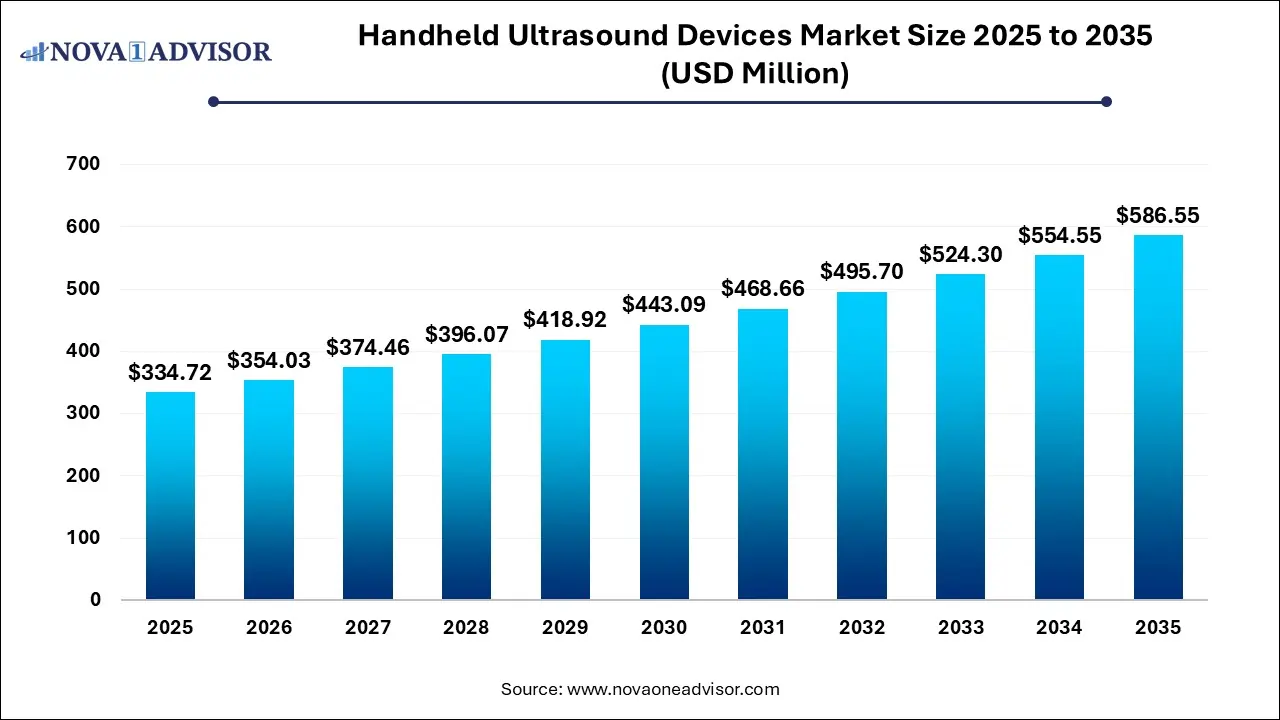

Handheld Ultrasound Devices Market Size and Growth

The handheld ultrasound devices market size was exhibited at USD 334.72 million in 2025 and is projected to hit around USD 586.55 million by 2035, growing at a CAGR of 5.77% during the forecast period 2026 to 2035.

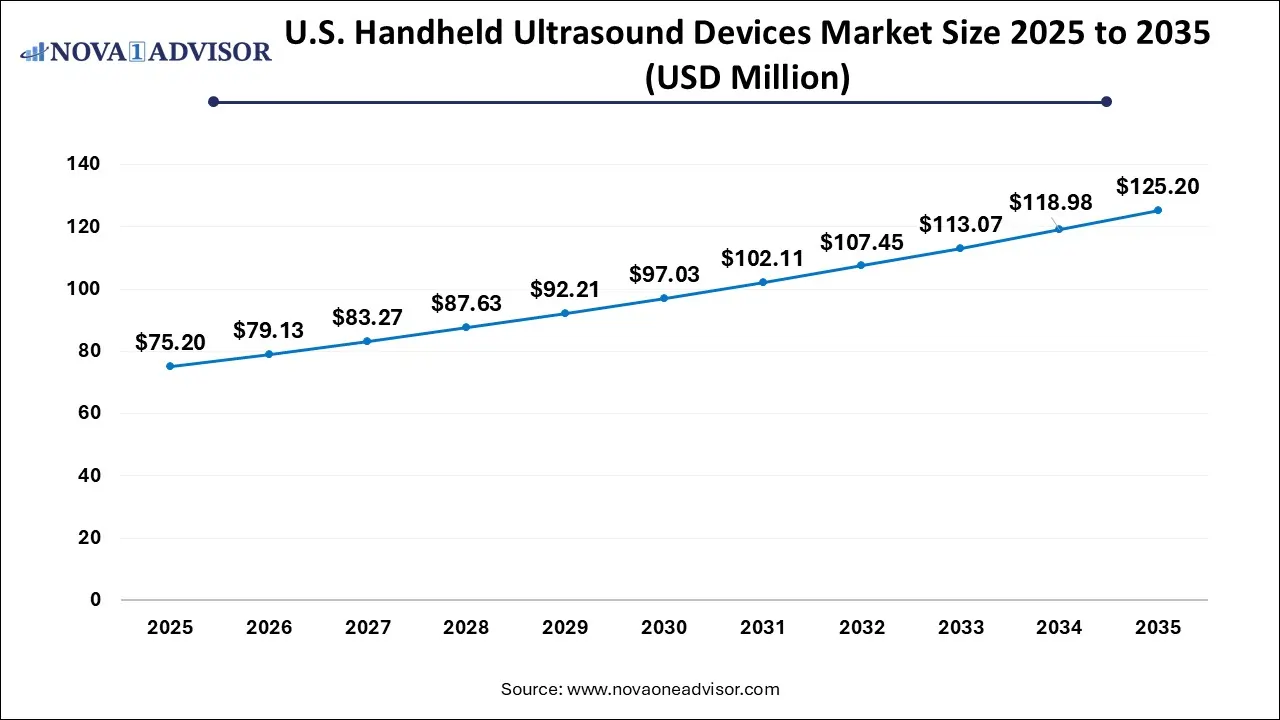

U.S. Handheld Ultrasound Devices Market Size and Growth 2025 to 2034

The U.S. handheld ultrasound devices market size is evaluated at USD 75.20 million in 2025 and is projected to be worth around USD 125.20 million by 2035, growing at a CAGR of 5.23% from 2026 to 2035.

North America dominated the the global handheld ultrasound devices market, primarily driven by its advanced healthcare infrastructure, early adoption of technology, and strong presence of leading manufacturers such as GE HealthCare, Butterfly Network, and Philips. The region benefits from a well-established reimbursement framework, high awareness of point-of-care diagnostics, and growing use of telehealth platforms. In the United States, handheld ultrasound usage has expanded beyond hospitals into home healthcare, military medicine, and medical education. Moreover, increasing investments in AI integration and cloud-based image analysis platforms are further supporting the regional market.

Asia Pacific is witnessing the fastest growth, owing to rapid healthcare infrastructure development, increasing demand for low-cost diagnostic solutions, and government initiatives to expand rural healthcare access. Countries like China, India, and Indonesia are experiencing a surge in maternal and primary healthcare demand, where handheld ultrasound tools are filling the gap left by a shortage of large imaging centers. The affordability and portability of these devices are making them an attractive solution for outreach programs, mobile clinics, and disaster response units. Additionally, rising local manufacturing activity and regulatory support are making Asia Pacific an attractive market for device suppliers and investors.

Market Overview

The global handheld ultrasound devices market has witnessed notable growth in recent years, catalyzed by the expanding demand for point-of-care diagnostics, the evolution of telehealth, and the miniaturization of medical imaging technologies. Handheld ultrasound devices—also referred to as portable or pocket ultrasound systems—are compact, lightweight, and user-friendly tools that provide real-time diagnostic imaging with the convenience of mobility. These devices are revolutionizing traditional sonography by enabling clinicians to perform ultrasound scans at the bedside, in remote areas, or during emergency scenarios.

This paradigm shift in diagnostic imaging is particularly evident across emergency departments, intensive care units (ICUs), primary care clinics, and even in home healthcare settings. Market players are continually pushing the boundaries of innovation by integrating artificial intelligence (AI) and wireless capabilities into handheld ultrasound systems, thereby improving ease of use and diagnostic accuracy. For instance, Butterfly Network’s Butterfly iQ+ offers a single probe solution that uses semiconductor technology to cover a broad range of imaging applications, and it seamlessly connects to smartphones or tablets.

As healthcare systems worldwide move toward value-based care models, handheld ultrasound devices have emerged as cost-effective alternatives to traditional imaging methods, enabling rapid diagnosis and treatment decisions while reducing the burden on central imaging departments. The COVID-19 pandemic further highlighted the importance of portable medical technologies, with frontline physicians leveraging handheld ultrasounds for lung imaging, cardiac evaluations, and vascular assessments at patients' bedsides to limit exposure risks and enhance care efficiency.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI): AI-enhanced handheld ultrasounds are helping automate image interpretation, making the technology accessible even to non-radiologist clinicians.

-

Expansion of Point-of-Care Ultrasound (POCUS): Widespread use in emergency care, sports medicine, and rural healthcare is pushing the adoption of POCUS-enabled handheld devices.

-

Cloud Connectivity and Data Sharing: Cloud-integrated ultrasound systems are allowing for remote consultations and real-time image sharing, improving collaboration among care teams.

-

Single-Probe Multi-Imaging Technology: Companies like Clarius and Butterfly Network are offering single-probe devices capable of multiple imaging modes, reducing equipment cost and complexity.

-

Rising Use in Veterinary and Home Healthcare: Beyond hospitals, portable ultrasound is gaining popularity in home care, military, and veterinary medicine due to its portability and versatility.

-

Growing Popularity of Subscription-Based Models: Some players are offering devices on a subscription basis, making them more affordable and accessible for individual practitioners.

-

Training and Simulation Enhancements: Increased investment in augmented reality and virtual training modules for POCUS and ultrasound device operation is reducing the learning curve.

-

Miniaturization and Wireless Connectivity: Progressive reduction in device size with wireless probe-to-screen connectivity is improving mobility and ease of handling.

-

Regulatory Approvals and Expedited Launches: Fast-track FDA clearances and CE approvals are enabling quicker time-to-market for innovative ultrasound devices.

Report Scope of Handheld Ultrasound Devices Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 354.03 Million |

| Market Size by 2035 |

USD 586.55 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 5.77% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology, Application, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

GE HealthCare; Koninklijke Philips N.V.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; BenQ Medical Technology; CHISON Medical Technologies Co., Ltd.; Dawei Medical (Jiangsu) Corp., Ltd.; Viatom Technology Co., Ltd.; Telemed Medical Systems S.r.l.; Butterfly Network, Inc; Pulsenmore Ltd.; Leltek Inc, |

Market Driver: Demand for Point-of-Care Diagnostics

A significant driver of the handheld ultrasound devices market is the surging demand for point-of-care diagnostics (POCD). In the contemporary medical landscape, healthcare providers are focusing on early diagnosis and faster decision-making. Handheld ultrasound devices fulfill this need by providing high-resolution imaging at the patient's bedside or in remote locations. The ability to conduct real-time, accurate diagnostic procedures without transporting patients to imaging centers significantly enhances clinical workflows.

For example, in rural and resource-limited settings, access to traditional imaging systems can be challenging due to infrastructure constraints. Handheld ultrasound systems have proven to be game-changers in such environments, allowing for timely diagnosis of pregnancy complications, cardiac anomalies, or abdominal pathologies. These devices are also vital in emergency medicine where rapid assessment can be the difference between life and death. In trauma care scenarios, clinicians rely on handheld ultrasound for focused assessment with sonography for trauma (FAST) to detect internal bleeding. Hence, the growth of POCD, coupled with the emphasis on decentralizing diagnostic services, is propelling the demand for handheld ultrasound solutions globally.

Market Restraint: Limited Imaging Capabilities Compared to Conventional Systems

Despite their advantages, handheld ultrasound devices face the limitation of reduced imaging capabilities when compared to high-end cart-based ultrasound systems. This remains a key restraint for market expansion, particularly in high precision diagnostic scenarios.

While handheld ultrasounds are ideal for rapid assessments and basic imaging tasks, they may fall short in offering comprehensive evaluations for complex cases requiring advanced Doppler analysis, high-frequency transducers, or contrast-enhanced imaging. Additionally, these devices may have limitations in terms of penetration depth, field of view, and battery life. In cases such as deep abdominal scans, vascular assessments in obese patients, or detailed fetal anomaly scans, clinicians still prefer traditional full-sized systems. As a result, some healthcare providers remain hesitant to rely solely on handheld devices for critical diagnostic decisions, restricting their usage to supplemental or preliminary assessments.

Market Opportunity: Rising Adoption in Home Healthcare and Telemedicine

One of the most promising opportunities for the handheld ultrasound devices market lies in the rising adoption of these devices within home healthcare and telemedicine ecosystems. As populations age and chronic disease prevalence increases, the demand for home-based diagnostic solutions has surged. Handheld ultrasound devices, due to their portability, affordability, and user-friendly design, are ideally positioned to meet this demand.

Healthcare providers and patients are increasingly favoring at-home diagnostic models to reduce hospital visits and minimize exposure to healthcare-associated infections. For instance, remote consultations facilitated by AI-enabled handheld ultrasound tools allow physicians to guide patients or caregivers in capturing ultrasound images, which are then analyzed remotely by specialists. Companies like EchoNous and Philips are developing devices that integrate seamlessly into telehealth platforms, expanding the role of handheld ultrasounds in virtual care. This shift is expected to accelerate further with improvements in device connectivity, imaging software, and clinician training programs tailored for remote use.

Handheld Ultrasound Devices Market By Technology Insights

By Technology: 2D Ultrasound Dominated; 3D/4D Ultrasound Is the Fastest-Growing

2D ultrasound technology continues to dominate the handheld ultrasound devices market due to its proven reliability, affordability, and wide range of clinical applications. It is the most commonly used imaging mode across all levels of healthcare, particularly in low-resource settings where high-end imaging systems are unavailable. 2D handheld ultrasound devices are often the first choice for general assessments in obstetrics, cardiology, and emergency medicine, enabling physicians to visualize organs and structures in real time. Their low learning curve and integration with mobile platforms also make them suitable for primary care and family medicine practitioners.

On the other hand, the fastest-growing segment is 3D/4D ultrasound technology. These advanced imaging modes offer superior visualization and are particularly beneficial in obstetrics, where fetal anatomy and movement can be observed in detail. The growing demand for high-resolution imaging in prenatal care and surgical planning is accelerating the adoption of 3D/4D ultrasound systems. Additionally, advances in probe miniaturization and AI-based image enhancement are overcoming the earlier limitations of 3D/4D portability, making it increasingly viable in handheld formats. Leading manufacturers are developing compact devices with real-time 3D imaging that cater to specialists in musculoskeletal, cardiovascular, and gynecological diagnostics.

Handheld Ultrasound Devices Market By End Use Insights

By End-Use: Hospitals Dominate; Primary Clinics Grow Rapidly

Hospitals are the dominant end-use segment, accounting for a significant share of handheld ultrasound usage. The diversity of clinical departments—including emergency rooms, ICUs, operating theaters, and maternity wards—makes hospitals major consumers of point-of-care ultrasound tools. These devices are integral to bedside monitoring, trauma evaluations, procedural guidance (e.g., catheter placement), and rapid triaging in critical care settings. Their ease of sterilization, wireless features, and integration with hospital IT systems have accelerated adoption across hospital networks.

However, primary clinics are emerging as the fastest-growing end-use segment due to the decentralization of healthcare services and the shift toward outpatient care. Physicians in private practices and community health centers are increasingly incorporating handheld ultrasound devices to enhance diagnostic capabilities and reduce dependency on hospital-based imaging. These tools are improving the quality of care in resource-limited settings, where referral infrastructure may be weak or delayed. Government programs encouraging primary care strengthening and preventive health have also contributed to the growth of this segment.

Handheld Ultrasound Devices Market By Application Insights

By Application: Obstetrics/Gynecology Leads; Musculoskeletal Emerges Fastest

Obstetrics and gynecology (OB/GYN) remains the leading application segment for handheld ultrasound devices. These devices are frequently used in prenatal screening, fetal monitoring, and pelvic examinations. The convenience of bedside scanning and non-invasive monitoring has made handheld ultrasounds indispensable in both hospitals and mobile maternal healthcare units. In developing countries, where access to imaging is often limited, these devices serve as essential tools in reducing maternal and neonatal mortality through timely prenatal diagnosis. Their role during antenatal visits in rural clinics and home-based care scenarios continues to grow, further strengthening this segment.

Musculoskeletal applications are the fastest-growing in this market, driven by the rise in sports injuries, orthopedic procedures, and rehabilitation services. Handheld ultrasound devices are being increasingly adopted by physical therapists, sports medicine specialists, and orthopedic surgeons for evaluating soft tissue injuries, muscle tears, and joint conditions. The ability to conduct immediate assessments and monitor healing progress at the point of care eliminates the need for costly and time-consuming referrals to imaging centers. Companies like Clarius and Sonosite have launched devices specifically designed for high-resolution musculoskeletal imaging, boosting demand in this sub-segment.

Some of the prominent players in the handheld ultrasound devices market include:

Handheld Ultrasound Devices Market Recent Developments

-

In February 2024, Butterfly Network announced a partnership with Mendaera to develop AI-powered robotic ultrasound systems, highlighting the company's focus on next-generation diagnostic platforms.

-

In October 2023, Philips launched its Lumify with Reacts, an advanced handheld ultrasound solution that supports virtual guidance and remote collaboration, strengthening its tele-ultrasound capabilities.

-

In August 2023, GE HealthCare unveiled updates to its Vscan Air handheld ultrasound, enhancing its AI-assisted image capture and adding support for new clinical applications.

-

In May 2023, Clarius Mobile Health introduced a third-generation wireless handheld ultrasound with improved battery life, imaging speed, and compatibility with iOS and Android systems.

-

In March 2023, EchoNous received FDA clearance for its AI-powered bladder scanner, which is part of the Kosmos platform—a modular handheld diagnostic suite gaining popularity in emergency care.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the handheld ultrasound devices market

By Technology

- 2D Ultrasound

- 3D/4D Ultrasound

- Doppler Ultrasound

By Application

- Obstetrics/Gynecology

- Cardiovascular

- Urology

- Gastroenterology

- Musculoskeletal

- Trauma

- Others

By End-use

- Hospitals

- Primary Clinics

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)