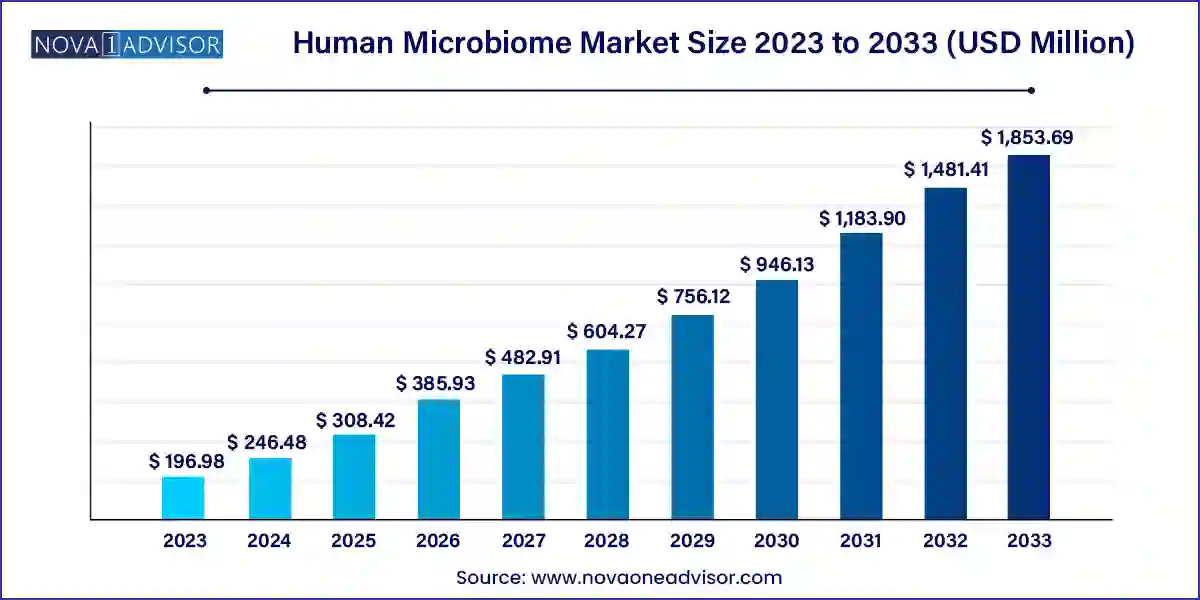

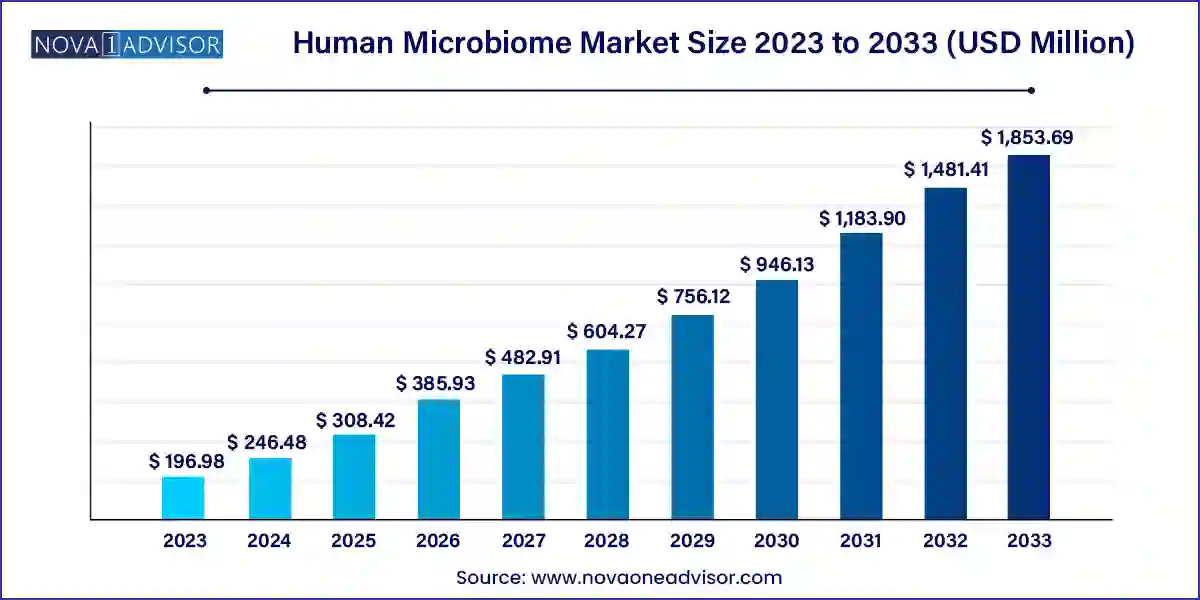

The global human microbiome market size was evaluated at USD 196.98 million in 2023 and is projected to hit around USD 1,853.69 million by 2032, growing at a CAGR of 25.13% from 2024 to 2033.

Key Takeaways:

- By geography, The Europe and North America lead the market.

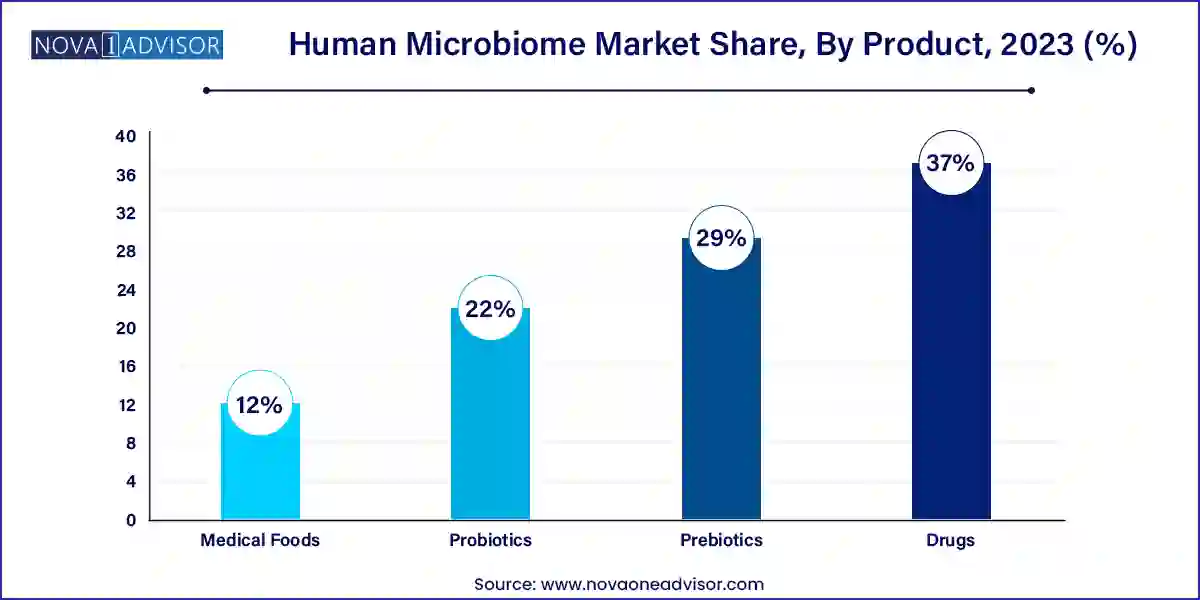

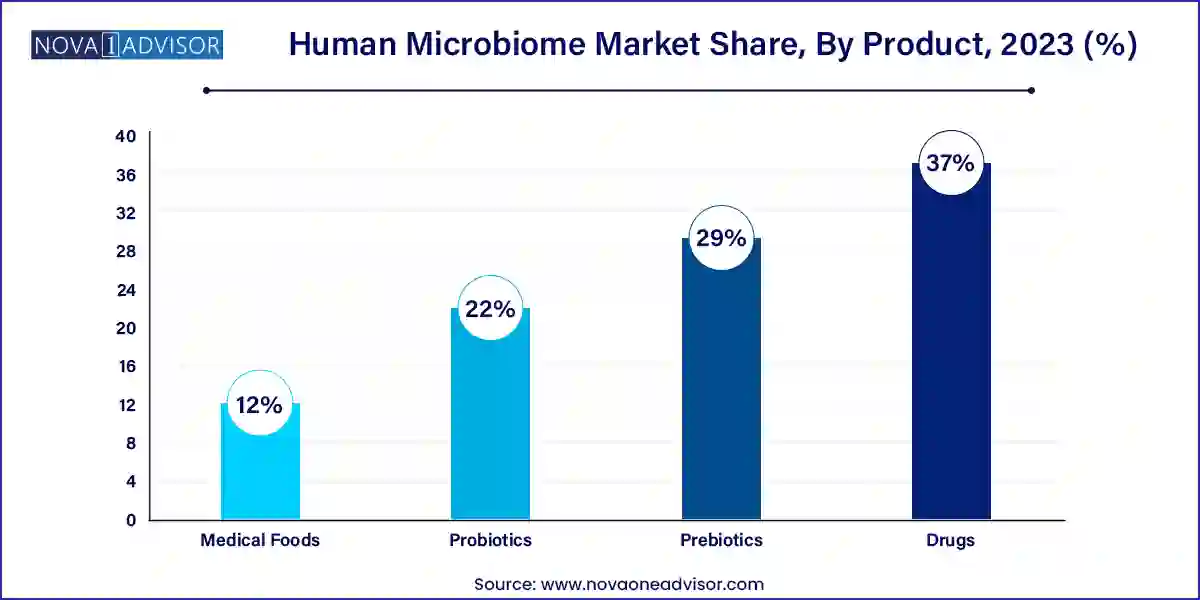

- By product, the drug segment accounted more than 37% of revenue share in 2023.

- By application, the therapeutics segment had the most significant market share in 2023 and is anticipated to achieve a sizable CAGR from 2024 to 2033.

Market Overview

The human microbiome market has evolved from a niche area of research into one of the most promising frontiers in healthcare, with transformative potential across diagnostics, therapeutics, and personalized medicine. The human microbiome comprising trillions of microorganisms residing primarily in the gut, skin, oral cavity, and other body sites plays a vital role in immunity, digestion, neurological functioning, and metabolic balance.

Recent scientific breakthroughs have highlighted how an imbalanced or dysbiotic microbiome contributes to a range of diseases, from metabolic disorders like obesity and diabetes to autoimmune conditions, neurodegenerative diseases, infectious illnesses, and even some forms of cancer. As a result, microbiome-based interventions are now being viewed not just as complementary approaches but as central pillars of next-generation healthcare.

This market encompasses a broad array of products and services, including prebiotics, probiotics, therapeutic drugs, diagnostic tools, and medical foods specifically developed to target the microbiome. Startups, pharmaceutical companies, food manufacturers, and diagnostic firms are converging in this space, propelled by strong academic interest, increasing clinical trial activity, and a growing consumer demand for gut-health products.

With the emergence of microbiome-based therapeutics (often referred to as "pharmabiotics"), microbiome diagnostics, and precision nutrition, the market is witnessing a major shift from supplement-style products to regulated, scientifically validated interventions. Regulatory agencies like the FDA and EMA are actively developing frameworks for microbiome therapies, a testament to the growing maturity of the sector.

Major Trends in the Market

-

Surge in Microbiome-Based Therapeutics

Pharmaceutical companies are investing in live biotherapeutic products (LBPs) and genetically engineered microbes for treating conditions like C. difficile infection, IBD, and cancer.

-

Integration with Precision Medicine and Genomics

Microbiome profiles are being integrated into personalized treatment plans for metabolic and neurological disorders, paving the way for microbiome-informed medicine.

-

Expansion of Microbiome Diagnostics

Advanced sequencing and metabolomic technologies are enabling non-invasive diagnostics for gastrointestinal and metabolic diseases based on microbiome composition.

-

Probiotics and Functional Foods in Consumer Health

There’s a surge in demand for probiotics, postbiotics, and synbiotics in functional beverages, dairy alternatives, and dietary supplements targeting gut and immune health.

-

Academic-Industry Collaborations Accelerating R&D

Joint ventures between universities and biotech companies are fostering innovations in microbiome research and pipeline development.

Report Scope of The Human Microbiome Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 246.48 Million |

| Market Size by 2033 |

USD 1,853.69 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 25.13% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Product, By Application and By Disease Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AOBiome, Yakult Honsha Co., Metabiomics Corp. (BioSpherex LLC), Enterome Biosciences SA, Osel, Inc., Microbiome Therapeutics LLC, Second Genome, Rebiotix, Inc., Synthetic Biologics, Inc., Seres Therapeutics, 4D Pharma, Vedanta Biosciences, Ferring Pharmaceuticals, Du Pont De Nemours and Co. and Others. |

Market Driver: Increasing Awareness of Gut Health and Its Systemic Impact

The recognition of the gut microbiome as a central regulator of systemic health is a key driver of this market. Scientific studies increasingly correlate gut microbiota composition with not only gastrointestinal diseases but also mental health, autoimmune conditions, allergies, metabolic syndrome, and skin disorders.

For example, research has demonstrated that individuals with depression often show altered gut microbial profiles, sparking development of microbiome-targeted psychobiotics. Similarly, obesity and type 2 diabetes have been linked to dysbiosis, prompting the development of dietary and pharmaceutical interventions aimed at restoring microbial balance.

This widespread systemic relevance, combined with rising consumer interest in wellness and preventive healthcare, has made the microbiome an attractive target for both pharma and nutrition companies. It’s no longer seen as a fringe science but rather as a foundational layer in the understanding of human health and disease.

Market Restraint: Lack of Standardization and Regulatory Clarity

Despite its promise, the human microbiome market faces a major restraint in the form of regulatory uncertainty and lack of standardization. While products like probiotics and prebiotics are often classified as dietary supplements and governed by food safety laws, emerging therapeutics especially live biotherapeutic products face a more complex regulatory path.

There is currently no globally harmonized framework for microbiome-based drugs, which creates ambiguity for manufacturers and investors. Additionally, microbiome diagnostics often lack clear clinical cut-offs, making them difficult to standardize for widespread clinical use. This lack of clarity slows adoption among healthcare providers and limits payer reimbursement in many regions.

Moreover, the inherent variability in microbiome profiles across individuals due to genetics, diet, environment, and lifestyle adds complexity in defining what constitutes a "healthy" or "dysbiotic" microbiome further complicating product development and marketing claims.

Market Opportunity: Microbiome Therapeutics for Non-Communicable and Rare Diseases

A substantial opportunity in the human microbiome market lies in developing therapeutics for non-communicable and rare diseases. The limitations of conventional drugs in treating complex, multifactorial conditions such as Crohn’s disease, ulcerative colitis, autism spectrum disorder, and even certain cancers have opened the door for microbiome-based solutions.

Live biotherapeutic products and fecal microbiota transplantation (FMT)-derived therapies are being explored as novel, low-toxicity treatment options. For example, several biotech startups are developing capsules containing consortia of beneficial microbes to modulate immune responses or restore metabolic balance in rare autoimmune conditions.

The orphan drug designation granted to certain microbiome therapies in the U.S. and Europe is further incentivizing innovation in this domain. As microbiome research becomes more disease-specific, there's a rising potential to create first-in-class therapeutics for conditions that have seen limited progress in decades.

Segments:

Human Microbiome Market By Application Insights

Therapeutics represent the dominant application of microbiome research and commercialization. This includes interventions that actively modulate the gut microbiota to restore balance, suppress pathogenic organisms, or enhance host immune responses.

From gastrointestinal conditions to metabolic syndromes, the therapeutic applications of microbiome interventions are expanding rapidly. Companies are developing microbiome modulators that can reduce insulin resistance, improve lipid metabolism, and regulate neuroinflammation. As scientific validation and clinical trial success increase, the therapeutic segment will continue to anchor the market’s trajectory.

Diagnostics is the fastest-growing application segment, driven by rising demand for personalized health assessments and early detection tools. Microbiome profiling kits that analyze stool, saliva, or skin samples are now available both for consumer health and clinical use.

Advances in next-generation sequencing (NGS), machine learning, and metagenomics are enabling high-resolution mapping of microbial populations. These tools are being used to predict risks of gastrointestinal diseases, metabolic disorders, and immune dysfunctions. Additionally, pharmaceutical companies use microbiome diagnostics in patient stratification and therapy response prediction, accelerating growth in this space.

Human Microbiome Market By Product Insights

Probiotics dominate the product segment due to their widespread acceptance in consumer health, over-the-counter wellness products, and functional foods. Probiotic formulations based on Lactobacillus, Bifidobacterium, and Saccharomyces strains are routinely marketed for gut health, immunity, and digestive comfort.

The growing consumer inclination toward preventive wellness, especially post-pandemic, has led to increased consumption of probiotic-rich yogurts, drinks, and capsules. Their perceived safety and ease of incorporation into daily diets further reinforce their dominance. Major pharmaceutical and nutraceutical companies have introduced targeted probiotic products for women’s health, pediatric immunity, and even mental well-being (psychobiotics).

The fastest-growing segment is microbiome-based therapeutics—specifically, drugs designed to treat diseases by modulating the microbiome. This category includes live biotherapeutics, engineered bacterial consortia, and FMT-derived products. Numerous candidates are in late-stage clinical trials targeting indications like Clostridioides difficile infections (CDI), irritable bowel syndrome, and inflammatory bowel diseases.

Unlike conventional probiotics, these are regulated as pharmaceutical products and are undergoing rigorous clinical validation. Their growth is driven by unmet medical needs and the failure of existing therapies in some chronic and recurrent conditions. The success of FDA-approved microbiome drugs in coming years will likely accelerate this segment’s evolution.

Regional Analysis

North America leads the human microbiome market due to its advanced R&D ecosystem, strong academic presence, and robust regulatory and investment landscape. The United States is home to numerous pioneering microbiome startups and hosts many ongoing clinical trials involving microbiome drugs and diagnostics.

FDA engagement in crafting regulatory pathways for microbiome therapeutics and the presence of leading research institutions (such as Harvard, MIT, and Stanford) further bolster North America's dominance. Strategic partnerships between biotech firms and pharma giants like Johnson & Johnson and Pfizer are also common, indicating high commercial interest in the region.

Asia-Pacific is emerging as the fastest-growing region, thanks to rising awareness about gut health, expanding functional food industries, and growing investments in life sciences. Countries like China, Japan, South Korea, and India are witnessing a boom in probiotic consumption, driven by changing dietary patterns and consumer preferences for wellness products.

Moreover, regional governments and private investors are funding microbiome research for traditional medicine, personalized nutrition, and chronic disease prevention. Japan, for instance, is exploring microbiome applications in aging and neurological health, aligning with its demographic profile. The region’s blend of innovation, market scale, and supportive policies makes it a future powerhouse in the global microbiome landscape.

Recent Developments

-

January 2025 – Finch Therapeutics announced the completion of Phase III trials for their microbiome-based drug targeting recurrent C. difficile infections.

The trial showed positive efficacy and safety results, potentially paving the way for one of the first FDA-approved microbiome therapeutics.

-

February 2025 – A China-based biotech startup launched a gut microbiome diagnostic kit that uses AI to predict risk factors for metabolic disorders, attracting major venture capital investment.

-

March 2025 – Nestlé Health Science expanded its prebiotic product line with a fiber-based formula designed to modulate the microbiome in diabetic patients, entering clinical trials in Europe.

Competitive Analysis

The market for the human microbiome is moderately competitive, and many competitors are developing new goods. Organizations including Axial Biotherapeutics, Inc., Series Therapeutics, DuPont, Second Genome, and Synthetic Biologics hold significant market shares. Important firms are improving the therapies pipeline by creating effective and secure medications.

Some of the prominent players in the Human microbiome market include:

- AOBiome

- Yakult Honsha Co.

- Metabiomics Corp. (BioSpherex LLC)

- Enterome Biosciences SA

- Osel, Inc.

- Microbiome Therapeutics LLC

- Second Genome

- Rebiotix, Inc.

- Synthetic Biologics, Inc.

- Seres Therapeutics

- 4D Pharma

- Vedanta Biosciences

- Ferring Pharmaceuticals

- Du Pont De Nemours and Co.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global human microbiome market.

By Product

- Prebiotics

- Probiotics

- Drugs

- Medical Foods

By Application

By Disease Type

- Metabolic

- Infectious

- Endocrine

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)