In Vivo CRO Market Size and Growth

The global in Vivo CRO market size was valued at USD 6.19 billion in 2023 and is anticipated to reach around USD 13.74 billion by 2033, growing at a CAGR of 8.34% from 2024 to 2033.

In Vivo CRO Market Key Takeaways

- In 2023, the rodent based segment dominated the market with a revenue share of 81.76%.

- The non-rodent based segment is expected to witness a significant CAGR over the forecast period.

- In 2023, the small molecules segment held the largest revenue share.

- The large molecules segment is anticipated to grow at the fastest CAGR during the forecast period.

- The GLP toxicology segment dominated the market with the largest revenue share in 2023.

- The non GLP segment is anticipated to witness a significant CAGR during the analysis period.

- The oncology segment held the largest market share in 2023.

- The CNS conditions segment is expected to register the fastest growth over the forecast period.

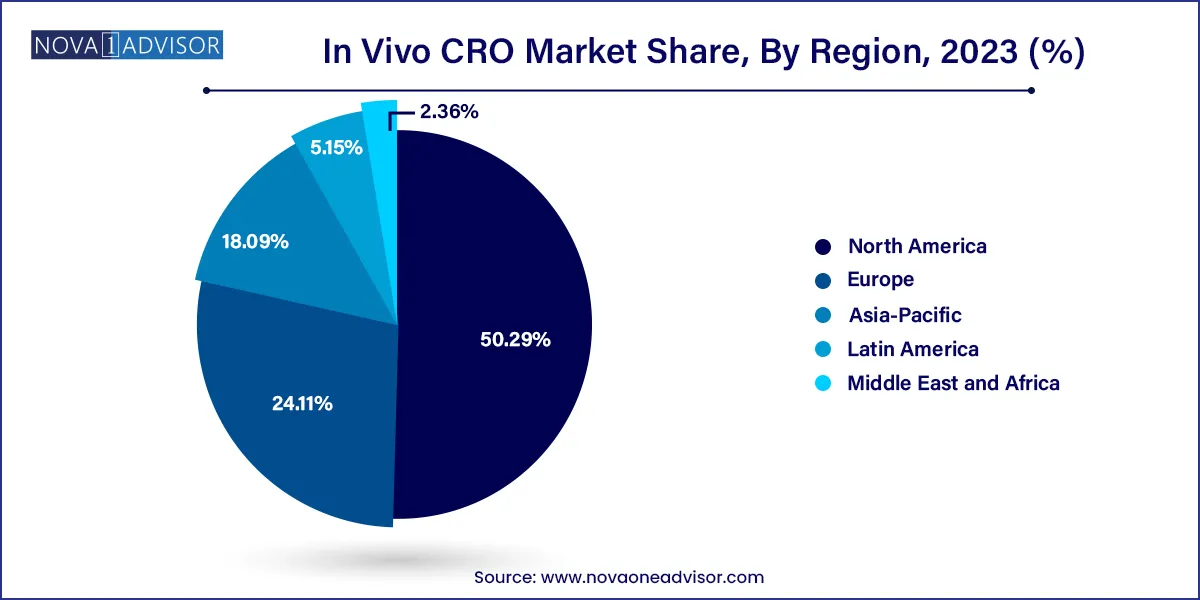

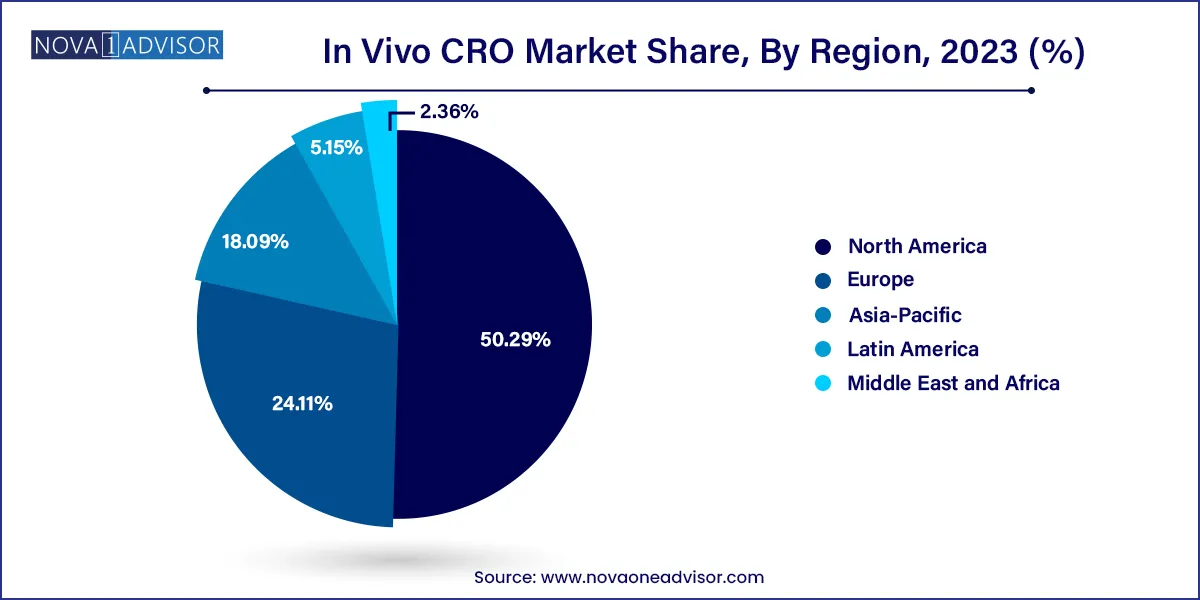

- North America dominated the market with a revenue share of 50.29% in 2023.

- Asia Pacific is expected to witness the fastest CAGR during the forecast period.

Market Overview

The In Vivo Contract Research Organization (CRO) Market plays a critical role in the global preclinical research and drug development ecosystem. In vivo CROs specialize in conducting animal-based studies to evaluate the safety, pharmacokinetics, pharmacodynamics, and efficacy of drug candidates before they transition into clinical trials. As the complexity of modern therapeutics increases—particularly in oncology, gene therapy, and neurodegenerative diseases—the need for precise, scalable, and regulatory-compliant in vivo research services is growing rapidly.

These CROs offer both GLP-compliant and non-GLP studies depending on the stage of drug development, ranging from proof-of-concept to toxicology. They are essential partners to pharmaceutical, biotechnology, and academic research institutions that seek to optimize resources and accelerate timelines. With R&D becoming more decentralized and competitive, outsourcing preclinical studies to specialized CROs has become a cost-effective and expertise-driven solution.

Furthermore, the market is benefiting from the surging innovation in modalities such as CAR-T, gene therapy, and RNA-based drugs, all of which require highly controlled and specialized animal models. As regulatory scrutiny increases around reproducibility and ethical standards in animal testing, CROs are also adopting advanced technologies like imaging-guided interventions, real-time telemetry, and AI-based pathology analytics to deliver higher value.

From specialized rodent models to non-rodent primate studies, the in vivo CRO market is undergoing a paradigm shift—one that prioritizes translational accuracy, regulatory readiness, and therapeutic specificity.

Major Trends in the Market

-

Rapid Uptake of Humanized Mouse and Xenograft Models: Demand for predictive tumor models like patient-derived xenografts (PDX) and humanized immune systems is rising, especially in oncology and immunotherapy research.

-

Increased Adoption of Advanced Modalities: Preclinical testing for CAR-T, RNA therapies, and gene editing technologies like CRISPR is driving investment in new animal models and custom study designs.

-

Digital Transformation and Data Integration: Use of real-time telemetry, AI-enabled image analysis, and digital histopathology is enhancing data quality, traceability, and decision-making.

-

Consolidation of Preclinical CROs: Larger CROs are acquiring niche players to build comprehensive in vivo portfolios and enter high-growth regions or therapeutic niches.

-

Regulatory Push for GLP Compliance: Increasing preference for GLP studies early in the pipeline to avoid rework and accelerate IND submissions is pushing CROs to expand GLP-capable infrastructure.

-

Personalized Medicine Driving Model Customization: CROs are offering tailored animal models to reflect patient subpopulations, genetic mutations, and comorbidity conditions in CNS and autoimmune diseases.

-

Growing Interest in Non-Rodent Models: Mini pigs, rabbits, and non-human primates are being used for higher translational validity, especially for safety pharmacology and toxicology studies.

In Vivo CRO Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 6.70 Billion |

| Market Size by 2033 |

USD 13.74 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.34% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Model type, modality, indication, GLP type, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

IQVIA Inc; Crown Bioscience; Taconic Biosciences, Inc.; PsychoGenics Inc.; Evotec; Janvier Labs; Biocytogen; GemPharmatech; Charles River Laboratories; Icon Plc; Labcorp Drug Development; Parexel International Corporation; SMO Clinical Research (I) Pvt Ltd. |

Key Market Driver: Growing Complexity in Drug Discovery Demands Specialized Preclinical Testing

The most significant driver for the in vivo CRO market is the increasing complexity of drug discovery, especially in the context of biologics, cell-based therapies, and gene editing technologies. Unlike traditional small molecules, these new modalities often require highly tailored and regulated in vivo testing frameworks that most in-house laboratories are ill-equipped to support.

Take CAR-T cell therapies, for instance these require the development of immunodeficient mouse models reconstituted with human immune cells to predict T-cell persistence, cytokine release, and tumor clearance. Similarly, gene therapies demand vector-specific biodistribution, immunogenicity, and off-target profiling that go far beyond conventional rodent toxicology.

As such, pharmaceutical and biotech companies increasingly turn to CROs not just for operational capacity, but for scientific guidance and model innovation. By outsourcing to CROs with validated models, GLP systems, and disease-area expertise, sponsors reduce their preclinical risk and improve clinical translation. The urgency to reduce attrition in late-phase clinical trials where costs are exponentially higher—further incentivizes robust in vivo validation early in the pipeline.

Key Market Restraint: Ethical Concerns and Regulatory Scrutiny in Animal Testing

One of the pressing restraints in the in vivo CRO market is the ethical and regulatory challenges surrounding animal experimentation. Animal welfare groups and bioethicists have long voiced concerns over the use of animals, particularly higher-order mammals like primates, in biomedical research. This public scrutiny has been translated into legislation such as the 3Rs (Replacement, Reduction, and Refinement) guidelines in the U.S., Europe, and Japan, which aim to minimize animal use in scientific research.

Moreover, new regulations from health authorities and ethics boards are demanding increased justification, documentation, and oversight for all in vivo studies. For example, GLP-compliant toxicology studies must now meet not only scientific rigor but also welfare benchmarks including housing standards, enrichment protocols, and humane endpoints.

While these measures promote more humane practices, they also raise operational complexity and compliance costs for CROs. Facilities must invest in staff training, facility upgrades, and advanced monitoring systems to align with global expectations. Smaller CROs, in particular, may find it difficult to maintain competitiveness amid such rising standards, which could slow down market expansion.

Key Market Opportunity: Personalized Animal Models for Precision Medicine Research

The rise of precision medicine presents a transformative opportunity for the in vivo CRO industry. Instead of using one-size-fits-all models, pharmaceutical developers now demand animal models that reflect the genetic, immunological, and phenotypic profiles of specific patient subgroups. This has led to a surge in demand for personalized or stratified models.

For instance, companies developing treatments for neurodegenerative conditions like ALS or Parkinson’s are collaborating with CROs to create transgenic mouse models that mirror specific mutations (e.g., SOD1, LRRK2) found in patient populations. Similarly, autoimmune diseases like multiple sclerosis and IBD require models that replicate disease flares and immunopathology in a highly controllable manner.

CROs that can deliver custom model creation, breeding, and validation services—combined with robust phenotyping and digital biomarker analysis—stand to benefit immensely. This opportunity is especially pronounced in the oncology and CNS sectors, where model fidelity is crucial for candidate prioritization. The future of in vivo CROs may well be defined by their ability to deliver tailored translational platforms that align preclinical outcomes with personalized clinical endpoints.

In Vivo CRO Market By Model Type Insights

Rodent-based models dominate the in vivo CRO landscape, primarily due to their cost-efficiency, genetic manipulability, and compatibility with various therapeutic areas. Mice models, particularly genetically modified strains and syngeneic tumor lines, are widely used in oncology, neuroscience, and immunology studies. Transgenic mice expressing human disease genes enable deeper insights into disease mechanisms and treatment responses. Meanwhile, rat models are extensively used in toxicology, pharmacokinetics, and CNS disorder research due to their larger size and more human-like physiological systems.

However, the non-rodent model segment is the fastest-growing, driven by the rising need for translational accuracy in advanced therapeutics. Mini pigs, non-human primates, and canines are gaining adoption in late-stage preclinical studies, particularly for large molecule biologics, gene therapies, and safety pharmacology. For example, non-human primate models are increasingly used to study CAR-T persistence and biodistribution before first-in-human trials. The high relevance of these models to human physiology justifies their cost in high-value therapeutic programs.

In Vivo CRO Market By Modality Insights

Small molecules currently lead the market in terms of volume, as they continue to represent a large share of the global drug development pipeline. CROs conduct high-throughput efficacy and toxicology studies using established rodent models to support these programs. Their long-standing presence in R&D pipelines ensures a steady base of demand for in vivo services.

However, large molecules and advanced therapies are the fastest-growing modality, especially cell and gene therapy, CAR-T, and RNA-based therapeutics. Each of these requires bespoke animal models and in-depth characterization techniques. RNA therapy, for instance, requires biodistribution and off-target studies in larger models to ensure delivery efficacy and immune tolerance. The regulatory requirement for detailed pharmacology in such cases is accelerating demand for advanced in vivo capabilities.

In Vivo CRO Market By GLP Type Insights

Non-GLP studies currently represent the majority, especially in early-stage discovery and mechanism-of-action research. These flexible, rapid-turnaround studies help filter compounds before progressing to formal regulatory work.

GLP toxicology studies, however, are growing faster, driven by regulatory demands and the high failure costs of late-stage development. These studies require comprehensive documentation, facility validation, and QA oversight, making them more expensive but necessary for IND/NDA submissions. As more advanced therapies enter IND-enabling phases, the demand for GLP-compliant in vivo studies is expected to rise.

In Vivo CRO Market By Indication Insights

Oncology dominates the indication segment, owing to the sheer volume of oncology pipelines and the critical role of in vivo tumor models in efficacy assessment. Within this, solid tumors, especially breast, colon, and lung cancer, are the most researched using xenografts and PDX models. Blood cancers also utilize syngeneic models and genetically modified mice for testing new immunotherapies.

CNS conditions are emerging as the fastest-growing indication, reflecting the pharmaceutical industry’s renewed focus on previously intractable neurological diseases. Conditions like Alzheimer’s, ALS, and Parkinson’s require highly specialized and often transgenic rodent models to mimic disease progression. Stroke and traumatic brain injury (TBI) models are also being refined for regenerative medicine and neuroprotection studies.

In Vivo CRO Market By Regional Insights

North America leads the global in vivo CRO market, supported by a mature pharmaceutical industry, advanced research institutions, and a well-established regulatory framework. The U.S. houses several global CRO leaders such as Charles River Laboratories, Labcorp Drug Development, and The Jackson Laboratory, offering full-spectrum in vivo services. The presence of major biotech clusters in Boston, San Francisco, and the Research Triangle boosts demand for both early and late-stage in vivo studies.

Moreover, the U.S. FDA’s clear expectations regarding IND-enabling studies, toxicology profiling, and model validation make North America a preferred region for global sponsors. The integration of AI and imaging technology in preclinical labs across the region further adds to the competitiveness and innovation quotient of North American CROs.

Asia-Pacific is the fastest-growing market, driven by cost-effective operations, increasing R&D investments, and a growing base of local biotech companies. Countries like China, India, South Korea, and Singapore are seeing a boom in preclinical CROs that offer competitive pricing and turnaround time.

China, in particular, is emerging as a hub for both rodent and non-rodent GLP toxicology services. The expansion of Indigenous pharma and biopharma companies, along with increasing foreign investment, is creating strong local demand for in vivo studies. Regional governments are also investing in bioscience parks and CRO hubs, helping Asia-Pacific compete on quality as well as cost.

In Vivo CRO Market Top Key Companies:

- IQVIA Inc.

- Crown Bioscience

- Taconic Biosciences, Inc.

- PsychoGenics Inc.

- Evotec

- Janvier Labs

- Biocytogen Boston Corp

- GemPharmatech

- Charles River Laboratories

- Icon Plc

- Labcorp Drug Development

- Parexel International Corporation

- SMO Clinical Research (I) Pvt Ltd.

- Comp14

- Comp15

In Vivo CRO Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the In Vivo CRO market.

By Model Type

- Rodent based

- Rat Models

- Mice Models

- Others

- Non-Rodent based

By Modality

- Small Molecules

- Large Molecules

- Cell & Gene Therapy

- CAR T-cell therapies

- CAR-NK cell therapy

- TCR-T cell therapy

- Other (Includes- TCR-NK, CARM, and TAC-T)

- RNA Therapy

- Others

By Indication

- Oncology

- Blood cancer

- Solid tumor

- Syngeneic model

- Patient derived xenograft

- Xenograft

- Others

- CNS Conditions

- Epilepsy

- Parkinson's disease

- Huntington's disease

- Stroke

- Muscular Dystrophy

- Alzheimer’s Disease

- Traumatic brain injury

- Amyotrophic lateral sclerosis (ALS)

- Spinal Muscular Atrophy

- Muscle regeneration

- Other Neurodevelopment Disorders

- Diabetes

- Obesity

- Pain management

- Autoimmune/inflammation conditions

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome

- Others

- Others

By GLP Type

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)