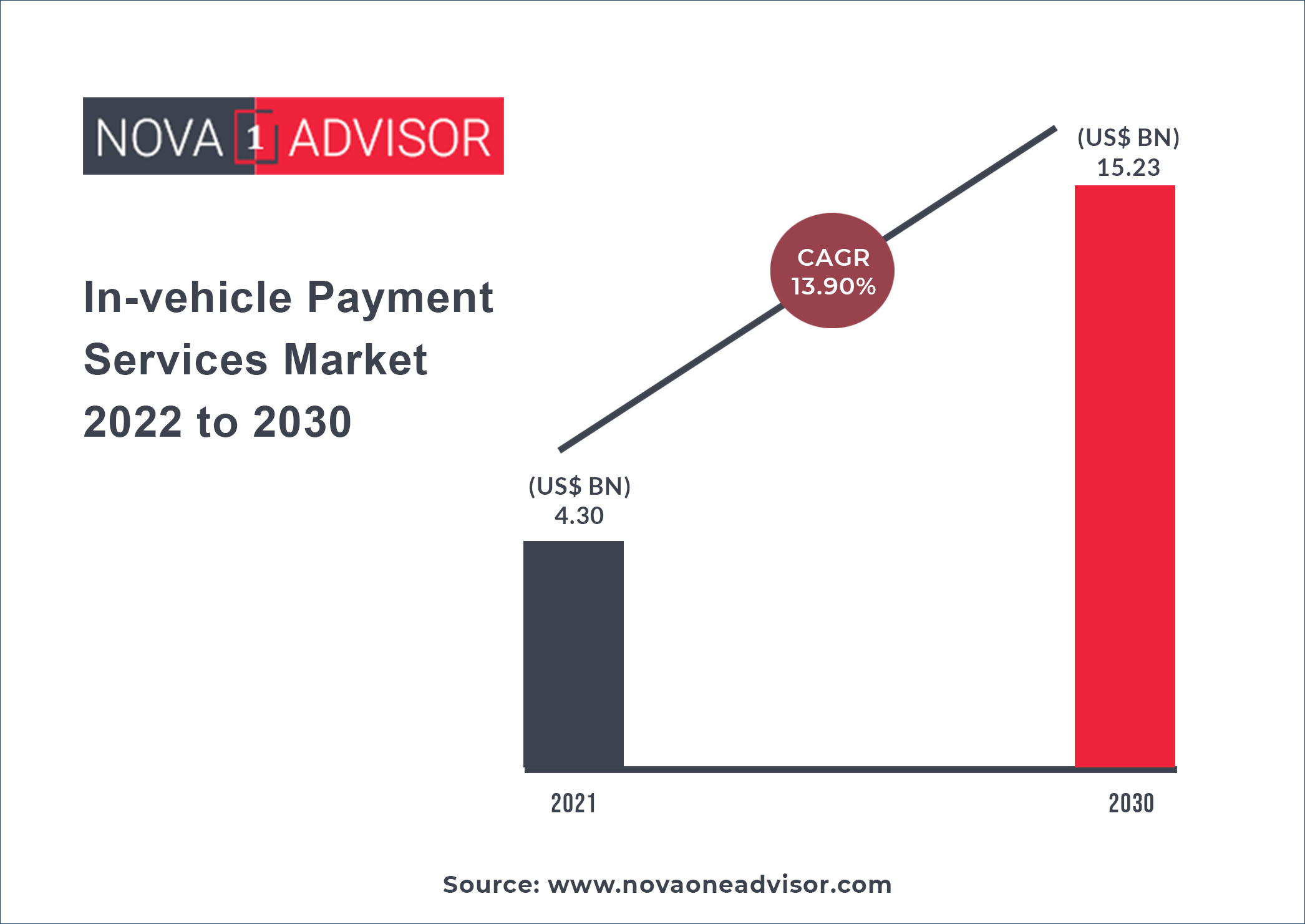

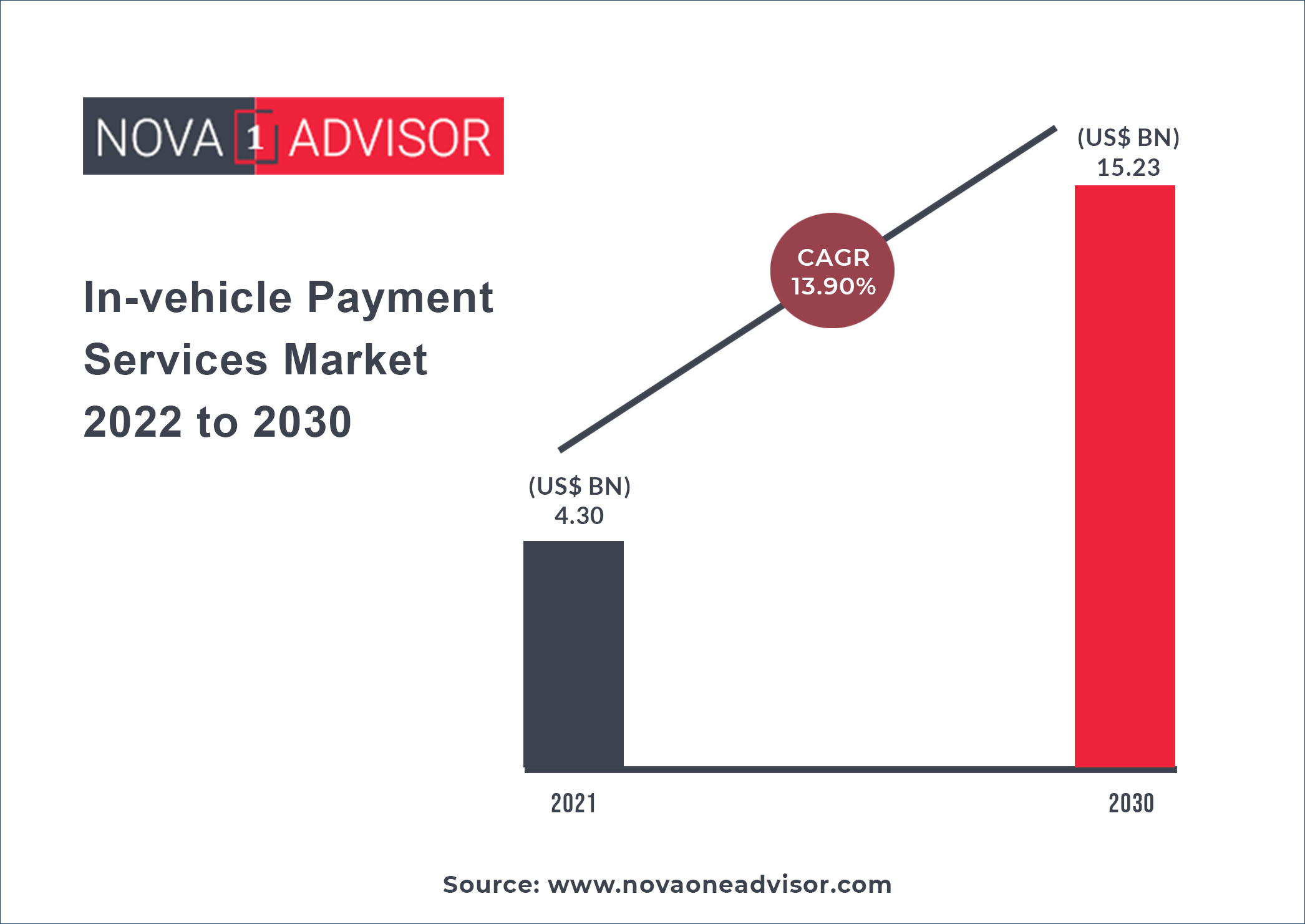

The global In-vehicle Payment Services market gathered revenue around USD 4.30 billion in 2021 and market is set to grow USD 15.23 billion by the end of 2030 and is estimated to expand at a modest CAGR of 13.9% during the prediction period 2022 to 2030.

Growth Factors:

In-vehicle payment services allow drivers to order and pay for food, coffee, gasoline, groceries, parking slots, and tolls without having to step out of the vehicle. Advances in the Internet of Things (IoT) technology and the efforts being pursued aggressively by various automakers to integrate new, advanced infotainment solutions in their vehicle models are expected to drive the growth of the market over the forecast period. The growing preference for contactless payment methods in the wake of the outbreak of the COVID-19 pandemic and continued innovations in smart vehicles also bode well for the growth of the market.

Various payment solution providers, including MasterCard, Visa, and PayPal, are partnering with automakers around the world to develop and integrate new payment processes and methods in vehicles. For instance, in May 2017, General Motors Co. announced a partnership with MasterCard to design and develop in-vehicle payment solutions. Similarly, in January 2019, Visa announced a collaboration with SiriusXM, to introduce a vehicle-based payments platform. Several other manufacturers such as Volkswagen AG, Honda Motor Co. Ltd., and Ford Motor Co. have also developed in-vehicle payment solutions and platforms. The outbreak of the COVID-19 pandemic has taken a severe toll on the global economy. Supply chains have got disrupted and manufacturing activity at several production facilities has been suspended temporarily owing to the lockdowns and other restrictions imposed by various governments in different parts of the world as part of the efforts to contain the spread of coronavirus. Nevertheless, the social distancing norms being advocated by various governments and the growing preference among individuals for contactless payments to avoid any potential coronavirus exposure are expected to contribute to the growth of the market over the forecast period.

Report Coverage

| Report Scope |

Details |

| Market Size |

USD 15.23 billion by 2030 |

| Growth Rate |

CAGR of 13.9% From 2022 to 2030 |

| Base Year |

2021 |

| Forecast Period |

2022 to 2030 |

| Report coverage |

Growth Factors, Revenue Status, Competitive Landscape, and Future Trends |

| Segments Covered |

Mode of payment, application, Region

|

| Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Companies Mentioned |

BMW AG; Daimler AG; Ford Motor Co.; General Motors Co.; Honda Motor Co. Ltd.; Hyundai Motor Co.; Jaguar Land Rover Automotive PLC; Volkswagen AG; ZF Friedrichshafen AG; Google; Amazon; Visa; MasterCard; PayPal.

|

Mode of Payment Insights

The credit/debit card segment accounted for the largest market share of around 53% in 2021. Debit cards and credit cards remain the most popular payment modes and are used extensively to make contact and contactless payments. The growing preference for card and cardless transactions and post cash transactions among individuals belonging to various age groups is expected to contribute to the growth of the market over the forecast period.

The app/e-wallet segment accounted for a significant share of the market in 2021 and is anticipated to register a CAGR of 14.1% from 2022 to 2030. The rising popularity of digital payment methods and the convenience and ease associated with wallet payments are particularly encouraging individuals to adopt in-vehicle payment services, thereby contributing to the growth of the market. As such, several apps or wallets, including Amazon Pay, Google Pay, AliPay, Apple Pay, Venmo, and Samsung Pay, among others, are being widely used for making payments. Meanwhile, Amazon and Google have linked their intelligent virtual assistants to their respective payment portals and e-wallets as part of the efforts to help consumers in shopping and making payments interactively.

Application Insights

The food/coffee segment accounted for a significant revenue share of around 27% in 2021. The preference to order coffee and food while on the way to workplaces, offices or other destinations is growing among passengers and drivers. Drivers have realized that waiting for buying food and coffee would not be possible due to the growing traffic. Hence, drivers are preferring to place orders, make payments from the vehicle itself, and simply pick up their orders on the way to save time and avoid any inconvenience, thereby driving the popularity of in-vehicle payment services.

The parking segment is projected to register a substantial CAGR of 15.4% from 2022 to 2030. The growing number of passenger and commercial vehicles is particularly expected to contribute to the growth of the parking segment over the forecast period. The data published by OICA revealed that the sales of commercial vehicles in China increased 18.7% over the year in 2020. The increasing number of passenger and commercial vehicles drive the demand for parking spaces. Adapting in-vehicle payment services in the parking spaces will assist in reducing long queues at these spaces.

Regional Insights

North America accounted for a market share of around 39% in 2021. The region has the maximum penetration of connected cars. Moreover, technology companies, including Apple Inc. and Google Inc., which are based in North America, have also entered the automotive market with their capabilities to innovate and compete with the automotive companies.

The Asia Pacific regional market is projected to register the highest CAGR of 14.5% from 2022 to 2030. The growing population and the rising levels of disposable income are expected to contribute to the growth. Adoption of the latest, advanced technologies and continued innovations in the way payments are made and processed would also play a vital role in driving the growth over the forecast period.

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the In-vehicle Payment Services Market include:

- BMW AG

- Daimler AG

- Ford Motor Co.

- General Motors Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Jaguar Land Rover Automotive PLC

- Volkswagen AG

- ZF Friedrichshafen AG

- Google

- Amazon

- Visa

- MasterCard

- PayPal

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for the period of 2017 to 2030 and covers subsequent region in its scope:

- By Mode of Payment

- NFC

- QR Code/RFID

- App/e-wallet

- Credit/Debit card

- By Application

- Parking

- Gas/charging stations

- Shopping

- Food/Coffee

- Toll Collection

- Others

By Geography

North America

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Research Methodology

In the study, a unique research methodology is utilized to conduct extensive research on the growth of the In-vehicle Payment Services market, and reach conclusions on the future growth parameters of the market. This research methodology is a combination of primary and secondary research, which helps analysts ensure the accuracy and reliability of the conclusions.

Secondary resources referred to by analysts during the production of the In-vehicle Payment Services market study are as follows - statistics from government organizations, trade journals, white papers, and internal and external proprietary databases. Analysts have also interviewed senior managers, product portfolio managers, CEOs, VPs, marketing/product managers, and market intelligence managers, all of whom have contributed to the development of this report as a primary resource.

Comprehensive information acquired from primary and secondary resources acts as a validation from companies in the market, and makes the projections on the growth prospects of the In-vehicle Payment Services markets more accurate and reliable.

Secondary Research

It involves company databases such as Hoover's: This assists us recognize financial information, structure of the market participants and industry competitive landscape.

The secondary research sources referred in the process are as follows:

- Governmental bodies, and organizations creating economic policies

- National and international social welfare institutions

- Company websites, financial reports and SEC filings, broker and investor reports

- Related patent and regulatory databases

- Statistical databases and market reports

- Corporate Presentations, news, press release, and specification sheet of Manufacturers

Primary Research

Primary research includes face-to face interviews, online surveys, and telephonic interviews.

- Means of primary research: Email interactions, telephonic discussions and Questionnaire based research etc.

- In order to validate our research findings and analysis we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

- CEOs, VPs, market intelligence managers

- Procuring and national sales managers technical personnel, distributors and resellers

- Research analysts and key opinion leaders from various domains

Key Points Covered in In-vehicle Payment Services Market Study:

- Growth of In-vehicle Payment Services in 2022

- Market Estimates and Forecasts (2017-2030)

- Brand Share and Market Share Analysis

- Key Drivers and Restraints Shaping Market Growth

- Segment-wise, Country-wise, and Region-wise Analysis

- Competition Mapping and Benchmarking

- Recommendation on Key Winning Strategies

- COVID-19 Impact on Demand for In-vehicle Payment Services and How to Navigate

- Key Product Innovations and Regulatory Climate

- In-vehicle Payment Services Consumption Analysis

- In-vehicle Payment Services Production Analysis

- In-vehicle Payment Services and Management