Hospital Services Market Size and Trends

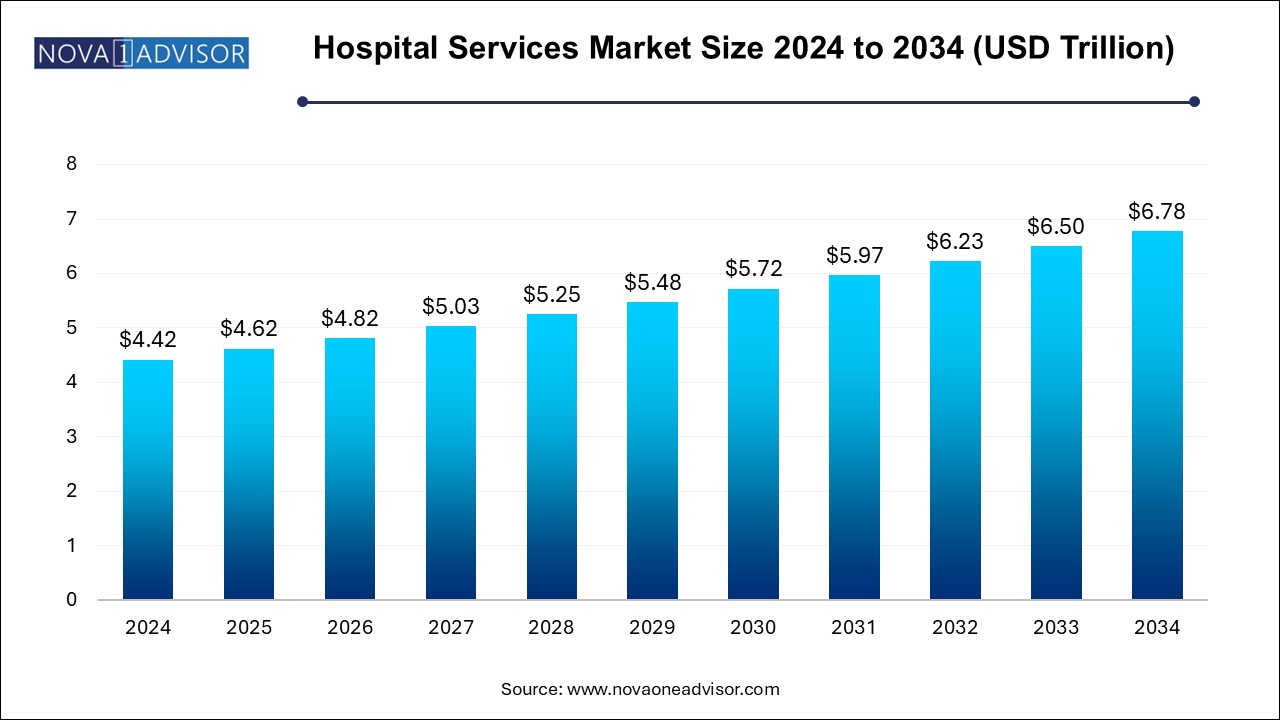

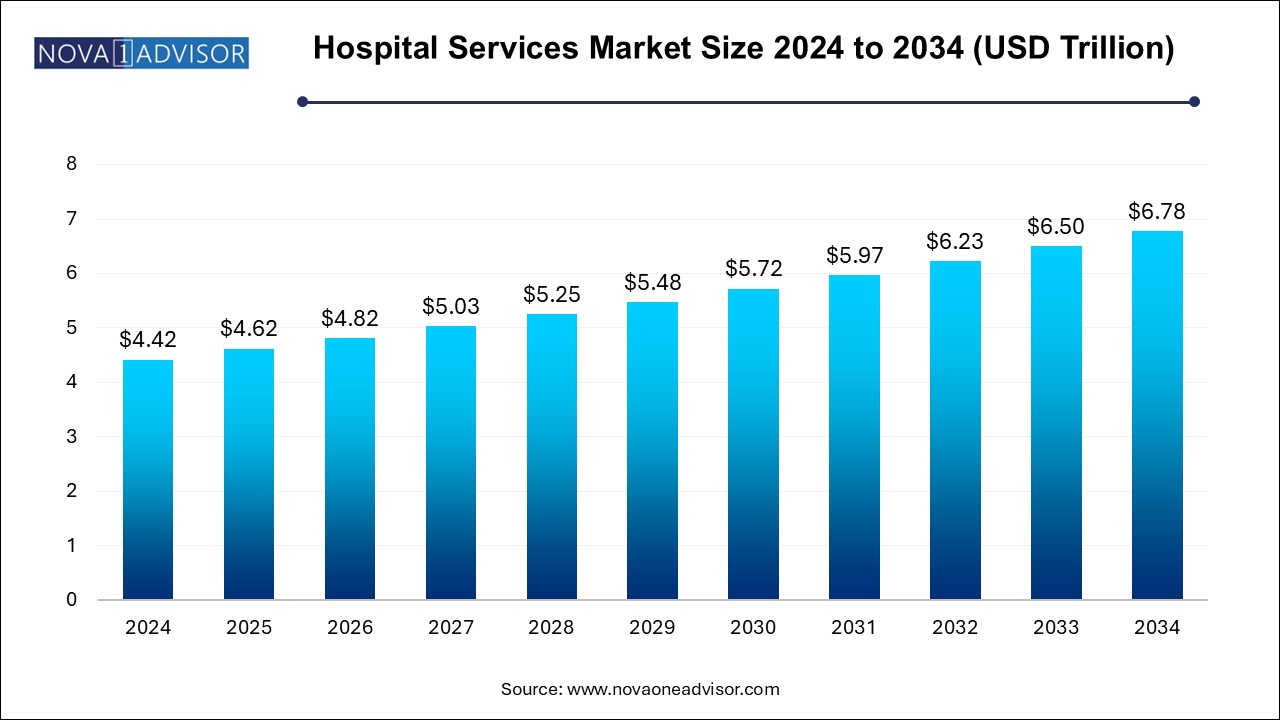

The hospital services market size was exhibited at USD 4.42 trillion in 2024 and is projected to hit around USD 6.78 trillion by 2034, growing at a CAGR of 4.36% during the forecast period 2025 to 2034.

Hospital Services Market Key Takeaways:

- Based on type, the inpatient services segment dominated the market, accounting for the largest market share of 48.71% in 2024.

- However, the outpatient services segment is expected to grow at the fastest CAGR over the forecast.

- The publicly/government-owned segment held the largest revenue share of 35.0% in 2024.

- However, the for-profit, privately owned segment is expected to witness the fastest CAGR over the forecast period.

- North America hospital services marketdominated the market with a share of 38.56% in 2024.

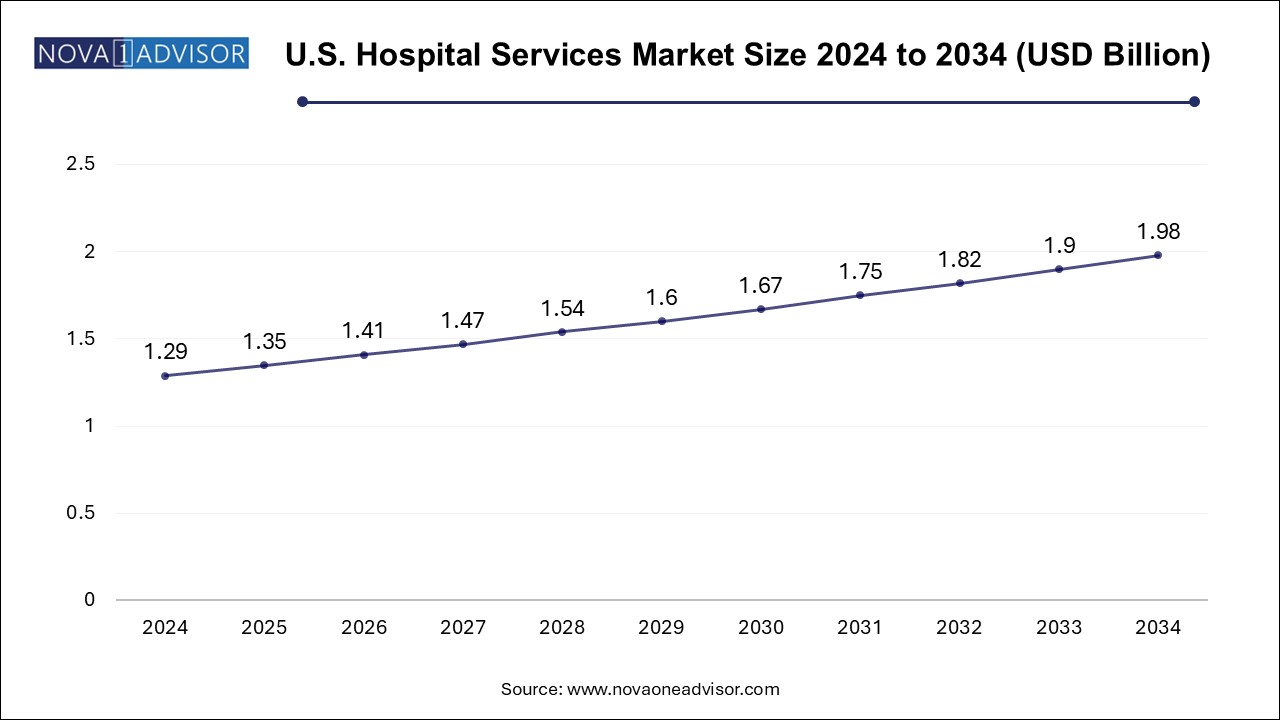

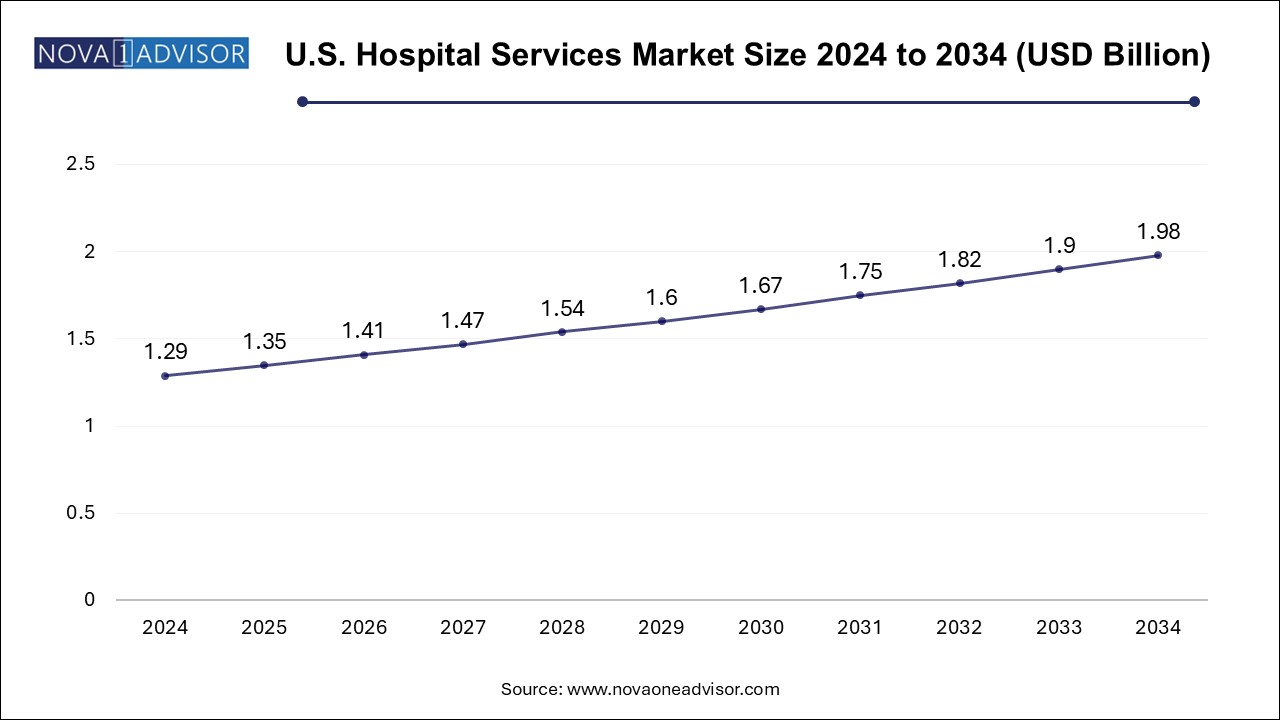

U.S. hospital services market Size and Growth 2025 to 2034

The U.S. hospital services market size is evaluated at USD 1.29 billion in 2024 and is projected to be worth around USD 1.98 billion by 2034, growing at a CAGR of 3.97% from 2025 to 2034.

North America, led by the United States, holds the largest share of the global hospital services market. The region benefits from an advanced healthcare infrastructure, high healthcare spending, and a large base of specialized tertiary and quaternary care hospitals. U.S. hospitals are at the forefront of digital transformation, robotic surgery, and hybrid care models combining in-person and virtual services. Large health systems and academic medical centers such as Mayo Clinic, Cleveland Clinic, and Kaiser Permanente offer integrated care across inpatient, outpatient, and ancillary settings.

Additionally, the expansion of Medicare, Medicaid, and private health insurance supports access to hospital services. Canada's universal healthcare system ensures comprehensive inpatient and emergency care across provinces. The region’s ongoing focus on value-based care, innovation funding, and population health management solidifies its leadership in the global market.

Asia Pacific is experiencing the fastest growth in the hospital services market, driven by rapid economic development, urbanization, and healthcare reforms. Countries such as India, China, Indonesia, and Vietnam are expanding their hospital networks, building smart hospitals, and upgrading public health infrastructure. Rising incomes and lifestyle-related diseases are also increasing demand for private hospital chains offering quality and specialized care.

China’s public health initiatives under the "Healthy China 2030" framework and India's Ayushman Bharat scheme have significantly improved access to secondary and tertiary care. The growth of regional hospital groups like Apollo Hospitals, Parkway Pantai, and Ramsay Sime Darby Health further illustrates the private sector’s role in bridging healthcare gaps. With expanding insurance coverage and foreign investment in medical tourism, Asia Pacific will continue to accelerate its share in the global market.

Market Overview

The hospital services market is a cornerstone of global healthcare systems, encompassing a wide range of diagnostic, therapeutic, surgical, and emergency care services delivered within hospital settings. This sector plays a vital role in delivering continuous and integrated care across inpatient, outpatient, and ancillary service categories, tailored to diverse medical needs spanning acute, chronic, and preventive care.

Driven by rising disease burden, population aging, and technological advancements, the hospital services market is undergoing dynamic transformations. The market includes both public and private healthcare facilities offering specialized and general healthcare services. Globally, hospitals have moved beyond traditional roles to become comprehensive hubs for medical innovation, multidisciplinary treatment, and digital transformation. With healthcare infrastructure expanding in emerging economies and developed countries prioritizing quality and efficiency, the hospital services market is poised for significant growth.

Demand is further fueled by the increasing prevalence of chronic diseases such as cardiovascular conditions, diabetes, respiratory disorders, and cancer, which require sustained hospital-based care. Additionally, advancements in diagnostics, surgical robotics, and telemedicine are reshaping how hospital services are accessed and delivered. Meanwhile, policy reforms and insurance penetration are influencing the landscape of healthcare affordability and accessibility. As health systems grapple with post-pandemic recovery and future-proofing strategies, hospitals remain at the epicenter of health service delivery.

Major Trends in the Market

-

Expansion of Outpatient Services and Ambulatory Care Centers

-

Rising Demand for Specialized Inpatient Services in Oncology, Cardiology, and Neurology

-

Integration of Telehealth in Hospital-Based Consultations and Remote Monitoring

-

Digitalization of Hospital Infrastructure (Electronic Health Records, AI, Cloud Integration)

-

Emergence of Daycare Surgeries Supported by Minimally Invasive Techniques

-

Increased Public-Private Partnerships to Expand Healthcare Access

-

Growth of Home-to-Hospital Continuum Care Models for Chronic Disease Management

-

Shift Toward Patient-Centric and Value-Based Hospital Care Models

-

Utilization of Robotic Surgery and Smart ICUs in Tertiary Hospitals

-

Consolidation in the Private Hospital Sector Through Mergers and Acquisitions

Report Scope of Hospital Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.62 Trillion |

| Market Size by 2034 |

USD 6.78 Trillion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.36% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Ownership, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Apollo Hospitals Enterprise Ltd., Max Healthcare, West Suffolk NHS Foundation Trust, Royal Papworth Hospital NHS Foundation Trust, Cedars-Sinai, UCLA Medical Centers, The Johns Hopkins Hospital, Mayo Clinic, Keio University (Medical Services), THE ROYAL MELBOURNE HOSPITAL, Burjeel Holdings |

Market Driver: Aging Population and Growing Prevalence of Chronic Diseases

A major driver of the hospital services market is the rising global burden of chronic diseases, coupled with a rapidly aging population. According to the World Health Organization, non-communicable diseases (NCDs) account for over 70% of global deaths, with conditions like heart disease, cancer, respiratory illnesses, and diabetes becoming more common due to sedentary lifestyles, poor diet, and environmental factors.

Hospitals remain the primary providers of complex and ongoing care for such patients. Aging populations, particularly in North America, Europe, and Asia Pacific, experience higher incidences of conditions requiring prolonged hospitalization, frequent monitoring, surgeries, and palliative care. This demographic shift is increasing the demand for integrated inpatient and outpatient hospital services, intensive care units (ICUs), and specialty clinics, thereby driving market growth.

Market Restraint: Rising Operational and Infrastructure Costs

A significant restraint to the expansion of hospital services is the high cost of infrastructure development, maintenance, and skilled labor, particularly in developing countries and rural areas. Constructing and equipping modern hospitals demands substantial capital investment—covering land acquisition, regulatory compliance, medical equipment, staffing, and IT infrastructure.

In addition, hospitals face increasing operational costs associated with maintaining hygiene, adopting new technologies, retaining medical personnel, and adhering to evolving accreditation standards. These challenges often strain public hospitals in resource-limited settings and restrict the scalability of private institutions. Furthermore, in countries without robust universal healthcare or insurance coverage, the cost burden is transferred to patients, creating barriers to service utilization and continuity of care.

A pivotal opportunity in the hospital services market lies in the integration of advanced technologies to enhance patient care, operational efficiency, and clinical outcomes. From AI-assisted diagnostics and robotic surgeries to digital health platforms and electronic medical records (EMRs), hospitals are embracing innovation to streamline workflows and personalize patient care.

Telemedicine, in particular, has evolved from a pandemic contingency to a strategic pillar of hybrid hospital models. Virtual consultations, remote patient monitoring, and digital triage systems are reducing hospital crowding and increasing access to specialist services. Technologies like IoT-enabled beds, automated medication dispensing, and AI-driven risk stratification tools are further improving safety and care delivery. Hospitals that invest in digital transformation stand to unlock significant efficiencies, patient satisfaction, and revenue opportunities.

Hospital Services Market By Type Insights

Based on type, the inpatient services segment dominated the market, accounting for the largest market share of 48.71% in 2024. These encompass medical interventions that require patients to be admitted for overnight or extended stays, covering treatment of serious conditions such as cancer, cardiovascular disorders, musculoskeletal diseases, and critical trauma care. Inpatient settings provide structured monitoring, post-surgical rehabilitation, and access to multidisciplinary teams. As tertiary and quaternary care centers expand their ICU and specialty surgery capacity, this segment continues to lead in terms of value and complexity.

Cardiovascular and cancer-related inpatient services are particularly dominant due to the prevalence of heart disease and oncology cases that demand extended care, frequent readmissions, and advanced surgical or therapeutic interventions. Hospitals offering cardiac catheterization labs, electrophysiology units, and cancer infusion centers are witnessing high occupancy rates and procedure volumes.

Simultaneously, outpatient services are the fastest-growing segment, driven by technological advancements that allow for complex procedures to be conducted on a same-day basis. Outpatient clinics now manage chronic conditions, diagnostics, dialysis, minor surgeries, and preventive health screenings, all while offering cost-efficiency and convenience. Ambulatory surgery centers (ASCs) affiliated with hospitals are also gaining popularity, especially in urban markets with younger patient demographics and robust insurance coverage.

Hospital Services Market By Ownership Insights

The publicly/government-owned segment held the largest revenue share of 35.0% in 2024.These institutions form the backbone of national health strategies, offering emergency, maternity, infectious disease, and trauma care. Their role in disaster response, public vaccination programs, and rural outreach ensures their continued relevance. Public hospitals often provide services at subsidized rates, ensuring healthcare equity and access.

However, for-profit privately owned hospitals are emerging as the fastest-growing ownership segment. These institutions are attracting investment from global healthcare groups and private equity firms due to the sector’s stable returns and high-growth potential. For-profit hospitals are typically well-equipped with advanced technology, shorter wait times, premium patient services, and strategic locations in urban areas. They are also driving medical tourism and elective surgery growth, particularly in Asia Pacific and Latin America.

Some of the prominent players in the hospital services market include:

- Apollo Hospitals Enterprise Ltd.

- Max Healthcare

- West Suffolk NHS Foundation Trust

- Royal Papworth Hospital NHS Foundation Trust

- Cedars-Sinai

- UCLA Medical Centers

- The Johns Hopkins Hospital

- Mayo Clinic

- Keio University (Medical Services)

- THE ROYAL MELBOURNE HOSPITAL

- Burjeel Holdings

Hospital Services Market Recent Developments

-

March 2025: Mayo Clinic announced the integration of generative AI into its clinical documentation workflow to reduce physician burnout and improve care efficiency across its U.S. hospital network.

-

February 2025: Apollo Hospitals (India) launched its first AI-driven hybrid hospital in Hyderabad, offering integrated teleconsultation, real-time diagnostics, and robotic surgery capabilities.

-

January 2025: HCA Healthcare (U.S.) acquired three major hospital networks in Florida, expanding its regional footprint and increasing its total inpatient capacity by 10%.

-

December 2024: Ramsay Health Care (Australia) entered a strategic partnership with Alibaba Health to digitize its patient management and billing systems in Southeast Asia.

-

November 2024: NHS England initiated a pilot project to roll out smart hospital wards using IoT sensors, AI-enabled nurse call systems, and automated medication dispensers to improve inpatient safety and resource allocation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the hospital services market

By Type

-

- Cardiovascular Disorders

- Cancer

- Musculoskeletal Diseases

- Emergency & Trauma

- Respiratory Disorder

- Gastroenterology

- CNS Disorders

- Pregnancy and Postpartum Care

- Urology & Nephrology Disorders

- Others

- Outpatient Services

- Ancillary Services

By Ownership

- Publicly/Government-owned

- Not-for-profit privately owned

- For-profit privately owned

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)