In Vitro Diagnostics Market Size and Trends 2026 to 2035

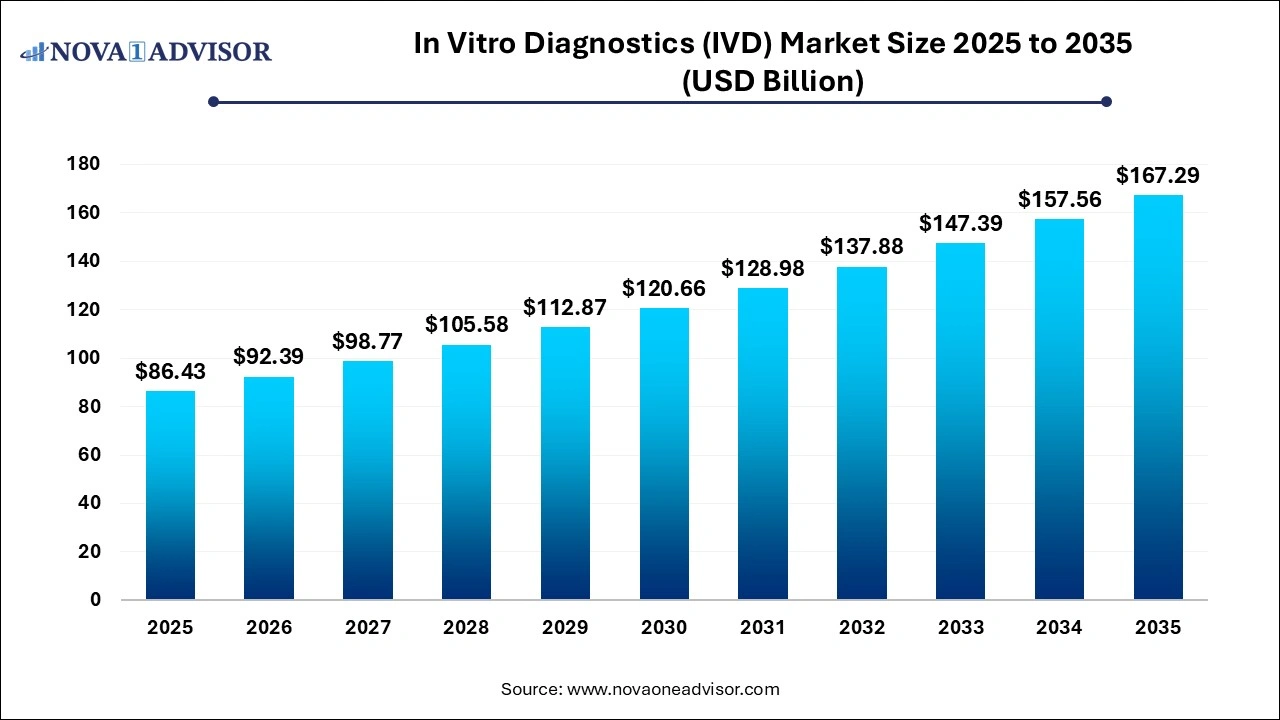

The in vitro diagnostics market size was exhibited at USD 86.43 billion in 2025 and is projected to hit around USD 167.29 billion by 2035, growing at a CAGR of 6.83% during the forecast period 2026 to 2035.

In Vitro Diagnostics Market Overview

The in vitro diagnostics (IVD) market is a foundational pillar in the global healthcare industry, providing essential tools for disease detection, monitoring, and management. IVD refers to diagnostic tests performed on biological samples such as blood, urine, tissue, and other bodily fluids to detect diseases, conditions, or infections. These tests are performed outside the body, often in laboratories, hospitals, or increasingly at the point of care and home settings.

IVD technologies play a pivotal role in clinical decision-making, enabling timely intervention, personalized therapy, and effective disease surveillance. From routine glucose tests and pregnancy kits to advanced molecular diagnostics used in oncology or infectious diseases, IVD tools span a wide spectrum of applications. The market encompasses instruments, reagents, and services that are integrated into both centralized laboratory systems and decentralized platforms.

The market has seen exponential growth, especially following the COVID-19 pandemic, which reinforced the importance of rapid, accurate diagnostic testing. Governments, healthcare institutions, and diagnostics companies invested heavily in expanding testing capacities, leading to infrastructure advancements and increased public awareness. Post-pandemic, this momentum continues, now focused on chronic disease management, antimicrobial resistance monitoring, and early cancer detection.

Driven by the global burden of infectious diseases, rising incidences of chronic illnesses like diabetes and cardiovascular disease, aging populations, and the surge in personalized medicine, the IVD market is expected to grow robustly. The expansion of healthcare access in emerging markets, increasing home diagnostics adoption, and continuous innovation in test accuracy and speed will be key to shaping the market landscape over the next decade.

Major Trends in the Market

-

Growth in Molecular Diagnostics: Rising demand for PCR and next-gen sequencing in infectious disease and cancer diagnostics.

-

Point-of-Care (POC) Expansion: Accelerated development of compact, rapid testing kits for use in clinics, pharmacies, and homes.

-

Integration with Digital Health Platforms: Increasing connectivity between IVD instruments and cloud-based patient data systems.

-

Rise of At-home Testing Solutions: Growing consumer preference for privacy, convenience, and direct access to health data.

-

AI and Machine Learning in IVD: Use of AI for assay optimization, test interpretation, and automated workflows.

-

Companion Diagnostics in Precision Medicine: IVDs being developed alongside therapies to predict patient response.

-

Demand for Multiplex Testing Platforms: Simultaneous detection of multiple pathogens or biomarkers in a single test.

-

Public Health Preparedness Initiatives: Governmental investments in diagnostic infrastructure post-COVID-19.

-

Development of Lab-on-a-Chip Devices: Miniaturization of complex lab workflows into single-use disposable devices.

-

Focus on Antimicrobial Resistance (AMR) Surveillance: IVD used to identify resistant strains and optimize treatment.

Report Scope of In Vitro Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 92.39 Billion |

| Market Size by 2035 |

USD 167.29 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.83% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Products, By Technology, By Application, By End-use, By Test Location |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott; bioMérieux SA; QuidelOrtho Corporation; Siemens Healthineers AG; Bio-Rad Laboratories, Inc.; Qiagen; Sysmex Corporation; Charles River Laboratories; Quest Diagnostics Incorporated; Agilent Technologies, Inc.; Danaher Corporation; BD; F. Hoffmann-La Roche Ltd. |

Market Driver: Rise in Chronic and Infectious Disease Prevalence

A primary driver for the in vitro diagnostics market is the increasing global burden of chronic and infectious diseases, prompting demand for reliable and timely diagnostics. Non-communicable diseases (NCDs) such as diabetes, cancer, cardiovascular disease, and autoimmune disorders now account for more than 70% of global deaths, requiring frequent monitoring and screening.

In parallel, infectious diseases such as tuberculosis, malaria, HIV/AIDS, and emerging viral outbreaks (e.g., COVID-19, monkeypox, dengue) emphasize the critical role of early detection. IVD technologies provide the tools for both disease surveillance and individual patient management. For example, HbA1c testing for diabetes monitoring and troponin assays for myocardial infarction diagnosis are now standard protocols globally. As populations age and multimorbidity becomes common, the need for efficient diagnostics that guide therapeutic decisions becomes indispensable, firmly anchoring IVD in healthcare workflows.

Market Restraint: Regulatory Complexity and Reimbursement Challenges

Despite the growth potential, the IVD market faces significant regulatory and reimbursement-related hurdles, particularly affecting new entrants and innovation scaling. IVD devices must undergo rigorous validation and approval processes due to their direct impact on patient care. In the United States, for instance, the FDA enforces strict requirements for clinical trials, labeling, and manufacturing. Similarly, the EU’s In Vitro Diagnostic Regulation (IVDR) has introduced extensive compliance demands for both existing and new tests.

Beyond regulatory approval, securing favorable reimbursement from insurance providers and national healthcare systems remains challenging. Payers often require cost-effectiveness data, long-term outcomes, and clinical utility evidence before covering new diagnostics. These hurdles can delay market entry and disincentivize innovation, especially for smaller firms or niche applications. Navigating regional and country-specific rules adds further complexity for global players.

Market Opportunity: Personalized Medicine and Companion Diagnostics

A transformative opportunity lies in the integration of IVD technologies with personalized medicine, particularly through companion diagnostics (CDx). These are IVD tests developed alongside therapeutic drugs to identify patient subgroups likely to benefit from or experience adverse effects from a specific treatment. Oncology is a leading field where CDx has gained traction, with tests used to determine HER2 status in breast cancer or EGFR mutations in lung cancer.

As targeted therapies expand across therapeutic areas ranging from immunology to neurology IVDs are being developed to stratify patients, improve treatment efficacy, and reduce adverse events. The integration of molecular profiling, genomic analysis, and AI-based interpretation positions IVDs at the heart of precision healthcare. Biopharma companies are increasingly partnering with diagnostics firms to co-develop assays, unlocking value for both providers and patients while expanding the market for specialized IVDs.

In Vitro Diagnostics Market Segment Insights

By Product Insights

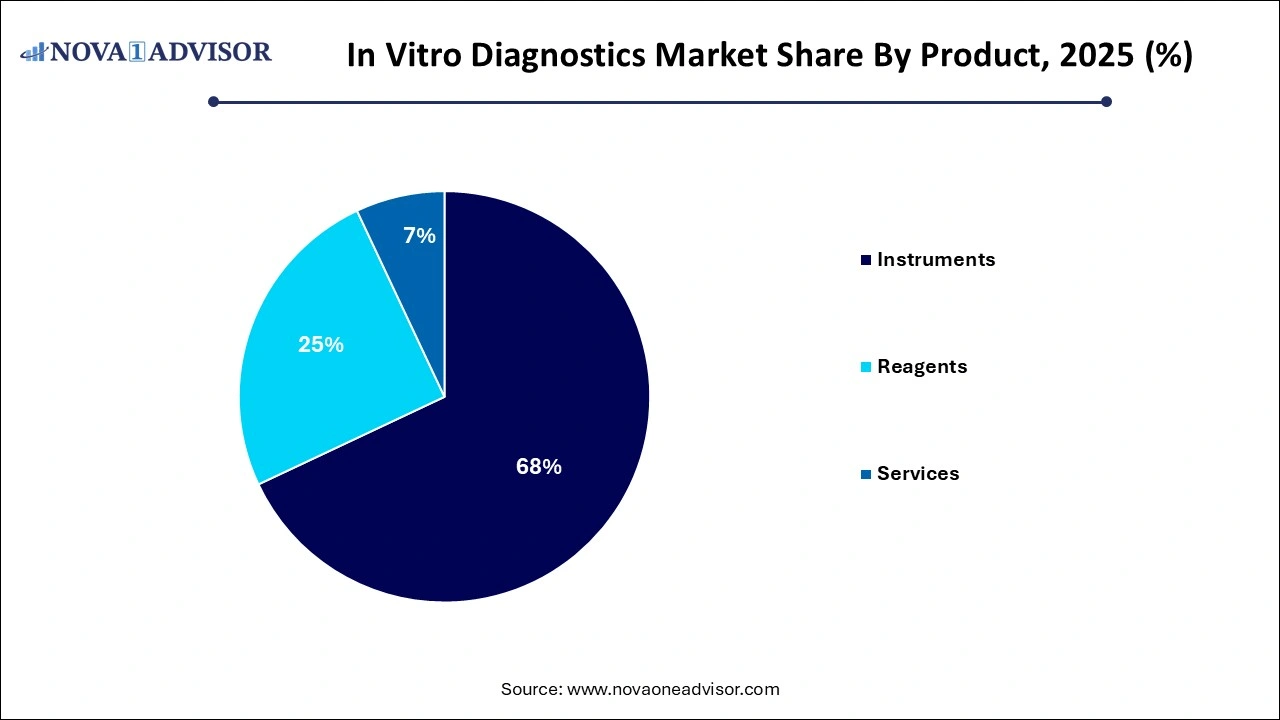

Reagents dominated the IVD market in 2025, owing to their essential role in testing across all platforms. These include antibodies, enzymes, buffers, primers, and other consumables that are required for conducting immunoassays, PCR, sequencing, and clinical chemistry analyses. Their recurring use in diagnostic labs and high volumes across disease testing make them a substantial revenue stream for manufacturers. Customization and disease-specific reagent kits are gaining momentum, particularly in infectious disease and oncology diagnostics.

Instruments are expected to be the fastest-growing segment, especially with increased adoption of fully automated analyzers, point-of-care systems, and digital imaging devices. Innovations such as multiplex analyzers, microfluidics-based lab-on-a-chip systems, and integrated molecular diagnostic platforms are reducing processing time while increasing accuracy. Hospitals and laboratories upgrading to high-throughput systems to handle growing sample volumes and enhance efficiency are driving this growth.

By Technology Insights

Immunoassay technologies accounted for the largest market share, extensively used in detecting hormones, infections, cardiac markers, and autoimmune indicators. The technology’s reliability, affordability, and adaptability to both central labs and POC settings support its widespread adoption. Enzyme-linked immunosorbent assays (ELISA) and lateral flow assays (LFAs) remain prominent formats used globally.

Molecular diagnostics is the fastest-growing technology segment, driven by increasing reliance on PCR, nucleic acid amplification, and sequencing for precise disease detection. Molecular assays are being deployed not only for infectious diseases (e.g., HPV, COVID-19, tuberculosis) but also for genetic disease screening, cancer profiling, and pharmacogenomics. Emerging tools such as CRISPR-based diagnostics and real-time isothermal amplification methods are expanding the potential of this segment.

By End-use Insights

Hospitals remained the largest end-use segment, as they manage high patient volumes and conduct complex tests that require integrated laboratory setups. Emergency diagnostics, preoperative screening, and inpatient monitoring all rely heavily on in-house IVD capabilities. Hospitals also act as referral centers, consolidating demand across specialties.

Laboratories, particularly independent and reference labs, are expected to grow fastest, fueled by outsourcing trends and the centralization of high-complexity testing. Commercial labs are investing in high-throughput systems and digital workflow management tools to handle large test volumes for COVID-19, oncology panels, and genetic screening. Their scalable infrastructure and cost-efficiency make them preferred partners for national screening programs and private payers.

By Application Insights

The Infectious diseases held the dominant position, as these tests are routinely used for screening, diagnosis, and outbreak surveillance. The COVID-19 pandemic massively accelerated adoption, leading to improved infrastructure, broader testing coverage, and increased awareness. Beyond COVID-19, testing for HIV, hepatitis, influenza, dengue, and respiratory syncytial virus (RSV) remain critical for both public health and patient care.

Oncology is projected to be the fastest-growing application, underpinned by advancements in liquid biopsy, tumor marker profiling, and companion diagnostics. As cancer incidence rises and early detection becomes a global priority, IVD tests are increasingly used to monitor disease progression, recurrence, and treatment response. Genetic testing for BRCA mutations, circulating tumor DNA (ctDNA) analysis, and multiplex tumor panels are key contributors to this surge.

By Test Location Insights

Point-of-care testing (POCT) led the market in 2025, offering immediate results for conditions like diabetes, infections, and cardiovascular events. The ability to diagnose and treat during the same clinical visit enhances patient outcomes and reduces healthcare burdens. POCT is also vital in resource-limited and rural settings, where centralized labs may be inaccessible.

Home-care testing is the fastest-growing location, driven by consumer demand for autonomy, convenience, and real-time monitoring. Glucose meters, pregnancy kits, and COVID-19 antigen tests are already common, while new tests for cholesterol, HbA1c, fertility hormones, and even STI detection are entering the DTC space. Regulatory support for over-the-counter diagnostics and digital health integration is further propelling this segment.

U.S. In Vitro Diagnostics Market Size and Growth 2026 to 2035

The U.S. in vitro diagnostics market size is evaluated at USD 30.97 illion in 2025 and is projected to be worth around USD 43.19 billion by 2035, growing at a CAGR of 3.38% from 2026 to 2035.

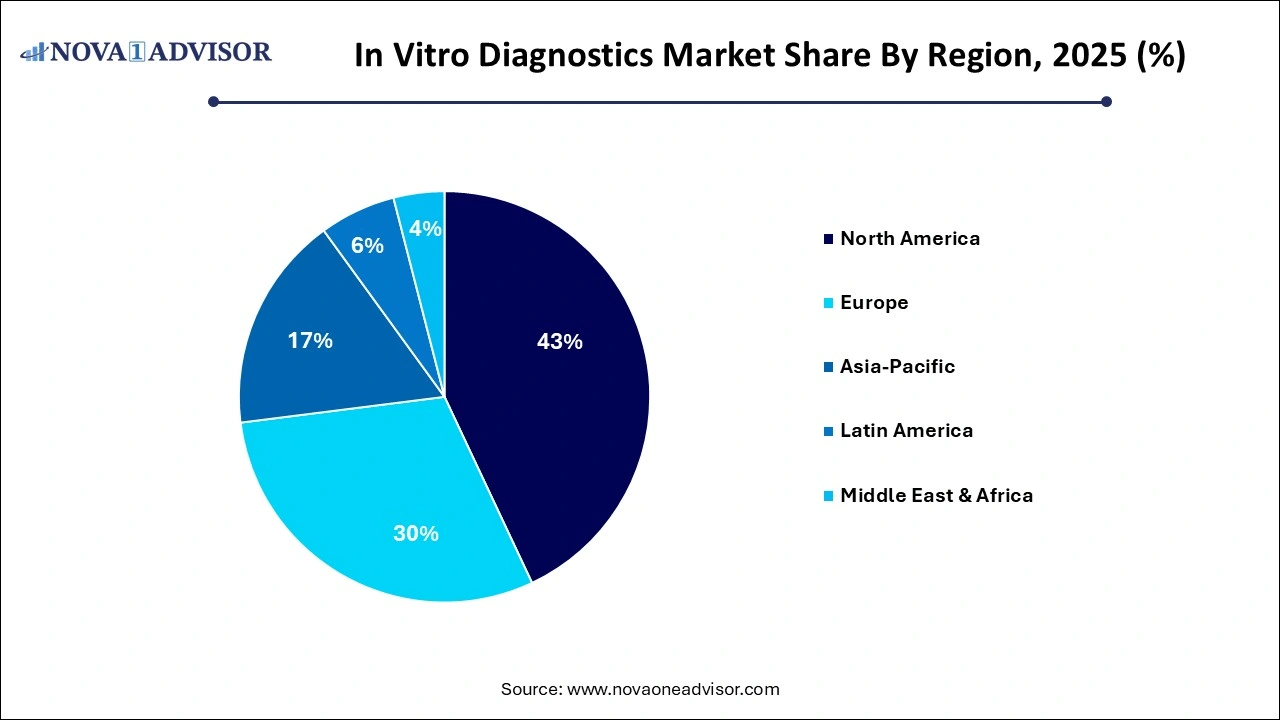

.webp) North America dominated the global IVD market in 2025, accounting for the highest revenue share due to well-developed healthcare systems, a high prevalence of chronic diseases, and a strong focus on early diagnosis. The United States, in particular, benefits from extensive healthcare spending, high diagnostic awareness, and favorable reimbursement for tests like cancer screening, infectious disease panels, and prenatal screening. The region is home to global leaders like Abbott, Thermo Fisher Scientific, and Becton Dickinson, which have made substantial investments in automation, molecular diagnostics, and AI-integrated solutions.

North America dominated the global IVD market in 2025, accounting for the highest revenue share due to well-developed healthcare systems, a high prevalence of chronic diseases, and a strong focus on early diagnosis. The United States, in particular, benefits from extensive healthcare spending, high diagnostic awareness, and favorable reimbursement for tests like cancer screening, infectious disease panels, and prenatal screening. The region is home to global leaders like Abbott, Thermo Fisher Scientific, and Becton Dickinson, which have made substantial investments in automation, molecular diagnostics, and AI-integrated solutions.

The FDA’s proactive stance on approving emergency-use diagnostics, particularly during the COVID-19 pandemic, showcased the region’s regulatory agility. In addition, ongoing public health initiatives such as Cancer Moonshot and CDC-driven infectious disease surveillance continue to boost test volumes across applications.

Asia Pacific is poised to register the highest growth over the forecast period, fueled by rising income levels, healthcare infrastructure expansion, and growing disease awareness. Countries like China, India, South Korea, and Japan are actively investing in diagnostic laboratories, mobile testing infrastructure, and molecular diagnostics capabilities. Local production of affordable reagents and instruments is helping reduce costs and expand access in both urban and rural areas.

Moreover, increasing government initiatives—such as India’s National Health Mission, China’s Healthy China 2030, and Japan’s genomic medicine programs—are integrating diagnostics into national health frameworks. Multinational companies are also establishing regional R&D hubs and forming public-private partnerships to localize innovation and meet region-specific needs.

Some of the prominent players in the in vitro diagnostics market include:

- Abbott

- bioMérieux SA

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Qiagen

- Sysmex Corporation

- Charles River Laboratories

- Quest Diagnostics Incorporated

- Agilent Technologies, Inc.

- Danaher Corporation

- BD

- F. Hoffmann-La Roche Ltd.

In Vitro Diagnostics Market Recent Developments

-

In March 2025, Roche launched its next-gen cobas® infinity edge molecular analyzer, featuring real-time cloud-based diagnostics integration for virology and oncology applications.

-

In January 2025, Abbott received CE marking for its ID NOW 2.0, an enhanced point-of-care molecular testing platform optimized for COVID-19 and flu dual detection.

-

In December 2024, Thermo Fisher Scientific expanded its CRISPR-based diagnostic pipeline by acquiring a biotech start-up focused on ultra-rapid nucleic acid detection.

-

In November 2024, Qiagen partnered with BioNTech to co-develop mRNA vaccine companion diagnostics, combining their molecular assay development capabilities.

-

In September 2024, Siemens Healthineers launched a suite of AI-enhanced immunoassay analyzers, improving result accuracy and reducing turnaround time in high-volume labs.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the in vitro diagnostics market

By Product

- Instruments

- Reagents

- Services

By Technology

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

By Application

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- Others applications

By Test Location

- Point of Care

- Home-care

- Others

By End-use

- Hospitals

- Laboratory

- Home-care

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

.webp) North America dominated the global IVD market in 2025, accounting for the highest revenue share due to well-developed healthcare systems, a high prevalence of chronic diseases, and a strong focus on early diagnosis. The United States, in particular, benefits from extensive healthcare spending, high diagnostic awareness, and favorable reimbursement for tests like cancer screening, infectious disease panels, and prenatal screening. The region is home to global leaders like Abbott, Thermo Fisher Scientific, and Becton Dickinson, which have made substantial investments in automation, molecular diagnostics, and AI-integrated solutions.

North America dominated the global IVD market in 2025, accounting for the highest revenue share due to well-developed healthcare systems, a high prevalence of chronic diseases, and a strong focus on early diagnosis. The United States, in particular, benefits from extensive healthcare spending, high diagnostic awareness, and favorable reimbursement for tests like cancer screening, infectious disease panels, and prenatal screening. The region is home to global leaders like Abbott, Thermo Fisher Scientific, and Becton Dickinson, which have made substantial investments in automation, molecular diagnostics, and AI-integrated solutions.