Heart Pump Device Market Size and Trends

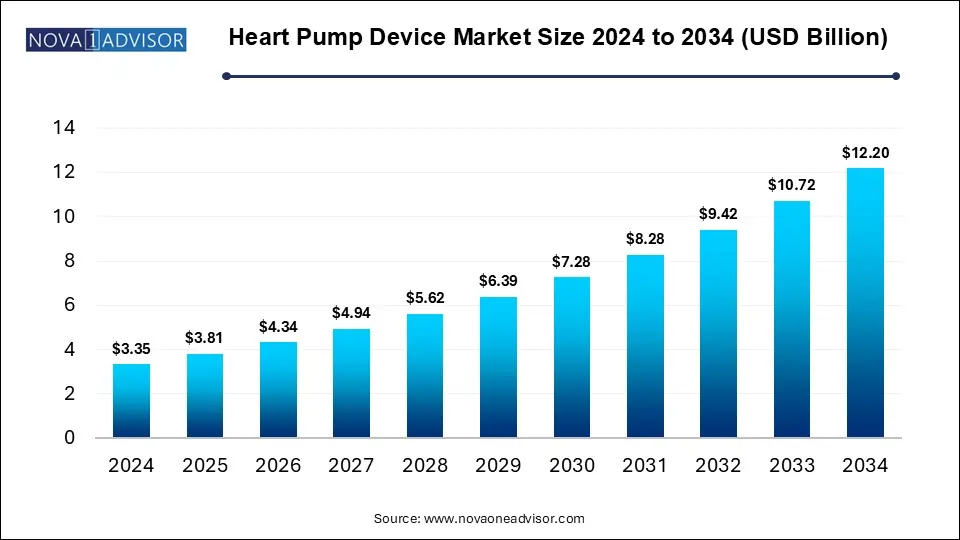

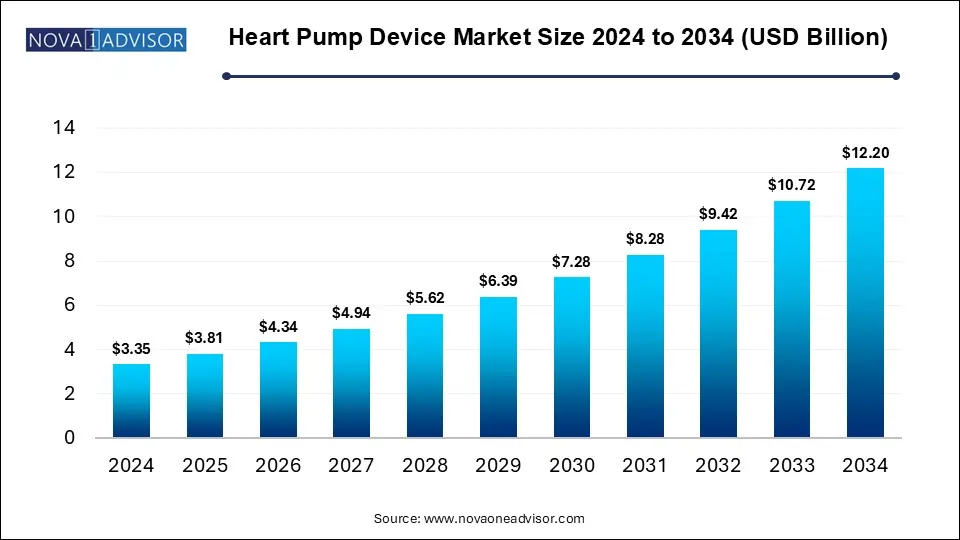

The heart pump device market size was exhibited at USD 3.35 billion in 2024 and is projected to hit around USD 12.20 billion by 2034, growing at a CAGR of 13.8% during the forecast period 2025 to 2034.

Key Takeaways:

- North America emerged as the leading region in the heart pump device market, contributing 53% of the total revenue in 2024.

- The United States dominated the North American heart pump device market, accounting for an 89% share of the region’s revenue in 2024.

- Implanted heart pump devices led the type segment, representing 70% of the market share in 2024.

- Within the product segment, ventricular assist devices (VADs) secured the top position with a commanding 69% market share in 2024.

- Hospitals were the primary end-users of heart pump devices, holding a dominant 80% share of the market in 2024.

Market Overview

The heart pump device market is an integral component of the broader cardiovascular medical devices industry. Designed to support or replace the function of a failing heart, heart pump devices are predominantly used in patients with end-stage heart failure and those awaiting heart transplants. Technological advancements, the increasing prevalence of cardiovascular diseases (CVDs), and rising geriatric populations are major forces contributing to market expansion.

Globally, millions suffer from heart failure, with the World Health Organization (WHO) estimating cardiovascular diseases as the leading cause of death. Heart pump devices offer a lifeline by either temporarily or permanently supporting the heart's pumping function, particularly when pharmacological treatments are insufficient. The growing acceptance of mechanical circulatory support systems and increased government investments in healthcare infrastructure are also accelerating the adoption of these devices.

The market has witnessed significant evolution, with the introduction of compact, battery-operated, and biocompatible heart pump systems. Companies are continually innovating to make devices more reliable, durable, and cost-effective. In parallel, the awareness among clinicians and patients about mechanical circulatory support has surged, catalyzing adoption across developed and emerging regions.

Major Trends in the Market

-

Miniaturization of Devices: Manufacturers are developing smaller, portable heart pump systems suitable for implantation or external use without sacrificing efficacy.

-

Growth in Bridge-to-Transplant (BTT) and Destination Therapy (DT): These applications are driving demand as more patients await transplants or use devices permanently.

-

Rising Use of Left Ventricular Assist Devices (LVADs): LVADs dominate product demand, particularly in patients with left ventricular heart failure.

-

Integration of Artificial Intelligence (AI): Smart heart pumps are being explored for real-time monitoring and automated function adjustment.

-

Shift Towards Implantable Devices: Due to better outcomes and mobility for patients, there is increasing preference for implanted solutions over extracorporeal systems.

-

Robust R&D and Clinical Trials: There is a surge in research efforts aimed at improving biocompatibility, reducing hemolysis, and enhancing device longevity.

-

Public and Private Investments in Cardiac Healthcare: Numerous countries are investing in cardiovascular health, including funding for advanced heart support systems.

-

Telemonitoring and Remote Diagnostics: The inclusion of digital health technologies enables post-implant monitoring, reducing hospital readmissions.

-

Rising Incidence of Heart Failure in Younger Populations: Lifestyle changes and metabolic syndromes are pushing the disease burden to younger demographics.

Report Scope of Heart Pump Device Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.81 Billion |

| Market Size by 2034 |

USD 12.20 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Product, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott; ABIOMED (Johnson & Johnson Services Inc; Getinge ;LivaNova PLC; Berlin Heart; Picard Medical Inc. (SynCardia Systems LLC); Jarvik Heart; BiVACOR Inc.; Leviticus Cardio; Teleflex Incorporated. |

Key Market Driver: Increasing Prevalence of Heart Failure

One of the strongest drivers of the heart pump device market is the rising incidence of heart failure, which affects over 26 million people globally. Sedentary lifestyles, dietary imbalances, hypertension, diabetes, and obesity contribute significantly to heart-related disorders. Heart pump devices serve as either short-term support during surgery or long-term aids for chronic heart failure patients.

For instance, in the United States alone, nearly 6.5 million adults suffer from heart failure, and approximately 1 in 9 deaths include heart failure as a contributing cause. With limited donor hearts available, mechanical devices like LVADs or extracorporeal systems become essential. This necessity is further amplified by aging demographics, as cardiovascular disease is more prevalent in older adults. As the need for mechanical circulatory support rises, so does demand for high-performance, minimally invasive heart pump devices.

Key Market Restraint: High Cost of Devices and Procedures

Despite technological advancement and proven efficacy, the high cost of heart pump devices and associated surgical procedures remains a significant barrier, especially in low- and middle-income countries. A typical LVAD can cost upwards of USD 80,000, excluding hospitalization, follow-up care, and medications. This limits access for a vast segment of patients who either lack insurance coverage or reside in countries with constrained healthcare budgets.

Moreover, maintenance and complications, such as infection or thromboembolism, may result in additional healthcare expenditures. Reimbursement challenges also hinder widespread adoption, particularly for novel or experimental devices. Although cost-containment strategies and government support are improving in some regions, affordability remains a pressing issue, curbing the market’s full potential.

Key Opportunity: Expansion in Emerging Markets

Emerging economies such as India, Brazil, and Southeast Asian nations present a compelling opportunity for market expansion, driven by improving healthcare infrastructure, rising awareness of heart failure management, and growing medical tourism.

Countries like India are investing in cardiac centers and medical device manufacturing, while also witnessing a rising middle-class population willing to spend on premium healthcare services. Strategic collaborations between global device manufacturers and regional hospitals or distributors are helping expand product accessibility.

Furthermore, initiatives by non-profits and government programs to subsidize heart failure treatment combined with the declining cost of older generation devices—can open doors for widespread adoption in these underpenetrated markets.

Segmental Analysis

Type Outlook: Implanted Heart Pump Devices Dominate the Market

Implanted heart pump devices hold the largest market share due to their effectiveness in long-term therapy. These devices, especially LVADs, are the preferred option for patients waiting for heart transplants or those who are ineligible for one. Clinical benefits such as improved mobility, survival rate, and quality of life significantly drive the demand for implantable systems.

Extracorporeal heart pump devices, although vital in acute care scenarios, are typically used in intensive care units or during cardiac surgeries. Their application remains largely hospital-based and limited in duration. However, the extracorporeal segment is also expanding steadily owing to the increased utilization of ECMO systems in emergency and pediatric care, especially in developed nations with advanced critical care setups.

Product Outlook: LVADs Lead, PVADs Grow Fastest

Left Ventricular Assist Devices (LVADs) dominate the product category owing to their widespread use in chronic heart failure cases and bridge-to-transplant strategies. They offer advanced support, improving hemodynamic parameters, exercise tolerance, and survival rates. Clinical trials and approvals, such as Medtronic's HeartWare HVAD and Abbott’s HeartMate 3, further strengthen the LVAD pipeline.

Conversely, Percutaneous Ventricular Assist Devices (PVADs) are experiencing the fastest growth due to their minimally invasive nature and rapid deployment, particularly in high-risk percutaneous coronary interventions (PCI). PVADs like Abiomed’s Impella series are gaining traction in interventional cardiology as they offer short-term hemodynamic support without the need for open-heart surgery, facilitating broader clinical adoption.

End Use Outlook: Hospitals Are the Leading End-Users

Hospitals account for the largest revenue share in the heart pump device market. With access to surgical facilities, intensive care units, and specialized cardiac teams, hospitals are the primary settings for device implantation and monitoring. The integration of advanced cardiac care units (CCUs) in major hospitals further supports this trend.

Cardiac centers, however, represent the fastest-growing end-use segment. These dedicated facilities are being increasingly established in urban areas and focus solely on cardiovascular treatments. With lower operating costs and specialized care pathways, cardiac centers are preferred by patients for elective procedures and follow-ups. Their popularity is growing especially in Asia Pacific and Latin America, where healthcare privatization is surging.

Regional Analysis

North America: The Dominant Regional Market

North America holds the lion’s share in the global heart pump device market, primarily due to high prevalence of heart failure, favorable reimbursement policies, and advanced healthcare infrastructure. The U.S., in particular, is home to major device manufacturers, robust clinical trial activity, and leading transplant centers.

Organizations like the American Heart Association (AHA) and Centers for Medicare & Medicaid Services (CMS) play crucial roles in promoting awareness and funding heart failure management. In addition, high disposable income and increased healthcare spending support adoption. For example, in June 2023, Abbott reported expanded clinical use of its HeartMate 3 in U.S. hospitals after receiving CMS reimbursement approvals.

Asia Pacific: The Fastest Growing Region

Asia Pacific is poised as the fastest-growing region, fueled by rising cardiovascular disease burden, economic development, and growing investment in healthcare infrastructure. Countries like China, Japan, and India are key contributors, with increasing cases of heart failure and improving accessibility to surgical interventions.

In particular, Japan has seen successful adoption of LVADs under its universal healthcare model, while Indian hospitals are increasingly adopting PVADs in urban centers. The region is also witnessing increased partnerships between Western device makers and regional distributors to enhance market penetration. For instance, in April 2024, Abiomed entered a distribution agreement with a Singapore-based medtech firm to expand access to its Impella pumps.

Some of The Prominent Players in The Heart Pump Device Market Include:

- Abbott

- ABIOMED (Johnson & Johnson Services, Inc.)

- Getinge

- LivaNova PLC

- Berlin Heart

- Picard Medical, Inc. (SynCardia Systems, LLC)

- Jarvik Heart, Inc.

- BiVACOR Inc.

- Leviticus Cardio

- Teleflex Incorporated.

Recent Developments

-

February 2025: Medtronic announced the completion of its pilot trial for a new wireless LVAD system in Europe, indicating a breakthrough in reducing driveline infections.

-

January 2025: Abbott received FDA approval for an upgraded version of its HeartMate 3 with enhanced monitoring capabilities and longer battery life.

-

October 2024: Abiomed launched the Impella ECP (Expandable Cardiac Pump) in select U.S. hospitals under an Early Access Program, emphasizing its role in high-risk PCI.

-

August 2024: Berlin Heart reported successful pediatric heart transplant bridge outcomes using the EXCOR Pediatric VAD in multiple European countries.

-

June 2024: A collaborative study between Cleveland Clinic and University of Tokyo showcased improved survival rates for ECMO-supported patients during the pandemic, strengthening clinical evidence for extracorporeal heart pump devices.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Type

- Implanted Heart Pump Devices

- Extracorporeal Heart Pump Devices

By Product

- Ventricular Assist Devices (VADs)

-

- Left Ventricular Assist Devices (LVADs)

- Right Ventricular Assist Devices (RVADs)

- BiVAD Ventricular Assist Devices (BiVADs)

- Percutaneous Ventricular Assist Devices (PVADs)

- Intra-Aortic Balloon Pumps (IABPs)

- Extracorporeal Membrane Oxygenation (ECMO)

By End Use

- Hospitals

- Cardiac Centers

- Research Institute

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)