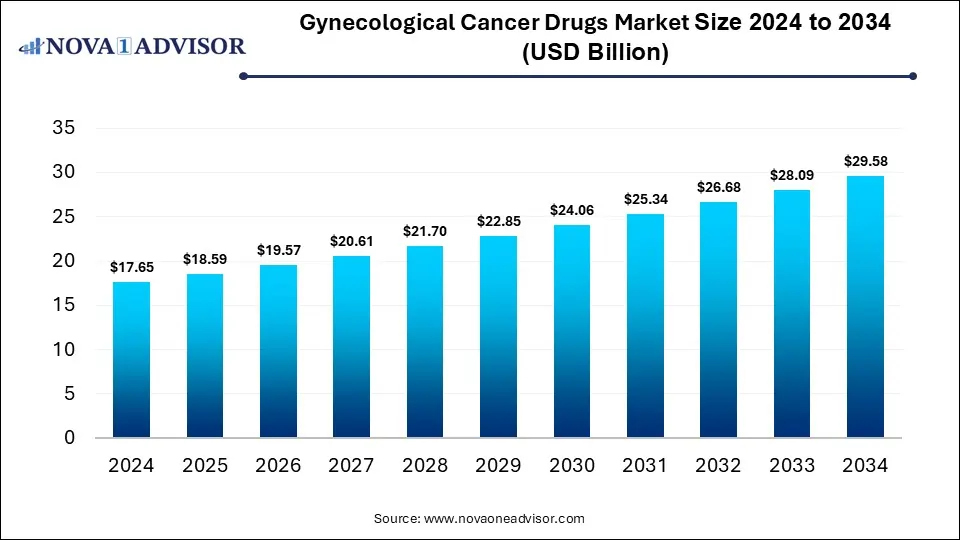

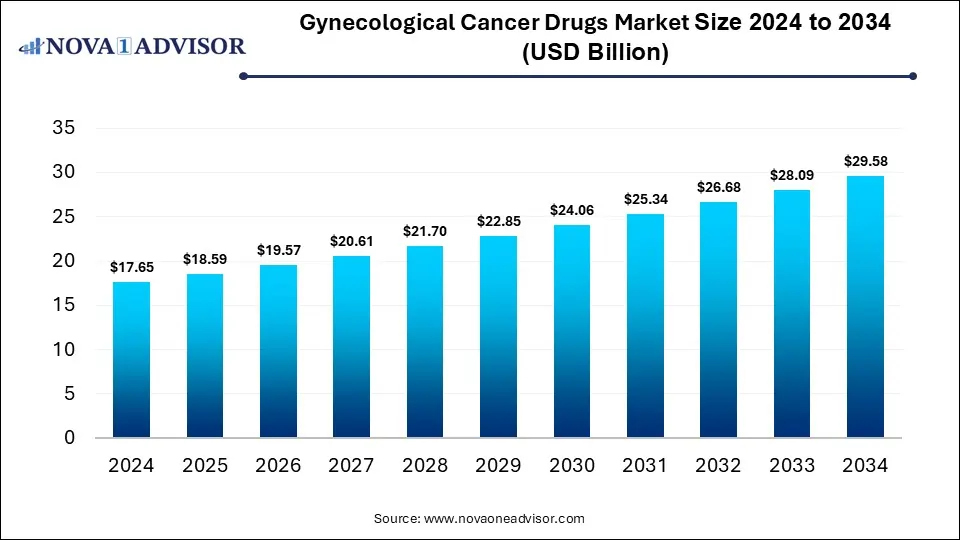

The global gynecological cancer drugs market size is calculated at USD 17.65 billion in 2024, grow to USD 18.59 billion in 2025, and is projected to reach around USD 29.58 billion by 2034, growing at a CAGR of 5.3% from 2025 to 2034. The market is growing due to the rising incidence of ovarian, cervical, and uterine cancers, along with increasing awareness and early diagnosis. Advancements in targeted therapies and personalized medicine are further driving demand.

Gynecological Cancer Drugs Market Key Takeaways

- North America dominated the gynecological cancer drugs market revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By indication, the cervical cancer segment held the largest market share in 2024.

- By indication, the ovarian cancer segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By therapeutic modality, the chemotherapy segment led the market with the largest revenue share in 2024.

- By therapeutic modality, the targeted therapy segment is expected to grow at the fastest CAGR in the market during the forecast period.

Which Factors are Driving the Growth of the Gynecological Cancer Drugs Market?

Gynecological cancer drugs are medications specifically developed to treat cancers affecting the female reproductive system, including ovarian, cervical, uterine, vaginal, and vulvar cancers. These drugs may include chemotherapy, targeted therapies, immunotherapies, and hormonal treatments aimed at destroying cancer cells, slowing tumor growth, or preventing recurrence. The gynecological cancer drugs market is expanding due to continuous innovation in drug development, leading to more effective and less toxic treatment options. Increased clinical trial activity and FDA approvals are accelerating market entry of novel therapies. Expanding healthcare access in emerging economies, coupled with higher healthcare spending, is supporting adoption. Moreover, collaborations between pharmaceutical companies and research institutes are fostering breakthroughs in precision medicine, while growing patient preference for advanced, targeted treatments fuels further demand.

What are the Key trends in the Market in 2024?

- In October 2025, the European Commission approved Merck & Co. Inc.’s Keytruda (pembrolizumab), an anti-PD-1 therapy, for treating recurrent or advanced endometrial carcinoma in patients whose disease has progressed after prior platinum-based chemotherapy. This milestone made Keytruda the first PD-1 inhibitor approved in Europe for this indication, marking a major step forward in treatment options for individuals with endometrial cancer.(Source: https://www.merck.com/)

- In February 2024, the FDA approved Roche Holding AG’s targeted therapy Polatuzumab Vedotin-piiq, combined with bendamustine and rituximab, for treating adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL). This approval broadened Roche’s oncology offerings and provided a new option for an area with significant unmet medical needs.(Source: https://www.fda.gov/)

What Impact does AI have on the Market?

AI is transforming the gynecological cancer drugs market by enabling earlier and more accurate diagnosis, predicting patient responses to specific treatments, and accelerating drug discovery through advanced data analysis. It helps in identifying novel therapeutic targets, optimizing clinical trial design, and personalizing treatment plans, leading to improved outcomes and reduced development timelines. This integration of AI enhances efficiency in research, supports precision medicine, and drives faster market availability of innovative gynecological cancer therapies.

Report Scope of Gynecological Cancer Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 18.59 Billion |

| Market Size by 2034 |

USD 29.58 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Indication, By Therapeutic Modality, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Roche, AstraZeneca , Pfizer, Inc, Merck & Co., Johnson & Johnson Services, Inc., Mylan N.V., Sanofi, Lilly, AbbVie Inc., Boehringer Ingelheim International GmbH |

Market Dynamics

Driver

Rising Incidence of Ovarian, Cervical, and Uterine Cancers

An increase in cases of ovarian, cervical, and uterine cancers is stimulating growth in the gynecological cancer drugs market by highlighting the urgent need for improved therapeutic solutions. The growing disease burden prompts accelerated research activities, boosts funding for oncology advancements, and encourages clinical adoption of cutting-edge treatments. Rising patient awareness and early diagnosis further expand the treatment pool, while healthcare providers increasingly seek more precise and effective drug options, collectively strengthening market expansion.

Restraint

The elevated pricing of cancer treatment and targeted therapies acts as a market restraint by narrowing the pool of patients who can realistically undergo these advanced options. Many healthcare providers in resource-limited settings are forced to rely on older, less effective drugs due to budget constraints. Even in developed regions, high out-of-pocket costs may discourage treatment adherence. This economic barrier reduces overall demand for premium gynecological cancer drugs and slows the pace of widespread therapeutic adoption.

Opportunity

Development of Next-generation Targeted Therapies and Immunotherapies

Advancements in next-generation targeted therapies and immunotherapies create promising pathways for future market growth by opening treatment possibilities for patients unresponsive to conventional drugs. These innovations can enhance survival rates, expand therapeutic indications, and tap into underserved patient segments. Ongoing breakthroughs in molecular biology and immune system modulation are expected to yield highly specialized drugs, attracting both clinical interest and investment, ultimately making this market a high-value growth area in gynecological cancer care.

Segmental Insights

How did Cervical Cancer Dominate the Market in 2024?

The dominance of the cervical cancer segment in 2024 was supported by a growing patient pool and the continuous introduction of innovative treatment approaches. Increased clinical research activity, along with expanded access to oncology drugs in emerging markets, boosted therapy uptake. Pharmaceutical companies prioritized cervical cancer in their development pipelines, leading to more products launched and wider availability. These factors collectively strengthened its position as the leading indication within the gynecological cancer drugs market.

The ovarian cancer segment is anticipated to record the fastest growth as ongoing scientific advances are uncovering new therapeutic targets and drug delivery methods. Rising focus on precision medicine and biomarker-based treatment selection is enhancing patient response rates. Collaborations between biotech firms and academic institutions are accelerating the introduction of breakthrough drugs. Furthermore, healthcare systems are prioritizing ovarian cancer in oncology programs, creating a favorable environment for the rapid adoption of novel and more effective treatment options.

Gynecological Cancer Drugs Market Size By Indication, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Cervical Cancer |

4.94 |

5.19 |

5.44 |

5.71 |

5.99 |

6.28 |

6.59 |

6.92 |

7.26 |

7.61 |

7.99 |

| Uterine Cancer |

3.88 |

4.1 |

4.33 |

4.56 |

4.82 |

5.08 |

5.37 |

5.66 |

5.98 |

6.31 |

6.66 |

| Ovarian Cancer |

7.95 |

8.37 |

8.82 |

9.31 |

9.81 |

10.35 |

10.9 |

11.49 |

12.11 |

12.77 |

13.45 |

| Vaginal & Vulvar Cancer |

0.88 |

0.93 |

0.98 |

1.03 |

1.08 |

1.14 |

1.2 |

1.27 |

1.33 |

1.4 |

1.48 |

What made the Chemotherapy Segment Dominant in the Market in 2024?

The chemotherapy segment maintained the largest revenue share in 2024 as it continues to be the cornerstone in gynecological cancer care, supported by a decade of proven clinical outcomes. Its adaptability for use across multiple cancer types and stages, along with strong integration into treatment guidance, sustains high utilization. In many regions, chemotherapy remains the most accessible and scalable option, ensuring its prominence despite the growing presence of targeted and immune-based therapies.

The targeted therapeutic segment is projected to witness the fastest growth as breakthroughs in oncology research are delivering highly specific treatment mechanisms. Pharmaceutical pipelines are increasingly focused on developing agents that address unique genetic mutations found in gynecological cancers. Growing use of companion diagnostics is enhancing treatment precision, while favorable clinical trial results are accelerating regulatory approvals. These factors, combined with rising clinician confidence in targeted approaches, are expected to propel rapid adoption during the forecast period.

Gynecological Cancer Drugs Market Size By Therapeutic Modality, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Chemotherapy |

7.06 |

7.4 |

7.75 |

8.12 |

8.51 |

8.91 |

9.34 |

9.78 |

10.24 |

10.73 |

11.24 |

| Targeted Therapy |

7.94 |

8.4 |

8.88 |

9.4 |

9.94 |

10.51 |

11.11 |

11.76 |

12.44 |

13.15 |

13.9 |

| Hormonal Therapy |

2.65 |

2.79 |

2.94 |

3.09 |

3.25 |

3.43 |

3.61 |

3.8 |

4 |

4.21 |

4.44 |

By Regional Insights

How is North America Contributing to the Expansion of the Gynecological Cancer Drugs Market?

North America held the largest revenue share in 2024 as substantial healthcare spending and robust insurance coverage facilitated broad patient access to advanced treatments. The region benefits from a dense network of cancer research centers, driving continuous innovation in gynecological oncology. Strategic collaborations between academic institutions and drug manufacturers have accelerated the introduction of novel therapies. Furthermore, a well-established clinical trial landscape and strong patient enrollment rates have reinforced North America’s market dominance.

How is Asia-Pacific Accelerating the Gynecological Cancer Drugs Market?

Asia-Pacific is projected to experience the fastest growth in the gynecological cancer drugs market as urbanization and lifestyle changes contribute to a rising cancer burden. Many countries in the region are prioritizing oncology care in national health strategies, creating a favorable environment for drug adoption. Increased participation in international research collaborations is accelerating the availability of advanced therapies, while competitive pricing by local manufacturers is making treatments more accessible to a wider patient base.

Gynecological Cancer Drugs Market Size By Regional Insights, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

6.71 |

7.06 |

7.4 |

7.78 |

8.16 |

8.58 |

9.01 |

9.45 |

9.93 |

10.43 |

10.94 |

| Europe |

4.94 |

5.19 |

5.46 |

5.74 |

6.03 |

6.34 |

6.66 |

7.01 |

7.36 |

7.74 |

8.14 |

| Asia Pacific |

4.41 |

4.67 |

4.95 |

5.24 |

5.56 |

5.88 |

6.23 |

6.6 |

6.99 |

7.4 |

7.84 |

| Latin America |

0.88 |

0.93 |

0.98 |

1.03 |

1.08 |

1.14 |

1.2 |

1.27 |

1.33 |

1.4 |

1.48 |

| Middle East and Africa (MEA) |

0.71 |

0.74 |

0.78 |

0.82 |

0.87 |

0.91 |

0.96 |

1.01 |

1.07 |

1.12 |

1.18 |

Top Companies in the Gynecological Cancer Drugs Market

- Roche

- AstraZeneca

- Pfizer, Inc

- Merck & Co.

- Johnson & Johnson Services, Inc.

- Mylan N.V.

- Sanofi

- Lilly

- AbbVie Inc.

- Boehringer Ingelheim International GmbH

Recent Developments in the Gynecological Cancer Drugs Market

- In March 2025, Pfizer Inc. partnered with Merck KGaA, Darmstadt, Germany, to co-develop and market avelumab, a fully human anti-PD-L1 antibody, for treating gynecological cancers such as ovarian and endometrial cancer. This alliance merges Pfizer’s commercial strength with Merck KGaA’s immuno-oncology expertise to advance innovative cancer therapies for patients. (Source: https://www.emdserono.com/)

- In June 2024, AstraZeneca plc finalized its USD 30 billion acquisition of Alexion Pharmaceuticals Inc., gaining access to Alexion’s complement-based therapies, including Ultomiris, a long-acting C5 inhibitor used to prevent PNH and aHUS in both adults and children. The deal strengthened AstraZeneca’s market position, particularly in the rare diseases segment. (Source: https://www.astrazeneca.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the gynecological cancer drugs market.

By Indication

- Cervical Cancer

- Uterine Cancer

- Ovarian Cancer

- Ovarian Cancer

By Therapeutic Modality

- Chemotherapy

- Targeted Therapy

- Hormonal Therapy

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)