The global healthcare third-party logistics market size was estimated at USD 205.6 billion in 2022 and is expected to surpass around USD 431.7 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 7.7% during the forecast period 2023 to 2032.

Key Takeaways:

- North America led the market with a revenue share of 43.6% in 2022.

- Asia Pacific is expected to register a CAGR of 9.2% during the forecast period

- The biopharmaceutical segment accounted for the largest revenue share of 63.0% in 2022.

- The medical devices segment is anticipated to register the fastest CAGR of 10.8% during the forecast period.

- The non-cold chain segment held the largest revenue share of 80.7% in 2022.

- The cold chain segment, on the other hand, is expected to register the fastest CAGR of 10.5% during the forecast period.

- Healthcare Third-party Logistics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 221.43 Billion |

| Market Size by 2032 |

USD 431.7 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 7.7% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Industry, Supply chain, Service type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Cardinal Health; DHL International GmbH; Agility; SF Express; Kinesis Medical B.V.; United Parcel Service of America, Inc.; Barrett Distribution; AmerisourceBergen Corporation; DB Schenker; FedEx; KUEHNE + NAGEL; Kerry Logistics Network Ltd.; Freight Logistics Solutions |

The rising trend of outsourcing logistics and the increasing use of advanced technology by integrating information between manufacturers, suppliers, retailers, and wholesalers have led to the growth of the industry. Additionally, pharmaceutical logistics companies are increasingly adopting retrieval systems and automated storage solutions, which are garnering substantial attention.

Moreover, the industry is poised to experience strong expansion throughout the assessment period, fueled by the increasing trend of collaborations between healthcare companies and third-party logistics (3PL) providers. This is complemented by the heightened emphasis of 3PL providers on extending their offerings into niche therapeutics. For instance, in June 2023, DHL Group announced a new partnership with Vizient Inc., a leading member-directed healthcare performance enhancement organization in the U.S., to establish DHL Supply Chain as an authorized provider of third-party logistics services for supply chain operations.

Through this agreement, members of Vizient, which includes healthcare suppliers and hospital systems, will gain enhanced opportunities to utilize the top-tier service logistics offerings provided by DHL Supply Chain. Also, in April 2023, AmerisourceBergen Corporation announced the launch of its Cell and Gene Therapy (CGT) Integration Hub, designed to seamlessly integrate with provider-oriented platforms or biopharmaceuticals. Its purpose is to enable the instantaneous exchange of data and assist in coordinating services throughout the entirety of treatment development and the patient's healthcare journey.

The COVID-19 pandemic has also boosted the demand for third-party logistics (3PL). During the pandemic, 3PL companies were able to handle the growing demand for healthcare supplies to prevent the pandemic by minimizing supply chain disruptions. They also formed close partnerships with suppliers and added specialized value-based services that helped them generate a good profit. They also collaborated with COVID-19 vaccine providers to supply them across the globe.

3PL services mainly help lower a company's operating costs through two methods. First, 3PL firms usually provide their customers with comprehensive warehousing and transportation services. Therefore, for the companies that use 3PL services, the capital and operational costs such as employee training costs, salaries of logistics personnel, and purchases of transportation trucks and warehouse construction get saved. Second, third-party logistics providers can significantly reduce information asymmetry and transaction costs by eliminating unnecessary distributors from the circulation link.

As a result, they can help businesses lower their operational costs. However, a company gives up some control over the delivery when they choose a 3PL provider. When a company chooses to work with a third-party logistics provider (3PL), they are placing a great deal of faith in 3PL to adhere to the agreed-upon rules for operations that may significantly impact customer satisfaction. Critical data exchanges might not go well. Furthermore, disclosing confidential data to a third party (such as sourcing or order details) may make businesses feel exposed in the event of a data breach.

Industry Insights

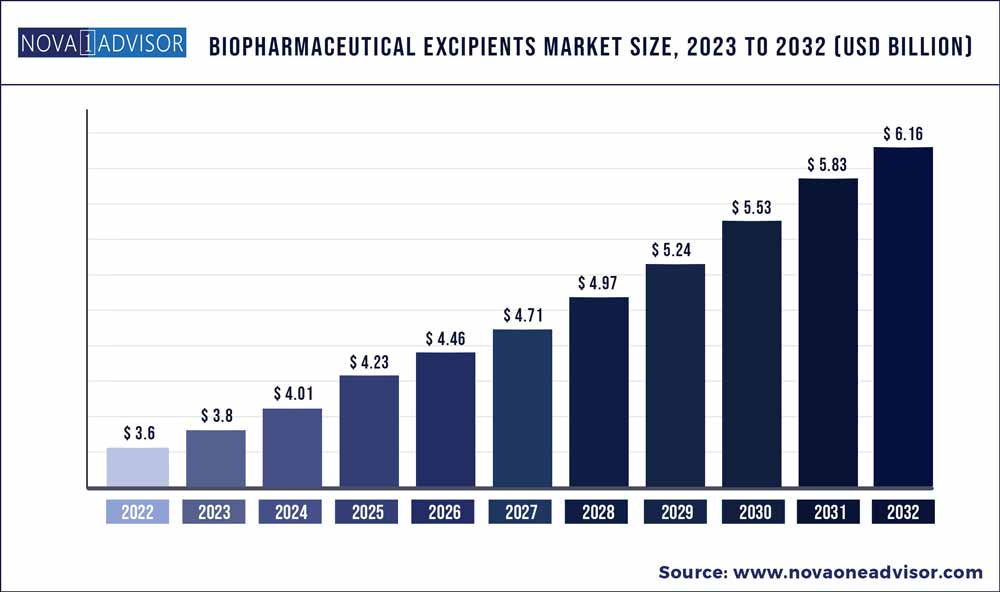

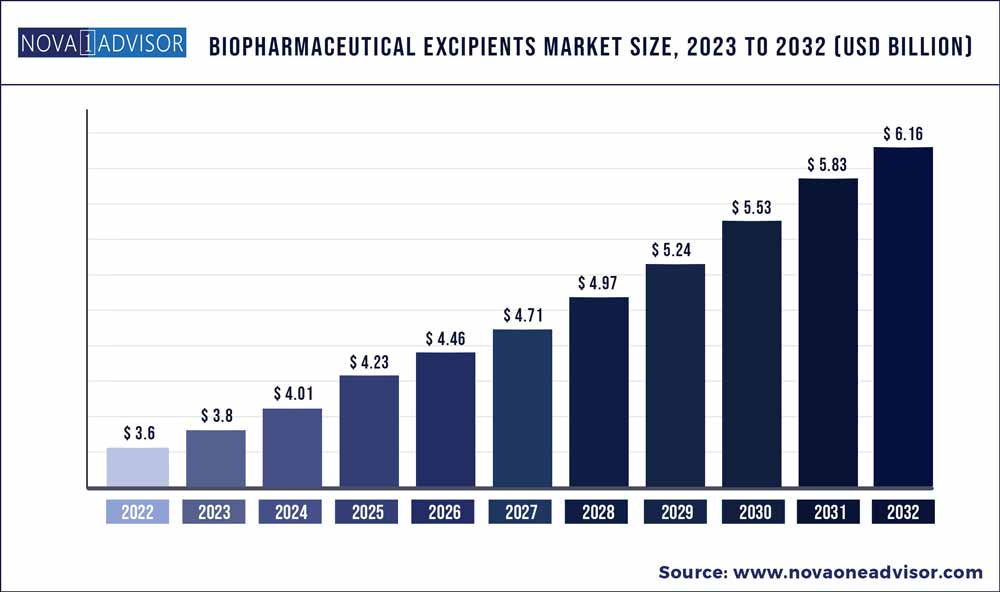

The biopharmaceutical segment accounted for the largest revenue share of 63.0% in 2022. The growth of the biopharmaceutical third-party logistics (3PL) market is being driven by factors such as the increasing demand for temperature-controlled logistics services to expanding distribution networks of biopharmaceutical companies to increase their sales and transport biologics in various geographical areas. Furthermore, several service providers are focusing on partnerships with biopharmaceutical companies to support their logistical concerns regarding newly approved biologics.

For instance, in September 2022, Outlook Therapeutics, Inc., a biopharmaceutical company, announced a strategic alliance with AmerisourceBergen Corporation. Per the agreement, AmerisourceBergen will provide third-party distribution and logistics services, as well as pharmacovigilance and medical information services, for Outlook Therapeutics, Inc. in the U.S.

The medical devices segment is anticipated to register the fastest CAGR of 10.8% during the forecast period in the healthcare third-party logistics market. The rising use of homecare medical devices for the growing geriatric population, increasing focus on personalized medicine by using health trackers and remote patient monitoring devices, and rising supply chain resilience and agility to overcome medical device shortages are the major driving factors.

For instance, in July 2021, the FDA announced a budget of USD 21.6 million for its new Resilient Supply Chain and Shortages Prevention Program (RSCSPP). The main aim of the program is to strengthen the supply chain. Moreover, increasing government initiatives for developing the medical devices industry by building MedTech parks for manufacturers to develop their base for R&D are further expected to drive industry growth.

Supply Chain Insights

The non-cold chain segment held the largest revenue share of 80.7% in 2022. This is due to greater scalability, improved visibility, and lower operating expenses, all of which contribute to the growth of a more robust logistics network with higher returns and lower risks. As a result, 3PL has become a crucial component of pharmaceutical companies' business strategies. The growth in the number of SKUs per distributor that do not require temperature-controlled transportation, unlike biologics, is another factor that has fueled the expansion of the non-cold chain segment.

The cold chain segment, on the other hand, is expected to register the fastest CAGR of 10.5% during the forecast period. This is mainly due to the meteoric rise in demand for biologics, a brand-new class of pharmaceuticals that has grown quickly in recent years. Aside from biologics, the healthcare 3PL market has witnessed the emergence of various types of precision medicine, such as blood products, biomarker testing, specific vaccines, cellular therapies, and regenerative medicine in the form of stem cells, which require both temperature- and time-controlled distribution.

Furthermore, biopharmaceutical logistics providers are upgrading their systems to include cold chain logistics for cell and gene therapies. For instance, in September 2022, Cryoport, a company specializing in temperature-controlled cold chain supply services, entered into a collaboration with BioLife Plasma Services, which is a part of Takeda Pharmaceutical Company Limited dedicated to plasma donation and collection. This partnership aims to provide uniform services for collecting, processing, and storing cell therapy products throughout the U.S. and Europe.

Regional Insights

North America led the market with a revenue share of 43.6% in 2022. This high revenue share is mostly due to the region's dominance in pharmaceutical and biologic medications as well as a surge in exports and imports of biopharmaceuticals. The adoption of new technologies is relatively high in the region due to the high cost of healthcare. As a result, healthcare businesses with operations in North America are increasingly dependent on 3PL service providers to optimize warehousing and transportation, which is fueling regional growth. The presence of prominent firms in this area is another factor contributing to the dominance of this region.

Asia Pacific is expected to register a CAGR of 9.2% during the forecast period owing to the rising demand for cold storage facilities, increasing adoption rate of technologically advanced facilities, and rise in merger & acquisition activities by industry players in the region. For instance, in August 2023, CEVA Logistics announced an agreement to purchase 96% of Stellar Value Chain Solutions, a Mumbai-based company specializing in cold chain logistics. The acquisition of the company will enable CEVA to expand its footprint in India, enhancing its local workforce, customer base, and competencies.

Some of the prominent players in the Healthcare Third-party Logistics Market include:

- Cardinal Health

- DHL Group

- Agility

- SF Express

- Kinesis Medical B.V.

- United Parcel Service of America, Inc.

- Barrett Distribution

- AmerisourceBergen Corporation

- DB Schenker

- FedEx

- KUEHNE + NAGEL

- Kerry Logistics Network Ltd.

- Freight Logistics Solutions

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Healthcare Third-party Logistics market.

By Industry

- Biopharmaceutical

- Vaccines

- Plasma Derived Products

- Others

- Medical Device

- Class I

- Class II

- Class III

- Pharmaceutical

By Service Type

- Transportation

- Air Freight

- Sea Freight

- Overland Transportation

- Warehousing and Storage

- Others

By Supply Chain

- Cold Chain

- Non-Cold Chain

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)