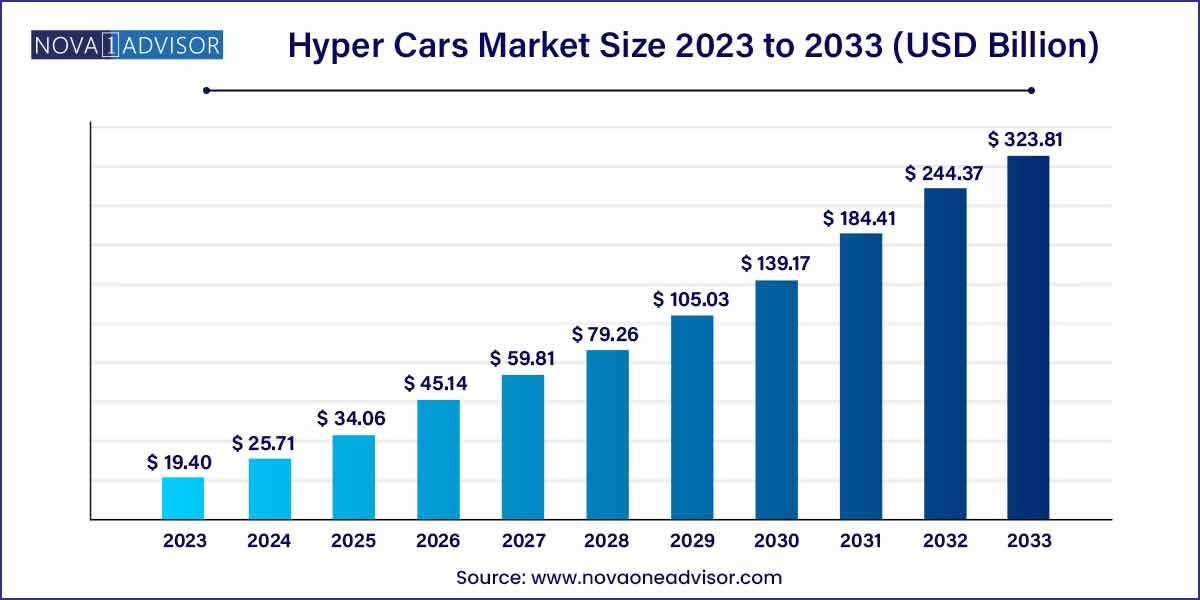

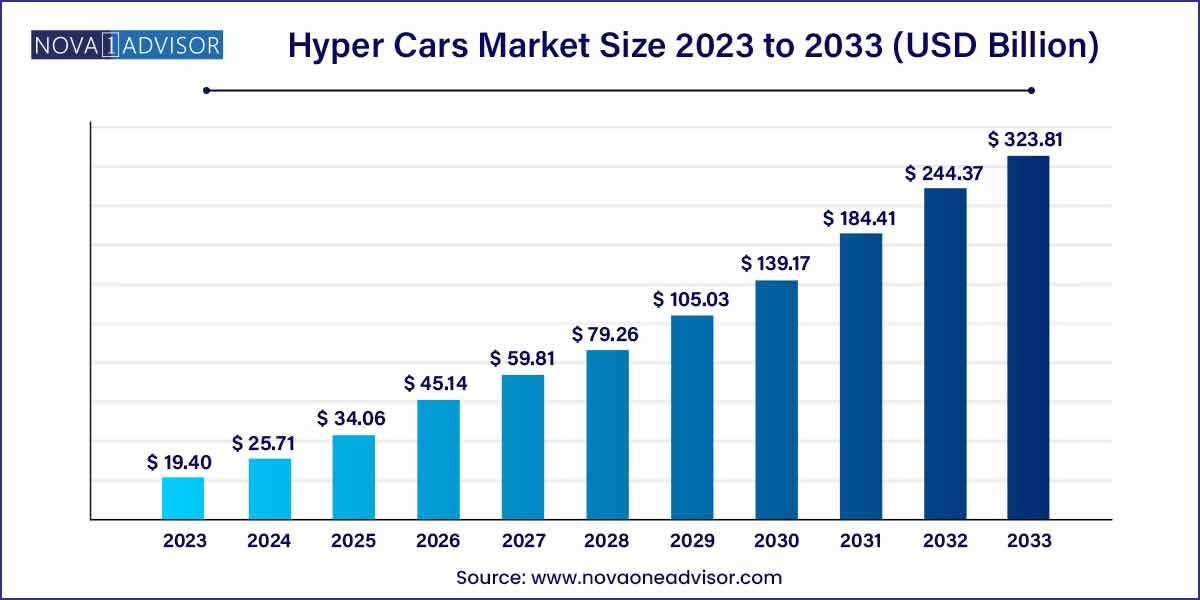

The global hypercar market size was exhibited at USD 19.40 billion in 2023 and is projected to hit around USD 323.81 billion by 2033, growing at a CAGR of 32.51% during the forecast period of 2024 to 2033.

Key Takeaways:

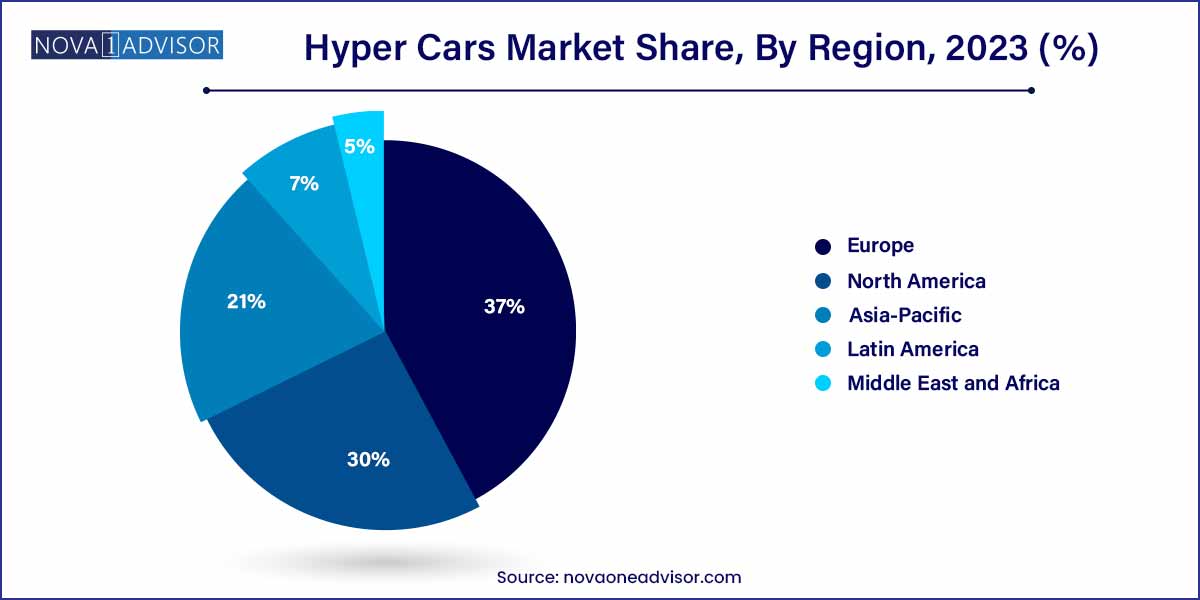

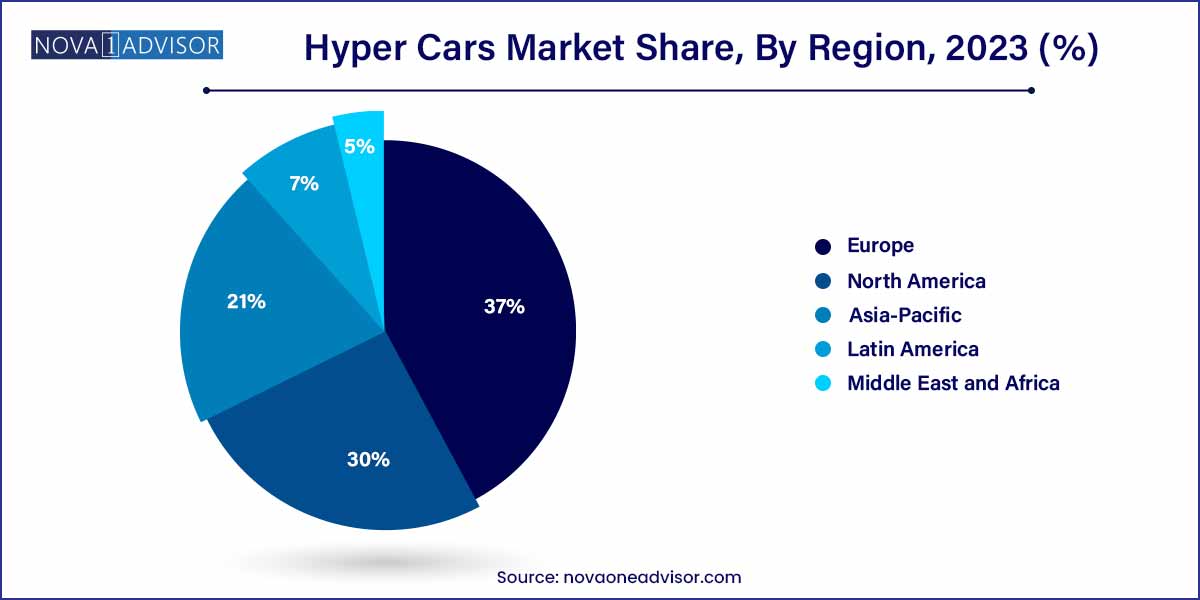

- In 2023, Europe held the largest market share of 37% in the hypercar market.

- North America is expected to expand at the fastest pace during the forecast period.

- By propulsion, the hybrid vehicle segment dominated the hypercar market with the highest share in 2023.

- By propulsion, the electric vehicle segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the racing competition segment held the largest share of 43% in 2023.

- By application, the private segment is expected to witness a significant increase during the forecast period.

Hyper Cars Market: Overview

The global hyper cars market represents the pinnacle of automotive engineering, luxury, and performance. Hyper cars, distinguished from supercars by their extraordinary top speeds, cutting-edge technology, and astronomical price tags, cater to a niche yet highly influential segment of affluent enthusiasts, collectors, and racing teams. These vehicles often showcase the latest innovations in propulsion systems, aerodynamics, lightweight materials, and safety technologies, setting benchmarks for the broader automotive industry.

With roots dating back to iconic models like the McLaren F1 in the 1990s, today's hyper cars, such as the Bugatti Chiron, Koenigsegg Jesko, and Aston Martin Valkyrie, symbolize technical mastery and brand prestige. The market is characterized by limited production runs, bespoke manufacturing, and a growing emphasis on hybrid and electric powertrains to meet performance and environmental expectations.

Despite the exclusivity and economic uncertainties affecting luxury goods sectors, the hyper cars market remains resilient. Demand is fueled by expanding global wealth pools, particularly in emerging economies, technological collaborations between OEMs and racing divisions, and the enduring allure of owning an engineering marvel. As new entrants and established players push boundaries with electrification, connectivity, and personalization, the hyper cars segment is poised for continued growth and transformation.

HyperCars Market Growth

The growth of the hypercar market is underpinned by several key factors driving its expansion. Technological advancements play a pivotal role, as breakthroughs in materials science, aerodynamics, and battery technology continually enhance the performance capabilities of hypercars, attracting enthusiasts and investors alike. Moreover, the rising affluence of high-net-worth individuals globally fuels demand for luxury goods, positioning hypercars as coveted symbols of status and prestige. Additionally, the rich racing heritage of hypercar manufacturers adds allure and credibility to their road-going models, attracting motorsport enthusiasts and collectors alike. These factors collectively contribute to the sustained growth and evolution of the hypercars market, promising an exciting future for automotive innovation and luxury.

Hyper Cars Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 19.40 Billion |

| Market Size by 2033 |

USD 323.81 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 32.51% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Propulsion and By Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Ferrari, McLaren Automotive, Lotus Cars, Bugatti, Porsche, Koenigsegg Automotive AB, Zenvo Automotive, Alfa Romeo, W Motors, JLR, Dendrobium, Xing Mobility, Pininfarina, Aspark, Ariel, Tesla, Hispano Suiza, Aston Martin, Pagani, Lamborghini, Rimac Automobili, Mercedes, Gordon Murray Automotive, and Others. |

Hypercars Market Dynamics

- Technological Advancements:

The hypercars market is propelled by continuous technological advancements, which enable manufacturers to push the boundaries of performance and innovation. Breakthroughs in materials science, aerodynamics, and propulsion systems allow hypercar makers to achieve unprecedented levels of speed, agility, and efficiency. Furthermore, the integration of cutting-edge technologies such as electric powertrains and advanced driver assistance systems (ADAS) enhances both performance and sustainability, catering to evolving consumer preferences and regulatory requirements.

Luxury and exclusivity are fundamental drivers shaping the hypercar market, catering to a niche segment of affluent consumers seeking bespoke automotive experiences. Hyper cars represent the epitome of automotive craftsmanship, with meticulous attention to detail and premium materials used in their construction. Manufacturers offer extensive customization options, allowing buyers to personalize every aspect of their hypercar, from exterior finishes to interior upholstery, creating truly unique vehicles tailored to individual preferences. Moreover, limited production runs and exclusive collaborations further enhance the allure of hypercars, positioning them as highly coveted collector's items.

HyperCars Market Restraint

One of the significant restraints facing the hypercars market is the prohibitively high cost of entry for both manufacturers and consumers. The development and production of hypercars entail substantial investments in research, development, and manufacturing processes, resulting in elevated production costs. For manufacturers, the high cost of entry limits the number of players in the market and acts as a barrier to entry for new entrants.

The hypercar market is subject to stringent regulatory requirements governing emissions, safety standards, and performance specifications, which pose challenges for manufacturers seeking to meet regulatory compliance while maintaining performance and innovation. Increasingly stringent emission regulations incentivize manufacturers to explore alternative powertrain technologies such as electrification, which present both opportunities and challenges in terms of performance, range, and infrastructure requirements. Moreover, evolving safety standards and certification processes add complexity and cost to the development and production of hypercars.

Hypercars Market Opportunity

The growing emphasis on sustainability presents a significant opportunity for innovation within the hypercars market. With increasing concerns about climate change and environmental impact, there is a growing demand for sustainable transportation solutions. Hypercar manufacturers have the opportunity to lead the industry in adopting environmentally friendly technologies, such as electric powertrains, advanced lightweight materials, and regenerative braking systems. By embracing sustainability, hyper car manufacturers can not only reduce their carbon footprint but also appeal to environmentally conscious consumers who seek high-performance vehicles with minimal environmental impact.

- Emerging Markets and Demographics:

Expanding into emerging markets and demographics presents a lucrative opportunity for growth within the hypercars market. As economies in regions such as Asia-Pacific, Latin America, and the Middle East continue to grow, so does the number of high-net-worth individuals with a penchant for luxury and performance. These emerging markets offer untapped potential for hyper car manufacturers to introduce their brands and products to new audiences. Moreover, the rising affluence of younger demographics, particularly millennials and Gen Z, presents an opportunity for hypercar manufacturers to appeal to a new generation of enthusiasts.

Hypercar Market Challenges

The hypercar market is subject to a complex web of regulatory requirements, spanning emissions standards, safety regulations, and performance criteria. Meeting these regulations while maintaining the high-performance characteristics and luxury attributes of hyper cars poses a significant challenge for manufacturers. Stricter emissions standards necessitate the adoption of alternative powertrain technologies such as electrification, which require substantial investments in research, development, and infrastructure. Moreover, evolving safety regulations require continuous innovation in crashworthiness and driver assistance systems, adding complexity and cost to the design and production process.

The limited production capacity of hypercars presents a significant challenge for manufacturers, impacting both supply and demand dynamics within the market. Hypercars are often handcrafted and produced in limited quantities, resulting in lengthy lead times and high production costs. Production constraints, such as limited skilled labor and specialized manufacturing processes, restrict the scalability of hypercar production and limit market accessibility. Additionally, the exclusivity associated with limited production runs and bespoke creations drives up prices, further constraining demand from price-sensitive consumers.

Segments Insights:

Propulsion Insight

ICE (Internal Combustion Engine) vehicles dominated the propulsion segment of the hyper cars market. Historically, hyper cars have been synonymous with roaring V8, V10, and V12 engines delivering unparalleled visceral experiences. Models like the Bugatti Veyron and Lamborghini Aventador have defined performance benchmarks with combustion-based powertrains. The dominance of ICE vehicles stems from their established engineering pedigree, emotional appeal, and brand heritage.

However, Electric Vehicles (EVs) are emerging as the fastest-growing propulsion segment. Recent years have witnessed a surge in electric hyper cars that deliver instant torque, zero emissions, and futuristic designs. Rimac Nevera, Lotus Evija, and Pininfarina Battista exemplify this shift. Startups and legacy automakers alike are channeling investments into high-performance electric platforms to meet evolving market expectations and sustainability mandates, making EVs the segment to watch for the future.

Application Insight

Private ownership dominated the application segment of the hyper cars market. A majority of hyper cars are owned by ultra-high-net-worth individuals who value exclusivity, craftsmanship, and investment potential. These owners often curate extensive car collections, with hyper cars serving as crown jewels. Private buyers are also drawn to the prestige of customizing their vehicles through bespoke programs offered by brands like Ferrari's "Tailor Made" or McLaren's "MSO Bespoke."

Meanwhile, Racing competition applications are witnessing significant growth. Hyper cars adapted for track use, such as the Ferrari FXX-K Evo and McLaren P1 GTR, are gaining popularity among motorsport enthusiasts and professional teams. Brands are organizing exclusive racing events, "track days," and performance programs for customers, blending private ownership with competitive experiences, thereby creating new revenue streams and deepening customer engagement.

Hypercars Market in Europe 2024–2033

Europe dominated the global hyper cars market in terms of production and demand. Home to iconic brands like Bugatti (France), Ferrari (Italy), McLaren (UK), and Koenigsegg (Sweden), Europe is the epicenter of hyper car manufacturing. The region benefits from a rich automotive heritage, skilled labor, robust R&D ecosystems, and a high concentration of wealthy consumers. Furthermore, Europe's extensive racing culture and access to high-speed road networks, such as Germany's autobahns, contribute to sustained demand for hyper cars.

Asia-Pacific is the fastest-growing region in the hyper cars market. Rapid economic growth, expanding high-net-worth populations, and increasing cultural emphasis on luxury goods are driving hyper car sales in countries like China, Japan, India, and the UAE (part of the broader MEA region but influential in APAC-linked luxury flows). Chinese collectors and investors, in particular, have shown increasing interest in limited-edition models and exclusive hyper car experiences, prompting manufacturers to intensify regional marketing efforts and open bespoke brand studios.

Recent Developments

-

April 2025: Bugatti revealed the "Tourbillon," its new hybrid hypercar featuring a naturally aspirated V16 engine coupled with three electric motors, signaling a bold step toward sustainable performance.

-

March 2025: Lotus Cars announced that production of its all-electric hypercar, the Evija, had commenced, with deliveries scheduled for Q2 2025.

-

February 2025: Rimac Automobili partnered with Pininfarina to supply battery and drivetrain technology for the Battista hypercar.

-

January 2025: Ferrari unveiled the "SF90 XX Stradale," an evolution of its hybrid SF90 platform with enhanced track-focused capabilities, blending electrification and motorsport engineering.

Some of the prominent players in the hypercar market include:

- Ferrari

- McLaren Automotive

- Lotus Cars

- Bugatti

- Porsche

- Koenigsegg Automotive AB

- Zenvo Automotive

- Alfa Romeo

- W Motors

- JLR

- Dendrobium

- Xing Mobility

- Pininfarina

- Aspark

- Ariel

- Tesla

- Hispano Suiza

- Aston Martin

- Pagani

- Lamborghini

- Rimac Automobili

- Mercedes

- Gordon Murray Automotive

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hyper cars market.

By Propulsion

- Hybrid vehicles

- Electric vehicles

- ICE vehicles

By Application

- Racing competition

- Private

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)