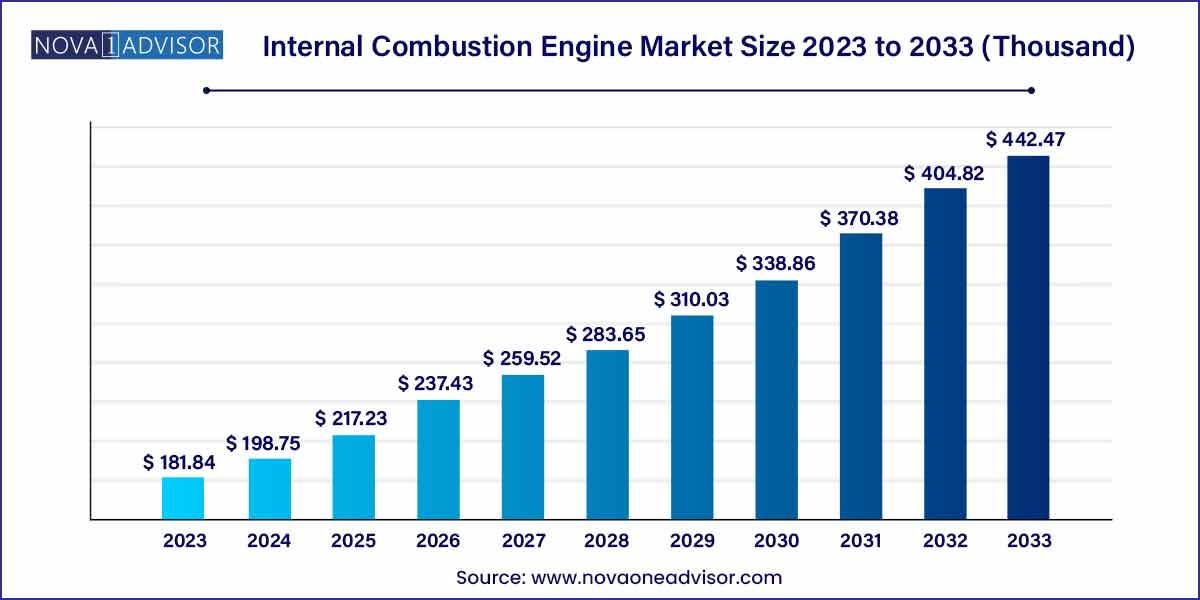

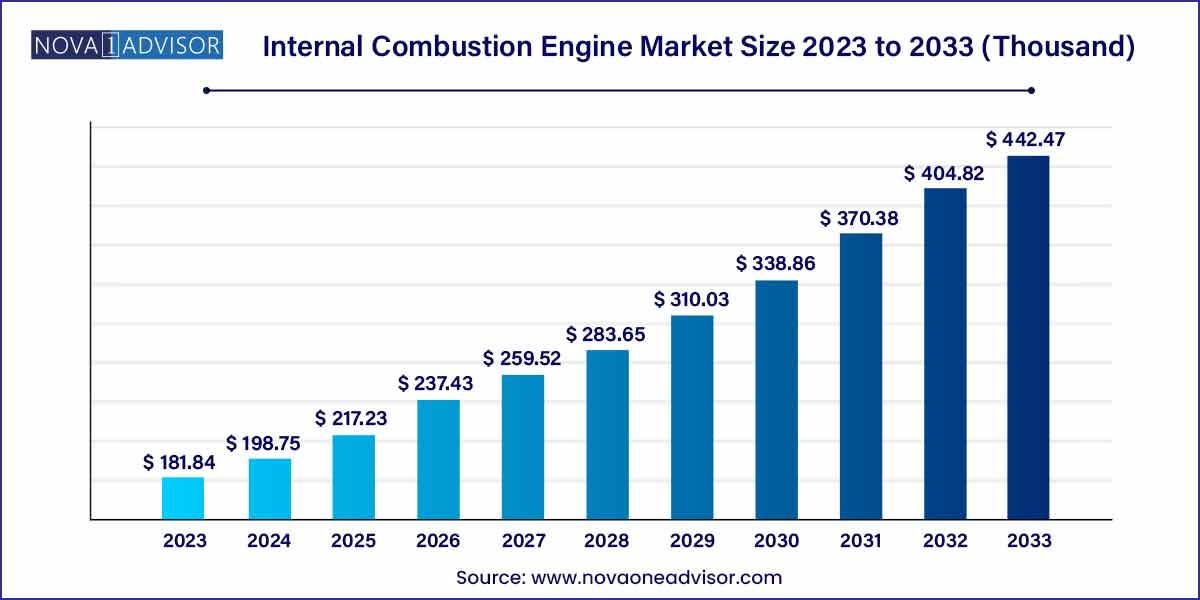

The global internal combustion engine market size was exhibited at USD 181.84 thousand in 2023 and is projected to hit around USD 442.47 thousand by 2033, growing at a CAGR of 9.3% during the forecast period of 2024 to 2033.

Key Takeaways:

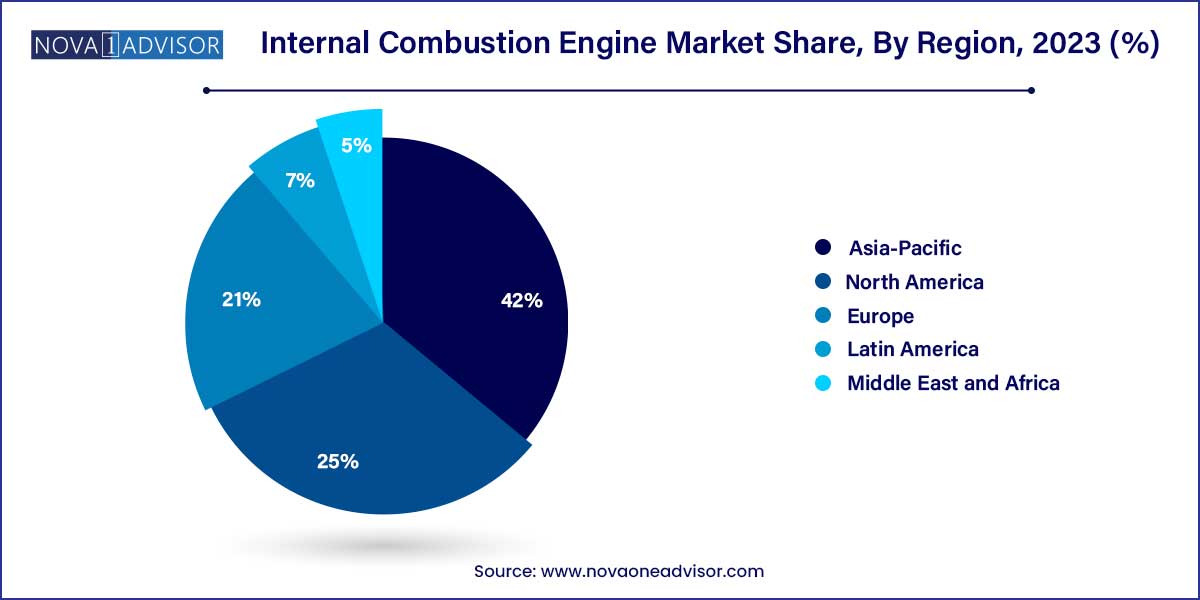

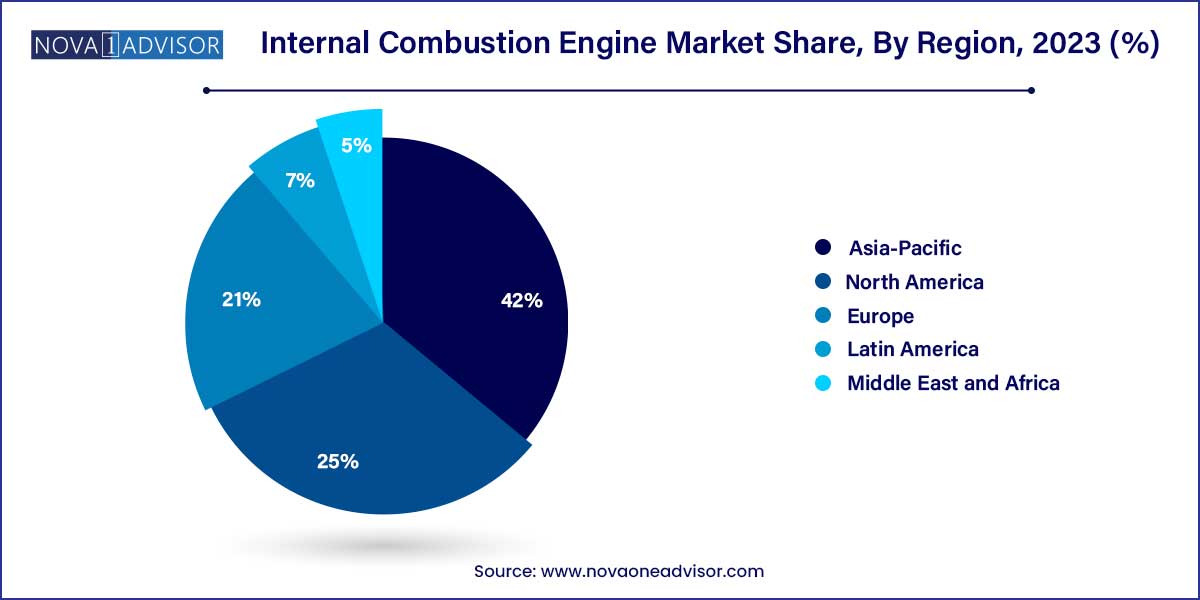

- Asia Pacific dominated the market and accounted for the largest volume share of 42.0% in 2023.

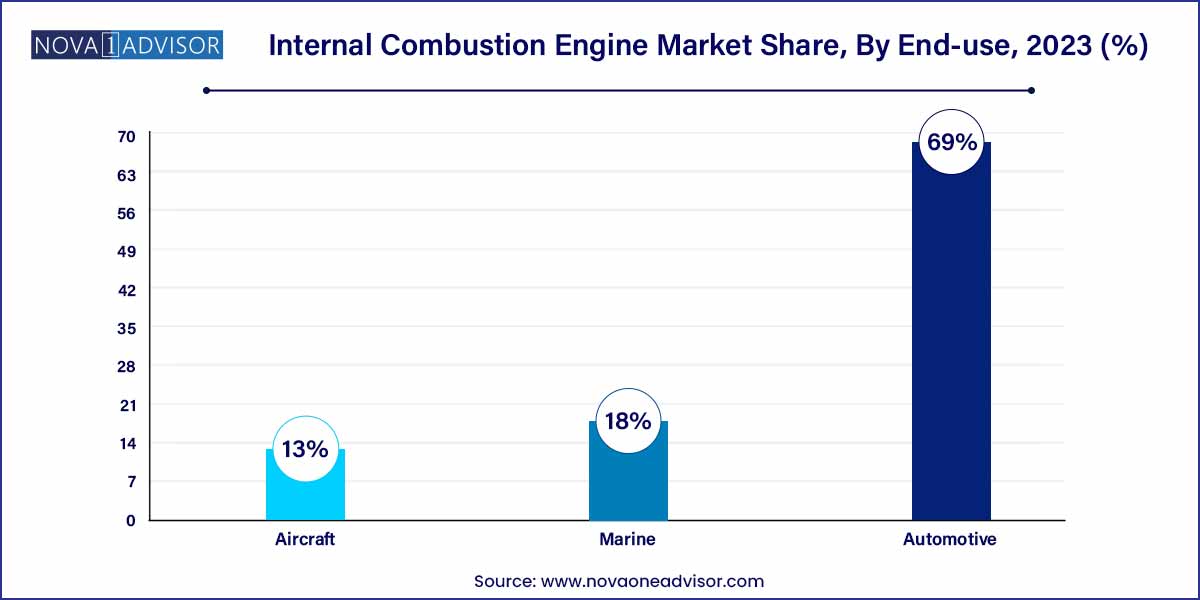

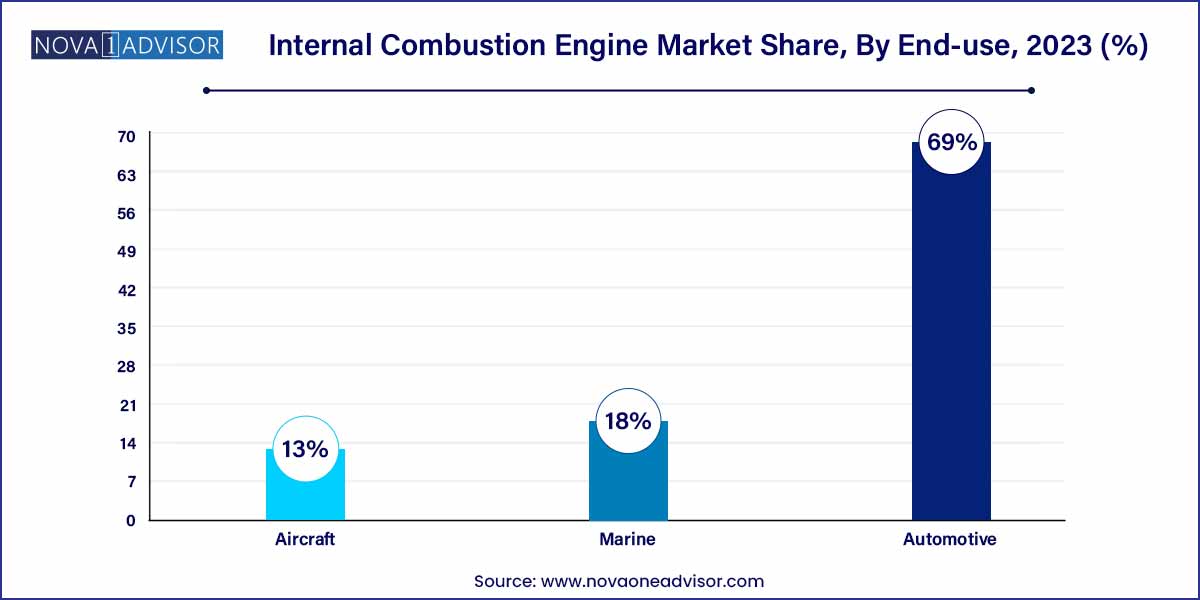

- The automotive segment accounted for the largest volume share of 69.0% in 2023.

- The petroleum segment accounted for the dominant share of 81.6% in 2023.

Internal Combustion Engine Market: Overview

The internal combustion engine (ICE) remains one of the most influential mechanical inventions in history, forming the operational backbone of various transportation and industrial applications. Even amid the growing shift toward electric mobility and decarbonization, ICE technology continues to hold significant ground across the globe. These engines work by igniting fuel—typically petroleum derivatives or natural gas—within a combustion chamber to generate mechanical energy, which powers vehicles, ships, aircraft, and even generators in remote or backup power systems.

The market for internal combustion engines is experiencing a dynamic phase characterized by dual pressures: sustainability mandates and operational necessity. On one hand, environmental regulations and carbon neutrality pledges are pushing industries toward alternative energy sources, including electric and hydrogen powertrains. On the other hand, existing infrastructure, high energy density requirements, and the operational reliability of ICEs still make them the preferred choice in several critical segments such as long-haul trucking, maritime shipping, military aviation, and energy generation in emerging markets.

While automotive applications account for the largest share of ICE demand, growth pockets are visible in marine propulsion and power systems for off-grid and industrial uses. Furthermore, continuous R&D investment into increasing fuel efficiency, hybridization, and alternative fuel compatibility is revitalizing the relevance of ICE technology. Major manufacturers are pursuing engine redesigns that integrate digital monitoring, reduced emissions, and dual-fuel adaptability, enabling a transitional pathway toward a more sustainable future.

Major Trends in the Market

-

Hybrid Internal Combustion-Electric Powertrains

ICEs are increasingly being combined with electric motors to create hybrid systems that improve fuel efficiency while reducing emissions in urban driving.

-

Use of Alternative Fuels

There's a growing adoption of engines that can operate on biofuels, synthetic fuels, and blends of ethanol and methanol to align with sustainability goals.

-

Smaller Engines with Higher Output (Engine Downsizing)

Manufacturers are engineering smaller displacement engines with advanced turbocharging and variable valve technologies to deliver higher power with lower emissions.

-

Focus on Emission Reduction Technologies

Exhaust Gas Recirculation (EGR), Selective Catalytic Reduction (SCR), and particulate filters are becoming standard in ICE designs, especially in diesel engines.

-

Digitalization and Remote Monitoring Integration

ICEs in industrial and commercial applications are now integrated with sensors, cloud-based diagnostics, and AI-driven maintenance prediction systems.

-

Expansion in Developing Regions for Backup Power and Industrial Use

In regions lacking consistent electric infrastructure, ICE-powered generators remain vital for reliable power supply and industrial activity.

Internal Combustion Engine Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 181.84 Thousand |

| Market Size by 2033 |

USD 442.47 Thousand |

| Growth Rate From 2024 to 2033 |

CAGR of 9.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Fuel Type, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AB Volvo; Toyota Motor Corporation; Volkswagen Group; Rolls-Royce plc; Mahindra & Mahindra Ltd.; Renault Group; Mitsubishi Heavy Industries, Ltd.; MAN; General Motors; Ford Motor Company; FCA US LLC; Robert Bosch GmbH; AGCO Corporation; Caterpillar; Shanghai Diesel Engine Co., Ltd. |

Internal Combustion Engine Market Dynamics

- Technological Advancements Driving Innovation:

The internal combustion engine market is undergoing a transformative phase fueled by rapid technological advancements. Innovations in combustion efficiency, materials science, and manufacturing processes are propelling the industry forward. Lightweight materials, advanced fuel injection systems, and precision engineering are becoming pivotal in enhancing engine performance and fuel efficiency. Additionally, the integration of smart technologies, such as IoT sensors and predictive maintenance solutions, is revolutionizing how internal combustion engines are monitored and optimized.

- Regulatory pressures and environmental sustainability:

One of the defining dynamics in the internal combustion engine market is the escalating emphasis on environmental sustainability, driven by stringent regulatory measures. Governments worldwide are enforcing increasingly stringent emission standards, compelling manufacturers to invest in cleaner and more fuel-efficient engine technologies. This push towards reducing carbon footprints has spurred the development of alternative fuels and hybrid solutions within the internal combustion engine sector. Moreover, the market is witnessing a paradigm shift with manufacturers exploring sustainable practices, such as biofuels and synthetic fuels, to align with global environmental goals.

Internal Combustion Engine Market Restraint

- Environmental Concerns and Stringent Emission Regulations:

One of the foremost challenges facing the internal combustion engine market is the intensifying scrutiny and stringent regulations related to environmental impact and emissions. As global awareness of climate change grows, governments and regulatory bodies are imposing increasingly stringent standards on exhaust emissions. This regulatory landscape poses a significant restraint on traditional internal combustion engines, prompting manufacturers to grapple with the development of cleaner combustion technologies and alternative fuels.

- Electrification Trends and the Rise of Alternative Propulsion:

The accelerating shift towards electrification in the automotive and industrial sectors presents a notable restraint for the Internal combustion engine market. The rise of electric vehicles (EVs) and hybrid technologies has challenged the long-standing dominance of traditional combustion engines. With the automotive industry and consumers increasingly embracing electric and hybrid alternatives, internal combustion engines face growing competition and a potential decline in market share.

Internal Combustion Engine Market Opportunity

- Integration of Advanced Materials for Enhanced Efficiency:

A significant opportunity within the internal combustion engine market lies in the integration of advanced materials to enhance overall efficiency. Manufacturers are increasingly focusing on incorporating lightweight materials, such as high-strength alloys and composite materials, to reduce the weight of engine components. This not only contributes to fuel efficiency but also improves the overall performance of internal combustion engines. The utilization of cutting-edge materials allows for the design of more compact and powerful engines, catering to the demands of diverse applications, including automotive, aviation, and power generation.

- Emerging Markets and Industrial Applications:

The expansion of emerging markets and increased industrial applications present a promising opportunity for the internal combustion engine market. In regions experiencing rapid industrialization and infrastructure development, there is a growing demand for reliable and efficient power sources. Internal combustion engines, with their proven track record of versatility and adaptability, are well-suited to meet the power generation needs of these emerging economies. Additionally, the industrial sector continues to rely on internal combustion engines for various applications, including construction equipment, generators, and marine propulsion.

Internal Combustion Engine Market Challenges

- Stringent Emission Standards and Environmental Concerns:

One of the foremost challenges confronting the internal combustion engine market is the relentless pressure imposed by stringent emission standards and escalating environmental concerns. Governments worldwide are increasingly prioritizing environmental sustainability and imposing strict regulations to curb emissions from combustion engines. The quest for compliance with these stringent standards poses a significant challenge for manufacturers, necessitating substantial investments in research and development to develop cleaner combustion technologies.

- Electrification Trends and Market Shifts:

The surge in electrification trends poses a substantial challenge to the internal combustion engine market, particularly in the automotive sector. The rise of electric vehicles (EVs) and the push towards hybrid technologies have disrupted the traditional dominance of internal combustion engines. As consumers increasingly embrace electric alternatives, the market for conventional combustion engines faces a potential decline. This necessitates a strategic pivot for manufacturers towards diversification and the development of hybrid solutions to stay competitive.

Segments Insights:

End-use Insights

Automotive applications continue to dominate the internal combustion engine market, accounting for a majority share due to the sheer volume of vehicles worldwide. Passenger cars, commercial trucks, buses, and motorcycles rely heavily on ICEs for their operational efficiency, affordability, and compatibility with current fueling infrastructure. Even as electric vehicles (EVs) gain traction, ICEs remain prevalent in rural and long-distance mobility segments where EVs lack sufficient range or charging infrastructure. Automakers are investing in hybrid ICE architectures to comply with fuel efficiency standards while maintaining affordability for consumers.

Marine is the fastest-growing end-use segment, particularly as maritime freight continues to expand in tandem with global trade. Marine ICEs, used in cargo ships, tankers, and fishing vessels, offer the high energy density and sustained output necessary for long voyages. Innovations in low-sulfur fuel engines and LNG-powered marine propulsion systems are gaining regulatory acceptance under the International Maritime Organization’s (IMO) 2020 sulfur cap regulations. Companies like MAN Energy Solutions and Wärtsilä are advancing ICE designs to meet emission benchmarks without sacrificing efficiency, opening new growth opportunities in green maritime transportation.

Fuel Type Insights

Petroleum-based ICEs dominated the fuel-type segment, largely due to their historic prevalence, infrastructure support, and established reliability across automotive and industrial use. Gasoline and diesel engines remain the primary power sources for over 90% of vehicles in developing countries and still represent a sizable market in developed nations. Diesel ICEs, in particular, are the preferred choice for commercial and off-road applications due to their high torque, fuel efficiency, and durability. Major manufacturers like Ford, Volkswagen, and Caterpillar continue to refine diesel engine technologies to reduce NOx emissions while maintaining performance standards.

Natural gas ICEs are the fastest-growing fuel segment, buoyed by increasing regulatory support and a growing push for lower-emission alternatives. Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) engines are now being used in city buses, light commercial fleets, and industrial power generation. Countries such as India, China, and the U.S. are investing in natural gas refueling infrastructure, encouraging fleet operators to transition toward cleaner-burning fuels. Additionally, dual-fuel technologies that allow switching between diesel and gas enhance operational flexibility and contribute to segmental growth.

Regional Insights

Asia-Pacific dominates the internal combustion engine market, fueled by massive vehicle production, industrial expansion, and robust demand for backup power solutions. Countries like China, India, Japan, and Indonesia are key contributors to ICE demand due to growing automotive sectors, expanding logistics networks, and increasing rural electrification projects. China, despite being the largest EV market, still manufactures millions of ICE vehicles annually for both domestic and international markets. In India, ICEs remain indispensable in agriculture, transportation, and infrastructure development, especially in Tier 2 and rural areas where electrification remains limited.

Middle East & Africa (MEA) is the fastest-growing region, primarily driven by industrial diversification, mining, and energy projects that require mobile and backup power solutions. The region’s reliance on diesel generators for electricity in remote areas, coupled with increasing investment in shipping and defense, is boosting ICE demand. Moreover, many countries in Africa are witnessing growth in used ICE vehicle imports due to affordability and lack of EV infrastructure. Gulf countries are also exploring dual-fuel ICEs to transition gradually toward cleaner fuels while maintaining high operational standards in construction and logistics sectors.

Recent Developments

-

March 2025 – Cummins Inc. announced the launch of a new hydrogen-fueled internal combustion engine platform, designed for medium and heavy-duty trucks as part of its "Fuel Agnostic" strategy.

-

January 2025 – Wärtsilä introduced a dual-fuel marine engine capable of operating on methanol and LNG, targeting compliance with IMO’s decarbonization targets.

-

November 2024 – Toyota revealed a prototype Corolla powered entirely by hydrogen combustion, continuing its research into zero-emission ICE alternatives.

-

October 2024 – Rolls-Royce Power Systems unveiled a gas-powered internal combustion engine for decentralized energy supply with carbon capture compatibility, aiming to cater to industrial clients in Europe and Africa.

-

August 2024 – MAN Energy Solutions signed a partnership with Stena Line to retrofit a series of passenger ferries with LNG-powered engines, reducing their carbon footprint across European routes.

Some of the prominent players in the internal combustion engine market include:

- AB Volvo

- TOYOTA MOTOR CORPORATION

- Volkswagen Group

- Rolls-Royce plc

- Mahindra & Mahindra Ltd.

- Renault Group

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- MAN

- General Motors

- Ford Motor Company

- FCA US LLC

- Robert Bosch GmbH

- AGCO Corporation

- Caterpillar

- Shanghai Diesel Engine Co., Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global internal combustion engine market.

Fuel Type

End-use

- Automotive

- Marine

- Aircraft

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)