The global high potency active pharmaceutical ingredients market size was exhibited at USD 27.19 billion in 2023 and is projected to hit around USD 62.39 billion by 2033, growing at a CAGR of 8.66% during the forecast period 2024 to 2033.

.webp)

Key Takeaways:

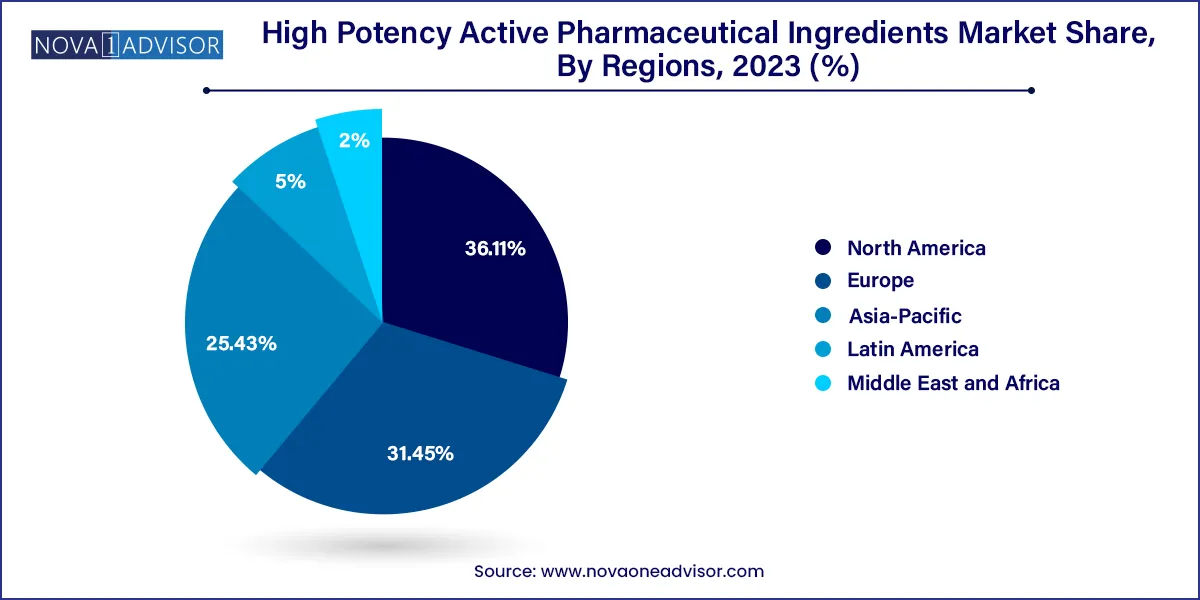

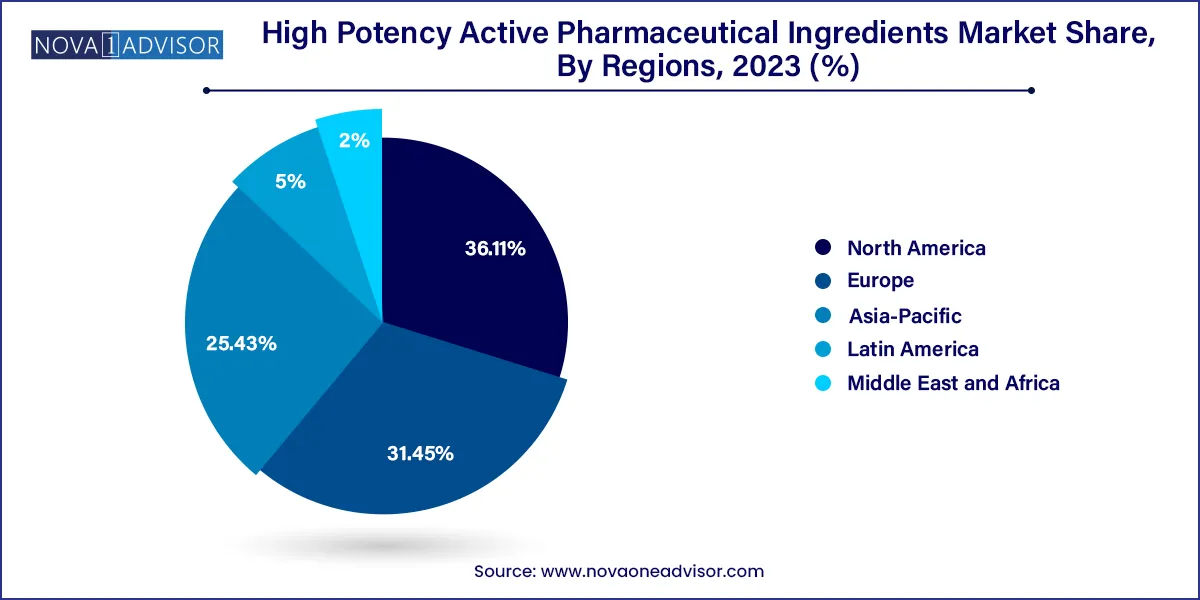

- The North America market accounted for more than 36.12% of the total revenue share in 2023.

- By manufacturer type, the in-house segment accounted for 71% of the revenue share in 2023.

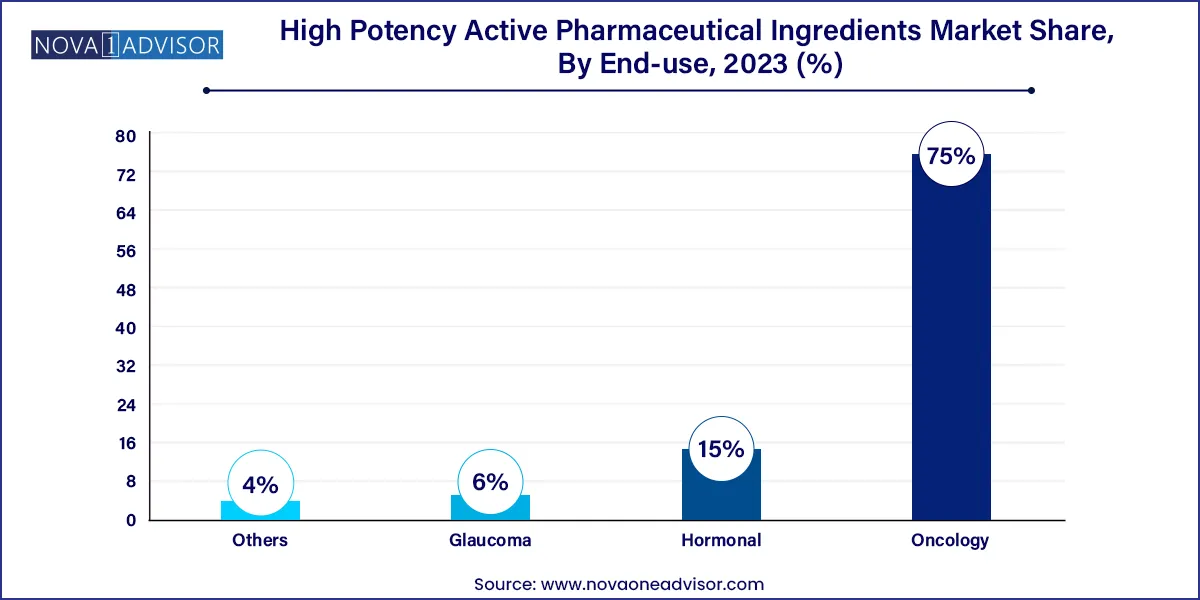

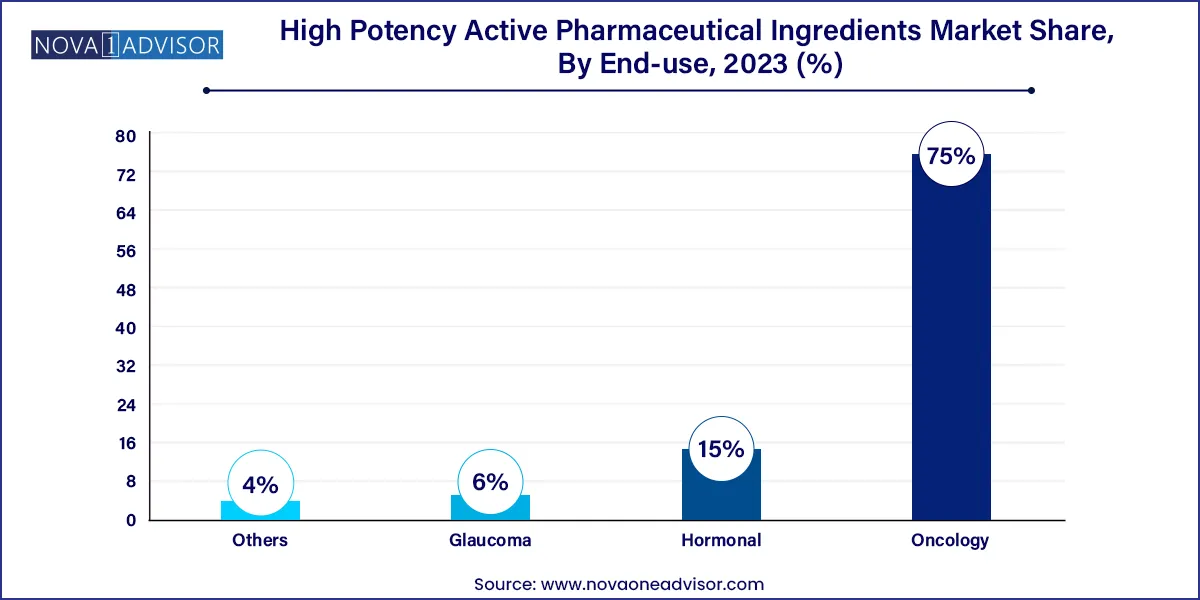

- By application, the oncology segment has captured a market share of around 75% in 2023.

- By drug type, innovative drugs have accounted revenue share of over 71.6% in 2023.

- By product, the synthetic segment accounted revenue share of around 70.5% in 2023.

Market Overview

The High Potency Active Pharmaceutical Ingredients (HPAPI) market has emerged as a dynamic and critical segment within the broader pharmaceutical industry, driven by the increasing demand for targeted therapies, especially in oncology and hormonal disorders. HPAPIs are a class of highly effective drugs that require very small doses to produce the desired therapeutic effect. Because of their potency, HPAPIs are handled under stringent safety standards and specialized containment technologies.

The rising incidence of cancer worldwide, growing preference for precision medicine, and a surge in the development of highly specific drugs have bolstered the demand for HPAPIs. These ingredients are now frequently used in antibody-drug conjugates (ADCs), cytotoxic drugs, and hormone therapies. As of 2025, pharmaceutical manufacturers are focusing on expanding their high containment production capabilities, either through in-house upgrades or outsourcing partnerships with contract development and manufacturing organizations (CDMOs).

Moreover, HPAPI production is characterized by complexity in synthesis, strict regulatory compliance, and significant capital investment in specialized facilities. Despite these challenges, the profitability and strategic importance of HPAPIs in modern pharmacotherapy have made them a central focus in the development pipelines of leading pharmaceutical firms. With increasing R&D activity and the advent of novel therapeutic modalities, the HPAPI market is positioned for sustained growth over the next decade.

Major Trends in the Market

-

Surge in Oncology-Focused Drug Development: A significant proportion of HPAPIs are utilized in cancer treatments, which continues to be a top therapeutic area for R&D.

-

Rising Adoption of Targeted Therapies and ADCs: Antibody-drug conjugates (ADCs), which require potent payloads, are gaining popularity for their ability to deliver HPAPIs directly to tumor cells.

-

Outsourcing to Specialized CDMOs: Given the complexity and cost of in-house HPAPI production, pharmaceutical firms are increasingly relying on third-party manufacturers.

-

Expansion of Containment Technologies: High investments in isolators, glove boxes, and negative pressure systems to ensure operator and environmental safety.

-

Growth in Generic HPAPI Production: As patents expire, generic drug manufacturers are entering the HPAPI space, particularly for oncology generics.

-

Integration of Biotech HPAPIs: Biotechnology-derived HPAPIs, especially peptides and oligonucleotides, are gaining traction due to their therapeutic potential.

-

Stringent Regulatory Oversight: Regulatory bodies such as the FDA and EMA are placing increasing emphasis on facility compliance and product quality in HPAPI production.

-

Emergence of Asia-Pacific as a Manufacturing Hub: India and China are investing in HPAPI capabilities to serve global pharmaceutical clients cost-effectively.

High Potency Active Pharmaceutical Ingredients Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 27.96 Billion |

| Market Size by 2033 |

USD 50.55 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Manufacturer Type, Drug Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

BASF SE; CordenPharma; Dr. Reddy’s Laboratories Ltd.; CARBOGEN AMCIS AG; Pfizer, Inc.; Sun Pharmaceutical Industries, Ltd.; Teva Pharmaceutical Industries Ltd.; Albany Molecular Research, Inc.; Sanofi; Merck & Co., Inc.; Novartis AG; F. Hoffmann-La Roche Ltd; Bristol-Myers Squibb Company; Boehringer Ingelheim International GmbH; Lonza; Cipla Inc. |

Key Market Driver

Escalating Demand for Oncology Drugs

The most significant driver propelling the HPAPI market is the escalating demand for oncology drugs. Cancer remains a global health challenge, with over 19 million new cases diagnosed in 2024 alone, according to WHO estimates. Traditional chemotherapy agents are being replaced or supplemented with newer, highly targeted therapies, many of which require HPAPIs as core components.

Pharmaceutical giants like Roche, Pfizer, and Novartis are investing heavily in the development of antibody-drug conjugates and small-molecule inhibitors that leverage HPAPI formulations. For example, ADCs such as Kadcyla (ado-trastuzumab emtansine) use highly potent cytotoxins linked to antibodies to specifically target cancer cells. The increasing pipeline of such therapeutics is accelerating the demand for HPAPI manufacturing capabilities and infrastructure.

Furthermore, the growing awareness among healthcare providers about early diagnosis and personalized medicine is pushing for more sophisticated drug formulations. HPAPIs fit perfectly into this paradigm, delivering high efficacy with minimal side effects when correctly targeted. This confluence of medical innovation and patient-centric care continues to drive the growth of the HPAPI market, particularly within the oncology space.

Key Market Restraint

High Capital and Operational Costs

One of the primary restraints for the HPAPI market is the significant capital and operational investment required for their safe production. Due to their toxic nature, HPAPIs must be manufactured in specialized containment facilities that include segregated air handling systems, high-efficiency particulate air (HEPA) filtration, and restricted access areas. The cost of setting up such a facility can range from $50 million to over $100 million, depending on scale and complexity.

Moreover, maintaining compliance with evolving regulatory standards from agencies like the FDA, EMA, and local health bodies adds another layer of complexity. Regular inspections, validation protocols, documentation, and training contribute to ongoing operational costs. As a result, smaller firms or startups often find it challenging to enter this market without significant external funding or partnership opportunities.

These high barriers to entry have limited the number of players capable of manufacturing HPAPIs, which in turn affects supply chain flexibility and can lead to delays in drug development. Additionally, these costs are often transferred to end-users, potentially impacting drug affordability and market penetration in cost-sensitive regions.

Market Opportunity

Growth in Outsourced Manufacturing and CDMO Partnerships

A major opportunity lies in the expansion of outsourcing partnerships with contract development and manufacturing organizations (CDMOs). As the demand for HPAPIs surges, pharmaceutical companies—especially mid-sized and virtual biotech firms—are increasingly turning to specialized CDMOs to mitigate the high costs and technical challenges associated with in-house production.

Leading CDMOs such as Lonza, Cambrex, and Piramal Pharma Solutions have made significant investments in high-containment manufacturing facilities. They offer end-to-end services ranging from process development to commercial-scale production, complete with regulatory support. These services are particularly appealing to firms with limited capital or those focusing on rapid time-to-market for new drugs.

The outsourcing model also allows companies to remain flexible and responsive to changing market dynamics without long-term infrastructural commitments. For example, a U.S.-based startup developing an HPAPI-based oncology drug may leverage a European CDMO’s existing facilities to speed up production and regulatory approvals. As CDMOs continue to expand their capabilities globally, particularly in Asia-Pacific and Europe, the market for outsourced HPAPI manufacturing is expected to grow exponentially.

Segments Insights:

By Product Insights

Synthetic HPAPIs currently dominate the market, largely due to their widespread use in oncology, hormonal therapy, and central nervous system (CNS) drugs. These molecules are chemically synthesized using complex multi-step processes in dedicated high-containment facilities. Their established efficacy and availability, particularly in chemotherapy agents and hormonal therapies, make them a mainstay in pharmaceutical manufacturing. For instance, drugs like doxorubicin, cyclophosphamide, and paclitaxel continue to rely heavily on synthetic HPAPIs.

Biotech HPAPIs are the fastest-growing segment, driven by advancements in biotechnology and the rise of biologics and biosimilars. These include peptides, proteins, and oligonucleotides that are either produced through recombinant techniques or synthesized via hybrid methods. Their high target specificity and lower toxicity profiles make them ideal candidates for chronic conditions and precision therapies. The increasing number of biologics entering clinical pipelines, particularly in oncology and autoimmune diseases, is accelerating the adoption of biotech HPAPIs.

By Manufacturer Type Insights

In-house manufacturing dominates the current landscape, as large pharmaceutical firms prefer to retain control over production processes, intellectual property, and regulatory compliance. Companies like Novartis, Merck, and Roche have invested in building high-containment facilities within their existing plants, ensuring quality control and process integrity. These in-house setups also enable faster scale-up from clinical development to commercial launch, making them attractive for blockbuster drug programs.

Outsourced manufacturing is growing at a rapid pace, fueled by the rise of CDMOs offering specialized HPAPI capabilities. Smaller firms and biotechs often lack the capital or technical know-how to develop HPAPI infrastructure and thus partner with external manufacturers. Outsourcing also provides scalability, flexibility, and access to global markets without direct investments. As CDMOs expand their global footprint and regulatory expertise, outsourced HPAPI production is expected to rival, if not surpass, in-house manufacturing over the next decade.

By Drug Type Insights

Innovative drugs continue to lead the HPAPI market, primarily due to their role in targeted and personalized therapies. These drugs often use novel mechanisms of action, many of which require HPAPIs for their cytotoxic or hormonal effects. Breakthrough drugs in oncology and rare diseases dominate this segment, supported by strong R&D investments, patent protections, and premium pricing models.

Generic drugs, however, are the fastest-growing segment, as the expiration of patents for several high-profile HPAPI-based drugs opens the door for generics. The rising focus on affordable cancer treatment, especially in emerging economies, is driving demand for HPAPI generics. Regulatory pathways like the FDA’s abbreviated new drug application (ANDA) process have made it easier for companies to enter the market with biosimilars and generic equivalents, creating substantial growth opportunities.

By Application Insights

Oncology remains the dominant application segment, accounting for the majority of HPAPI usage. The effectiveness of HPAPIs in killing rapidly dividing cancer cells has made them a staple in chemotherapy regimens, targeted therapies, and ADCs. With over 1,200 oncology drugs currently in various stages of development globally, HPAPI demand in this segment is expected to remain robust.

Hormonal therapies are growing steadily, particularly for conditions such as breast cancer, prostate cancer, and thyroid disorders. HPAPIs used in these treatments are often steroidal hormones or hormone antagonists that require precise dosing and high purity. Increasing incidence of hormone-sensitive cancers and growing awareness about hormonal imbalances are fueling this segment's expansion.

By Regional Insights

North America, particularly the United States, dominates the global HPAPI market, driven by a strong pharmaceutical industry, advanced healthcare infrastructure, and favorable regulatory environment. The presence of leading pharmaceutical companies and CDMOs with state-of-the-art high-containment facilities ensures the region’s leadership. Furthermore, the U.S. FDA has well-established guidelines for HPAPI handling, manufacturing, and compliance, which streamline the drug approval process for HPAPI-based products.

The demand for oncology drugs, rising prevalence of chronic diseases, and extensive R&D activity in biologics and ADCs have all contributed to North America’s stronghold. The region is also home to several CDMOs, such as Cambrex and Catalent, which have recently expanded their HPAPI capabilities to meet growing client needs.

Asia-Pacific is emerging as the fastest-growing region in the HPAPI market, thanks to cost-effective manufacturing, growing pharmaceutical exports, and increased government support. Countries such as India and China have significantly invested in building HPAPI production infrastructure that meets international regulatory standards. These nations are now exporting HPAPIs and finished formulations to North America and Europe, gaining global recognition.

Additionally, the rising burden of cancer and hormonal disorders in Asia-Pacific is creating domestic demand for HPAPI-based therapies. Strategic collaborations between global pharmaceutical companies and regional CDMOs are becoming increasingly common. With supportive regulatory reforms, expanding clinical trial activity, and skilled labor, Asia-Pacific is poised to play a crucial role in the future growth of the HPAPI market.

Some of the prominent players in the High potency active pharmaceutical ingredients market include:

- BASF SE

- CordenPharma

- Bristol-Myers Squibb Company

- CARBOGEN AMCIS AG

- Pfizer, Inc.

- Boehringer Ingelheim International GmbH

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries, Ltd.

- Albany Molecular Research, Inc.

- Sanofi

- Lonza

- Cipla Inc.

- Merck & Co., Inc.

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- F. Hoffmann-La Roche Ltd.

Recent Developments

-

March 2025 – Cambrex announced a $75 million expansion of its HPAPI manufacturing facility in Iowa, USA, aimed at meeting increased demand for oncology APIs.

-

February 2025 – Lonza Group entered a strategic partnership with a mid-sized U.S. biotech company to produce HPAPIs for a novel ADC in Phase III clinical trials.

-

January 2025 – Piramal Pharma Solutions launched a new high-containment HPAPI production line in its Maharashtra, India facility, targeting U.S. and European markets.

-

December 2024 – Novasep unveiled plans to invest €30 million in expanding its HPAPI capabilities in France, emphasizing the growing European demand for cytotoxic drugs.

-

October 2024 – AstraZeneca reported successful Phase II trials for a new oncology drug that utilizes a synthetic HPAPI, scheduled for FDA fast-track review.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global high potency active pharmaceutical ingredients market.

Product

Manufacturer Type

Drug Type

Application

- Oncology

- Hormonal

- Glaucoma

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.webp)