Healthcare Digital Twins Market Size and Trends

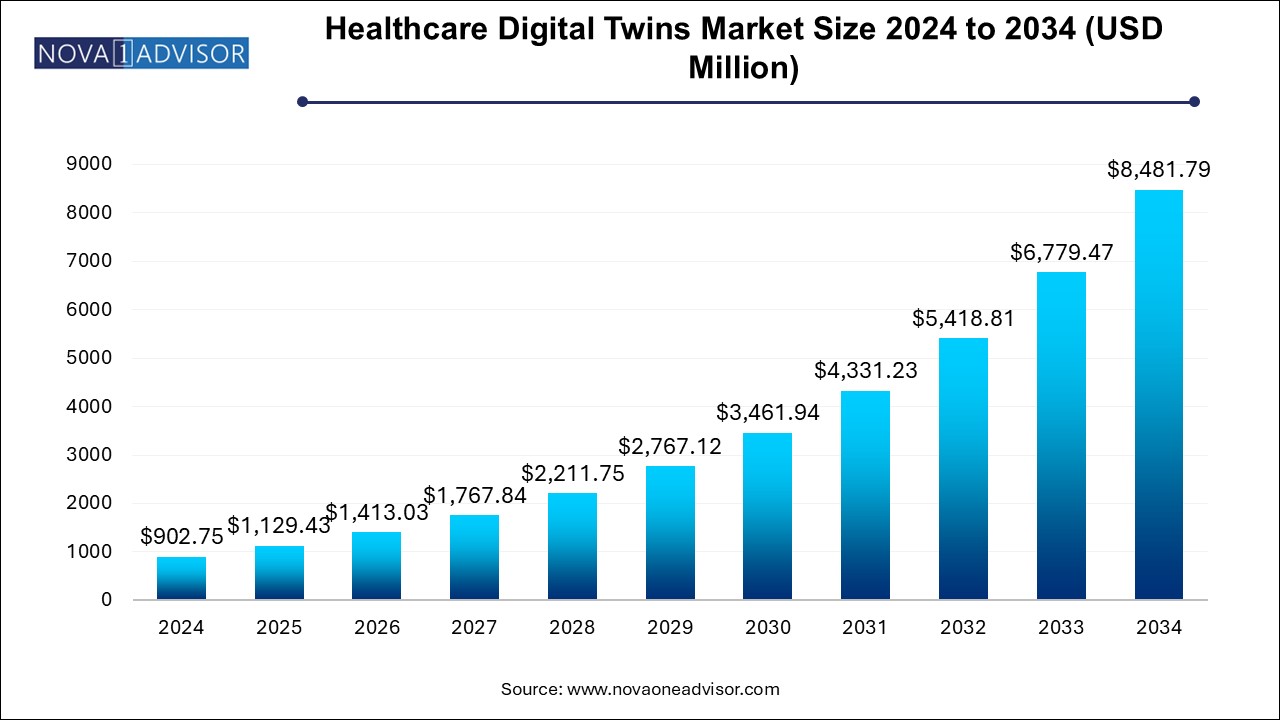

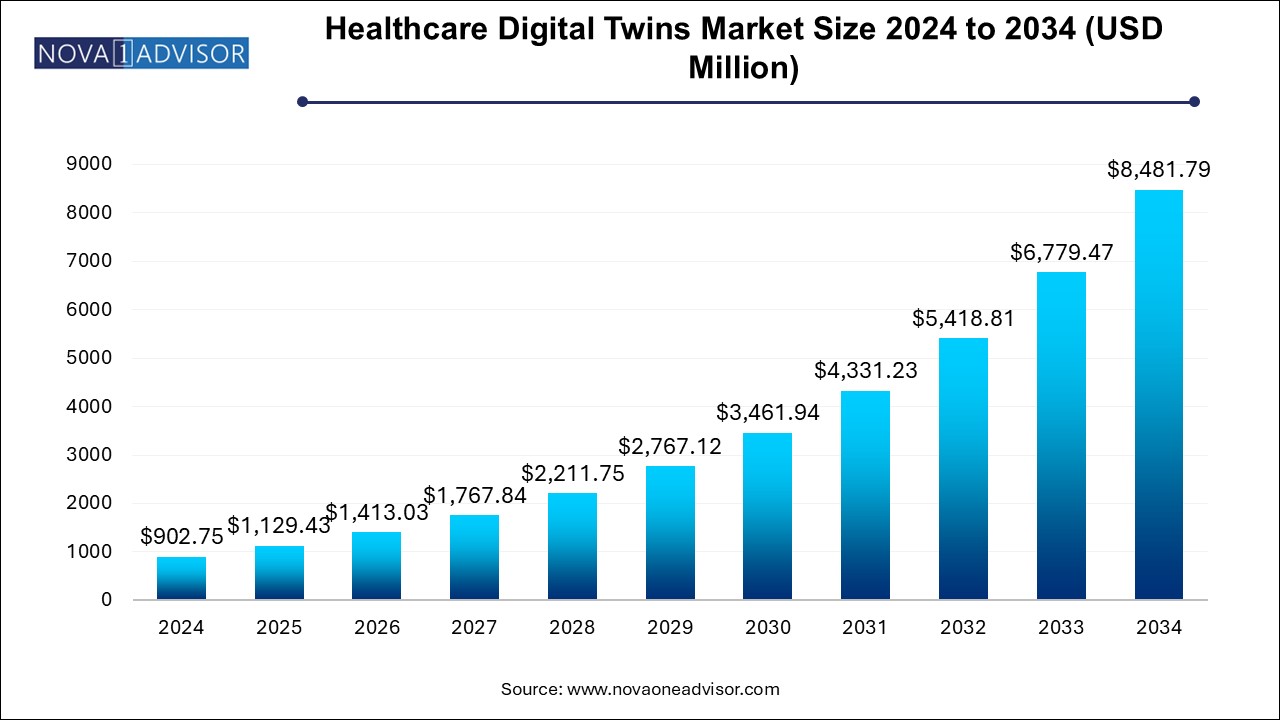

The healthcare digital twins market size was exhibited at USD 902.75 million in 2024 and is projected to hit around USD 8481.79 million by 2034, growing at a CAGR of 25.11% during the forecast period 2024 to 2034. The growth of the healthcare digital twins market can be linked to the digitalization of healthcare systems with innovative technologies, focus on preventive healthcare, advancements in medical device designing and increased adoption of telemedicine platforms.

Healthcare Digital Twins Market Key Takeaways:

- Based on component, the software segment led the market with the largest revenue share of 78.8% in 2024 and is anticipated to register at the fastest CAGR of 26.3% over the forecast period.

- Based on application, the personalized medicine segment led the market with the largest revenue share of 27.4% in 2024.

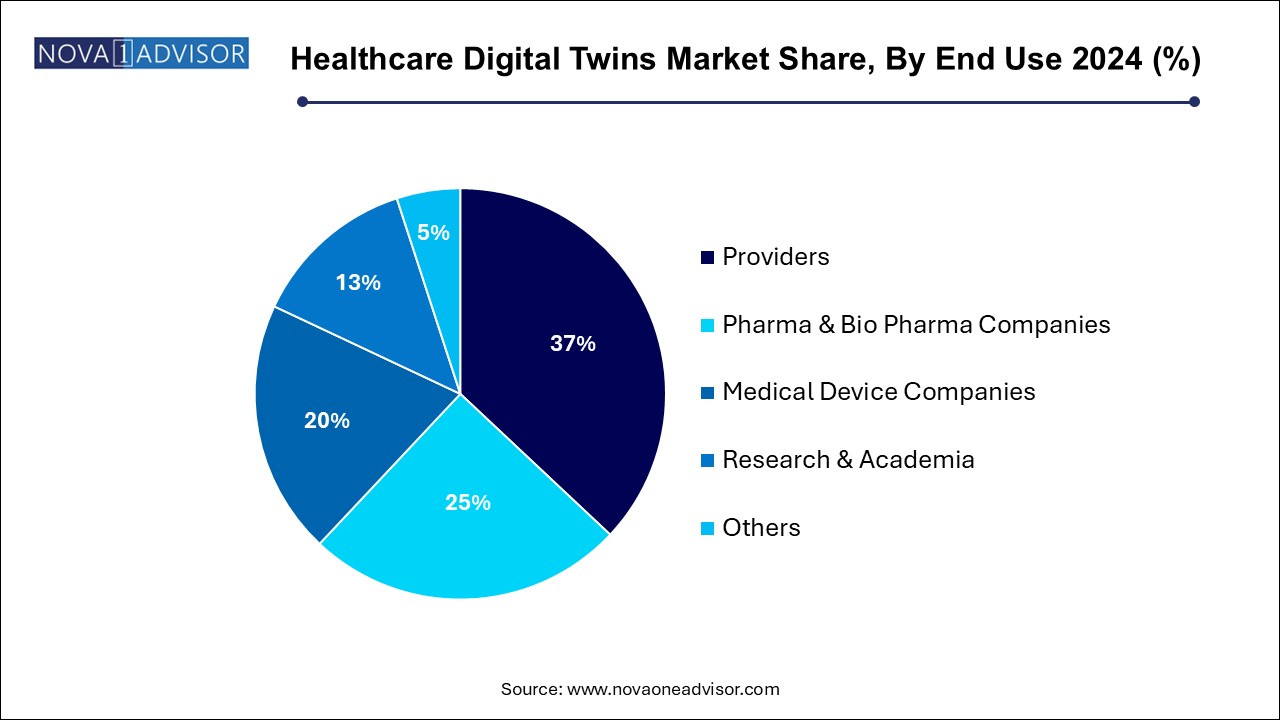

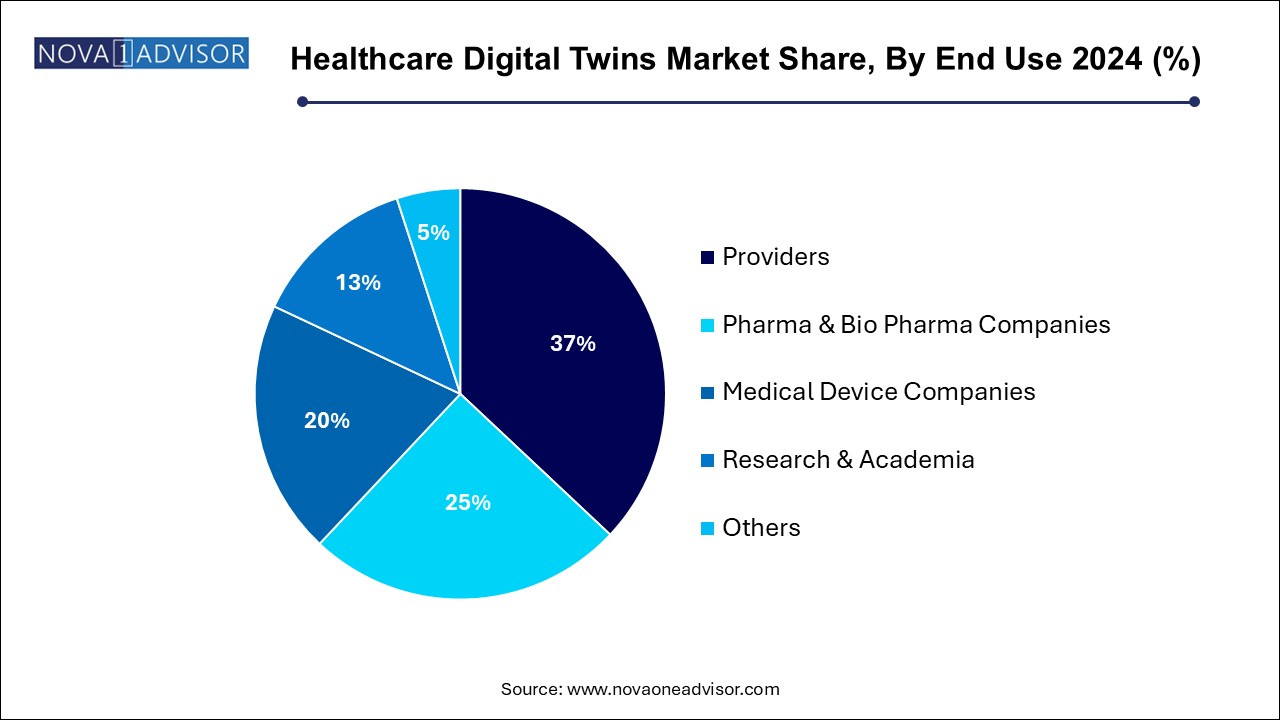

- Based on end use, the providers segment led the market with the largest revenue share of 37.0% in 2024.

- North America healthcare digital twins market is dominated with the largest revenue share of 46.8% in 2024.

Market Overview

The Healthcare Digital Twins Market is witnessing transformative momentum, redefining the paradigms of patient care, healthcare operations, drug development, and medical education. At its core, a healthcare digital twin is a virtual replica of a physical entity—such as a patient, hospital process, or medical device—that can simulate, monitor, and predict performance or outcomes using real-time data. These twins integrate historical clinical data, wearable sensor outputs, genomics, AI, and simulation algorithms to reflect real-time behavior and conditions.

Originally applied in aerospace and manufacturing, the digital twin concept is now gaining traction across healthcare due to its potential to personalize treatment, reduce trial-and-error in clinical decisions, and optimize hospital systems. Whether replicating a human organ to predict disease progression, modeling hospital infrastructure to streamline workflows, or simulating drug effects for faster R&D, digital twins are rapidly becoming a cornerstone of precision medicine and healthcare digitalization.

The market is being fueled by the rising need to manage complex clinical data, minimize healthcare costs, improve treatment outcomes, and accelerate innovation cycles in pharma and medical devices. COVID-19 further highlighted the value of real-time simulation tools to assess disease spread, evaluate capacity planning, and test operational scenarios without endangering lives or delaying care.

Tech giants, startups, research institutes, and medical centers are investing heavily in digital twin platforms that blend AI, IoT, cloud computing, and high-performance computing. As regulatory clarity improves and interoperability standards evolve, healthcare digital twins are expected to become mainstream across provider and research ecosystems globally.

Major Trends in the Market

-

Rising deployment of patient-specific digital twins for personalized medicine and outcome prediction.

-

Integration of AI and machine learning models into digital twin platforms for predictive diagnostics and real-time intervention.

-

Expansion of digital twins into hospital asset management and infrastructure simulation, enabling workflow optimization and cost reduction.

-

Use of digital twins in drug discovery and clinical trial simulation, reducing development timelines and regulatory risks.

-

Growth of organ-specific twins, such as cardiovascular, pulmonary, and neurological system models, for surgical planning and disease modeling.

-

Increased academic-industry collaboration to create open-source frameworks and validate twin accuracy through multi-modal datasets.

-

Rising interest in twins for medical device prototyping, testing, and performance monitoring in real-life environments.

-

Cloud-native digital twin platforms and SaaS models, allowing scalable deployment in multi-institutional healthcare systems.

-

Adoption of twins for remote care, virtual ICUs, and home monitoring, particularly for chronic and elderly patient populations.

What Technological Shifts Are Reshaping the Healthcare Digital Twins Market?

Digitalization of healthcare with significant advancements through the adoption of several interconnected technologies is enabling the development of more precise, dynamic and powerful virtual replicas with expanded applications impact across the healthcare ecosystem. Automated analysis of data enabling predictive analytics and generation of actionable insights enhancing decision support with the artificial intelligence and machine learning algorithms is improving the efficacy and reliability of digital twins. Internet of Things (IoT) and 5G technology is facilitating the collection and transmission of real-time physiological data keeping the digital twins updated continuously, leading to comprehensive patient monitoring, especially in remote patient monitoring and telehealth settings.

Big data analytics are being leveraged by digital twins models for handling large datasets which provides them with evidence-based insights for personalizing recommendations. Cloud computing and edge computing solutions are enhancing the accessibility and scalability of digital twins by reducing hardware investments and providing remote access to these complex models in various locations. Additionally, advanced simulation and modelling techniques such as development of high-fidelity replicas by using advanced technologies like computational fluid dynamics, finite element analysis and multi-scale modelling are enabling the creation of more accurate and realistic virtual representations of tissues, organs and also complete physiological systems.

Report Scope of Healthcare Digital Twins Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1129.43 Million |

| Market Size by 2034 |

USD 8481.79 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 25.11% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Component, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Atos; Microsoft; Philips Healthcare; PrediSurge; Unlearn AI; QiO Technologies; Verto Healthcare; Dassault Systems (3DS System); ThoughWire; Faststream Technologies; Twin Health. |

Market Driver: Demand for Personalized and Predictive Healthcare Solutions

A key driver of the healthcare digital twins market is the growing demand for personalized medicine, coupled with the increasing burden of chronic diseases and complex treatment protocols. Traditional "one-size-fits-all" treatment approaches often lead to suboptimal results, higher costs, and increased hospital readmissions. Digital twins can model how a specific patient’s physiology, lifestyle, and genetics interact with medications or surgical interventions.

For instance, in cardiology, a heart digital twin built using patient-specific imaging and telemetry data can be used to simulate stent placement or predict arrhythmia risks. In oncology, virtual tumors modeled using genomics and pathology data enable oncologists to test drug combinations before administration. This precision-guided approach significantly improves outcomes, reduces adverse reactions, and supports evidence-based decisions. As healthcare systems globally shift toward value-based care, digital twins will play a pivotal role in customizing treatments while containing costs.

Market Restraint: Data Interoperability and Privacy Concerns

Despite promising capabilities, a major restraint is the lack of standardized data interoperability and heightened concerns around data security and patient privacy. For digital twins to accurately simulate real-world outcomes, they must ingest, analyze, and synchronize data from various sources—including EHRs, wearables, imaging platforms, lab systems, and cloud networks. However, these systems often operate in silos and use proprietary formats, hindering seamless data flow.

Moreover, the integration of patient-level data raises significant compliance challenges under HIPAA, GDPR, and other privacy regulations. Breaches or misuse of highly granular health data could result in ethical dilemmas and legal ramifications. Without robust data governance frameworks, privacy-preserving analytics, and stakeholder trust, widespread adoption of digital twins in healthcare may face delays.

Market Opportunity: Acceleration of Clinical Trials and Drug Development

A transformative opportunity in the healthcare digital twins market lies in their application to expedite clinical trials and pharmaceutical innovation. Drug development is notoriously costly and time-consuming, with high failure rates in Phase II and III trials. Digital twins allow researchers to create virtual patients with simulated disease profiles and co-morbidities, enabling the testing of multiple hypotheses before advancing to costly real-world trials.

For example, digital twins of cancer patients can be used to simulate tumor responses to different drug doses, predicting progression-free survival and optimizing clinical trial endpoints. Similarly, in rare diseases with limited patient pools, virtual populations created through digital twins can support regulatory submissions. This model-informed drug development (MIDD) approach is gaining favor among regulators and investors, unlocking faster timelines and de-risking pipelines.

Healthcare Digital Twins Market By Component Insights

Software currently dominates the healthcare digital twins market, forming the core of simulation engines, real-time analytics, and 3D modeling platforms. These software systems integrate patient data from multiple modalities, apply predictive algorithms, and render interactive simulations used by clinicians, researchers, or administrators. Leading software platforms offer modular designs that can be tailored for organ modeling, clinical decision support, or hospital workflow analysis.

As cloud computing and edge analytics evolve, more AI-powered software platforms are being designed for scalability and interoperability. Examples include virtual twin environments for ICUs, digital musculoskeletal models for orthopedics, and pharmacokinetic simulation tools for personalized dosing.

Services are the fastest growing segment, reflecting the demand for implementation support, customization, integration, and maintenance of digital twin systems. Hospitals, pharma companies, and research institutes require professional services to deploy, scale, and validate digital twin models across diverse infrastructure landscapes. This segment also includes training, consulting, and regulatory compliance assistance.

Healthcare Digital Twins Market By Application Insights

Personalized medicine is the dominant application, as digital twins enable tailoring of diagnostics, treatment, and monitoring plans to an individual’s unique physiological profile. Applications include predicting cancer treatment response, optimizing cardiac device settings, or managing diabetes with virtual pancreas models. Providers use these twins to simulate various care paths, empowering clinicians with insights to choose the safest and most effective option.

Drug discovery and development is the fastest growing application, as the pharma and biopharma sectors embrace simulation-driven pipelines. Digital twins allow for rapid hypothesis testing, dose optimization, and virtual cohort generation. Combined with regulatory acceptance of in silico trials and AI-driven design, digital twins are increasingly used in Phase I and II protocol development, rare disease modeling, and biomarker discovery.

Healthcare Digital Twins Market By End Use Insights

Based on end use, the providers segment led the market with the largest revenue share of 37.0% in 2024. Adopting digital twins for clinical decision support, personalized treatments, and infrastructure simulation. Use cases include creating ICU patient twins to predict deterioration, modeling hospital bed turnover, and planning complex surgeries using virtual anatomy. Academic medical centers are also deploying twins for surgical rehearsal and education.

Medical device companies are the fastest growing end users, leveraging digital twins to simulate device performance, reduce physical prototyping, and monitor devices in the field. Twin-enabled device development shortens regulatory approval cycles and enhances post-market surveillance. For example, orthopedic firms use bone and joint twins to test implant fit, while cardiovascular device manufacturers simulate hemodynamics to optimize valve designs.

Healthcare Digital Twins Market By Regional Insights

North America leads the healthcare digital twins market, backed by advanced healthcare infrastructure, early adoption of AI, and strong investments in digital transformation. The U.S. in particular has seen major deployments of digital twin platforms in hospitals like the Mayo Clinic and Cleveland Clinic for ICU simulation, cardiac care, and operational analytics.

The region is also home to leading software vendors, medical technology innovators, and academic research in biomedical engineering. Moreover, government funding through NIH and support for digital health startups provides a fertile ground for innovation. Regulatory openness to model-informed drug development by the FDA further accelerates twin adoption in life sciences.

Asia Pacific is the fastest growing region, with countries like China, Japan, India, and South Korea investing in smart healthcare systems and AI-based medical innovation. The need to manage large patient populations with limited clinical resources is driving interest in simulation tools and predictive models.

Governments and private players are funding R&D in digital twins for hospital planning, chronic disease modeling, and robotic surgery training. In China, AI-led platforms are being used to create digital twins for pandemic preparedness and remote monitoring. Collaborations between tech companies, public health agencies, and research universities are setting the stage for rapid regional expansion.

How are Government Initiatives Strengthening India’s Digital Twin Infrastructure?

In July 2024, the Indian Department of Telecommunications (DoT) successfully concluded its series of networking events under the Sangam-Digital Twin initiative. The events were focused on transforming infrastructure planning by developing comprehensive blueprints for Digital Twin-enabled solutions through advanced digital technologies and leveraging multiple data sources. Breakout sessions covering key verticals for various areas which included aspirational blocks focused on health and nutrition were conducted during the events. The Sangam Health Twin platform development was coordinated for several Health Digital Twins which include Community Twins for management of communicable diseases, Discrete Health Digital Twins for modelling of specific organs, Medical Equipment Twins for infrastructure and predictive maintenance, and Training Twins for healthcare providers.

Some of the prominent players in the Healthcare Digital Twins Market include:

- Atos

- Microsoft

- Philips Healthcare

- PrediSurge

- Unlearn AI

- QiO Technologies

- Verto Healthcare

- Dassault Systems (3DS System)

- ThoughWire

- Faststream Technologies

- Twin Health

Healthcare Digital Twins Market By Recent Developments

-

On 16 May 2025, researchers from the Alan Turing Institute, King’s College London and Imperial College London published a research article in the Nature Cardiovascular Research Journal. The researchers created over 3,800 anatomically accurate digital hearts for investigating the influence of age, sex and lifestyle factors on heart disease and electrical function across diverse demographics. The cardiac digital twins were developed by utilizing real patient’s data and ECG readings obtained from the UK Biobank and a cohort of patients suffering from heart disease.

-

In April 2025, Unlearn.ai, Inc., a leading provider of AI-powered solutions for clinical trials crating digital twins of participants, entered into a partnership with Trace Neuroscience, a biotechnology company focused on creating genomic therapies for neurodegenerative diseases. The collaboration aims at leveraging Unlearn’s Digital Twin Generator for ALS (ALS DTG) and the Unlearn Platform for advancing Trace Neuroscience’s upcoming Phase ½ clinical trial in amyotrophic lateral sclerosis (ALS).

-

In January 2025, JD Health launched two breakthrough AI systems, namely, the AI Jingyi suite and JOY DOC at the 2025 Annual Doctor Gala and Digitally Intelligent Health Conference in Beijing. The systems are built on the company’s specialized Large Language Model (LLM), “Jingyi Qianxun”. The AI Jingyi suite comprises of several products including the AI Diagnosis Assistant 2.0, AI Research Assistant, and AI Doctor Digital Twin, whereas the JOY DOC AI system developed for comprehensive hospital applications consists of the Personal Medical Butler for patients, Doctor Digital Twin for physicians, and Future Digital Hospital for hospital management.

-

In November 2024, Fujitsu, a Japanese IT company, developed an innovative digital twin technology, Policy Twin for simulating the social impact of local government policies to maximize their efficacy by addressing societal issues. The product built by leveraging generative AI and machine learning methodologies assist in identifying measures for reducing costs and enhancing health outcomes in preventive healthcare trial.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the healthcare digital twins market

By Component

By Application

- Personalized medicine

- Healthcare workflow optimization & Asset Management

- Medical Device Design and Testing

- Drug Discovery & development

- Surgical planning and medical education

- Others

By End Use

- Providers

- Pharma & Bio Pharma Companies

- Medical Device Companies

- Research & Academia

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)