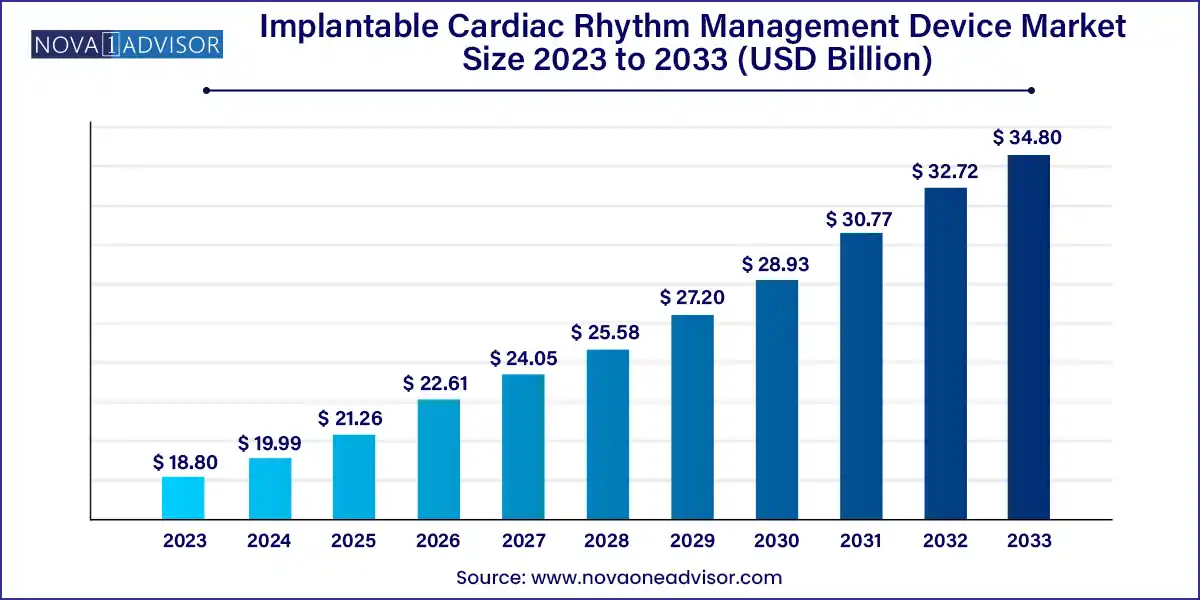

The global implantable cardiac rhythm management device market size was exhibited at USD 18.80 billion in 2023 and is projected to hit around USD 34.80 billion by 2033, growing at a CAGR of 6.35% during the forecast period 2024 to 2033.

Key Takeaways:

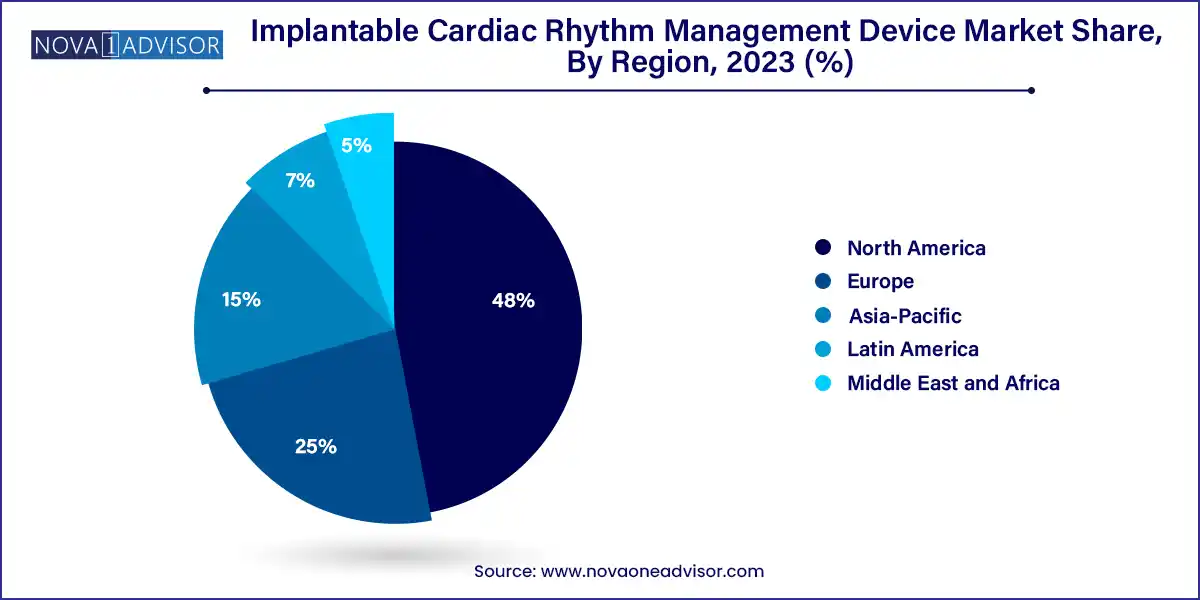

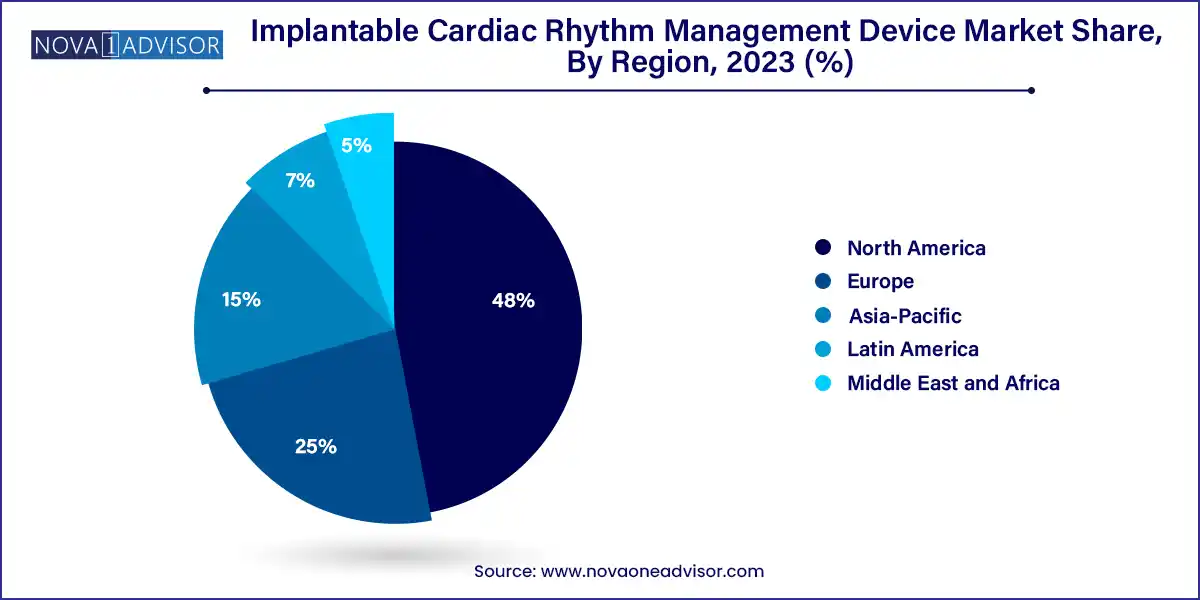

- North America captured the largest revenue share of over 48.0% in 2023

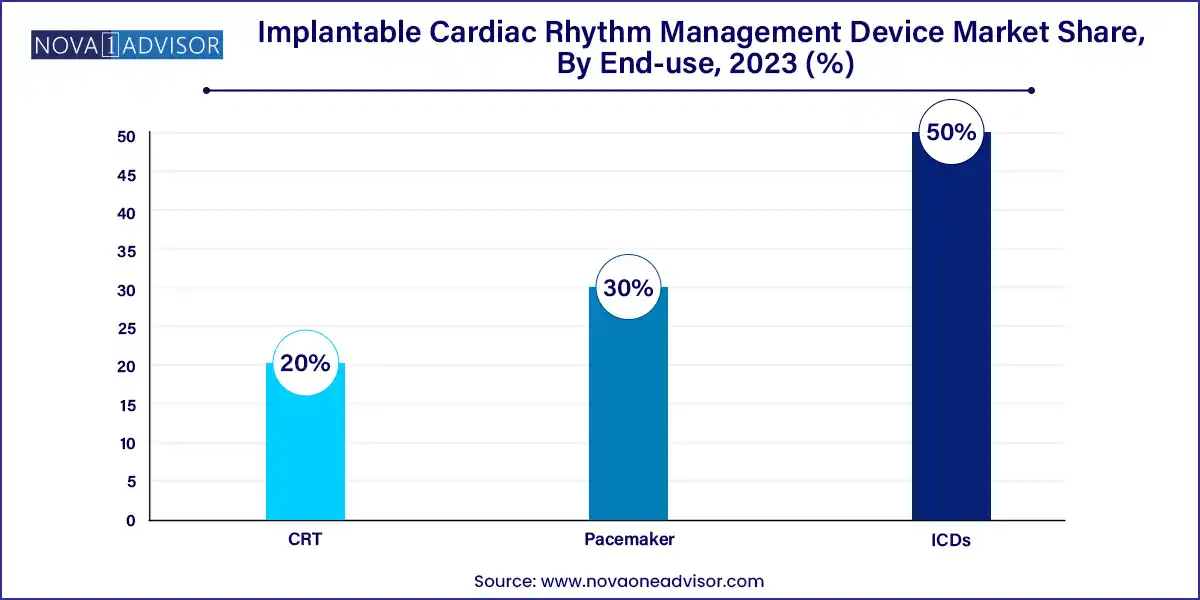

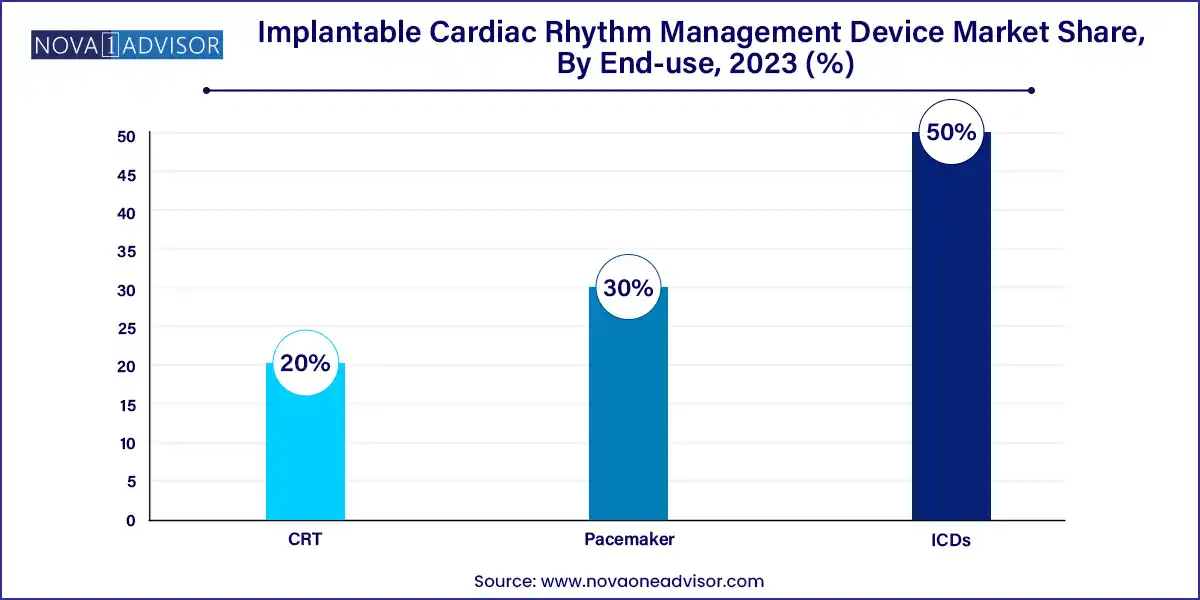

- The ICDs segment accounted for the largest revenue share of over 50.0% in 2023.

- The hospitals segment accounted for the leading revenue share of over 50.0% in 2023.

Market Overview

The Implantable Cardiac Rhythm Management (CRM) Device Market represents a vital segment of the global cardiovascular medical device industry, providing life-sustaining solutions for patients suffering from arrhythmias and other rhythm-related cardiac disorders. Implantable CRM devices including pacemakers, implantable cardioverter defibrillators (ICDs), and cardiac resynchronization therapy (CRT) devices are designed to regulate heart rate, prevent sudden cardiac death, and improve the heart's pumping efficiency in patients with heart failure.

As cardiovascular disease continues to top global mortality charts accounting for nearly 18 million deaths per year according to WHO technological innovations in CRM devices are offering longer battery lives, wireless remote monitoring, and improved patient outcomes. These advancements, coupled with the increasing prevalence of heart disease, aging demographics, and greater awareness of rhythm management therapies, are significantly boosting market demand.

Furthermore, evolving healthcare infrastructure, particularly in emerging markets, is widening access to advanced cardiac care. Reimbursement frameworks in developed countries are supporting wider adoption, while global health systems are integrating telecardiology and remote diagnostics. The COVID-19 pandemic highlighted the importance of remote patient monitoring, leading to a surge in connected CRM devices that allow physicians to monitor heart rhythms in real-time from a distance.

The Implantable CRM device market is thus positioned at the intersection of medical innovation, chronic disease management, and digital healthcare transformation an intersection expected to expand dynamically in the coming years.

Major Trends in the Market

-

Miniaturization of Devices: Advances in microelectronics are enabling smaller, less invasive CRM devices with easier implantation and improved patient comfort.

-

Integration with Remote Monitoring Systems: Modern CRM devices come equipped with Bluetooth and cellular telemetry, enabling real-time data transmission to physicians for continuous monitoring.

-

Development of MRI-Compatible Devices: Growing demand for MRI-safe CRM implants is driving manufacturers to develop MRI-conditional devices that allow patients to undergo MRI scans without device interference.

-

Emergence of Leadless Pacemakers: New-generation pacemakers eliminate the need for leads, reducing complications like infection and lead dislodgment.

-

Personalized and AI-Driven Therapy Adjustments: Machine learning algorithms are being used to fine-tune device settings based on patient-specific data, improving therapeutic outcomes.

-

Growth in Outpatient Implant Procedures: Minimally invasive implantation techniques and shorter recovery times are enabling same-day discharge in many cases.

-

Emphasis on Battery Longevity and Rechargeable Systems: Efforts to extend device longevity and introduce rechargeable ICDs and CRTs are gaining momentum.

Implantable Cardiac Rhythm Management Device Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 19.99 Billion |

| Market Size by 2033 |

USD 34.80 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.35% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Stryker; Schiller AG; Medtronic; Abbott; Boston Scientific Corporation; Koninklijke Philips N.V.; Zoll Medical Corporation; BIOTRONIK; Nihon Kohden Corporation; Microport Scientific Corporation. |

Market Driver: Rising Incidence of Cardiovascular Diseases and Aging Population

A primary driver for the implantable CRM device market is the increasing global burden of cardiovascular diseases, particularly arrhythmias, congestive heart failure, and bradycardia. With sedentary lifestyles, high-stress environments, obesity, diabetes, and smoking contributing to heart conditions, the patient pool requiring rhythm management solutions is expanding.

Moreover, aging is a significant risk factor for arrhythmias, and the global population aged 65 and over is projected to double by 2050, according to the United Nations. This demographic is especially prone to atrial fibrillation (AFib), bradycardia, and heart block conditions treatable with pacemakers, ICDs, and CRT devices. For instance, in the U.S., over 5 million people are affected by atrial fibrillation, many of whom eventually require implantable cardiac rhythm support.

Additionally, advancements in diagnostic tools like ECGs and wearable monitors are leading to early detection of cardiac arrhythmias, prompting timely intervention with CRM implants. This has made CRM therapy an essential component of modern cardiology care, driving device demand across hospital systems and specialty cardiac centers globally.

Market Restraint: High Cost of Devices and Implantation Procedures

Despite the significant clinical benefits, the high cost of implantable CRM devices and associated surgical procedures remains a major restraint, particularly in low- and middle-income countries. Pacemakers, ICDs, and CRTs can range from $5,000 to $40,000 per device, excluding implantation costs, hospital stay, follow-up visits, and remote monitoring setup.

This makes access to CRM devices limited in regions without comprehensive health insurance or public reimbursement systems. Even in developed countries, stringent payer policies and high out-of-pocket expenses may delay or discourage implantation, especially among elderly patients with multiple comorbidities.

Additionally, cost concerns extend to device recalls, lead malfunctions, or battery failures, which necessitate revision surgeries, increasing healthcare expenditures and regulatory scrutiny. While innovations are driving device performance, affordability remains a barrier to widespread adoption in underserved markets, demanding innovation in business models, pricing strategies, and reimbursement policies.

Market Opportunity: Growth in Remote Patient Monitoring and Telecardiology

A rapidly emerging opportunity lies in the integration of remote patient monitoring (RPM) systems with CRM devices, enhancing post-implantation care and reducing hospital readmissions. Modern ICDs and CRTs are equipped with telemetry systems that transmit patient data such as heart rhythm, pacing frequency, and arrhythmia episodes directly to care providers via secure cloud platforms.

This allows physicians to proactively adjust therapy, detect device malfunctions, and intervene before a patient’s condition worsens. During the COVID-19 pandemic, the importance of remote monitoring was magnified, as patients avoided in-person visits and relied on telemedicine for continuity of care. RPM improves patient engagement, ensures data continuity, and aligns with the global trend toward value-based care and outcome-driven reimbursement.

Healthcare providers and payers are recognizing RPM as a tool to reduce overall healthcare costs while enhancing outcomes. Future opportunities lie in AI-powered dashboards, predictive analytics, and integration with electronic health records (EHRs), creating a smart CRM ecosystem that delivers personalized and preventive cardiac care.

Segments Insights:

By Product Insights

Pacemakers dominate the product segment, owing to their long-standing use in treating bradycardia and heart block. These devices have evolved significantly over the decades from external pulse generators to today's highly sophisticated, MRI-safe, dual-chamber systems. Pacemakers are widely implanted and are often the first step in rhythm correction therapy. Due to a large aging population and continued demand from emerging countries, pacemakers maintain a steady growth curve. Companies like Medtronic, Boston Scientific, and Abbott dominate this subsegment with reliable, clinically validated pacemaker portfolios.

However, ICDs are the fastest-growing product segment, driven by increasing incidences of sudden cardiac arrest (SCA), ventricular arrhythmias, and cardiac conditions with lethal potential. ICDs continuously monitor heart rhythms and deliver shocks to restore normalcy during life-threatening episodes. These devices are increasingly being implanted in younger patients with inherited cardiac disorders, athletes with arrhythmic risk, and post-MI patients. Technological improvements such as smaller form factors, longer battery life, and hybrid CRT-D (combined CRT and defibrillator) devices are boosting the appeal and clinical acceptance of ICDs worldwide.

By End-use

Hospitals represent the leading end-use segment, due to the concentration of cardiac surgery units, electrophysiology labs, and trained cardiologists. Most CRM device implantations are performed in hospital settings under close monitoring with post-procedure recovery facilities. The availability of advanced imaging, hybrid operating rooms, and multidisciplinary cardiac teams ensures procedural safety and higher success rates. Hospitals also account for the bulk of government and insurance-backed CRM procurement, supporting their dominance in this segment.

That said, specialty cardiac centers are the fastest-growing end-use segment, offering focused care, shorter wait times, and advanced CRM therapy options. These centers specialize in electrophysiology and rhythm disorders, attracting patients with complex arrhythmias or comorbidities. As outpatient CRM implantations become more common thanks to minimally invasive techniques specialty centers are leading the way in high-volume, efficient, and cost-effective care. Additionally, their integration with telehealth, remote monitoring, and follow-up services makes them a preferred choice for long-term CRM management.

By Regional Insights

North America dominates the global CRM device market, accounting for the largest share due to its highly developed healthcare system, widespread cardiovascular disease prevalence, and robust reimbursement ecosystem. The U.S. leads in both device implantation volumes and innovation, supported by FDA approvals, clinical trials, and leading manufacturers such as Medtronic, Abbott, and Boston Scientific. Medicare and private insurers typically cover CRM devices for eligible patients, reducing financial barriers. Furthermore, strong adoption of remote monitoring technologies and integrated cardiac care centers keeps North America at the forefront of CRM therapy.

In contrast, Asia-Pacific is the fastest-growing regional market, driven by rapid healthcare infrastructure expansion, growing public-private investments, and increasing awareness of cardiac disease management. Countries like China, India, and Japan are witnessing a surge in cardiovascular procedures due to aging populations, rising urbanization, and improved diagnostic capabilities. Government programs and partnerships with multinational device firms are making advanced CRM therapies more accessible. For example, India’s Ayushman Bharat program and China's "Healthy China 2030" plan aim to improve chronic disease outcomes, directly supporting CRM market growth. As affordability improves and skilled cardiologists increase, Asia-Pacific is expected to lead future expansion.

Some of the prominent players in the Implantable cardiac rhythm management device market include:

- Stryker

- Schiller AG

- Medtronic

- Abbott

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Zoll Medical Corporation

- BIOTRONIK

- Nihon Kohden Corporation

- Microport Scientific Corporation

Recent Developments

-

March 2025 – Medtronic launched its Micra AV2 leadless pacemaker globally, featuring expanded MRI compatibility and adaptive pacing technology for atrioventricular synchronization.

-

January 2025 – Abbott received CE mark approval for its Navitor CRT-D System, combining triple-chamber pacing with wireless telemetry and extended battery life.

-

November 2024 – Boston Scientific initiated global trials for a subcutaneous ICD system, designed to offer defibrillation without the need for transvenous leads.

-

September 2024 – Biotronik introduced its CardioMessenger Smart 4G monitoring system, improving real-time CRM data transfer to clinicians via mobile networks.

-

August 2024 – MicroPort CRM partnered with the Indian government to pilot an affordable ICD implantation initiative across select public hospitals under the national health scheme.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global implantable cardiac rhythm management device market.

Product

End-use

- Hospitals

- Specialty Cardiac Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)