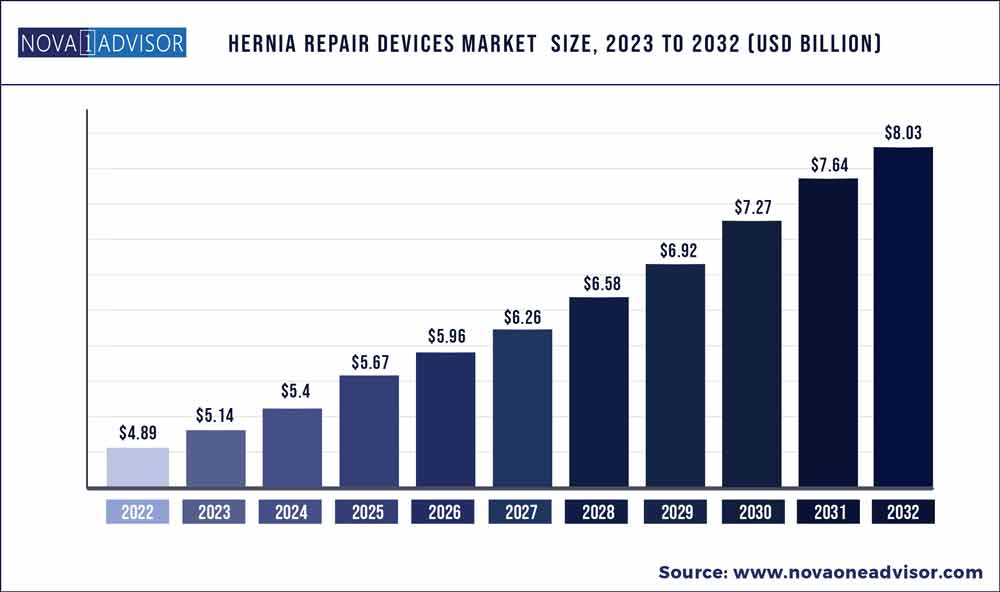

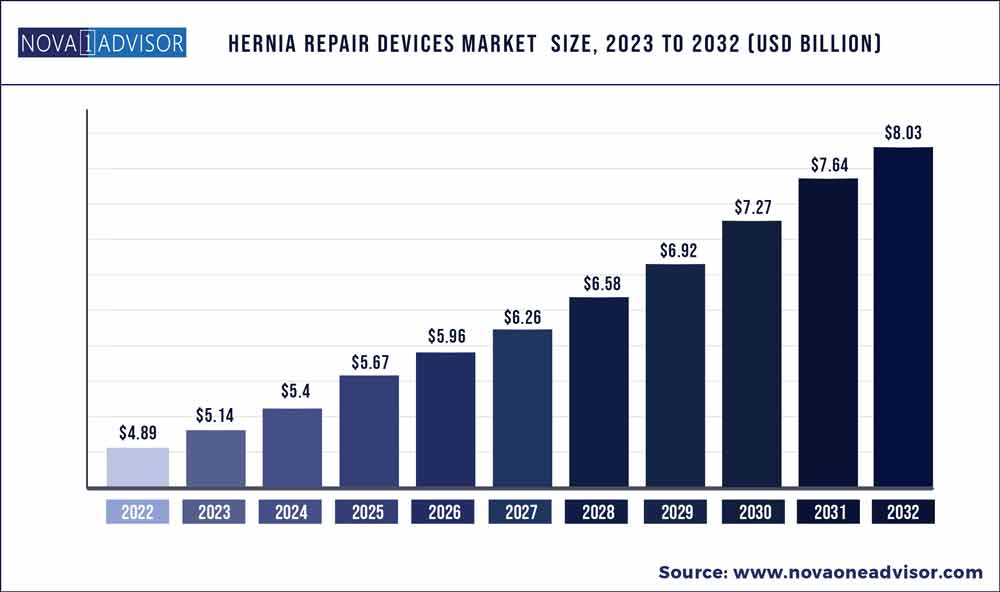

The global hernia repair devices market size was exhibited at USD 4.89 billion in 2022 and is projected to hit around USD 8.03 billion by 2032, growing at a CAGR of 5.08% during the forecast period 2023 to 2032.

Key Pointers:

- By geography, North America dominated the market and generated more than 51.19% of the revenue share in 2022.

- By product type, the hernia mesh segment led the market and captured more than 77.11% of the revenue share in 2022.

- By procedure type, the inguinal hernia segment has generated more than 67.7% of the revenue share in 2022.

- By surgery type, the open surgery segment captured more than 77.9% of revenue share in 2022 and is expected to maintain its dominance between 2023 and 2032.

Hernia Repair Devices Market Report Scope

Key factors contributing to market growth include the increasing incidence of hernia, favorable reimbursement policies, and technological advancements related to repair devices. The high incidence of hernia is creating a growing demand for efficient repair devices, which is expected to supplement the market growth. According to the U.S. FDA, more than a million hernia repair procedures are done annually in the U.S. alone. The high incidence of hernia is creating demand for an efficient solution, which is expected to be responsible for the market growth.

It was estimated that around 28 million elective operations and surgeries were canceled during the peak 12 weeks of interruption caused by the COVID-19 pandemic. In February 2019, the proportion of emergency repairs and operations was approximately 2.5% for inguinal hernias and 5.9% for incisional and umbilical hernias. In mid-March 2020, an announcement was made by the German government to stop elective surgical interventions. In addition, the number of hernia repairs registered by Herniamed during March 2020 was reduced substantially. The lowest cases of hernia repair were registered in April 2020, during which, hernia repair surgeries were equivalent to about 25% of those conducted from February to June 2019.

With the gradual decrease in COVID-19 cases after May 2020, restrictions executed on overall elective surgery across German hospitals were lifted, resulting in an increase in the number of elective hernia repairs. Despite the normalization of hospitalization policies in Germany, the caseload of hernia repairs in June 2020 was considerably lower than that in June 2019.

Hernia repair is one of the most common surgical procedures performed across the world. The incidence of hernia is higher in men than in women. Around 28% of males and 3% of females develop inguinal hernia. This disorder is associated with risk factors such as obesity, smoking, unhealthy lifestyle, and age. About 79% of all hernias occur in the groin among adults, leading to an increase in the adoption of hernia repair devices among the demographic. The high incidence of hernia is creating demand for efficient hernia repair, which is expected to boost the market growth over the forecast period.

Technological advancements in hernia repair devices have rapidly increased in recent years. Advancements such as articulating fixation devices and self-fixating (gripping) meshes are developed to overcome the problems occurring during laparoscopic processes. In addition, such devices offer surgeons with better access to weak spots within the abdominal wall and enable them to securely place the mesh at the desired body site, which is likely to boost the market growth.

Some of the prominent players in the Hernia Repair Devices Market include:

- B Braun Melsungen AG

- Cook Medical

- Medtronic Plc

- W.L. Gore & Associates

- Ethicon Inc.

- C.R Bard Inc.

- Atrium

- LifeCell Corporation

- Baxter International

- Hernia mesh S.R.L.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Hernia Repair Devices market.

By Product Type

- Hernia Mesh

- Biologic Mesh

- Synthetic Mesh

- Hernia Fixation Devices

- Sutures

- Tack Applicators

- Glue Applicators

By Surgery Type

- Inguinal Hernia

- Umbilical Hernia

- Incisional Hernia

- Femoral Hernia

- Others

By Procedure Type

- Open Surgery

- Laparoscopic Surgery

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)