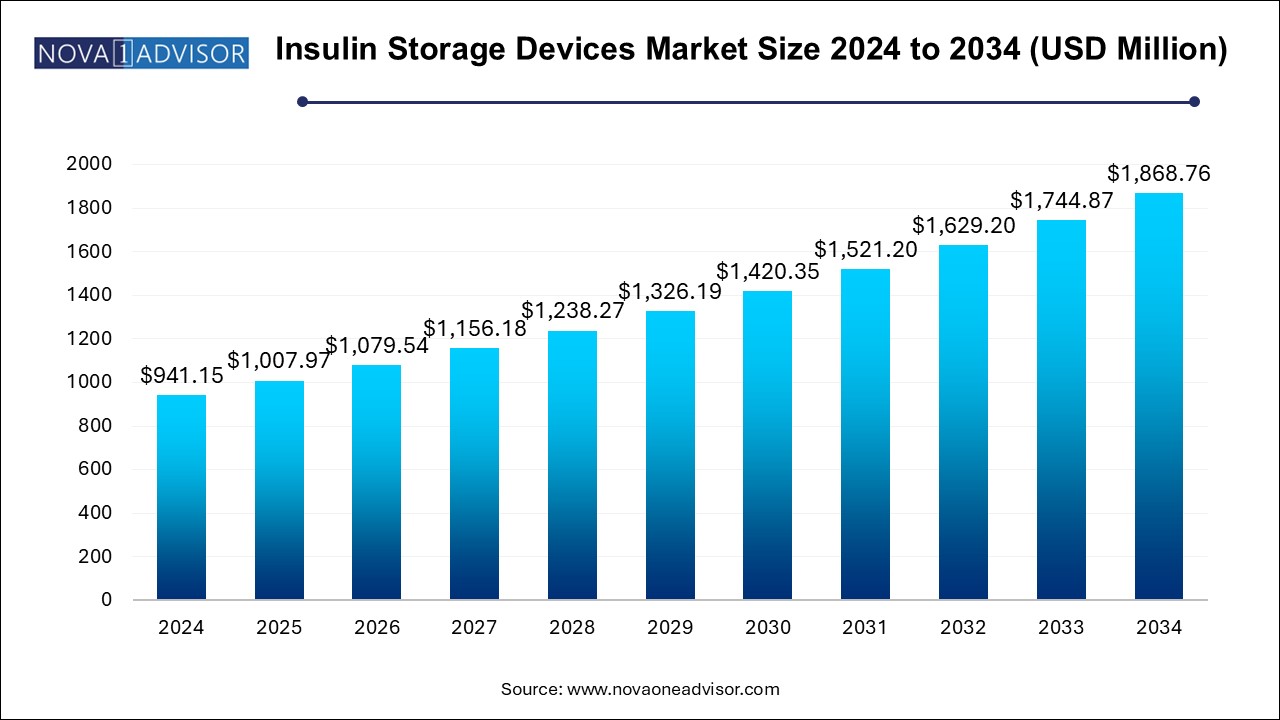

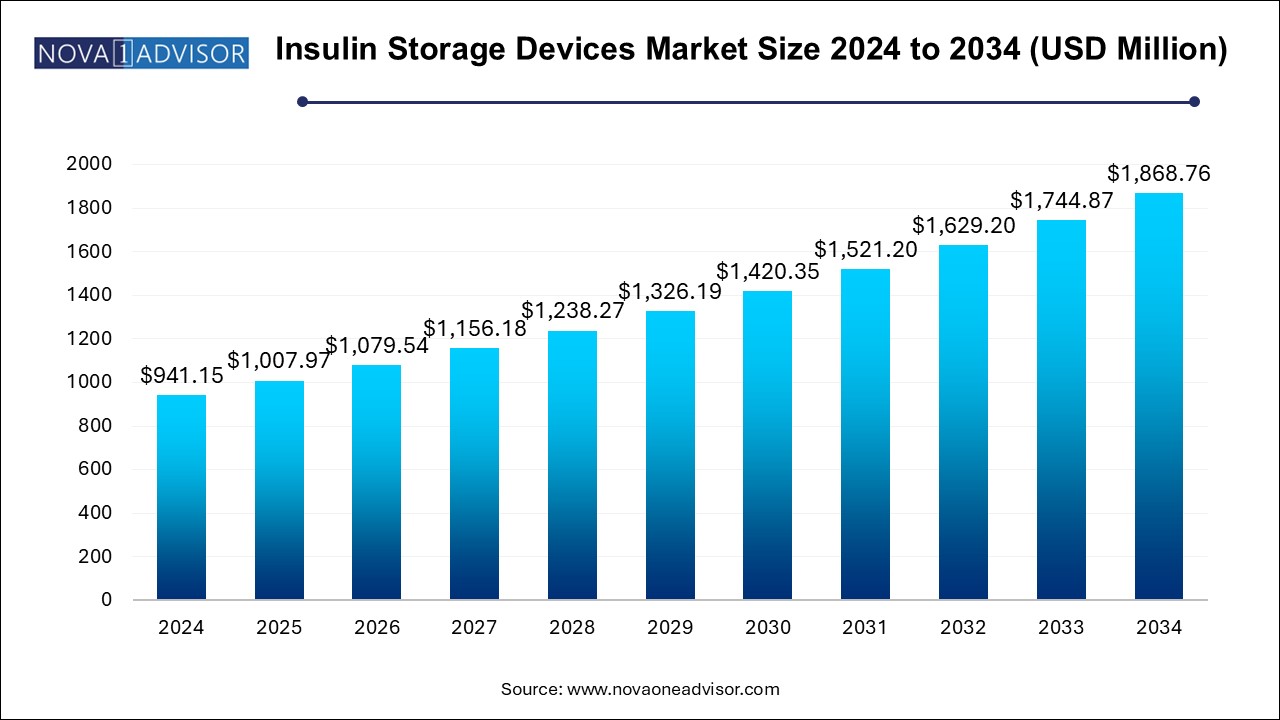

Insulin Storage Devices Market Size and Growth

The insulin storage devices market size was exhibited at USD 941.15 million in 2024 and is projected to hit around USD 1,868.76 million by 2034, growing at a CAGR of 7.1% during the forecast period 2024 to 2034.

Insulin Storage Devices Market Key Takeaways:

- The battery-operated device segment accounted for the largest revenue share in 2023 and is expected to grow at the fastest CAGR during the forecast period.

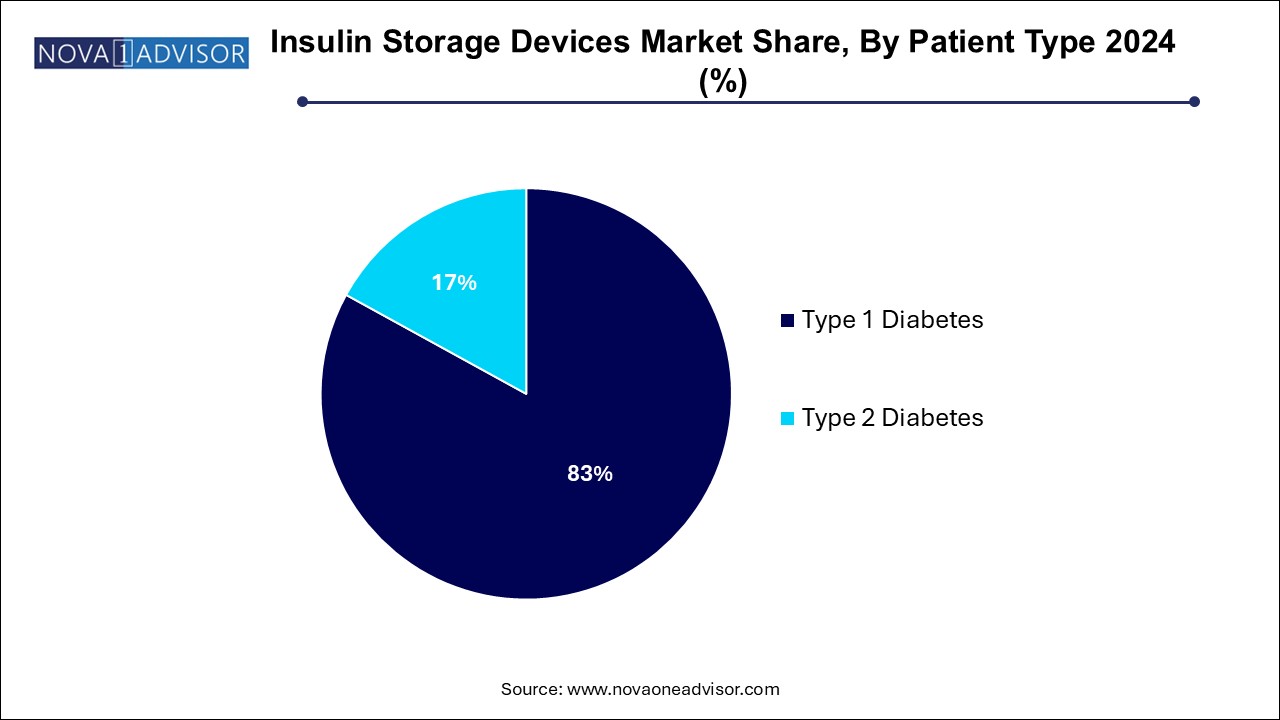

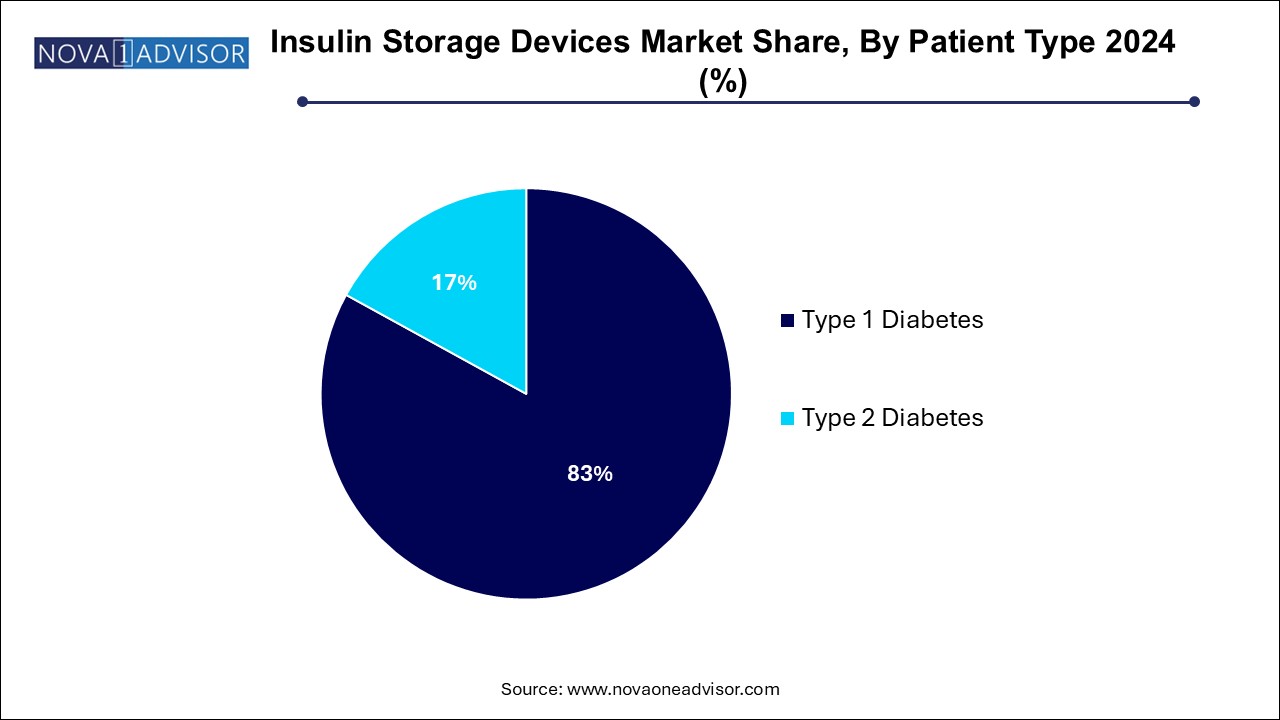

- The diabetes type 1 segment accounted for the largest revenue share of 83.0% in 2023.

- The diabetes type 2 segment is estimated to register the fastest CAGR of 8.0% over the forecast period.

- North America dominated the market and accounted for the largest revenue share of 45.7% in 2023.

- Asia Pacific is expected to grow at the fastest CAGR of 8.2% during the forecast period.

Market Overview

The Insulin Storage Devices Market represents an essential aspect of diabetes management, offering solutions to maintain insulin efficacy through proper temperature control. Insulin is highly sensitive to temperature variations, with exposure to extreme heat or freezing temperatures compromising its potency, leading to poor glycemic control and increased risk of diabetic complications.

As the global prevalence of diabetes continues to rise currently affecting over 537 million adults worldwide according to the International Diabetes Federation (IDF) the demand for reliable, portable, and user-friendly insulin storage solutions is escalating. Insulin storage devices encompass a range of products from insulated cooling wallets to technologically advanced battery-operated refrigeration units.

With growing awareness among patients regarding insulin handling, advancements in device design for portability and durability, and rising healthcare investments across emerging economies, the insulin storage devices market is poised for significant growth. The market's evolution is being fueled by patient-centric innovation, the expansion of home-based diabetes management, and the rising adoption of insulin pump therapies that require backup storage solutions.

Major Trends in the Market

-

Surge in Portable and Travel-friendly Devices: Development of lightweight, compact cooling devices to support diabetes management during travel.

-

Introduction of Smart Insulin Storage Units: Devices with integrated temperature monitoring, alarms, and app connectivity are emerging.

-

Focus on Eco-friendly and Reusable Solutions: Growing preference for reusable cooling wallets and biodegradable insulated pouches.

-

Expansion of Battery-operated Storage Systems: Offering consistent temperature control for long durations, especially during emergencies.

-

Rising Demand from Low and Middle-income Countries: Awareness initiatives are expanding market penetration in emerging economies.

-

Customization and Design Innovation: Patient-friendly designs, stylish aesthetics, and multifunctionality are becoming standard.

-

Integration with Insulin Pump Technologies: Combining storage and administration solutions for seamless diabetes management.

-

Growth of Online Pharmacies and E-commerce: Easy accessibility to specialized storage products through online platforms.

-

Increased Focus on Pediatric and Geriatric Diabetic Populations: Special solutions catering to vulnerable demographic groups.

-

Partnerships Between Pharma Companies and Device Manufacturers: Collaboration to bundle storage devices with insulin therapy kits.

Report Scope of Insulin Storage Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1,007.97 Million |

| Market Size by 2034 |

USD 1,868.76 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 7.1% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Device Type, Patient Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

ReadyCare, LLC; DISIONCARE; Medicool; Tawa Outdoor; Cooluli; ARKRAY, Inc.; zzolive; Zhengzhou Defrigus Electric Device Co., Ltd.; COOL Sarl-FR; Godrej.com |

Key Market Driver: Rising Prevalence of Diabetes and Growing Adoption of Insulin Therapy

A primary driver fueling the insulin storage devices market is the rising prevalence of diabetes globally and the corresponding increase in insulin therapy adoption. According to the IDF, by 2045, approximately 783 million adults are projected to have diabetes, signifying a growing patient pool reliant on insulin.

Insulin therapy remains critical for Type 1 diabetes management and is increasingly prescribed for Type 2 diabetes patients as disease progression necessitates. With insulin therapy becoming more widespread, ensuring that insulin remains potent throughout storage and administration cycles is crucial. Poorly stored insulin can lose efficacy, leading to poor glucose control, increased healthcare costs, and a heightened risk of complications like neuropathy, nephropathy, and cardiovascular events.

Thus, as the diabetic population grows and self-administration of insulin becomes more common, patient demand for convenient, reliable, and durable insulin storage solutions is set to escalate, driving market growth globally.

Key Market Restraint: Limited Awareness and Affordability Issues in Developing Regions

Despite increasing need, a significant restraint for the insulin storage devices market is limited awareness regarding proper insulin storage practices and affordability challenges in developing regions.

In low- and middle-income countries, where healthcare infrastructure and diabetes education initiatives are still evolving, many patients store insulin improperly, often using rudimentary methods like household refrigerators that can experience power fluctuations or fail to maintain optimal temperatures. Specialized storage devices, especially battery-operated units, may be seen as luxury products due to their higher costs, restricting widespread adoption.

Moreover, supply chain challenges and lack of targeted marketing by manufacturers in rural or underserved areas further hinder market penetration. Overcoming this barrier requires broader awareness campaigns, partnerships with public health agencies, and affordable device innovation tailored to resource-limited settings.

Key Market Opportunity: Growth of Smart and Connected Storage Solutions

An emerging opportunity for the insulin storage devices market lies in the development of smart and connected storage solutions. Modern patients are increasingly seeking real-time monitoring of their medications to ensure safety and efficacy.

Smart insulin storage devices equipped with IoT sensors, Bluetooth connectivity, temperature loggers, and smartphone alerts can notify users when storage conditions deviate from safe ranges. Such solutions can dramatically enhance patient compliance, reduce insulin wastage, and offer peace of mind during travel or power outages.

Further integration of AI-driven predictive alerts and cloud-based data storage could allow healthcare providers to monitor patient insulin usage remotely. As the world moves towards digital healthcare ecosystems, companies offering connected, smart storage options stand to capture a significant share of future demand.

Insulin Storage Devices Market By Device Type Insights

Insulated Kits dominated the insulin storage devices market in 2024. Insulated cooling wallets, pouches, and cooler bags are among the most widely used devices due to their simplicity, affordability, and portability. They are especially popular among travelers, students, and professionals who require non-electric, reusable solutions for short trips or daily commutes. Products like FRIO cooling wallets and MedAngel pouches are standard choices for everyday insulin management, offering 48-hour to 72-hour temperature maintenance without requiring power sources.

Battery-operated insulin storage devices are expected to be the fastest-growing segment. These devices offer reliable temperature regulation for extended periods, making them indispensable for patients residing in areas with frequent power outages, harsh climates, or limited access to refrigeration. Brands like LifeinaBox and Cooluli have introduced battery-powered mini refrigerators specifically designed for insulin, offering mobile app integration, USB charging, and in-built temperature regulation. With the growing popularity of smart health management, battery-operated solutions are gaining ground rapidly.

Insulin Storage Devices Market By Patient Type Insights

Type 1 Diabetes patients accounted for the largest share of device usage in 2024. Type 1 diabetes patients are entirely dependent on external insulin administration throughout their lives. The need for consistent, safe insulin storage is critical, especially considering that insulin vials and pens are often used over several weeks. For young adults, children, and even active older adults with Type 1 diabetes, portable storage solutions are a daily necessity.

Type 2 Diabetes is the fastest-growing patient segment. Historically, Type 2 diabetes management relied heavily on oral antidiabetics. However, with disease progression and the trend towards earlier initiation of basal insulin therapies, a larger segment of Type 2 diabetic patients is now insulin-dependent. This shift, along with improved patient education on self-care, is leading to growing adoption of home-based insulin storage solutions in this demographic.

Insulin Storage Devices Market By Regional Insights

North America dominated the insulin storage devices market in 2024, fueled by a high prevalence of diabetes, well-established healthcare infrastructure, and strong patient awareness levels. The United States alone hosts over 37 million diabetes patients, many of whom use insulin therapy. Furthermore, a robust ecosystem of specialty pharmacies, online healthcare retailers, and insurance coverage for diabetes accessories enhances market access.

Technological adoption is high in North America, with patients readily embracing smart, portable, and battery-operated storage devices. Public health initiatives by organizations like the American Diabetes Association (ADA) and the Juvenile Diabetes Research Foundation (JDRF) continue to advocate for better diabetes management practices, reinforcing demand.

Asia Pacific is poised to witness the fastest growth in the insulin storage devices market. Rapid urbanization, sedentary lifestyles, and dietary changes have led to an alarming surge in diabetes prevalence across China, India, and Southeast Asia. Governments across these countries are prioritizing diabetes care programs, including patient education and subsidized access to insulin.

Rising middle-class incomes, increased healthcare awareness, and improved healthcare access in emerging economies are boosting demand for specialized insulin storage solutions. Moreover, local players are entering the market with cost-effective insulated kits and portable refrigeration units tailored to regional needs, accelerating adoption.

Some of the prominent players in the insulin storage devices market include:

- ReadyCare, LLC

- DISIONCARE

- Medicool

- Tawa Outdoor

- Cooluli

- ARKRAY, Inc.

- zzolive

- Zhengzhou Defrigus Electric Device Co., Ltd.

- COOL Sarl-FR

- Godrej.com

Recent Developments

-

March 2025 – FRIO Ltd. launched a new eco-friendly line of insulin cooling wallets, featuring biodegradable fabrics and extended cooling durations without refrigeration, targeting environmentally conscious consumers.

-

January 2025 – MedAngel introduced its latest Bluetooth-enabled smart sensor designed to integrate with most insulin storage bags and send real-time temperature alerts to users’ smartphones.

-

November 2024 – LifeinaBox expanded its distribution network across North America and Europe, partnering with online pharmacies to offer battery-powered portable mini refrigerators tailored for insulin users.

-

September 2024 – Cooluli announced the release of a new solar-powered insulin cooling device aimed at improving access for diabetic patients in rural and off-grid regions of Africa and Asia.

-

July 2024 – TEMPTIME (a Zebra Technologies company) enhanced its electronic temperature monitoring tags to support better tracking of insulin cold chain logistics for pharmaceutical companies and hospitals.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the insulin storage devices market

Device Type

-

- Insulin Cooling Wallets

- Insulin Cooling Pouches

- Insulated Cooler Bags

Patient Type

- Type 1 Diabetes

- Type 2 Diabetes

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)