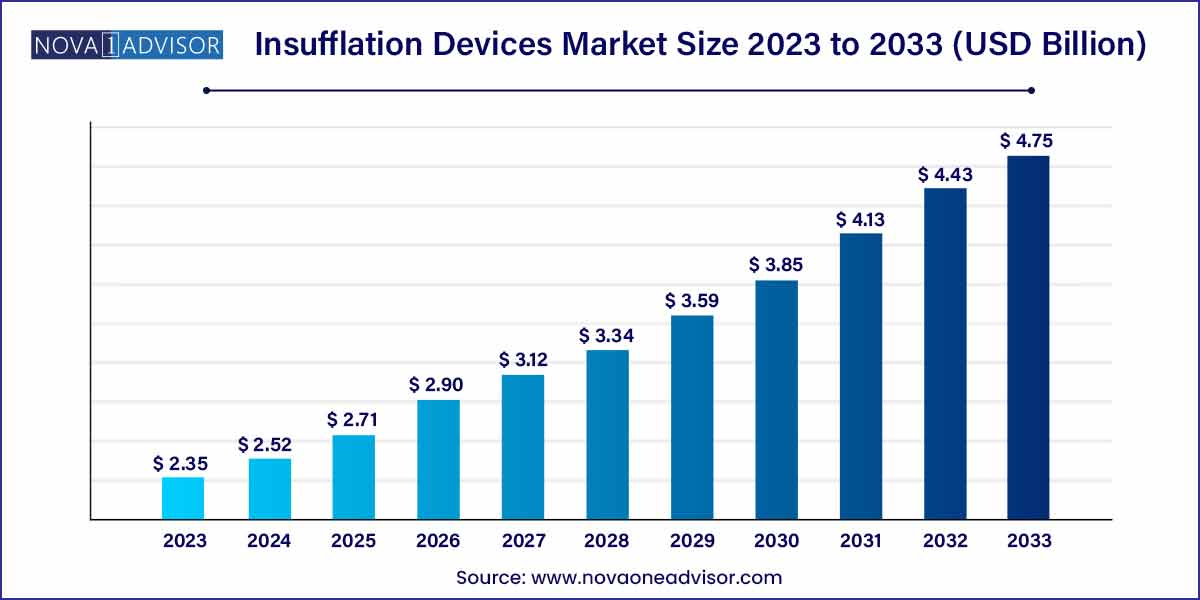

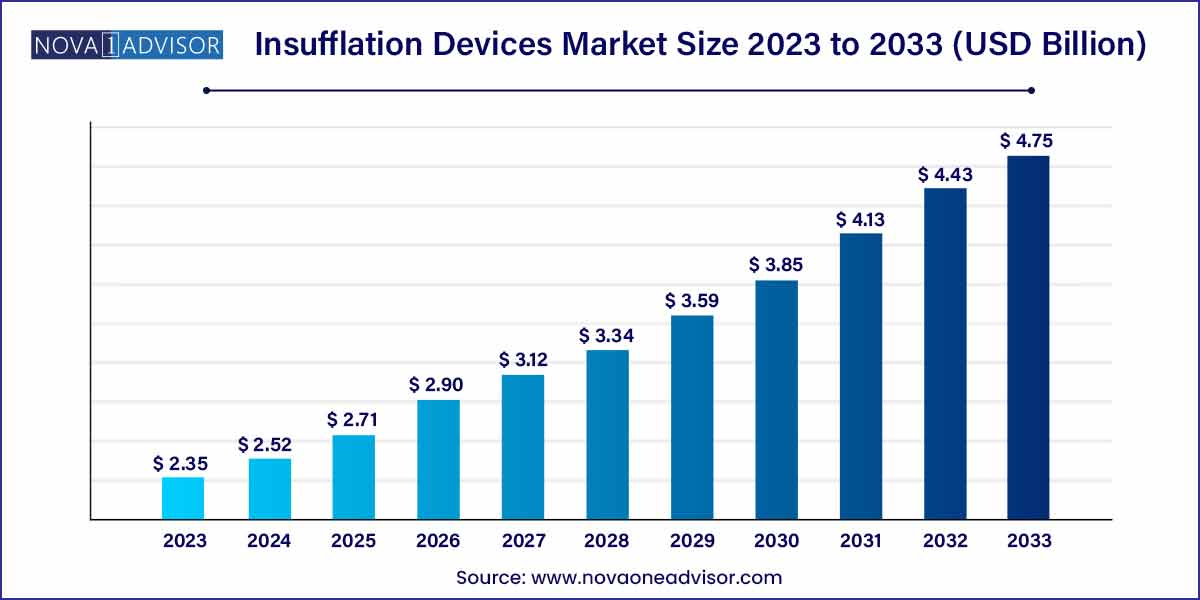

The global insufflation devices market size was exhibited at USD 2.35 billion in 2023 and is projected to hit around USD 4.75 billion by 2033, growing at a CAGR of 7.3% during the forecast period of 2024 to 2033.

Key Takeaways:

- The laparoscopic surgery segment held the largest share of over 35.0% in 2023 and is anticipated to witness considerable growth over the forecast period.

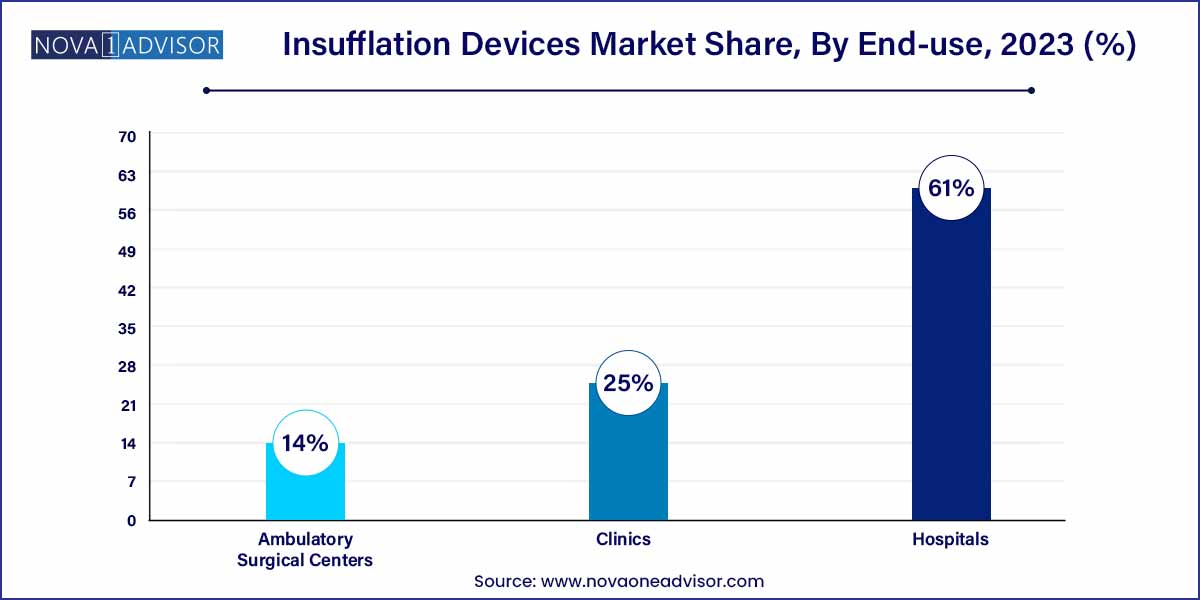

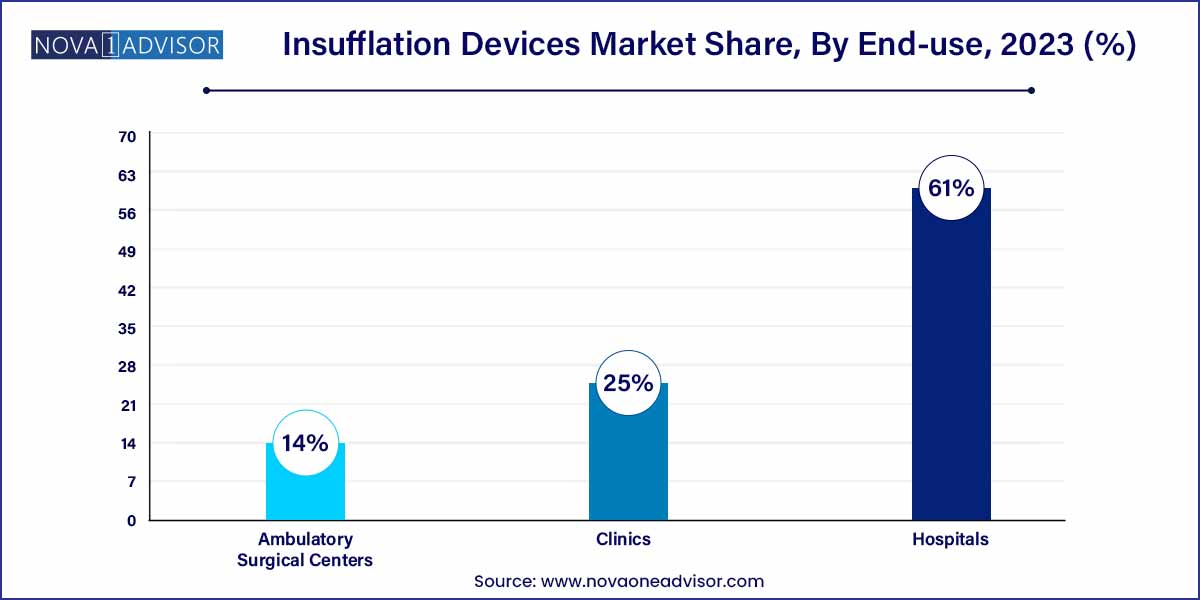

- The hospitals segment held the largest share of more than 61.0% in 2023.

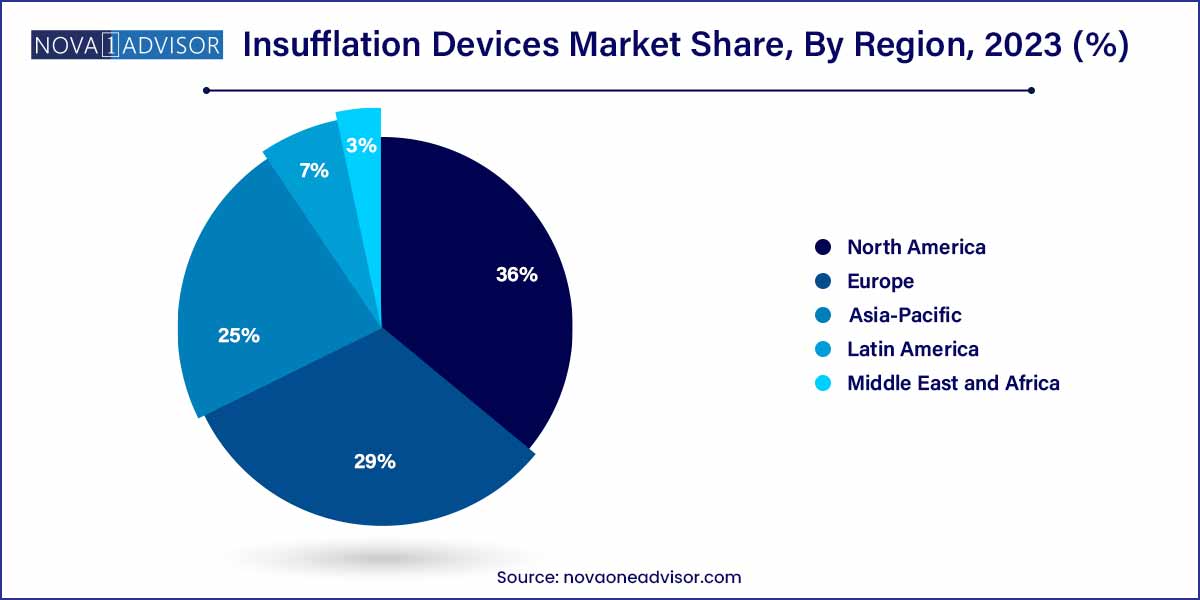

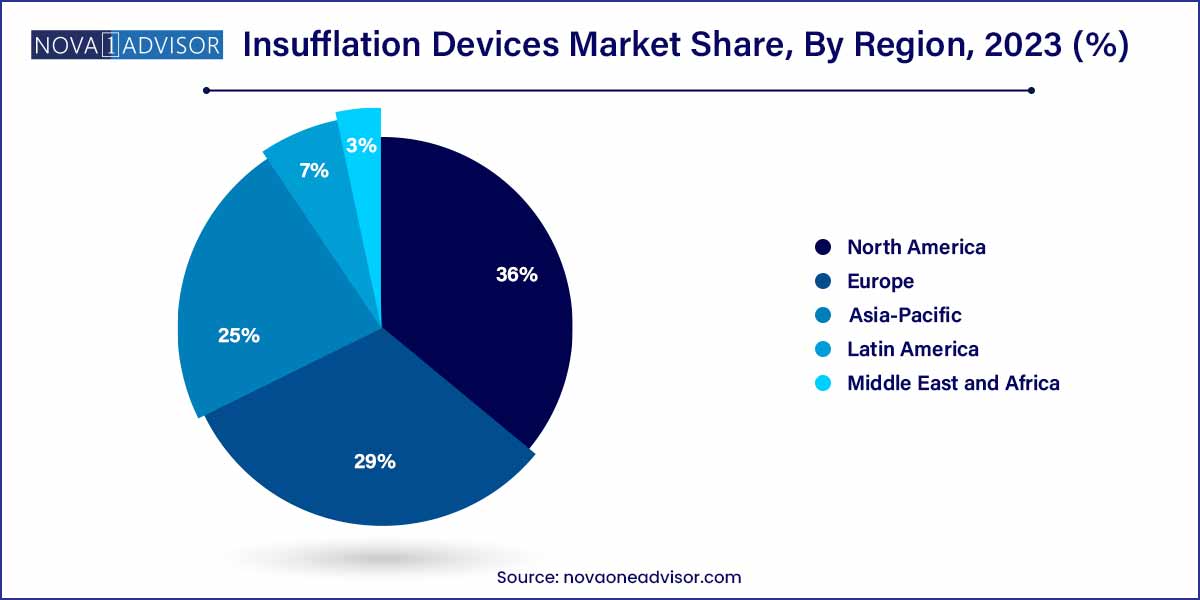

- North America dominated the market with as hare of over 36.0% in 2023 and is expected to witness considerable growth over the forecast period.

Market Overview

The Insufflation Devices Market has become an indispensable part of minimally invasive surgeries, where the creation of a working space within body cavities is essential. Insufflation devices are used to introduce gases, typically carbon dioxide, into the abdominal cavity during procedures like laparoscopy, bariatric surgeries, and cardiac surgeries. This controlled inflation allows for better visualization, manipulation of organs, and access during surgical interventions.

The growth of the insufflation devices market is driven by the rising adoption of minimally invasive surgical techniques, an increasing burden of chronic diseases requiring surgical intervention, and technological advancements that enhance patient safety and surgical efficiency. Insufflation devices now offer features like pressure regulation, gas heating, and humidification, significantly improving patient outcomes and reducing postoperative complications.

Leading companies like Stryker Corporation, Karl Storz GmbH, and Olympus Corporation are investing in the development of next-generation insufflators equipped with intelligent control mechanisms, wireless connectivity, and user-friendly interfaces. The future of this market is closely tied to the expansion of laparoscopic procedures, the aging population, and the ongoing evolution of surgical technologies.

Major Trends in the Market

-

Integration of Intelligent Insufflation Systems: Smart insufflators with automated pressure and flow adjustments.

-

Rise in Demand for Heated and Humidified Insufflation: Reducing postoperative pain and enhancing recovery.

-

Growth in Bariatric and Cardiac Minimally Invasive Surgeries: Expanding use of insufflation across diverse surgical fields.

-

Shift Toward Disposable and Single-Use Insufflation Devices: Enhancing infection control.

-

Adoption of Robotic-Assisted Laparoscopic Surgeries: Driving the need for precise and integrated insufflation systems.

-

Expansion into Emerging Markets: Increasing healthcare infrastructure development fueling device adoption.

-

Focus on Reducing Insufflation-Related Complications: Innovations to manage gas embolisms and cardiovascular effects.

Insufflation Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.35 Billion |

| Market Size by 2033 |

USD 4.75 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Fujifilm; Medtronic; Stryker; BD; Olympus; B. Braun Melsungen; Smith & Nephew; Karl Storz; Steris; CONMED; Richard Wolf |

Key Market Driver

Rising Adoption of Minimally Invasive Surgeries Globally

The escalating preference for minimally invasive surgeries (MIS) is a major driver for the insufflation devices market. MIS techniques offer several advantages over traditional open surgeries, including reduced hospital stays, minimal scarring, faster recovery, and lower postoperative pain. According to a report published by the Society of American Gastrointestinal and Endoscopic Surgeons in March 2024, laparoscopic procedures accounted for over 65% of all general surgeries performed in developed economies, underscoring the strong momentum behind this trend. Insufflation devices are critical enablers of MIS, thereby directly benefiting from its growing adoption.

Key Market Restraint

Risks Associated with Insufflation Procedures

Despite their advantages, insufflation devices can be associated with complications such as gas embolisms, hypercapnia, and adverse hemodynamic effects, particularly in high-risk patients. These risks, although relatively rare with modern systems, can discourage some surgeons and institutions from widespread adoption, especially in cardiac and critical care settings. Moreover, device malfunctions or user errors during insufflation can lead to serious intraoperative complications, highlighting the importance of rigorous training and device reliability.

Key Market Opportunity

Emergence of Advanced Heated and Humidified Insufflation Systems

A significant opportunity in the market lies in the development and commercialization of insufflation devices offering heated and humidified gas delivery. Traditional cold, dry gas insufflation can cause peritoneal desiccation, hypothermia, and postoperative pain. Newer devices that warm and humidify COâ‚‚ before insufflation help maintain core body temperature, reduce inflammation, and improve patient comfort. In February 2024, a major clinical trial published by the American Journal of Surgery reported a 30% reduction in postoperative pain scores among patients who underwent heated, humidified gas insufflation compared to conventional methods.

By Application

Laparoscopic Surgery dominated the application segment in 2024. Laparoscopy, used across general surgery, gynecology, urology, and oncology, represents the largest share due to its widespread adoption, technological advancements, and surgeon familiarity. Insufflation devices designed for laparoscopy are becoming more sophisticated, integrating feedback mechanisms to maintain optimal intra-abdominal pressures without manual adjustments. This application benefits from a growing global trend toward day surgeries and cost-efficient surgical procedures.

Bariatric Surgery is the fastest-growing application segment. With global obesity rates continuing to rise, bariatric procedures like laparoscopic sleeve gastrectomy and gastric bypass are seeing unprecedented demand. Insufflation devices adapted for bariatric patients—who often require higher flow rates and greater pressure regulation—are becoming a focus area for manufacturers. In March 2024, the World Obesity Federation reported a 15% annual growth rate in bariatric surgeries worldwide, directly boosting the insufflation device market.

By End-use Insights

Hospitals dominated the end-use segment. Most laparoscopic and bariatric surgeries are conducted in hospitals due to the need for comprehensive perioperative care, intensive monitoring, and access to emergency services. Hospitals typically invest in premium insufflation devices equipped with multiple safety features, enabling a broader range of complex surgeries.

Ambulatory Surgical Centers (ASCs) are the fastest-growing end-use segment. ASCs focus on outpatient surgeries with rapid turnaround times, and their rising popularity is driving demand for compact, cost-effective insufflation devices. Increasing insurer support for same-day surgeries and patients’ preference for lower-cost alternatives to hospitals are reinforcing ASC growth. In January 2024, a major ASC network in the U.S. announced plans to equip all its facilities with next-gen portable insufflation units to support an expanding list of laparoscopic procedures.

By Regional Insights

North America dominated the global insufflation devices market in 2024. High adoption rates of minimally invasive surgeries, advanced healthcare infrastructure, strong reimbursement frameworks, and ongoing technological innovation contribute to North America's market leadership. The U.S. particularly commands a large share due to its early adoption of laparoscopic techniques, large number of bariatric surgeries, and focus on patient safety protocols. In March 2024, the American College of Surgeons reported a continued rise in laparoscopic surgeries across major healthcare systems.

Asia-Pacific is the fastest-growing region. Rapid improvements in healthcare infrastructure, rising middle-class populations, increased medical tourism, and growing awareness about the benefits of minimally invasive surgeries are fueling demand. Countries such as China, India, and South Korea are experiencing double-digit growth rates in laparoscopic procedures. In February 2024, the Indian Ministry of Health announced a national initiative to subsidize laparoscopic surgery training, further accelerating market expansion in the region.

Some of the prominent players in the inflation device market include:

- Fujifilm

- Medtronic

- Stryker

- BD

- Olympus

- B. Braun Melsungen

- Smith & Nephew

- Karl Stor

- Steris

- CONMED

- Richard Wolf

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global Insufflation devices market.

Application

- Laparoscopic Surgery

- Bariatric Surgery

- Cardiac Surgery

- Other Surgeries

End-use

- Hospitals

- Clinics

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)