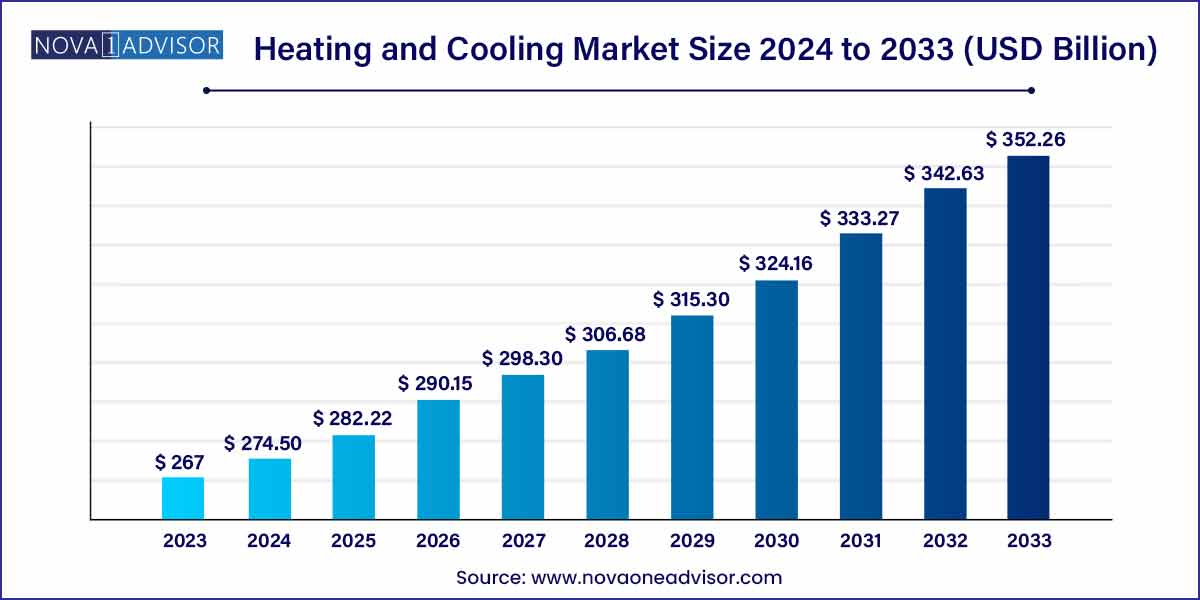

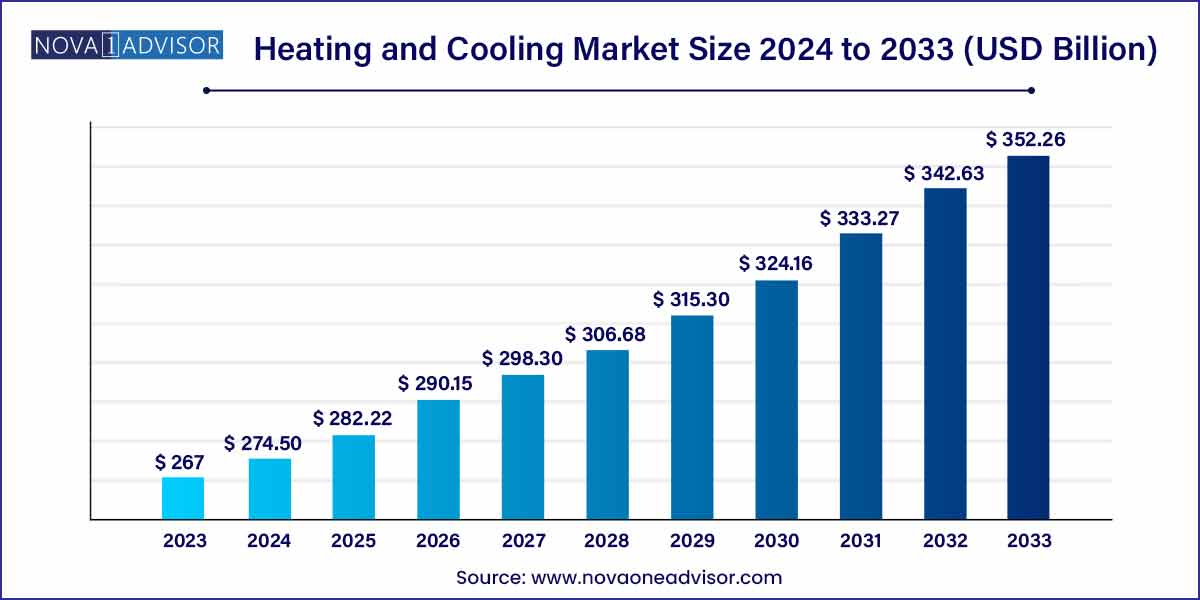

The global heating and cooling market size was exhibited at USD 267.00 billion in 2023 and is projected to hit around USD 352.26 billion by 2033, growing at a CAGR of 2.81% during the forecast period of 2024 to 2033.

Key Takeaways:

- The U.S. heating & cooling market was valued at US$ 62.10 billion in 2023

- North America dominated the global heating and cooling market in 2023.

- Based on the category, the heating segment will account for more than 91% of the market share in 2023.

- The residential segment will dominate the global heating and cooling market in 2023.

Heating and Cooling Market by Overview

The heating and cooling market is a crucial sector within the broader realm of HVAC (Heating, Ventilation, and Air Conditioning). As societies worldwide strive for comfort, energy efficiency, and environmental sustainability, the dynamics within this market are continually evolving. This overview aims to provide insights into the key aspects, trends, and challenges shaping the heating and cooling industry today.

Heating and Cooling Market Growth

The global heating and cooling market is shaped by the stringent government regulations regarding carbon emissions and rising investments by the government on the development of infrastructure. The development of regulatory frameworks encourages the transition towards the adoption of the low carbon emission technologies, which is expected to drive the growth of the global heating and cooling market. The rising adoption of renewable energy sources and increasing demand for the green energy is expected to boost the market growth in the forthcoming years. The rapid industrialization and the rising focus towards sustainability is augmenting the demand for the renewable energy. Therefore, the rising popularity of the green energy is expected to positively impact the growth of the heating and cooling market across the globe. Moreover, the growing concerns pertaining to climate change and optimization of energy is influencing the global heating and cooling market. The increased adoption of the electrical energy has fostered the growth in the demand for heating across the globe. The stringent government regulations regarding the optimization of energy and energy consumption standards is expected to shape the future of the heating and cooling market.

The surging demand for the efficient heating and cooling solutions along with the favorable regulations regarding the HVAC systems in the residential sector is driving the market growth. The rapid urbanization and rising investments in the real estate sector is positively impacting the global heating and cooling market. Moreover, the rising demand for energy coupled with growing investments in the industries for the adoption of district heating solutions is expected to foster the market growth. The district heating and cooling segment is estimated to have a positive growth owing to its economic feasibility and sustainability feature. The rising awareness across the globe towards the benefits of adopting the district heating and cooling solutions is expected to augment the global heating and cooling market.

Heating & Cooling Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 267.00 Billion |

| Market Size by 2033 |

USD 352.26 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 2.81% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Category, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Johnson Controls, Siemens, Daikin, Lennox International, Trane, Rheem Manufacturing, Engie, Mitsubishi Electric, Haier, Danfoss, Empower, Veolia, Goodman, Fortum. |

Heating and Cooling Market Dynamics

- Technological Advancements Driving Innovation:

Technological advancements are revolutionizing the heating and cooling market, paving the way for innovative solutions that prioritize energy efficiency and user convenience. Smart technologies, in particular, are reshaping how HVAC systems operate, offering features like remote monitoring, adaptive controls, and predictive maintenance.

Smart thermostats, for instance, enable users to regulate indoor temperatures remotely via smartphone apps, optimizing energy usage and reducing utility costs. Furthermore, advancements in variable refrigerant flow (VRF) systems allow for precise temperature control in different zones of a building, improving comfort and energy efficiency.

- Regulatory Landscape Shaping Market Trends:

The heating and cooling market is heavily influenced by regulatory standards and policies aimed at promoting energy efficiency and environmental sustainability.Governments worldwide are implementing stringent regulations to curb greenhouse gas emissions, reduce energy consumption, and phase out ozone-depleting refrigerants.

For instance, initiatives like the European Union's Energy Performance of Buildings Directive (EPBD) and the U.S. Environmental Protection Agency's (EPA) Energy Star program set minimum efficiency requirements for heating and cooling equipment, driving manufacturers to develop more eco-friendly and efficient products.

Heating and Cooling Market Restraint

Initial cost barrier:

One of the primary restraints hindering widespread adoption of heating and cooling systems is the significant upfront cost associated with high-efficiency equipment. While these systems offer long-term energy savings and environmental benefits, the initial investment can be prohibitive for many consumers, particularly in regions with limited access to financing or subsidies.

The high upfront cost of energy-efficient HVAC systems often acts as a barrier, deterring homeowners and businesses from upgrading to more sustainable solutions. This is especially true for residential customers who may prioritize short-term budget considerations over long-term energy savings. Additionally, small and medium-sized enterprises (SMEs) may find it challenging to justify the upfront investment in energy-efficient heating and cooling systems, especially when faced with competing financial priorities.

- Maintenance and Serviceability Challenges:

Another significant restraint within the heating and cooling market is the complexity of maintenance and serviceability associated with modern HVAC systems. While advanced technologies offer improved energy efficiency and performance, they also require specialized skills and knowledge for installation, maintenance, and repair.

Complex HVAC systems often necessitate regular maintenance to ensure optimal performance and longevity. However, the availability of skilled technicians and qualified professionals capable of servicing these systems may be limited, particularly in rural or underserved areas. This can lead to extended downtime, increased repair costs, and frustration for consumers.

Heating and Cooling Market Opportunity

- Growing Demand for Energy-Efficient Solutions:

One of the significant opportunities within the heating and cooling market is the growing demand for energy-efficient solutions driven by increasing awareness of environmental sustainability and the need to reduce energy consumption. Consumers, businesses, and governments are increasingly prioritizing energy efficiency as a means to lower utility bills, mitigate greenhouse gas emissions, and achieve long-term cost savings.

This shift towards energy-efficient heating and cooling systems presents a lucrative opportunity for manufacturers, suppliers, and service providers to capitalize on rising demand. By offering innovative products and solutions that deliver superior energy performance, stakeholders can cater to environmentally conscious consumers and businesses seeking to reduce their carbon footprint.

- Expansion of Smart Technologies and IoT Integration:

Another significant opportunity within the heating and cooling market lies in the expansion of smart technologies and the integration of Internet of Things (IoT) capabilities into HVAC systems. Smart thermostats, connected sensors, and IoT-enabled devices are revolutionizing how heating and cooling systems are controlled, monitored, and optimized for efficiency and comfort.

The proliferation of smart technologies presents a vast opportunity for manufacturers and service providers to offer innovative solutions that enhance user experience, improve energy efficiency, and enable remote management and control of HVAC systems. By integrating IoT sensors and connectivity features into heating and cooling equipment, stakeholders can gather real-time data on energy usage, indoor air quality, and system performance, allowing for more precise control and optimization of HVAC operations.

Heating and Cooling Market Challenges

- Regulatory Uncertainty and Compliance Challenges:

One of the significant challenges facing the heating and cooling market is regulatory uncertainty and compliance complexities related to energy efficiency standards, environmental regulations, and refrigerant phase-outs. Governments worldwide are implementing stringent regulations to reduce greenhouse gas emissions, promote energy efficiency, and phase out the use of ozone-depleting substances in HVAC systems.

However, frequent changes in regulations and standards pose challenges for manufacturers, distributors, and end-users in terms of compliance and adaptation. Keeping up with evolving regulatory requirements requires significant investment in research and development, product testing, and certification processes. Moreover, the transition to alternative refrigerants to comply with phase-out regulations can lead to technical challenges, supply chain disruptions, and increased costs for stakeholders.

- Supply Chain Disruptions and Component Shortages:

Another significant challenge affecting the heating and cooling market is supply chain disruptions and component shortages, exacerbated by factors such as geopolitical tensions, natural disasters, and global pandemics. The interconnected nature of the supply chain, coupled with increasing demand for HVAC equipment and components, has led to volatility and uncertainty in the availability and pricing of raw materials, parts, and finished products.

Supply chain disruptions can impact manufacturing operations, lead times, and product availability, resulting in delays, increased costs, and customer dissatisfaction. Component shortages, in particular, can hinder production schedules and limit the ability of manufacturers to meet customer demand, especially during peak seasons or periods of high demand.

Segments Insights:

Category Insights

Heating dominated the category segment, accounting for a major share of the market. Heating systems are indispensable in residential, commercial, and industrial settings, especially in colder regions like North America and Europe. Among the heating sources, natural gas remains the most widely used due to its efficiency, availability, and relatively lower carbon emissions compared to coal or oil products. District heating systems, particularly in Europe and parts of Asia, are witnessing significant adoption as cities aim to centralize heat production for efficiency gains.

Renewable heating sources, including biomass boilers and geothermal systems, are also experiencing notable traction as regulations tighten around carbon emissions. For instance, countries like Sweden and Denmark have successfully integrated biofuels and district heating into their energy matrices, significantly reducing their fossil fuel dependencies. In terms of growth, renewable-based heating solutions such as geothermal and solar thermal systems are the fastest-growing categories, driven by an increasing emphasis on sustainability and innovations reducing installation costs.

Cooling is the fastest-growing category, especially in emerging economies. Rising global temperatures, urbanization, and increased disposable incomes are driving demand for air conditioning and refrigeration systems in Asia-Pacific and Latin America. Modern cooling solutions are focusing on energy efficiency and environmental impact, with the development of systems using low-GWP refrigerants and inverter technology. Furthermore, the concept of "green cooling," promoting solar-powered air conditioning and energy recovery systems, is increasingly becoming popular. Notably, India and China are witnessing an unprecedented surge in residential air conditioner installations, paving the way for cooling solutions to overtake heating in overall market demand in the coming decades.

Application Insights

The residential application segment dominated the market and continues to hold the largest share. Driven by increasing homeownership rates, consumer preferences for better living standards, and government incentives for energy-efficient home upgrades, residential heating and cooling systems have become indispensable. The advent of smart home technologies has further accelerated adoption, allowing homeowners to control heating and cooling remotely, optimize energy use, and reduce costs. In regions with extreme weather variations, such as Canada and Northern Europe, residential heating is a critical infrastructure component, with energy-efficient furnaces and heat pumps seeing widespread adoption.

The industrial application segment is the fastest-growing application segment. Industries such as pharmaceuticals, food and beverage, and manufacturing sectors require stringent temperature control for processes and storage, leading to rising demand for specialized heating and cooling systems. Moreover, the need to maintain optimal working conditions for employees in manufacturing plants, coupled with energy-saving mandates, is driving investments in industrial-grade HVAC systems. Cooling is particularly critical in industries like data centers, where overheating can lead to catastrophic failures, thus fueling the need for innovative cooling technologies such as liquid cooling and modular chillers.

Regional Analysis

Europe dominated the global heating and cooling market, owing to stringent energy efficiency standards, widespread adoption of district heating systems, and robust renewable energy initiatives. Countries such as Germany, Sweden, Denmark, and Finland are pioneers in implementing green heating and cooling technologies, driven by policy frameworks like the European Green Deal and Net Zero Emission Targets for 2050. Europe's strong focus on reducing carbon emissions has led to significant investments in renewable heating and energy-efficient building renovations. The retrofit market in Europe is particularly vibrant, as older building stocks undergo transformation to meet new energy standards. For example, in Germany, programs like "Energy-efficient Renovation" by KfW Bank are promoting extensive upgrades.

Asia-Pacific is the fastest-growing regional market, fueled by rapid urbanization, rising disposable incomes, and increasing temperatures. China and India, with their massive populations and economic growth, are at the forefront of this surge. Cooling demand is exponentially increasing in this region, supported by government initiatives like India's "Cooling Action Plan" and China's push for sustainable urban development. Furthermore, the construction boom across Southeast Asia is catalyzing demand for both heating and cooling systems, creating immense opportunities for global and regional players.

Key Market Development

-

March 2025: Carrier Global Corporation announced a partnership with Schneider Electric to deliver integrated, energy-efficient building management solutions that combine smart heating, cooling, and energy management technologies.

-

February 2025: Daikin Industries unveiled its latest "R-32" refrigerant-based air conditioners, highlighting a reduction in GWP by 75% compared to traditional refrigerants.

-

January 2025: Johnson Controls introduced its new line of YORK® YVAA air-cooled chillers featuring enhanced energy performance metrics suitable for commercial and industrial sectors.

-

December 2024: Trane Technologies launched an "All-Electric Heat Pump" product range designed for extremely cold climates, promoting the phase-out of gas heating systems in residential and commercial settings.

-

November 2024: LG Electronics announced the expansion of its smart HVAC portfolio with the launch of AI-powered dual inverter air conditioners, optimized for residential and light commercial use.

Some of the prominent players in the heating and cooling market include:

- Johnson Controls

- Siemens

- Daikin

- Lennox International

- Trane

- Rheem Manufacturing

- Engie

- Mitsubishi Electric

- Haier

- Danfoss

- Empower

- Veolia

- Goodman

- Fortum

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global heating and cooling market.

By Category

-

- Electricity

- Renewables

- District Heating

- Geothermal

- Biofuels

- Oil Products

- Natural Gas

- Coal

- Others

By Application

- Residential

- Industrial

- Service

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)