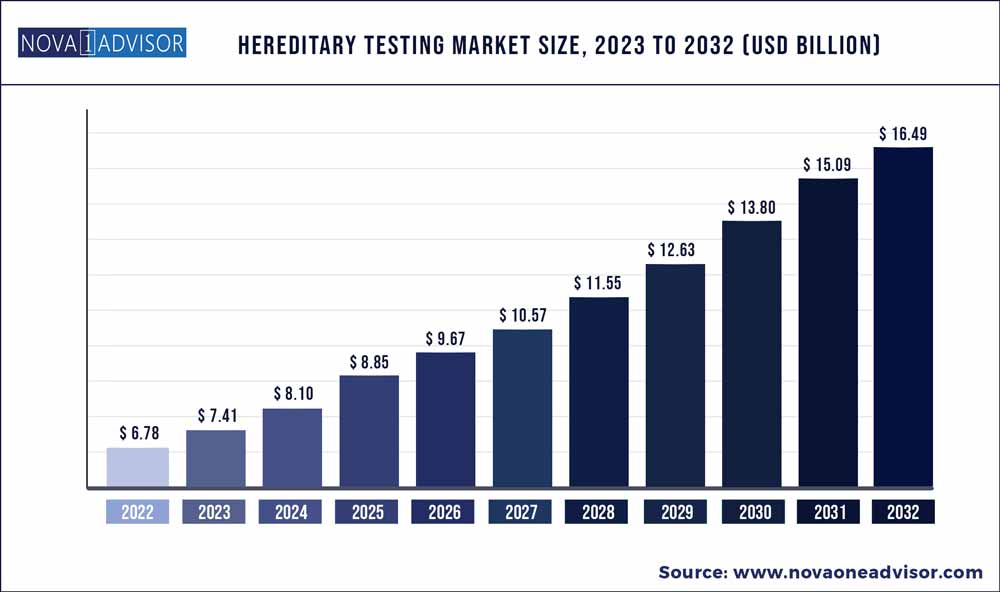

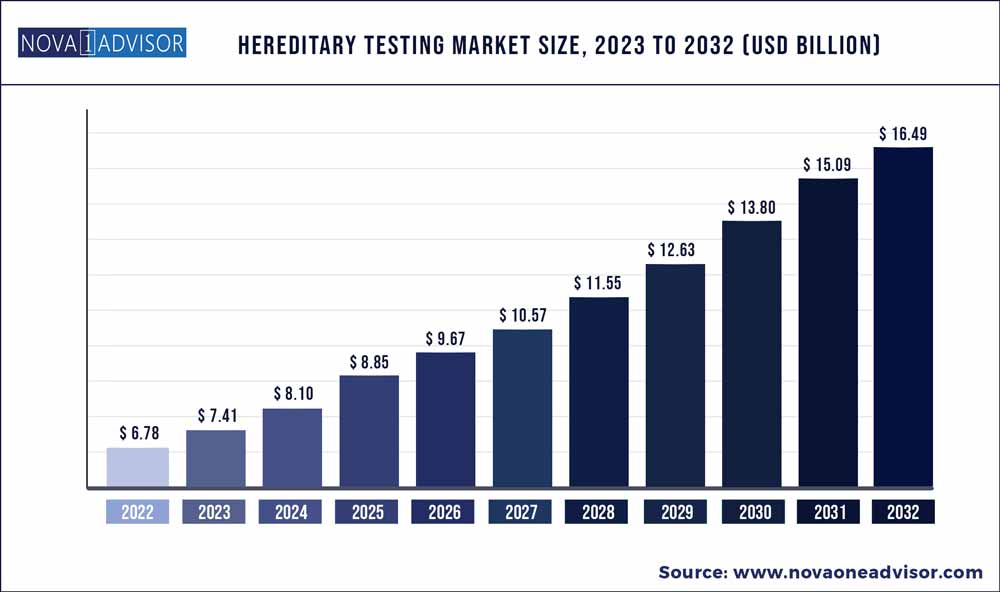

The global hereditary testing market size was exhibited at USD 6.78 billion in 2022 and is projected to hit around USD 16.49 billion by 2032, growing at a CAGR of 9.3% during the forecast period 2023 to 2032.

Key Pointers:

- The hereditary cancer testing disease type segment is expected to expand at a considerable rate over the forecast period. A substantial number of CLIA-certified laboratories perform tests to determine whether an individual carries an inherited mutated gene that can cause cancer

- The breast cancer testing segment dominated the hereditary cancer testing market in 2022 owing to its high penetration and increased inheritability. Most of the cases of cervical cancer are non-hereditary, resulting in the lowest revenue share of this segment

- In the hereditary non-cancer testing disease type segment, the cardiac diseases segment is driven by the emergence of high-throughput sequencing, which has resulted in the commercial availability of a significant number of sequencing assays for cardiomyopathies

- The Non-invasive Prenatal Testing (NIPT) and cancer screening tests segment and the newborn genetic screening segment continue to witness lucrative growth due to the increased adoption across the globe

- Moreover, the newborn screening program has been made mandatory in several regions and countries, resulting in the growth of newborn genetic screening in the hereditary non-cancer testing disease type segment

- Europe and North America collectively accounted for over 66.9% share of the overall revenue in 2022 owing to the assisted reproductive technology space, coupled with the high penetration of newborn genetic screening

- Key companies are engaged in securing regulatory approval in emerging countries to expand their business footprint. A substantial number of diagnostic companies have collaborated with technology developers to obtain technology licenses and deliver high-value services to their customers

Hereditary Testing Market Report Scope

The Key factors driving the market are the declining cost of sequencing and the availability of genetic tests at a lower price. Furthermore, the availability of niche and fragmented point solutions across the genomics value chain, namely sequencing, analytics, interpretation, aggregation, and marketplace, is anticipated to propel the market growth over the forecast period.

The advent of direct-to-consumer genetics is anticipated to play a major role in the genetic testing market by enabling individuals to carry out self-testing. This expands the role of genetic counselors, which further aids in understanding the importance of genetic tests and helps in the selection of appropriate tests. A growing number of registered genetic counselors is anticipated to boost the adoption of hereditary genetic tests in the coming years.

Another important market trend is the growing field of reproductive genetic health. For instance, Natera has seen a consistent increase in test numbers in hereditary illnesses genetic analysis for women's health. This indicates a rise in public acceptance of hereditary testing, which is fueling the market expansion. A rise in the trade of newborn screening equipment has corresponded with a rise in the trade of DNA experiment equipment. Progressing the sharpness of newborn screening all over the world is also assisting in earnings increase. A multigene board trial was formed for introducing genetic melanoma into the clinical application, which has been prompted by changes in genetic experimentation standards. The growing generative hereditary health scope is one of the most important key factors driving the market.

The COVID-19 pandemic had a detrimental impact on the market. For example, after the World Health Organization declared COVID-19 a pandemic, governments all around the world used lockdowns to compel social distancing as a prophylactic measure. In every industry, this resulted in upheaval, constraints, challenges, and adjustments. Similarly, the outbreak has a negative impact on the inherited genetic analysis sector.

Technology developers are introducing advanced products to enhance the efficiency of genetic tests by diagnostic companies. For example, in December 2020, the QuantiFERON SARS-CoV-2 RUO solution was introduced by QIAGEN, a business that provides technologies and products for pre-analytical samples and related molecular test solutions. The solution detects immune system T-cell responses to the infection that causes COVID-19. The solution would give precise information on illness development and immunity levels.

Some of the prominent players in the Hereditary Testing Market include:

- Myriad Genetics, Inc.

- Invitae Corporation

- Illumina, Inc.

- Natera, Inc.

- Laboratory Corporation of America Holdings

- F. Hoffmann-La Roche Ltd.

- Quest Diagnostics Incorporated

- CooperSurgical, Inc.

- Agilent Technologies, Inc.

- Thermo Fisher Scientific, Inc.

- Twist Bioscience

- Sophia Genetics

- Fulgent Genetics, Inc.

- MedGenome

- CENTOGENE N.V.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Hereditary Testing market.

By Disease Type

- Hereditary Cancer Testing

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Cervical Cancer

- Ovarian Cancer

- Prostate Cancer

- Stomach/Gastric Cancer

- Melanoma

- Sarcoma

- Uterine Cancer

- Pancreatic Cancer

- Others

- Hereditary Non-cancer Testing

- Genetic Tests

- Cardiac Diseases

- Rare Diseases

- Other Diseases

- Newborn Genetic Screening

- Preimplantation Genetic Diagnosis & Screening

- Non-invasive Prenatal Testing (NIPT) & Carrier Screening Tests

By Technology

- Cytogenetic

- Biochemical

- Molecular Testing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)