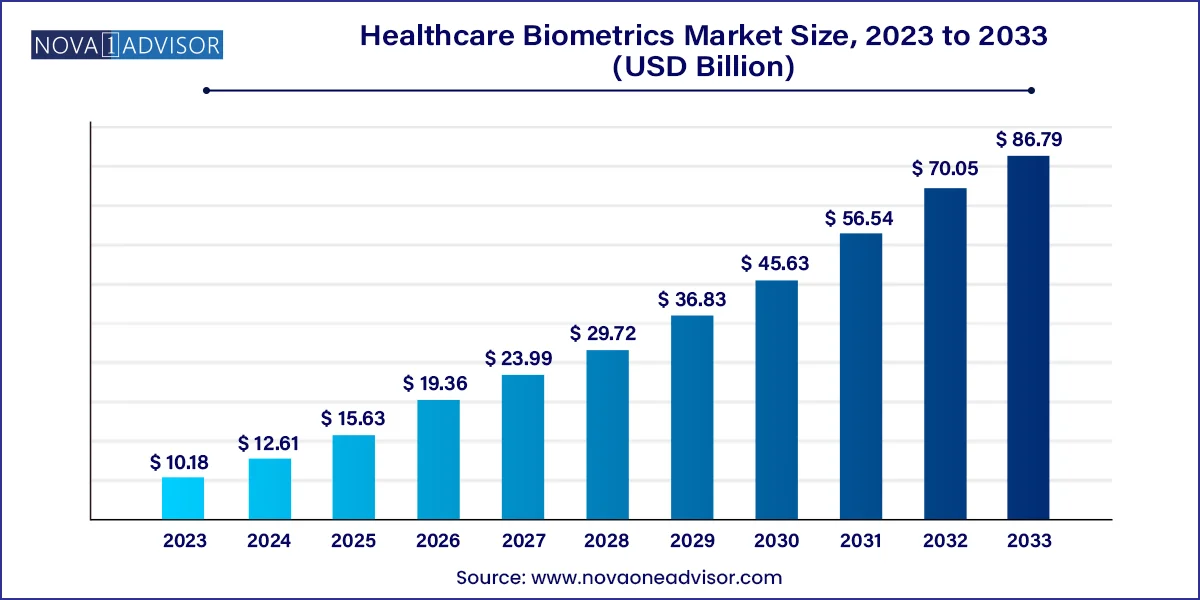

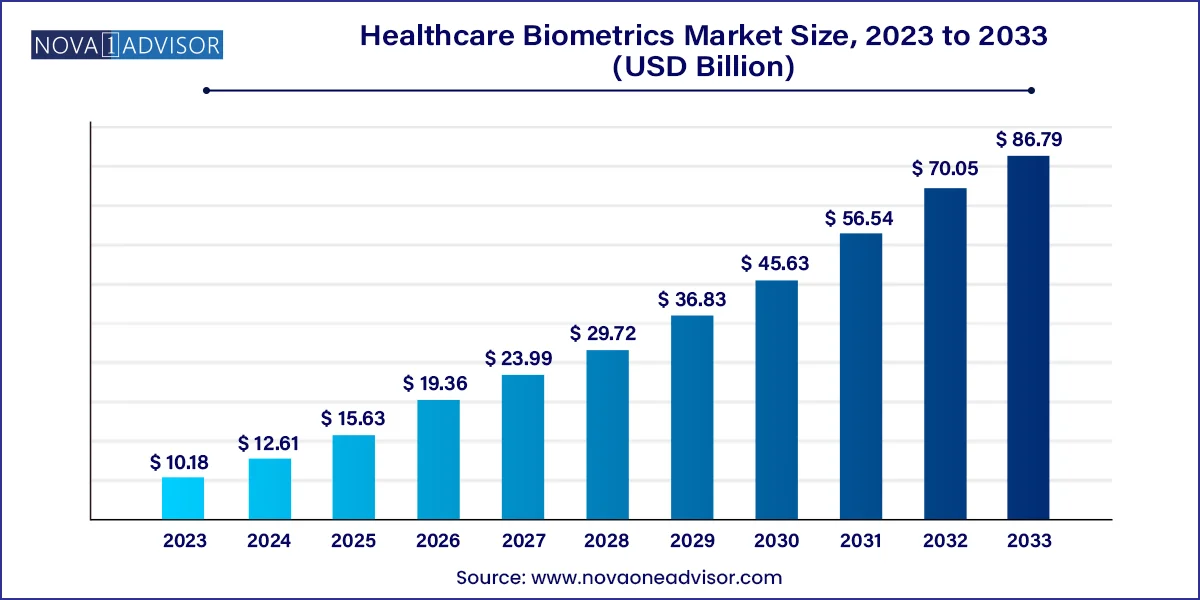

Healthcare Biometrics Market Size and Forecast 2024 to 2033

The global healthcare biometrics market size was valued at USD 10.18 billion in 2023 and is anticipated to reach around USD 86.79 billion by 2033, growing at a CAGR of 23.9% from 2024 to 2033.

Healthcare Biometrics Market Key Takeaways

- The fingerprint recognition segment dominated the market in 2023, with a revenue share of 39.18%.

- The iris recognition segment is anticipated to grow at a CAGR of 24.1% over the forecast period.

- The single-factor authentication segment dominated the market in 2023 with a share of 64.14% 2023.

- The multimodal authentication segment is expected to register the fastest CAGR over the forecast period.

- The patient identification & tracking segment dominated the market in 2023 with a share of 35.11% in 2023.

- The medical record security & data protection segment is anticipated to grow at a CAGR of 25.1% during the forecast period.

- North America dominated the healthcare biometrics market with a market share of 37.06% in 2023.

- U.S. dominated the market of North America in 2023 with a market share of 83.19%.

- Europe healthcare biometrics market was identified as a lucrative region in this industry as it had a market share of 28.11% in 2023.

- Asia Pacific held a market share of 23.03% in 2023.

Market Overview

The global healthcare biometrics market has emerged as a critical component in the pursuit of improving patient security, healthcare fraud prevention, accurate patient identification, and operational efficiency within the medical industry. Biometric technologies which authenticate individuals based on physical or behavioral characteristics such as fingerprints, facial features, or iris patterns have found increasing adoption in hospitals, clinics, research laboratories, and healthcare institutions.

Driven by the rising incidence of medical identity theft, data breaches, and the growing demand for seamless patient management, biometrics in healthcare offer unmatched precision and security. These technologies enhance authentication during patient admission, secure access to electronic health records (EHRs), control drug dispensing, and enable remote patient monitoring with heightened trust.

Additionally, the COVID-19 pandemic accelerated the need for contactless biometric solutions and remote authentication, reinforcing the relevance of biometrics in health services. As governments and private healthcare providers invest heavily in digital transformation initiatives, the healthcare biometrics market is positioned for steady expansion, propelled by technological advancements, regulatory mandates, and growing global healthcare needs.

Major Trends in the Market

-

Rise of Contactless Biometric Solutions: Surge in demand for touchless technologies like facial and iris recognition post-COVID-19.

-

Integration of AI and Machine Learning: Enhanced accuracy and real-time identification through AI-driven biometrics.

-

Multi-modal Biometric Systems: Combining two or more biometric modalities (e.g., fingerprint and facial recognition) for heightened security.

-

Blockchain in Healthcare Biometrics: Deployment of blockchain for secure storage and sharing of biometric data.

-

Remote Patient Monitoring (RPM): Use of biometrics in home healthcare settings for authenticating patients and monitoring vitals.

-

Behavioral Biometrics Adoption: Incorporating voice patterns, typing rhythms, and gait analysis into healthcare authentication systems.

-

Healthcare Workforce Management: Application of biometrics to track staff attendance, access to restricted areas, and compliance with hygiene protocols.

-

Regulatory Compliance Focus: Increasing emphasis on meeting HIPAA, GDPR, and other data protection regulations through biometric safeguards.

Healthcare Biometrics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 12.61 Billion |

| Market Size by 2033 |

USD 86.79 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 23.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Technology, type, application, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

NEC Corporation, Thales, Fujitsu, HID Global Corporation, IDEMIA, BIO-key International, Aware, Inc., Imprivata, Inc., Suprema, Inc., Hitachi Ltd., Qualcomm Technologies, Inc. |

Global Healthcare Biometrics Market Report Segmentation Insights

By Technology Segment

Fingerprint recognition dominated the technology segment of the healthcare biometrics market. Fingerprint scanners are widely adopted due to their affordability, reliability, and user familiarity. They are extensively used for patient check-ins, securing access to EHR systems, and managing drug dispensing cabinets. Solutions like Crossmatch’s Verifier series and SecuGen’s fingerprint readers highlight the enduring appeal of fingerprint-based systems in both developed and developing healthcare ecosystems.

However, Face recognition technology is emerging as the fastest-growing segment. Post-COVID-19, the demand for contactless solutions surged, and facial recognition emerged as an ideal technology offering hygienic, non-intrusive authentication. Hospitals are increasingly deploying facial recognition for patient registration, staff access control, and telehealth verification. Enhanced by AI algorithms, face recognition is set to become a cornerstone of next-generation healthcare biometric solutions.

By Type Segment

Single factor authentication dominated the type segment. Initially, the healthcare industry adopted single-factor biometric systems, such as fingerprint-only or face-only authentication, to simplify access control and patient identification processes. Single-factor systems offered a balance between security, convenience, and cost-efficiency, making them the preferred choice for many facilities, especially smaller clinics and outpatient centers.

Conversely, Multi-factor authentication is witnessing rapid adoption. As cyber threats evolve and regulatory demands tighten, combining biometric identifiers with passwords or smart cards has become essential for sensitive applications like EHR access and remote patient monitoring. Multi-factor and multimodal systems significantly enhance security by reducing the risk of false acceptance or identity spoofing, paving the way for their widespread deployment.

By Application Segment

Patient identification and tracking dominated the application segment. Ensuring accurate patient identification is fundamental to delivering safe, effective healthcare. Biometrics prevent errors such as duplicate records, misidentification, and treatment mistakes. Systems like Imprivata PatientSecure use palm vein biometrics to link patients to their medical histories, improving clinical outcomes and operational efficiency.

Meanwhile, Remote patient monitoring is the fastest-growing application area. As healthcare delivery increasingly shifts outside traditional settings, biometric-enabled RPM solutions are gaining traction. Wearable devices equipped with voice recognition or gait analysis capabilities are being used to authenticate patients and monitor their health metrics remotely, a trend accelerated by the growing elderly population and chronic disease management needs.

By End-use Segment

Hospitals and clinics dominated the end-use segment. As primary touchpoints for patient care, hospitals and clinics have been early adopters of biometric technologies to enhance patient safety, manage staff access, and secure medical records. From large multi-specialty hospitals to mid-sized clinics, biometrics streamline operations while ensuring compliance with patient privacy regulations.

Healthcare institutions and research laboratories are emerging as fast-growing end-users. Institutions involved in clinical trials, pharmaceutical R&D, and public health management increasingly utilize biometrics for securing sensitive data, ensuring researcher identity verification, and protecting proprietary information. In clinical laboratories, biometrics also aid in ensuring sample integrity and audit trail accuracy.

Regional Analysis

North America dominated the global healthcare biometrics market. With its sophisticated healthcare infrastructure, high cybersecurity awareness, and stringent regulatory frameworks like HIPAA, North America’s hospitals, research centers, and insurance providers have been at the forefront of biometric adoption. Companies such as 3M Cogent, Imprivata, and BIO-key International are headquartered in the region, offering innovative solutions that drive market leadership.

Asia-Pacific is the fastest-growing region in the healthcare biometrics market. Rapid healthcare digitalization, rising medical tourism, government mandates for secure health ID systems (like India’s Ayushman Bharat Digital Mission), and growing investments in health IT infrastructure are propelling growth across China, India, Japan, and Southeast Asia. The combination of a burgeoning patient population and increasing awareness of data security is fueling substantial market opportunities for biometric vendors in the region.

Healthcare Biometrics Market Key Company Insights

Some of the major companies in the healthcare biometrics market are NEC Corporation, Thakes, Fujitsu, Biometrics Research Group, Inc., IDEMIA, and more. Companies are focusing on developing products with contactless biometric authentication and improving the security in order to deal with security and data breaches.

- Thales specializes in designing, developing and manufacturing of electrical systems and devices for sectors such as defense, aerospace, and security. The company also provides services in identity security, data analytics, cybersecurity, connectivity, and cloud computing.

- HID Global Corporation specializes in manufacturing security identity products, door and access control solutions. The company also deals in products such as physical access control products, logical access control products, and more.

Healthcare Biometrics Market Top Key Companies:

- NEC Corporation

- Thales

- Fujitsu

- HID Global Corporation

- IDEMIA

- BIO-key International

- Aware, Inc.

- Imprivata, Inc.

- Suprema, Inc.

- Hitachi Ltd.

- Qualcomm Technologies, Inc.

Healthcare Biometrics Market Recent Developments

- In February 2024, Imprivata, Inc. a digital identity company announced the launch of Biometric Patient Identity, a facial recognition solution developed for healthcare institutes in order to ensure efficient and accurate patient identification. The product allowed healthcare providers in identifying patient securely and accurately, mitigating the risk of medical errors.

- In November 2022, NEC Corporation announced the launch of its multimodal biometric authentication solution from its flagship ‘Bio-Idiom’ brand of biometric authentication. The solution will combine face and iris recognition in order to provide accurate recognition.

Healthcare Biometrics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Healthcare Biometrics market.

By Technology

- Face Recognition

- Fingerprint Recognition

- Iris Recognition

- Vein Recognition

- Palm Geometry Recognition

- Behavioral Recognition

- Others

By Type

- Single Factor Authentication

- Multi Factor Authentication

- Multimodal Authentication

By Application

- Medical Record Security & Data Protection:

- Patient Identification & Tracking

- Remote Patient Monitoring

- Workforce Management

- Pharmacy Dispensing

- Others

By End-use

- Hospitals & Clinics

- Healthcare Institutions

- Research & Clinical Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)