Hospital Electronic Health Records Market Size and Growth 2025 to 2034

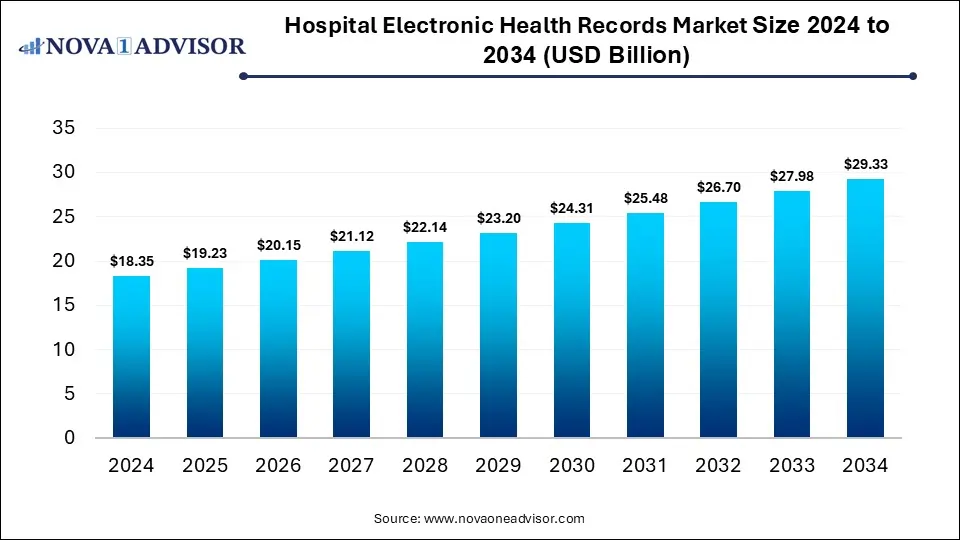

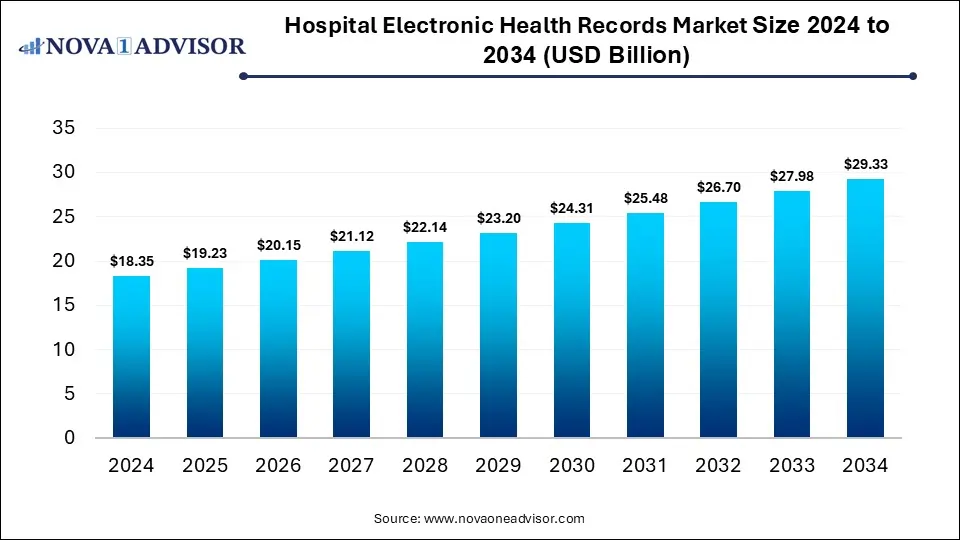

The global hospital electronic health records market size was estimated at USD 18.35 billion in 2024 and is expected to reach USD 29.33 billion by 2034, expanding at a CAGR of 4.8% during the forecast period of 2025 to 2034. The growth of the market is being driven by rising demand for improved patient care, regulatory mandates & incentives, increased adoption of cloud and AI‑powered technologies, and the push for interoperability and operational efficiency.

Hospital Electronic Health Records Market Key Takeaways

- By region, North America held the largest share of the hospital electronic health records market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By deployment, the cloud-based segment dominated the market in 2024.

- By deployment, the web-based segment is expected to grow at a significant rate over the projection period.

- By type, the acute segment held the largest share of the market in 2024.

- By type, the post-acute segment is expected to expand at the fastest CAGR in the upcoming period.

- By business model, the professional services segment led the market in 2024.

- By business model, the subscriptions segment is expected to grow at the highest CAGR during the forecast period.

- By product, the integrated segment captured the maximum share of the market in 2024.

- By product, the standalone segment is expected to grow at the fastest rate between 2025 and 2034.

- By hospital size, the medium hospitals segment dominated the market in 2024.

- By hospital size, the large hospitals segment is likely to grow at a rapid pace in the coming years.

- By application, the cardiology segment contributed the largest market share in 2024.

- By application, the ophthalmology segment is expected to expand at the highest CAGR over the forecast period.

Impact of AI on the Hospital Electronic Health Records Market

Artificial Intelligence (AI) is significantly transforming the hospital electronic health records market by enhancing data management, clinical decision support, and administrative efficiency. AI-powered tools are being integrated into EHR systems to automate tasks such as clinical documentation, predictive analytics, and population health monitoring, reducing physician burnout and improving accuracy. Natural Language Processing (NLP) enables real-time transcription and summarization of clinical notes, while machine learning models assist in early diagnosis and risk stratification based on patient data. AI also supports personalized treatment planning and helps hospitals derive actionable insights from vast amounts of unstructured EHR data.

- In December 2024, Oracle Health unveiled a completely reimagined EHR system, set to launch in 2025, built from the ground up to transform how clinicians interact with patient data. Key features include voice-activated navigation, AI-powered documentation and coding, integrated analytics from clinical and social data, and a cloud-based infrastructure for scalability and security. Unlike a simple upgrade, this platform is a full rebuild, designed to replace outdated systems with a modern, AI-driven, cloud-native solution.

Market Overview

The hospital electronic health records market refers to the segment of healthcare IT focused on the digital management of patient records within hospital settings, enabling real-time, centralized access to patient information across departments. EHR systems streamline clinical workflows, improve patient safety, enhance coordination of care, and reduce medical errors through accurate and accessible data. They support various hospital functions including inpatient documentation, medication management, surgical planning, billing, and decision support. The market is experiencing rapid growth due to factors such as increasing digitalization of healthcare, government mandates for EHR adoption, rising demand for efficient data sharing, and the integration of advanced technologies like AI and cloud computing. As hospitals seek to improve outcomes and reduce costs, EHRs are becoming essential tools in both developed and emerging healthcare systems.

What are the Major Trends in the Hospital Electronic Health Records Market?

- Cloud-Based EHR Adoption: Hospitals are increasingly shifting from on-premise to cloud-based EHR systems to improve scalability, reduce infrastructure costs, and enable remote access. Cloud EHRs also support faster updates, better disaster recovery, and easier integration with third-party tools and mobile applications.

- AI and Machine Learning Integration: EHR platforms are integrating AI for clinical decision support, predictive analytics, and automated documentation using Natural Language Processing (NLP). This reduces physician workload, enhances diagnostic accuracy, and supports personalized treatment planning.

- Interoperability and Data Exchange Standards: With rising emphasis on coordinated care, there is growing demand for EHRs that support seamless data exchange across systems and providers. Adoption of standards like HL7 FHIR (Fast Healthcare Interoperability Resources) is enabling better interoperability between hospital EHRs, labs, pharmacies, and external care networks.

- Mobile and Remote Access Capabilities: Hospitals are adopting mobile-friendly EHR platforms that allow clinicians to access and update patient data from tablets, smartphones, or remote locations. This enhances flexibility, improves responsiveness in emergency situations, and supports telehealth integration.

Report Scope of Hospital Electronic Health Records Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 19.23 Billion |

| Market Size by 2034 |

USD 29.33 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Deployment, By Type, By Business Model, By Product, By Hospital Size, By Application, By Regional |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Government Initiatives and Regulatory Mandates

Government initiatives and regulatory mandates are driving the growth of the hospital electronic health records market by encouraging hospitals to adopt digital health technologies for improved care quality and patient safety. Programs like the U.S. HITECH Act and the European Union’s Digital Health initiatives provide financial incentives, set interoperability standards, and enforce compliance with data security regulations. These mandates push hospitals to transition from paper-based records to certified EHR systems that support standardized data exchange and meaningful use. Additionally, governments worldwide are increasingly investing in national health IT infrastructure, which accelerates EHR implementation. As a result, regulatory frameworks create a favorable environment for EHR vendors and hospitals to prioritize digital transformation.

- For instance, the Central Government of India extended the Digital Health Incentive Scheme (DHIS) until June 30, 2025, to boost digitization of patient health records and their linkage with ABHA IDs. Launched by the National Health Authority in January 2023, the scheme incentivizes hospitals, labs, clinics, and pharmacies to adopt digital health solutions. The extension follows positive outcomes in digital adoption and aims to build on this momentum across healthcare facilities and digital solution providers.

Rising Focus on Patient-Centric Care

The rising focus on patient-centric care also drives the growth of the market, as healthcare providers aim to deliver more personalized, coordinated, and efficient care. EHR systems enable this by providing comprehensive, real-time access to patient histories, treatment plans, and test results, empowering clinicians to make informed decisions tailored to individual needs. Features such as patient portals, secure messaging, and remote monitoring foster active patient engagement and improve communication between patients and care teams. This shift towards patient-centered models also aligns with value-based care initiatives, where better outcomes and patient satisfaction are prioritized. Consequently, hospitals are investing heavily in advanced EHR solutions to support these evolving care delivery models and enhance overall patient experience.

Restraints

High Implementation and Maintenance Cost

High implementation and maintenance costs create barriers, especially for small and mid-sized hospitals with limited budgets. The initial expenses for purchasing software, upgrading hardware, and training staff can be substantial, often requiring long-term financial commitment. Additionally, ongoing maintenance, system updates, and cybersecurity measures add to operational costs, making it challenging for some healthcare providers to sustain EHR usage. These financial barriers can delay adoption or lead to incomplete implementations, slowing overall market expansion.

Data Privacy Concerns and Resistance to Change

Data privacy concerns and resistance to change significantly restrain the growth of the hospital electronic health records market. Hospitals and patients alike worry about the security of sensitive health information, with fears of data breaches, unauthorized access, and compliance challenges limiting widespread adoption. Additionally, healthcare professionals may resist transitioning from familiar paper-based or legacy systems to digital platforms due to the learning curve, workflow disruptions, and skepticism about technology reliability. This cultural resistance can slow implementation and reduce effective utilization of EHR systems.

Opportunities

Integration with Telemedicine

Integration with telemedicine creates immense opportunities in the market by enabling seamless remote patient care and real-time data sharing between patients and healthcare providers. By connecting telehealth platforms with EHR systems, hospitals can ensure that virtual consultations, diagnoses, and treatment plans are accurately documented and accessible across care teams. This integration improves care continuity, especially for patients in rural or underserved areas, and supports growing demand for convenient, accessible healthcare services. Additionally, combining telemedicine with EHR data enhances remote monitoring and chronic disease management, driving greater efficiency and better patient outcomes.

Focus on Data Analytics

The growing focus on data analytics creates significant opportunities in the hospital electronic health records market by enabling hospitals to harness vast amounts of patient data for improved clinical decision-making and operational efficiency. Advanced analytics tools integrated within EHR systems help identify trends, predict patient outcomes, and support population health management initiatives. This data-driven approach enhances personalized care and resource allocation, leading to better patient outcomes and cost savings. As healthcare providers increasingly prioritize value-based care, the demand for EHRs with robust analytics capabilities continues to rise, propelling market growth.

Impact of Macroeconomic Factors on the Market

Economic Growth and GDP

Economic growth and rising GDP generally drive the growth of the market by enabling greater investment in healthcare infrastructure and digital technologies. Higher national income allows governments and private hospitals to allocate more funds toward modernizing systems, including the adoption of advanced EHR platforms. In contrast, in low-GDP or economically strained regions, limited budgets can restrain EHR adoption due to high implementation and maintenance costs.

Inflation Rates

High inflation rates typically restrain the growth of the market by increasing the cost of technology acquisition, implementation, and ongoing maintenance. Rising prices can lead healthcare providers to delay or reduce investments in digital infrastructure, including EHR systems. However, moderate inflation coupled with economic stability may have a limited impact, allowing gradual market growth to continue.

Segment Outlook

By Deployment

Why Did the Cloud-Based Segment Dominate the Hospital Electronic Health Records Market?

The cloud-based segment dominated the market with a major share in 2024 due to its scalability, cost-effectiveness, and ease of access. Unlike on-premise systems, cloud solutions reduce the need for heavy infrastructure investments and allow hospitals to pay on a subscription basis, which is especially appealing to small and mid-sized facilities. The growing need for remote access to patient data, driven by telehealth expansion and multi-location hospital networks, further accelerated cloud adoption. Additionally, advancements in data security, compliance with healthcare regulations, and integration of AI for real-time insights made cloud-based EHRs more reliable and attractive.

The web-based segment is expected to grow at a significant rate over the projection period due to its affordability, ease of implementation, and minimal IT infrastructure requirements. These systems offer a flexible alternative for smaller hospitals and clinics that may lack the resources for full cloud or on-premise solutions. Web-based EHRs also support remote accessibility and real-time data updates, making them ideal for improving care coordination. As digital literacy among healthcare providers increases, the adoption of web-based platforms is projected to accelerate significantly in the coming years.

Hospital Electronic Health Records Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| On-premise |

6.79 |

6.98 |

7.17 |

7.37 |

7.57 |

7.77 |

7.97 |

8.18 |

8.38 |

8.59 |

8.80 |

| Web-Based |

5.14 |

5.37 |

5.60 |

5.85 |

6.11 |

6.38 |

6.66 |

6.96 |

7.26 |

7.58 |

7.92 |

| Cloud-Based |

6.42 |

6.88 |

7.38 |

7.90 |

8.46 |

9.05 |

9.68 |

10.34 |

11.05 |

11.81 |

12.61 |

By Type

How Does Acute Segment Lead the Market in 2024?

The acute segment led the hospital electronic health records market while holding the largest share in 2024. This is mainly due to the high demand for advanced data management in short-term care settings like emergency departments and general hospitals. These facilities handle a large volume of patients with critical conditions, requiring quick access to accurate and comprehensive patient data for effective decision-making. Government initiatives and funding programs, especially in developed countries, have also prioritized EHR implementation in acute care hospitals to improve clinical outcomes and reduce medical errors. Furthermore, acute care providers are more likely to adopt sophisticated EHR systems that support interoperability, real-time updates, and integration with diagnostic tools.

The post-acute segment is expected to expand at the fastest CAGR in the upcoming period, owing to the rising emphasis on continuity of care and long-term patient management. As populations age and chronic conditions become more prevalent, there is increasing demand for EHR systems that support rehabilitation, skilled nursing, and home health services. Regulatory pressures and value-based care models are also pushing post-acute providers to adopt digital solutions that ensure seamless data sharing with acute care facilities. This growing need for coordinated, patient-centric care is driving rapid adoption of EHRs in the post-acute space.

By Business Model

What Made Professional Services the Dominant Segment in the Hospital Electronic Health Records Market?

The professional services segment dominated the market in 2024 due to the critical need for specialized support in implementing, customizing, and maintaining complex EHR systems. Hospitals often require expert guidance for system integration, workflow optimization, staff training, and compliance with regulatory standards, all of which are provided through professional services. As EHR solutions become more advanced, incorporating AI, analytics, and interoperability features, the demand for consulting and technical expertise has grown significantly.

Additionally, healthcare providers are increasingly relying on service providers to ensure minimal downtime and smooth transitions during system upgrades or migrations. This reliance on external expertise solidified the dominance of the professional services segment in the market.

The subscriptions segment is expected to grow at the highest CAGR during the forecast period due to its cost-effective, scalable, and flexible payment model. Hospitals, especially small to mid-sized facilities, are increasingly favoring subscription-based EHR solutions to avoid large upfront capital investments associated with traditional licensing. This model also ensures continuous updates, technical support, and easier access to the latest features, making it ideal for evolving healthcare needs. As cloud-based and web-based EHR adoption rises, the subscription model is becoming the preferred choice for long-term sustainability and ease of budgeting.

Hospital Electronic Health Records Market Size 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Licensed Software |

6.06 |

6.25 |

6.45 |

6.65 |

6.86 |

7.08 |

7.29 |

7.52 |

7.74 |

7.98 |

8.21 |

| Technology Resale |

1.47 |

1.51 |

1.55 |

1.59 |

1.64 |

1.68 |

1.73 |

1.77 |

1.82 |

1.86 |

1.91 |

| Subscriptions |

5.32 |

5.66 |

6.03 |

6.41 |

6.82 |

7.25 |

7.71 |

8.19 |

8.70 |

9.25 |

9.82 |

| Professional Services |

4.59 |

4.86 |

5.14 |

5.44 |

5.76 |

6.09 |

6.44 |

6.82 |

7.21 |

7.63 |

8.06 |

| Others |

0.92 |

0.95 |

0.99 |

1.02 |

1.06 |

1.10 |

1.14 |

1.18 |

1.23 |

1.27 |

1.32 |

By Product

Why Did the Integrated Segment Dominate the Market in 2024?

The integrated segment dominated the hospital electronic health records market by capturing the maximum share in 2024. This is primarily due to the growing demand for unified platforms that streamline clinical, administrative, and financial processes. Integrated EHR systems enable seamless data flow across departments, such as radiology, pharmacy, laboratory, and billing, improving workflow efficiency and reducing errors. Hospitals increasingly preferred integrated solutions to enhance patient care coordination, ensure regulatory compliance, and support data-driven decision-making. These systems also reduce the complexity and cost of managing multiple standalone applications. As healthcare facilities prioritized interoperability and holistic patient management, integrated EHRs emerged as the dominant choice.

The standalone segment is expected to grow at the fastest rate in the coming years. This is mainly due to its appeal among smaller hospitals and specialty clinics seeking targeted, cost-effective solutions. These systems allow healthcare providers to address specific departmental needs, such as radiology or billing, without investing in a full-scale integrated platform. The flexibility, ease of deployment, and lower upfront costs make standalone EHRs an attractive option for institutions with limited IT infrastructure. As digital adoption spreads across smaller healthcare settings, demand for these focused solutions is projected to rise rapidly.

By Hospital Size

How Does the Medium Hospitals Segment Dominate the Market in 2024?

The medium hospitals segment dominated the hospital electronic health records market in 2024. This is mainly due to the increased need for advanced digital infrastructure and cost-effective solutions among medium hospitals. These hospitals typically manage a higher patient volume than small facilities, requiring more robust EHR systems to handle clinical, administrative, and operational demands. At the same time, they are more agile and quicker to adopt new technologies compared to large hospitals, which often face longer procurement and integration cycles. Medium-sized hospitals also benefited from government incentives and vendor support tailored to their scale, making EHR adoption more feasible.

The large hospitals segment is likely to grow at a rapid pace throughout the forecast period due to their increasing focus on comprehensive digital transformation and advanced sdata analytics. Large hospitals manage complex patient care workflows across multiple departments and locations, driving the need for sophisticated, interoperable EHR systems. They also have greater financial resources to invest in cutting-edge technologies like AI and cloud integration, enhancing operational efficiency and patient outcomes. Additionally, regulatory pressures and the demand for value-based care models are accelerating EHR adoption in large healthcare institutions.

By Application

How Does the Cardiology Segment Hold the Largest Market Share in 2024?

The cardiology segment held the largest share of the hospital electronic health records market in 2024, owing to the high prevalence of cardiovascular diseases and the critical need for precise, real-time patient data management in cardiac care. Cardiology departments require specialized EHR features to monitor complex diagnostic information, imaging results, and treatment plans, which enhances clinical decision-making and patient outcomes. Additionally, increasing government initiatives focused on cardiovascular health and the integration of advanced technologies like AI and predictive analytics in cardiology boosted EHR adoption.

The ophthalmology segment is expected to expand at the highest CAGR over the projection period. The growth of the segment is attributed to the rising prevalence of vision-related disorders and increasing demand for specialized eye care. Advanced EHR systems tailored for ophthalmology help manage complex diagnostic data, imaging, and treatment workflows, improving patient outcomes. Growing adoption of teleophthalmology and remote monitoring technologies is also driving the need for integrated digital solutions. Additionally, expanding geriatric populations and increasing awareness about eye health are fueling rapid EHR adoption in ophthalmology.

Wat Made North America the Dominant Region in the Hospital Electronic Health Records Market?

In 2024, North America registered dominance in the hospital electronic health records market by capturing the largest share. This is due to its well-established healthcare infrastructure, high digital literacy, and strong regulatory support for EHR adoption. Government initiatives like the Health Information Technology for Economic and Clinical Health (HITECH) Act in the U.S. have played a pivotal role in promoting the widespread use of EHR systems. Additionally, the region's high concentration of major EHR vendors and early adoption of advanced technologies such as AI, cloud computing, and interoperability standards further boosted market growth. The growing focus on value-based care and data-driven decision-making also contributed to the region’s leadership.

The U.S. is the major contributor to the North America hospital electronic health records market, driven by its advanced healthcare infrastructure and strong federal support for health IT adoption. U.S. government initiatives like the HITECH Act and Meaningful Use program have incentivized widespread EHR implementation across hospitals and healthcare systems. Additionally, the presence of leading EHR vendors and high investments in digital health innovation have further solidified the country’s position in the regional market. The U.S. continues to lead in adopting cutting-edge technologies such as AI-powered EHRs, interoperability solutions, and cloud-based platforms.

Top Three Hospital EHR Vendors Ranked by U.S. Market Share as of May 2025

- Epic Systems Corporation leads the EHR market with 41.3% of hospital installations. Backed by over 40 years of experience and strong integration across its platforms, Epic continues to hold a dominant position in the industry.

- Oracle Cerner holds the second-largest share of the U.S. hospital EHR market at around 22%. Oracle’s 2022 acquisition of Cerner strengthened its position in the industry, combining Cerner’s established presence with Oracle’s advanced cloud infrastructure to enhance usability and drive future growth.

- MEDITECH ranks third in the U.S. hospital EHR market with an 11.9% share. While not the largest in the U.S., it leads the hospital EHR market in Canada and is steadily expanding globally, with deployments in 23 countries.

What Makes Asia Pacific the Fastest-Growing Market for Hospital Electronic Health Records?

Asia Pacific is poised to grow at the fastest CAGR in the coming years due to rapid healthcare infrastructure development, increasing government investments in health IT, and a growing focus on digital transformation. Rising patient populations and the growing burden of chronic diseases are driving the need for efficient data management and streamlined hospital operations. Countries like China, India, and Japan are actively adopting EHR systems to improve care quality and accessibility, especially in urban and semi-urban areas. Additionally, the expansion of private healthcare providers and the increasing availability of affordable cloud-based solutions are accelerating adoption. As awareness of EHR benefits grows across the region, Asia Pacific is poised to become a major driver of market growth.

India is emerging as a major player in the Asia Pacific hospital electronic health records market, driven by rapid digitization of healthcare services and strong government initiatives like the Ayushman Bharat Digital Mission. The country's large and growing patient population, combined with increasing demand for efficient healthcare delivery, is pushing hospitals to adopt EHR systems. Additionally, the expanding private healthcare sector and rising investments in health IT infrastructure are accelerating EHR deployment across both urban and semi-urban regions.

- In May 2025, Rajasthan government announced a plan to integrate its medicine distribution portal (e‑Aushadhi) with the Integrated Health Management System (iHMS) so that medicine dispensation data will also feed into ABHA‑linked EHRs.

Hospital Electronic Health Records Market Size Analysis

Currently, the hospital electronic health records market size is estimated to be valued at USD 18.35 billion in 2024 and is projected to reach USD 29.33 billion by 2034. The market is poised to grow at a higher CAGR of 4.8% during the projected period. This highest growth potential is likely to be the result of growing demand for target specific therapies for the treatment of chronic diseases.

Region-Wise Breakdown of the Hospital Electronic Health Records Market

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 7.6 Bn |

5.91% |

Strong regulatory mandates & government incentives; well‑developed healthcare infrastructure; high digital maturity; focus on value‑based care; high adoption of cloud/web EHR |

High implementation & maintenance costs; data privacy & security concerns; compliance burdens |

Dominant market with steady growth |

| Asia Pacific |

USD 5.4 Bn |

6.94% |

Rapid modernization of healthcare infrastructure; government eHealth / digital health initiatives; need to handle growing burden of chronic disease; rising investments in healthcare IT |

Limited healthcare infrastructure & connectivity in rural or remote areas; skill gaps; regulatory, privacy, standardization issues |

Fastest-growing market |

| Europe |

USD 4.3 Bn |

9.86% |

Strong regulatory push; high awareness among providers; increasing demand for patient‑centric services; government funding / public health investments; transition to cloud EHR |

Stricter regulations; budget constraints; high saturation; slow replacement of legacy systems; privacy/security cost |

Mature market with steady growth |

| Latin America |

USD 1.5 Bn |

4.75% |

Government initiatives; awareness; cloud based deployments; rising adoption within urban hospitals |

Political instability; uneven tech access; standardization issues; funding limitations |

Developing market with gradual growth |

| MEA |

USD 0.9 Bn |

4.1% |

Increasing healthcare spending; digital health agendas; demand for efficiency & safety; cloud adoption |

Infrastructure deficits; regulatory immaturity; skills shortage; disparity between countries in the region |

Emerging market with slow but promising growth |

Hospital Electronic Health Records Market Value Chain Analysis

1. Research & Development (R&D)

This stage involves the conceptualization, design, and initial prototyping of EHR software systems tailored for hospital use. EHR developers invest heavily in R&D to understand clinical workflows, compliance requirements, and user needs. R&D efforts focus on building scalable, interoperable, secure, and user-friendly platforms that meet both medical and administrative demands of hospitals.

2. Software Development & Testing

At this stage, the actual coding, software architecture, and system modules are developed and rigorously tested for functionality and compliance. Development teams convert R&D prototypes into functional systems with features such as patient records, billing integration, e-prescriptions, and clinical decision support tools. Rigorous testing (unit, system, integration, and user acceptance testing) ensures the software is reliable, secure, and can operate efficiently within complex hospital environments without downtime or data loss.

3. Regulatory Compliance & Certification

This stage ensures that EHR systems meet regional and international health IT standards, regulations, and security protocols. Vendors must ensure compliance with government mandates (e.g., ONC certification in the U.S., GDPR in Europe, or NDHM in India). Certification assures hospitals that the EHR system supports standardized data formats, security protocols, and interoperability, all essential for safe patient data exchange and continuity of care.

4. Sales & Marketing

Sales teams promote EHR products to hospitals, healthcare networks, and governments through B2B marketing strategies. Marketing efforts focus on highlighting the product's features, benefits (such as improved patient safety and administrative efficiency), and compliance with health regulations. Direct sales, partnerships, and vendor exhibitions at healthcare IT events are key strategies in this stage.

5. Deployment & Integration

In this phase, the EHR system is installed, customized, and integrated with the hospital’s existing IT infrastructure and third-party systems. Successful implementation requires seamless integration with laboratory systems, pharmacy software, radiology systems, and billing platforms. Deployment teams also migrate historical patient data and ensure the system is configured to support the hospital’s clinical workflows. This stage is critical for user adoption and minimizing operational disruption during the transition.

6. Maintenance, Support & Updates

Continuous system monitoring, bug fixing, and version updates are provided to ensure system stability and security. Post-deployment, EHR vendors offer technical support and periodic updates to comply with evolving standards or customer feedback. This phase also includes cybersecurity updates to protect sensitive patient data and performance tuning to support high user loads. A responsive support team is essential to address urgent issues and avoid operational delays in hospitals.

7. Data Analytics & Value-Added Services

Advanced EHR platforms offer analytics tools, population health dashboards, and integration with telehealth and mobile health platforms. Hospitals increasingly seek to derive actionable insights from EHR data to improve patient outcomes, monitor clinical KPIs, and support value-based care models. Vendors offering AI, predictive analytics, or integration with wearable and remote monitoring devices enhance the value of EHR systems beyond simple record-keeping. These services differentiate premium offerings and open new revenue streams.

Top Companies in the Hospital Electronic Health Records Market

1. Epic Systems Corporation

Epic is the leading provider of EHR systems for hospitals, particularly large health systems. Its fully integrated software suite supports clinical, administrative, and billing functions, and is renowned for high interoperability, patient engagement tools, and enterprise scalability.

2. Allscripts Healthcare Solutions, Inc. (Now part of Veradigm)

Allscripts, now operating under Veradigm in the EHR space, has served hospitals with scalable EHR platforms like Sunrise, supporting both clinical and financial workflows. It is known for its open, interoperable design and emphasis on data-driven care coordination across acute and ambulatory settings.

3. McKesson Corporation

McKesson was historically a key player in the hospital EHR market through its Paragon EHR system before selling this business to Allscripts. Today, McKesson’s focus has shifted to healthcare distribution and pharmacy technologies, but its legacy systems still exist in some hospital environments under Allscripts management.

4. MEDITECH (Medical Information Technology, Inc.)

MEDITECH is a major EHR provider to community and mid-sized hospitals globally, offering integrated platforms like Expanse that support inpatient, emergency, and ambulatory care. It is known for delivering cost-effective, interoperable solutions with a growing emphasis on cloud deployment and AI-driven clinical decision support.

5. athenahealth, Inc.

athenahealth delivers cloud-based EHR solutions with a strong presence in ambulatory settings and growing partnerships with hospitals and health systems. Its strength lies in interoperability, revenue cycle management integration, and network-enabled insights that help hospital systems improve patient outcomes and reduce administrative overhead.

6. eClinicalWorks

eClinicalWorks offers an EHR and practice management platform used by some hospital outpatient departments, focusing heavily on cloud deployment, telehealth integration, and population health tools. While more prominent in ambulatory care, its technology is increasingly leveraged by hospitals looking to unify outpatient and inpatient workflows.

7. NextGen Healthcare, Inc.

NextGen specializes in ambulatory EHR systems but partners with hospital networks to integrate specialty care and outpatient services into broader hospital workflows. It contributes to the hospital EHR market by enabling continuity of care, especially in multi-specialty networks with hospital affiliations.

8. GE Healthcare

GE Healthcare offered Centricity EHR systems, once widely used in hospitals and imaging centers, though it has since shifted away from core EHRs to focus on digital health infrastructure, imaging IT, and AI-driven clinical tools. Its legacy EHR systems still operate in some hospitals, and its new focus supports EHRs through data integration and imaging workflow enhancement.

9. Siemens Healthineers

Siemens previously provided hospital EHRs under platforms like Soarian, but sold its EHR business to Dedalus Group in 2020. Siemens now contributes indirectly to hospital digitization through advanced imaging, diagnostics, and digital health platforms that integrate with hospital EHRs to support clinical decision-making.

10. Oracle Cerner

Oracle Cerner is a leading provider of comprehensive EHR solutions, leveraging Oracle’s cloud infrastructure to enhance scalability, security, and AI-driven clinical workflows. It supports large health systems with integrated platforms that improve interoperability, data analytics, and patient care coordination.

11. TruBridge

TruBridge offers cloud-based healthcare IT solutions tailored for small to mid-sized hospitals, helping them modernize EHR systems and improve operational efficiency. Its flexible SaaS offerings support clinical, financial, and administrative workflows, enabling easier access and management of patient records.

12. WellSky

WellSky specializes in EHR and health IT solutions for post-acute, home health, and long-term care settings, enabling hospitals to extend care beyond inpatient settings. Its platforms facilitate care coordination, remote patient monitoring, and transitions of care, improving outcomes in complex care environments.

13. MEDHOST

MEDHOST focuses on community and rural hospitals, providing cost-effective EHR systems designed to streamline clinical and emergency department workflows. The company’s solutions help smaller facilities adopt digital records with ease, improving care delivery and administrative processes.

14. Netsmart Technologies

Netsmart delivers specialized EHR solutions for behavioral health, social services, and post-acute care, integrating these with hospital systems to enhance comprehensive patient care. Their focus on interoperability supports hospitals with psychiatric units and rehabilitation services in delivering coordinated care.

15. Vista

Vista provides cloud-based EHR and practice management software primarily for ambulatory care but increasingly supports hospital outpatient departments and specialty care. Its platform emphasizes user-friendly design and data integration to streamline workflows across care settings.

16. Altera Digital Health a Harris Company

Altera Digital Health offers cloud-native EHR solutions like Paragon Denali, targeting rural and critical access hospitals to improve digital health adoption. Built on Microsoft Azure, their SaaS model provides scalable, cost-effective tools to modernize hospital record-keeping and care coordination.

Recent Developments

- In November 2024, Altera Digital Health announced that its Paragon Denali EHR, built on Microsoft Azure, is now available as a SaaS solution for health systems. This cloud-based EHR aims to serve rural, critical access, and community hospitals, enhancing their digital capabilities.

- In October 2024, Oracle previewed its next-generation EHR at the Oracle Health Summit, built on Oracle Cloud Infrastructure for high performance and military-grade security. This AI-powered EHR automates clinical workflows, simplifies documentation and appointment management, and delivers real-time insights for physicians. With native integration across Oracle Health applications, it enhances data exchange between payers and providers, supports clinical trial recruitment, streamlines compliance, optimizes financial performance, and accelerates value-based care adoption.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the hospital electronic health records market.

By Deployment

- On-premise

- Web-Based

- Cloud-Based

By Type

- Acute

- Outpatient

- Post Acute

By Business Model

- Licensed Software

- Technology Resale

- Subscriptions

- Professional Services

- Others

By Product

By Hospital

- Large Hospital

- Medium Hospital

- Small Hospital

By Application

- Cardiology

- Neurology

- Radiology

- Oncology

- Mental and Behavioral Health

- Nephrology and Urology

- Gastroenterology

- Pediatrics

- General Medicine

- Physical Therapy and Rehabilitation

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)