Implantable Medical Devices Market Size and Research

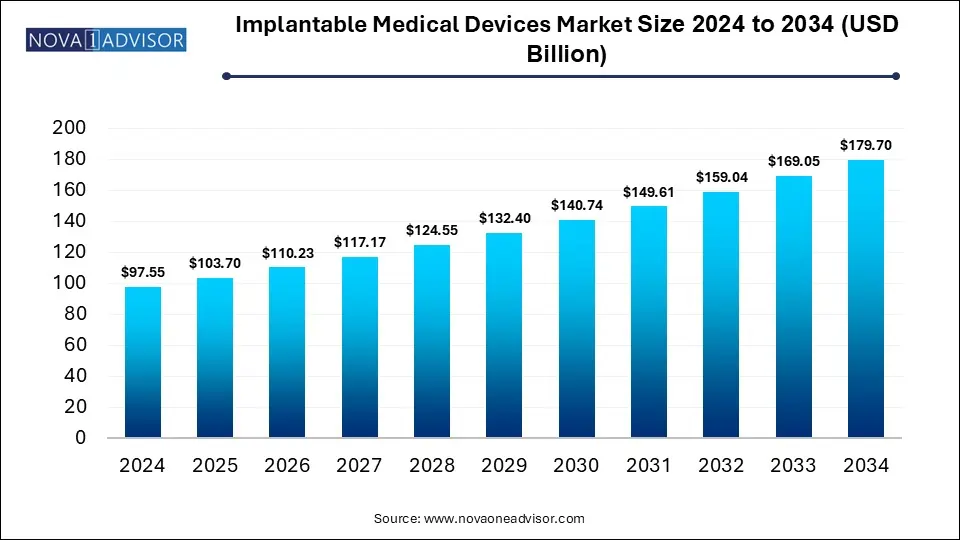

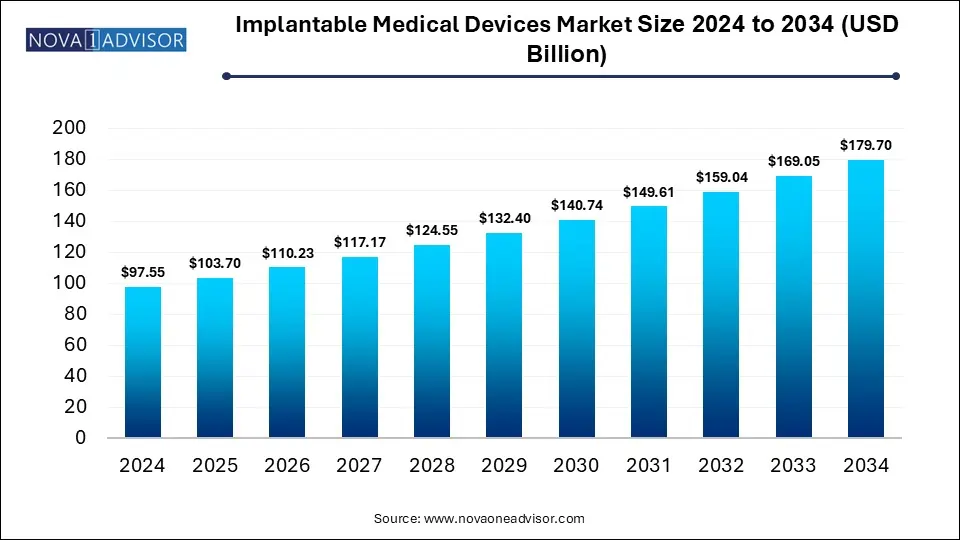

The global implantable medical devices market size is calculated at USD 97.55 billion in 2024, grows to USD 103.70 billion in 2025, and is projected to reach around USD 179.70 billion by 2034, growing at a CAGR of 6.3% from 2025 to 2034. The implantable medical devices market growth is driven by the increasing demand for implants, rising regulatory approvals and innovative product launches.

Implantable Medical Devices Market Key Takeaways

- North America dominated the global implantable medical devices market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By product, the cardiovascular implants segment dominated the market with the largest share in 2024.

- By material type, the dental implants segment is expected to show the fastest growth over the forecast period.

- By biomaterial, the metallic segment accounted for the highest market share in 2024.

- By biomaterial, the natural segment is expected to expand rapidly during the predicted timeframe.

- By end use, the hospitals segment captured the largest market share in 2024.

- By end use, the outpatient facilities segment is expected to register fastest growth during the forecast period.

How is the Implantable Medical Devices Market Experiencing Significant Growth?

Implantable medical devices refer to health tools that are intended to be placed completely or partially into the body, either temporarily or permanently for addressing a specific medical need. These devices are used for various applications such as for treatment of a health problem, to track bodily functions and for improving capabilities. The implantable medical devices market is expanding due to factors such as rising chronic disease burden, need for addressing unmet medical needs, rising disposable incomes and continuous advancements in material science.

What Are the Key Trends in the Implantable Medical Devices Market in 2025?

- In June 2025, Neuspera Medical received the U.S. Food and Drug Administration’s approval for its integrated sacral neuromodulation (iSNM) system which is implanted near the sacral nerve for treatment of urinary urge incontinence (UUI).

- In February 2025, Auxilium Biotechnologies in collaboration with NASA successfully installed its revolutionary 3D bioprinter, Auxilium Microfabrication Platform (AMP-1) bioprinter on the International Space Station (ISS). The advanced, first-of-its-kind platform simultaneously printed eight implantable medical devices intended for peripheral nerve repair by utilizing microgravity on the ISS in two hours.

How is AI Reshaping the Implantable Medical Devices Market?

Integration of artificial intelligence (AI) in the implantable medical devices market is enhancing the accuracy and efficiency of these devices. Implantable sensors which can detect changes in patient health and transmit data in real-time can be integrated with AI algorithms, allowing timely interventions before the problem escalates. Personal health information analysed by AI can enable personalized treatments by optimizing device settings and delivery of medication. AI-powered medical devices can facilitate better integration of medical implants within the body through biomimicry, leading to reduced immunogenicity and improved functionality.

Report Scope of Implantable Medical Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 103.70 Billion |

| Market Size by 2034 |

USD 179.70 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Biomaterial, By End Use, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott Laboratories, Biotronik SE and Co. KG, Boston Scientific Corporation, Cochlear Limited, Institut Straumann AG, Integra LifeSciences Corporation, Johnson and Johnson, LivaNova PLC, Medtronic, Smith & Nephew plc, Stryker |

Market Dynamics

Drivers

Rising Chronic Illnesses and Aging Demographics

Increasing disease burden of chronic illnesses such as cardiovascular diseases, diabetes and neurological disorders, especially in the aging demographics are driving the demand for implantable medical devices for effective management and treatment of these conditions. Increased healthcare expenditure and advancing infrastructure in developing nations as well as rising awareness among patients and healthcare professionals is driving the adoption of implantable medical devices.

Restraints

Regulatory Hurdles and High Costs

Stringent regulatory approval processes of medical devices requiring several compliance requirements are time consuming and can delay the market entry of novel implantable products. Additionally, high costs associated with implant procedures and medical devices can potentially restrict access to these treatments for certain patients.

Opportunities

Smart Implants and Advanced Materials

Continuous investments in research and development activities are encouraging innovation in implantable medical devices and helping address unmet medical needs. Integration of smart sensor technologies in implants and improved connectivity with Internet of Medical Things (IoMT) technology are enabling seamless data transmission in real-time, further allowing continuous monitoring of patient vitals, especially in remote settings. Furthermore, advancements in material technology for improving the safety, efficacy and longevity of implants is creating opportunities for market growth.

Segmental Insights

What Made Cardiovascular Implants the Dominant Segment in 2024?

By product, the cardiovascular implants segment accounted for the largest market share in 2024. Rising prevalence of cardiovascular diseases such as arrhythmias, coronary artery disease, heart failure and myocardial infarction across the globe are driving the demand for effective medical devices such as coronary stents, heart valves, implantable cardioverter-defibrillators (ICDs) and pacemakers for better management and improvement of patient life. Moreover, expanding healthcare infrastructure in emerging economies, increasing demand for minimally invasive procedures, rising healthcare expenditure and supportive reimbursement policies are fuelling the market growth. Continuous technological innovations such as miniaturization of medical devices and integration of smart connectivity features enabling real-time monitoring are driving the adoption of cardiovascular implants.

By product, the dental implants segment is expected to register the fastest growth during the forecast period. Increasing cases of dental disorders and tooth loss, especially in the aging population as well as increased awareness regarding cosmetic dentistry and dental aesthetics are driving the adoption of dental implants in patients actively seeking effective solutions. Ongoing advancements in dental implantology such as 3D imaging technology and CAD/ CAM (computer-aided deisgn/ manufacturing) for precise treatment planning and guided implant surgery, surface treating technologies and improved materials are enhancing treatment outcomes. Additionally, increasing disposable incomes, growing trend of dental tourism, demand for minimally invasive dental procedures and rise in number of dental clinics are the factors anticipated to fuel the market growth of this segment in the upcoming years.

How Metallic Segment Dominated the Market in 2024?

By biomaterial, the metallic segment dominated the market with the highest share in 2024. Metals such as cobalt-chromium alloys and stainless steel with superior mechanical properties are widely used in cardiovascular stents, dental implants, orthopedic implants and neurosurgical implants. Excellent biocompatibility and corrosion resistance offered by medical-grade metals such as titanium’s ability to osseointegrate and resist degradation, leading to long-term implants success with improved integrity and safety is driving adoption of metals. Furthermore, continuous advancements in metallic biomaterials such as development of innovative alloys and composites, use of surface modification techniques as well as development of patient-specific implants with additive manufacturing techniques like 3D printing are driving the market dominance of this segment.

By biomaterial, the natural segment is expected to show the fastest growth over the forecast period. Multitude of advantages of naturally derived biomaterials such as biodegradability, bioresorbability, improved biocompatibility, support for tissue regeneration and reduced infection risk are driving their adoption for development of natural implantable medical devices. Natural biomaterials like scaffolds for bone grafts, nerve repair and skin substitutes are gaining traction in regenerative medicine. Additionally, increased awareness and demand for naturally derived implantable medical devices, growing emphasis on stem cell therapies, rising global trend towards sustainable products and surge in R&D activities are the factors boosting the market growth of this segment.

Why Did the Hospitals Segment Dominate in 2024?

By end use, the hospitals segment held the largest market share in 2024. Hospitals are primary center for conducting complex medical procedures such as cardiac surgeries, orthopedic surgeries and other type of surgeries which use medical implants devices. Access to state-of-the-art facilities and multidisciplinary approach provided by skilled healthcare professionals in complex surgical processes is driving the market dominance of this segment. Furthermore, capacity to manage to high patient volumes, availability of emergency care, favourable insurance coverages and conduction of clinical trials for developing innovative implantable device technologies are fuelling the market expansion.

By end use, the outpatient facilities segment is expected to expand rapidly during the predicted timeframe. Rising demand for minimally invasive implantable device procedures are shifting patient preference towards outpatient facilities such as ambulatory surgery centers, emergency departments, primary care clinics and specialized outpatient clinics. Affordable procedures, less trauma, fast recovery times and same day discharge offered by outpatient facilities are driving their popularity among patients.

Regional Insights

What Drives North America’s Dominance in the Implantable Medical Devices Market?

North America captured the largest share in the global implantable medical devices market in 2024. The market dominance of this segment can be linked to the rising incidences of trauma and chronic diseases such as orthopaedic disorders, cardiovascular disorders, diabetes and neurological disorders which require implantable medical devices for managing, treating and improving the patient quality life. Advanced healthcare infrastructure with skilled medical professionals, ongoing research activities, increased healthcare spending and supportive regulatory frameworks, growing preference for minimally invasive techniques and rising awareness among the population are driving the market growth.

What Makes Asia Pacific the Fastest Growing Region in the Implantable Medical Devices Market?

Asia Pacific is anticipated to witness lucrative growth in the market over the forecast period. Countries like China, India, Japan and South Korea in Asia Pacific with huge and rapidly aging population susceptible to chronic diseases and age-related disorders is creating the demand for implantable medical devices such as cochlear implants, joint replacements and pacemakers. Increased investments for improving healthcare infrastructure and adoption of advanced diagnostic tools are contributing to the market growth. Furthermore, availability of skilled labor, increased emphasis on domestic production, rising disposable incomes, support government policies and surging trend of medical tourism are fuelling the market expansion.

Some of the Prominent Players in the Implantable Medical Devices Market

- Abbott Laboratories

- Biotronik SE and Co. KG

- Boston Scientific Corporation

- Cochlear Limited

- Institut Straumann AG

- Integra LifeSciences Corporation

- Johnson and Johnson

- LivaNova PLC

- Medtronic

- Smith & Nephew plc

- Stryker

Recent Developments in the Implantable Medical Devices Market

- In February 2025, ABANZA received the 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its innovative WasherCap Mini Implantable Fixation Device which is engineered for several applications such as ACL reconstruction and meniscal root repair.

- In January 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) published a new set of guidance designed for assisting medical devices manufacturers to gain better comprehension and preparing them for new Post-market surveillance (PMS) regulation for medical devices in Great Britain (GB). The new guidance will come into effect on 16th June 2025.

- In October 2024, UPM Biomedicals, launched FibGel which is a novel natural injectable nanocellulose hydrogel made for permanent implantable medical devices. The FibGel empty implants can be applied for broad range of implantable medical device applications such as aesthetics, drug delivery, cell therapy, orthopaedics and soft tissue repair.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Implantable Medical Devices Market.

By Product

- Aesthetic Implants

- Cardiovascular Implants

- Dental Implants

- Neurology Implants

- Orthopedic Implants

- Ophthalmology Implants

By Biomaterial

- Ceramic

- Metallic

- Natural

- Polymers

By End Use

- Hospitals

- Outpatient Facilities

- Specialty Clinics & Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)