Healthcare Business Intelligence Market Size and Forecast 2025 to 2034

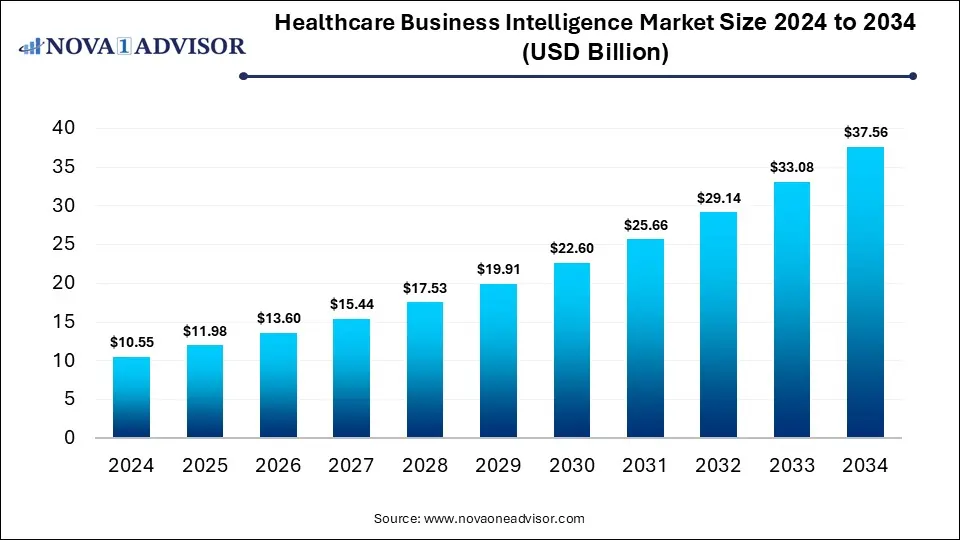

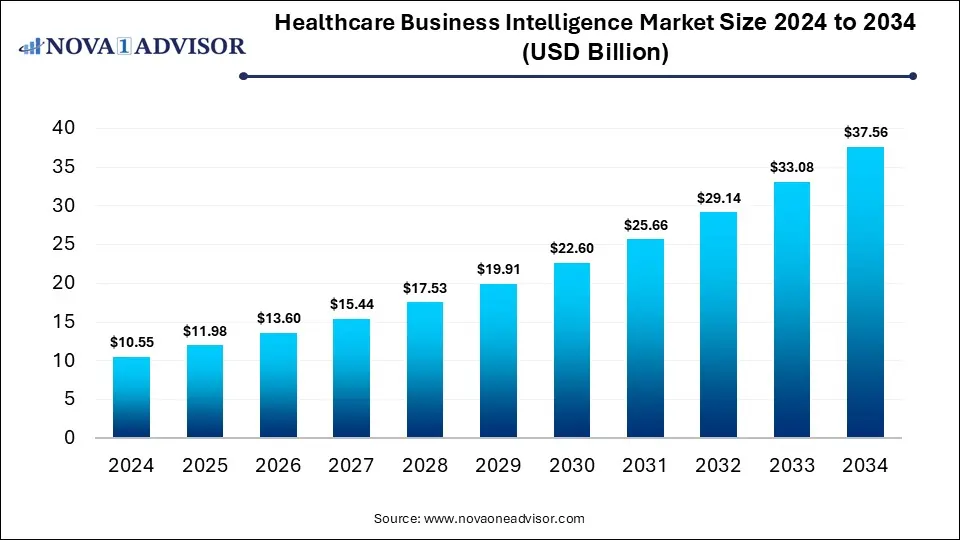

The global healthcare business intelligence market size was estimated at USD 10.55 billion in 2024 and is expected to reach USD 37.56 billion in 2034, expanding at a CAGR of 13.54% during the forecast period of 2025 to 2034. The growth of the market is driven by advancements in AI, the shift towards value-based care, and the need for real-time data analysis.

Key Takeaways

- By region, North America held the largest share of the healthcare business intelligence market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By component, the software segment dominated the market in 2024.

- By component, the services segment is expected to expand at the fastest rate over the projection period.

- By mode of delivery, the cloud-based segment led the market with a major share in 2024.

- By mode of delivery, the on-premises segment is expected to expand at the highest CAGR in the upcoming period.

- By deployment, the self-service BI segment led the market in 2024.

- By deployment, the corporate BI segment is likely to grow at a significant rate during the forecast period.

- By application, the financial analysis segment dominated the market in 2024.

- By application, the patient care segment is expected to expand at the highest CAGR in the coming years.

- By end use, the healthcare payers segment contributed the largest market share in 2024.

- By end use, he healthcare manufacturers segment is expected to expand at the fastest CAGR between 2025 and 2034.

How Can AI Impact the Healthcare Business Intelligence Market?

AI can significantly impact the healthcare business intelligence market by enhancing data analysis and decision-making processes. AI algorithms can automate data analysis, identify patterns, and predict outcomes with greater accuracy and speed. This allows healthcare organizations to gain deeper insights from their data, leading to improved patient care and operational efficiency. Moreover, AI-powered BI tools can personalize treatment plans and optimize resource allocation. As AI technology continues to evolve, its integration into BI solutions will further drive innovation and transform the healthcare landscape.

Market Overview

The healthcare business intelligence market revolves around the use of data analytics, reporting, and visualization tools to transform complex healthcare data into actionable insights for decision-making. BI solutions offer numerous advantages, including improved patient care, optimized operational efficiency, reduced costs, and enhanced regulatory compliance across applications like hospitals, clinics, payers, and pharmaceutical companies. The growing need for data-driven decision-making, rising adoption of electronic health records (EHRs), and the increasing pressure to reduce healthcare costs are key factors driving market growth. Additionally, advancements in AI and machine learning integration into BI tools are further accelerating adoption across the healthcare sector.

What are the Major Trends in the Healthcare Business Intelligence Market?

- Integration of AI and Machine Learning: Advanced BI tools are leveraging AI and machine learning to perform predictive analytics, identify patterns in patient data, and support early diagnosis and treatment decisions, improving clinical outcomes.

- Emphasis on Real-Time Data Analytics: Real-time analytics is becoming essential for monitoring patient vitals, managing hospital operations, and responding to emergencies, helping improve both patient care and operational agility.

- Focus on Patient-Centered Analytics: There is a growing emphasis on using BI tools to analyze patient behavior, treatment outcomes, and satisfaction metrics, helping providers deliver more personalized and value-based care.

- Growing Use of Self-Service BI Tools: Self-service BI solutions empower non-technical healthcare staff to create reports, dashboards, and visualizations independently, reducing reliance on IT departments and speeding up decision-making.

- Increased Focus on Population Health Management: BI tools are being used to analyze health trends across populations, identify at-risk groups, and design preventive care programs, supporting a shift toward value-based care models.

Report Scope of Healthcare Business Intelligence Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 11.98 Billion |

| Market Size by 2034 |

USD 37.56 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.54% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Component, Mode of Delivery, Application, End Use, Deployment, Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Increasing Volume of Healthcare Data

The increasing volume of healthcare data is driving the growth of the healthcare business intelligence market. With the proliferation of electronic health records, wearable devices, and other data sources, healthcare organizations are generating massive amounts of information. This data, however, is often complex and difficult to analyze without advanced tools. Healthcare BI solutions provide the necessary infrastructure and analytics capabilities to process, interpret, and extract valuable insights from this growing data volume. As the volume of data continues to increase, the demand for sophisticated BI tools is expected to rise. This enables healthcare providers to make data-driven decisions, improve patient outcomes, and optimize operational efficiency.

- Today, healthcare generates about 30% of the world’s data, with its data volume expected to grow at a 36% CAGR by 2025, outpacing manufacturing by 6%, financial services by 10%, and media & entertainment by 11%.

Focus on Value-Based Care and Regulatory Compliance

The focus on value-based care and regulatory compliance is significantly driving the growth of the market. Value-based care models emphasize patient outcomes and cost-effectiveness, requiring healthcare providers to analyze data to measure performance and identify areas for improvement. BI solutions provide the tools needed to track key metrics, assess patient outcomes, and demonstrate the value of care. Additionally, the healthcare industry faces stringent regulatory requirements, such as those related to data privacy and security. BI tools assist organizations in monitoring compliance, generating reports, and ensuring adherence to regulations. As the industry continues to prioritize value-based care and navigate complex regulatory landscapes, the demand for robust BI solutions is expected to grow.

Restraints

Data Security and Privacy Concerns

Data security and privacy concerns pose significant restraint on the growth of the healthcare business intelligence market. Healthcare data is highly sensitive, containing personal health information that must be protected from unauthorized access and breaches. Implementing and maintaining robust security measures to safeguard this data can be costly and complex. Concerns about data breaches and non-compliance with privacy regulations can deter healthcare organizations from adopting BI solutions. As a result, the market's growth is tempered by the need for stringent data protection protocols and the associated challenges. Addressing these concerns through advanced security technologies and compliance strategies is crucial for fostering trust and accelerating market expansion.

High Implementation Costs and Integration Challenges

Implementing BI solutions often involves substantial upfront investments in software, hardware, and consulting services. Integrating these solutions with existing healthcare IT infrastructure, such as electronic health records and other systems, can be complex and time-consuming. These integration challenges lead to delays, increased costs, and compatibility issues. Smaller healthcare organizations, in particular, may find these costs and complexities prohibitive. As a result, the market's expansion is limited by the financial burden and technical hurdles associated with implementing and integrating BI solutions.

Opportunities

Growth of Cloud BI Solutions

The growth of cloud BI solutions is creating immense opportunities in the healthcare business intelligence market. Cloud-based BI offers several advantages, including lower upfront costs, scalability, and accessibility from anywhere with an internet connection. This allows healthcare organizations of all sizes to leverage advanced analytics without significant capital investments. Cloud solutions also facilitate easier integration with other cloud-based healthcare applications and data sources. The flexibility and cost-effectiveness of cloud BI are driving increased adoption, enabling healthcare providers to make data-driven decisions more efficiently.

- In November 2024, Waters Corporation launched waters_connect Data Intelligence, a cloud-based software that enhances data access, organization, and analysis for regulated laboratories. Integrating with Waters Empower Chromatography Data System (CDS), it enables real-time audit readiness and faster response to audit inquiries. The platform delivers comprehensive business intelligence on chromatographic data, streamlining product development and reducing audit preparation time.

Development of Mobile and Specialized BI Solutions

Another major opportunity lies in the development of mobile and specialized BI solutions. Mobile BI allows healthcare professionals to access data and insights on the go, improving decision-making at the point of care. Specialized BI solutions tailored to specific areas, such as population health management or clinical analytics, provide targeted insights and improve operational efficiency. These advancements enhance the usability and relevance of BI tools, leading to increased adoption across various healthcare settings. As mobile and specialized solutions continue to evolve, they propel market growth by addressing the unique needs of healthcare providers.

Segment Outlook

Component Insights

What Made Software the Dominant Component in the Healthcare Business Intelligence?

The software segment dominated the healthcare business intelligence market in 2024 due to its critical role in enabling data integration, visualization, and real-time analytics across healthcare systems. As healthcare organizations increasingly shifted toward value-based care and digital transformation, there was a strong demand for robust BI software to support clinical, operational, and financial decision-making. These solutions offered user-friendly dashboards, customizable reporting tools, and advanced analytics capabilities, including AI and machine learning integration, which helped improve patient outcomes and reduce costs. Additionally, the growing adoption of cloud-based BI platforms made software more accessible, scalable, and cost-effective for organizations of all sizes. This widespread applicability and adaptability solidified the software segment’s leading position in the market.

The services segment is expected to expand at the fastest rate in the upcoming period due to the increasing complexity of BI implementations and the growing need for expert support. As healthcare organizations adopt advanced BI tools, they often require consulting, system integration, training, and ongoing maintenance services to ensure successful deployment and optimal performance. The shift toward cloud-based and AI-powered BI solutions also demands specialized expertise, further driving demand for professional services. Additionally, smaller healthcare providers and organizations with limited in-house IT capabilities are increasingly outsourcing BI-related tasks to service providers, supporting segmental growth.

Healthcare Business Intelligence Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Software |

5.28 |

6.02 |

6.87 |

7.83 |

8.94 |

10.2 |

11.63 |

13.26 |

15.13 |

17.25 |

19.67 |

| Services |

5.28 |

5.96 |

6.73 |

7.61 |

8.59 |

9.71 |

10.97 |

12.4 |

14.01 |

15.83 |

17.89 |

Mode of Delivery Insights

Why Did the Cloud-Based Segment Lead the Healthcare Business Intelligence Market?

The cloud-based segment led the market in 2024 due to its scalability, cost-effectiveness, and ease of deployment. Cloud-based BI solutions enabled healthcare organizations to access data and analytics tools from anywhere, facilitating real-time decision-making and collaboration across departments and locations. These platforms reduced the need for significant upfront infrastructure investment, making them especially attractive to mid-sized and smaller providers. Additionally, advancements in cloud security and compliance with healthcare regulations such as HIPAA increased trust in cloud-based systems. The ability to seamlessly integrate with electronic health records (EHRs) and other digital tools further solidified the dominance of this delivery mode.

The on-premises segment is expected to grow at the highest CAGR over the projection period. This is mainly due to increasing concerns over data security, privacy, and regulatory compliance. Many healthcare organizations, especially large hospitals and government institutions, prefer on-premises solutions as they offer greater control over sensitive patient data and infrastructure. As cyber threats become more sophisticated, some providers are opting for localized systems to minimize external vulnerabilities. Additionally, on-premises BI systems are often favored for their ability to be highly customized to an organization’s specific workflows and integration needs. This growing emphasis on data governance and control is driving renewed interest in on-premises BI deployments.

Deployment Insights

How Does the Self-Service BI Segment Dominate the Market in 2024?

The self-service BI segment dominated the healthcare business intelligence market with a significant revenue share in 2024. This is primarily due to the rising demand for user-friendly, accessible analytics tools that empower non-technical users to make data-driven decisions. Healthcare professionals, including clinicians, administrators, and department heads, sought solutions that allowed them to independently generate reports, visualize trends, and explore data without relying on IT teams. This shift improved operational efficiency and accelerated decision-making processes in clinical and administrative settings. The growing focus on real-time insights and the need for agility in responding to patient care and operational challenges further fueled adoption.

The corporate BI segment is expected to grow at a significant rate in the coming years, as large healthcare organizations increasingly seek centralized, enterprise-wide analytics solutions. These platforms offer advanced capabilities for integrating data across departments, ensuring consistency, regulatory compliance, and strategic oversight. With the growing emphasis on system-wide performance, population health management, and coordinated care, corporate BI enables organizations to align clinical, financial, and operational goals. This comprehensive approach is particularly valuable for integrated delivery networks (IDNs) and health systems aiming to optimize outcomes at scale.

Application Insights

Why Did the Financial Analysis Segment Dominate the Market in 2024?

The financial analysis segment dominated the healthcare business intelligence market in 2024, owing to the increasing pressure on healthcare organizations to control costs, improve revenue cycles, and enhance financial performance. BI tools were widely adopted to support key financial functions such as claims processing, fraud detection, payment integrity, and risk assessment. As healthcare systems faced rising operational costs and reimbursement challenges, financial analysis solutions provided critical insights into budgeting, cost allocation, and profitability. These tools enabled providers and payers to make data-driven financial decisions, reduce waste, and ensure compliance with complex billing regulations. The strong return on investment (ROI) and measurable financial impact of BI in this area drove its widespread adoption and market dominance.

The patient care segment is expected to expand at the highest CAGR during the forecast period due to the rising demand for personalized, data-driven healthcare delivery. As value-based care models gain traction, healthcare providers are leveraging BI tools to enhance clinical outcomes, track patient journeys, and identify care gaps more effectively. Advanced analytics support more accurate diagnoses, early intervention, and improved treatment plans, ultimately leading to better patient satisfaction and reduced readmissions. Additionally, the integration of BI with electronic health records (EHRs), wearable devices, and remote monitoring tools enables real-time insights into patient health. This growing emphasis on proactive and preventive care is accelerating the adoption of BI solutions focused on patient-centered outcomes.

End Use Insights

How Did Healthcare Payers Hold the Largest Market Share in 2024?

The healthcare payers segment held the largest share of the business intelligence market in 2024 due to their critical need for cost containment, fraud prevention, and optimized claims management. Payers, including private insurers and government agencies, relied heavily on BI tools to analyze vast volumes of claims data, identify billing irregularities, and improve payment integrity. These solutions also supported risk adjustment, member segmentation, and population health analysis, enabling payers to design more effective insurance products and care programs. The shift toward value-based reimbursement models further increased the demand for real-time analytics to monitor provider performance and patient outcomes. This strategic use of BI to drive financial and operational efficiency solidified the segment’s leading position in the market.

The healthcare manufacturers segment is expected to grow at the fastest CAGR during the projection period. This is mainly due to the increasing adoption of business intelligence tools to streamline operations, enhance product development, and ensure regulatory compliance. Pharmaceutical and medical device companies are leveraging BI to analyze market trends, monitor supply chains, and optimize manufacturing processes in real time. As competition intensifies and the demand for precision medicine grows, manufacturers are using advanced analytics to accelerate R&D, reduce time-to-market, and improve forecasting. Additionally, the integration of BI with IoT and cloud platforms is enabling greater agility and data visibility across global operations. These strategic advantages are driving rapid BI adoption among healthcare manufacturers.

Regional Analysis

What Made North America the Dominant Region in the Market in 2024?

In 2024, North America dominated the healthcare business intelligence market by holding the largest share in 2024. This is mainly due to its advanced healthcare infrastructure, high adoption of digital health technologies, and strong focus on value-based care. The region benefits from significant investments in healthcare IT, supportive government policies, and a large number of key BI solution providers headquartered there. Additionally, stringent regulatory requirements around patient data and reporting have driven healthcare organizations to implement sophisticated BI tools for compliance and quality improvement. The widespread use of electronic health records (EHRs) and growing emphasis on data-driven decision-making in both public and private sectors further fueled market growth.

The U.S. is a major contributor to the North America healthcare business intelligence market due to its well-established healthcare system and rapid adoption of advanced technologies. The country’s substantial healthcare expenditure, combined with widespread implementation of electronic health records (EHRs), has created a strong demand for BI solutions to improve patient outcomes and operational efficiency. Additionally, supportive government initiatives like the Health Information Technology for Economic and Clinical Health (HITECH) Act have accelerated digital transformation in healthcare. The presence of numerous leading BI vendors and healthcare providers investing heavily in analytics further strengthens the U.S.’s position within North America.

What Factors Make Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to experience the fastest growth in the healthcare business intelligence market in the coming years due to rapid digitalization, expanding healthcare infrastructure, and increasing government investments in health IT. Emerging economies like China and India are witnessing rising healthcare demands, driven by growing populations, urbanization, and a rising middle class seeking better quality care. The adoption of cloud-based BI solutions and mobile health technologies is accelerating, supported by improved internet connectivity and smartphone penetration. Additionally, regulatory reforms and initiatives aimed at enhancing healthcare efficiency and patient outcomes are driving BI adoption across hospitals, payers, and manufacturers.

China is a major player in the market within Asia Pacific due to its large population, rapid urbanization, and significant investments in healthcare infrastructure and digital technologies. The country is aggressively expanding its healthcare IT ecosystem, with strong government support for initiatives like “Healthy China 2030” that emphasize data-driven healthcare reforms. China’s growing adoption of electronic health records (EHRs), telemedicine, and cloud-based BI solutions is fueling demand for advanced analytics to improve patient outcomes and operational efficiency. Additionally, the increasing prevalence of chronic diseases and rising healthcare expenditure are pushing providers and payers to leverage BI tools for better resource management and cost control.

India is emerging as a major player in the market in Asia Pacific due to its rapidly growing healthcare infrastructure and increasing adoption of digital health technologies. The country’s vast population and rising prevalence of chronic diseases drive demand for data-driven solutions that improve patient outcomes and operational efficiency. Additionally, supportive government initiatives, coupled with advancements in AI and analytics, are fueling innovation and investment in healthcare BI across India.

- On August 11, 2023, India enacted the Digital Personal Data Protection (DPDP) Act, 2023, establishing a legal framework for handling personal data with a focus on privacy and accountability. This law significantly impacts the healthcare sector by enforcing stricter data governance, enhancing trust in digital systems, and encouraging responsible data usage. This promotes secure data sharing, essential for analytics and BI applications.

Region-Wise Breakdown of the Healthcare Business Intelligence Market

|

Region

|

Market Size (2024)

|

Projected CAGR (2025-2034)

|

Key Growth Factors

|

Key Challenges

|

Market Outlook

|

|

North America

|

USD 4.4 Bn

|

5.82%

|

Advanced healthcare infrastructure, strong EHR adoption, value‑based care mandates

|

Data silos, legacy systems, high total cost of ownership

|

Dominant market with steady, mature growth.

|

|

Asia Pacific

|

USD 3.1 Bn

|

6.96%

|

Healthcare digitization, government initiatives, rising IT investment

|

Infrastructure gaps, talent shortages, governance hurdles

|

Fastest-growing region

|

|

Europe

|

USD 2.5 Bn

|

9.81%

|

Strong regulatory frameworks, aging population, digital health mandates

|

Interoperability issues, fragmented health systems across countries

|

Stable growth

|

|

Latin America

|

USD 0.9 Bn

|

4.1%

|

Emerging healthcare digitization, growing BI awareness

|

Budget constraints and limited BI maturity

|

Emerging market with strong potential

|

|

MEA

|

USD 0.5 Bn

|

4.37%

|

Healthcare reforms, investment in digital health infrastructure

|

Regulatory disparities and uneven infrastructure across countries

|

Gradual uptake; emerging and underpenetrated

|

Healthcare Business Intelligence Market Value Chain Analysis

1. Data Collection & Integration

This is the foundational stage where raw healthcare data is gathered from various sources such as Electronic Health Records (EHRs), medical devices, billing systems, and patient management platforms. Integration tools aggregate and normalize this data to prepare it for analysis, ensuring accuracy and completeness.

2. Data Warehousing & Storage

Once collected, data needs to be securely stored and organized in centralized repositories or data warehouses for easy access and processing. Cloud-based and on-premise storage solutions are used depending on the organization’s scale and compliance requirements.

3. Data Processing & Management

In this phase, data is cleaned, structured, and transformed into formats suitable for analytics. Data governance, quality control, and metadata management also occur here to ensure data integrity and compliance with healthcare regulations like HIPAA.

4. Analytics & Insight Generation

This is the core value-creation stage where BI tools analyze the structured data to extract actionable insights through dashboards, reports, predictive modeling, and visualizations. It supports strategic decisions in clinical care, operations, and financial planning.

5. Application & Decision-Making

The insights generated are applied to improve healthcare delivery, optimize costs, enhance patient outcomes, and streamline workflows. This stage involves collaboration between IT, clinical staff, and executives to embed data-driven decision-making into operations.

6. Support Services & Consultancy

Consulting firms and managed service providers offer ongoing support, customization, and training to help healthcare organizations maximize BI investments. These services also assist with compliance, integration, and scaling the solutions across departments.

Healthcare Business Intelligence Market Companies

Microsoft contributes to the healthcare BI market through Power BI, offering scalable data visualization, reporting, and dashboard tools that help healthcare providers track performance and outcomes. It integrates with Microsoft Cloud for Healthcare, enabling seamless data management and analytics across clinical, operational, and financial systems.

- Oracle Corporation (including Cerner)

Oracle enhances the healthcare BI landscape through its cloud infrastructure and analytics platforms, especially following its acquisition of Cerner, a major EHR provider. The company enables data integration, population health management, and predictive analytics tailored for hospitals and large health systems.

IBM provides advanced analytics and AI-driven insights through IBM Watson Health, supporting clinical decision-making and value-based care initiatives. It helps healthcare organizations analyze large volumes of structured and unstructured data to optimize patient care and operational efficiency.

SAP offers enterprise-grade BI and performance management tools that help healthcare providers streamline operations, monitor financial performance, and maintain regulatory compliance. Its analytics solutions integrate with hospital information systems to provide real-time, actionable insights.

SAS specializes in predictive analytics, data mining, and population health management tailored to healthcare providers and payers. Its solutions enable organizations to detect trends, reduce risk, and enhance decision-making through sophisticated statistical models.

- Tableau Software (Salesforce)

Tableau empowers healthcare professionals with user-friendly, interactive data visualization tools that simplify complex data analysis. It is widely used for quality improvement, clinical benchmarking, and strategic reporting across hospitals and health systems.

Qlik provides a robust data analytics platform that enables healthcare organizations to integrate and analyze data from multiple sources. Its associative data model allows users to explore clinical, operational, and financial data simultaneously for deeper insights.

Health Catalyst focuses specifically on healthcare, offering a data platform and analytics applications that support clinical, operational, and financial transformation. It enables health systems to leverage data for improving patient outcomes, reducing costs, and advancing value-based care.

Infor delivers cloud-based analytics and enterprise resource planning (ERP) solutions tailored for healthcare organizations. Its platforms support operational efficiency, financial analysis, and workforce management through integrated business intelligence tools.

Epic embeds BI and analytics capabilities within its widely used EHR platform, enabling providers to monitor clinical outcomes, patient safety, and operational metrics. It supports population health and predictive analytics initiatives from within its ecosystem.

Recent Developments

- In May 2025, Innovaccer Inc. launched Innovaccer Gravity, a Healthcare Intelligence Platform that integrates enterprise data to unlock its full value and accelerate AI-driven transformation. Built on a secure, cloud-agnostic architecture with 400+ connectors and 100+ FHIR resources, it unifies data from EHRs, claims, finance, supply chain, HR, and more into a single source of truth. The platform enables seamless interoperability across clinical, operational, and financial domains, helping organizations improve patient care, optimize operations, and reduce total cost of ownership.

- In September 2024, Zoho Corporation launched the latest version of Zoho Analytics, enhancing its self-service BI platform with advanced AI and ML features. Key updates include diagnostic insights, predictive analytics, automated reporting, a custom ML model studio, and seamless integration with OpenAI and third-party BI tools. These improvements boost the platform’s intelligence, flexibility, and appeal to a wider range of businesses.

- In 2024, ATHMA and Medha Analytics, subsidiaries of Narayana Health, have partnered with ClearMedi Healthcare, backed by Morgan Stanley, to provide Healthcare Information System (HIS) and Business Intelligence (BI) analytics. ClearMedi will utilize Narayana’s ATHMA services and Medha Analytics’ BI dashboards to enhance its healthcare operations.

Segments Covered in the Report

By Component

By Mode of Delivery

- On-premise

- Cloud-based

- Hybrid

By Application

-

- Claims Processing

- Revenue Cycle Management

- Payment Integrity and Fraud, Waste, & Abuse (FWA)

- Risk Adjustment and Risk Assessment

- Clinical Analysis

-

- Quality Improvement and Clinical Benchmarking

- Clinical Decision Support

- Regulatory Reporting and Compliance

- Comparative Analytics/Effectiveness

- Precision Health

- Operational Analysis

-

- Supply Chain Analysis

- Workforce Analysis

- Strategic Analysis

- Patient Care

By End Use

- Payers

- Healthcare Providers

- Healthcare Manufacturers

By Deployment

- Self-service BI

- Corporate BI

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)