Healthcare Contract Development And Manufacturing Organization Market Size and Growth

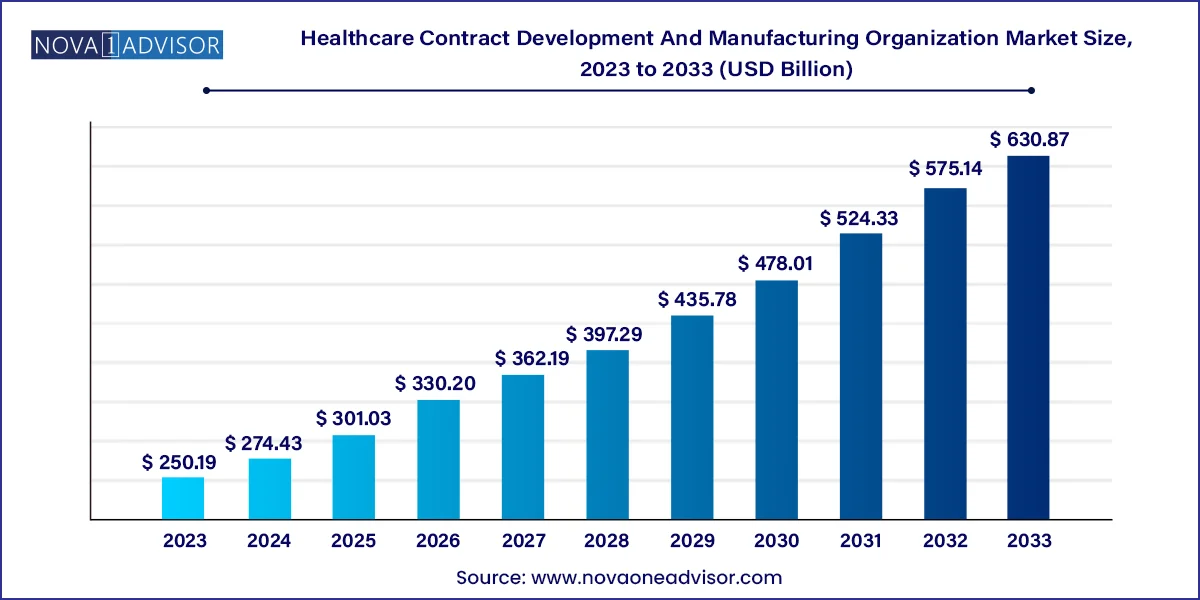

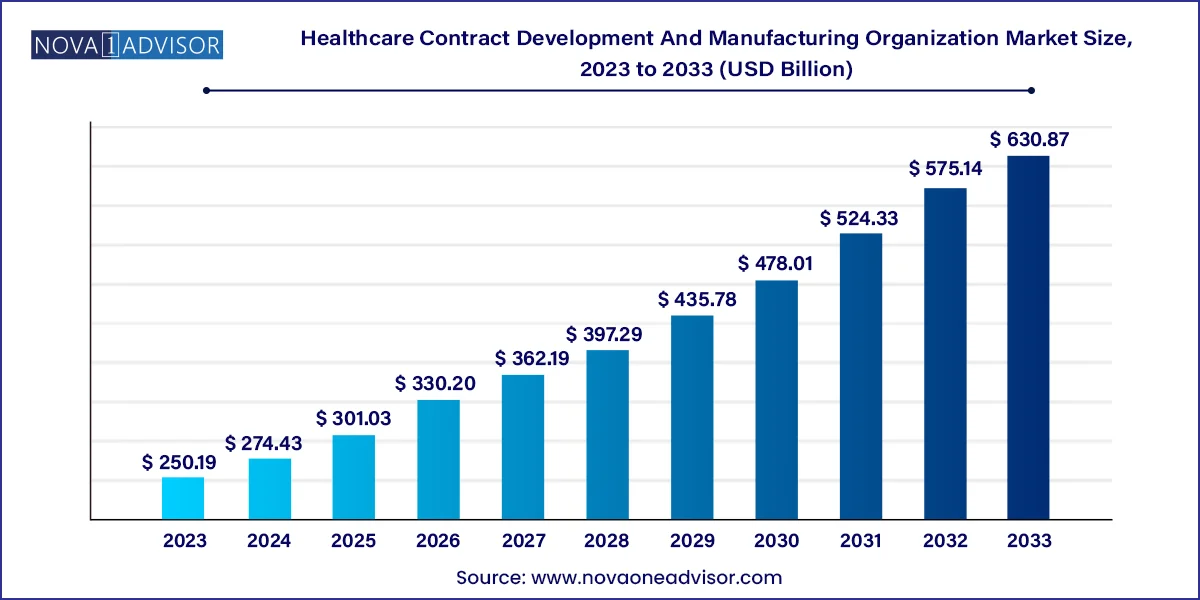

The global healthcare contract development and manufacturing organization market size was valued at USD 250.19 billion in 2023 and is anticipated to reach around USD 630.87 billion by 2033, growing at a CAGR of 9.69% from 2024 to 2033.

Healthcare Contract Development And Manufacturing Organization Market Key Takeaways

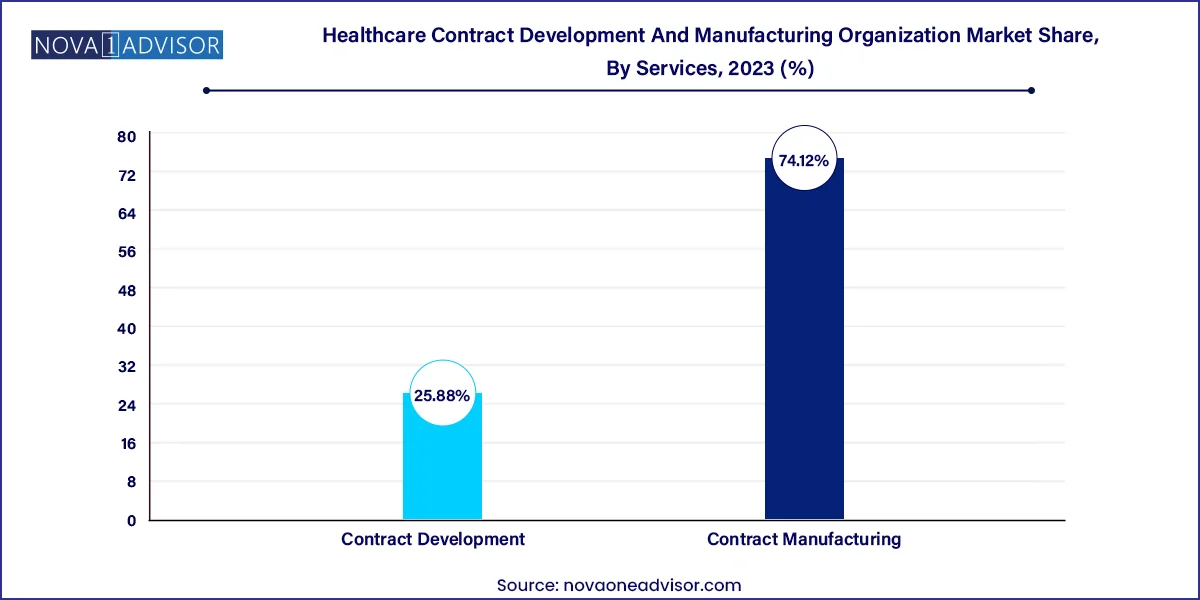

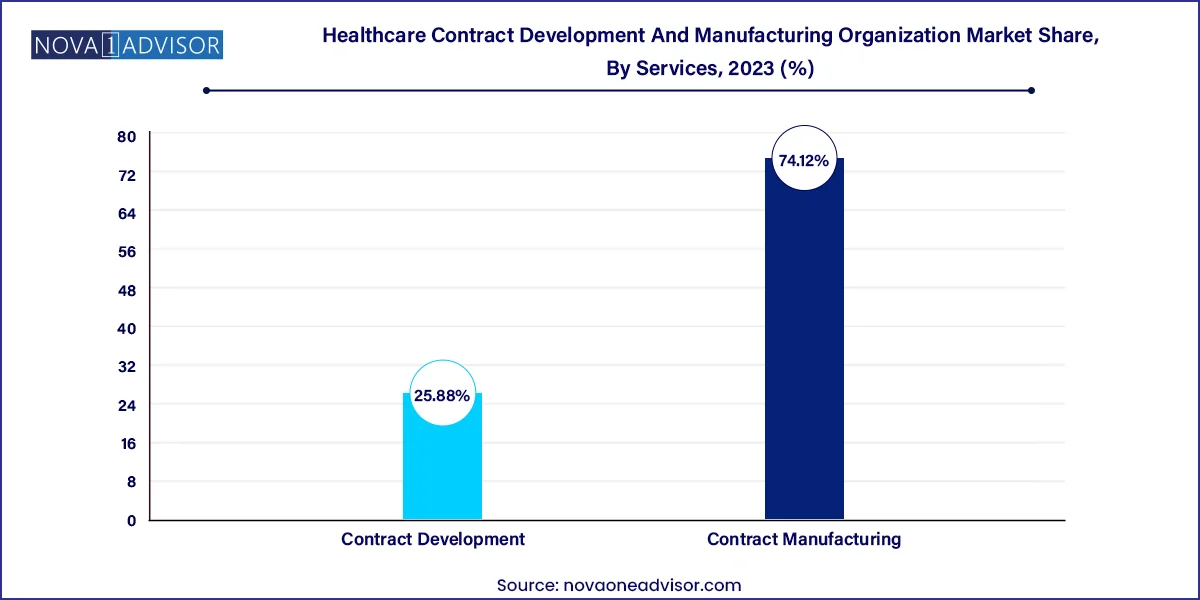

- Based on services, the market is segregated into contract development and contract manufacturing. The contract manufacturing segment accounted for the largest revenue share of 74.12% in 2023.

- The contract development segment is anticipated to grow at the fastest CAGR of 9.52%over the forecast period.

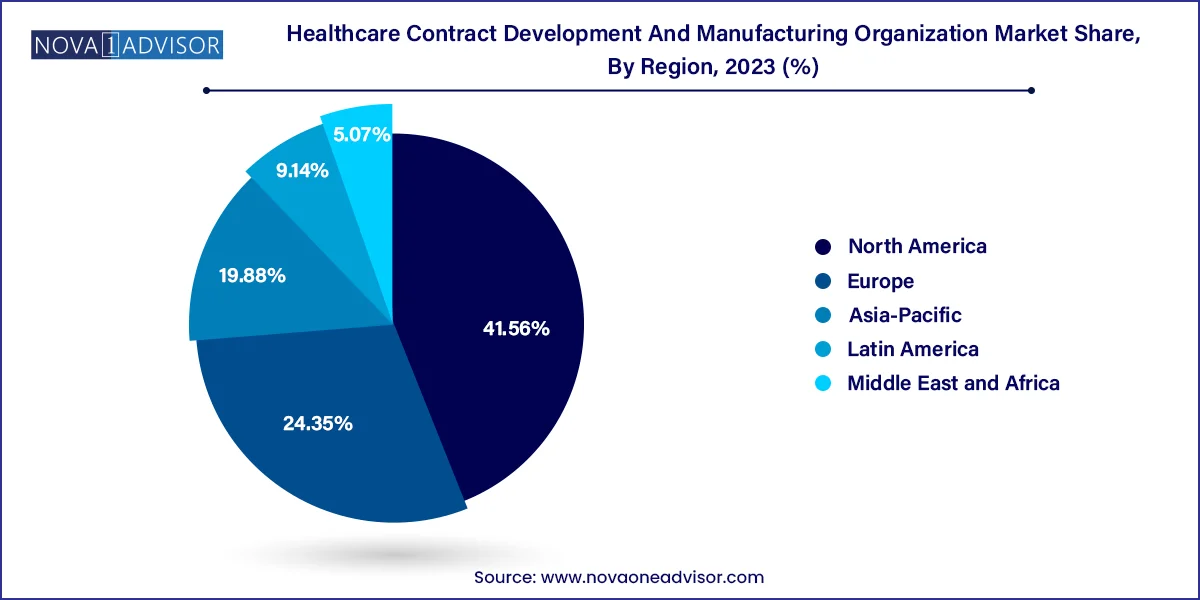

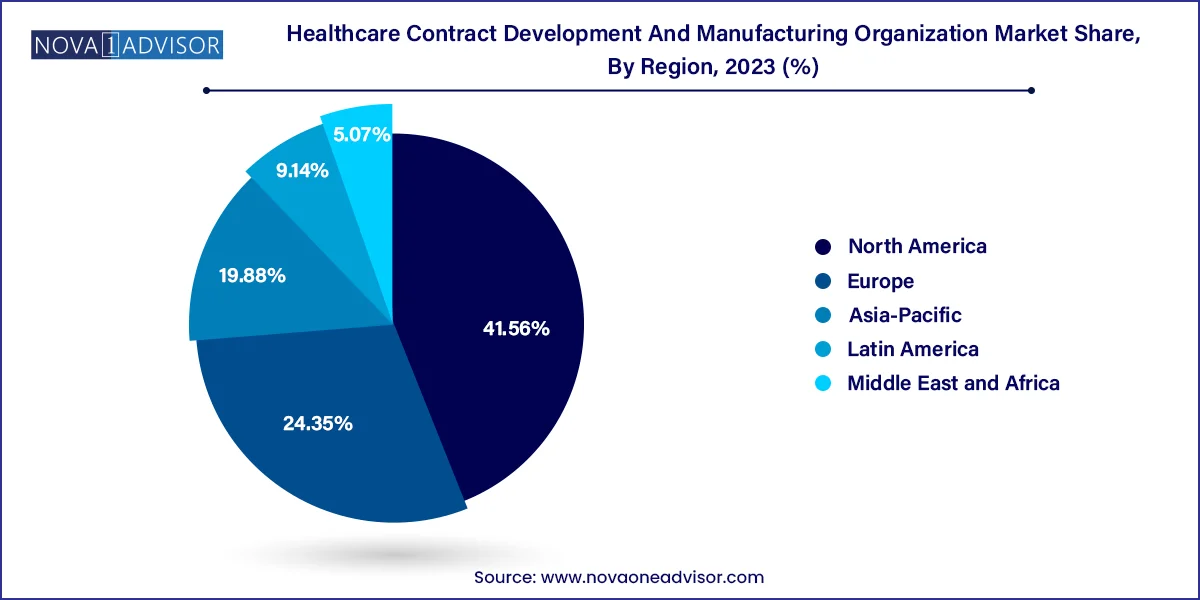

- North America healthcare contract development and manufacturing organization market accounted for the largest share of 41.56% of the global healthcare CDMO industry

- The healthcare contract development and manufacturing organization market in Asia Pacific is expected to grow at a CAGR of 10.60% during the forecast period.

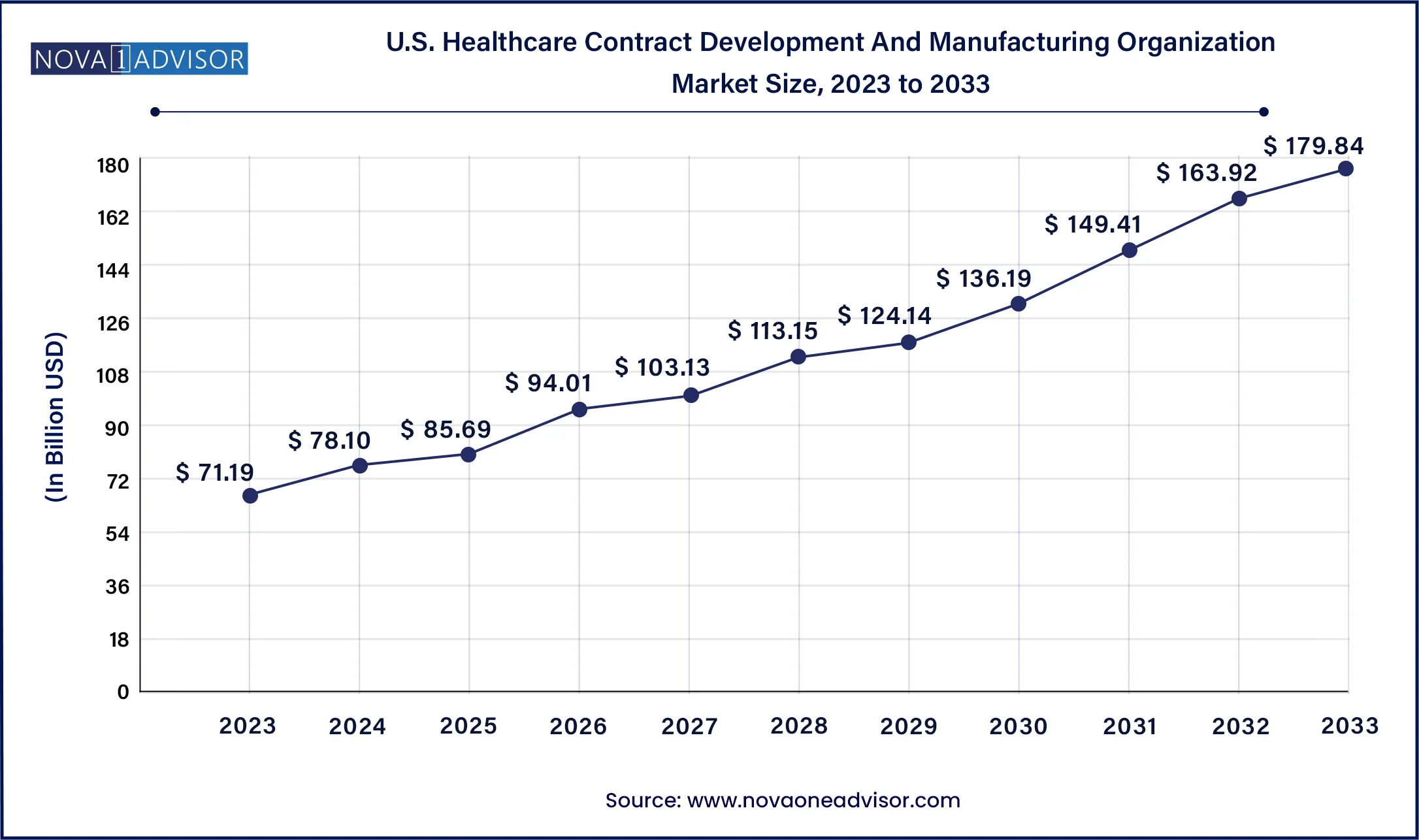

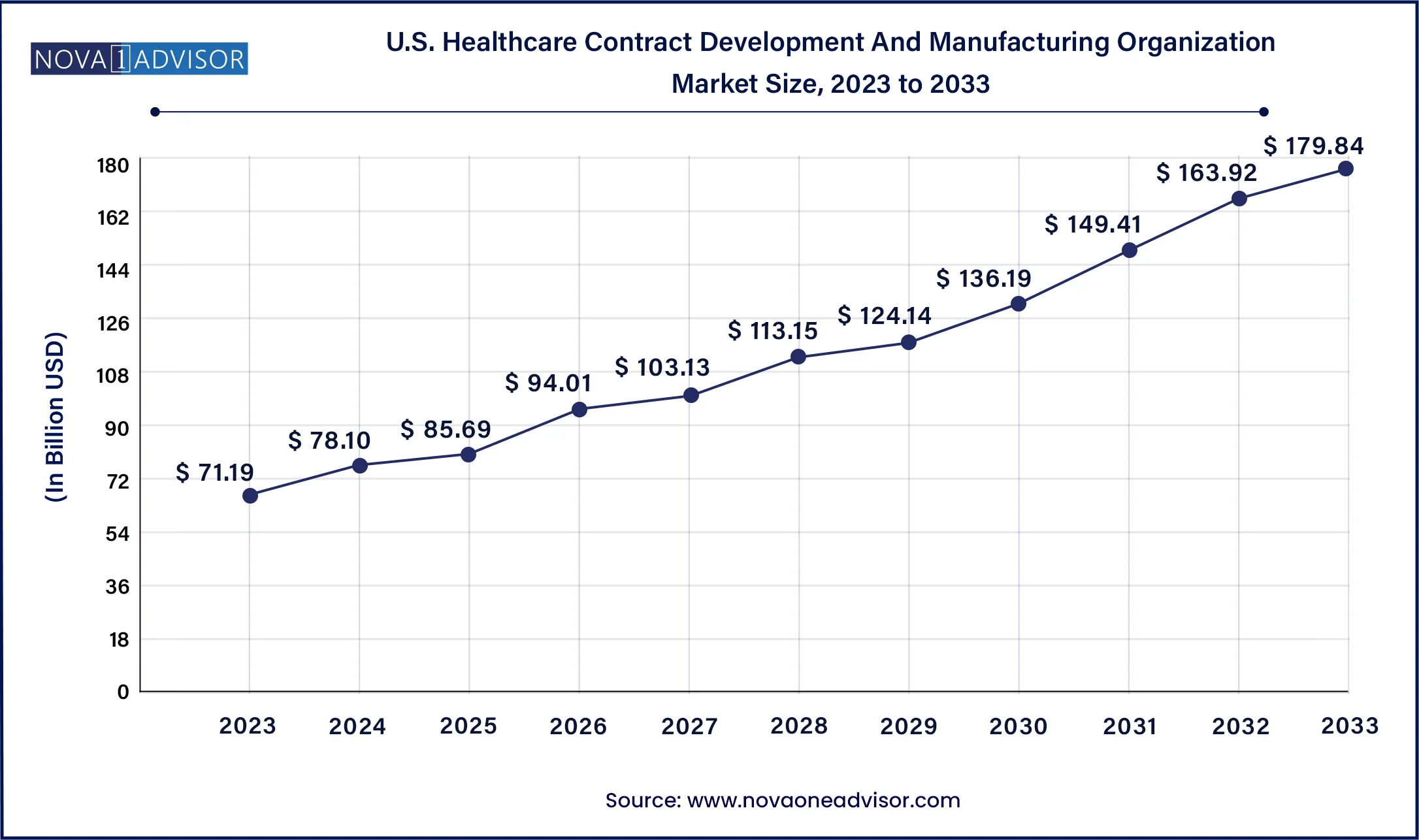

U.S.Healthcare Contract Development And Manufacturing Organization Market Size and Growth 2024 to 2034

The U.S. Healthcare contract development and manufacturing organization market size was estimated at USD 71.19 billion in 2023 and is projected to hit around USD 179.84 billion by 2033, growing at a CAGR of 9.71% during the forecast period from 2024 to 2033.

North America dominates the CDMO market, particularly the United States, which serves as a hub for biotech innovation, pharmaceutical R&D, and regulatory leadership. The region benefits from a mature healthcare infrastructure, high investment in drug discovery, and a strong presence of top-tier CDMOs like Catalent, Thermo Fisher Scientific, and Lonza. Additionally, regulatory pathways such as the FDA’s fast-track approval support rapid translation of innovations into the market, further encouraging outsourcing.

Asia-Pacific is the fastest-growing region, with countries like China, India, and South Korea witnessing a surge in CDMO investments. The availability of skilled labor, lower operational costs, and supportive government policies are attracting Western pharmaceutical companies to set up or collaborate with regional CDMOs. Additionally, the maturing regulatory frameworks and growing domestic demand for innovative drugs in APAC further accelerate market expansion.

Market Overview

The Healthcare Contract Development and Manufacturing Organization (CDMO) market has evolved into a critical backbone of the global pharmaceutical, biotechnology, and medical device industries. As pharmaceutical pipelines become more complex and the regulatory environment grows increasingly demanding, pharmaceutical and biopharmaceutical companies especially small and mid-sized firms are increasingly outsourcing research, development, and manufacturing activities to specialized CDMOs.

A CDMO offers a comprehensive range of services from early-stage drug development through clinical trials and commercial-scale manufacturing. These services can span both contract development including preclinical, clinical, and analytical services and contract manufacturing covering small molecule and large molecule production, high-potency active pharmaceutical ingredients (HPAPIs), and finished dose formulations. Additionally, many CDMOs have expanded into medical device manufacturing, addressing the needs of the growing diagnostics and therapeutic device sectors.

The growing complexity of biologics, the emergence of cell and gene therapies, rising costs of in-house R&D, and the pressure for faster time-to-market are reshaping the competitive dynamics in healthcare manufacturing. With increasing demand for personalized medicine and global health crises such as COVID-19, CDMOs are not only meeting production capacity but also providing strategic innovation in development, scalability, and compliance.

Major Trends in the Market

-

Convergence of Biologics and Advanced Therapies: CDMOs are investing heavily in cell and gene therapy development and viral vector manufacturing.

-

Increased Outsourcing by Emerging Biotechs: Small firms with limited infrastructure are outsourcing almost all stages of development and production.

-

Strategic Partnerships and Long-Term Alliances: Big Pharma is entering into multi-year collaborations with CDMOs for end-to-end solutions.

-

Digitalization and Automation: Implementation of AI, digital twins, and cloud-based platforms to optimize production and compliance workflows.

-

Expansion into Asia-Pacific and Latin America: Cost efficiencies and favorable regulatory reforms are attracting CDMO investments in emerging markets.

-

Modular and Flexible Manufacturing Facilities: Demand for speed and scalability is encouraging the adoption of modular cleanrooms and single-use technologies.

-

Sustainability and Green Chemistry Initiatives: CDMOs are investing in eco-friendly production processes and carbon-neutral facilities.

Healthcare Contract Development And Manufacturing Organization Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 274.43 Billion |

| Market Size by 2033 |

USD 630.87 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.69% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Services, and region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Catalent Inc.; Lonza; Recipharm AB; Siegfried Holding AG; Thermo Fisher Scientific; Inc.; Labcorp Drug Development; Jabil Inc; Syngene International Limited; IQVIA Inc.; Almac Group; Ajinomoto Bio-Pharma; Adare Pharma Solutions; Alcami Corporation; Vetter Pharma International among others. |

Market Driver: Rising Demand for Biologics and Personalized Therapies

The expansion of biologics, biosimilars, and personalized medicine is a primary growth driver for the CDMO market. Unlike small molecule drugs, biologics require specialized capabilities for cell line development, upstream/downstream bioprocessing, and cold-chain logistics. Many pharma companies lack in-house expertise or infrastructure to manage the complexities of biologic development, prompting them to partner with CDMOs equipped with state-of-the-art biomanufacturing capabilities.

Moreover, with increasing investment in gene therapy, monoclonal antibodies (mAbs), recombinant proteins, and nucleic acid-based therapeutics, CDMOs that offer end-to-end biologics solutions—from process development to GMP-compliant manufacturing are in high demand. These organizations are not only expanding capacity but also offering speed and compliance assurance, which is critical in time-sensitive therapeutic areas like oncology and rare diseases.

Market Restraint: Regulatory Complexity and Quality Assurance Challenges

One of the major constraints in the CDMO space is regulatory compliance across diverse regions, especially as regulatory bodies like the FDA, EMA, and PMDA continue to tighten their scrutiny over data integrity, supply chain transparency, and manufacturing protocols. The increasing volume of highly potent and complex therapies has added new dimensions of compliance, requiring investments in high-containment facilities and sophisticated quality control systems.

Moreover, inconsistencies in quality systems and data documentation can result in delays in product approvals and, in extreme cases, contract termination. CDMOs serving clients across multiple regulatory jurisdictions must navigate variable standards, site audits, and data harmonization. The cost of maintaining compliance and the risk of reputational damage from quality lapses remain significant challenges for both emerging and established players.

Market Opportunity: Increasing Biotech Funding and Pipeline Expansion

An exciting opportunity is arising from the surge in biotech innovation and funding, particularly from venture capital firms, public offerings, and strategic partnerships. Many of these biotechs operate as “virtual companies” with minimal physical infrastructure, relying extensively on CDMOs for preclinical development, clinical trial material supply, and scale-up manufacturing.

In 2024 alone, the biotech sector witnessed over $20 billion in early-stage funding globally, with startups focusing on oncology, immunotherapy, rare genetic diseases, and RNA-based drugs. These innovators require agile, compliant, and cost-effective CDMO partners to bring their novel molecules from bench to bedside. CDMOs that can offer tailored, scalable, and rapid development frameworks stand to benefit from long-term commercial contracts and early access to breakthrough innovations.

Healthcare Contract Development And Manufacturing Organization Market By Services Insights

Contract manufacturing dominates the service segment, as pharmaceutical and biopharmaceutical companies increasingly rely on CDMOs for commercial production of APIs, biologics, and finished dose formulations. High costs, complexity, and the need for GMP compliance make it more viable for companies to outsource. Among these, the manufacturing of large molecules—especially monoclonal antibodies and recombinant proteins—is experiencing exponential growth due to the rising number of FDA-approved biologics and biosimilars. Injectable dose formulation also leads among finished products due to its prevalent use in chronic disease therapies and vaccines.

Contract development is the fastest-growing segment, driven by growing demand for early-stage services such as process development, preclinical studies, and bioanalytical testing. Small molecule services remain vital, particularly toxicology and DMPK (drug metabolism and pharmacokinetics) studies. However, large molecule development, especially in mammalian cell line development and downstream processing (e.g., purification of MABs), is expanding rapidly. CDMOs offering integrated development and manufacturing under one roof—minimizing tech transfer risks—are gaining favor across the industry.

Healthcare Contract Development And Manufacturing Organization Market Top Key Companies:

- Catalent Inc.

- Lonza

- Recipharm AB

- Siegfried Holding AG

- Thermo Fisher Scientific, Inc.

- Labcorp Drug Development

- Jabil Inc

- Syngene International Limited

- IQVIA Inc.

- Almac Group

- Ajinomoto Bio-Pharma

- Adare Pharma Solutions

- Alcami Corporation

- Vetter Pharma International

Healthcare Contract Development And Manufacturing Organization Market Recent Developments

-

Lonza Group (April 2025): Announced a $1.2 billion expansion of its biomanufacturing facilities in the U.S. and Switzerland to support the production of mRNA-based therapies and cell/gene therapies.

-

Catalent Inc. (March 2025): Launched a new dedicated high-potency API facility in Belgium to support oncology and hormonal therapy development under safe containment.

-

WuXi AppTec (February 2025): Opened a new large-scale biologics manufacturing facility in Shanghai, enhancing its capacity to serve global biotech clients.

-

Samsung Biologics (January 2025): Signed a strategic multi-year manufacturing agreement with a leading U.S. pharma company to produce monoclonal antibody therapeutics.

-

Thermo Fisher Scientific (December 2024): Completed its acquisition of a mid-sized CDMO in Europe to strengthen its formulation and sterile fill-finish capabilities.

Healthcare Contract Development And Manufacturing Organization Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Healthcare Contract Development And Manufacturing Organization market.

By Services

- Contract Development

- Small Molecule

- Preclinical

- Bioanalysis and DMPK Studies

- Toxicology Testing

- Other Preclinical Services

- Clinical

- Phase I

- Phase II

- Phase III

- Phase IV

- Laboratory Services

- Bioanalytical Services

- Analytical Services

- Large Molecule

- Cell Line development

- Process Development

- Upstream

- Microbial

- Mammalian

- Others

- Downstream

- MABs

- Recombinant Proteins

- Others

- Others

- Contract Manufacturing

- Small Molecule

- Large Molecule

- MABs

- Recombinant Proteins

- Others

- High Potency API

- Finished Dose Formulations

- Solid Dose Formulation

- Liquid Dose Formulation

- Injectable Dose Formulation

- Medical Devices

- Class I

- Class II

- Class III

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)