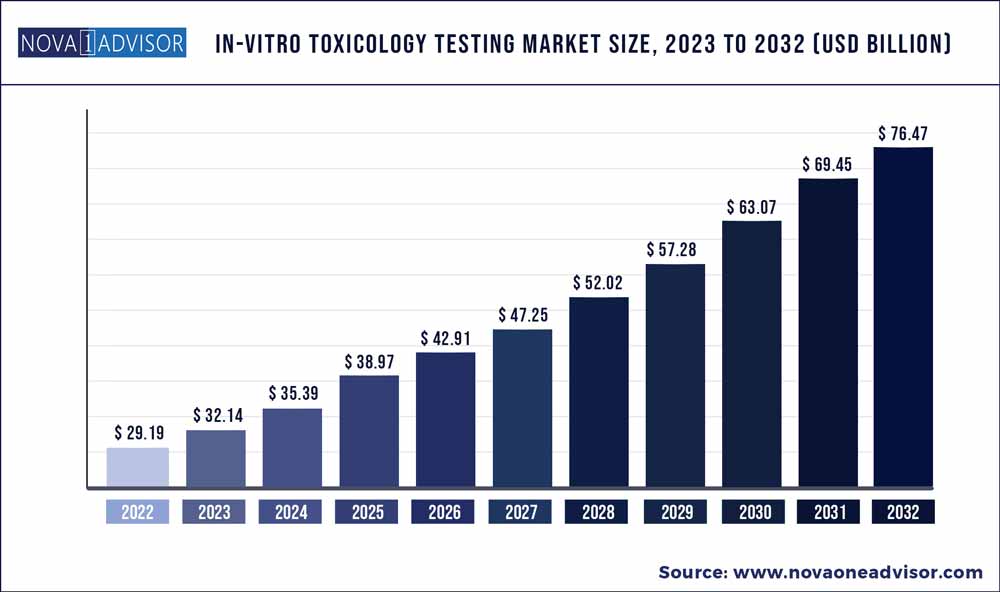

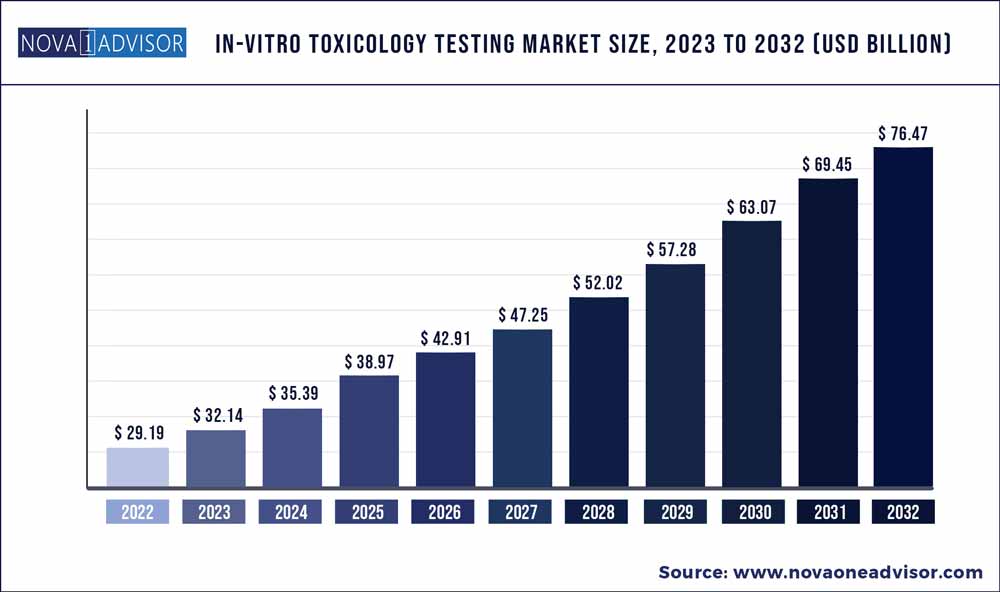

The global in-vitro toxicology testing market size was exhibited at USD 29.19 billion in 2022 and is projected to hit around USD 76.47 billion by 2032, growing at a CAGR of 10.11% during the forecast period 2023 to 2032.

Key Pointers:

- North America held the largest revenue share of 47.11% in market during 2022.

- Asia Pacific will also register significant CAGR during the forecast period

- The cell culture technology segment held the highest market share of 43.18% in 2022.

- The systemic toxicology segment captured the largest market share of 67.19% in 2022

- The cellular assay segment captured the largest market share of 44.15% in 2022.

In-vitro Toxicology Testing Market Report Scope

Over the years, acceptance of in-vitro toxicology testing methods by regulatory authorities is increasing at a faster pace & thus validation of these tests methods opposed to conventional testing is even rising. Also, development of technologies to substitute animal use for toxicology tests has fueled the usage of in-vitro models such as in-silico simulation, assays, 3D cell cultures and many more, thereby boosting market growth.

Screening of a new drug candidate involves the use of animals for preclinical studies which is very tedious and expensive. However, in recent times, several jurisdictions are promoting ban for animal-based chemical testing. For example, for several years, the EU has been promoting the reduction, replacement, and refinement of animal tests. The Regulation on cosmetic products (1223/2009), REACH (2007/2006), the Directive on the protection of animals used for scientific purposes (2010/63), and Classification, Labelling and Packaging (CLP) (1272/2008) are some examples of EU legislation that are engaged in strongly encouraging the replacement of animal toxicology testing. Furthermore, in June 2018, the Cruelty-Free Cosmetics Act was passed in California to ban the selling of animal-tested products after 2020.

Many governments and private organization are taking actions to minimize conventional testing models, providing funds to support & develop in-vitro toxicology assays and form conducive government policies. Thus, increase in government initiatives that are focused on banning animal testing can be attributed to the rise in adoption of in-vitro toxicological models and creates many opportunities within the market. For instance, approximately USD 3.2 million were contributed by People for the Ethical Treatment of Animals (PETA) and its international associates to promote the development of non-animal test methods.

The advancements in computational and screening methods such as biological, high throughput, and chemical coupled with the vast number of public databases for toxicity analysis has expanded largely. This has allowed researchers to access information for drug discovery studies, toxicology profiling, and drug development programs. For instance, the MetaTox HS project by Agilent Technologies, Inc. brings advanced solutions for toxicity assays & high sensitivity metabolism during drug development procedures.

Technology Insights

The cell culture technology segment held the highest market share of 43.18% in 2022. As cell cultures provide reproducible results to consistent samples, they serve as excellent models for toxicology assays. This further enables early stage drug toxicity testing due to which this technology is gaining popularity & extensive application. Moreover, cell culturing technology is adopted in comparison to animal testing by healthcare academic institutions, biotechnology industries, and pharmaceutical manufacturers across the globe.

There has been rising adoption of high throughput technologies (HTTs) in the pharmaceutical industry and this can be attributed for the highest growth rate of this segment. The increase in need for reducing toxicity failure burden along with multiple drugs in product pipeline will contribute to the growth during the forecast.as the attrition rate for the drugs due to toxicity in clinics have not declined.Furthermore, incorporation of HTT in vitro models aids in examining varied dose levels, chemicals, and their effects. Researchers are keen on making use of such data to carry out predictive analysis.

Application Insights

The systemic toxicology segment captured the largest market share of 67.19% in 2022 and anticipated to witness the fastest growth during 2023 - 2032. Owing to the understanding of adverse reactions that occurs in relatively short time after drug administration will drive the adoption of this segment in the market.There are various types of systemic toxicology studies which includes acute systemic toxicity, sub-acute systemic toxicity, sub-chronic systemic toxicity and chronic systemic toxicity. Hence, the goal is to generate a precise data points like- minimum dose that results in toxicity, maximum tolerated dose, plasma concentration which leads to toxicity and margin of safety which is used to make decisions.

Similarly, the dermal toxicity segment will also witness significant CAGR during the forecasted years. In-vitro toxicology assays for assessing dermal toxicity are much simple, cost-reliable and effective rather than animal testing. The regulatory framework for toxicity tests of cosmetics is also driving the demand for in-vitro dermal toxicity testing. In the current scenario many countries like Israel, Norway, Brazil and India are following the suit with the ban which was been introduced in Europe. Government which could ban testing of cosmetics on animals can also ban the sale of cosmetics that are tested on animals. Besides, the advancements in in-vitro tools for risk assessment during dermal toxicity will also fuel growth in the market.

Method Insights

The cellular assay segment captured the largest market share of 44.15% in 2022. As cell cultures are excellent models and are available widely for analyzing the pharmacokinetic profile of drugs, cellular assays attribute to the high revenue in in-vitro toxicology testing market. Furthermore, early stage drug toxicity profiling also contributes to this segment’s revenue and drives its growth.

Cellular assays as in-vitro models offer several benefits such as speed of analysis, minimum cost, and even potential technological advances such as automation. In addition, key efforts laid down by manufacturers for the development of novel cellular assays will also boost the market progression during the forecast. For instance, Enzo Life Sciences provides a board range of fluorescence-based live cell assays, CELLESTIAL, that are capable of investing cell biology and its interconnection with disease pathology.

In-silico analysis for toxicology testing will also expand at a significant CAGR during the 2023 -2032 period. Implementation of analysis strategy via computational tools for safety assessment in an informed and efficient manner will propel the product development during all stages. This technological development will create new market opportunities & result in higher demand in the toxicology testing industry.

End-user Insights

In 2022, the pharmaceutical industry segment held the highest share of 42.9% in the market. It is attributed to the high use of toxicology testing for analyzing the pharmacokinetic properties of pharmaceutical drugs. Both novel and generic drugs require assays for toxicology testing. Areas such as absorption, distribution, metabolism, and excretion (ADME), genotoxicity, safety pharmacology necessitate the use of toxicity assays. Additionally, the continuous development and research for new drugs coupled with candidate drug pipeline will propel the demand for in-vitro testing methods.

The diagnostics segment is estimated to witness the fastest growth rate during the forecast due to rising number of diagnostic devices. The COVID-19 pandemic also pushed the diagnostic segment to develop innovative solutions for virus detection. Moreover, companies provide a comprehensive diagnostics product line for detection of therapeutic drug monitoring, long-term alcohol abuse, and point-of-care drug testing, thereby boosting the segment growth.

Regional Insights

North America held the largest revenue share of 47.11% in market during 2022. Owing to the rising government funding for research of therapeutics, increased healthcare expenditure, advanced infrastructure & processes for drug discovery and strong regulatory framework for approval has increased the demand as well as adoption on in-vitro testing methods in this region’s market.

Furthermore, launch of biologics by biopharmaceutical players in North America, particularly the U.S. has driven the adoption of toxicology testing and will contribute to future revenue generation. Presence of multiple government & private agencies for funding programs will also contribute to the fastest growth rate in 2023-2032.

On the other hand, Asia Pacific will also register significant CAGR during the forecast period due to development of health care settings, increased geriatric population in need of medicines, and various government incentives for enhancing technology and development.

Some of the prominent players in the In-vitro Toxicology Testing Market include:

- Charles River Laboratories International, Inc.

- SGS S.A.

- Merck KGaA

- Eurofins Scientific

- Abbott Laboratories

- Laboratory Corporation of America Holdings

- Evotec S.E.

- Thermo Fisher Scientific, Inc.

- Quest Diagnostics Incorporated

- Agilent Technolgies, Inc.

- Catalent, Inc.

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- BioIVT

- Gentronix

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global In-vitro Toxicology Testing market.

By Technology

- Cell Culture Technology

- High Throughput Technology

- Molecular Imaging

- OMICS Technology

By Application

- Systemic Toxicology

- Dermal Toxicity

- Endocrine Disruption

- Occular Toxicity

- Others

By Method

- Cellular Assay

- Live Cells

- High Throughput / High Content Screening

- Molecular Imaging

- Confocal Microscopy

- Others

- Others

- Fixed Cells

- Biochemical Assay

- In-silico

- Ex-vivo

By End-user

- Pharmaceutical Industry

- Cosmetics & Household Products

- Academic Institutes & Research Laboratories

- Diagnostics

- Chemicals Industry

- Food Industry

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)