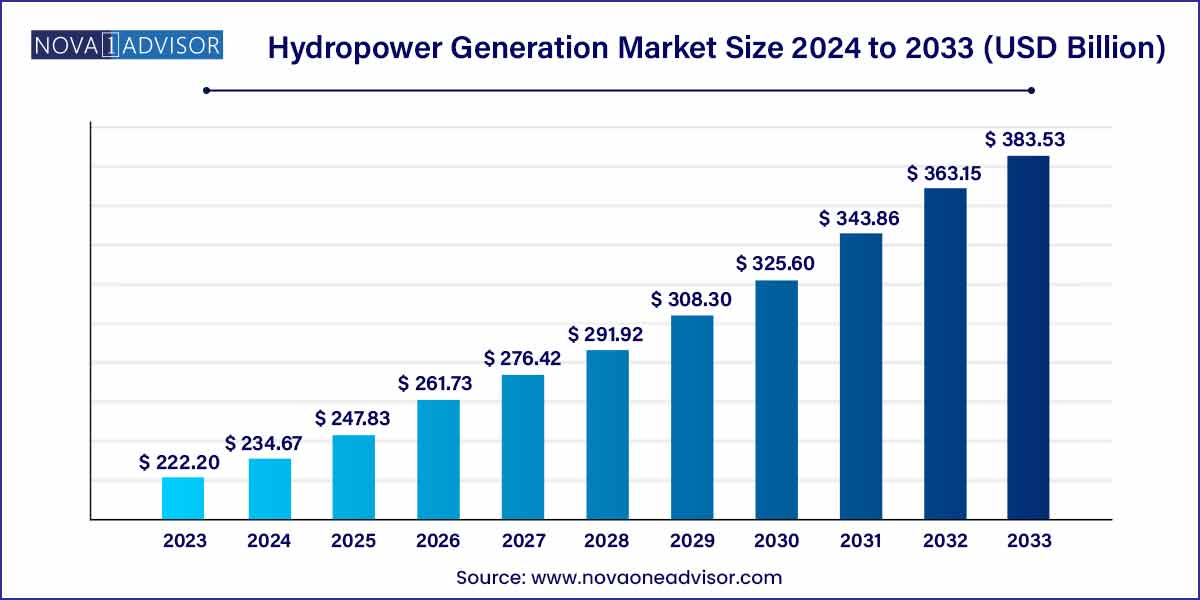

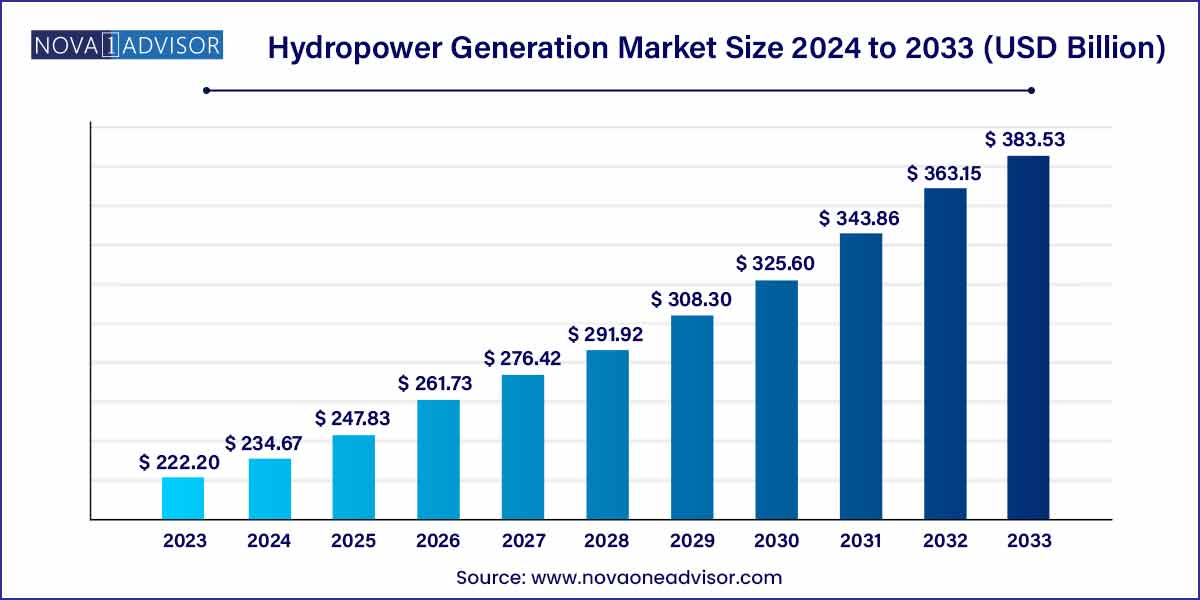

The global hydropower generation market size was exhibited at USD 222.20 billion in 2023 and is projected to hit around USD 383.53 billion by 2033, growing at a CAGR of 5.61% during the forecast period of 2024 to 2033.

Key Takeaways:

- Europe dominated the hydropower generation market in 2023.

- The large hydro power segment dominated the hydropower generation market in 2023.

- The small hydro power segment is fastest growing segment of the hydropower generation market in 2023.

Market Overview

The hydropower generation market stands as a cornerstone of the global renewable energy landscape, owing to its ability to deliver large-scale, reliable, and sustainable electricity. Derived from the kinetic energy of flowing water, hydropower has been harnessed for centuries, evolving from simple water wheels to sophisticated dam and turbine systems. As of 2025, hydropower accounts for around 16% of the world’s total electricity production and about 60% of all renewable electricity, making it the largest renewable source globally.

The growing need for clean energy, combined with supportive government policies and incentives, is propelling the hydropower market forward. Moreover, the strategic importance of energy security and rural electrification, particularly in emerging economies, continues to boost investments in hydropower infrastructure. The sector is characterized by a mix of large-scale hydroelectric dams, small and medium hydro plants, and innovative pumped storage projects aimed at energy balancing in grids integrated with intermittent renewable sources like wind and solar.

However, environmental concerns, displacement issues, and high initial capital investment requirements pose significant challenges. Nonetheless, technological advancements such as fish-friendly turbines, digital monitoring solutions, and more sustainable construction techniques are helping address these concerns and shaping a more sustainable future for hydropower.

Major Trends in the Market

-

Digitalization of Hydropower Plants: Remote monitoring, predictive maintenance, and AI-driven efficiency optimization are increasingly being adopted.

-

Hybrid Systems: Integration of hydropower with solar PV systems is gaining popularity, especially in regions with seasonal rainfall.

-

Pumped Storage Expansion: Pumped storage projects are being developed as large-scale energy storage solutions, vital for stabilizing renewable-heavy grids.

-

Small and Micro Hydropower Growth: Increasing focus on decentralized energy systems is driving demand for small and micro hydropower solutions.

-

Environmental Innovations: Eco-friendly designs, like fish passage systems and sediment management, are becoming standard to reduce ecological impact.

-

Private Sector Participation: Liberalization policies are inviting private players into hydropower development and operations.

-

Climate Resilient Infrastructure: There is a growing emphasis on designing hydro plants that can withstand extreme climate variability.

Hydropower Generation Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 222.20 Billion |

| Market Size by 2033 |

USD 383.53 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.61% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Capacity, Application, Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Andritz Hydro USA Inc., GE Energy, CPFL Energia S.A., Sinohydro Corporation, IHI Corporation, Alstom Hydro, China Hydroelectric Corporation, China Three Gorges Corporation, ABB Ltd., Tata Power Corporation |

Driver: Growing Demand for Renewable and Sustainable Energy Sources

The transition to a low-carbon economy is heavily reliant on renewable energy, and hydropower plays a pivotal role in this shift. Governments worldwide are setting ambitious targets for carbon neutrality, and hydropower provides a dependable solution due to its consistent generation capacity, unlike solar and wind which are intermittent. For instance, the European Union aims for climate neutrality by 2050, and hydropower is integral to achieving this. Similarly, countries like China, Brazil, and India are heavily investing in new hydro projects to ensure energy security while meeting their environmental commitments. The ability of hydropower to provide baseload power, grid stability, and ancillary services such as frequency regulation makes it indispensable in modern energy systems.

Restraint: High Initial Capital Investment

One of the major barriers restraining the growth of the hydropower generation market is the substantial upfront capital required for the development of hydropower plants. Large-scale projects involve significant expenses related to feasibility studies, environmental impact assessments, land acquisition, construction of dams, installation of turbines, and setting up transmission infrastructure. For example, the construction of the Belo Monte Dam in Brazil cost over $16 billion, highlighting the enormous financial commitment required. Moreover, prolonged gestation periods and regulatory hurdles further escalate costs and discourage private investment. This economic burden is particularly challenging for developing nations where financial resources are limited, thereby hindering market expansion.

Opportunity: Revamping and Modernization of Existing Infrastructure

A major opportunity within the hydropower market lies in the upgrading and modernization of existing aging infrastructure. Many hydropower facilities worldwide were constructed several decades ago and now operate below optimal efficiency. By retrofitting older plants with modern turbine technologies, digital control systems, and environmental mitigation measures, operators can significantly enhance capacity and efficiency with comparatively lower investment than building new facilities. For instance, the U.S. Department of Energy has initiatives supporting the refurbishment of non-powered dams, providing an avenue for increasing renewable capacity without new construction. Such modernization efforts offer a lucrative market segment for technology providers, construction firms, and operators alike.

Segmental Analysis

By Capacity

Large hydropower plants (above 10MW) dominated the hydropower generation market, accounting for a major share in 2024. These plants are often national or regional flagship projects, providing consistent, large-scale electricity generation critical for grid stability. The Three Gorges Dam in China, the world’s largest hydroelectric power station, stands as a testament to the dominance of this segment. The economies of scale achieved with large projects result in lower cost per unit of electricity over the plant's lifetime, making them attractive long-term investments. Large plants also offer multi-functional benefits, such as flood control, irrigation support, and water supply.

Conversely, small hydropower plants (up to 1MW) are expected to be the fastest-growing segment during the forecast period. Their growth is fueled by the rising demand for decentralized and off-grid energy solutions, especially in remote and rural areas. Countries like India and Nepal are actively promoting small hydro projects to enhance rural electrification. Additionally, small hydro plants face fewer regulatory hurdles, have shorter construction times, and exert a lesser environmental impact compared to large dams. This agility makes them an ideal solution for sustainable development initiatives and community-driven energy projects.

By Application

The industrial segment dominated the application landscape of the hydropower generation market. Industries with high energy demands, such as mining, metal processing, and chemical manufacturing, increasingly rely on dedicated hydroelectric facilities to ensure reliable power supply and control energy costs. In regions like Latin America, particularly Brazil and Chile, industries are major off-takers of hydro-generated electricity, leveraging it to maintain competitive operational costs and reduce carbon footprints.

Meanwhile, the residential application segment is anticipated to witness the fastest growth in the coming years. Growing awareness about sustainable energy, along with supportive subsidies and incentives for micro and mini-hydropower installations, is encouraging households to adopt hydropower. Technological advancements enabling efficient small-scale turbines and easier grid integration are making residential hydropower more accessible, particularly in eco-conscious and remote communities.

Regional Analysis

Asia-Pacific dominated the hydropower generation market with the largest installed capacity and ongoing expansion activities. China remains the global leader, boasting projects like the Baihetan and Wudongde Dams, coupled with aggressive policies promoting clean energy transitions. India, Vietnam, and Indonesia are also rapidly expanding their hydropower capacities to meet burgeoning energy demands fueled by economic growth and urbanization. Government initiatives, abundant water resources, and large-scale investments are sustaining Asia-Pacific's leadership in the market.

Africa is poised to be the fastest-growing region in the hydropower generation market. Countries such as Ethiopia, Uganda, and Angola are making significant investments in large hydro projects to address chronic energy shortages and drive economic development. The Grand Ethiopian Renaissance Dam, once fully operational, will greatly enhance Ethiopia's energy export potential across East Africa. Multilateral funding from entities like the World Bank and African Development Bank is accelerating project development, positioning Africa as a future hydropower powerhouse.

Key Developments

-

March 2025: GE Vernova announced the successful commissioning of hydropower modernization projects across India, enhancing efficiency and sustainability.

-

February 2025: Voith Hydro secured a contract for the modernization of the Mica and Revelstoke hydropower plants in Canada, with an emphasis on integrating digital monitoring technologies.

-

January 2025: EDF announced plans to invest €2 billion in upgrading its French hydropower fleet over the next five years to improve resilience against climate change.

-

November 2024: China Three Gorges Corporation completed the construction of new power generation units at the Baihetan Dam, adding an additional 4 GW capacity.

-

October 2024: Andritz Hydro unveiled a new fish-friendly turbine technology aimed at reducing the environmental impact of hydroelectric plants.

Some of the prominent players in the hydropower generation market include:

- Andritz Hydro USA Inc.

- GE Energy

- CPFL Energia S.A.

- Sinohydro Corporation

- IHI Corporation

- Alstom Hydro

- China Hydroelectric Corporation

- China Three Gorges Corporation

- ABB Ltd.

- Tata Power Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hydropower generation market.

By Capacity

- Small Hydro Power Plant (Up to 1MW)

- Medium Hydro Power Plant (1MW - 10MW)

- Large Hydro Power Plant (Above 10MW)

By Application

- Commercial

- Industrial

- Residential

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)