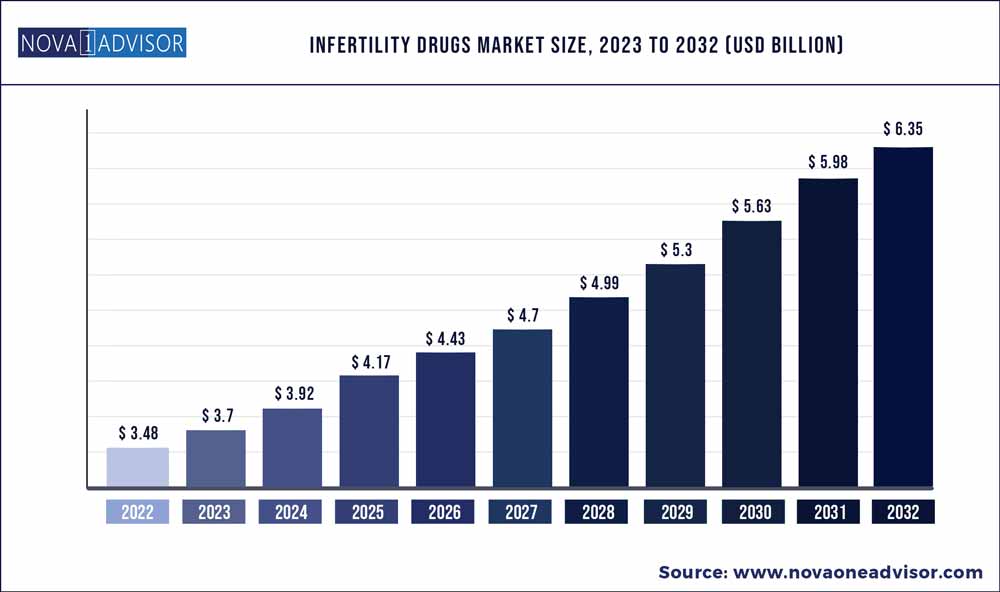

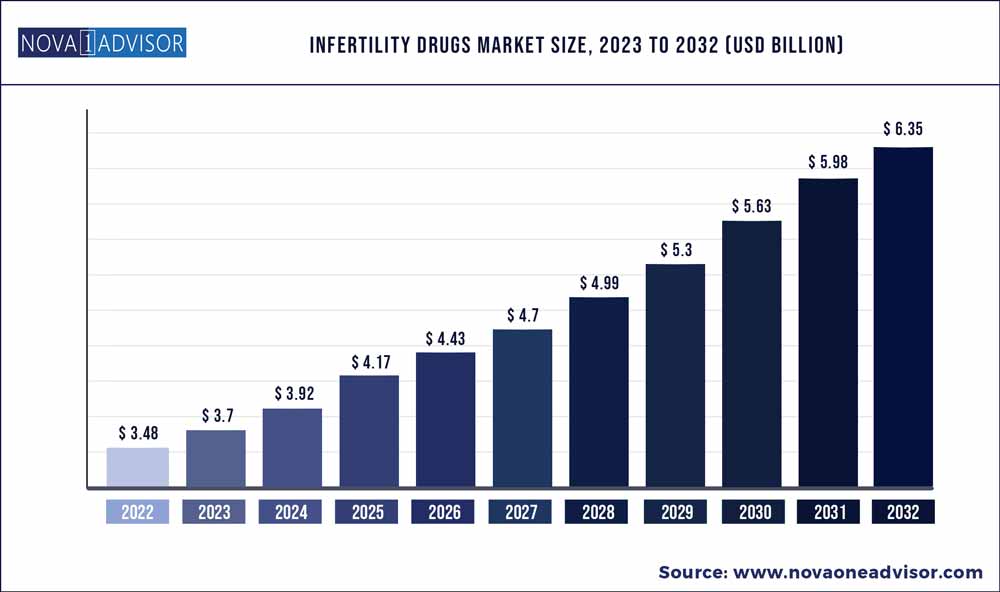

The global infertility drugs market size was exhibited at USD 3.48 billion in 2022 and is projected to hit around USD 6.35 billion by 2032, growing at a CAGR of 6.20% during the forecast period 2023 to 2032.

Key Pointers:

- The gonadotropins segment dominated the infertility drugs market with a revenue share of 39.75% in 2022 and is expected to witness highest growth over the forecast period.

- The typical cost of a chorionic gonadotropin injection without health insurance costs around USD 397.85 per vial and with insurance, it costs USD 304.76 per vial.

- The hospital pharmacy segment dominated the infertility drugs market with a revenue share of 54.40% in 2022.

- The online pharmacy segment is expected to grow at a high growth rate over the forecast period.

- The women segment dominated the infertility drugs market with a revenue share of 72.45% in 2022.

- North America dominated the overall infertility drugs market in terms of the revenue share of 38.9% in 2022

- Asia Pacific is expected to witness a growth rate of 6.9% over the forecast period.

The market players are engaged in introducing novel medicines for treating infertility. For instance, key players including Oxolife are currently engaged in the development of first in class product candidate OXO-001, that improves the embryo implantation process by enhancing the binding on inner lining of endometrium in the uterus. Since there is no available substitute to improve the endometrium's conditions for the embryo implantation, the development of such products address a medical need that affects women undergoing assisted reproduction worldwide.

The market seems to be saturated with fewer opportunities for new entrants. The companies including Merck & Co. Inc., Ferring B.V., and Organon group of companies holds majority of market share. Thus, the pharmaceutical companies are focusing on developing biosimilar of gonadotropins for market penetration. For instance, Qilu Pharmaceutical Co., Ltd. focuses on developing QL1012, a recombinant human follicle stimulating hormone which is under phase 3 clinical trial. Successful completion of of trial and subsequent launch is anticipated to drive market.

Increasing initiatives undertaken by public and private organizations to support patients living with infertility are expected to positively contribute to infertility treatment market growth. For instance, in March 2022, the French government introduced new IVF law under which single women and same sex-couple avail treatment free of cost under the country’s national healthcare system.

In addition, in November 2022, Saudi Arabia’s Health Insurance Council conducted studies with regard to the inclusion of medicines under medical insurance coverage. The successful completion of the study and inclusion of medication under insurance is anticipated to increase patient access to treatment, subsequently, increase demand for medicines over the forecast period.

Rising awareness about disease and its available medicines among patients and physicians is anticipated to increase the target population for the market. For instance, in September 2021, Mubadala Health and United Eastern Medical Services (UEMedical) organized the ‘3rd HealthPlus Middle East Fertility Conference with an aim to rise awareness about the advancements in the treatment of this conditions and its benefits among physicians and patients in Dubai.

Moreover, there are several initiatives undertaken by the national government worldwide to tackle low fertility rate issues and promote childbirth which may increase the demand for drugs. For instance, in August 2022, the South Korean Government announced a provision for a monthly allowance of USD 740 per new child born in the family with an aim to tackle the low fertility rate in the country and encourage childbirth.

Infertility drugs Market Segmentation

| By Drug Class |

By Distribution Channel |

By End-user |

|

Gonadotropins

Aromatase Inhibitors

Selective Estrogen Receptor Modulators (SERMs)

Dopamine Agonists

Others

|

Hospital Pharmacy

Specialty & Retail Pharmacy

Online Pharmacy

|

Men

Women

|

Infertility drugs Market Key Players And Regions

| Companies Profiled |

Regions Covered |

|

Merck & Co., Inc.

Ferring B.V.

Organon Group of Companies

Abbott

Novartis AG

Bayer AG

Pfizer Inc.

Mankind Pharma

Teva Pharmaceutical Industries LTD.

Sanofi

|

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa (MEA)

|