Healthcare Analytics Market Size and Growth

The healthcare analytics market size was exhibited at USD 53.25 billion in 2024 and is projected to hit around USD 364.2 billion by 2034, growing at a CAGR of 21.2% during the forecast period 2025 to 2034.

Healthcare Analytics Market Key Takeaways

- In 2024, descriptive analysis accounted for the highest market share at 36.0%.

- The services category led the market, capturing a 38.0% share.

- Life science firms held the largest portion of market revenue, contributing 45.0%.

- The on-premises deployment model emerged as the leader, securing a 48.0% revenue share.

- Financial applications represented the most significant share of the market at 37.0%.

- North America led the global market in 2024, holding a 49.0% revenue share.

- Meanwhile, the Asia Pacific region is projected to experience the fastest growth, with an anticipated rate of 23.0%.

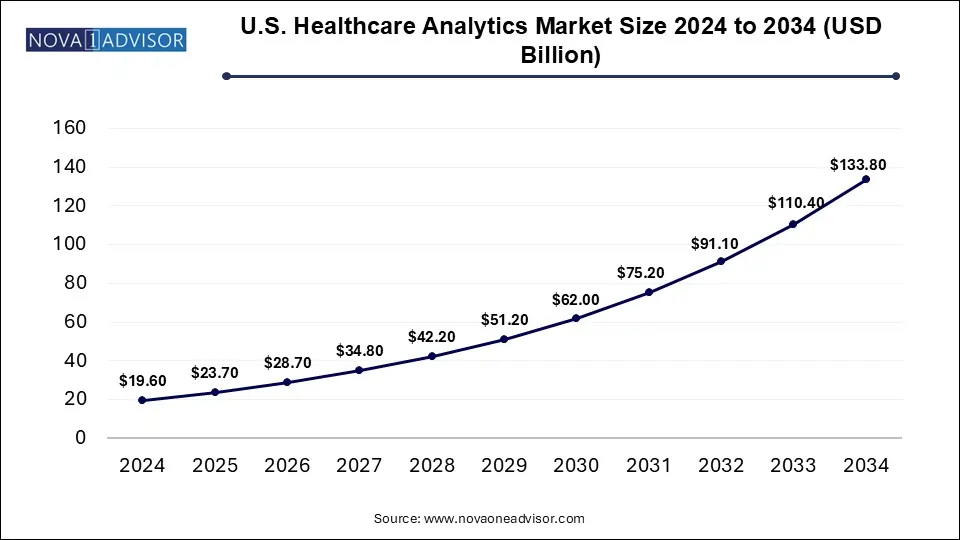

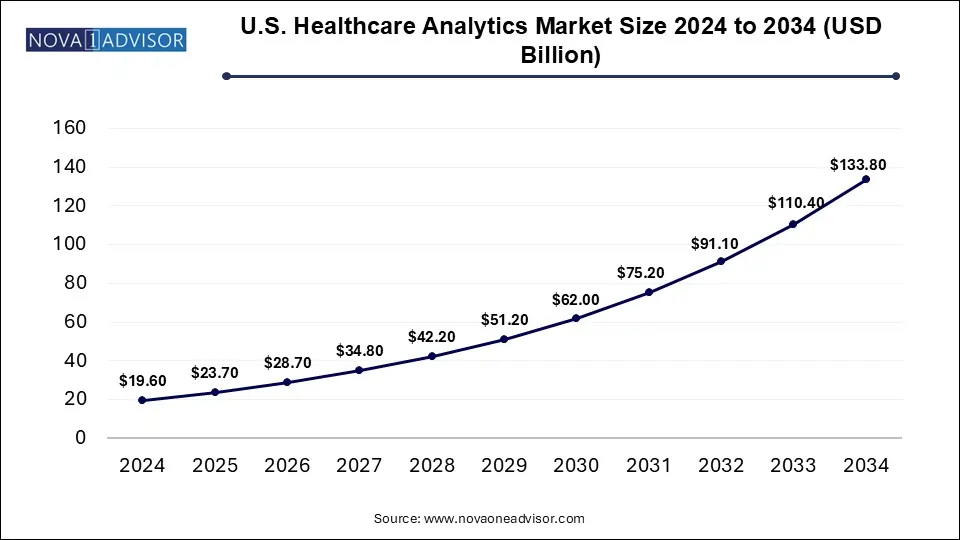

U.S. Healthcare Analytics Market Size and Growth 2025 to 2034

The U.S. healthcare analytics market size was valued at USD 19.6 billion in 2024 and is expected to reach around USD 133.8 billion by 2034, growing at a CAGR of 19.07% from 2025 to 2034.

North America led the market in 2024, accounting for a revenue share of 49.0%. The region benefits from advanced healthcare infrastructure, widespread adoption of analytics platforms, and superior technological capabilities—all contributing to its dominant market position. The growing prevalence of chronic diseases and an aging population have driven the need for hospitals and related institutions to implement analytics tools. Furthermore, the presence of major industry players has further supported this high revenue share. For instance, in March 2024, Microsoft introduced Microsoft Cloud for Healthcare—a solution aimed at enhancing collaboration between patients and healthcare providers to improve insights into patient care.

Asia Pacific is expected to experience the highest growth rate of 23.0%. Rapid economic development, increased disposable incomes, and a rising population have all fueled this accelerated growth. The region has witnessed notable industrial progress and technological advancements, which have further boosted market expansion. With growing dependence on IT solutions among consumers and healthcare organizations, the adoption of analytics technologies has increased significantly. As an example, Australian healthcare analytics start-up Prospection has established a branch in Japan and plans to partner with global pharmaceutical companies to support the development of innovative treatments tailored to the Japanese population.

Report Scope of Healthcare Analytics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 64.54 Billion |

| Market Size by 2034 |

USD 364.2 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 21.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Component, Delivery Mode, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

McKesson Corporation; Optum, Inc.; Verisk Analytics Inc.; Elsevier; Medeanalytics Inc.; Truven Health Analytics; Allscripts Healthcare Solutions Inc.; IBM; Cerner Corporation; IQVIA; Oracle; SAS Institute, Inc. |

Healthcare Analytics Market By Type Insights

In 2024, descriptive analytics held the leading position in the market with a 36% share. This form of analysis was extensively utilized during the pandemic to evaluate historical trends and patient data, helping understand the spread of the virus—one of the primary growth drivers for this segment. By converting past data into meaningful insights, descriptive analytics has become a vital tool for understanding past occurrences. Moreover, hospitals are employing this method to track and identify anomalies in insurance claim processing. Numerous organizations are increasingly leveraging these tools to tap into market expansion opportunities.

Predictive analytics emerged as the most rapidly growing segment. It utilizes datasets produced through descriptive analytics to forecast outcomes and generate actionable insights. The growing focus of businesses on analytics for strategic growth has significantly propelled this segment. Predictive tools are now essential for identifying upcoming market trends, enabling organizations to take preemptive actions to ensure future success.

Healthcare Analytics Market By Component Insights

The services category led the market in 2024 with a 38% share. Healthcare organizations have been channeling significant investments into IT infrastructure to build digital platforms and enable data-driven decision-making. As many companies require specialized analytics capabilities, they are opting to outsource these functions. This demand has fueled the expansion of firms providing comprehensive analytics services. The rising availability of service offerings from analytics providers has significantly boosted the segment.

This segment is also projected to witness the highest growth rate of 21.9%. A surge in patient volumes and the increasing incidence of diseases have led to vast amounts of clinical data being produced. The healthcare industry is under increasing pressure to deliver improved care, better clinical outcomes, and cost-efficient treatments. This, in turn, has amplified the need for advanced analytics solutions to monitor patient health and optimize treatment plans, further contributing to segment growth.

Healthcare Analytics Market By End-use Insights

In 2024, life sciences companies held the top position in terms of market revenue, accounting for 45%. These firms are currently among the most active users of analytics tools, leveraging them to cut production costs, improve profit margins, and enhance product development and market adoption. With ongoing investments in product innovation and broader outreach, there is a growing need for data analytics to better understand market dynamics and support strategic decision-making.

Healthcare providers are expected to witness the highest growth rate of 25.9% by 2034. The pandemic and its aftermath placed immense pressure on hospitals and medical professionals to deliver efficient, affordable care. This has driven the increased use of analytics in managing patient records, disease tracking, and improving treatment outcomes. The widespread adoption of analytics in this area is anticipated to fuel further segment expansion.

Healthcare Analytics Market By Delivery Mode Insights

The on-premises delivery model held the largest share of the market in 2024, with 48% revenue contribution. Many institutions prefer storing their data on-site due to better control, accessibility, and security, supporting the dominance of this delivery approach. While on-premises solutions are suitable for smaller organizations, scaling can become resource-intensive as data volumes grow, often requiring significant investments in infrastructure and cybersecurity.

Conversely, the cloud-based segment is expected to record the fastest growth rate of 24.5%. This mode offers advantages such as lower upfront costs, scalability, and operational flexibility, making it an increasingly attractive option. Although cloud solutions can also be hosted on-site, public cloud services are driving growth in this space. However, concerns remain regarding data privacy and security, which may pose challenges to broader adoption.

Healthcare Analytics Market By Application Insights

In 2024, financial applications held the largest market share at 37%. Healthcare providers are consistently seeking ways to cut treatment costs while maintaining high-quality care, driving growth in this segment. This area is also projected to grow at the fastest pace in the coming years. By adopting analytics, institutions are improving operational efficiency, reducing expenses, and identifying fraud more effectively.

A significant portion of healthcare costs stems from insurance claims, which are susceptible to fraudulent activities. To combat these issues, organizations are increasingly turning to predictive and descriptive analytics tools. These solutions assist in enhancing patient care, optimizing expenditures, and minimizing risks tied to insurance fraud. The push for stronger financial performance has been a central factor in driving adoption in this application category.

Some of The Prominent Players in The Healthcare Analytics Market Include:

- McKesson Corporation

- Optum, Inc.

- IBM

- Oracle

- SAS Institute, Inc.

- IQVIA

- Verisk Analytics, Inc.

- Elsevier

- Medeanalytics, Inc.

- Truven Health Analytics, Inc.

- Allscripts Healthcare Solutions, Inc

- Cerner Corporation

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Healthcare Analytics Market

By Type

- Descriptive Analysis

- Predictive Analysis

- Prescriptive Analysis

By Component

- Software

- Hardware

- Services

By Delivery Mode

- On-premises

- Web-hosted

- Cloud-based

By Application

- Clinical

- Financial

- Operational and Administrative

By End-use

- Healthcare Payers

- Healthcare Providers

- Life Science Companies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)