Hormonal Replacement Therapy Market Size, Share, Growth, Report 2025 to 2034

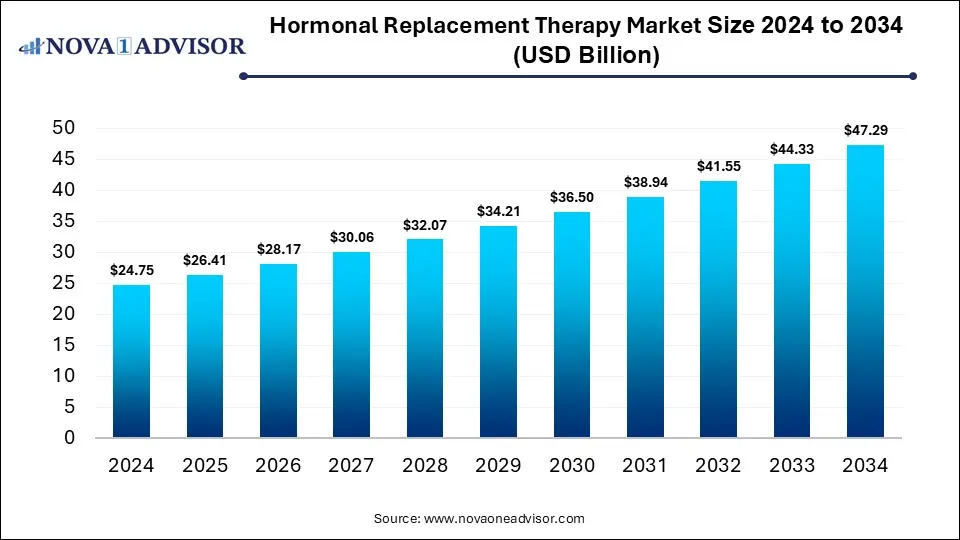

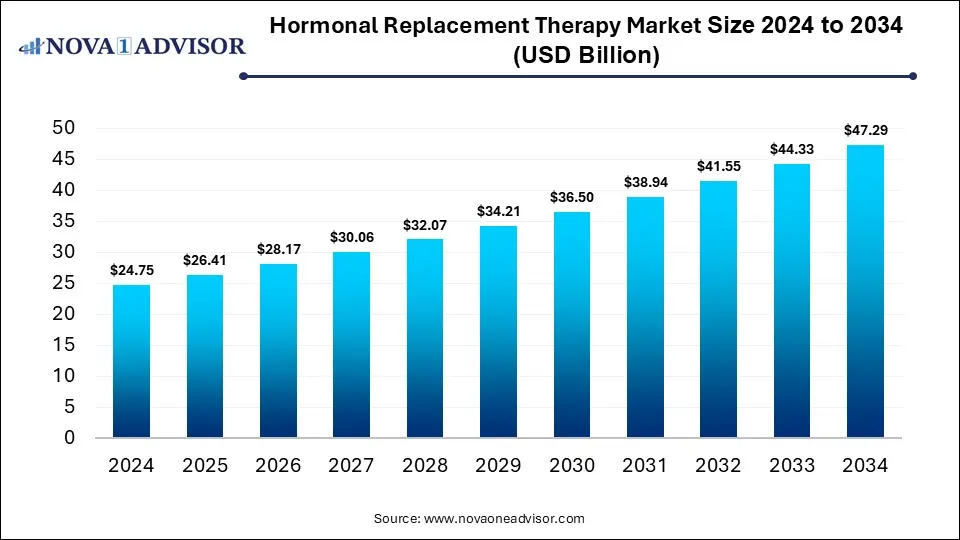

The global hormone replacement therapy market size was estimated at USD 24.75 billion in 2024 and is expected to reach USD 47.29 billion by 2034, expanding at a CAGR of 6.69% during the forecast period of 2025 to 2034. The growth of the market is driven by rising awareness of menopause management, increasing elderly population, and advancements in drug delivery technologies.

Key Takeaways

- By region, North America dominated the hormonal replacement therapy market with the largest share in 2024.

- By region, Asia Pacific is expected to expand at the fastest rate between 2025 and 2034.

- By product, the estrogen & progesterone replacement therapy segment led the market in 2024.

- By product, the parathyroid hormone replacement therapy segment is expected to expand at the fastest CAGR over the projection period.

- By route of administration, the oral segment dominated the market in 2024.

- By route of administration, the parenteral segment is expected to grow at the fastest rate in the upcoming period.

- By disease type, the menopause segment contributed the largest market share in 2024.

- By disease type, the hypoparathyroidism segment is expected to expand at the highest CAGR during the forecast period.

How AI is Impacting the Hormone Replacement Therapy Market?

AI is significantly revolutionizing the hormone replacement therapy market by enabling more personalized and precise treatment approaches. Through data analytics and machine learning, AI can analyze patient hormone levels, medical history, and genetic markers to help clinicians tailor hormone dosages and select the most suitable therapy. It also aids in early diagnosis of hormone deficiencies and menopause-related conditions by identifying subtle patterns in lab results or symptoms that may be missed by traditional methods. Additionally, AI is being integrated into drug discovery, helping pharmaceutical companies accelerate the development of safer and more effective hormone therapies. As digital health tools become more common, AI-driven apps and platforms are also enhancing patient monitoring and improving long-term treatment adherence.

Market Overview

The hormone replacement therapy (HRT) market refers to the industry focused on developing and delivering treatments that supplement or replace deficient hormones, commonly used to manage symptoms of menopause, andropause, hypothyroidism, and other hormonal disorders. HRT offers several benefits, including relief from hot flashes, mood swings, osteoporosis, and other hormone-related symptoms, significantly improving quality of life, especially for aging populations. The market is experiencing significant growth due to the growing awareness of hormonal health, rising life expectancy, and increased prevalence of conditions like menopause, hypogonadism, and PCOS.

- According to the World Health Organization (WHO), polycystic ovary syndrome (PCOS) affects 6–13% of reproductive-aged women, with up to 70% remaining undiagnosed globally. It is the leading cause of anovulation and infertility, and is linked to long-term physical and emotional health issues.

What are the Major Trends in the Hormone Replacement Therapy Market?

- Rising Demand for Bioidentical Hormones: Bioidentical hormone therapy, which uses hormones chemically identical to those naturally produced by the body, is gaining popularity due to perceived safety and fewer side effects. Consumers are increasingly opting for these "natural" alternatives, especially in North America and Europe.

- Integration of Digital Health and AI: AI and digital platforms are being used to personalize HRT by analyzing hormone levels, symptoms, and patient history for more accurate dosing and improved outcomes. Telemedicine and wearable tech are also helping monitor treatment adherence and effectiveness remotely.

- Growth of Non-Oral Delivery Methods: Transdermal patches, gels, implants, and vaginal rings are increasingly replacing oral hormone therapies due to their convenience and reduced risk of side effects like blood clots. These alternatives also improve patient compliance and offer more consistent hormone release.

- Expanding Access in Emerging Markets: Developing regions like Asia-Pacific and Latin America are witnessing rising demand for HRT due to better healthcare infrastructure, growing awareness, and aging populations. Companies are targeting these markets with cost-effective and accessible hormone therapies.

- Increasing Focus on Men’s Hormonal Health: While HRT has traditionally focused on women's health, there's growing recognition of male hormone deficiencies such as low testosterone (hypogonadism). This shift is expanding the market scope, leading to increased research and product development in male HRT.

Report Scope of Hormonal Replacement Therapy Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 26.41 Billion |

| Market Size by 2034 |

USD 47.29 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.69% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Route of Administration, By Disease Type, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Increasing Aging Population

The increasing aging population is a major factor driving the growth of the hormone replacement therapy market, as age-related hormonal imbalances become more prevalent. Women entering menopause and older adults experiencing conditions like osteoporosis or testosterone deficiency often require hormone therapy to manage symptoms and maintain quality of life. As life expectancy rises globally, especially in developed and emerging economies, the demand for long-term hormonal support continues to grow. This demographic shift also increases the patient pool for both preventive and therapeutic HRT applications. Moreover, healthcare providers and governments are investing more in age-related care, further supporting the expansion of the HRT market.

- According to the WHO, by 2030, 1 in 6 people globally will be aged 60 or older, with this number rising from 1 billion in 2020 to 1.4 billion. By 2050, the 60+ population will double to 2.1 billion, and those aged 80+ will triple to 426 million.

Rising Awareness of Symptoms

Rising awareness of menopause and andropause symptoms is significantly driving the growth of the market. As more individuals recognize the physical and emotional impact of hormonal changes, such as hot flashes, mood swings, fatigue, and reduced libido, they are increasingly seeking medical support and treatment. Educational campaigns, healthcare initiatives, and digital platforms are helping to destigmatize these conditions, encouraging earlier diagnosis and proactive management. This growing awareness is prompting healthcare providers to recommend HRT more frequently.

Favorable Regulatory Environment

A favorable regulatory environment also drives the growth of the hormone replacement therapy market by facilitating faster approvals and market entry for new and innovative therapies. Regulatory agencies in many countries are streamlining processes for hormone-related treatments, especially those addressing menopause, andropause, and endocrine disorders. This encourages pharmaceutical companies to invest in research and development, knowing that supportive regulations can reduce time-to-market. Additionally, clearer guidelines and safety monitoring frameworks help build public trust in HRT products, increasing adoption among both physicians and patients. As a result, regulatory support not only boosts innovation but also expands market access and accelerates overall growth.

- On July 17, 2025, the FDA convened an expert panel to review the risks and benefits of menopause hormone therapy (MHT), focusing on conditions such as breast and uterine cancer, cardiovascular disease, and benefits to bone, cognitive, and genitourinary health. Discussions highlighted how age of initiation, hormone type, dose, and delivery method may influence outcomes since the original Women’s Health Initiative findings. Following the meeting, the FDA opened a public docket to gather data and perspectives that could inform potential updates to MHT product labeling.

Restraints

Risk of Side Effects

The risk of side effects is a significant factor restraining the growth of the market, as concerns about potential adverse outcomes such as cancer, cardiovascular disease, and stroke discourage some patients and healthcare providers from opting for these treatments. Negative publicity and conflicting study results have heightened public fear around long-term safety, leading to reduced demand in certain regions. Additionally, these risks often result in stricter regulatory scrutiny and warnings, which can limit market expansion and product adoption. Many patients may also seek alternative therapies perceived as safer, further impacting HRT uptake. Consequently, managing the safety profile of HRT remains a critical challenge for market growth.

High Treatment Cost and Availability of Alternative Treatments

High treatment costs and the availability of alternative therapies act as significant restraints on the growth of the hormone replacement therapy market. Many branded HRT products and advanced delivery systems come with a premium price tag, making them less accessible to patients in price-sensitive and emerging markets. Additionally, the presence of alternative treatments such as herbal supplements, lifestyle changes, and non-hormonal medications offer patients other options, often perceived as safer or more affordable. These alternatives can reduce the demand for traditional HRT, especially among individuals wary of side effects or long-term hormone use.

Opportunities

Development of Novel HRT Formulations

The development of novel HRT formulations presents immense opportunities for the market by addressing key patient concerns such as safety, convenience, and efficacy. Innovations like bioidentical hormones, transdermal patches, gels, and slow-release implants improve hormone delivery while minimizing side effects and enhancing patient adherence. These advanced formulations also enable more personalized treatment options, catering to individual hormonal needs and preferences. As pharmaceutical companies invest in R&D to create safer and more effective products, the market is expanding to attract a broader patient base. Ultimately, these innovations help overcome existing barriers, driving growth and transforming the future landscape of HRT.

Rising Demand for Personalized Medicine

Rising demand for personalized medicine is creating immense opportunities in the hormone replacement therapy market by enabling tailored treatments that better meet individual patient needs. Advances in genetic testing, biomarker analysis, and AI-driven diagnostics allow healthcare providers to customize hormone types, dosages, and delivery methods for improved safety and effectiveness. This personalized approach reduces the risk of side effects and enhances patient satisfaction and adherence, driving higher therapy success rates. As awareness of personalized medicine grows, more patients are seeking individualized HRT solutions, expanding the market potential. Pharmaceutical companies are responding by investing in precision therapies and digital health tools, further accelerating innovation and growth in the HRT sector.

What Macroeconomic Factors Impact the Growth of the Hormone Replacement Therapy Market?

GDP and Economic Growth

Economic growth and rising GDP positively impact the growth of the market. As income levels rise, healthcare infrastructure improves and more individuals can afford advanced treatments like HRT. Additionally, higher GDP enables greater healthcare spending by both governments and private sectors, expanding access and awareness.

Inflation Rates

High inflation rates generally restrain the growth of the market. Inflation increases the overall cost of healthcare, making treatments like HRT less affordable for patients and putting pressure on healthcare budgets. This can lead to reduced demand, delayed treatments, and limited access, especially in price-sensitive or developing markets.

Interest Rates

Rising interest rates typically hamper the growth of the market. Higher interest rates increase borrowing costs for healthcare providers, pharmaceutical companies, and consumers, potentially slowing investment in new treatments and reducing patient affordability. This financial tightening can limit market expansion, particularly in regions where healthcare spending is already constrained.

Monetary and Fiscal Policies

Monetary and fiscal policies can have both positive or negative impact on the hormone replacement therapy market, depending on their direction. Expansionary policies, such as lower interest rates, increased government healthcare spending, or subsidies, can boost market growth by improving access and affordability. In contrast, contractionary policies that reduce public health budgets or increase costs for consumers may limit demand and slow the market’s expansion.

Consumer Spending

Consumer spending generally drives the growth of the market. When individuals have higher disposable income, they are more likely to invest in healthcare solutions, including elective or long-term treatments like HRT. Increased consumer spending boosts demand, encourages innovation, and supports wider adoption of therapy options across different demographics.

Segment Outlook

Product Insights

How Does the Estrogen & Progesterone Replacement Therapy Segment Lead the Market?

The estrogen & progesterone replacement therapy segment led the hormone replacement therapy market in 2024. This is primarily due to its widespread use in managing menopausal symptoms and preventing postmenopausal osteoporosis. This combination therapy is highly effective in treating hot flashes, mood swings, and other hormone-related imbalances, particularly in women undergoing menopause.

The increasing awareness about women's health and the growing acceptance of HRT as a safe and beneficial treatment have further supported segment growth. Additionally, the availability of various formulations such as oral tablets, patches, and gels has improved accessibility and patient compliance. Ongoing research and endorsements from healthcare professionals have also contributed to the segment's continued dominance.

The parathyroid hormone replacement therapy segment is expected to expand at the fastest CAGR over the projection period. The growth of the segment is attributed to the rising prevalence of hypoparathyroidism and increased awareness about its long-term complications. Unlike traditional calcium and vitamin D supplements, parathyroid hormone therapies offer a more targeted and effective treatment by directly addressing the hormone deficiency.

Advancements in biotechnology and the development of recombinant hormone therapies have significantly improved treatment outcomes, further fueling demand. Additionally, regulatory approvals and growing investment in rare disease therapeutics are making these treatments more accessible. As healthcare providers and patients seek more precise and personalized solutions, the adoption of parathyroid hormone replacement is poised to accelerate rapidly.

Route of Administration Insights

What Made Oral the Dominant Segment in the Market in 2024?

The oral segment dominated the hormone replacement therapy market with a major share in 2024 due to its convenience, ease of administration, and widespread availability. Oral formulations such as tablets are often preferred by both patients and healthcare providers for their simplicity in dosing and adherence. Additionally, pharmaceutical advancements have improved the bioavailability and safety profiles of oral HRT, making them more effective and well-tolerated. The lower cost compared to other routes like injectables or transdermal patches also contributes to higher adoption, especially in cost-sensitive markets.

The parenteral segment is expected to grow at the fastest rate in the upcoming period, owing to its higher efficacy, faster onset of action, and suitability for patients who cannot tolerate oral medications. Injectable hormone therapies offer precise dosing and are often preferred for long-term management of conditions like growth hormone deficiencies and certain cases of testosterone or estrogen therapy. Advances in delivery technologies, such as long-acting injectables and auto-injectors, have also improved patient convenience and compliance.

Moreover, the rising demand for personalized and targeted hormone treatments is boosting the adoption of parenteral options. As more healthcare providers opt for effective and controlled hormone delivery methods, this segment is poised for significant growth.

Disease Type Insights

How Does the Menopause Segment Contribute the Largest Market Share in 2024?

The menopause segment held the largest share of the hormone replacement therapy market in 2024. This is primarily due to the high prevalence of menopausal symptoms among aging women and the growing awareness around menopause management. Estrogen and progesterone replacement therapies are widely prescribed to alleviate symptoms such as hot flashes, night sweats, mood swings, and bone density loss. Increased health consciousness and proactive approaches toward women's health have led to higher demand for effective treatments.

Additionally, supportive government and healthcare initiatives, along with improved access to hormone therapies, have further driven segment growth. The availability of multiple HRT options, including oral, transdermal, and injectable, has also boosted adoption across various patient preferences.

The hypoparathyroidism segment is expected to expand at the highest CAGR during the forecast period, driven by increasing diagnosis rates and the rising availability of targeted treatments. Unlike traditional calcium and vitamin D therapies, hormone-based approaches like recombinant parathyroid hormone offer more effective and physiological management of the condition. Growing awareness among healthcare providers about the long-term risks of untreated hypoparathyroidism is driving adoption of hormone-based therapies.

Additionally, advancements in biotechnology and supportive regulatory pathways are encouraging the development and commercialization of new therapies. As patient demand for precise, long-term treatment options rises, this segment is set to experience significant expansion.

- In August 2024, Ascendis Pharma announced FDA approval of YORVIPATH® (palopegteriparatide), a once-daily prodrug of parathyroid hormone (PTH[1-34]), for treating hypoparathyroidism in adults. Designed for 24-hour continuous PTH exposure, YORVIPATH targets a rare endocrine disorder affecting an estimated 70,000–90,000 people in the U.S.

By Region Insights

What Made North America the Dominant Region in the Hormone Replacement Therapy Market?

In 2024, North America dominated the hormone replacement therapy market by capturing the largest share. This is mainly due to its advanced healthcare infrastructure, high awareness about hormone-related conditions, and strong presence of leading pharmaceutical companies. The region has a large aging population, particularly in the U.S., driving demand for therapies to manage menopause, hypogonadism, and other hormone deficiencies. Favorable reimbursement policies and increased focus on women’s health have also boosted HRT adoption. Moreover, continued investments in research and development, along with quicker regulatory approvals, have facilitated the introduction of innovative hormone therapies.

The U.S. is the major contributor to the North America hormone replacement therapy market, primarily due to its advanced healthcare infrastructure and high prevalence of hormone-related disorders such as menopause, hypogonadism, and hypothyroidism. The country has a large aging population, especially women entering postmenopausal age, which significantly drives demand for HRT. Strong presence of key pharmaceutical companies, widespread health insurance coverage, and early adoption of innovative therapies further boost market growth. Moreover, increasing awareness of hormone health and proactive healthcare-seeking behavior among patients contribute to the U.S. maintaining a leading position in the regional market.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to grow at the fastest rate in the market in the coming years due to rising awareness about hormone-related disorders and increasing healthcare access across emerging economies. Rapidly aging populations in countries like China and Japan are driving demand for treatments related to menopause and other hormone deficiencies. Improvements in healthcare infrastructure, government initiatives promoting women’s health, and growing acceptance of HRT are also fueling market expansion. Additionally, rising disposable incomes and increasing penetration of private healthcare are making advanced therapies more accessible. The entry of global pharmaceutical players and growing local manufacturing further support the region’s robust growth potential.

- In May 2024, Jagsonpal launched MemUp, India’s first HRT with a USFDA-approved combination of bio-identical estradiol and progesterone in a single daily oral capsule. Designed to manage menopause symptoms like hot flashes, night sweats, and sleep disturbances, MemUp represents a major step forward in women's healthcare.

Japan is a major contributor to the Asia Pacific hormone replacement therapy market due to its rapidly aging population and well-established healthcare system. The country has one of the highest life expectancies globally, leading to increased demand for treatments related to age-associated hormonal imbalances, especially among postmenopausal women. High health literacy, government support for geriatric care, and the availability of advanced hormone therapies further strengthen Japan’s market position. Additionally, strong pharmaceutical industry presence and a growing focus on quality of life in aging contribute to market growth in Japan.

China and India are emerging as major players in the Asia Pacific hormone replacement therapy market due to their large and growing aging populations, which increase the demand for hormone-related treatments. Rising awareness about women’s health, improving healthcare infrastructure, and increasing disposable incomes are driving market growth in both countries. Additionally, expanding healthcare access in rural and urban areas and growing adoption of advanced hormone therapies contribute to their rising prominence. Both nations are also witnessing increased investments from pharmaceutical companies aiming to tap into these vast, underserved markets, further accelerating their role in the regional market.

Region-Wise Breakdown of the Hormone Replacement Therapy Market

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 10.3 Bn |

5.87% |

Advanced healthcare infrastructure, high prevalence of menopause and andropause, strong regulatory support and insurance coverage, advancements in personalized HRT solutions |

High cost of treatments, limited insurance coverage for certain therapies, regulatory hurdles |

Dominant market with steady growth |

| Asia Pacific |

USD 7.2 Bn |

7.09% |

Increasing healthcare access and awareness, rising female life expectancy, growing prevalence of menopause-related symptoms |

Cultural stigmas and limited understanding, unequal healthcare infrastructure and affordability issues |

Fastest-growing region |

| Europe |

USD 5.8 Bn |

9.91% |

Rising cases of menopause-related conditions, growing use of bioidentical hormones, expanding geriatric populations |

Supply shortages and access disparities, regulatory challenges affecting availability |

Significant growth |

| Latin America |

USD 2.0 Bn |

4.66% |

Rising awareness of HRT, improving access to endocrinology services, supportive public health initiatives |

Economic disparities affecting access, limited availability of advanced therapies |

Moderate growth |

| MEA |

USD 1.3 Bn |

3.0% |

Growing healthcare investments, rising focus on women’s health, increasing incidence of thyroid disorders and male hypogonadism |

Cultural barriers and limited awareness, economic challenges affecting affordability |

Emerging market with steady growth prospects |

Hormone Replacement Therapy Market Value Chain Analysis

1. Research & Development (R&D)

This stage involves extensive scientific research to discover and develop effective hormone replacement formulations. Pharmaceutical companies and research institutions focus on improving hormone bioavailability, safety profiles, and delivery mechanisms such as patches, gels, and oral pills to meet patient needs.

2. Raw Material Sourcing

Raw materials primarily include active pharmaceutical ingredients (APIs) such as estrogen, progesterone, testosterone, and other hormones. These materials are sourced from chemical suppliers or extracted from natural sources, with quality control ensuring compliance with regulatory standards to maintain safety and efficacy.

3. Manufacturing

Manufacturing transforms raw materials into finished HRT products. This stage includes formulation, mixing, processing, packaging, and quality assurance testing to ensure product consistency, stability, and compliance with Good Manufacturing Practices (GMP).

4. Distribution and Logistics

Finished products are distributed through pharmaceutical wholesalers, specialty pharmacies, hospitals, and clinics. Efficient logistics and cold-chain management are crucial to maintain product integrity during transportation, especially for hormone formulations sensitive to temperature variations.

5. Marketing & Sales

Marketing strategies involve educating healthcare professionals and patients about HRT benefits, new products, and treatment protocols. Sales teams engage with endocrinologists, gynecologists, and general practitioners to increase adoption and market penetration.

6. End-User Application

End-users include menopausal women, patients with hormone deficiencies, and others prescribed HRT. Healthcare providers tailor treatments based on individual patient needs, monitoring efficacy and side effects to optimize therapy outcomes.

7. After-Sales Services & Support

This includes patient education, follow-up consultations, and pharmacovigilance to monitor adverse effects. Support services enhance patient adherence and satisfaction, playing a critical role in long-term treatment success.

Key Players Operating in the Hormone Replacement Therapy Market

1. AbbVie, Inc.

AbbVie offers extensive portfolio of hormone therapies, particularly for menopause and testosterone replacement. Its acquisition of Allergan enhanced its position in women’s health, allowing it to deliver both branded and innovative formulations globally.

2. ASCEND Therapeutics US, LLC

ASCEND Therapeutics specializes in transdermal hormone delivery systems, notably offering products like EstroGel® for estrogen replacement. The company focuses on improving patient compliance and comfort through non-invasive therapies, targeting menopause-related conditions.

3. Bayer AG

Bayer has a strong presence in the market, leveraging its legacy in women's health and offering combination hormone products like Climara® and other estrogen-progestin therapies. It continues to invest in safer delivery methods such as patches and non-oral formulations to enhance treatment adherence.

4. Eli Lilly and Company

Eli Lilly contributes to the market through its focus on endocrine disorders and menopause-related treatments, including therapies for osteoporosis linked to hormone deficiency. Its research and development efforts aim at improving efficacy and reducing side effects of long-term hormone use.

5. F. Hoffmann-La Roche Ltd.

Roche is involved in the production of hormonal therapies and biologics, particularly in growth hormone replacement and endocrine-related oncology. The company emphasizes targeted therapies and precision medicine, which supports the development of safer hormone treatments.

6. Merck & Co., Inc.

Merck offers a range of HRT solutions including estrogen therapies and combination products, especially under its legacy brands in women's health. It also invests in advancing hormone formulations and personalized treatment strategies to address individual patient needs more effectively.

7. Noven Pharmaceuticals, Inc.

Noven is a key player in transdermal drug delivery systems, producing innovative hormone patches such as Minivelle® and CombiPatch®. It focuses on making hormone therapy more convenient and safer by avoiding first-pass metabolism through skin-based delivery.

8. Novo Nordisk A/S

Novo Nordisk is a leader in growth hormone replacement therapy, with flagship products like Norditropin® targeting both pediatric and adult hormone deficiencies. The company is actively expanding into other hormonal disorders and invests heavily in R&D to enhance delivery and efficacy.

9. Pfizer Inc.

Pfizer is a dominant force in the market with products such as Premarin® and Prempro®, widely prescribed for menopause symptom relief. Its global distribution network and strong brand recognition support wide access and adoption of hormone therapies across regions.

10. Viatris, Inc.

Viatris, formed from the merger of Mylan and Upjohn, offers a broad range of generic and branded hormone therapies, making HRT more affordable and accessible. It plays a crucial role in emerging markets where cost-effective hormone treatments are in growing demand.

11. Theramex

Theramex specializes in women’s health, with a strong focus on menopause and osteoporosis treatment, offering hormone therapies such as Bijuva® and Femoston®. By acquiring and licensing key HRT products globally, the company enhances access to advanced therapies across Europe, Latin America, and Asia.

12. Besins Healthcare

Besins Healthcare is a niche leader in hormone therapies, particularly for both male and female hormone deficiencies, offering transdermal gels like AndroGel® and Estreva®. With a dedicated focus on hormone delivery innovation, the company operates globally to address reproductive and endocrine health with high-quality products.

13. Organon & Co.

Organon, spun off from Merck & Co., has made women’s health and HRT a strategic priority, with legacy brands like Femring® and partnerships aimed at expanding HRT accessibility. The company focuses on underserved therapeutic areas and continues to invest in expanding its hormone therapy pipeline through innovation and acquisition.

Recent Developments

- In June 2025, the HRT Club has announced a strategic partnership with Posterity Health to offer a more comprehensive and inclusive approach to hormonal health. This collaboration connects HRT Club members with expert-led male hormone evaluation and treatment, while Posterity Health patients gain access to The HRT Club’s affordable, insurance-free model for FDA-approved therapies. The partnership supports both individuals and couples through a blend of telehealth and in-person care.

- In June 2023, Pfizer Inc. announced the return of DUAVEE® (conjugated estrogens/bazedoxifene) to the U.S. market with updated packaging, following a voluntary recall caused by packaging concerns unrelated to the product’s safety or effectiveness. DUAVEE, an estrogen-based menopause hormone therapy approved by the FDA, is indicated for the treatment of moderate-to-severe hot flashes and the prevention of postmenopausal osteoporosis.

- In May 2023, the FDA approved Veozah® (fezolinetant), the first neurokinin 3 (NK3) receptor antagonist for treating moderate to severe hot flashes due to menopause. Veozah works by blocking NK3 receptors involved in the brain’s temperature regulation.

Segments Covered in the Report

By Product

- Estrogen & Progesterone Replacement Therapy

- HGH Replacement Therapy

- Parathyroid Hormone Replacement

- Testosterone Replacement Therapy

- Thyroid Hormone Replacement Therapy

By Route of Administration

- Oral

- Parenteral

- Transdermal

- Others

By Disease Type

- Growth Hormone Deficiency

- Hypoparathyroidism

- Hypothyroidism

- Male Hypogonadism

- Menopause

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

-

Table 1: U.S. Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 2: U.S. Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 3: U.S. Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 4: Canada Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 5: Canada Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 6: Canada Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 7: Mexico Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 8: Mexico Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 9: Mexico Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 10: Germany Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 11: Germany Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 12: Germany Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 13: France Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 14: France Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 15: France Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 16: UK Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 17: UK Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 18: UK Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 19: Italy Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 20: Italy Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 21: Italy Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 22: Rest of Europe Hormonal Replacement Therapy Market, by Segments, 2024–2034

-

Table 23: China Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 24: China Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 25: China Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 26: Japan Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 27: Japan Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 28: Japan Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 29: South Korea Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 30: South Korea Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 31: South Korea Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 32: India Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 33: India Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 34: India Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 35: Southeast Asia Hormonal Replacement Therapy Market, by Segments, 2024–2034

-

Table 36: Rest of Asia Pacific Hormonal Replacement Therapy Market, by Segments, 2024–2034

-

Table 37: Brazil Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 38: Brazil Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 39: Brazil Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 40: Rest of Latin America Hormonal Replacement Therapy Market, by Segments, 2024–2034

-

Table 41: GCC Countries Hormonal Replacement Therapy Market, by Product, 2024–2034

-

Table 42: GCC Countries Hormonal Replacement Therapy Market, by Route of Administration, 2024–2034

-

Table 43: GCC Countries Hormonal Replacement Therapy Market, by Disease Type, 2024–2034

-

Table 44: Turkey Hormonal Replacement Therapy Market, by Segments, 2024–2034

-

Table 45: Africa Hormonal Replacement Therapy Market, by Segments, 2024–2034

-

Table 46: Rest of MEA Hormonal Replacement Therapy Market, by Segments, 2024–2034

-

Figure 1: U.S. Hormonal Replacement Therapy Market Share, by Product, 2024–2034

-

Figure 2: U.S. Hormonal Replacement Therapy Market Share, by Route of Administration, 2024–2034

-

Figure 3: U.S. Hormonal Replacement Therapy Market Share, by Disease Type, 2024–2034

-

Figure 4: Canada Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 5: Mexico Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 6: Germany Hormonal Replacement Therapy Market Share, by Product, 2024–2034

-

Figure 7: France Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 8: UK Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 9: Italy Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 10: China Hormonal Replacement Therapy Market Share, by Product, 2024–2034

-

Figure 11: Japan Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 12: South Korea Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 13: India Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 14: Brazil Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 15: GCC Countries Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 16: Turkey Hormonal Replacement Therapy Market Share, by Segments, 2024–2034

-

Figure 17: Africa Hormonal Replacement Therapy Market Share, by Segments, 2024–2034