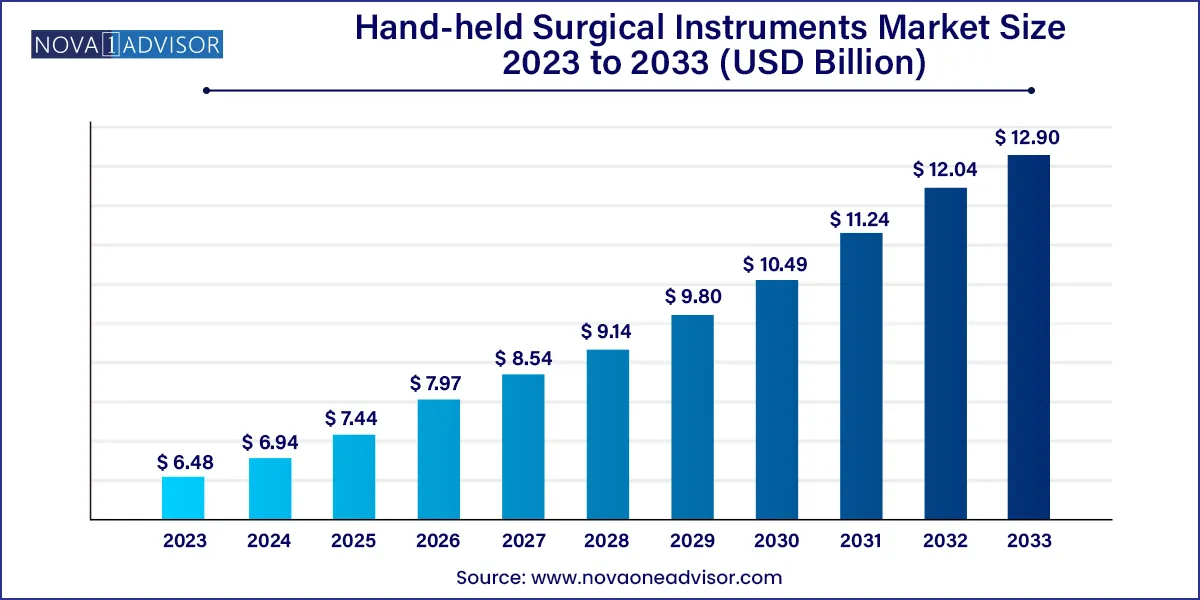

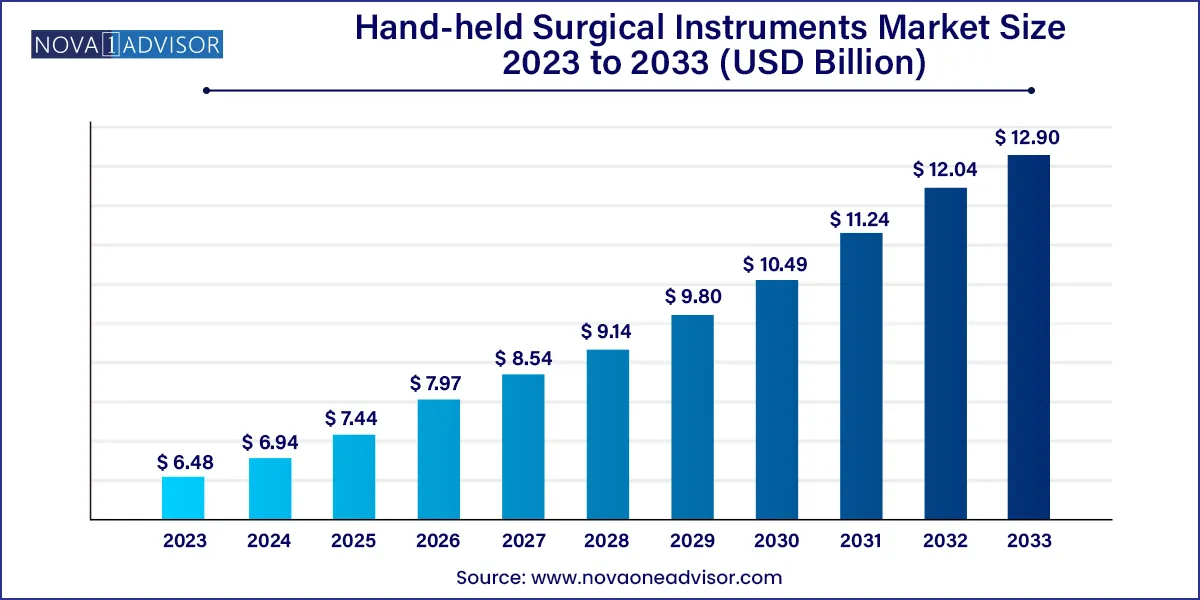

The global hand-held surgical instruments market size was exhibited at USD 6.48 billion in 2023 and is projected to hit around USD 12.90 billion by 2033, growing at a CAGR of 7.13% during the forecast period 2024 to 2033.

Key Takeaways:

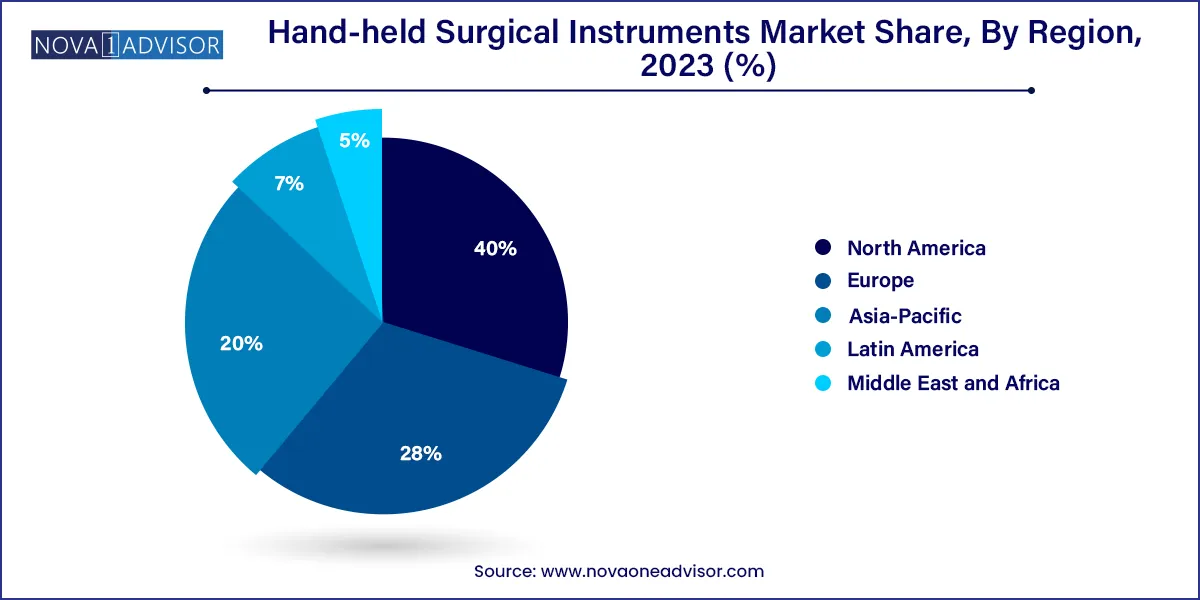

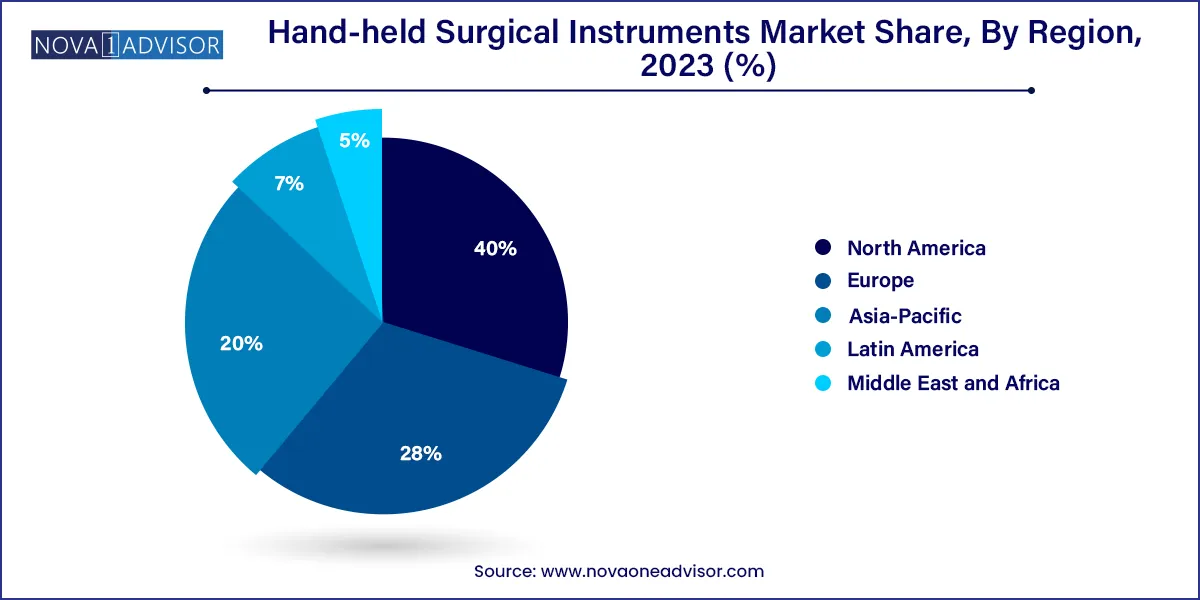

- North America dominated the global hand-held surgical instrument market with an overall market share of 40.0% in 2023.

- The forceps segment held the highest market share in 2023 of 19.6% owing to its increasing usage.

- Orthopedic surgery segment held highest market share of 18.4% in 2023

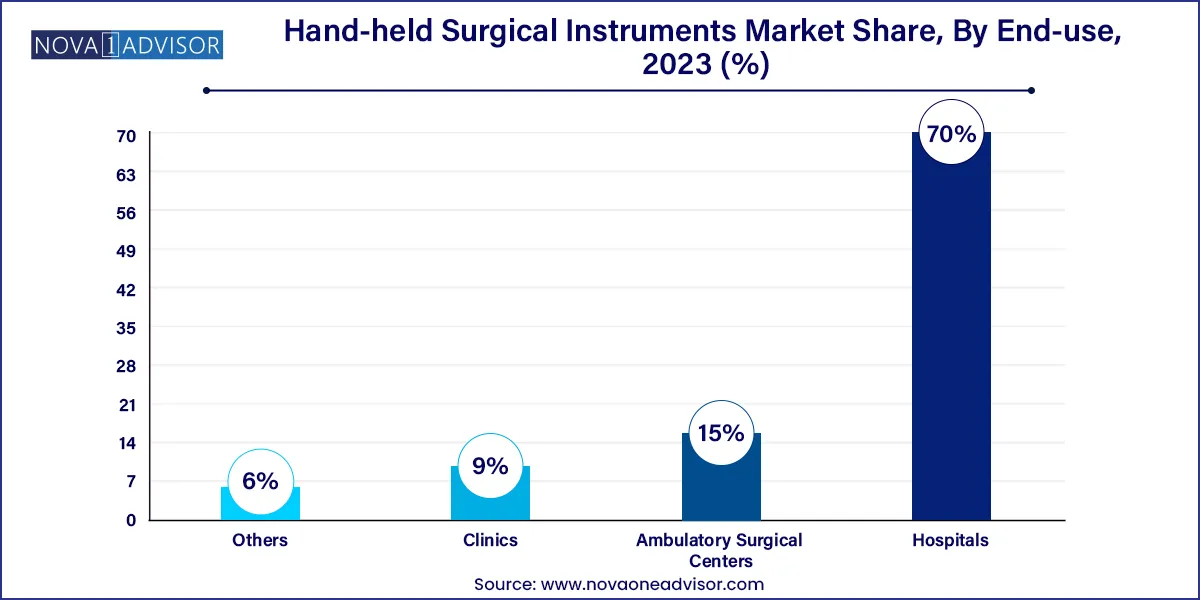

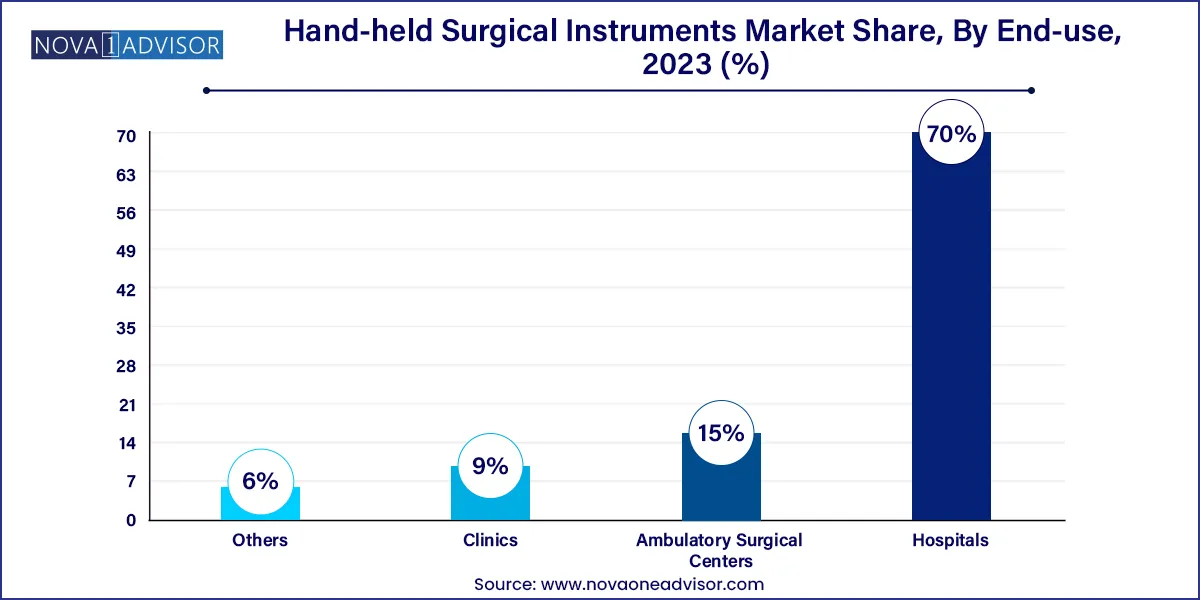

- The hospitals segment held for highest revenue share in 2023 of 70.0% owing large number of cases and preventive surgeries being performed in these settings.

Market Overview

The Hand-held Surgical Instruments Market is witnessing substantial growth as advancements in surgical technologies and rising global healthcare expenditure accelerate the demand for high-precision, ergonomically designed, and reliable tools. These instruments are pivotal across a broad range of surgical procedures, from minimally invasive to complex open surgeries. Their portability, ease of use, and cost-effectiveness make them indispensable in operating rooms worldwide, particularly as healthcare shifts toward greater surgical precision and faster patient recovery.

Hand-held surgical instruments such as forceps, scalpels, trocars, and cannulas are widely used across specialties like orthopedics, cardiology, neurosurgery, and gynecology. They enable surgeons to perform critical tasks such as cutting, dissecting, clamping, and retracting with high control and tactile feedback, which is often lost in robotic surgeries. The market growth is further driven by the surge in chronic diseases, rising geriatric population, and increased access to surgical care in emerging markets.

Additionally, rising patient preference for minimally invasive procedures and the global shift toward outpatient care settings such as ambulatory surgical centers (ASCs) have increased the demand for efficient and easy-to-use hand-held devices. With the COVID-19 pandemic disrupting supply chains and healthcare operations, the industry initially witnessed a slowdown. However, recovery has been swift due to the backlog of elective surgeries and an increasing number of patients seeking medical care.

Major Trends in the Market

-

Growing Demand for Minimally Invasive Surgeries: Rising adoption of laparoscopic and endoscopic surgeries due to reduced recovery time and hospital stays.

-

Surge in Single-Use Surgical Instruments: Increasing preference for disposable tools to reduce risk of cross-contamination and hospital-acquired infections.

-

Ergonomic Design Innovations: Development of instruments with improved grip, precision, and reduced surgeon fatigue.

-

Integration of Smart Features: Emergence of instruments with embedded sensors for real-time monitoring and feedback.

-

Customization and Modular Instrument Sets: Growing trend of specialized instruments designed for specific surgeries or surgeons.

-

Expansion in Outpatient Surgical Settings: Rising number of ambulatory surgical centers driving the need for portable and efficient tools.

-

Sustainability in Manufacturing: Focus on biodegradable materials and recycling programs for single-use instruments.

-

3D Printing and Prototyping: Use of additive manufacturing for rapid design, prototyping, and customization.

Hand-held Surgical Instruments Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.94 Billion |

| Market Size by 2033 |

USD 12.90 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.13% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

B. Braun Melsungen AG; Integra LifeSciences Corporation; Medtronic; Smith & Nephew; Zimmer Biomet Holdings; Johnson & Johnson Services, Inc.; Becton, Dickinson and Company; CooperSurgical, Inc.; Thompson Surgical Instruments Inc.; Aspen Surgical. |

Market Driver: Increasing Volume of Surgeries

One of the key drivers of the hand-held surgical instruments market is the rising global volume of surgical procedures. According to WHO, an estimated 313 million surgeries are performed globally each year, a number projected to grow with aging populations and the prevalence of non-communicable diseases like cancer, cardiovascular disorders, and orthopedic injuries. As more patients seek surgical solutions for health issues, the demand for reliable and precise surgical tools continues to climb. Countries investing in expanding healthcare infrastructure, such as India and Brazil, are experiencing significant upticks in surgical procedure volumes, further boosting market demand. Additionally, the popularity of elective and cosmetic surgeries in regions like North America and Europe supports this trend.

Market Restraint: Cost Pressures and Budget Constraints

Despite growth prospects, cost pressures in public healthcare systems and among small-scale private practitioners pose a substantial restraint. Many hospitals, particularly in developing countries, face budget constraints that hinder the purchase of high-end surgical instruments or frequent replacement of devices. Furthermore, rising prices of raw materials such as stainless steel and titanium, coupled with stringent sterilization standards, increase the total cost of ownership for reusable instruments. Cost containment initiatives in regions like Europe, where centralized procurement policies are common, further limit flexibility for healthcare providers to invest in advanced or customized hand-held instruments.

Market Opportunity: Expansion in Emerging Economies

The rapid expansion of healthcare infrastructure in emerging economies represents a key opportunity. Countries like China, India, Indonesia, and several African nations are investing heavily in hospital construction, medical education, and technological upgrades. This expansion opens up significant opportunities for surgical instrument manufacturers to supply both reusable and single-use instruments tailored to these markets’ price sensitivities and clinical needs. Moreover, the increasing presence of international NGOs and government initiatives to provide surgical care in rural and underserved regions (e.g., India’s Ayushman Bharat scheme) creates a fertile ground for market penetration.

Segments Insights:

Hand-held Surgical Instruments Market By Product Insights

Forceps dominated the product segment due to their versatility in grasping, holding, and manipulating tissues during various surgical procedures. Their prevalence in both open and minimally invasive surgeries makes them essential across multiple specialties. The availability of a wide range of forceps hemostatic, tissue, dressing, and specialized ones for neurosurgery or plastic surgery supports their extensive usage. In orthopedic and cardiovascular surgeries, forceps allow surgeons to maneuver delicate tissues with high precision, minimizing trauma. Additionally, forceps are among the most frequently sterilized and reused instruments, further contributing to their dominant market share.

Dermatomes are expected to be the fastest growing segment during the forecast period, driven by rising demand in reconstructive and cosmetic surgeries. Dermatomes are essential in skin grafting procedures, especially for burn patients or those undergoing skin-related cosmetic enhancements. With the growing awareness of aesthetic procedures and the increasing incidence of skin injuries due to accidents and burns, the dermatome market is witnessing rapid adoption. Technological advancements like powered dermatomes and air-driven models provide enhanced precision and reduced surgeon fatigue, accelerating their usage across hospitals and outpatient centers.

Hand-held Surgical Instruments Market By Application Insights

Orthopedic surgery holds the largest market share in the application segment. This dominance is attributed to the high frequency of orthopedic procedures such as joint replacements, arthroscopies, and spinal surgeries. As global aging accelerates, so does the incidence of osteoarthritis, osteoporosis, and musculoskeletal injuries, all of which require surgical intervention. Hand-held tools like scalpels, retractors, and bone saws are indispensable in these procedures. Furthermore, orthopedic surgeries often require tool sets tailored to specific joints, further driving product demand.

Plastic surgery is projected to be the fastest growing application area, driven by the booming cosmetic surgery industry and increased demand for reconstructive procedures. From facial enhancements to post-mastectomy reconstructions, plastic surgeries rely heavily on fine, precision-oriented instruments like micro-scissors, dermatomes, and fine forceps. The American Society of Plastic Surgeons reports a consistent rise in cosmetic procedures annually, a trend mirrored in countries like Brazil, South Korea, and India. The increasing acceptance of aesthetic surgeries and rising medical tourism are major contributors to this segment’s growth.

Hand-held Surgical Instruments Market By End-use Insights

Hospitals dominated the end-use segment due to their comprehensive surgical capabilities, including complex and emergency procedures that require a wide array of instruments. Public and private hospitals often maintain dedicated surgical departments with high patient inflow, creating sustained demand for hand-held instruments. Moreover, hospital-based procurement cycles and sterilization facilities enable the use of both reusable and high-end surgical tools. Large hospitals, especially teaching hospitals, also emphasize training with the latest tools, enhancing demand further.

Ambulatory Surgical Centers (ASCs) are the fastest growing end-user segment, supported by the shift toward outpatient surgeries. ASCs offer same-day surgical procedures, which are less expensive and require less recovery time. Their growing popularity, particularly in the U.S., is boosting demand for compact, user-friendly, and disposable surgical tools. ASCs typically prefer lightweight and multi-functional hand-held instruments that can be used across a variety of procedures, making them an attractive market for manufacturers seeking rapid adoption.

Hand-held Surgical Instruments Market By Regional Insights

North America holds the dominant position in the hand-held surgical instruments market, primarily driven by its advanced healthcare infrastructure, high surgical volumes, and strong presence of leading medical device companies. The U.S. healthcare system performs millions of surgical procedures annually, and surgical innovations are routinely adopted due to favorable reimbursement policies and well-funded healthcare institutions. The region also benefits from extensive R&D, strong surgical training programs, and early adoption of ergonomic and digital enhancements in surgical instruments.

Asia-Pacific is the fastest growing region, owing to rising healthcare spending, expanding hospital networks, and growing patient awareness in countries such as China, India, and Indonesia. Governments in these regions are investing in surgical infrastructure and access, while private healthcare is booming due to increasing insurance coverage and out-of-pocket spending. Furthermore, the region’s large population base and increasing prevalence of chronic diseases create a vast potential customer base. Medical tourism in countries like Thailand and Malaysia is another factor driving surgical volume, thus boosting demand for hand-held instruments.

Some of the prominent players in the Hand-held surgical instruments market include:

- Zimmer Biomet

- B. Braun Melsungen AG

- Integra LifeSciences Corporation

- Medtronic, plc.

- Smith & Nephew

- Zimmer Biomet Holdings

- Johnson & Johnson Services, Inc.

- Becton, Dickinson and Company

- CooperSurgical, Inc.

- Thompson Surgical Instruments Inc.

- Aspen Surgical

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hand-held surgical instruments market.

Product

- Forceps

- Retractors

- Dilators

- Graspers

- Scalpels

- Cannulas

- Dermatome

- Trocars

- Others

Application

- Orthopedic Surgery

- Cardiology

- Ophthalmology

- Wound Care

- Audiology

- Thoracic Surgery

- Urology & Gynecology Surgery

- Plastic Surgery

- Neurosurgery

- Others

End-use

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)