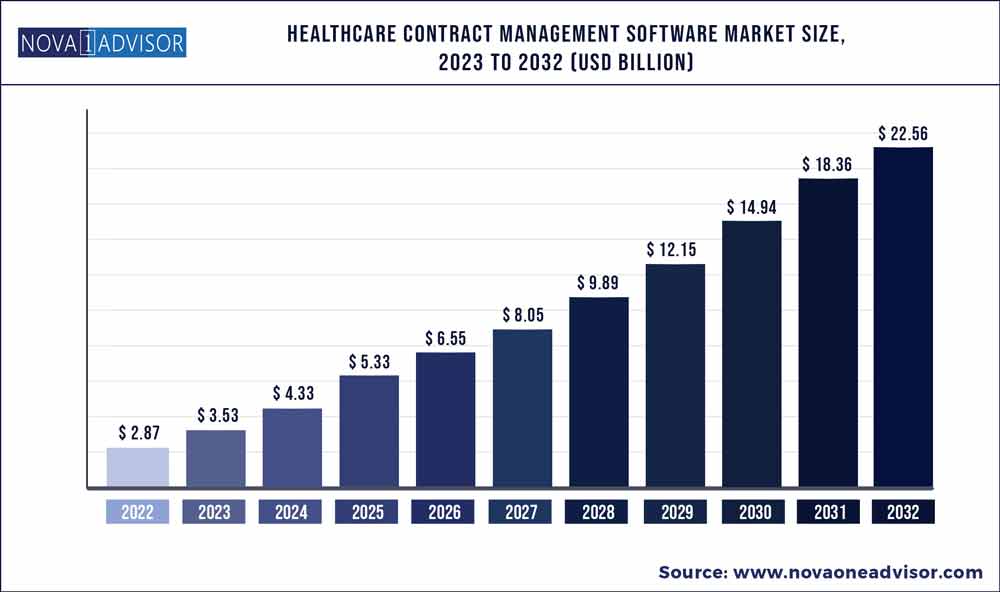

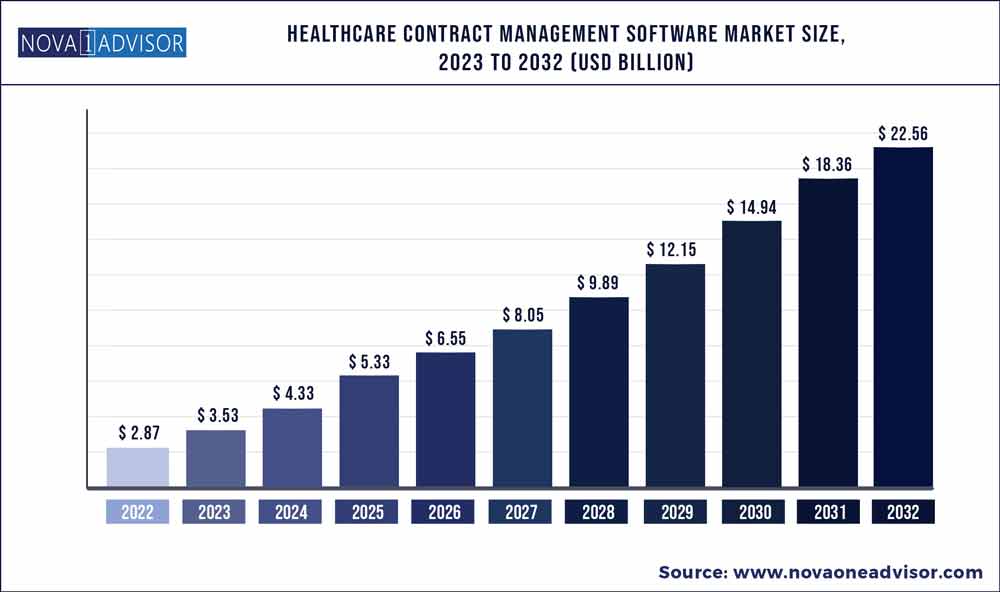

The global healthcare contract management software market size was exhibited at USD 2.87 billion in 2022 and is projected to hit around USD 22.56 billion by 2032, growing at a CAGR of 22.9% during the forecast period 2023 to 2032.

Key Pointers:

- The software segment accounted for the largest revenue share of over 87.19% in 2022.

- In 2022, the subscription-based pricing model dominated the market with a share of over 73.1%

- Cloud-based contract software dominated the market with a share of over 80.2% in 2022.

- The healthcare providers segment held the dominant share of over 47.8% as of 2022

- North America held the largest share of over 45.2% in 2022.

- Asia Pacific is projected to grow at a lucrative rate over the forecast period.

Healthcare Contract Management Software Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 3.53 Billion

|

|

Market Size by 2032

|

USD 22.56 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 22.9%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Component, pricing model, deployment, end-use, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Icertis; Conga; CobbleStone Software; Experian Information Solutions, Inc.; nThrive, Inc.; Concord Worldwide, Inc.; Coupa Software Inc.; Contract Logix, LLC; SecureDocs, Inc.; Ultria Inc.; PandaDoc Inc.

|

The key factors driving the market include the growing adoption of cloud computing, investments by market players, digitization in healthcare, and demand for operational efficiency. The rising demand for affordable and effective contract process automation solutions, the need for regulatory compliance, and technological developments in healthcare IT are some of the other key factors estimated to propel the market growth in the years to come.

Contract lifecycle management (CLM) software witnessed high demand during the COVID-19 pandemic as it is considered to be a reliable and viable solution to manage the surge in contracts of doctors, sanitation workers, lab technicians, nurses, student-doctors, and others. The increasing contracts made during clinical trial studies and vendor agreements amidst the pandemic also increased the demand for secure contract management solutions. The pandemic acted as an accelerator for the adoption of CLM software solutions and it is expected to continue throughout the forecast period.

The market is also driven by various strategic initiatives by market participants. These include growing investments, funding for innovation, product launch, partnerships and collaborations, mergers & acquisitions, etc. For instance, in September 2020, Icertis deployed its Contract Intelligence (ICI) platform at Moda Health to help manage the latter’s large volume of provider agreements as well as ensure regulatory compliance. In March 2021, Icertis received USD 80 million in Series F funding. This brought the company’s total funding to USD 280 million. It also enabled Icertis to invest in its AI and Blockchain development, sales expansion, and marketing initiatives. These kinds of strategies implemented by companies are expected to fuel the market demand over the forecast period.

Component Insights

The software segment accounted for the largest revenue share of over 87.19% in 2022. The adoption of software is rising in the healthcare industry as the software helps patients with efficient compliance, streamlines contract lifecycle processes, and maintains complex contract documents in the repository. Contract Lifecycle Management (CLM) software emerged as a reliable and viable solution to manage the surge in contracts of doctors, sanitation workers, lab technicians, nurses, student-doctors, and more during the COVID-19 pandemic. The pandemic thus became a key driver that catalyzed the adoption of contract lifecycle management software solutions, and this trend is expected to continue.

A CLM software provides features such as centralized document repository, e-signatures, tracking, analytics, contract templates, and AI and machine learning. These are used by healthcare organizations, hospitals, providers, and companies to manage end-to-end contract lifecycles. For instance, CobbleStone Software offers two custom solutions of its Contract Insight CLM- for the healthcare industry and pharma and life sciences industry. Moreover, strategic collaborations and partnerships, along with product innovation, have augmented market growth. For instance, in November 2019, B. Braun Company implemented Apttus CLM to speed up procurement processes across its global enterprise.

Healthcare contract management services include implementation, on-boarding or training, data extraction and migration, consultation/advisory services, content management, risk and performance management, and post-sale customer support. The growing adoption of healthcare contract management software, the lack of skilled IT personnel, and the need to reduce labor costs by outsourcing services are anticipated to fuel the segment growth.

Pricing Model Insights

In 2022, the subscription-based pricing model dominated the market with a share of over 73.1% owing to the increased adoption of cloud-based healthcare contract management software. As a high percentage of vendors offer subscription-based pricing for cloud-based solutions, the adoption of these software has increased, which is expected to propel the segment growth over the forecast period. For instance, ContractWorks by SecureDocs offers its platform at three different pricing levels- standard, professional, and enterprise, all billed annually and includes unlimited users. Implementation is provided at no extra cost while data migration services are chargeable and provided in partnership with Cenza.

One-time purchase and pay as you go make up the others segment. Pay as you go and licensed software enables customers to pick a pricing model best suited to their consumption and needs. Additional payments, extensions, or upgrades to data storage or scalability are paid on an as-needed basis. Pay as you go and one-time purchase models have low barriers to entry with better cost-per-use and no long-term commitment. These benefits are anticipated to fuel the demand in the coming years.

Deployment Insights

Cloud-based contract software dominated the market with a share of over 80.2% in 2022. This type of deployment is safe and secure as compared to the on-premise system. These solutions gained traction in recent years. The COVID-19 pandemic and the AI trend in healthcare have positively impacted the adoption of cloud-based systems in contract management and this is expected to continue over the coming years.

Many providers have begun offering cloud-first solutions with options to deploy on-premise or on an as-needed basis. As the vendors are in charge of the data security and control the entire system in the cloud-based CLM system, many vendors have obtained security certifications to show compliance and their commitment to protecting customer data. The degree of customization and integration is another aspect, which influences the adoption of cloud-based systems among the numerous vendors in the market.

End-use Insights

The healthcare providers segment held the dominant share of over 47.8% as of 2022 owing to the increased adoption of contract management solutions by hospitals, physicians, and clinics. The growing need to reduce operational costs while increasing operational efficiency and the need to comply with regulatory policies have led to the increased adoption of healthcare contract management systems by healthcare organizations and providers.

Pharmaceutical and biotech organizations use healthcare contract management systems to manage clinical trial agreements, vendors, distributor agreements, consultants, and HCP payments. The growing regulatory requirements and the need to comply with complex laws and policies are expected to drive this segment. For instance, ContractWorks partnered with Xeris, a pharmaceutical company, to deploy a contract management solution to tighten internal controls around contract execution, track contract milestones, and easily report on contract data.

Regional Insights

North America held the largest share of over 45.2% in 2022. The growth is attributed to the favorable reimbursement policies and government regulations, such as Meaningful Use (MU) and the Health Insurance Portability & Accountability Act (HIPPA). MU facilitates the electronic exchange of patient information, submits claims electronically, and generates electronic records for patients and the HIPPA act focuses on ensuring privacy and security of health information, including information in electronic health records (EHR). The presence of strong regulatory requirements and demand for streamlining the process in this region are driving the market.

Asia Pacific is projected to grow at a lucrative rate over the forecast period. Increasing demand for outsourcing activities from this region, demand for a high level of data security, quick return on investment (ROI), and increasing demand for efficient tools to achieve operational goals are some of the factors contributing to this high demand. The migration of healthcare organizations towards digitization to streamline their complete workflow and ensure patient safety and care has resulted in an increased demand for contract management software in this region.

Some of the prominent players in the Healthcare Contract Management Software Market include:

- Icertis

- Conga

- CobbleStone Software

- Experian Information Solutions, Inc.

- nThrive, Inc.

- Concord Worldwide, Inc.

- Coupa Software Inc.

- Contract Logix, LLC

- SecureDocs, Inc.

- Ultria Inc.

- PandaDoc Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Healthcare Contract Management Software market.

By Component

- Software

- Contract Lifecycle Management Software

- Contract Document Management Software

- Services

- Support and Maintenance Services

- Implementation and Integration Services

- Training and Education Services

By Pricing Model

- Subscription Based

- Others (One time purchase, Pay as you go)

By Deployment

By End-use

- Healthcare Providers

- Medical Device Manufacturers and Pharma & Biotechnology Companies

- Others (Payers, Research Organization)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)