Hemato Oncology Testing Market Size and Growth 2025 to 2034

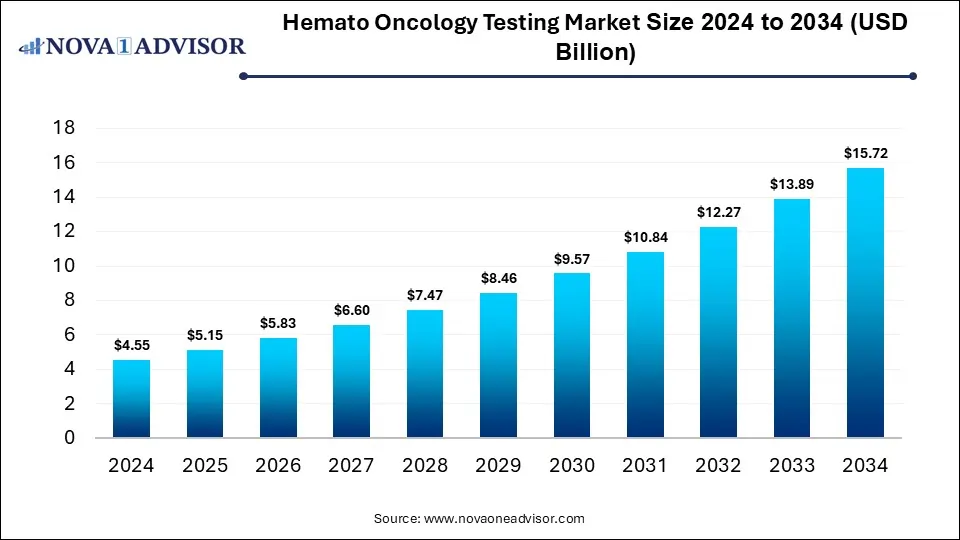

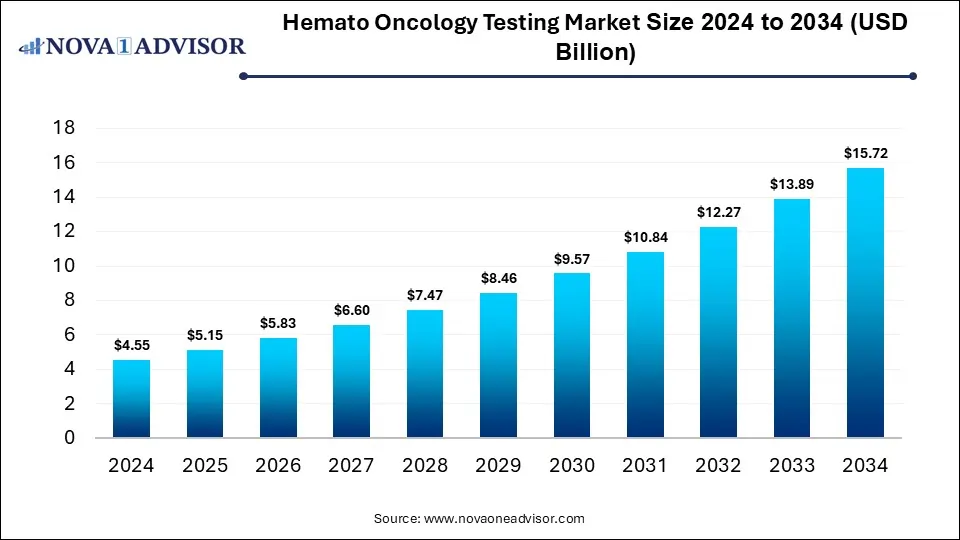

The global hemato oncology testing market size is calculated at USD 4.55 billion in 2024, grow to USD 5.15 billion in 2025, and is projected to reach around USD 15.72 billion by 2034, growing at a CAGR of 13.2% from 2025 to 2034. The market is growing due to rising cancer prevalence and increasing demand for personalized medicine. Advancements in molecular diagnostics and early detection techniques also fuel market expansion.

Hemato Oncology Testing Market Key Takeaways

- North America dominated the hemato oncology testing market revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By cancer, the lymphoma segment dominated the market with a revenue share in 2024.

- By cancer, the leukemia segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the services segment held the largest market share in 2024.

- By product, the assay kits and reagents segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the PCR segment led the market with the largest revenue share in 2024.

- By technology, the NGS segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end use, the hospitals segment held the highest market share in 2024.

- By end use, the academic & research institute segment is expected to grow at the fastest CAGR in the market during the forecast period.

Which Factors are Driving the Growth of the Hemato Oncology Testing Market?

Hemato oncology testing refers to diagnostic tests used to detect, monitor, and manage blood cancers such as leukemia, lymphoma, and myeloma by analyzing genetic, molecular, and cellular markers. The market is growing primarily due to the increasing global incidence of hematological malignancies and a rising demand for early, accurate diagnostics. Concurrently, rapid technological advancements such as next-generation sequencing, molecular diagnostics, flow cytometry, liquid biopsy for MRD detection, AI-powered analytics, and companion diagnostic assays are significantly enhancing the precision and personalization of blood cancer diagnosis and monitoring.

- For Instance, In 2024, Oxford Gene Technology (OGT) introduced the SureSeq Myeloid Fusion Panel, an RNA-based NGS tool for detecting key fusion genes in AML. Developed with experts, it identifies over 30 fusions, including rare ones, using a partner-gene agnostic approach in a single assay.

What are the emerging trends in the Hemato Oncology Testing Market for 2024?

- In January 2025, Adaptive Biotechnologies partnered with NeoGenomics in a multi-year agreement to advance personalized monitoring for blood cancer patients. The collaboration combines Adaptive’s FDA-approved clonoSEQ test for detecting minimal residual disease (MRD) with NeoGenomics’ COMPASS and CHART services, aiming to deliver more detailed clinical insights and support better treatment decisions.

- In July 2024, Thermo Fisher Scientific collaborated with the National Cancer Institute (NCI) on the myeloMATCH precision medicine trial. The study leverages next-generation sequencing (NGS) to quickly detect genetic biomarkers in patients diagnosed with acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS), aiming to support targeted treatment strategies.

What Impact does AI have on the Hemato Oncology Testing Market?

AI is significantly transforming the market by enhancing diagnostic accuracy, speeding up data analysis, and enabling early detection of blood cancers. It helps in interpreting complex genomic data, identifying patterns, and predicting disease progression, leading to more precise and personalized treatment approaches. AI-powered tools also streamline laboratory workflows and reduce human error, ultimately improving efficiency and clinical decision-making in hemato oncology diagnostics.

Report Scope of Hemato Oncology Testing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.15 Billion |

| Market Size by 2034 |

USD 15.72 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.2% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Cancer, Product, Technology, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd, Abbott, EntroGen, Inc., Qiagen N.V., Cepheid (Danaher Corporation), Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., Amoy Diagnostics Co., Ltd., ASURAGEN, INC, ArcherDX, Inc. (IDT) |

Market Dynamics

Driver

Rising Prevalence of Blood Cancer

The growing number of blood cancer cases is boosting the demand for advanced hemato oncology testing, as timely and precise diagnosis is essential for effective treatment planning. This surge in cases encourages healthcare providers to adopt innovative diagnostic methods, including molecular and genomic testing, to improve patient outcomes. As awareness and screening efforts increase, the need for reliable and sensitive testing technologies continues to rise, driving the overall market growth.

- For Instance, In May 2025, experts in New Delhi reported around 3,000 new cases of acute myeloid leukemia (AML) annually, with a rise among adults aged 30–40. Delays in diagnosis and limited access to genetic testing highlighted the need for advanced diagnostics, driving increased use of hemato-oncology testing solutions.

Restraint

Limited Diagnostic Infrastructure

Inadequate infrastructure poses a challenge to the hemato oncology testing market by restricting access to high-end diagnostic tools and specialized testing capabilities. Many healthcare centers, especially in remote or low-income areas, lack the technological setup and skilled personnel required for advanced cancer diagnostics. This results in delayed or missed diagnostics, reducing the effectiveness of treatment plans and limiting the overall market growth for precision-based testing solutions.

Opportunity

Development of Affordable and Portable Technologies

Affordable and portable diagnostic technologies are opening new possibilities in the hemato oncology testing market by simplifying complex procedures and reducing overall costs. These compact solutions enable faster and more accessible testing, particularly in rural or low-resource areas where advanced labs are unavailable. As these innovations continue to evolve, they support early detection and timely treatment, helping to bridge healthcare gaps and expand the reach of blood cancer diagnostics globally.

- For Instance, In January 2024, researchers from Harbin Institute of Technology and Peking University developed a palm-sized optofluidic hematology analyzer capable of detecting white blood cells with high accuracy. Weighing just 39g, this portable device enables point-of-care blood testing in remote and low-resource settings, offering a low-cost alternative to traditional lab equipment. This innovation highlights a key opportunity for expanding hemato oncology diagnostics through accessible and affordable technologies.

Segmental Insights

How will the Lymphoma Segment Dominate the Hemato Oncology Testing Market in 2024?

In 2024, the lymphoma segment led the market due to its rising global incidence and the growing need for early, accurate diagnosis. Increased awareness, advancements in molecular testing, and wider availability of targeted therapies further boosted demand for precise lymphoma detection, making it the most widely tested blood cancer type.

- For Instance, In 2024, the Leukemia & Lymphoma Society reported about 89,190 new lymphoma cases in the U.S., including both Hodgkin and non-Hodgkin types. Rising FDA approvals for advanced diagnostic tools are further boosting segment growth by enabling faster and more accurate detection.

The leukemia segment is expected to grow rapidly in the hemato oncology testing market due to the rising number of cases and the need for early, precise diagnosis. Advanced molecular diagnostics, minimal residual disease (MDR) testing, and personalized treatment approaches are driving demand. Frequent monitoring requirements and the complexity of leukemia subtypes also contribute to the increased adoption of advanced testing solutions, supporting the market's fast growth.

Hemato Oncology Testing Market Size By Cancer, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Leukemia |

1.83 |

2.04 |

2.31 |

2.6 |

2.92 |

3.3 |

3.72 |

4.19 |

4.71 |

5.3 |

5.97 |

| Lymphoma |

1.36 |

1.55 |

1.76 |

2 |

2.27 |

2.58 |

2.93 |

3.33 |

3.78 |

4.29 |

4.87 |

| Myeloproliferative Neoplasms |

0.68 |

0.78 |

0.88 |

1 |

1.14 |

1.29 |

1.46 |

1.66 |

1.89 |

2.15 |

2.44 |

| Other Cancers |

0.68 |

0.78 |

0.88 |

1 |

1.14 |

1.29 |

1.46 |

1.66 |

1.89 |

2.15 |

2.44 |

How will the Services Segment Dominate the Hemato Oncology Testing Market in 2024?

The services segment led the market in 2024 due to the growing reliance on specialized labs for complex diagnostic procedures. Many healthcare providers prefer outsourcing to access advanced technologies, expert analysis, and faster results without investing in expensive infrastructure. This convenience and efficiency make service-based testing a widely adopted approach for accurate and timely cancer diagnosis.

The assay kits and reagents segment is expected to grow rapidly due to increasing demand for quick, accurate, and standardized testing solutions in blood cancer diagnosis. These kits simplify complex procedures, support high-throughput screening, and are widely used in advanced techniques like PCR and NGS. Their ease of use, reliability, and adaptability to various testing platforms make them a preferred choice in both clinical and research settings, driving strong market growth.

Hemato Oncology Testing Market Size By Product, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Assay Kits and Reagents |

2.96 |

3.34 |

3.77 |

4.25 |

4.8 |

5.42 |

6.1 |

6.9 |

7.78 |

8.78 |

9.9 |

| Services |

1.59 |

1.81 |

2.06 |

2.35 |

2.67 |

3.04 |

3.47 |

3.94 |

4.49 |

5.11 |

5.82 |

How Does the PCR Segment Dominate the Hemato Oncology Testing Market?

PCR technology dominated the market in 2024 due to its high sensitivity, fast turnaround time, and ability to detect even low levels of genetic mutations. Its wide application in routine clinical diagnostics, especially for identifying specific cancer-related genes, makes it a preferred method. Additionally, PCRs' cost-effectiveness and ease of use across various laboratory settings have supported their continued adoption for blood cancer testing on a large scale.

The NGS segment is expected to grow rapidly in the hemato oncology testing market due to its ability to analyze multiple genetic markers in a single test with high accuracy. It supports detailed molecular profiling essential for personalized treatment plans and monitoring disease progression. As precision medicine advances, NGS is becoming the preferred choice for comprehensive and efficient blood cancer diagnostics, driving its widespread adoption in both clinical and research settings.

- For Instance, In December 2023, the Huntsman Cancer Institute at the University of Utah highlighted that next-generation sequencing (NGS) holds strong potential in predicting minimal residual disease (MRD) relapse risk among children and young adults. This approach enhances early detection and supports timely treatment decisions.

Hemato Oncology Testing Market Size By Technology, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| PCR |

1.27 |

1.43 |

1.61 |

1.81 |

2.03 |

2.28 |

2.57 |

2.88 |

3.24 |

3.64 |

4.09 |

| IHC |

1 |

1.13 |

1.27 |

1.43 |

1.61 |

1.82 |

2.05 |

2.31 |

2.6 |

2.93 |

3.3 |

| NGS |

1.18 |

1.35 |

1.55 |

1.78 |

2.03 |

2.33 |

2.65 |

3.05 |

3.48 |

3.99 |

4.56 |

| Cytogenetics |

0.64 |

0.72 |

0.82 |

0.92 |

1.05 |

1.18 |

1.34 |

1.52 |

1.72 |

1.94 |

2.2 |

| Others |

0.46 |

0.52 |

0.58 |

0.66 |

0.75 |

0.85 |

0.96 |

1.08 |

1.23 |

1.39 |

1.57 |

Why does the Hospitals Segment hold the Largest Market Share in 2024?

Hospitals dominated the hemato oncology testing market in 2024 due to their ability to offer comprehensive care, combining diagnostics and treatment under one roof. They are equipped with advanced technologies and skilled professionals, allowing for quicker test processing and accurate results. The growing number of cancer patients seeking specialized care in hospitals further boosted testing hemato oncology diagnostics.

- For Instance, In March 2025, Mayo Clinic Laboratories partnered with KYAN Technologies to introduce KYAN’s Optim.AI, a drug sensitivity test powered by AI, to the U.S. market. This ex vivo testing platform uses artificial intelligence to assess how individual cancer cells respond to different treatments, aiming to support more personalized and effective therapy decisions.

Academic and research institutes are expected to witness the fastest growth in the hemato oncology testing market due to their active role in advancing diagnostic technologies and exploring novel biomarkers. These institutions are often at the forefront of innovation, driving clinical research and contributing to the development of more precise and personalized testing methods. Increased funding and collaborative projects further accelerate their efforts, making them key players in shaping the future of blood cancer diagnostics.

Hemato Oncology Testing Market Size By End Use, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospitals |

2.72 |

3.07 |

3.48 |

3.92 |

4.42 |

4.99 |

5.62 |

6.36 |

7.16 |

8.08 |

9.12 |

| Academic and Research Institutes |

1.37 |

1.56 |

1.77 |

2.02 |

2.3 |

2.62 |

2.99 |

3.4 |

3.88 |

4.42 |

5.03 |

| Others |

0.46 |

0.52 |

0.58 |

0.66 |

0.75 |

0.85 |

0.96 |

1.08 |

1.23 |

1.39 |

1.57 |

Regional Insights

How is the North America approaching the Hemato Oncology Testing Market in 2024?

In 2024, North America advanced the market through widespread adoption of cutting-edge technologies like NGS and liquid biopsy. Strong research initiatives, strategic industry collaborations, and supportive regulatory frameworks have accelerated innovation in diagnostics. The region’s focus on personalized medicine and early cancer detection continues to drive the integration of advanced testing solutions across hospitals and research institutions, reinforcing its leadership in the field.

- For Instance, According to the Canadian Cancer Statistics report, nearly 2 in 5 Canadians are expected to face a cancer diagnosis in their lifetime, while 1 in 4 may die from the disease. In 2021 alone, an estimated 229,200 individuals in Canada were diagnosed with cancer, and around 84,600 lost their lives to it, highlighting the significant impact of cancer on the country's population.

How is Asia-Pacific Accelerating the Hemato Oncology Testing Market?

In 2024, Asia-Pacific accelerated the market through growing healthcare investments, rising awareness of early cancer detection, and increasing adoption of advanced diagnostics like NGS and liquid biopsy. Countries like China, India, and Japan are expanding access to personalized medicine and strengthening research collaborations. Government initiatives and improved diagnostic infrastructure are also supporting faster integration of innovative testing solutions, making the region a key driver of market growth.

- For Instance, In January 2025, the Advanced Centre for Treatment, Research, and Education in Cancer (ACTREC), part of the Tata Memorial Centre, launched a major expansion aimed at advancing cancer research and patient care. The initiative focuses on accelerating clinical innovations, enhancing treatment quality, and setting up state-of-the-art therapeutic facilities. This move strengthens India’s position in cutting-edge cancer care and reinforces its commitment to medical progress and innovation.

Hemato Oncology Testing Market Size By By Regional, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

1.72 |

1.95 |

2.19 |

2.47 |

2.78 |

3.13 |

3.52 |

3.97 |

4.47 |

5.04 |

5.66 |

| Asia Pacific |

1.14 |

1.3 |

1.48 |

1.69 |

1.93 |

2.2 |

2.51 |

2.86 |

3.26 |

3.72 |

4.24 |

| Europe |

1.05 |

1.18 |

1.34 |

1.52 |

1.72 |

1.95 |

2.2 |

2.49 |

2.82 |

3.19 |

3.62 |

| Latin America |

0.32 |

0.36 |

0.41 |

0.46 |

0.52 |

0.59 |

0.67 |

0.76 |

0.86 |

0.97 |

1.1 |

| Middle East and Africa |

0.32 |

0.36 |

0.41 |

0.46 |

0.52 |

0.59 |

0.67 |

0.76 |

0.86 |

0.97 |

1.1 |

Top Companies in the Hemato Oncology Testing Market

- F. Hoffmann-La Roche Ltd

- Abbott

- EntroGen, Inc.

- Qiagen N.V.

- Cepheid (Danaher Corporation)

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Illumina, Inc.

- Amoy Diagnostics Co., Ltd.

- ASURAGEN, INC

- ArcherDX, Inc. (IDT)

Recent Developments in the Hemato Oncology Testing Market

- In April 2025, scientists at ACTREC, Tata Memorial Centre in Mumbai, introduced RAPID-CRISPR, a breakthrough diagnostic test capable of identifying acute promyelocytic leukemia (APL) in under three hours. This innovative method significantly shortens detection time, allowing for quicker diagnosis and timely treatment initiation.

- In March 2025, NeoGenomics, Inc., a key player in oncology diagnostics, acquired Pathline, LLC—a certified lab based in New Jersey. This move enhances NeoGenomics’ reach in the Northeastern U.S., a region with growing demand but previously limited access to its services. The acquisition strengthens the company’s capabilities in molecular and hemato-oncology testing while supporting faster growth by establishing a direct presence in a strategically important and expanding market.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the hemato oncology testing market.

By Cancer

-

- Acute Myeloid Leukemia (AML)

- Acute Lymphocytic Leukemia (ALL)

- Chronic Lymphocytic Leukemia

- Chronic Myeloid Leukemia

-

- Non-Hodgkin Lymphoma

- Hodgkin Lymphoma

- Myeloproliferative Neoplasms

-

- Polycythemia vera (PV)

- Essential thrombocythemia (ET)

- Myelofibrosis (MF)

By Product

- Assay Kits and Reagents

- Services

By Technology

-

- Real-time qPCR

- Digital PCR

- IHC

- NGS

- Cytogenetics

- Others

By End Use

- Hospitals

- Academic and Research Institutes

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)